Excellent

performance of LVMH in 2014

Record Revenue and Net Profit

Paris, 3 February 2015

LVMH Moët Hennessy Louis Vuitton,

the world's leading luxury products group, recorded revenue of

€30.6 billion in 2014, an increase of 6% over the previous year.

Organic revenue growth was 5%. Revenue in all business groups

increased with the exception of Wines & Spirits which continued

to be affected by the destocking of distributors in China. The

Group maintained strong momentum in the United States. Europe

demonstrated good resilience despite the economic environment,

while Asian countries displayed mixed trends.

In the fourth quarter, revenue

increased by 10% compared to the same period of 2013. Organic

growth was 5%.

Profit from recurring operations reached €5 715

million, resulting in an operating margin of 19%. Group share of

net profit was €5 648 million.

Bernard Arnault, Chairman and CEO

of LVMH, said: "The 2014 results confirm the capacity for LVMH to

progress despite economic and currency uncertainty. Revenue and net

profit reached new record levels. Commitment to excellence, a

passion for quality and our capacity to innovate underpin our

growth momentum and are all values epitomised by the Fondation

Louis Vuitton and its emblematic building inaugurated in October

2014. The year was also marked by the arrival in the Group of Loro

Piana, which saw a good performance. LVMH reached an agreement with

Hermès and disposed of its stake in this company, in the form of a

distribution to our shareholders. In 2014, all our Maisons

demonstrated outstanding flexibility. By adapting their strategies

to global changes and by continuing to evolve, they have shown the

creativity and entrepreneurship that drive them forward. In an

uncertain economic environment, we can rely on the desirability of

our brands and the agility of our teams to further strengthen our

leadership in the world of high quality products."

Key highlights from 2014 include:

-

Good momentum in the United States and continued

growth in Europe

-

A major increase in net profit

-

Large negative exchange rate effect, principally

impacting Fashion & Leather Goods

-

Wines & Spirits' performance penalized by

the destocking by distributors in China

-

The success of new products at Louis Vuitton,

where profitability remains at an exceptional level

-

Continued investment in our fashion brands

-

Worldwide market share gains by Christian

Dior

-

Excellent results from Bvlgari

-

Strong progress at Sephora

-

Free cash flow of €2.8 billion

-

A gearing ratio of 21% as at the end of December

2014

Euro millions |

2013* |

2014 |

% change |

| Revenue |

29 016 |

30 638 |

+ 6 % |

| Profit from recurring operations |

6 017 |

5 715 |

- 5 % |

| Group

share of net profit |

3 436 |

5 648 |

+ 64 % |

| Free cash

flow** |

3 057 |

2 832 |

- 7 % |

* Restated to reflect the impact of IFRS 10 and 11 on

consolidation

** Before available for sale financial assets and

investments, transactions relating to equity and financing

activities

Revenue by

business group:

| Euro

millions |

2013* |

2014 |

% change

2014/2013

Reported Organic** |

| Wines & Spirits |

4 173 |

3 973 |

- 5 % |

- 3 % |

| Fashion & Leather Goods |

9 883 |

10 828 |

+ 10 % |

+ 3 % |

| Perfumes & Cosmetics |

3 717 |

3 916 |

+ 5 % |

+ 7 % |

| Watches & Jewelry |

2 697 |

2 782 |

+ 3 % |

+ 4 % |

| Selective Retailing |

8 903 |

9 534 |

+ 7 % |

+ 8 % |

| Other activities and eliminations |

(357) |

(395) |

- |

- |

| Total LVMH |

29 016 |

30 638 |

+ 6 % |

+ 5 % |

* Restated to

reflect the impact of IFRS 10 and 11 on consolidation

** With comparable structure and exchange rates.

The structural impact is +3% and the exchange rate impact is -2%

.

Profit from

recurring operations by business

group:

| Euro

millions |

2013* |

2014 |

% change |

| Wines

& Spirits |

1 367 |

1 147 |

- 16

% |

| Fashion

& Leather Goods |

3 135 |

3 189 |

+ 2 % |

| Perfumes

& Cosmetics |

414 |

415 |

0 % |

| Watches

& Jewelry |

367 |

283 |

- 23 % |

| Selective

Retailing |

908 |

882 |

- 3 % |

| Other activities and eliminations |

(174) |

(201) |

- |

| Total LVMH |

6 017 |

5 715 |

- 5 % |

* Restated to reflect the impact of IFRS 10 and 11 on

consolidation

Wines &

Spirits: destocking by distributors in China and growth in the

United States

The Wines &

Spirits business group recorded a decrease in organic revenue

of 3% in 2014. Profit from recurring operations reached €1 147

million. This situation is essentially explained by the evolution

of cognac in China linked to the continued destocking by

distributors. Against this background, Hennessy leveraged its

extensive portfolio and global presence, in particular in the

United States, where its growth remains strong. Other spirits,

Glenmorangie and Belvedere continue their development. The

champagne business performed well, driven in particular by its

prestige vintages. The American and Asian markets benefited from

strong demand.

Fashion &

Leather Goods: major success of new products at Louis Vuitton and

successful investments in other brands

The Fashion &

Leather Goods business group recorded organic revenue growth of

3% in 2014. Profit from recurring operations reached €3 189

million. For Louis Vuitton, 2014 was characterised by strong

creative momentum, dominated by the enthusiastic reception of

Nicolas Ghesquière's first runway shows and of the new products.

The celebration of the Monogram canvas as

revisited by six leading designers and the inauguration of the

Avenue Montaigne flagship store in Paris are among the highlights

of the last quarter. 2014 marks the first year of Loro Piana's

integration into the business group. Fendi experienced strong

growth driven by the success of its iconic lines. Celine continued

its remarkable performance. Other fashion brands such as Givenchy,

Kenzo and Berluti experienced accelerated growth while Donna Karan

and Marc Jacobs are in a redeployment phase.

Perfumes &

Cosmetics: market share gains and remarkable vitality of iconic

products

The Perfumes

& Cosmetics business group significantly outperformed the

market with organic revenue growth of 7%. Profit from recurring

operations amounted to €415 million. The business group's momentum

was boosted by continuous innovation and sustained investments.

Iconic perfumes of Christian Dior, J'adore,

Miss Dior and Dior Homme

continued to demonstrate their exceptional appeal. The make-up

segment also contributed to the good performance of the Maison,

notably thanks to Dior Addict Fluid Stick.

Guerlain benefited from the successful launch of its new fragrance

L'Homme Idéal and the success of its high-end

skincare range Abeille Royale. Benefit

confirmed its strong global momentum and is ranked as the leading

make-up brand in the UK. Fresh and Make Up For Ever continued to

strengthen their positions.

Watches &

Jewelry: strengthened positioning of jewelry and cautious

purchasing behaviour of multi-brand watch retailers

The Watches

& Jewelry business group recorded organic revenue growth of

4%. Profit from recurring operations reached €283 million. While

jewelry revenue showed remarkable momentum, watches were penalized

by the cautious purchasing behaviour of multi-brand retailers in an

uncertain economic environment. Bvlgari recorded strong growth

driven by the success of its iconic lines and enhanced its watch

collections with its new Lvcea watch for

women. TAG Heuer refocused on its core offering, adapting its

organization accordingly. While maintaining tight control, the

Maisons continued to selectively invest in their distribution

network and production capacity.

Selective

Retailing: strong growth at Sephora, DFS's progress impacted by

currency and geopolitical developments

The Selective

Retailing business group recorded organic revenue growth of 8%.

Profit from recurring operations reached €882 million in 2014.

Sephora had an exceptional year and continued to gain market share.

Performance was excellent especially in North America, the Middle

East and Asia. Online sales grew significantly, supported by

innovative mobile features. The store network expansion continued:

the company established a new presence in Indonesia and Australia

while several flagship stores, such as the Champs-Elysées and Dubai

Mall, have been renovated. New brands enhanced the product

offering, bringing a diversity that never ceases to keep Sephora

ahead in beauty innovation.

Faced with a complex situation in Asia, particularly relating to

currency and geopolitical developments, DFS continued to focus on

optimizing its offer and deploying its loyalty program. Its

profitability was equally impacted by the expansion and renovation

of several airport concessions.

Confidence for 2015

Despite a climate of economic, currency and

geopolitical uncertainties, LVMH is well-equipped to continue its

growth momentum across all business groups in 2015. The Group will

maintain a strategy focused on developing its brands by continuing

to build on strong innovation and a constant quest for quality in

their products and their distribution.

Driven by the agility of its

teams, the balance of its different businesses and geographic

diversity, LVMH enters 2015 with confidence and has, once again,

set an objective of increasing its global leadership position in

luxury goods.

Dividend increase of 3%

At the Annual Shareholders'

Meeting on April 16, 2015, LVMH will propose a dividend of €3.20

per share, an increase of 3%. An interim dividend of €1.25 per

share was paid on December 4 of last year. The balance of €1.95 per

share will be paid on April 23, 2015.

The LVMH Board

met on 3 February 2015 to approve the financial statements for

2014.

Audit procedures have been carried out and the

audit report is being issued.

Regulated information related to this press

release, the presentation of annual results and the report

"Financial Documents" are available at www.lvmh.fr.

APPENDIX

Revenue by business

group and by quarter

2014

| (Euro millions) |

Wines

& Spirits |

Fashion

& Leather Goods |

Perfumes

& Cosmetics |

Watches

& Jewelry |

Selective

Retailing |

Other

Activities and Eliminations |

Total |

| First quarter |

888 |

2

639 |

941 |

607 |

2

222 |

(91) |

7 206 |

| Second quarter |

789 |

2

391 |

898 |

659 |

2

160 |

(94) |

6 803 |

| Third quarter |

948 |

2

647 |

961 |

706 |

2

234 |

(108) |

7 388 |

| Fourth quarter |

1

348 |

3

151 |

1

116 |

810 |

2

918 |

(102) |

9 241 |

| Total revenue |

3 973 |

10 828 |

3 916 |

2 782 |

9 534 |

(395) |

30 638 |

2013

restated*

| (Euro millions) |

Wines

& Spirits |

Fashion

& Leather Goods |

Perfumes

& Cosmetics |

Watches

& Jewelry |

Selective

Retailing |

Other

Activities and Eliminations |

Total |

| First quarter |

967 |

2

383 |

932 |

608 |

2

113 |

(90) |

6 913 |

| Second quarter |

828 |

2

328 |

872 |

667 |

2

085 |

(61) |

6 719 |

| Third quarter |

1

032 |

2

428 |

879 |

655 |

2

093 |

(97) |

6 990 |

| Fourth quarter |

1

346 |

2

744 |

1

034 |

767 |

2

612 |

(109) |

8 394 |

| Total revenue |

4 173 |

9 883 |

3 717 |

2 697 |

8 903 |

(357) |

29 016 |

* Restated

to reflect the impact of IFRS 10 and 11 on consolidation

2013

| (Euro millionss) |

Wines

& Spirits |

Fashion

& Leather Goods |

Perfumes

& Cosmetics |

Watches

& Jewelry |

Selective

Retailing |

Other

Activities and Eliminations |

Total |

| First quarter |

979 |

2

383 |

932 |

624 |

2

122 |

(93) |

6 947 |

| Second quarter |

829 |

2

328 |

872 |

686 |

2

093 |

(60) |

6 748 |

| Third quarter |

1

032 |

2

428 |

879 |

677 |

2

101 |

(97) |

7 020 |

| Fourth

quarter |

1 347 |

2 743 |

1 034 |

797 |

2 622 |

(109) |

8 434 |

| Total revenue |

4 187 |

9 882 |

3 717 |

2 784 |

8 938 |

(359) |

29 149 |

LVMH

LVMH Moët Hennessy Louis Vuitton is represented in

Wines and Spirits by a portfolio of brands that includes Moët &

Chandon, Dom Pérignon, Veuve Clicquot Ponsardin, Krug, Ruinart,

Mercier, Château d'Yquem, Domaine du Clos des Lambrays, Château

Cheval Blanc, Hennessy, Glenmorangie, Ardbeg, Wen Jun, Belvedere,

Chandon, Cloudy Bay, Terrazas de los Andes, Cheval des Andes, Cape

Mentelle, Newton et Numanthia. Its Fashion and Leather Goods

division includes Louis Vuitton, Céline, Loewe, Kenzo, Givenchy,

Thomas Pink, Fendi, Emilio Pucci, Donna Karan, Marc Jacobs,

Berluti, Nicholas Kirkwood and Loro Piana. LVMH is present in the

Perfumes and Cosmetics sector with Parfums Christian Dior,

Guerlain, Parfums Givenchy, Parfums Kenzo, Perfumes Loewe as well

as other promising cosmetic companies (BeneFit Cosmetics, Make Up

For Ever, Acqua di Parma and Fresh). LVMH is also active in

selective retailing as well as in other activities through DFS,

Sephora, Le Bon Marché, la Samaritaine and Royal Van Lent. LVMH's

Watches and Jewelry division comprises Bulgari, TAG Heuer, Chaumet,

Dior Watches, Zenith, Fred, Hublot and De Beers Diamond Jewellers

Ltd, a joint venture created with the world's leading diamond

group.

"Certain

information included in this release is forward looking and is

subject to important risks and uncertainties and factors beyond our

control or ability to predict, that could cause actual results to

differ materially from those anticipated, projected or implied. It

only reflects our views as of the date of this presentation. No

undue reliance should therefore be based on any such information,

it being also agreed that we undertake no commitment to amend or

update it after the date hereof."

| Contacts: |

|

|

| Analysts

and investors: |

Chris

Hollis

LVMH |

+ 33 1.4413.2122 |

|

|

|

|

| Media: |

|

|

|

France : |

Michel

Calzaroni/Olivier Labesse/

Sonia Fellmann/Hugues Schmitt |

+ 33 1.4070.1189 |

|

|

DGM Conseil |

|

|

|

|

|

| UK: |

Hugh

Morrison |

+ 44.773.965 5492 |

|

|

|

|

|

Italy: |

Michele

Calcaterra/ Matteo Steinbach |

+39 02 6249991 |

|

|

SEC and Partners |

|

| US: |

James

Fingeroth/Molly Morse/

Anntal Silver |

+1 212.521.4800 |

|

|

Kekst & Company |

|

Press Release in pdf

format

This

announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: LVMH via Globenewswire

HUG#1891428

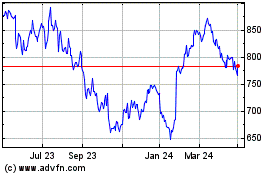

Lvmh Moet Hennessy Louis... (EU:MC)

Historical Stock Chart

From Nov 2024 to Dec 2024

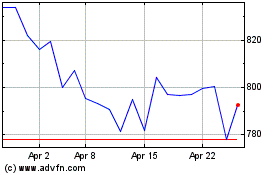

Lvmh Moet Hennessy Louis... (EU:MC)

Historical Stock Chart

From Dec 2023 to Dec 2024