Ameristar Casinos, Inc. (NASDAQ: ASCA)

- Net Revenues declined YOY by $7.3 million

(2.5%) for 4Q and $19.3 million (1.6%) for the year

- Adjusted EBITDA decreased YOY by $3.9 million

(4.6%) for 4Q and $3.6 million (1.0%) for the year

- Majority of properties improved both 4Q and

Full-Year Adjusted EBITDA Margins YOY

- Adjusted EPS increased YOY by $0.11 (52.4%)

for 4Q and $0.36 (20.7%) for the year

- Progress made toward completion of pending

merger with Pinnacle Entertainment, Inc.

Ameristar Casinos, Inc. (NASDAQ: ASCA) today announced financial

results for the fourth quarter and year ended Dec. 31, 2012.

Fourth Quarter 2012 Results

Consolidated net revenues for the fourth quarter decreased year

over year by $7.3 million (2.5%), to $288.8 million. New

competition in Kansas City and a more challenging competitive

environment in the Chicagoland market adversely impacted the

quarterly results. Net revenues for Kansas City and East Chicago

decreased $4.5 million (8.1%) and $2.0 million (3.7%),

respectively, representing 88.1% of the consolidated net revenue

decline from the fourth quarter of 2011. The Jackpot properties had

a year-over-year net revenue decline of $0.8 million (5.8%), mostly

as a result of lower than expected slot hold. The year-over-year

variances in net revenues at the other four properties were

relatively modest, with declines at Council Bluffs and Vicksburg

and increases at Black Hawk and St. Charles.

For the fourth quarter of 2012, consolidated Adjusted EBITDA

decreased $3.9 million (4.6%) from the prior-year fourth quarter.

The combined effects of new competition in the Kansas City market,

a favorable property tax adjustment in Black Hawk in the prior-year

fourth quarter and a year-over-year increase in the gaming tax rate

in Colorado accounted for $3.1 million, or 80.8% of the

year-over-year consolidated Adjusted EBITDA decline. The balance of

the decline is substantially attributable to $0.7 million in

expenses related to our recently terminated efforts to pursue a

gaming license in western Massachusetts, as Adjusted EBITDA at each

of our other properties and other corporate expense were relatively

stable year over year. Fourth quarter 2012 Adjusted EBITDA excludes

the impact of an $8.6 million impairment of the land value in

Springfield, Massachusetts, $6.7 million in merger costs, $0.9

million in expensed design costs and $0.2 million in

non-capitalizable costs associated with the development of our

luxury casino resort in Lake Charles, La.

Consolidated Adjusted EBITDA margin decreased from 28.4% in the

fourth quarter of 2011 to 27.8% in the current-year fourth quarter,

which is within what we consider to be the normal range of

fluctuation for our operating performance due to the uncontrollable

nature of various factors that can affect revenue and certain

expenses. We generated operating income of $32.5 million in the

fourth quarter of 2012, compared to $44.1 million in the same

period in 2011.

For the quarter ended Dec. 31, 2012, we reported net income of

$1.2 million, compared to net income of $7.4 million for the same

period in 2011. Diluted earnings per share were $0.04 for the

fourth quarter of 2012, compared to diluted earnings per share of

$0.22 in the prior-year fourth quarter. Our Adjusted EPS of $0.32

for the quarter ended Dec. 31, 2012 represents an increase of $0.11

over Adjusted EPS for the 2011 fourth quarter. The year-over-year

improvement in Adjusted EPS was mostly attributable to a lower

effective income tax rate and a reduction in non-cash stock-based

compensation expense, which was elevated in the 2011 fourth quarter

from the accelerated recognition of expense resulting from certain

equity award modifications.

Our St. Charles property posted year-over-year growth in all

three of our key property financial metrics -- net revenues,

Adjusted EBITDA and Adjusted EBITDA margin. As anticipated, an

Interstate 70 bridge maintenance project resulted in the closure of

four of the 10 lanes near our property commencing in November 2012

for approximately one year. Although disruption from this

maintenance project did not appear to significantly impact the

property's performance during the fourth quarter of 2012, the

nearest competitor underwent an ownership change at about the same

time as the partial closure of the bridge, and this competitor was

closed intermittently during the transition to facilitate system

changes. The competing property is currently in the process of

rebranding and is undergoing some renovations to its casino floor.

As a result, the fourth quarter results may not reflect the level

of disruption our St. Charles property will experience from the

bridge maintenance project for the duration of the project.

Full Year 2012 Results Consolidated net

revenues for fiscal year 2012 were $1.20 billion, a $19.3 million

(1.6%) decrease from $1.21 billion in 2011. Consolidated Adjusted

EBITDA for 2012 declined $3.6 million (1.0%) from 2011, to $361.6

million. Slightly more than one-third of this variance is

attributable to $1.3 million in expenses related to the

now-terminated pursuit of a Massachusetts gaming license. Excluding

those expenses and the results of our properties in Kansas City and

East Chicago that were adversely impacted by the competitive

environment changes for most of 2012, annual consolidated net

revenues and consolidated Adjusted EBITDA improved year over year

by $6.4 million (0.8%) and $4.1 million (1.7%), respectively. In

2012, Black Hawk, Council Bluffs and Vicksburg improved from the

prior year in all three of our key property financial metrics.

Our efficient operating model produced an increase in

consolidated Adjusted EBITDA margin from 30.1% in 2011 to 30.3% in

2012, notwithstanding the Massachusetts development expenses. The

majority of our properties improved Adjusted EBITDA margin from

2011.

For the full year, consolidated net income increased from $6.8

million in 2011 to $76.3 million in 2012. The pre-tax impairment

charge of $8.6 million relating to the Massachusetts land

negatively affected 2012 net income by $5.1 million on an after-tax

basis. A pre-tax loss on early retirement of debt of $85.3 million

($55.1 million on an after-tax basis) adversely impacted 2011.

Adjusted EPS was $2.10 for the year ended Dec. 31, 2012,

compared to $1.74 for 2011. Adjusted EPS for 2012 was favorably

impacted by the reduction from 2011 of approximately 7.4 million

weighted-average diluted shares outstanding, a lower effective

income tax rate and a decrease in stock-based compensation

expense.

Ameristar Casino Resort Spa Lake Charles

Construction of Ameristar Casino Resort Spa Lake Charles began on

July 20, 2012 and is expected to open in the third quarter of 2014.

The resort is being developed on a leased 243-acre site and will

include a casino with approximately 1,600 slot machines and 60

table games, a hotel with 700 guest rooms (including 70 suites), a

variety of food and beverage outlets, an 18-hole golf course, a

tennis club, swimming pools, a spa and other resort amenities, and

approximately 3,000 parking spaces, 1,000 of which will be in a

garage.

The cost of the project (including the purchase price) is

expected to be between $560 million and $580 million, excluding

capitalized interest and pre-opening expenses. Through Dec. 31,

2012, total invested capital in the Lake Charles project was $107.4

million, including purchase price, capital expenditures and escrow

deposits. To date, we have not made any borrowings under our

revolving credit facility related to the Lake Charles project.

Additional Financial Information

Cash and Cash Equivalents. At Dec. 31, 2012,

total cash was $89.4 million, representing an increase of $3.7

million from total cash as of Dec. 31, 2011.

Debt. At Dec. 31, 2012, the face amount of

our outstanding debt was $1.92 billion, a decrease of $15.4 million

from Dec. 31, 2011. Net repayments in the fourth quarter of 2012

totaled $3.0 million. As of Dec. 31, 2012, we had $496.0 million

available for borrowing under the revolving credit facility. At

Dec. 31, 2012, our Total Net Leverage Ratio (as defined in the

senior credit facility) was required to be no more than 6.50:1. As

of that date, our Total Net Leverage Ratio was 5.08:1.

Capital Expenditures. For the quarters

ended Dec. 31, 2012 and 2011, capital expenditures totaled $50.0

million and $36.5 million, respectively. Fourth quarter 2012

capital expenditures included $31.6 million associated with the

Lake Charles construction project. The fourth quarter 2011 capital

expenditures included a $9.3 million litigation settlement payment

to the general contractor for our St. Charles hotel construction

project completed in 2008. For the years ended Dec. 31, 2012 and

2011, capital expenditures were $133.1 million and $82.6 million,

respectively.

Dividends. During the fourth quarter of

2012, our Board of Directors declared a cash dividend of $0.125 per

share, which we paid on Dec. 14, 2012. On Feb. 6, 2013, the Board

declared a cash dividend of $0.125 per share, payable on March 15,

2013 to stockholders of record on Feb. 28, 2013.

Outlook

In the first quarter of 2013, we currently expect:

- depreciation to range from $24.5 million to $25.5 million.

- interest expense, net of capitalized interest, to be between

$28.5 million and $29.5 million, including non-cash interest

expense of approximately $1.3 million.

- the combined state and federal income tax rate to be in the

range of 40% to 42%.

- capital spending of $49.0 million to $54.0 million, including

approximately $15.0 million for maintenance capital expenditures

and $36.0 million related to Lake Charles design and construction

costs.

- non-cash stock-based compensation expense of $3.6 million to

$4.1 million.

- corporate expense, including merger costs and excluding

corporate's portion of non-cash stock-based compensation expense,

to be between $13.5 million and $14.0 million.

Pending Merger As previously announced, on

Dec. 20, 2012, Ameristar Casinos, Inc. entered into an agreement

and plan of merger with Pinnacle Entertainment, Inc., pursuant to

which Pinnacle will acquire all of the outstanding common shares of

Ameristar for $26.50 per share in cash. The merger is subject to

customary closing conditions, required regulatory approvals and

approval by Ameristar's stockholders. The transaction is expected

to close in the second or third quarter of 2013.

Ameristar and Pinnacle filed the required Hart-Scott-Rodino

premerger notification and report forms on Jan. 11, 2013. Pinnacle

has filed applications for regulatory approvals as required under

applicable gaming laws. On Feb. 1, 2013, Ameristar filed a

preliminary proxy statement with the Securities and Exchange

Commission (SEC) relating to a special meeting of Ameristar's

stockholders to consider and approve the merger agreement. No

assurance can be given that the merger will be completed.

Additional Information about the Pending Merger

and Where to Find It This press release may be deemed to be

solicitation material in respect of the pending merger of Pinnacle

and Ameristar. In connection with the proposed merger, Ameristar

has filed a preliminary proxy statement with the SEC and will later

file a definitive proxy statement and mail it to its stockholders.

INVESTORS AND AMERISTAR'S STOCKHOLDERS ARE URGED TO READ CAREFULLY

THE PRELIMINARY AND DEFINITIVE PROXY STATEMENTS AND OTHER PROXY

MATERIALS THAT AMERISTAR FILES WITH THE SEC AS THEY BECOME

AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT

AMERISTAR, THE MERGER AND RELATED MATTERS. The preliminary and

definitive proxy statements and other relevant materials, and any

other documents filed by Ameristar with the SEC, may be obtained

free of charge at the SEC's website at www.sec.gov. In addition,

stockholders can obtain free copies of the proxy statement from

Ameristar by contacting Ameristar's Investor Relations Department

by telephone at (702) 567-7000, or by mail at Ameristar Casinos,

Inc., 3773 Howard Hughes Parkway, Suite 490 South, Las Vegas,

Nevada 89169, Attention: Investor Relations Department, or at

Ameristar's website at www.ameristar.com.

Participants in the Solicitation Ameristar

and its directors and executive officers and other persons may be

deemed to be participants in the solicitation of proxies from the

stockholders of Ameristar in connection with the pending merger.

Information about Ameristar's directors and executive officers is

included in our Annual Report on Form 10-K for the year ended Dec.

31, 2011 and the proxy statement for our 2012 Annual Meeting of

Stockholders, filed with the SEC on April 30, 2012. Additional

information regarding the interests of Ameristar's directors and

executive officers in the merger is included in the preliminary

proxy statement for the special meeting of Ameristar's stockholders

and will be included in the definitive proxy statement described

above.

Forward-Looking Information This release

contains certain forward-looking information that generally can be

identified by the context of the statement or the use of

forward-looking terminology, such as "believes," "estimates,"

"anticipates," "intends," "expects," "plans," "is confident that,"

"should," "could," "would," "will" or words of similar meaning,

with reference to Ameristar or our management. Similarly,

statements that describe our future plans, objectives, strategies,

financial results or position, operational expectations or goals

are forward-looking statements. It is possible that our

expectations may not be met due to various factors, many of which

are beyond our control, and we therefore cannot give any assurance

that such expectations will prove to be correct. For a discussion

of relevant factors, risks and uncertainties that could materially

affect our future results, attention is directed to "Item 1A. Risk

Factors" and "Item 7. Management's Discussion and Analysis of

Financial Condition and Results of Operations" in our Annual Report

on Form 10-K for the year ended Dec. 31, 2011, "Item 2.

Management's Discussion and Analysis of Financial Condition and

Results of Operations" in our Quarterly Report on Form 10-Q for the

quarter ended Sept. 30, 2012, and "Item 1A. Risk Factors" in our

Quarterly Report on Form 10-Q for the quarter ended June 30,

2012.

On a monthly basis, gaming regulatory authorities in certain

states in which we operate publish gross gaming revenue and/or

certain other financial information for the gaming facilities that

operate within their respective jurisdictions. Because various

factors in addition to our gross gaming revenue (including

operating costs, promotional allowances and corporate and other

expenses) influence our operating income, Adjusted EBITDA and

diluted earnings per share, such reported information, as it

relates to Ameristar, may not accurately reflect the results of our

operations for such periods or for future periods.

About Ameristar Ameristar Casinos is an

innovative casino gaming company featuring the newest and most

popular slot machines. Our 7,200 dedicated team members pride

themselves on delivering consistently friendly and appreciative

service to our guests. We continuously strive to increase the

loyalty of our guests through the quality of our slot machines,

table games, hotel, dining and other leisure offerings. Our eight

casino hotel properties primarily serve guests from Colorado,

Idaho, Illinois, Indiana, Iowa, Kansas, Louisiana, Mississippi,

Missouri, Nebraska and Nevada. We began construction on our ninth

property, a casino resort in Lake Charles, La., in July 2012, which

we expect will open in the third quarter of 2014. We have been a

public company since 1993, and our stock is traded on the Nasdaq

Global Select Market. We generate more than $1 billion in net

revenues annually.

Visit Ameristar Casinos' website at www.ameristar.com (which

shall not be deemed to be incorporated in or a part of this news

release).

Please refer to the tables at the end of this release for the

reconciliation of the non-GAAP financial measures Adjusted EBITDA

and Adjusted EPS reported throughout this release. Additionally,

more information on these non-GAAP financial measures can be found

under the caption "Use of Non-GAAP Financial Measures" at the end

of this release.

AMERISTAR CASINOS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Amounts in Thousands, Except Per Share Data)

(Unaudited)

Three Months Ended Year Ended

December 31, December 31,

2012 2011 2012 2011

---------- ---------- ---------- ----------

REVENUES:

Casino $ 298,498 $ 305,040 $1,228,958 $1,248,616

Food and beverage 36,037 34,067 139,565 138,192

Rooms 19,152 18,842 77,698 77,870

Other 6,653 6,954 27,957 28,905

---------- ---------- ---------- ----------

360,340 364,903 1,474,178 1,493,583

Less: promotional allowances (71,513) (68,741) (278,957) (279,077)

---------- ---------- ---------- ----------

Net revenues 288,827 296,162 1,195,221 1,214,506

OPERATING EXPENSES:

Casino 134,385 135,113 537,862 548,635

Food and beverage 13,599 14,484 53,634 54,414

Rooms 2,031 2,340 8,121 8,266

Other 2,452 2,701 9,761 10,669

Selling, general and

administrative 68,337 69,808 251,395 259,151

Depreciation and

amortization 25,761 27,264 106,317 105,922

Impairment of fixed assets 9,563 245 9,563 245

Net loss (gain) on

disposition of assets 208 79 408 (45)

---------- ---------- ---------- ----------

Total operating expenses 256,336 252,034 977,061 987,257

Income from operations 32,491 44,128 218,160 227,249

OTHER INCOME (EXPENSE):

Interest income 5 12 44 15

Interest expense, net of

capitalized interest (29,383) (27,090) (114,740) (106,623)

Loss on early retirement

of debt - - - (85,311)

Other - 508 835 (784)

---------- ---------- ---------- ----------

INCOME BEFORE INCOME TAX

PROVISION 3,113 17,558 104,299 34,546

Income tax provision 1,898 10,179 27,964 27,752

---------- ---------- ---------- ----------

NET INCOME $ 1,215 $ 7,379 $ 76,335 $ 6,794

========== ========== ========== ==========

EARNINGS PER SHARE:

Basic $ 0.04 $ 0.23 $ 2.32 $ 0.17

========== ========== ========== ==========

Diluted $ 0.04 $ 0.22 $ 2.26 $ 0.17

========== ========== ========== ==========

CASH DIVIDENDS DECLARED PER

SHARE $ 0.125 $ 0.105 $ 0.50 $ 0.42

========== ========== ========== ==========

WEIGHTED-AVERAGE SHARES

OUTSTANDING:

Basic 32,837 32,681 32,906 40,242

========== ========== ========== ==========

Diluted 34,225 34,014 33,743 41,136

========== ========== ========== ==========

AMERISTAR CASINOS, INC. AND SUBSIDIARIES

SUMMARY CONSOLIDATED FINANCIAL DATA

(Dollars in Thousands)

(Unaudited)

December 31, 2012 December 31, 2011

---------------------- ----------------------

Balance sheet data

Cash and cash equivalents $ 89,392 $ 85,719

Total assets $ 2,074,274 $ 2,012,039

Total debt, including net

discount of $926 and

$8,258 $ 1,917,979 $ 1,926,064

Stockholders' deficit $ (22,259) $ (90,578)

Three Months Ended Year Ended

December 31, December 31,

2012 2011 2012 2011

---------- ---------- ---------- ----------

Consolidated cash flow

information

Net cash provided by

operating activities $ 20,901 $ 44,070 $ 223,970 $ 253,349

Net cash used in investing

activities $ (41,359) $ (33,608) $ (180,824) $ (52,283)

Net cash used in financing

activities $ (6,461) $ (16,658) $ (39,473) $ (186,533)

Net revenues

Ameristar St. Charles $ 66,424 $ 66,129 $ 268,928 $ 269,759

Ameristar Kansas City 51,435 55,939 211,791 226,054

Ameristar Council Bluffs 40,262 40,675 166,003 164,523

Ameristar Black Hawk 38,649 38,143 160,212 153,203

Ameristar Vicksburg 27,701 28,133 119,766 118,094

Ameristar East Chicago 50,817 52,773 210,482 221,893

Jackpot Properties 13,539 14,370 58,039 60,980

---------- ---------- ---------- ----------

Consolidated net

revenues $ 288,827 $ 296,162 $1,195,221 $1,214,506

========== ========== ========== ==========

Operating income (loss)

Ameristar St. Charles $ 15,159 $ 14,347 $ 68,163 $ 68,908

Ameristar Kansas City 13,698 15,268 61,400 66,088

Ameristar Council Bluffs 13,474 13,977 60,635 57,962

Ameristar Black Hawk 8,607 9,877 40,733 37,562

Ameristar Vicksburg 7,828 7,923 39,719 38,365

Ameristar East Chicago 5,002 3,920 21,100 22,445

Jackpot Properties 2,418 2,419 11,567 13,642

Corporate and other (33,695) (23,603) (85,157) (77,723)

---------- ---------- ---------- ----------

Consolidated operating

income $ 32,491 $ 44,128 $ 218,160 $ 227,249

========== ========== ========== ==========

Adjusted EBITDA

Ameristar St. Charles $ 22,531 $ 22,333 $ 96,231 $ 96,885

Ameristar Kansas City 17,433 19,195 76,159 81,448

Ameristar Council Bluffs 15,598 15,671 68,816 66,182

Ameristar Black Hawk 13,160 14,518 58,770 56,009

Ameristar Vicksburg 11,783 11,773 54,768 53,361

Ameristar East Chicago 8,531 8,477 38,853 39,921

Jackpot Properties 3,894 4,119 17,279 19,507

Corporate and other (12,540) (11,834) (49,291) (48,177)

---------- ---------- ---------- ----------

Consolidated Adjusted

EBITDA $ 80,390 $ 84,252 $ 361,585 $ 365,136

========== ========== ========== ==========

AMERISTAR CASINOS, INC. AND SUBSIDIARIES

SUMMARY CONSOLIDATED FINANCIAL DATA - CONTINUED

(Dollars in Thousands)

(Unaudited)

Three Months Ended Year Ended

December 31, December 31,

2012 2011 2012 2011

-------- -------- -------- --------

Operating income margins (1)

Ameristar St. Charles 22.8% 21.7% 25.3% 25.5%

Ameristar Kansas City 26.6% 27.3% 29.0% 29.2%

Ameristar Council Bluffs 33.5% 34.4% 36.5% 35.2%

Ameristar Black Hawk 22.3% 25.9% 25.4% 24.5%

Ameristar Vicksburg 28.3% 28.2% 33.2% 32.5%

Ameristar East Chicago 9.8% 7.4% 10.0% 10.1%

Jackpot Properties 17.9% 16.8% 19.9% 22.4%

Consolidated operating income

margin 11.2% 14.9% 18.3% 18.7%

Adjusted EBITDA margins (2)

Ameristar St. Charles 33.9% 33.8% 35.8% 35.9%

Ameristar Kansas City 33.9% 34.3% 36.0% 36.0%

Ameristar Council Bluffs 38.7% 38.5% 41.5% 40.2%

Ameristar Black Hawk 34.1% 38.1% 36.7% 36.6%

Ameristar Vicksburg 42.5% 41.8% 45.7% 45.2%

Ameristar East Chicago 16.8% 16.1% 18.5% 18.0%

Jackpot Properties 28.8% 28.7% 29.8% 32.0%

Consolidated Adjusted EBITDA

margin 27.8% 28.4% 30.3% 30.1%

(1) Operating income margin is operating income (loss) as a

percentage of net revenues. (2) Adjusted EBITDA margin is Adjusted

EBITDA as a percentage of net revenues.

RECONCILIATION OF OPERATING INCOME (LOSS) TO ADJUSTED EBITDA

(Dollars in Thousands) (Unaudited)

The following tables set forth reconciliations of operating income (loss), a

GAAP financial measure, to Adjusted EBITDA, a non-GAAP financial measure.

Three Months Ended December 31, 2012

---------------------------------------------------

Impairment

Loss and

Loss (Gain)

Operating Depreciation on

Income and Disposition Stock-Based

(Loss) Amortization of Assets Compensation

---------- ------------ ----------- -------------

Ameristar St. Charles $ 15,159 $ 7,096 $ - $ 276

Ameristar Kansas City 13,698 3,396 9 330

Ameristar Council Bluffs 13,474 1,904 12 208

Ameristar Black Hawk 8,607 4,370 - 183

Ameristar Vicksburg 7,828 3,726 - 229

Ameristar East Chicago 5,002 3,278 (7) 258

Jackpot Properties 2,418 1,283 - 193

Corporate and other (33,695) 708 9,757 3,828

---------- ------------ ----------- -------------

Consolidated $ 32,491 $ 25,761 $ 9,771 $ 5,505

========== ============ =========== =============

Three Months Ended December 31, 2012

------------------------------------

Non-

Non- Capitalizable

Operational Lake Charles

Professional Development Adjusted

Fees Costs EBITDA

------------ ------------- --------

Ameristar St. Charles $ - $ - $ 22,531

Ameristar Kansas City - - 17,433

Ameristar Council Bluffs - - 15,598

Ameristar Black Hawk - - 13,160

Ameristar Vicksburg - - 11,783

Ameristar East Chicago - - 8,531

Jackpot Properties - - 3,894

Corporate and other 6,669 193 (12,540)

------------ ------------- --------

Consolidated $ 6,669 $ 193 $ 80,390

============ ============= ========

Three Months Ended December 31, 2011

-----------------------------------------------------

Impairment

Loss and

(Gain) Loss

Operating Depreciation on

Income and Disposition Stock-Based

(Loss) Amortization of Assets Compensation

------------ ------------ ------------ ------------

Ameristar St. Charles $ 14,347 $ 7,468 $ (10) $ 528

Ameristar Kansas City 15,268 3,700 - 227

Ameristar Council

Bluffs 13,977 1,885 - 303

Ameristar Black Hawk 9,877 4,401 - 240

Ameristar Vicksburg 7,923 3,546 - 303

Ameristar East Chicago 3,920 4,337 89 131

Jackpot Properties 2,419 1,283 - 417

Corporate and other (23,603) 644 245 10,186

------------ ------------ ------------ ------------

Consolidated $ 44,128 $ 27,264 $ 324 $ 12,335

============ ============ ============ ============

Three Months Ended December 31, 2011

----------------------------------------------

Deferred Net River

Compensation Flooding

Plan Expense (Reimbursements) Adjusted

(1) Expenses (2) EBITDA

------------- ---------------- -------------

Ameristar St. Charles $ - $ - $ 22,333

Ameristar Kansas City - - 19,195

Ameristar Council

Bluffs - (494) 15,671

Ameristar Black Hawk - - 14,518

Ameristar Vicksburg - 1 11,773

Ameristar East Chicago - - 8,477

Jackpot Properties - - 4,119

Corporate and other 694 - (11,834)

------------- ---------------- -------------

Consolidated $ 694 $ (493) $ 84,252

============= ================ =============

(1) Deferred compensation plan expense represents the change in

the Company's non-cash liability based on plan participant

investment results. This expense is included in selling, general

and administrative expenses in the condensed consolidated

statements of operations. (2) River flooding expenses are net of

insurance reimbursements and represent non-capitalizable costs

incurred to reduce exposure to significant property damage from

extraordinary flood levels, as well as required flood cleanup

costs.

RECONCILIATION OF OPERATING INCOME (LOSS) TO ADJUSTED EBITDA - CONTINUED

(Dollars in Thousands) (Unaudited)

Year Ended December 31, 2012

-------------------------------------------------------------

Impairment

Loss and

(Gain) Loss Deferred

Operating Depreciation on Compensation

Income and Disposition Stock-Based Plan Expense

(Loss) Amortization of Assets Compensation (1)

--------- ------------ ----------- ------------ ------------

Ameristar St.

Charles $ 68,163 $ 27,488 $ (150)$ 730 $ -

Ameristar

Kansas City 61,400 14,248 (100) 611 -

Ameristar

Council

Bluffs 60,635 7,844 (88) 558 -

Ameristar

Black Hawk 40,733 17,618 (72) 491 -

Ameristar

Vicksburg 39,719 14,428 (1) 622 -

Ameristar East

Chicago 21,100 16,559 603 591 -

Jackpot

Properties 11,567 5,149 22 541 -

Corporate and

other (85,157) 2,983 9,757 14,109 1,227

--------- ------------ ----------- ------------ ------------

Consolidated $ 218,160 $ 106,317 $ 9,971 $ 18,253 $ 1,227

========= ============ =========== ============ ============

Year Ended December 31, 2012

--------------------------------------------------

Non-

Non- Capitalizable

Operational Lake Charles Net River

Professional Development Flooding Adjusted

Fees Costs Expenses (2) EBITDA

------------ ------------- ------------ --------

Ameristar St.

Charles $ - $ - $ - $ 96,231

Ameristar

Kansas City - - - 76,159

Ameristar

Council

Bluffs - - (133) 68,816

Ameristar

Black Hawk - - - 58,770

Ameristar

Vicksburg - - - 54,768

Ameristar East

Chicago - - - 38,853

Jackpot

Properties - - - 17,279

Corporate and

other 6,669 1,121 - (49,291)

------------ ------------- ------------ --------

Consolidated $ 6,669 $ 1,121 $ (133) $361,585

============ ============= ============ ========

Year Ended December 31, 2011

-------------------------------------------------

Impairment

Loss and

(Gain) Loss

Operating Depreciation on

Income and Disposition Stock-Based

(Loss) Amortization of Assets Compensation

--------- ------------ ----------- ------------

Ameristar St. Charles $ 68,908 $ 26,922 $ (6) $ 1,052

Ameristar Kansas City 66,088 14,855 (80) 585

Ameristar Council Bluffs 57,962 7,542 (105) 670

Ameristar Black Hawk 37,562 17,834 (21) 634

Ameristar Vicksburg 38,365 13,997 (1) 750

Ameristar East Chicago 22,445 16,854 156 466

Jackpot Properties 13,642 5,068 13 784

Corporate and other (77,723) 2,850 244 19,404

--------- ------------ ----------- ------------

Consolidated $ 227,249 $ 105,922 $ 200 $ 24,345

========= ============ =========== ============

Year Ended December 31, 2011

------------------------------------------------

Deferred Non-

Compensation Operational Net River

Plan Expense Professional Flooding Adjusted

(1) Fees Expenses (2) EBITDA

------------ ------------ ------------ --------

Ameristar St. Charles $ - $ - $ 9 $ 96,885

Ameristar Kansas City - - - 81,448

Ameristar Council Bluffs - - 113 66,182

Ameristar Black Hawk - - - 56,009

Ameristar Vicksburg - - 250 53,361

Ameristar East Chicago - - - 39,921

Jackpot Properties - - - 19,507

Corporate and other 75 6,973 - (48,177)

------------ ------------ ------------ --------

Consolidated $ 75 $ 6,973 $ 372 $365,136

============ ============ ============ ========

(1) Deferred compensation plan expense represents the change in

the Company's non-cash liability based on plan participant

investment results. This expense is included in selling, general

and administrative expenses in the condensed consolidated

statements of operations. (2) River flooding expenses are net of

insurance reimbursements and represent non-capitalizable costs

incurred to reduce exposure to significant property damage from

extraordinary flood levels, as well as required flood cleanup

costs.

RECONCILIATION OF NET INCOME TO ADJUSTED EBITDA

(Dollars in Thousands) (Unaudited)

The following table sets forth a reconciliation of consolidated net income,

a GAAP financial measure, to consolidated Adjusted EBITDA, a non-GAAP

financial measure.

Three Months Ended Year Ended

December 31, December 31,

2012 2011 2012 2011

---------- ---------- ---------- ----------

Net income $ 1,215 $ 7,379 $ 76,335 $ 6,794

Income tax provision 1,898 10,179 27,964 27,752

Interest expense, net of

capitalized interest 29,383 27,090 114,740 106,623

Interest income (5) (12) (44) (15)

Other - (508) (835) 784

Net loss (gain) on disposition

of assets 208 79 408 (45)

Impairment of fixed assets 9,563 245 9,563 245

Depreciation and amortization 25,761 27,264 106,317 105,922

Stock-based compensation 5,505 12,335 18,253 24,345

Non-operational professional

fees 6,669 - 6,669 6,973

Non-capitalizable Lake Charles

development costs 193 - 1,121 -

Deferred compensation plan

expense - 694 1,227 75

Loss on early retirement of

debt - - - 85,311

Net river flooding

(reimbursements) expenses - (493) (133) 372

---------- ---------- ---------- ----------

Adjusted EBITDA $ 80,390 $ 84,252 $ 361,585 $ 365,136

========== ========== ========== ==========

RECONCILIATION OF DILUTED EPS TO ADJUSTED DILUTED EPS

(Shares in Thousands) (Unaudited)

The following table sets forth a reconciliation of diluted earnings per

share (EPS), a GAAP financial measure, to adjusted diluted earnings per

share (Adjusted EPS), a non-GAAP financial measure.

Three Months Ended Year Ended

December 31, December 31,

2012 2011 2012 2011

---------- ---------- ---------- ----------

Diluted earnings per share

(EPS) $ 0.04 $ 0.22 $ 2.26 $ 0.17

Non-operational professional

fees 0.11 - 0.12 0.14

Impairment of fixed assets 0.17 - 0.17 -

Cumulative effect from tax

elections - - (0.47) -

Non-capitalizable Lake

Charles development costs - - 0.02 -

Loss on early retirement of

debt - - - 1.34

Non-cash tax provision

impact from change in

Indiana state tax rate - - - 0.08

Net river flooding

(reimbursements) expenses - (0.01) - 0.01

---------- ---------- ---------- ----------

Adjusted diluted earnings per

share (Adjusted EPS) $ 0.32 $ 0.21 $ 2.10 $ 1.74

========== ========== ========== ==========

Weighted-average diluted

shares outstanding used in

calculating Adjusted EPS 34,225 34,014 33,743 41,136

========== ========== ========== ==========

Use of Non-GAAP Financial Measures

Securities and Exchange Commission Regulation G, "Conditions for

Use of Non-GAAP Financial Measures," prescribes the conditions for

use of non-GAAP financial information in public disclosures. We

believe our presentation of the non-GAAP financial measures

Adjusted EBITDA and Adjusted EPS are important supplemental

measures of operating performance to investors. The following

discussion defines these terms and explains why we believe they are

useful measures of our performance.

Adjusted EBITDA is a commonly used measure of performance in the

gaming industry that we believe, when considered with measures

calculated in accordance with United States generally accepted

accounting principles, or GAAP, gives investors a more complete

understanding of operating results before the impact of investing

and financing transactions, income taxes and certain non-cash and

non-recurring items and facilitates comparisons between us and our

competitors.

Adjusted EBITDA is a significant factor in management's internal

evaluation of total Company and individual property performance and

in the evaluation of incentive compensation for employees.

Therefore, we believe Adjusted EBITDA is useful to investors

because it allows greater transparency related to a significant

measure used by management in its financial and operational

decision-making and because it permits investors similarly to

perform more meaningful analyses of past, present and future

operating results and evaluations of the results of core ongoing

operations. Furthermore, we believe investors would, in the absence

of the Company's disclosure of Adjusted EBITDA, attempt to use

equivalent or similar measures in assessment of our operating

performance and the valuation of our Company. We have reported

Adjusted EBITDA to our investors in the past and believe its

inclusion at this time will provide consistency in our financial

reporting.

Adjusted EBITDA, as used in this press release, is earnings

before interest, taxes, depreciation, amortization, other

non-operating income and expenses, stock-based compensation,

deferred compensation plan expense, non-operational professional

fees, non-capitalizable development costs, impairment loss, loss on

early retirement of debt and river flooding expenses and

reimbursements. In future periods, the calculation of Adjusted

EBITDA may be different than in this release. The foregoing tables

reconcile Adjusted EBITDA to operating income (loss) and net

income, based upon GAAP.

Adjusted EPS, as used in this press release, is diluted earnings

per share, excluding the after-tax per-share impact of loss on

early retirement of debt, the cumulative effect from tax elections,

non-operational professional fees, non-capitalizable development

costs, impairment loss, non-cash tax provision impact from state

tax rate change and river flooding expenses and reimbursements.

Management adjusts EPS, when deemed appropriate, for the evaluation

of operating performance because we believe that the exclusion of

certain items is necessary to provide the most accurate measure of

our core operating results and as a means to compare

period-to-period results. We have chosen to provide this

information to investors to enable them to perform more meaningful

analysis of past, present and future operating results and as a

means to evaluate the results of our core ongoing operations.

Adjusted EPS is a significant factor in the internal evaluation of

total Company performance. Management believes this measure is used

by investors in their assessment of our operating performance and

the valuation of our Company. In future periods, the adjustments we

make to EPS in order to calculate Adjusted EPS may be different

than or in addition to those made in this release. The foregoing

table reconciles EPS to Adjusted EPS.

Limitations on the Use of Non-GAAP Measures The use of Adjusted

EBITDA and Adjusted EPS has certain limitations. Our presentation

of Adjusted EBITDA and Adjusted EPS may be different from the

presentations used by other companies and therefore comparability

among companies may be limited. Depreciation expense for various

long-term assets, interest expense, income taxes and other items

have been and will be incurred and are not reflected in the

presentation of Adjusted EBITDA. Each of these items should also be

considered in the overall evaluation of our results. Additionally,

Adjusted EBITDA does not consider capital expenditures and other

investing activities and should not be considered as a measure of

our liquidity. We compensate for these limitations by providing the

relevant disclosure of our depreciation, interest and income tax

expense, capital expenditures and other items both in our

reconciliations to the GAAP financial measures and in our

consolidated financial statements, all of which should be

considered when evaluating our performance.

Adjusted EBITDA and Adjusted EPS should be used in addition to

and in conjunction with results presented in accordance with GAAP.

Adjusted EBITDA and Adjusted EPS should not be considered as an

alternative to net income, operating income or any other operating

performance measure prescribed by GAAP, nor should these measures

be relied upon to the exclusion of GAAP financial measures.

Adjusted EBITDA and Adjusted EPS reflect additional ways of viewing

our operations that we believe, when viewed with our GAAP results

and the reconciliations to the corresponding GAAP financial

measures, provide a more complete understanding of factors and

trends affecting our business than could be obtained absent this

disclosure. Management strongly encourages investors to review our

financial information in its entirety and not to rely on a single

financial measure.

Add to Digg Bookmark with del.icio.us Add to Newsvine

CONTACT: Tom Steinbauer Senior Vice President, Chief

Financial Officer Ameristar Casinos, Inc. 702-567-7000

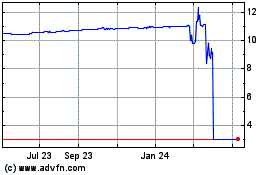

A SPAC I Acquisition (NASDAQ:ASCA)

Historical Stock Chart

From Apr 2024 to May 2024

A SPAC I Acquisition (NASDAQ:ASCA)

Historical Stock Chart

From May 2023 to May 2024