TIDMTRX

RNS Number : 0077B

Tissue Regenix Group PLC

04 June 2019

Tissue Regenix Group plc

Annual Results for the year ended 31 December 2018

Revenues increase to 47% pro forma to GBP11.6m

Up to $20m credit facilities secured

Leeds, 4 June 2019 - Tissue Regenix Group (AIM:TRX) ("Tissue

Regenix" or "The Group") the regenerative medical devices company,

today announces its annual results for the period ending 31

December 2018.

Financial Highlights

-- Increased pro forma revenues by 47% to GBP11.6m (2017: GBP5.2m)

o DermaPure - sales increased by 75% to GBP3.4m (2017: GBP1.9m)

reflecting changes to sales strategy and infrastructure

o Orthopaedics and Dental sales of BioRinse products grew 31% on

a pro forma basis to GBP6.4m

o GBM-v sales grew by 62% to GBP1.8m (2017: GBP1.1m)

-- Gross profit increased to GBP2.6m (2016: GBP0.7m)

-- Operating loss before exceptional items narrowed to GBP8.2m (2017: GBP9.7m)

-- Cash at 31 December 2018 of GBP7.8m

Operational Highlights

-- Signed initial US distribution agreement with Arthrex, Inc.

for selected BioRinse products, which was extended in Q4 to include

Europe

-- Received Human Tissue Authority license for the import of

human tissue products from the US to UK facility to support

International sales growth

-- Successful technical transfer of DermaPure production to San

Antonio facility ahead of schedule

-- Two year clinical data for OrthoPure XT submitted for CE mark

-- Ongoing discussions with potential strategic partners

Corporate and Recent Highlights

-- Credit facilities of up to $20m secured to invest in

additional capital expenditure, to sustain future business growth,

generate further clinical and health economic real world data to

support brand differentiation within dCELL and BioRinse, and for

general corporate and working capital purposes, as announced

separately today

-- Secured additional GPO agreement; coverage now at 95%

-- Successful FDA audit of San Antonio facility

Current trading

The Company exited 2018 with a positive momentum and believes it

can deliver continued growth in 2019 and beyond. This growth will

be driven by its revised focus on the development of strategic

partnerships, identified opportunities in additional geographic

territories, and additional product launches in its pipeline. The

Company continues to trade in line with management expectations for

2019, with a significant weighting towards the second half of the

year due to a continued increase in supply across both the

BioSurgery and Orthopaedics divisions in Q2, a strong order book

and additional upcoming product launches.

Steve Couldwell, CEO, Tissue Regenix Group, commented:

"2018 was an extremely successful year for the Group, as we

continued to expand the attractiveness of our product portfolio

with both clinicians and procurement professionals.

During the year, we significantly grew our top line sales whilst

navigating through the integration of the acquisition of CellRight

technologies, which completed in August 2017. We are now beginning

to experience both commercial and operational synergies of

combining the businesses.

We have continued to develop our commercial partnerships and

have a strong pipeline of both new product launches and product

line extensions, which are expected in the near term. We remain

committed to optimising operations and have introduced new shift

patterns to meet increasing demand. We are optimistic these

benefits will continue into the future.

The additional capital secured through the credit facilities

allows us to focus on further scaling the manufacturing capacity of

the business and pursue further partnership opportunities, driving

the business trajectory towards self-sustainability. With the

commercial foundations now firmly set and the financial position of

the Group stronger, I look forward to another year of exciting

business development and continued business growth."

For more Information:

Tissue Regenix Group plc Tel: 0330 430 3073 /

Caitlin Pearson, Head of Communications 07920272 441

--------------------------------------------- ---------------------

Stifel Nicolaus Europe Limited (Nominated Tel: 0207 710 7600

Adviser and Broker)

Jonathan Senior / Alex Price / Ben Maddison

--------------------------------------------- ---------------------

FTI Consulting Tel: 0203 727 1000

Brett Pollard / Victoria Foster Mitchell

/ Mary Whittow

============================================= =====================

About Tissue Regenix

Tissue Regenix is a leading medical devices company in the field

of regenerative medicine. Tissue Regenix was formed in 2006 when it

was spun-out from the University of Leeds, UK. The company's

patented decellularisation ('dCELL(R) ') technology removes DNA and

other cellular material from animal and human soft tissue leaving

an acellular tissue scaffold which is not rejected by the patient's

body and can then be used to repair diseased or worn out body

parts. Current applications address many critical clinical needs

such as sports medicine, heart valve replacement and wound

care.

In November 2012 Tissue Regenix Group plc set up a subsidiary

company in the United States - 'Tissue Regenix Wound Care Inc.',

January 2016 saw the establishment of joint venture GBM-V, a multi-

tissue bank based in Rostock, Germany.

In August 2017 Tissue Regenix acquired CellRight Technologies(R)

, a biotech company that specializes in regenerative medicine and

is dedicated to the development of innovative osteoinductive and

wound care scaffolds that enhance healing opportunities of defects

created by trauma and disease. CellRight's human osteobiologics may

be used in spine, trauma, general orthopedic, foot & ankle,

dental, and sports medicine surgical procedures.

Highlights

Group sales increased to GBP11.6m (2017: GBP5.2m)

+47% pro forma, driven by;

- DermaPure(R) sales grew by 75% on a reported basis, to GBP3.4m (2017: GBP1.9m)

- CellRight contribution of GBP6.4m via Orthopaedics & Dental, +31% on a pro forma basis

- Increased sales from GBM-V by 62% to GBP1.8m (2017: GBP1.1m)

Significantly reduced Group LBIT for the period GBP8.7m (2017:

GBP10.8m)

Strategic partnerships signed

- Arthrex BioRinse OEM US distribution agreement

- Arthrex EU distribution agreement

- ARMS medical DermaPure distribution agreement

- A number of further strategic opportunities identified

HTA Licence

- Granted for the import of BioRinse(TM) products into the UK,

and over time, as a gateway to Europe

Integration activities

- In-house manufacturing of DermaPure(R) commenced ahead of schedule

- Global employee engagement programme launched - "Verto"

DermaPure(R) positioning

- GPO agreements signed- Premier three year extension

- Premier Supplier Horizon Award

- Commercial "Accelerator" programme established - "Narrow & Deep"

Clinical data programmes

- OrthoPure XT two year clinical data submitted to the regulatory body for CE mark approval

- DermaPure(R) clinical trial for urogynaecology in partnership with ARMS medical

- Protocol for 100 patient prospective observational clinical

trial for DermaPure(R) in orthopaedic trauma

R&D, Product pipeline

- Ongoing discussions with significant R&D partners, initial projects chartered

- SurgiPure XD commercial manufacturing commenced at Leeds facility

- Launch pathway for OrthoPure XT established

Governance

- QCA Corporate Governance Code implemented

- FDA audit Q1 2019 completed

- American Association of Tissue Banks audit Q1 2019

Chairman's statement

"We remain focused on delivering positive, sustainable growth

across all divisions of the business. Our strategic realignment has

been successful and having integrated CellRight Technologies into

the Group, we have achieved considerable commercial and operational

progress. We are well positioned to capitalise on these

achievements, as well as bring new products to the market

throughout the year."

Introduction

2018 was a successful and transformative year

Following the repositioning of the DermaPure(R) product range we

are starting to generate real commercial traction with our dCELL(R)

technology as the market recognises the benefits that these

products can offer both patients and the wider healthcare sector.

Following the acquisition of CellRight Technologies Inc in late

2017, our strategic approach has enabled us to integrate this

business effectively and realise the synergistic benefits that

BioRinse(TM) Technology can offer.

Our Strategy

Following the successful integration of the businesses

throughout 2018 we saw benefits through commercial catalysts such

as the Arthrex US, and laterally the UK distribution agreements;

the ARMS medical distribution agreement and further GPO approvals.

This year we expect that these milestones will act as the

foundations for us to drive momentum and deliver top line revenue

growth.

Financial Performance

We finished the year in line with Board expectations, posting

sales that have grown by 47% pro forma year-on-year across the

three operating divisions. We achieved a strong cash position of

GBP7.8m, due to efficient management of working capital provisions

and an improved LBIT of GBP8.7m.

The Board

In December we announced that Steve Couldwell, CEO would be

taking a leave of absence during Q1 for health reasons. I would

like to thank Gareth Jones, who joined the Company in Q4 and

stepped into the role of interim COO while Steve was away. Steve

continues to be central to our activities and I look forward to his

full return this month.

Corporate Governance

There were many changes implemented throughout 2018 with regard

to the Corporate Governance framework. Most notably, in September

2018, the changes to the AIM Rules for Companies. The Board have

implemented the Quoted Companies Alliance Corporate Governance

Code.

Our People

Through the continued hard work and commitment of our employees,

we have delivered a transformational year of growth and progress. I

would like to extend my thanks to all involved. Jesus Hernandez,

CEO of CellRight Technologies, retired as planned in April 2019. He

played a fundamental role in guiding the businesses through the

integration process and we wish him well in his future

endeavours.

We have appointed Daniel Lee, who has nearly 30 years of

experience within the industry, to the position of President of US

Operations, and since joining in Q1 2019, has already implemented

operational efficiencies within the San Antonio facility.

I would also like to take this opportunity to acknowledge the

achievements that have been made since Steve Couldwell was

appointed CEO. Steve has led the refinement of the commercial

strategy, as well as alignment of the businesses following the

acquisition, and the internal employee engagement initiatives.

His experience and hard-work has been invaluable and play a

fundamental part in the results that we can now report.

As a Board, we also understand that this progress would not be

possible without the dedication and motivation of our employees and

the responsibility that we hold to ensure that their development

and training allows us, as a business, to stay at the forefront of

regenerative medicine developments. Alongside this, we seek to

establish a supportive and innovative working environment allowing

for professional development. It is our responsibility to ensure

that the Company is supported by the correct calibre of people and

talent to secure its ongoing success.

Post balance sheet event

On 3 June 2019, the Group entered into a new loan facility

providing a total of $20m. $10.5m is available for immediate

drawdown with the remaining $9.5m available subject to the

satisfaction of certain conditions at a later date. We believe that

this provides the funding required to continue the growth and

expansion of the business in line with expectations. It will

provide the opportunity to expand our manufacturing capacity in

order to sustain future business growth, build our clinical and

health economic real world data to support brand differentiation,

as well as supporting the continued working capital expenditure as

we move towards self-sustainability in the near future.

Outlook

We have successfully delivered a strong financial performance

while building solid commercial foundations. With opportunities in

additional geographic territories, and additional product launches

in the pipeline, we believe that we can deliver continued growth in

2019 and beyond. We have grown the business in line with our

expectations and projections and the Board and I remain confident

that, with a revised focus on the development of strategic

partnerships, we can achieve sustainable profitability and enhance

shareholder returns. The Board remains confident in the performance

of the business and the commercial expectations for 2019.

Business review

We have an experienced and motivated management team. With

specialists leading each area, we ensure that we can execute

against the deliverable strategy outlined for each division.

Alongside this, we have Executive Directors with extensive

experience in the healthcare industry and the capital markets, and

an experienced and well balanced Board of Directors.

BioSurgery

2018 has been an exceptional year for the BioSurgery division,

growing revenue by 79% on a constant currency basis, highlighting

the increasing market demand for DermaPure(R) and the advantages of

our refined strategic focus.

Expanded GPO coverage and Strategic Partnerships

We have continued to expand our Group Purchasing Organization

(GPO) approvals and now have coverage in institutions accounting

for 95% of the total spend under these agreements. This has opened

up opportunities for us in the hospital arena, where we have seen

the utilisation of DermaPure(R) move into new indications within

the surgical suite, augmenting our historic woundcare

applications.

This was expedited by the ARMS medical agreement which was

announced in February 2018 moving DermaPure(R) into women's health

and particularly urogynecology applications. With an increasing

focus on the safety of alternative solutions, such as a mesh

treatments, where historically between 150,000-200,000 procedures

per year in the US result in serious complications(1) , around 5%

of the total number performed, DermaPure(R) offers advantages due

to its natural regenerative properties. The uptake that we have

seen has driven the advocacy of the product within this application

area with over 300 patients treated by mid-July and the demand in

this area has led to the ongoing development of a DermaPure(R)

product tailored specifically for this application, which we hope

to bring to market during 2019.

Improved DermaPure(R) Positioning

Orthopaedic trauma is another area in which we have seen

significant clinician interest, with DermaPure(R) being used in

tendon wrapping for the achilles tendon through to rotator cuff

repair in the shoulder. As we drive clinician conversion in this

area we are undertaking several case studies in order to strengthen

our clinical data. You can read a case study on page 15.

This verifies the benefits of our 'narrow & deep' sales

philosophy which we have implemented in targeted key institutions,

resulting in greater conversion of applicable physicians and has

also expanded our network of Key Opinion Leaders (KOLs) who are

driving the advocacy of the product throughout their peer

groups.

Surgeons are becoming increasingly aware of the benefits that

DermaPure(R) can offer to both the patient and healthcare provider.

This was highlighted by the world-renowned Cleveland Clinic which

began using DermaPure(R) in 2018, with a case series being shown at

the prestigious VEITH Symposium.

SurgiPure XD

SurgiPure XD, a porcine dermis for use in hernia repair was

previously granted 510(K) approval for the US and underwent a soft

launch at the end of 2018. SurgiPure XD will be manufactured at our

facility in Leeds and is the first commercial dCELL(R) product to

be manufactured there. We expect to engage multiple relevant

distributors for this product during 2019.

Outlook

2018 was a successful year for TRX BioSurgery having

repositioned DermaPure(R) in the hospital arena, forged key

distribution partnerships, increased the clinical application areas

and grown our clinician advocacy and clinical case studies. With

these foundations now in place we expect 2019 to deliver strong

returns as we look to augment our product portfolio with additional

sizes of DermaPure(R) , launch SurgiPure XD with distribution

partners and increase our GPO coverage accessing a new pool of

physicians and patients. In order to meet our projected level of

sales we have augmented our in-house manufacturing of DermaPure by

renewing our agreement with Community Tissue Services as a

third-party manufacturer, allowing us the capacity required to meet

our customers' expectations during 2019 and beyond.

Orthopaedics and Dental

The year to 31 December 2018 was again positive for the

orthopaedics and dental division, with a 31% pro forma increase in

revenue, primarily consisting of the BioRinse(TM) portfolio, and

was the first year in which we benefited from the CellRight

acquisition for a full fiscal year. In addition to the BioRinse(TM)

portfolio there is the potential for dCELL(R) products to also be

utilized in this space, with orthopaedic trauma, sports medicine

and foot and ankle applications for DermaPure(R) the opportunity

for collaboration between the operating divisions offers

opportunities to further our market penetration.

Strategic Partnerships

In March 2018 we announced the first of several notable

strategic partnerships with Arthrex, Inc. who took three of the

BioRinse(TM) portfolio under their own brand 'AlloSync' for

distribution in the US. Arthrex are one of the largest sports

medicine company's in the world having over 2,700 sales reps

globally. The US distribution agreement offers third-party

validation of the differentiation of the BioRinse(TM) technology

and strong advocacy to leverage when securing new customers.

We expanded the Arthrex relationship in November 2018 by

entering a branded distribution agreement in the EU, following the

approval of the Human Tissue Authority (HTA) license which allows

for the importation of our human tissue products from the US into

the UK. Initially our focus will be on the UK market before

expanding into additional European countries; the first training

for the Arthrex European sales reps was undertaken at the facility

in Leeds in Q1 2019, and we expect this agreement to gain traction

over the next 12-18 months as we continue with the education

process and physician conversion.

To accommodate the increasing demand for our products and the

scale of these new partnerships we expanded our BioRinse(TM)

manufacturing capacity through the commencement of a second shift

within the San Antonio facility in Q1 2019.

dCELL(R) Technology

OrthoPure XT continues to progress through the regulatory

approval process for a CE mark. We have collated the 2 year

clinical data which has been submitted to our notified body and

continues to show clinical evidence as a suitable choice for ACL

reconstruction, with biomechanical testing equivalent to current

graft choices, including allograft or autograft. During 2018 we

commenced discussions with the FDA around a pre-clinical trial for

OrthoPure XT in the US. After scoping this out the strategic

decision was made to keep our resources focussed on the E.U market

launch. Likewise, with increasing demand on our dCELL manufacturing

capacity the launch of pathfinder product OrthoPure HT has been

paused.

We remain confident in the clinical outcome and health economic

benefits provided by the product and are poised to commercialise as

soon as the approval is granted. Our launch timeline has been

delayed by the ongoing implementation of the Medical Device

Regulations across Europe and the additional strain that this has

placed on the notified bodies. Our initial focus will be the UK

market where we have several Key Opinion Leaders ready to utilise

the product, before further expanding into Europe, as we gain

country registrations, through a network of distributors.

Dental

In dental, we see huge potential for the use of both the

dCELL(R) and BioRinse(TM) portfolios. Throughout 2019 we will

concentrate on further penetration of the US market which accounts

for half of the total global market.

With a favourable reimbursement framework, consisting primarily

of cash payments dental is an area which we believe has a vast

market opportunity that we will be able to penetrate quickly with

both product portfolios. We see use across the dental market,

including general dentists and maxilliofacial specialists for

routine and complex or corrective cases. The BioRinse(TM) portfolio

is being utilised in procedures such as ridge augmentation whilst

DermaPure(R) provides a soft tissue covering following extraction

or in cases of receding gumlines.

A case study can be viewed on page 15.

Outlook

During 2018 we achieved several important commercial milestones

that allowed the orthopaedics and dental division to accelerate its

growth trajectory. The agreement with Arthrex offers third party

validation of the differentiation of the products and shows the

level of external confidence in our BioRinse(TM) products. With the

further expansion of this partnership into Europe offering

potential access to new markets by leveraging their commercial

experience and infrastructure and we are confident that this growth

will continue throughout 2019.

To maintain these important relationships, we appointed a number

of commercial heads in Q1 2019, including a VP of strategic

partnerships and two additional regional sales directors to support

our expected growth in this division.

Cardiac & GBM-V

Our cardiac division continues to develop a strong clinical data

portfolio from the collaborative work with Dr Francisco da Costa in

Brazil, with the data from a multicentre paediatric trial being

presented at the Heart Valve Society meeting in Sitges in April

2019. We are excited to share this data which further highlights

the advantages of our CardioPure products specifically in younger

patients who typically experience a higher instance of re-operation

or rejection.

The work with our colleagues at GBM-V continues to develop and

we are confident that after navigating the regulatory pathway we

will be able to launch the CardioPure product in Germany in 2020 as

planned.

In addition, GBM-V have established new supply agreements with

additional tissue banks ensuring that the supply of donor materials

is consistent to allow the cornea business to continue to grow,

evidenced in the top line revenue figures which increased by 62%.

This also allows a greater deal of cash self-sufficiency, an

important aspect of the Group reducing its overall cash dependency

and cash burn.

The main focus of GBM-V continues to be the regulatory clearance

and launch for the CardioPure product line.

Commercial

Invested in Operations and Management

In June 2018 we were awarded a Human Tissue Authority (HTA)

license for our facility in Leeds. This allows us to import the

BioRinse(TM) portfolio from the US into the UK for distribution

primarily under the Arthrex agreement. The UK facility will be used

as a hub to allow for further European distribution as individual

Country registrations are granted.

In the US, we transferred the processing of DermaPure(R)

in-house, allowing for end to end control of the manufacturing

process, product quality and product mix. As demand for the

products increased we sourced additional capacity and reduced our

manufacturing risk by engaging with Community Tissue Services to

assist with processing efficiency, donor yield and supplementary

supply.

Additionally, we commenced a second shift within the San Antonio

facility to increase the output of BioRinse(TM) products. This will

allow us to meet the increased demand driven by the throughput of

our partnership agreements in the short term whilst we explore

options to increase manufacturing capacity.

Clinical

In order to strengthen our product positioning and

differentiation we are enhancing the clinical data package to

highlight both the clinical and health economic advantages that

DermaPure(R) can offer. We increased our Key Opinion Leaders and

have undertaken a number of case studies in order to highlight its

use in the various procedures. During 2018 we established a

protocol for a multi-centre prospective observational study which

we intend to commence in the first half of 2019. In addition, we

augmented our clinical team adding an additional three clinical

affairs managers to ensure that commercial reps and distributors

have the required clinical support.

Alongside this, we are also running a number of case series for

both the dCELL(R) and BioRinse(TM) portfolios to enable peer to

peer discussions and the collection of real life, practical

examples.

Delivering new Product Development and I.P.

As we build relationships with strategic partners we also look

to align ourselves with their product development and R&D

functions. The Group has vast experience of bringing products from

concept to completion and has the agility to undertake these tasks

quickly. This allows us to identify opportunities and quickly

create a prototype for testing. Moving forward we look to develop

these skills further and deepen the relationships allowing us to be

positioned as an R&D partner to larger industry players.

We continue to protect and monitor our intellectual property by

maintaining several patents worldwide for the dCELL(R) portfolio

encompassing both the core dCELL(R) Technology and individual

product processes.

The BioRinse(TM) portfolio remains protected by know-how and we

continue to register trademarks for all relevant logos and trade

names.

As we look to expand the opportunities for each product

portfolio and exploit the Global market potential, we also look to

create efficiencies in the processing and manufacturing to allow

for a reduction in both the associated time and financial cost

while maintaining the integrity of the product to allow for

superior clinical outcomes.

Management

In November 2018 Gareth Jones joined as Group CFO and later

stepped into the interim role of COO whilst CEO Steve Couldwell

took a period of leave for health reasons.

Outlook

We focus ourselves around two platform technologies, in three

key clinical application areas with four strategic growth

drivers.

As we look to expand our commercial presence across the globe,

the opportunity for us to license our technology platforms to

potential strategic partners in new territories offers a route to

market, market expertise and access to scalability. This also

allows our direct sales and management team to remain focused on

key markets, in which we are seeing increasing market penetration

and a growth trajectory.

Our strategy around establishing strategic partnerships to help

scale our commercialisation efforts has proven fruitful throughout

2018 and we expect this to continue as we pursue further

partnership opportunities.

Outside of establishing these partnerships we have identified

several commercial synergies to leverage across our portfolio, for

example the use of DermaPure(R) in orthopaedic trauma and dental

procedures. This has also led to specific product specifications

being sought that we can bring to market quickly to address these

procedures.

The Group has made significant commercial progress throughout

the last year and we have positioned ourselves to continue to

develop and grow this momentum. Focusing on our identified

strategic drivers of growth we expect to continue to build strong

commercial foundations which will drive our success far into in the

future.

Financial overview

Revenue

In the year ended 31 December 2018 revenue increased by 122% to

GBP11,619K (2017: GBP5,233K). Revenue from the legacy Tissue

Regenix dCELL(R) product DermaPure(R) increased 75% to GBP3,381K

(2017: GBP1,932k) driven by increased GPO penetration, a strategic

partnership with ARMS Medical and a move into the Orthopaedic

trauma space. With these initiatives in their infancy, we expect

this growth to continue during 2019.

CellRight Technologies, reported under the Orthopaedics and

Dental division, grew revenue 31% year on year to GBP6.4m (2017:

GBP4.9m) on a pro forma basis. In March 2018 we announced a

strategic partnership with Athrex, one of the world's leading

orthopaedic and sports medicine companies, and later successfully

expanded this agreement. They initially took 3 BioRinse products

under their own brand 'AlloSync'. Following the approval of a Human

Tissue Authority License for the UK facility, we extended this

partnership to cover the EU and received our first orders in Q1

2019. This is a partnership we expect to continue to grow

substantially during FY 2019.

The remaining top line revenue growth was derived from GBM-v,

our controlled joint venture in Germany. GBM-v was able to

significantly increase the volume of corneas processed during the

year resulting in revenue growing by 62% to GBP1,842K (2017:

GBP1,135K)

Cost of sales and gross profit

The revenue growth and full year effect of CellRight has

resulted in a commensurate increase in gross profit by 127% to

GBP5,917K (2017: GBP2,606K).Gross margin percentage increased

marginally from 50% to 51% due to a combination of favourable

product mix and realised production efficiencies. As the business

continues to deliver products in greater quantities it has been

possible to realise synergies along with our in-house manufacturing

capabilities and the established nature of the CellRight

business.

Included in cost of sales is, cost of product of GBP4,723K

(2017: GBP2,039K) and third party commissions of GBP979K (2017:

GBP588K).

Administrative Expenses

Administrative expenses increased by GBP1,184K from GBP13,422K

to GBP14,606K. This included GBP423K (2017 GBP1,098K) of

exceptional costs.

Admin expenses before exceptional items increased by GBP1,859K

(mainly attributable to a full year effect of CellRight being in

the Group). Overheads included staff costs (53%), sales and

marketing (8%), research and development (12%), establishment and

administration costs (30%). Operating loss was narrowed to

GBP8,689K (2017: GBP10,816K).

Exceptional items

Cost relating to the settlement of a LifeNet litigation case are

accounted in the exceptional items, covering a final legal payment

and insurance upfront excess. There are no other costs to be

incurred relating to this case.

Finance income / charges

Finance income of GBP72K (2017: GBP47K) represents interest

earned on cash deposits. Finance charges of GBP262K (2017 - nil)

relate to the discounting of earnout consideration on the CellRight

acquisition in line with IFRS (discount rate of 10% applied).

Taxation

The Group submits enhanced research and development tax claims

and elects to exchange tax losses for a cash refund. The refund

receivable for the year ended 31 December 2018 is GBP790K (2017:

GBP1,348K). This fall was due to a reduction in tax credits claimed

as the Group commercialises additional products moving them out of

the R&D phase.

Corporation Tax payable in the US amounted to GBP72K (2017:

GBPnil) due to the profits of CellRight.

Gross tax losses carried forward in the UK were GBP43,352K

(2017: GBP35,819K). The Group does not currently pay tax in the UK.

A deferred tax asset has not been recognised as the timing and

recoverable value of the tax losses is uncertain.

Loss for the year

Loss for the year was GBP8,259K (2017: Loss GBP9,421K). The

number of shares in issue at the reporting date was 1,171,730,823

(2017:1,170,990,924) resulting in a basic loss per share of (0.70p)

(2017: loss (1.00p)).

Balance sheet

At 31 December 2018 the Group had net assets of GBP32,570K

(2017: GBP39,522K) of which cash in hand totalled GBP7,816K (2017:

GBP16,423K) which was ahead of expectations.

Intangible assets increased to GBP19,938k (2017: GBP19,305k) as

foreign exchange revaluation exceeded amortisation. A further

GBP116,000 of development costs were capitalised.

Net working capital increased slightly to GBP3,054k (2017:

GBP2,596k) which reflect the continued growth of the business. The

balance sheet includes corporations tax receivable of GBP1,200k

(2017: GBP1,665k) in respect of UK research and development tax

credits.

Cash absorbed by operations was GBP6,838K (2017: GBP9,786K) as

we continue to move towards breakeven and subsequent

profitability.

Following the acquisition of CellRight, the business

successfully achieved the revenue performance criteria necessary

for the payment of the first milestone. This was due following the

completion of revenue criteria in the first twelve months post

acquisition. This payment amounted to GBP1,564K and, at this stage,

it is currently expected that the second milestone, of equivalent

value, will be paid in full in September 2019.

Dividend

No dividend has been proposed for the year to 31 December 2018

(2017:Nil)

Accounting policies

The Group's consolidated financial information has been prepared

in accordance with International Financial Reporting Standards as

adopted in the EU. The Group's significant accounting policies

which have been applied consistently throughout the year are set

out on pages 50 to 54.

Going Concern

As at 31 December 2018, the Group had GBP7,816k of cash and cash

equivalents available to it. The Directors have considered their

obligation, in relation to the assessment of the going concern of

the Group and each statutory entity within it and have reviewed the

current budget cash forecasts and assumptions as well as the main

risk factors facing the Group as set out on pages 25 to 27.

As separately reported, the Group has successfully raised a debt

facility totalling $20m, of which $10.5m became available

immediately to the Group to drawdown at completion. The Directors

are therefore confident the Group has adequate financial resources

to fund its activities for the forthcoming period.

Principal risks and uncertainties

The principal risks and uncertainties facing the Group are set

out on pages 25 to 27.

Cautionary Statement

The Strategic report, containing the Strategic and Financial

reports of the Group, contains forward looking statements that are

subject to risk factors associated with, amongst other things,

economic and business circumstances occurring from time to time

within the markets in which the Group operates. The expectations

expressed within these statements are believed to be reasonable but

could be affected by a wide variety of variables out-with the

Group's control. These variables could cause the results to differ

materially from current expectations. The forward-looking

statements reflect the knowledge and information available at the

time of preparation.

Consolidated statement of comprehensive income

For the year ended 31 December 2018

Year to Year to

31 December 31 December

2018 2017

Notes GBP000 GBP000

---------------------------------------------- ----- ------------ ------------

REVENUE 2 11,619 5,233

Cost of sales (5,702) (2,627)

---------------------------------------------- ----- ------------ ------------

GROSS PROFIT 5,917 2,606

Administrative expenses before exceptional

items 2 (14,183) (12,324)

Exceptional items (423) (1,098)

---------------------------------------------- ----- ------------ ------------

Total administrative expenses (14,606) (13,422)

---------------------------------------------- ----- ------------ ------------

OPERATING LOSS (8,689) (10,816)

Finance income 72 47

Finance charges (262) -

---------------------------------------------- ----- ------------ ------------

LOSS BEFORE TAXATION (8,879) (10,769)

Tax 3 620 1,348

---------------------------------------------- ----- ------------ ------------

LOSS FOR YEAR (8,259) (9,421)

---------------------------------------------- ----- ------------ ------------

ATTRIBUTABLE TO:

Equity holders of the parent 4 (8,186) (9,221)

Non-controlling interests (73) (200)

---------------------------------------------- ----- ------------ ------------

(8,259) (9,421)

---------------------------------------------- ----- ------------ ------------

OTHER COMPREHENSIVE INCOME:

Foreign currency translation differences -

foreign operations 1,360 (614)

---------------------------------------------- ----- ------------ ------------

TOTAL COMPREHENSIVE EXPENSE FOR THE YEAR (6,899) (10,035)

---------------------------------------------- ----- ------------ ------------

ATTRIBUTABLE TO:

Equity holders of the parent (6,826) (9,835)

Non-controlling interests (73) (200)

---------------------------------------------- ----- ------------ ------------

(6,899) (10,035)

---------------------------------------------- ----- ------------ ------------

LOSS PER SHARE

Basic and diluted loss attributable to equity

holders of parent 4 (0.70)p (1.00)p

---------------------------------------------- ----- ------------ ------------

The loss for the period arises from the Group's continuing

operations.

The accompanying notes form an integral part of the financial

statements.

Consolidated statement of financial position

At 31 December 2018

31 December 31 December

2018 2017

Notes GBP000 GBP000

------------------------------------------------ ----- ----------- -----------

ASSETS

Non-current assets

Property, plant and equipment 2,828 2,994

Intangible assets 19,938 19,305

------------------------------------------------ ----- ----------- -----------

TOTAL NON-CURRENT ASSETS 22,766 22,299

------------------------------------------------ ----- ----------- -----------

Current assets

Inventory 2,330 2,872

Trade and other receivables 3,551 2,503

Corporation tax receivable 1,200 1,665

Cash and cash equivalents 7,816 16,423

------------------------------------------------ ----- ----------- -----------

TOTAL CURRENT ASSETS 14,897 23,463

------------------------------------------------ ----- ----------- -----------

TOTAL ASSETS 37,663 45,762

------------------------------------------------ ----- ----------- -----------

LIABILITIES

Non-current liabilities

Other payables - (635)

Deferred Tax (791) (824)

------------------------------------------------ ----- ----------- -----------

TOTAL NON-CURRENT LIABILITIES (791) (1,459)

------------------------------------------------ ----- ----------- -----------

Current liabilities

Trade and other payables (4,302) (4,781)

------------------------------------------------ ----- ----------- -----------

TOTAL CURRENT LIABILITIES (4,302) (4,781)

------------------------------------------------ ----- ----------- -----------

TOTAL LIABILITIES (5,093) (6,240)

------------------------------------------------ ----- ----------- -----------

NET ASSETS 32,570 39,522

------------------------------------------------ ----- ----------- -----------

EQUITY

Share capital 5 5,859 5,855

Share premium 5 86,398 86,398

Merger reserve 5 10,884 10,884

Reverse acquisition reserve 5 (7,148) (7,148)

Reserve for own shares (831) (831)

Share based payment reserve 1,129 1,186

Retained earnings deficit (63,239) (56,413)

------------------------------------------------ ----- ----------- -----------

EQUITY ATTRIBUTABLE TO EQUITY HOLDERS OF PARENT 33,052 39,931

Non-controlling interests (482) (409)

------------------------------------------------ ----- ----------- -----------

TOTAL EQUITY 32,570 39,522

------------------------------------------------ ----- ----------- -----------

Approved by the Board of Directors and authorised for issue on 3

June 2019.

Steven Couldwell

Chief Executive Officer

Company number: 5969271

Consolidated statement of changes in equity

For the year ended 31 December 2018

Attributable to equity holders of parent

-------------- -----------------------------------------------------------------------------------------------------------

Reserve Share

Reverse for based Retained

Share Share Merger acquisition own payment earnings Non-controlling Total

capital premium reserve reserve shares reserve deficit Total interests equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

-------------- -------- ------- -------- ----------- ------- ------- --------- ------- --------------- ----------

At 31 December

2016 3,801 50,461 10,884 (7,148) (831) 1,156 (46,578) 11,745 (209) 11,536

-------------- -------- ------- -------- ----------- ------- ------- --------- ------- --------------- ----------

Loss for the

period - - - - - - (9,221) (9,221) (200) (9,421)

Other

comprehensive

expense - - - - - - (614) (614) - (614)

-------------- -------- ------- -------- ----------- ------- ------- --------- ------- --------------- ----------

Loss and total

comprehensive

expense for

the

period - - - - - - (9,835) (9,835) (200) (10,035)

Issue of

shares 2,000 38,000 - - - - - 40,000 - 40,000

Cost of issue

of

new equity - (2,318) - - - - - (2,318) - (2,318)

Exercise of

share

options 54 255 - - - - - 309 - 309

Share based

payment

expense - - - - - 30 - 30 - 30

-------------- -------- ------- -------- ----------- ------- ------- --------- ------- --------------- ----------

At 31 December

2017 5,855 86,398 10,884 (7,148) (831) 1,186 (56,413) 39,931 (409) 39,522

-------------- -------- ------- -------- ----------- ------- ------- --------- ------- --------------- ----------

Loss for the

period - - - - - - (8,186) (8,186) (73) (8,259)

Other

comprehensive

expense - - - - - - 1,360 1,360 - 1,360

-------------- -------- ------- -------- ----------- ------- ------- --------- ------- --------------- ----------

Loss and total

comprehensive

expense for

the

period - - - - - - (6,826) (6,826) (73) (6,899)

Exercise of

share

options 4 - - - - - - 4 - 4

Share based

payment

credit - - - - - (57) - (57) - (57)

-------------- -------- ------- -------- ----------- ------- ------- --------- ------- --------------- ----------

At 31 December

2018 5,859 86,398 10,884 (7,148) (831) 1,129 (63,239) 33,052 (482) 32,570

-------------- -------- ------- -------- ----------- ------- ------- --------- ------- --------------- ----------

Consolidated statement of cash flows

For the year ended 31 December 2018

Year to Year to

31 December 31 December

2018 2017

Notes GBP000 GBP000

------------------------------------------------- ----- ------------ ------------

OPERATING ACTIVITIES

Loss before taxation (8,879) (10,769)

Adjustment for:

Depreciation of property, plant and equipment 598 482

Amortisation of intangible assets 575 225

Share based payments (57) 30

Interest receivable (72) (47)

Interest payable 262 -

------------------------------------------------- ----- ------------ ------------

Operating cash outflow before working capital

movements (7,573) (10,079)

------------------------------------------------- ----- ------------ ------------

Decrease/(Increase) in inventory 542 (503)

(Increase) in trade and other receivables (1,188) (783)

(Decrease)/Increase in trade and other payables 156 38

------------------------------------------------- ----- ------------ ------------

Cash outflows from operations (8,063) (11,327)

------------------------------------------------- ----- ------------ ------------

Research & Development tax credit received 1,225 1,541

------------------------------------------------- ----- ------------ ------------

Net cash outflow from operations (6,838) (9,786)

------------------------------------------------- ----- ------------ ------------

INVESTING ACTIVITIES

Interest received 72 47

Purchases of property, plant and equipment (290) (130)

Capitalised development expenditure (116) (93)

Acquisition of subsidiary (including contingent

consideration) (1,564) (19,945)

------------------------------------------------- ----- ------------ ------------

Net cash (outflow) from investing activities (1,898) (20,121)

------------------------------------------------- ----- ------------ ------------

FINANCING ACTIVITIES

Proceeds from issue of share capital 5 - 37,682

Proceeds from exercised share options 4 309

------------------------------------------------- ----- ------------ ------------

Net cash inflow from financing activities 4 37,991

------------------------------------------------- ----- ------------ ------------

(Decrease)/Increase in cash and cash equivalents (8,732) 8,084

Foreign exchange translation movement 125 166

Cash and cash equivalents at start of period 16,423 8,173

------------------------------------------------- ----- ------------ ------------

CASH AND CASH EQUIVALENTS AT OF PERIOD 7,816 16,423

------------------------------------------------- ----- ------------ ------------

Notes to the financial statements

For the year ended 31 December 2018

1) Basis of Preparation

The Company is incorporated and domiciled in the United Kingdom

and its registered number is 5969271. The address of the registered

office is Unit 1 and 2 Astley Way, Astley Industrial Estate,

Swillington LS26 8XT. The Company was incorporated on 17 October

2006. The principle activity of Tissue Regenix Group is develop,

manufacture and commercialise biological medical devices.

The figures for the years ended 31 December 2018 and 2017 do not

constitute statutory accounts within the meaning of Section 434 of

the Companies Act 2006. The information contained within this

announcement has been extracted from the audited financial

statements which have been prepared in accordance with

International Financial Reporting Standards ('IFRS') as endorsed by

the European Union ('adopted IFRS'), and those parts of the

Companies Act 2006 applicable to companies reporting under adopted

IFRS. They have been prepared using the historical cost convention

except where the measurement of balances at fair value is required.

The information in this preliminary statement has been extracted

from the audited financial statements for the year ended 31

December 2018 and as such, does not contain all the information

required to be disclosed in the financial statements prepared in

accordance with IFRS.

The auditors have issued an unqualified opinion on the full

financial statements for the year ended 31 December 2018 which will

be made available for shareholders and delivered to the Registrar

of Companies in due course. The financial information for 2018 and

2017 does not comprise statutory financial statements within the

meaning of Section 434 of the Companies Act 2006. Statutory

financial statements for the year ended 31 December 2017, on which

the auditors gave an unqualified opinion, have been delivered to

the Registrar of Companies. No statement has been made by the

auditor under Section 498(2) or (3) of the Companies Act 2006 in

respect of either of these sets of accounts. Further copies of

these results, and the full financial statements when published,

will be available on the Company's website at

www.tissueregenix.com and at the Company's registered office:

Unit 1&2, Astley Way, Astley Lane Industrial Estate,

Swillington, Leeds.LS26 8XT

Going Concern

As at 31 December 2018, the Group had GBP7,816k of cash and cash

equivalents available to it and on 3 June 2019 the group entered

into a new debt facility providing total funds of $20m of which

$10.5m is available immediately, $5m is available from 2020 subject

to further equity funding, and $2.5m is available from 2021 on

achievement of sales targets, with a further $2m available to draw

down at any time. The new debt facility comprises a term loan of

$15m, repayable over four years from 2020 to 2024 and a revolving

credit facility of $5m.

The Directors have considered their obligation, in relation to

the assessment of the going concern of the Group and each statutory

entity within it and have reviewed the current budget cash

forecasts and assumptions through to 31 December 2020 as well as

the main risk factors facing the Group as set out on pages 26-27.

The Directors have also considered the mitigating actions that

could be taken in the event that the conditional elements of the

new debt facility do not become available.

After due enquiry and consideration, and taking account of the

currently available elements of the new debt facility, the

Directors consider that the Group has adequate financial resource

to continue in operational existence for at least 12 months from

the date of approval of these financial statements. Accordingly,

they have adopted the going concern basis in preparing the

financial statements.

2) Segmental Reporting

The following table provides disclosure of the Group's revenue

by geographical market based on location of the customer:

Year Year

to to

31 December 31 December

2018 2017

GBP000 GBP000

-------------- ------------ ------------

USA 9,434 4,098

Rest of world 2,185 1,135

-------------- ------------ ------------

11,619 5,233

-------------- ------------ ------------

Analysis of revenue by customer

During the year ending 31 December 2018 the Group had no

customers who individually exceeded 10% of revenue (2017:13% and

11%).

Operating segments

The Group is organised into BioSurgery, Orthopaedics &

Dental, Cardiac and Other divisions for internal management,

reporting and decision-making, based on the nature of the products

of the Group's businesses. Managers have been appointed within

these divisions, who report to the Chief Executive Officer. These

are the reportable operating segments in accordance with IFRS8

"Operating Segments". The Directors recognise that the operations

of the Group are dynamic and therefore this position will be

monitored as the Group develops.

In accordance with IFRS8, the Group has derived the information

for its operating segments using the information used by the Chief

Operating Decision Maker. The Group has identified the Chief

Executive Officer as the Chief Operating Decision Maker as he is

responsible for the allocation of resources to the operating

segments and assessing their performance.

Central overheads, which primarily relate to operations of the

Group function, are not allocated to the business unit.

Orthopaedics

BioSurgery & Dental Cardiac Other Central Total

----------------- ---------------- ---------------- --------------- --------------- ---------------- ------------------

Year Year Year Year Year Year Year Year Year Year Year Year

to to to to to to to to to to to to

31 Dec 31 Dec 31 Dec 31 Dec 31 Dec 31 Dec 31 Dec 31 Dec 31 Dec 31 Dec 31 Dec 31 Dec

2018 2017 2018 2017 2018 2017 2018 2017 2018 2017 2018 2017

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

----------------- ------- ------- ------- ------- ------ ------- ------- ------ ------- ------- -------- --------

Revenue 3,381 1,932 6,396 2,166 - - 1,842 1,135 - - 11,619 5,233

Cost of sales (1,769) (916) (2,676) (829) - - (1,257) (882) - - (5,702) (2,627)

----------------- ------- ------- ------- ------- ------ ------- ------- ------ ------- ------- -------- --------

Gross Profit 1,612 1,016 3,720 1,337 - - 585 253 - - 5,917 2,606

Administrative

costs (4,169) (4,737) (4,992) (3,297) (428) (481) (551) (484) (4,043) (3,325) (14,183) (12,324)

Exceptional

costs - - - - - - - - (423) (1,098) (423) (1,098)

----------------- ------- ------- ------- ------- ------ ------- ------- ------ ------- ------- -------- --------

Operating

loss (2,557) (3,721) (1,272) (1,960) (428) (481) 34 (231) (4,466) (4,423) (8,689) (10,816)

Finance

income/(expense) - - - 3 - - - - (190) 44 (190) 47

----------------- ------- ------- ------- ------- ------ ------- ------- ------ ------- ------- -------- --------

Loss before

taxation (2,557) (3,721) (1,272) (1,957) (428) (481) 34 (231) (4,656) (4,379) (8,879) (10,769)

Taxation 73 372 543 722 102 254 - - (98) - 620 1,348

----------------- ------- ------- ------- ------- ------ ------- ------- ------ ------- ------- -------- --------

Loss for

the year (2,484) (3,349) (729) (1,235) (326) (227) 34 (231) (4,754) (4,379) (8,259) (9,421)

----------------- ------- ------- ------- ------- ------ ------- ------- ------ ------- ------- -------- --------

Revenue from all operating segments derives from the sale of

biologic medical devices.

Administrative costs are broken down as follows:

Orthopaedics

BioSurgery & Dental Cardiac Other Central Total

--------------- ---------------- ---------------- --------------- -------------- ---------------- ------------------

Year Year Year Year Year Year Year Year Year Year Year Year

to to to to to to to to to to to to

31 Dec 31 Dec 31 Dec 31 Dec 31 Dec 31 Dec 31 Dec 31 Dec 31 Dec 31 Dec 31 Dec 31 Dec

2018 2017 2018 2017 2018 2017 2018 2017 2018 2017 2018 2017

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

--------------- ------- ------- ------- ------- ------ ------- ------ ------ ------- ------- -------- --------

Staff costs (2,936) (3,343) (2,639) (1,837) (222) (281) (297) (181) (1,365) (1,135) (7,459) (6,777)

--------------- ------- ------- ------- ------- ------ ------- ------ ------ ------- ------- -------- --------

Sales and

marketing

costs (901) (64) (125) (17) (25) (4) (20) (21) - - (1,071) (106)

--------------- ------- ------- ------- ------- ------ ------- ------ ------ ------- ------- -------- --------

Research and

development (164) (277) (1,307) (894) (164) (147) - (32) - - (1,635) (1,350)

--------------- ------- ------- ------- ------- ------ ------- ------ ------ ------- ------- -------- --------

Depreciation

and

amortisation (20) (25) (279) (97) - - (7) (25) (867) (560) (1,173) (707)

--------------- ------- ------- ------- ------- ------ ------- ------ ------ ------- ------- -------- --------

Establishment

and

administration

costs (148) (1,028) (642) (452) (17) (49) (227) (225) (1,811) (1,630) (2,845) (3,384)

--------------- ------- ------- ------- ------- ------ ------- ------ ------ ------- ------- -------- --------

Administrative

costs (4,169) (4,737) (4,992) (3,297) (428) (481) (551) (484) (4,043) (3,325) (14,183) (12,324)

--------------- ------- ------- ------- ------- ------ ------- ------ ------ ------- ------- -------- --------

Balance Sheet

Orthopaedics/

BioSurgery Dental Cardiac Other Central Total

------------ --------------- ---------------- --------------- ---------------- ---------------- ----------------

2018 2017 2018 2017 2018 2017 2018 2017 2018 2017 2018 2017

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

------------ ------ ------- ------- ------- ------ ------- ------- ------- ------- ------- ------- -------

Non-current

assets

------------ ------ ------- ------- ------- ------ ------- ------- ------- ------- ------- ------- -------

Intangible

Assets 759 643 4,649 4,373 - - - - 14,530 14,289 19,938 19,305

------------ ------ ------- ------- ------- ------ ------- ------- ------- ------- ------- ------- -------

Property,

Plant &

Equipment 20 2 2,153 2,290 - - 101 69 264 503 2,538 2,864

------------ ------ ------- ------- ------- ------ ------- ------- ------- ------- ------- ------- -------

Additions 6 38 204 - - - 54 40 26 52 290 130

------------ ------ ------- ------- ------- ------ ------- ------- ------- ------- ------- ------- -------

Total

non-current

assets 785 683 7,006 6,663 - - 155 109 14,820 14,844 22,766 22,299

------------ ------ ------- ------- ------- ------ ------- ------- ------- ------- ------- ------- -------

Current

assets

------------ ------ ------- ------- ------- ------ ------- ------- ------- ------- ------- ------- -------

Inventory 222 648 1,957 2,123 - - 74 15 77 86 2,330 2,872

------------ ------ ------- ------- ------- ------ ------- ------- ------- ------- ------- ------- -------

Trade &

other

receivables 939 780 2,856 2,138 200 221 121 348 635 681 4,751 4,168

------------ ------ ------- ------- ------- ------ ------- ------- ------- ------- ------- ------- -------

Cash & cash

equivalents 170 254 409 89 2 6 35 47 7,200 16,027 7,816 16,423

------------ ------ ------- ------- ------- ------ ------- ------- ------- ------- ------- ------- -------

Total

current

assets 1,331 1,682 5,222 4,350 202 227 230 410 7,912 16,794 14,897 23,463

------------ ------ ------- ------- ------- ------ ------- ------- ------- ------- ------- ------- -------

Total assets 2,116 2,365 12,228 11,013 202 227 385 519 22,732 31,638 37,663 45,762

------------ ------ ------- ------- ------- ------ ------- ------- ------- ------- ------- ------- -------

Current

liabilities

------------ ------ ------- ------- ------- ------ ------- ------- ------- ------- ------- ------- -------

Trade &

other

payables (553) (697) (2,474) (1,998) (42) (22) (102) (271) (1,922) (3,252) (5,093) (6,240)

------------ ------ ------- ------- ------- ------ ------- ------- ------- ------- ------- ------- -------

Total

liabilities (553) (697) (2,474) (1,998) (42) (22) (102) (271) (1,922) (3,252) (5,093) (6,240)

------------ ------ ------- ------- ------- ------ ------- ------- ------- ------- ------- ------- -------

Net Assets 1,563 1,668 9,754 9,015 160 205 283 248 20,810 28,386 32,570 39,522

------------ ------ ------- ------- ------- ------ ------- ------- ------- ------- ------- ------- -------

3) Taxation

Tax on loss on ordinary activities

Year to Year to

31 December 31 December

2018 2017

GBP000 GBP000

--------------------------------------------------------- ------------ ------------

Current tax:

UK corporation tax credit on losses of period (790) (1,348)

US corporation tax payable 72 -

--------------------------------------------------------- ------------ ------------

718 (1,348)

Deferred tax:

Origination and reversal of temporary timing differences 98 -

--------------------------------------------------------- ------------ ------------

Tax credit on loss on ordinary activities (620) (1,348)

--------------------------------------------------------- ------------ ------------

Factors affecting the current tax charges

The tax assessed for the year varies from the main rate of

corporation tax as explained below:

Year to Year to

31 December 31 December

2018 2017

GBP000 GBP000

----------------------------------------------------------- ------------ ------------

The tax assessed for the period varies from the small

company rate of corporation tax as explained below:

Loss on ordinary activities before tax (8,879) (10,769)

Tax at the standard rate of corporation tax 19% (2017:

19.25%) (1,687) (2,074)

Effects of:

Research and development tax credits received (583) (799)

Surrender of research and development relief for repayable

tax credit 792 1,098

Research and development enhancement (448) (621)

Prior period adjustment (141) (549)

Other 170 -

Unutilised tax losses 1,277 1,597

----------------------------------------------------------- ------------ ------------

Tax credit for the period (620) (1,348)

----------------------------------------------------------- ------------ ------------

Deferred Tax

Year to Year to

31 December 31 December

2018 2017

GBP000 GBP000

--------------------------------------------------------- ------------ ------------

Tax losses

Losses available to carry forward against future trading

profits 43,254 35,819

Deferred tax asset - unrecognised* 7,353 6,089

--------------------------------------------------------- ------------ ------------

*The Group has not recognised a deferred tax asset relating to

these losses as their recoverability is uncertain.

4) Loss Per Share (Basic and Diluted)

Basic loss per share is calculated by dividing the loss

attributable to equity holders of the parent by the weighted

average number of ordinary shares in issue during the period

excluding own shares held jointly by the Tissue Regenix Employee

Share Trust and certain employees. Diluted loss per share is

calculated by adjusting the weighted average number of ordinary

shares in issue during the year to assume conversion of all

dilutive potential ordinary shares.

Year to Year to

31 December 31 December

2018 2017

GBP000 GBP000

----------------------------------------------------- ------------ ------------

Total loss attributable to the equity holders of the

parent (8,186) (9,221)

----------------------------------------------------- ------------ ------------

No. No.

---------------------------------------------------- ------------- -----------

Weighted average number of ordinary shares in issue

during the year 1,171,633,442 920,506,514

---------------------------------------------------- ------------- -----------

Loss per share

Basic and diluted loss for the year (0.70)p (1.00)p

---------------------------------------------------- ------------- -----------

The Company has issued employee options over 53,577,615 (2017:

53,119,254) ordinary shares and there are 16,112,800 jointly owned

shares which are potentially dilutive. There is, however, no

dilutive effect of these issued options as there is a loss for each

of the periods concerned.

5) Share Capital and reserves

Reverse

Merger acquisition

Share capital Share premium reserve reserve Total

Number GBP000 GBP000 GBP000 GBP000 GBP000

------------------------ ------------- ------------- ------------- -------- ------------ -------

Total Ordinary shares

of 0.5 p each as at

31 December 2016 760,124,264 3,801 50,461 10,884 (7,148) 57,998

Issue of shares 400,000,000 2,000 35,682 - - 37,682

Share options exercised 10,866,660 54 255 - - 309

------------------------ ------------- ------------- ------------- -------- ------------ -------

Total Ordinary shares

of 0.5p each as at 31

December 2017 1,170,990,924 5,855 86,398 10,884 (7,148) 95,989

Share options exercised 739,899 4 - - - 4

------------------------ ------------- ------------- ------------- -------- ------------ -------

Total Ordinary shares

of 0.5p each as at 31

December 2018 1,171,730,823 5,859 86,398 10,884 (7,148) 95,993

------------------------ ------------- ------------- ------------- -------- ------------ -------

As permitted by the provisions of the Companies Act 2006, the

Company does not have an upper limit to its authorised share

capital. All shares are ordinary shares which are fully paid and

entitle the holder to full voting rights, to full participation or

distribution of dividends.

Directors and Officers

DIRECTORS

John Samuel (Chairman)

Steven Couldwell (Chief Executive Officer)

Gareth Jones (Chief Financial Officer)

Jonathan Glenn (Non-Executive Director)

Alan Miller (Non-Executive Director)

Randeep Singh Grewal (Non-Executive Director)

Shervanthi Homer-Vanniasinkam (Non-Executive Director)

COMPANY SECRETARY

Gareth Jones

COMPANY WEBSITE

www.tissueregenix.com

COMPANY NUMBER

05969271 (England & Wales)

REGISTERED OFFICE

Unit 1 & 2

Astley Way

Astley Lane Industrial Estate

Leeds

West Yorkshire

LS26 8XT

REGISTRAR

Link Asset Services

The Registry

34 Beckenham Road

Beckenham

Kent

BR3 4TU

AUDITOR

RSM UK Audit LLP

Central Square

29 Wellington Street

Leeds

LS1 4DL

LEGAL ADVISER

DLA Piper UK LLP

Princes Exchange

Princes Square

Leeds

LS1 4BY

NOMINATED ADVISER AND BROKER

Stifel Nicolaus Europe Ltd

150 Cheapside

London

EC2V 6ET

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR FJMTTMBJMTRL

(END) Dow Jones Newswires

June 04, 2019 02:00 ET (06:00 GMT)

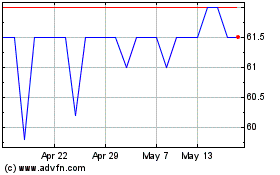

Tissue Regenix (LSE:TRX)

Historical Stock Chart

From May 2024 to Jun 2024

Tissue Regenix (LSE:TRX)

Historical Stock Chart

From Jun 2023 to Jun 2024