RA International Group PLC Launch of Share Buyback Programme (1816P)

June 08 2020 - 2:00AM

UK Regulatory

TIDMRAI

RNS Number : 1816P

RA International Group PLC

08 June 2020

8 June 2020

This announcement contains inside information

RA INTERNATIONAL GROUP PLC

("RA International" or the "Company")

Launch of Share Buyback Programme

RA International Group PLC (AIM: RAI), a leading provider of

services to remote locations in Africa and the Middle East,

announces that the Board has approved the commencement of a share

buyback programme through which the Company will seek to make

on-market purchases of ordinary shares of GBP0.1 each in the

capital of the Company ("Ordinary Shares") up to a maximum of

5,000,000 Ordinary Shares ("the "Buyback Programme").

The Buyback Programme is being launched with immediate effect

and is intended to provide the Company with a pool of Ordinary

Shares which can primarily be used to incentivise and retain key

Directors, officers and staff, who are critical to enhancing the

future market value of the Company. The first tranche of awards is

expected to be made in the second half of 2020.

In accordance with the resolution passed at the Company's Annual

General Meeting held on 24 June 2019 ("AGM"), purchases can be made

pursuant to the Buyback Programme provided, inter alia, that:

i. the maximum aggregate number of ordinary shares which may be purchased is 17,357,574;

ii. the minimum price (exclusive of expenses) which may be paid

for each ordinary share is GBP0.1;

iii. the maximum price (exclusive of expenses) which may be paid

for any ordinary share does not exceed the higher of: (a) 5% above

the average middle market prices of the ordinary shares on the

London Stock Exchange Daily Official List for the five business

days immediate preceding the date on which the Company agrees to

buy the shares concerned; and (b) the higher of the price of the

last independent trade of any ordinary share and the highest

independent current bid for an ordinary share derived from the

London Stock Exchange at the time the purchase is carried out.

At the time of the AGM the Company indicated that following a

market purchase of its own shares, the shares purchased would be

cancelled. The Company intends to retain the ability to re-issue

any Ordinary Shares acquired through the Buyback Programme in order

to incentivise and retain key Directors, officers and staff and

pursuant to the future exercise of existing options and warrants.

Accordingly, any Ordinary shares acquired as a result of the

Buyback Programme will be held in treasury and their purchase will

be announced to the market without delay.

The Buyback Programme will be independently managed by Cenkos

Securities plc, the Company's broker, which will make trading

decisions independently and without the influence of the

Company.

Due to the liquidity in the issued Ordinary Shares, any Buyback

of Ordinary Shares pursuant to the Company's existing authority on

any trading day may represent a significant proportion of the daily

trading volume in the Ordinary Shares on AIM and may exceed 25 per

cent of the average daily trading volume, being the limit laid down

in Article 5(1) of Regulation (EU) No 596/2014 and, accordingly,

the Company will not benefit from the safe harbour contained in

this Article.

* * * * *

Enquiries:

RA International Group PLC Via Hudson Sandler

Soraya Narfeldt, Chief Executive Officer

Lars Narfeldt, Chief Operating Officer

Andrew Bolter, Chief Financial Officer

Cenkos Securities PLC (Nominated Adviser

and Broker)

Derrick Lee +44 (0)131 220

Peter Lynch 6939

Hudson Sandler LLP (Financial PR & IR) +44 (0)207 796

Daniel de Belder 4133

Bertie Berger rainternational@hudsonsandler.com

About RA International

RA International is a leading provider of services to remote

locations in Africa and the Middle East. The Company offers its

services through three channels: construction, integrated

facilities management and supply chain, and services three main

client groups: humanitarian and aid agencies, governments and

commercial customers, predominantly in the oil and gas and mining

sectors. It has a strong customer base, largely comprising UN

agencies, western governments and global corporations.

The Company provides comprehensive, flexible, mission critical

support to its clients enabling them to focus on the delivery of

their respective businesses and services. Focusing on integrity and

values alongside making on-going investment in its people,

locations and operations has over time created a reliable and

trusted brand within its sector.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

POSUBUURRUUNRAR

(END) Dow Jones Newswires

June 08, 2020 02:00 ET (06:00 GMT)

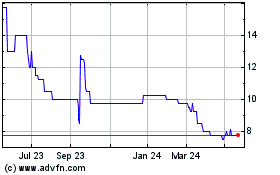

Ra (LSE:RAI)

Historical Stock Chart

From May 2024 to Jun 2024

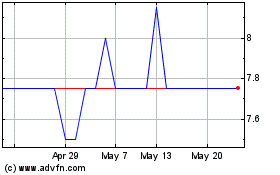

Ra (LSE:RAI)

Historical Stock Chart

From Jun 2023 to Jun 2024