TIDMRAI

RNS Number : 1844B

RA International Group PLC

19 September 2018

19 September 2018

RA INTERNATIONAL GROUP PLC

("RA International" or the "Company" and, together with its

subsidiaries, the "Group")

Interim Results for the six months to 30 June 2018

RA International Group PLC (AIM: RAI), a leading provider of

services to remote locations in Africa and the Middle East, is

pleased to announce its interim results in respect of the six

months ended 30 June 2018.

INTERIM HIGHLIGHTS

-- Admission to trading on AIM on 29 June 2018 raising gross

proceeds of GBP18.8m (approximately US$24.7m)

-- Half yearly revenue of US$ 23.9 m and EBITDA(1) of US$ 7.4m

-- During the period, total contracts awarded of approximately

US$ 33m including a 5-year contract with UNICEF providing,

accommodation, catering, cleaning services and offices for their

staff

-- Net cash of US$ 28.0m at 30 June 2018

-- Acquired RA SB Ltd., a provider of remote site services in

Sudan, in line with strategy of further geographical expansion in

Africa

-- Commenced a US$ 5.2m construction and services project in

Oman for the UK MOD. Besides supporting the Company's geographical

diversification efforts, the successful mobilisation of this

contract demonstrates RA International's ability to support UK

Government agencies worldwide

(1) EBITDA is earnings before interest, tax, depreciation and

the deduction of exceptional items detailed within the Condensed

Consolidated Income Statement.

POST PERIOD HIGHLIGHTS

-- Company now debt free with US$ 0.6m of term loans settled in

H1 18 and remaining US$ 1.3m settled by 31 August 2018

-- Contracted revenue backlog of US$ 114m at 31 August 2018 with

US$ 63m of contracts awarded since 1 January 2018

-- The average term of ongoing contracts is 2.2 years or 4.2

years when weighted by contract value

-- Five-year contract of US$ 30m awarded by the United Nations

Support Office in Somalia, in line with the Company's focus on

securing larger and longer-term contracts supporting key

customers

-- Regional project Management Office established and opened in

Nairobi, Kenya, to provide technical project support leading to

future project efficiencies around Africa

Soraya Narfeldt, CEO of RA International, commented:

"The Company is delivering on its strategy of geographical

expansion and securing larger and longer term contracts. We have

seen a significant increase in the bid pipeline since admission to

trading on AIM in June, and we expect this to translate into

contracts in the second half of this year and beyond.

"We are now focussing on larger contracts, and being a publicly

quoted company will enhance our status and competitive position. We

are grateful to the support shown by shareholders since June and

look forward to the next phase of RA International's

development."

Enquiries:

RA International Group PLC Via IFC Advisory

Soraya Narfeldt, Chief Executive Officer

Lars Narfeldt, Chief Operating Officer

Andrew Bolter, Chief Financial Officer

Cenkos Securities PLC (Nominated Adviser and

Broker)

Beth McKiernan +44 (0)131 220

Derrick Lee 6939

IFC Advisory Limited (Financial PR & IR)

Tim Metcalfe

Heather Armstrong +44 (0)20 3934

Florence Chandler 6600

Background to the Company

RA International is a leading provider of services to remote

locations in Africa and the Middle East. It specialises in five

service verticals: construction; integrated facilities management;

operation and maintenance; accommodation; and supply chain

logistics. It has a strong customer base, largely comprising UN

agencies, western governments and global corporations.

The Group provides comprehensive, flexible, mission critical

support to its clients enabling them to focus on the delivery of

their respective businesses and services. RA International's focus

on integrity and values alongside on-going investment in people,

locations and operations has over time created a reliable and

trusted brand within its sector.

CHIEF EXECUTIVE'S REVIEW

Admission to AIM

Admission to AIM was an important step in the Group's

development, enabling us to raise additional capital to support our

strategic objectives of broadening our geographical presence and

undertaking larger, multi-year contracts with both existing and new

customers, and in new sectors such as mining and oil and gas. By

becoming a public company we are able to build on our existing

strong reputation within our market place and provide additional

confidence to customers when we bid for larger contracts.

The funds we raised at the time of Admission in addition to our

existing cash resources, will be utilised to fund the

following:

-- strengthen the Group's balance sheet enabling us to meet

customer demand to bid on larger scale contracts within our core

competencies;

-- promote a client multiplier effect, adding to the Group's

ability to upsell additional services to existing clients.

Opportunities for upselling have been identified across all five

verticals; and

-- enter new territories and sectors through leveraging existing relationships and reputation.

Contracts

The Company reported backlog revenue at 31 August of US$ 114m

compared with US$ 112m at 31 December 2017, with US$ 63m worth of

new contracts awarded this financial year to date. The average term

of ongoing contracts is 2.2 years or 4.2 years when weighted by

contract value.

During the period, we have delivered on our long-term strategy

of providing high quality and reliable service to generate trust

with our customers. We have built on our existing relationship with

the United Nations, resulting in a 5-year contract with UNICEF for

accommodation, offices, catering and cleaning services. Following

this award, the UN High Commissioner for Refugees (UNHCR) renewed

their contract with RA International for similar services in

Mogadishu for a long-term period.

We announced on 16 August 2018, post period end, that the

Company successfully bid and was selected by the United Nations

Support Office and the African Mission in Somalia to deliver a

power infrastructure project worth US$ 30m over 5 years.

The Company continues to actively bid on future contracts with

larger contract values and longer terms. Additionally, we expect to

continue to win follow on work from our key clients based on the

quality and execution of our projects. A prime example of this, was

the contract win for the UK MOD in Oman. This was a customer led

contract win which expanded our geographical footprint. Further

contract awards from the UK MOD and FCO demonstrate a continued

confidence in RA International as a service provider to UK

Government agencies.

The Company's strategy for US Government business development is

to partner with companies for each of the Africa-centric Government

programs and support them in winning work across the continent. In

addition, the Company has partnered with a firm who specialise in

Overseas Building Operations for the US Department of State and is

bidding on multiple projects at present.

Since the Company's Admission to AIM in June it has also bid or

is in the process of bidding for large construction and service

contracts in the mining, oil and gas sector.

While there are a number of factors that influence the timing of

contract awards and the recognition of revenue, we are confident

that a proportion of our significant pipeline will contribute to

our full year results for 2019. We maintain close relationships

with our customers and look forward to providing updates on a

number of contracts during the remainder of the year.

Operations

We have completed a number of key operational projects so far in

2018, including the acquisition of RA SB Ltd. in Sudan which adds

an additional geographic territory to our already strong African

coverage. Through this acquisition we have been able to enter into

a support contract within the mining, oil and gas industry.

During the period, we appointed a Legal Officer and Group

Compliance Manager to work at Group level, and further enhanced our

operating capacity through the hiring of a new Group Supply Chain

Manager and Head of Engineering. We also opened a Project

Management Office in Nairobi, Kenya, on 10 September 2018 to

support ongoing project work in the region. It is anticipated that

the consolidation of technical project support in Kenya will lead

to future efficiencies when executing projects across Africa.

Overall, the Company has reduced its East Africa concentration,

increasing projects in Central African Republic, Oman and Sudan. We

have increased local hires from 62% in 2016 to 67% in 2017 and in

2018 we are very pleased to have 70% of total employees of RA

International being local staff.

The UN is a significant customer for us and to ensure we

continue to meet the agency's high Sustainable Development Goals

(SDG), we have initiated work on developing a new Corporate Social

Responsibility (CSR) strategy. This will be done by formalizing our

sustainability work and pursuing a new structure that will revolve

around the SDG, with the intention of creating lasting long-term

impact for our stakeholders and the environment.

Strategy for growth

There are four core elements to our strategy to enhance our

growth plans:

1. Diversify our customer base;

2. Diversify our geographic reach;

3. Bid for larger, longer-term contracts which we have started

to submit since our Admission in June; and

4. Cross sell our services to new and existing customers.

Market Developments

Overseas Development Aid (ODA) expenditure by international

governments is driven by a number of aims including providing

stability in conflicted regions, promoting democracy, contributing

to counter terrorism and law enforcement efforts, as well as

humanitarian aid to alleviate short term humanitarian crises. ODA

can be delivered bilaterally, directly by individual governments,

or multilaterally, through a multitude of organisations such as UN

agencies, and charitable organisations. RA International typically

undertakes contracts for western governments and international

agencies to help deliver ODA in remote locations, as well as acting

for international companies.

In 2016, UN agencies and USAID spent approximately US$ 4.4

billion and US$ 3.1 billion respectively in the Central African

Republic, the Democratic Republic of Congo, Eritrea, Ethiopia,

Libya, Mali, Somalia, South Sudan and Sudan. These are countries in

which the Group is presently working or can provide its services at

short notice. In the same year the UK, which is the second largest

contributor by monetary value in overseas aid to Africa, spent

approximately GBP2.9 billion in ODA to Africa. In aggregate, over

US$100 billion in planned expenditure has been announced by the US,

UK, United Nations and the mining sector for investment in Africa

in the next three years. RA International believes that a

proportion of this planned expenditure will be directly related to

the services the Company is able to deliver.

The US is the largest contributor by monetary value in overseas

aid to Africa and the majority of the US Government funds spent is

through Indefinite Delivery/Indefinite Quantity (IDIQ) contracts.

IDIQ contracts are awarded, after a pre-qualification round, to a

group of 3 to 5 companies who compete for Task Orders over a 5 to

10 year period. For the most part, only US companies can qualify

for these IDIQ contracts because of security clearance

requirements. Most of these companies that qualify to bid on Task

Orders do not have a large presence in Africa and require a partner

to execute the primary contract scope or provide support services.

This presents a significant opportunity for RA International given

the scope of our service offering, geographical reach, and

experience successfully completing US Government projects.

Current Trading and Outlook

At RA International, we are committed to delivering our projects

to a high standard and on time. Our contract delivery in the first

half of the year has remained excellent. Looking to the future,

both the size and contract length of the bids we are working on has

increased. We are continuing to diversify our customer base and

deliver geographical expansion. The management undertook a huge

challenge in the first half of the year with the Admission to AIM

and we have been delighted with the support we have seen from the

London market. We look forward to the second half of 2018 with

confidence.

Soraya Narfeldt

Chief Executive Officer

19 September 2018

FINANCIAL REVIEW

Overview

Financial performance for the first-half of 2018 is consistent

with our expectations. While the Company does not experience

seasonality, it does frequently execute short term contracts

("STCs") which often have a significant effect on revenue and

profitability in a given quarter or half-year period. As a result,

interim figures are often not directly comparable to those of the

previous year. To provide readers with a more complete

understanding of our financial performance we have chosen to

present the financial results of the interim period (H1 18) and the

two preceding half-year periods (H2 17 and H1 17). It is

anticipated that the Company will have a strong second-half of 2018

and that going forward, as the Company secures higher value,

longer-term contracts, the effect of STCs will diminish.

6 months 6 months 6 months

ended ended ended

30 June 31 December 30 June

2018 2017 2017

US$'000 US$'000 US$'000

Notes Unaudited Unaudited Unaudited

Revenue 23,855 25,919 27,342

Gross profit 9,906 9,426 11,503

Gross margin 41.5% 36.4% 42.1%

EBITDA (1) 7,377 6,335 9,451

EBITDA margin (1) 30.9% 24.4% 34.6%

Normalised EPS (cents) (2) 4.7 3.5 6.3

Net cash (end of period) (3) 27,978 5,602 2,202

(1) EBITDA is earnings before interest, tax, depreciation and

the deduction of exceptional items detailed within the Condensed

Consolidated Income Statement. EBITDA margin is a key performance

measurement monitored by management of the Group.

(2) Normalised earnings per share represents basic earnings per

share excluding exceptional items.

(3) Net cash represents the end of period cash balance less term

loans and notes outstanding.

Revenue

Reported revenue for H1 18 was US$ 23.9m (H2 17: 25.9m, H1 17:

27.3m). This represents a 12.8% decrease when compared with H1 17

and is due to a US$ 5.7m reduction in revenue being reported from

short-term construction and supply contracts. The Company completed

US$ 7.0m of STCs in 2017 with US$ 6.8m of revenue recorded in H1 17

and US$ 0.2m recorded in H2 17. The Company is currently executing

5 STCs with an aggregate value of US$ 8.0m. US$ 1.1m of revenue is

included in the H1 18 results with US$ 6.9m anticipated to be

recognized in H2 18. Of the US$ 63.2m of contracts awarded to the

Company this year, US$ 50.2m relate to contracts with five-year

terms.

Profit Margin

Gross margin in H1 18 was 41.5% (H2 17: 36.4%, H1 17: 42.1%)

which is consistent with the Company's expectations. The variance

in H2 17 was due to the Company executing a construction project

for the UK MOD in Somalia which was substantially completed in the

second half of 2017. Excluding the effect of this contract, H2 17

gross margin would have been 39.0%. The Company feels the

successful completion of this contract was instrumental to the UK

MOD awarding RA International a contract in Oman earlier this

year.

EBITDA margin, excluding costs of the IPO and related charges,

was 30.9% in the period (H2 17: 24.4%, H1 17: 34.6%) which was

consistent with the Company's expectations. The decrease in margin

of 3.7% from H1 17 is primarily due to an additional US$ 0.7m of

other income recognized in H1 17. Excluding other income, EBITDA

margin is 29.1% (H2 17: 24.2%, H1 17: 30.6%). The majority of other

income relates to customer reimbursements of project costs incurred

which have been expensed in prior accounting periods.

Exceptional Items

Exceptional items of US$ 2.9m have been recorded as costs in the

period. These items represent expenses incurred in relation to the

Company's Admission to AIM which, in accordance with international

accounting standards, are to be presented as expenses in the income

statement. Within the interim accounts exceptional items are split

into two categories; advisory fees and other costs associated with

the AIM Admission totalled US$ 1.3m and stock-based compensation

totalled US$ 1.6m. The stock-based compensation charge relates to

the transfer of shares by the majority shareholder of the Company

to certain employees at the AIM Admission date. While the Company

was not a party to this transfer, IFRS mandates that the

transaction be accounted for as a cost on the date of share grant.

The transfer of shares was conditional on the Company's successful

Admission to AIM.

Earnings Per Share

Normalised earnings per share, being earnings before exceptional

items divided by the weighted number of shares outstanding in the

period, was 4.7 cents per share in the period (H2 17: 3.5 cents, H1

17: 6.3 cents).

Basic earnings per share was 2.6 cents (H2 17: 3.5 cents, H1 17:

6.3 cents) and is equal to diluted earnings per share.

Cashflow

Net cash flow from operations was US$ 3.5m in the period (H2 17:

6.2m, H1 17: 6.3m) which represented 51.9% cash conversion, well

below previously reported results (H2 17: 106.2%, H1 17: 70.2%).

The primary factors contributing to the differential were:

1) A build-up in receivable balances from one UN agency. As at

30 June 2018 this specific account receivable balance was US$ 3.9m

(31 December 17: US$ 0.4m). The Company collected US$ 3.0m of this

balance in July 2018.

2) A build-up of inventory relating to the mobilisation of the

UK MOD Oman contract, and the construction of hotel and office

facilities in Somalia to accommodate UNICEF who have signed a

five-year contract with the Company. Additionally, goods-in-transit

balances on route to project sites in the Central African Republic

increased compared with prior periods. Increasing the value of

goods in the supply chain has led to increased operational

efficiency in the current trading period where we have seen a 15%

increase in monthly revenue being generated from the country's

operations when compared with the first six-months of the year.

The Company targets a 100% cash conversion ratio but significant

increases in operational activity, such as mobilising for material

contracts, can lead to short-term divergences.

Balance Sheet

Net of share issuance and AIM Admission costs, the Company

raised US$ 21.4m in IPO proceeds. As a result, net cash increased

to US$ 28.0m at 30 June 2018 (31 December 2017: US$ 5.6m, 30 June

2017: US$ 2.2m). The Company repaid US$ 0.6m of debt in the period

and cleared the remaining balance by 31 August 2018. While the

Company does not anticipate raising debt in the near future, it

does plan to explore the availability and pricing of working

capital facilities in case such a facility is required in 2019 to

finance the working capital needs of certain large pipeline

opportunities.

Liquidity and cash on hand is often assessed by potential

customers during the contract adjudication process. The completion

of the IPO and related fundraising was a milestone for the Company

in that it will now qualify to bid for larger projects and has the

financial capacity to mobilize for multiple large projects

simultaneously. Net assets were US$ 54.1m at 30 June 2018 with the

majority of the total balance sheet being cash and other current

assets.

The Company continues to invest in revenue generating fixed

assets, with the majority of the US$ 1.6m increase in fixed assets

relating to the accommodation facility being built for UNICEF.

Dividend

The Company anticipates declaring an annual dividend when it

reports its earnings for the fiscal year ended 31 December

2018.

Andrew Bolter

Chief Financial Officer

19 September 2018

Condensed Consolidated Income Statement

6 months 6 months 6 months

ended ended ended

30 June 31 December 30 June

2018 2017 2017

USD'000 USD'000 USD'000

Notes Unaudited Unaudited Unaudited

Revenue 23,855 25,919 27,342

Direct costs (13,949) (16,493) (15,839)

---------------- ---------------- ----------------

GROSS PROFIT 9,906 9,426 11,503

Other income 424 54 1,098

Administrative expenses (2,953) (3,145) (3,150)

---------------- ---------------- ----------------

Profit before depreciation, amortisation,

finance costs, and exceptional

items 7,377 6,335 9,451

Depreciation (547) (531) (404)

Amortisation - - (17)

Finance costs (294) (908) (252)

---------------- ---------------- ----------------

Profit for the period before exceptional

items 6,536 4,896 8,778

Exceptional items 3 (2,908) - -

---------------- ---------------- ----------------

PROFIT FOR THE PERIOD 3,628 4,896 8,778

Other comprehensive income for - - -

the period

---------------- ---------------- ----------------

TOTAL COMPREHENSIVE INCOME FOR

THE PERIOD 3,628 4,896 8,778

BASIC AND DILUTED EARNINGS PER

SHARE (cents) 4 2.6 3.5 6.3

NORMALISED BASIC AND DILUTED EARNINGS

PER SHARE (cents) 4 4.7 3.5 6.3

The Group has no recognised gains or losses other than those

disclosed in the Consolidated Income Statement.

The notes 1 to 9 form part of the Condensed Financial

Statements.

Condensed Consolidated Statement Of Financial Position

As at As at As at

30 June 31 December 30 June

2018 2017 2017

USD'000 USD'000 USD'000

Notes Unaudited Audited Unaudited

ASSETS

Non-current assets

Property, plant, and equipment 10,769 9,170 8,726

---------------- ---------------- ----------------

Current assets

Inventories 4,013 2,660 3,915

Accounts receivable, deposits,

and other receivables 17,308 13,138 13,380

Bank balances and cash 8 29,271 7,469 5,224

---------------- ---------------- ----------------

50,592 23,267 22,519

---------------- ---------------- ----------------

TOTAL ASSETS 61,361 32,437 31,245

EQUITY AND LIABILITIES

Equity

Share capital 24,300 272 272

Additional contributed capital - 1,809 1,809

Share premium 18,256 - -

Merger reserve (17,803) - -

Retained earnings 29,350 24,269 20,023

---------------- ---------------- ----------------

Total equity 54,103 26,350 22,104

---------------- ---------------- ----------------

Non-current liabilities

Term loans and notes - long-term

portion - 6 1,866

Employees' end of service benefits 308 251 404

---------------- ---------------- ----------------

308 257 2,270

---------------- ---------------- ----------------

Current liabilities

Term loans and notes - short-term

portion 1,293 1,861 1,156

Accounts payable and accruals 5,657 3,969 5,715

---------------- ---------------- ----------------

6,950 5,830 6,871

---------------- ---------------- ----------------

Total liabilities 7,258 6,087 9,141

---------------- ---------------- ----------------

TOTAL EQUITY AND LIABILITIES 61,361 32,437 31,245

Consolidated Statement of Changes In Equity

Additional

Share Contributed Share Merger Retained

Capital Capital Premium Reserve Earnings Total

Notes USD'000 USD'000 USD'000 USD'000 USD'000 USD'000

As at 1

January 2017 272 1,809 - - 11,370 13,451

Profit for the

period - - - - 8,778 8,778

Dividends

declared and

paid 5 - - - - (125) (125)

---------------- ---------------- ---------------- ---------------- ---------------- ----------------

As at 30 June

2017 272 1,809 - - 20,023 22,104

Profit for the

period - - - - 4,896 4,896

Dividends

declared and

paid 5 - - - - (650) (650)

---------------- ---------------- ---------------- ---------------- ---------------- ----------------

As at 31

December 2017 272 1,809 - - 24,269 26,350

Share exchange 2 19,612 (1,809) - (17,803) - -

Profit for the

period - - - - 3,628 3,628

Non-cash

employee

compensation 3 - - - - 1,578 1,578

Issue of share

capital (net

of issue

costs) 2 4,416 - 18,256 - - 22,672

Dividends

declared and

paid 5 - - - - (125) (125)

---------------- ---------------- ---------------- ---------------- ---------------- ----------------

As at 30 June

2018 24,300 - 18,256 (17,803) 29,350 54,103

Consolidated statement of Cashflows

6 months 6 months 6 months

ended ended ended

30 June 31 December 30 June

2018 2017 2017

USD'000 USD'000 USD'000

Notes Unaudited Unaudited Unaudited

OPERATING ACTIVITIES

Profit for the period 3,628 4,896 8,778

Non-cash adjustments to reconcile profit to net cash

flows:

Depreciation on property, plant, and equipment 547 531 404

Loss on disposal of property, plant, and equipment 7 28 135

Amortisation of intangible assets - - 17

Finance costs 294 908 252

Provision for employees' end of service benefits 57 49 234

Exceptional items 3 2,908 - -

---------------- ---------------- ----------------

7,441 6,412 9,820

Working capital adjustments:

Inventories (1,337) 1,255 (570)

Accounts receivable, deposits, and other

receivables (3,497) 242 (3,300)

Accounts payable and accruals 941 (1,746) 386

---------------- ---------------- ----------------

Cash flows generated from operations 3,548 6,163 6,336

Employees' end of service benefits paid - (202) (19)

Stock-based compensation and related costs 3 (24) - -

---------------- ---------------- ----------------

Net cash flows from operating activities 3,524 5,961 6,317

---------------- ---------------- ----------------

INVESTING ACTIVITIES

Deposits under lien released during the period - - 201

Deposit of cash margin against guarantees issued - (2,000) -

during the period

Purchase of property, plant, and equipment (2,159) (1,008) (2,398)

Proceeds from disposal of property, plant, and

equipment 74 3 20

Acquisition of subsidiary 6 (565) - -

---------------- ---------------- ----------------

Net cash flows used in investing activities (2,650) (3,005) (2,177)

---------------- ---------------- ----------------

FINANCING ACTIVITIES

Repayment of term loans and notes (573) (1,155) (2,005)

Proceeds from term loans and notes - - 2,432

Finance costs paid (371) (803) (310)

Dividends paid 5 (125) (650) (125)

Share listing costs 3 (935) - -

Issue of share capital (net of issue costs paid) 2 22,859 - -

---------------- ---------------- ----------------

Net cash flows from / (used in) financing activities 20,855 (2,608) (8)

---------------- ---------------- ----------------

NET INCREASE IN CASH AND CASH EQUIVALENTS 21,729 348 4,132

Cash and cash equivalents at start of period 5,469 5,224 1,035

Effect of foreign exchange on cash and cash

equivalents 73 (103) 57

---------------- ---------------- ----------------

CASH AND CASH EQUIVALENTS AT OF PERIOD 27,271 5,469 5,224

NOTES TO THE CONDENSED FINANCIAL STATEMENTS

1. BASIS OF PREPARATION

The principal activity of RA International Group plc ("RAI" or

the "Company") and its subsidiaries (together the "Group") is

providing services in demanding and remote areas. These services

include engineering and construction, life support services,

operation and maintenance, and procurement and logistics.

RAI was incorporated on 13 March 2018 as a public company in

England and Wales under registration number 11252957. The address

of its registered office is One Fleet Place, London, EC4M 7WS. The

Company acquired, by way of share for share exchange (the

'Exchange") the entire issued share capital of RA International

FZCO and its subsidiaries ("RA") on 12 April 2018. The Group

reorganisation is treated as a common control transaction, for

which there is no specific accounting guidance under IFRS.

Consequently, the integration of the Company has been accounted for

using merger accounting principles. The policy, which does not

conflict with IFRS, reflects the economic substance of the

transaction.

The adoption of merger accounting presents the Company as if it

had always been the parent of the Group. As the Company was not

incorporated until 13 March 2018, the condensed interim

consolidated financial statements of the Group represent a

continuation of consolidated financial statements of RA

International FZCO, the former parent of the Group. Comparative

information presented in these interim consolidated financial

statements, relate to that of RA, not the Group. The financial

information set out in these interim condensed consolidated

financial statements does not constitute the Group's statutory

financial statements within the meaning of section 434 of the

Companies Act 2006.

The unaudited condensed interim financial statements for the six

months ended 30 June 2018 have been prepared in accordance with IAS

34, 'Interim Financial Reporting'. They do not include all the

information required for full annual financial statements and

should be read in conjunction with the consolidated financial

statements of RA for the year ended 31 December 2017 which are

presented in the RAI Admission Document. The unaudited condensed

financial information has been prepared using the same accounting

policies and methods of computation which will be used to prepare

the Annual Report for the year ended 31 December 2018. The

financial statements of the Group are prepared in accordance with

IFRS.

There are no new standards or interpretations mandatory for the

first time for the financial year ending 31 December 2017 that have

a material effect on the half year results.

2. GROUP REORGANISATION

2.1 Share for Share Exchange

On 12 April 2018, RAI acquired 100% ownership of RA through a

share for share exchange transaction (the "Exchange"). The cost of

RA was established and accounted for with reference to IAS 27 which

states that when a parent reorganizes the structure of its group by

establishing a new entity as its parent, and meets specific

criteria, the new parent measures cost at the carrying amount of

its share of the equity items shown in the separate financial

statements of the original parent at the date of the

reorganisation. In the case of the Exchange, RA was the former

parent of the Group and all relevant criteria were met, as a result

the cost of RA was determined to be USD 29,278,000, being the

carrying amount of the equity of RA at the date of the

Exchange.

USD'000

Equity balances of RA at date

of Exchange

Share capital 272

Additional contributed capital 1,809

Retained Earnings 27,700

----------------

Total equity balances of RA at

date of Exchange 29,781

The consideration paid to the shareholders of RA was 139,999,998

ordinary shares of GBP 0.10 each.

The difference between the total equity balances of RA and the

nominal value of shares issued by RAI at the date of the Exchange

is recorded as a merger reserve. Upon consolidation, all

intra-group transactions, balances, income and expense are

eliminated, and the merger reserve is equal to the difference

between the nominal value of the shares issued by RAI and the total

share capital and additional contributed capital of RA at the date

of the Exchange.

2.2 Initial Public Offering

On 29 June 2018, RAI undertook an initial public offering

("IPO") and was admitted to trade on the Alternative Investment

Market ("AIM"), a sub-market of the London Stock Exchange. New

ordinary shares of 33,575,741 were issued on the date of the IPO

bringing the total number of shares outstanding to 173,575,741.

These shares have a par value of GBP 0.10 and were sold by RAI at

GBP 0.56 per share.

During the IPO process, the Group incurred USD 2,059,000 of

expenses which were incremental and directly attributed to the

equity raise. As per IAS 32, these costs are to be accounted for as

a deduction from equity raised and as a result the net proceeds of

the IPO were USD 22,672,000.

USD'000

Reconciliation of IPO proceeds

Proceeds from issue of share capital 24,731

Costs incurred and attributable

to issue of share capital (2,059)

----------------

Net proceeds from issue of share

capital 22,672

At 30 June 2018, USD 187,000 of IPO related costs were included

in Accounts Payable and Accruals, and subsequently settled in July

2018.

3. EXCEPTIONAL ITEMS

USD'000

Share listing costs (1) 1,306

Stock-based compensation and related

costs (2) 1,602

----------------

2,908

(1) Share listing costs represent advisory, legal, and other

costs incurred in connection with the IPO which have not been

accounted for as a deduction from equity raised. At 30 June 2018,

USD 371,000 of share listing costs were included in Accounts

Payable and Accruals, and subsequently settled in July 2018.

(2) On 29 June 2018, the majority shareholder of RAI gifted

2,142,855 personally owned shares of the Company to certain

employees of RA International FZCO as a reward for past employment

service. The fair value of the shares on the grant date was GBP

0.56 per share.

4. EARNINGS PER SHARE

The Group presents basic earnings per share ("EPS") data for its

ordinary shares. Basic EPS is calculated by dividing the profit

attributable to ordinary shareholders of the Group by the weighted

average number of ordinary shares outstanding during the period.

Diluted earnings per share is identical to basic earnings per

share.

Normalised earnings per share is calculated by dividing the

profit before exceptional items attributable to ordinary

shareholders of the Group by the weighted average number of

ordinary shares outstanding during the period.

As per IFRS 3, where a new parent entity is established by means

of a share for share exchange and its consolidated financial

statements have been presented as a continuation of the existing

group, the number of shares taken as being in issue for both the

current and preceding periods should be the number of shares issued

by the new parent entity. As a result, the historical weighted

average number of shares presented in the comparative EPS

calculation is 139,999,998, being the number of ordinary shares

exchanged for the entire share capital of RA.

6 months 6 months 6 months

ended ended ended

30 June 31 December 30 June

2018 2017 2017

Unaudited Unaudited Unaudited

Profit for the period (USD'000) 3,628 4,896 8,778

Weighted average number of ordinary

shares 140,371,001 139,999,998 139,999,998

---------------- ---------------- ----------------

Basic and diluted earnings per

share (cents) 2.6 3.5 6.3

Profit for the period before exceptional

item (USD'000) 6,536 4,896 8,778

---------------- ---------------- ----------------

Normalised basic and diluted earnings

per share (cents) 4.7 3.5 6.3

5. DIVIDS

During the interim period, a dividend of USD 12,500 per share

(10 shares) totalling USD 125,000 was declared and paid (6 months

ending 30 June 2017: USD 12,500 per share (10 shares) totalling USD

125,000 and 6 months ending 31 December 2017: USD 65,000 per share

(10 shares) totalling USD 650.000).

6. ACQUISITION OF SUBSIDIARY

On 1 January 2018, the Group acquired 100% of the share capital

of RA SB Ltd. and its subsidiary (together "RASB"), from one of its

shareholders, who is also a member of key management. The purchase

consideration of USD 594,000 represents the net book value of RASB

as at 1 January 2018. RA SB Ltd. is registered in Ras Al Khaimah,

UAE and operates in the Republic of Sudan through its subsidiary

which provides remote site services to the mining industry. The

acquisition is consistent with the Group's strategy of operating

across Africa.

The fair values of the identifiable assets and liabilities of

RASB as at the date of acquisition were:

USD'000

ASSETS

Property, plant, and equipment 69

Inventories 16

Accounts receivable, deposits,

and other receivables 688

Bank balances and cash 29

LIABILITIES

Accounts payable and accruals (208)

----------------

NET ASSETS 594

Net cash outflow on acquisition

USD'000

Consideration paid 594

Less:

Bank balances and cash acquired (29)

----------------

565

Acquisition costs of USD 6,000 relating to the acquisition of

RASB are included in Administrative Expenses within the current

accounting period.

For the 6 months ended 30 June 2018, RASB contributed USD

913,000 revenue and USD 239,000 profit before finance costs to the

Group results.

7. SEGMENT INFORMATION

For management purposes, the Group is organised into one segment

based on its products and services, which is the provision of

services in demanding and remote areas. Accordingly, the Group only

has one reportable segment. The Chief Operating Decision Maker

monitors the operating results of the business as a single unit for

the purpose of making decisions about resource allocation and

performance assessment.

Operating segments

Revenue, operating results, assets and liabilities presented in

the Condensed Financial Statements relate to the provision of

services in demanding and remote areas business of the Group.

Geographic segment

The Group is currently predominantly operating in Africa.

8. CASH AND CASH EQUIVALENTS

Cash and cash equivalents in the consolidated statement of cash

flows consist of the following condensed consolidated statement of

financial position amounts:

As at As at As at

30 June 31 December 30 June

2018 2017 2017

Unaudited Audited Unaudited

Bank balances and cash in hand 29,271 7,469 5,224

Less: restricted cash (2,000) (2,000) -

---------------- ---------------- ----------------

27,271 5,469 5,224

Restricted cash represents cash margin provided to a commercial

bank against issuance of a guarantee to a subsidiary. The value of

cash margin is equal to that of the value of the guarantee.

9. APPROVAL OF INTERIM FINANCIAL STATEMENTS

The condensed interim financial statements were approved by the

board of directors on 17 September 2018.

INDEPENDENT REVIEW REPORT TO RA INTERNATIONAL GROUP PLC (the

"Company")

Introduction

We have been engaged by the Company to review the condensed set

of financial statements in the half yearly financial report for the

six months ended 30 June 2018, which comprises the Interim

Condensed Consolidated Statement of Financial Position, the Interim

Condensed Consolidated Income Statement, the Interim Condensed

Consolidated Statement of Comprehensive Income, the Interim

Condensed Consolidated Statement of Changes in Equity, the Interim

Condensed Consolidated Statement of Cash Flows and related notes 1

to 9. We have read the other information contained in the half

yearly financial report and considered whether it contains any

apparent misstatements or material inconsistencies with the

information in the condensed set of financial statements.

This report is made solely to the Company in accordance with

guidance contained in International Standard on Review Engagements

2410 (UK and Ireland) "Review of Interim Financial Information

Performed by the Independent Auditor of the Entity" issued by the

Auditing Practices Board. To the fullest extent permitted by law,

we do not accept or assume responsibility to anyone other than the

Company, for our work, for this report, or for the conclusions we

have formed.

Directors' Responsibilities

The half-yearly financial report is the responsibility of, and

has been approved by, the directors. The directors are responsible

for preparing the half-yearly financial report in accordance with

International Accounting Standard 34, "Interim Financial

Reporting," as adopted by the European Union.

As disclosed in note 1, the annual financial statements of the

Group are prepared in accordance with International Financial

Reporting Standards ('IFRSs') as adopted by the European Union. The

condensed set of financial statements included in this half yearly

financial report has been prepared in accordance with International

Accounting Standard 34, "Interim Financial Reporting", as adopted

by the European Union.

Our Responsibility

Our responsibility is to express to the Company a conclusion on

the condensed set of financial statements in the half yearly

financial report based on our review.

Scope of Review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410, "Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity" issued by the Auditing Practices Board for use in

the United Kingdom. A review of interim financial information

consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures. A review is substantially less in scope than an

audit conducted in accordance with International Standards on

Auditing (UK) and consequently does not enable us to obtain

assurance that we would become aware of all significant matters

that might be identified in an audit. Accordingly, we do not

express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half yearly financial report for the six months ended 30

June 2018 is not prepared, in all material respects, in accordance

with International Accounting Standard 34 as adopted by the

European Union.

Ernst & Young LLP

Edinburgh

19 September 2018

Notes:

1. The maintenance and integrity of the RA International Group

PLC website is the responsibility of the directors; the work

carried out by the auditors does not involve consideration of these

matters and, accordingly, the auditors accept no responsibility for

any changes that may have occurred to the financial statements

since they were initially presented on the website.

2. Legislation in the United Kingdom governing the preparation

and dissemination of financial statements may differ from

legislation in other jurisdictions.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR GGUPUBUPRPUR

(END) Dow Jones Newswires

September 19, 2018 02:01 ET (06:01 GMT)

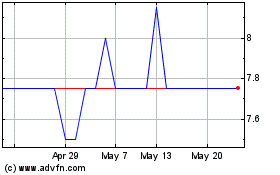

Ra (LSE:RAI)

Historical Stock Chart

From May 2024 to Jun 2024

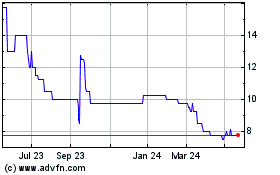

Ra (LSE:RAI)

Historical Stock Chart

From Jun 2023 to Jun 2024