TIDMPFD TIDMIRSH

RNS Number : 3940U

Premier Foods plc

29 July 2020

29 July 2020

Premier Foods plc (the "Company" or the "Group")

Trading update for the 13 weeks ended 27 June 2020

Strong Q1 trading +22.5%, supporting recently upgraded full year

expectations

-- Q1 Group sales up +22.5%, Q1 Branded sales up +27.0%

-- Q1 UK sales up +23.0%, Q1 Branded UK sales up +27.9%

-- Outperforming the market in every category

-- Online growth of +115%; ahead of the channel and gaining +2.7ppts share

-- Strong household penetration growth, particularly for Grocery brands

-- Advertising investment increasing from four to six major brands this year

-- Recently upgraded expectations for the full year unchanged;

initial Q2 volumes remain elevated

Alex Whitehouse, Chief Executive Officer

"As expected, we continued to see strong demand for our Grocery

brands in Q1, with consumers eating the vast majority of their

meals at home. We have grown faster than our categories during this

period, both in standard retail and online channels. This reflects

not only the strength of our market leading brands but also the

excellent performance of our colleagues across the supply chain to

ensure product availability while working in close collaboration

with our customers to meet this elevated demand."

"The health and wellbeing of all our colleagues has been, and

remains, of paramount importance to us. The additional measures we

put in place to safeguard our teams from early March are unchanged

and our manufacturing and distribution sites have all remained

fully operational."

"We continue to deploy our branded growth model strategy; our

innovation has performed particularly well in Q1 and the first of

our six brands on air this year benefitted from an extended period

of TV advertising in the quarter. We have also observed significant

increases in household penetration of our brands in the quarter, as

Britain has got cooking again and consumers expand their repertoire

of dishes prepared at home. For example, we have seen two million

new households buy our Sharwood's products over the quarter."

"We repaid GBP80m of our floating rate bonds in the quarter

which will reduce our annual interest bill by at least GBP4m and we

are exploring further opportunities to reduce our financing costs

as we continue to reduce Net debt. As anticipated, early Q2 trading

has seen further positive volume trends and our recently upgraded

expectations for the full year remain unchanged."

Q1 Sales % change Grocery Sweet Treats Group

Branded +39.2% +0.5% +27.0%

Non-branded (4.5%) +1.7% (3.3%)

-------- ------------- -------

Total +31.7% +0.7% +22.5%

-------- ------------- -------

Trading Update

===============

Group sales in Q1 increased 22.5% compared to the prior year,

with branded sales up 27.0%. These results substantially reflected

trends seen in the UK business, where total sales increased 23.0%

and branded sales were 27.9% ahead of last year. The Group saw

elevated levels of demand for its Grocery portfolio throughout the

quarter as households continued to experience few opportunities for

eating occasions out of home. While sales grew in double digit

percentage terms in each of the three months within the quarter,

the sales growth rate at the end of Q1 was lower than observed at

the beginning of the period.

The Group benefits from brands which are market leaders in their

respective categories. During the quarter, the Group delivered

consistently high availability of its product ranges through the

supply chain, during this prolonged period of higher demand. As a

result, the Group grew ahead of its categories in the quarter, with

particularly strong market share gains seen in Flavourings &

Seasonings; Quick Meals Snacks & Soups and Cakes. This

performance reflects sustained and dedicated efforts by all those

in the supply chain, keeping all the Group's sites fully

operational, while working in close collaboration with all our

customers.

Another notable feature of the quarter was the extent of growth

in the online channel. Over the last couple of years, the Group has

been investing in its online proposition and capabilities, working

closely with its retail partners. As a result of this, and the

wider market trend, the Group delivered growth of 115% in the

quarter, gaining 270 basis points of market share in this

channel.

Household penetration of the Company's brands has also grown

significantly over the last twelve weeks, due to increased demand

during lockdown. For example, household penetration of our Grocery

brands has increased by 620 basis points in the quarter to nearly

75%, when compared to the prior year.

Grocery

Grocery reported sales of GBP162.1m in Q1 and within this,

branded sales grew significantly, up 39.2% on the prior year. The

Group benefitted from more UK households buying its brands in the

quarter, as consumers sought to expand their range of home cooked

recipes and meals as lockdown restrictions continued. As a result,

all the Group's major Grocery brands delivered double-digit sales

increases compared to the same quarter a year ago, with

particularly notable performances from Ambrosia, Oxo and

Sharwood's. Nissin noodles products also proved to be extremely

popular, with sales more than doubling in the quarter.

The Group also saw demand for its new product ranges higher than

last year's rate of 6.5% of branded revenue, a good example being

the recently launched Cadbury baking mixes which were very well

received by consumers, reflecting a substantial rise in baking at

home during the quarter. This demonstrates that demand for the

Group's product ranges have been not only for its core ranges, but

also new product innovation, as consumers expand their repertoire

of meals eaten in home.

Non-branded Grocery sales declined by (4.5%) reflecting lower

end user demand for the Group's business to business product ranges

due to impacts from less out of home eating and drinking during the

Covid pandemic. This was partly offset by higher volumes of own

label Grocery to retail customers.

Sweet Treats

Sweet Treats sales increased by +0.7% compared to the same

quarter a year ago with branded sales up +0.5%. Cake volumes were

lower than the prior year in the earlier part of Q1, but delivery

of strong commercial plans resulted in a return to growth in the

latter part of the quarter. Mr Kipling was also supported by eight

weeks on air of its Little Thief TV advertising campaign and

benefits from the launch of its Mini pies range and Signature

premium ranges. Cadbury cake sales also grew in the UK, with the

core Cadbury Mini Rolls range performing very well across all

customers.

International

International sales grew by 13% in the quarter at constant

currency, partly due to a softer comparative in the prior year as

Brexit demand stocks unwound in Ireland. Australia cake sales were

lower as demand fell during lockdown restrictions, partly offset by

a strong Sharwood's performance in all geographies. As previously

announced, the Group has implemented a revised strategy for its

International business with the objective of building a

sustainable, profitable growing business, with greater market and

executional focus.

Outlook

========

Q2 sales have started strongly, however the Group anticipates

this trend to normalise through the quarter as consumers gradually

return to eating out of home. Looking to the full year, the Group

expects to make further progress as it continues to employ its

successful branded growth model strategy, which has been

instrumental in delivering twelve successive quarters of UK revenue

growth. Recently upgraded expectations for FY20/21 are unchanged,

which includes anticipated further Net debt reduction this

year.

Ends

For further information, please contact:

Institutional investors and analysts:

+44 (0) 1727

Duncan Leggett, Chief Financial Officer 815 850

Richard Godden, Director of Investor +44 (0) 1727

Relations & Treasury 815 850

Media enquiries:

Headland

+44 (0) 7884

Ed Young 666830

+44 (0) 7884

Francesca Tuckett 667661

Conference Call

A conference call for investors and analysts will take place on

29 July 2020 at 9.00am, details of which are outlined below. A

replay of the conference call will be available on the Company's

website later in the day.

Telephone number: +44 20 7192 8000

Telephone number (UK Toll

free) 0800 376 7922

Conference ID: 6549513

http://www.premierfoods.co.uk/investors/results-centre

A Premier Foods image gallery is available using the following

link:

http://www.premierfoods.co.uk/media/image-gallery

Certain statements in this trading update are forward looking

statements. By their nature, forward looking statements involve a

number of risks, uncertainties or assumptions that could cause

actual results or events to differ materially from those expressed

or implied by those statements. Forward looking statements

regarding past trends or activities should not be taken as

representation that such trends or activities will continue in the

future. Accordingly, undue reliance should not be placed on forward

looking statements .

Notes to editors:

1. Sales data is for the thirteen weeks to 27 June 2020 or 29 June 2019 as appropriate.

Q1 Sales (GBPm) FY20/21 FY19/20 % Change

Grocery

Branded 141.8 101.8 +39.2%

Non-branded 20.3 21.3 (4.5%)

-------- -------- ---------

Total 162.1 123.1 +31.7%

Sweet Treats

Branded 47.2 47.0 +0.5%

Non-branded 4.8 4.7 +1.7%

-------- -------- ---------

Total 52.0 51.7 +0.7%

-------- -------- ---------

Group

Branded 189.0 148.8 +27.0%

Non-branded 25.1 26.0 (3.3%)

-------- -------- ---------

Total 214.1 174.8 +22.5%

-------- -------- ---------

2. Market share data sourced from IRI, 13 weeks ended 27 June 2020.

3. Household penetration data sourced from Kantar Worldpanel, 12 weeks ended 14 June 2020.

4. Online channel data sourced from Major multiple retailer online channel platforms

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTFLFVTDSITFII

(END) Dow Jones Newswires

July 29, 2020 02:00 ET (06:00 GMT)

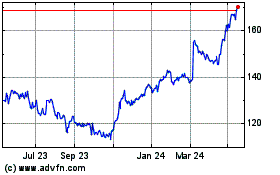

Premier Foods (LSE:PFD)

Historical Stock Chart

From May 2024 to Jun 2024

Premier Foods (LSE:PFD)

Historical Stock Chart

From Jun 2023 to Jun 2024