TIDMMIL

RNS Number : 8316S

Myanmar Investments Intl Ltd

09 November 2023

9 November 2023

Myanmar Investments International Limited

Proposed Cancellation of Admission to Trading on AIM and Notice

of a General Meeting

Myanmar Investments International Limited [AIM: MIL] ("MIL" or

the "Company"), the AIM-quoted Myanmar focused investment company,

today announces a proposal to cancel the admission of the Company's

ordinary shares to trading on AIM in accordance with Rule 41 of the

AIM Rules for Companies ("Cancellation").

A circular including a Notice of General Meeting and the

associated form of proxy (the "Circular") will be posted to

Shareholders today to convene the necessary general meeting of the

Company at 11.00 (GMT) on 1 December 2023 (the "General Meeting")

to approve the Cancellation. The Notice of General Meeting and the

associated form of proxy will be available on the Company's website

at: http://www.myanmarinvestments.com/

An extract of selected parts of the Circular is copied out

below, including the full text of the Chairman's letter contained

in the Circular, along with an expected timetable of principal

events related to the Cancellation. The definitions that apply

throughout this announcement can be found at the end of this

announcement.

The information contained within this announcement is deemed to

constitute inside information as stipulated under the retained EU

law version of the Market Abuse Regulation (EU) No. 596/2014 (the

"UK MAR") which is part of UK law by virtue of the European Union

(Withdrawal) Act 2018. The information is disclosed in accordance

with the Company's obligations under Article 17 of the UK MAR. Upon

the publication of this announcement, this inside information is

now considered to be in the public domain.

For further information please contact:

Nick Paris Jay Edwin

Managing Director CFO

Myanmar Investments International Myanmar Investments International

Limited Limited

+ 44 7738 470550 +95 9 262 277 338

nickparis@myanmarinvestments.com jayedwin@myanmarinvestments.com

Nominated Adviser

Philip Secrett / Jamie Barklem Broker

/ Ciara Donnelly William Marle

Grant Thornton UK LLP Cavendish Capital Markets Limited

+44 (0) 20 7383 5100 +44 (0) 20 7220 0500

Proposed Cancellation of Admission to Trading on AIM and

Notice of a General Meeting

1. Introduction

In June 2013, the Company was the first Myanmar-focused

investment company to be admitted to trading on AIM. The Company

was established with the intention of building long term

shareholder value by proactively investing in a diversified

portfolio of Myanmar businesses and it made investments in

businesses active in the telecom towers, microfinance and retail

pharmacy sectors. Since October 2019, the Company has however been

seeking to harvest its investments after Shareholders resolved to

make no new investments and to wind down the Company. As a result,

the retail pharmacy business was sold in December 2019.

The military coup in Myanmar took place in February 2021 and

there are increasing signs that it will be a long time before

business conditions normalise and the country again becomes

acceptable to broad range of international investors. As a result,

the Board of Directors has concluded that the realisation of the

remaining investments could be some time away and that urgent steps

are needed to conserve the Company's cash reserves which stood at

US$ 476,547.60 as at 6 November 2 023 in order to ensure that they

do not fall below 12 months forecast cash outflows which could then

mean that the Company is no longer a going concern.

The Company therefore announced on 12 June 2023 when issuing its

audited accounts to 31 March 2023 that further cost reduction

measures were under consideration including the cancellation of

admission of its Ordinary Shares to trading on AIM. Following

consultation with several Shareholders, the Directors have

concluded that it is in the best interests of the Company and its

Shareholders to cancel the admission of the Ordinary Shares to

trading on AIM.

Pursuant to Rule 41 of the AIM Rules, the Cancellation is

conditional on the approval of not less than 75 per cent. of those

votes cast by Shareholders (whether present in person, by corporate

representative or by proxy) at the General Meeting, notice of which

is set out on page 14 of this document. In connection with the

Cancellation, the Company proposes to amend and restate the

Articles to a form that, among others, reflects that the Company is

no longer AIM quoted. A summary of the proposed amendments to the

Articles is set out in paragraph 4 below. Pursuant to the Articles,

the Company may amend its Articles by a resolution approved by an

affirmative vote of 75 per cent. of the votes cast by Shareholders.

The amendments to the Articles are not effective until registered

with the BVI Registry of Corporate Affairs.

The purpose of the Circular is to provide notice of the General

Meeting, seek Shareholders' approval for the Resolutions, to

provide information on the background to and reasons for the

proposed Cancellation, to explain the consequences of the

Cancellation and provide reasons why the Directors unanimously

consider the Cancellation to be in the best interests of the

Company and its Shareholders as a whole.

2. Background to and reasons for the cancellation

The Directors believe that the military coup in Myanmar has

created significant uncertainty to the business prospects of the

Company's remaining investments and to the possibility of selling

them as planned (as further explained below). As neither of the

Company's investments pay dividends to the Company, its operating

costs have to be paid out of the Company's cash holding and

although the Directors have undertaken significant cost cutting in

recent years reflecting the decision to wind down the Company, the

current rate of annual operating costs, without the Cancellation,

is such that the cash reserves could be used up within a period of

approximately 22 months from the date of this document.

The Directors have identified that the costs of remaining on AIM

are significant and believe that approximately US$115,185 of direct

costs per annum could be saved in a full year through the

Cancellation, although the exercise of doing so will involve one

off costs including professional advisory costs of approximately

US$182,131, much of which have already been incurred by the

Company. In addition, the Company will after Cancellation make

other cuts to operating costs amounting to US$113,600 per annum as

a result of the reduced complexity of running the Company as an

unquoted business and all costs will be kept under constant review

to see if they can be reduced further. Shareholders need to be

aware that there is still no visibility on when the Company is

likely to be able to sell its interest in either of its two

remaining investments or any certainty that this will happen before

the current cash balances are used up by September 2025. In the

absence of a sale which brings in cash proceeds, the Company would

need to raise additional finance from its Shareholders or face the

prospect of being put into liquidation by the Directors.

The Directors have conducted a review of the benefits and

drawbacks to the Company and its Shareholders of remaining admitted

to trading on AIM and believe that the Cancellation is in the best

interests of the Company and the Shareholders as a whole. In

reaching this conclusion the Directors have considered the

following key factors:

-- the current investment objective of the Company is to realise

its remaining investments in an orderly fashion and return the net

proceeds to Shareholders. The Board remains committed to this

objective and will continue to do so should the Cancellation become

effective;

-- the considerable costs and legal and regulatory requirements

associated with maintaining the admission of the Ordinary Shares to

trading on AIM are, in the Director's opinion, now disproportionate

to the benefits to the Company and are not conducive to maximising

distributions to Shareholders;

-- the Company needs to ensure that its existing cash reserves

will last as long as possible given the current uncertainty to the

exit plans for its two remaining investments and reducing the

operating costs by implementing the Cancellation will extend the

time over which the current cash reserves can be expected to last

and preserving cash should enable the best possible exit prices to

be negotiated for the remaining investments as it will avoid the

situation where potential purchasers reduce their offer prices in

the anticipation that the Company has insufficient cash to allow it

time to seek other purchase offers; and

-- the Directors believe that the low levels of turnover in the

Ordinary Shares since the decision was taken to wind down the

Company in October 2019 indicate that few Shareholders have wanted

to trade their Ordinary Shares whilst they await the sale of the

Company's investments.

3. THE PROCESS FOR THE CANCELLATION

The Directors are aware that certain Shareholders may be unable

or unwilling to hold Ordinary Shares if the Cancellation is

approved and becomes effective. Such Shareholders should consider

selling their interests in the market prior to the Cancellation

becoming effective.

Under the AIM Rules, it is a requirement that the Cancellation

must be approved by not less than 75 per cent. of votes cast by

Shareholders at the General Meeting. Accordingly, the Notice of

General Meeting set out at the end of this document contains a

resolution of the Shareholders to approve the Cancellation.

Furthermore, Rule 41 of the AIM Rules requires any AIM company

that wishes the London Stock Exchange to cancel the admission of

its shares to trading on AIM to notify Shareholders and to

separately inform the London Stock Exchange of its preferred

cancellation date at least 20 clear Business Days prior to such

date. In accordance with AIM Rule 41, the Directors have notified

the London Stock Exchange of the Company's intention, subject to

the Resolutions being passed at the General Meeting, to cancel the

Company's admission of the Ordinary Shares to trading on AIM on 12

December 2023.

Accordingly, if the Cancellation Resolution is passed, the last

day of dealings in Ordinary Shares on AIM will be 11 December 2023

and the Cancellation will take effect at 7.00 a.m. on 12 December

2023. If the Cancellation becomes effective, Grant Thornton UK LLP

will cease to be the Nominated Adviser of the Company and the

Company will no longer be required to comply with the AIM Rules. If

the Resolutions relating to the amendment and restatement of the

Articles are passed, then the amended and restated Articles will be

in effect on or after the Cancellation.

If the Resolutions are not approved at the General Meeting and

Cancellation does not become effective, the admission of the

Ordinary Shares to trading on AIM will be maintained and the

Company's investment objective will remain unchanged. However, the

Company will then be unable to make the reductions in operating

costs that would have come as the result of the Cancellation.

4. THE PRINCIPAL EXPECTED EFFECTS oF THE cancellation

The principal expected effects of the Cancellation include the

following:

-- there will no longer be a formal market mechanism enabling

Shareholders to trade their Ordinary Shares and no other recognised

market is intended to be put in place to facilitate the trading of

Ordinary Shares;

-- the Company will no longer have an independent Nominated

Adviser or a broker after the Cancellation;

-- whilst the Ordinary Shares will still be freely transferable

and held within the CREST settlement system, it is likely that

their liquidity and marketability will be significantly reduced and

the current secondary market value of them may be adversely

affected as a consequence;

-- in the absence of a formal market and quote, it will be more

difficult for Shareholders to determine the market value of their

investment in the Company at any given time. There is no guarantee

that Shareholders will be able to realise their investment in the

Company following the Cancellation;

-- the regulatory and financial reporting regime applicable to

companies whose shares are admitted to trading on AIM will no

longer apply to the Company;

-- Shareholders will lose certain protections to minority

shareholders under the AIM Rules, such as the independence of the

Board and scrutiny of transactions with related parties,

potentially allowing larger shareholders to exercise more influence

and control;

-- the Company may no longer be required to seek Shareholder

approval, where applicable, for reverse takeovers and fundamental

changes in the Company's business;

-- the Company will not be required to announce material

developments as required by the AIM Rules, such as interim results,

final results, substantial transactions, related party

transactions, and the information maintained on the Company's

website under AIM Rule 26. However, the Company will continue to

maintain its website (https://www.myanmarinvestments.com/ ) and the

Directors intend to make all significant information available on

it and to continue to publish audited annual and unaudited interim

accounts of the Company;

-- the Company will no longer be subject to UK MAR regulating

inside information and other matters;

-- the Company will no longer be required to publicly disclose

any change in major shareholdings in the Company under the

Disclosure Guidance and Transparency Rules, although the Articles

do retain certain similar requirements;

-- whilst the Company's CREST facility will remain in place

immediately post the Cancellation, the Company's CREST facility may

be cancelled in the future and, although the Ordinary Shares will

remain transferable, they may cease to be transferable through

CREST. Post the Cancellation, additional formalities, such as a

written instrument of transfer, will be required pursuant to BVI

law in order to effect a transfer of Ordinary Shares; and

-- the Company will remain (and will comply with all regulatory

requirements to remain) registered as a company limited by shares

in the British Virgin Islands and will also remain subject to the

provisions of the Articles, pursuant to which Shareholder approval

is required for certain matters.

Pursuant to the Cancellation, the Company proposes to amend and

restate its Articles to reflect the consequences of the

Cancellation and to introduce certain protections for minority

shareholders. The form of the proposed amended and restated

Articles can be found on the Company's website

(https://www.myanmarinvestments.com/). In summary, the key proposed

amendments are set out below:

-- Deletion of definitions related to the listing, including

"Admission", "Securities Regulations", "Stock Exchange" and "UK

Companies Act", together with the corresponding provisions

throughout the M&A, including Takeover Provisions.

-- The maximum number of directors of the Company shall now be five, instead of twelve.

-- New share transfer restrictions have been incorporated with

the inclusion of pre-emption rights in favour of existing

Shareholders for transfers exceeding 3 per cent. of the issued

share capital and drag rights and tag-along rights for existing

Shareholders where other Shareholders intend to sell or transfer

more than 75 per cent. of the Ordinary Shares.

-- The Company shall not issue new shares at a discount without

the approval of not less than 75 per cent. of those votes cast by

Shareholders (whether present in person, by corporate

representative or by proxy) at a general meeting.

-- The emoluments of all directors and officers shall be fixed

by the Directors and shall be subject to an annual cap of US$50,000

per director or officer (as applicable).

-- In order to transfer shares in the Company after the

Cancellation, a share transfer form will be required pursuant to

BVI law and this has been reflected in the proposed amendments to

the Articles.

-- For convenience purposes, flexibility has been provided so

that for future Shareholder meetings, a form of proxy may be

delivered to the Company via email.

-- In light of the Cancellation, references to the rules and

legislation applicable to companies listed on the London Stock

Exchange have been removed. Regulation 24 (Disclosure of Interest

in Shares and Failure to Disclose) and Regulation 25 (Untraced

Shareholders) of the Articles have been retained with certain

appropriate amendments to reflect that the Company is no longer

trading on AIM.

Following Cancellation there will be a reduction in the number

of Directors. Subject to the Cancellation Resolution being approved

by Shareholders it is intended that I will resign effective

immediately after the Cancellation. It is also proposed that,

subject to the Cancellation Resolution being approved by

Shareholders, Nick Paris will resign on 31 December 2023.

The above considerations are not exhaustive, and all

Shareholders should seek their own independent advice when

assessing the likely impact of the Cancellation and of any possible

tax effects on them.

Certain Shareholders may be unable or unwilling to hold Ordinary

Shares following the Cancellation and they should consider selling

their Ordinary Shares on AIM prior to the Cancellation becoming

effective. The Board is however making no recommendation as to

whether or not Shareholders should buy or sell Ordinary Shares.

5. The Employee Share Option Plan

Cancellation will have the effect of accelerating the exercise

date of all of the outstanding options under the ESOP to the date

of Cancellation and thereafter all unexercised options would

expire. The ESOP holds options on behalf of current and former

employees of MIL which can be converted into 2,180,527 Ordinary

Shares representing approximately 5.7 per cent. of the number of

Ordinary Shares already in issue and the exercise prices of the

options vary according to the date that they were issued and range

between US$1.100 and US$1.265 per option. The options currently

expire at varying times up to November 2026 but as the price of MIL

shares was US$0.06 per Ordinary Share on 6 November 2023 they are

significantly out of the money.

The carried interest scheme that was put into effect in

September 2018 and which replaced the ESOP will not be affected by

the Cancellation, although this scheme would not result in any

payments if the investments were sold at their current net asset

values.

6. The Company's remaining investments and their disposal plans

The Company currently owns investments in Asia Pacific Towers

("APT") and Myanmar Finance International Limited ("MFIL") as

follows:

-- the investment in APT represents a holding of 4.1 per cent.

in the equity of this telecom towers business and it is held

alongside a stake of 2.1 per cent. owned by LIM Asia Special

Situations Master Fund Limited, a co-investor giving a combined

stake in APT of 6.2 per cent. MIL's stake was valued by the

Directors at US$10.0 million in the audited interim accounts for

the eighteen months ended 31 March 2023 before the portfolio level

discount of 25 per cent. was applied to calculate the net asset

value. The Directors anticipated being able to exit from APT via a

trade sale or flotation of APT on an Asian stock exchange although

the military coup in Myanmar on 1 February 2021 has delayed the

possibility of this happening and it is currently unclear when such

an exit can be achieved.

-- the investment in MFIL represents a holding of 37.5 per cent.

in the equity of this microfinance lender and MIL's stake was

valued by the Directors at US$0.5 million in the audited accounts

for the eighteen months ended 31 March 2023 before the portfolio

level discount of 25 per cent. was applied to calculate the net

asset value. On 1 April 2020, MIL announced that terms had been

agreed for all the equity shareholders in MFIL to sell 100 per

cent. of the company to Thitikorn plc, a Thai finance company.

However, on 31 August 2023, the Company announced that it had

mutually agreed with Thitikorn plc not to extend the terms with

respect to the sale by the Company and its co-shareholders of 100

per cent. of MFIL. MIL, and its co-shareholders, will continue to

explore other exit options, including with Thitikorn plc, to enable

a sale at the earliest opportunity.

In the audited accounts for the eighteen months ended 31 March

2023, the Directors also imposed a 25 per cent. valuation discount

on the value of the Company's two investments to reflect the added

uncertainty to their business prospects and to the possibilities of

selling them following the military coup which valued APT at US$7.5

million and MFIL at US$0.5 million.

The Company had net assets attributable to Shareholders as at 31

March 2023 of US$8.7 million or US$0.23 per Ordinary Share.

7. POTENTIAL DISTRIBUTION TO SHAREHOLDERS FOLLOWING DISPOSALS

The Directors are intent on disposing of the remaining two

investments owned by the Company in an orderly fashion and

subsequently, and subject to the requirements of applicable law,

consider a potential distribution to Shareholders and wind up the

Company. However, given the uncertain timing of the sale of both

APT and MFIL, the Directors believe that the cash reserves should

be conserved within the Company to pay future operating expenses as

they are incurred. When the sale of an investment has been

completed, the Directors will re-consider this decision and

consider capital distributions to Shareholders. If the investments

have not been sold before the time that the Company reaches a cash

level representing one year's forecast expenses, the Directors will

need to arrange alternative funding such as a loan from or

placement of new Shares with Shareholders or new investors.

EXPECTED TIMETABLE OF PRINCIPAL EVENTS

Event Time and/or date (1)(2)

Announcement of the proposed Cancellation 9 November 2023

Publication and posting of the Circular 9 November 2023

Latest time and date for receipt 11.00 a.m. (GMT) on 29

of Form of Proxy for General Meeting November 2023

Record date in respect of the General close of business on 29

Meeting November 2023

General Meeting 11.00 a .m. (GM T ) on

1 December 2023

Announcement of the results of the 1 December 2023

General Meeting

Last day of dealings in the Ordinary 11 December 2023

Shares on AIM

Cancellation of the Company's admission 7.00 a.m. on 12 December

of the Ordinary Shares to trading 2023

on AIM

DEFINITIONS

The following words and expressions shall have the following

meanings in this document unless the context otherwise

requires:

'AIM' AIM, the market operated by the London

Stock Exchange;

'AIM Rules' the rules for AIM companies as published

by the London Stock Exchange from time

to time;

'Announcement' the Company's announcement relating

to the contents of this Circular, dated

9 November 2023;

'Articles' the amended and restated memorandum

and articles of association of the Company;

'Board' or 'Directors' the directors of the Company;

'Business Day' any day which is not a Saturday, Sunday

or public holiday) on which banks are

open for business in the City of London;

'certificated' or 'in a share or other security which is not

certificated form' in uncertificated form;

'Cancellation' cancellation of the admission to trading

on AIM of the Ordinary Shares, in accordance

with Rule 41 of the AIM Rules, subject

to passing of the Cancellation Resolution;

'Cancellation Resolution' Resolution 1 to be proposed at the General

Meeting;

'Circular' or 'this the circular dated 9 November 2023;

document'

'Company' or 'MIL' Myanmar Investments International Limited,

a company incorporated in the British

Virgin Islands with registration number

1774652 and having its registered office

at Jayla Place, Wickhams Cay I, Road

Town, Tortola VG1110, British Virgin

Islands;

'CREST' the computerised settlement system to

facilitate transfer of title to or interests

in securities in uncertificated form

operated by Euroclear UK & Ireland Limited;

'ESOP' the employee share option plan that

operated from June 2013 to November

2016;

'Form of Proxy' the form of proxy for use at the General

Meeting, which accompanies this document;

'General Meeting' the general meeting of the Shareholders,

notice of which is set out on page 14

at the end of this document;

'London Stock Exchange' London Stock Exchange plc;

'Notice of General the notice of the General Meeting, which

Meeting' is set out on page 14 at the end of

this document;

'Ordinary Shares' ordinary shares of nil par value each

in the Company;

'Registrars' Link Market Services (Guernsey) Limited

of Mont Crevelt House, Bulwer Avenue,

St. Sampson, Guernsey, GY2 4LH, Channel

Islands;

'Regulatory Information has the meaning given to it in the AIM

Service' Rules for any of the services approved

by the London Stock Exchange for the

distribution of AIM announcements and

included within the list maintained

on the website of the London Stock Exchange;

'Resolutions' the resolutions to be proposed at the

General Meeting, as set out in the Notice

of General Meeting;

'Shareholder(s)' holder(s) of Ordinary Shares;

'UK' or 'United Kingdom' the United Kingdom of Great Britain

and Northern Ireland;

'UK MAR' Regulation (EU) (No 596/2014) of the

European Parliament and of the Council

of 16 April 2014 on market abuse to

the extent that it forms part of the

domestic law of the United Kingdom including

by virtue of the European Union (Withdrawal)

Act 2018 (as amended by virtue of the

European Union (Withdrawal Agreement)

Act 2020);

'uncertificated' or a share or security recorded in the

'in uncertificated form' Company's register of members as being

held in uncertificated form, title to

which may be transferred by means of

CREST (subject to BVI law requirements);

and

'US' or 'United States' the United States of America.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCUPGQPGUPWGAR

(END) Dow Jones Newswires

November 09, 2023 02:00 ET (07:00 GMT)

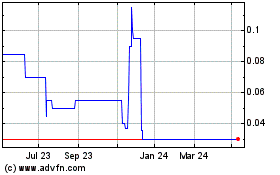

Myanmar Investments (LSE:MIL)

Historical Stock Chart

From Oct 2024 to Nov 2024

Myanmar Investments (LSE:MIL)

Historical Stock Chart

From Nov 2023 to Nov 2024