TIDMMER

RNS Number : 3853A

Mears Group PLC

21 January 2020

21 January 2020

The information contained within this announcement is deemed by

the Company to constitute inside information stipulated under the

Market Abuse Regulation (EU) No 596/2014). Upon the publication of

this announcement via the Regulatory Information Service, this

inside information is now considered to be in the public

domain.

Mears Group PLC

("Mears" or "the Group" or "the Company")

Full Year Trading Update, planned disposal of standalone

Domiciliary Care activities

and Notice of Results

Mears (LSE: MER), the provider of support services to the UK

Housing sector, announces the following unaudited update for the

year ended 31 December 2019 ('FY2019') and also that it is at an

advanced stage in the sale and exit from its standalone Domiciliary

Care operations.

Overview

Mears expects to report underlying profit before tax on

continuing activities in line with Board expectations and with a

strong closing cash performance. The Board has reached an advanced

stage in the sale of the England and Wales Domiciliary Care

business and intends to dispose of its Scottish standalone

Domiciliary Care business in 2020. Both these activities will

accordingly be reported as discontinuing within the 2019

results.

The Board expects to report revenues, on continuing activities

which excludes the Group's standalone Domiciliary Care activities,

of more than GBP900m (2018 adjusted: GBP773m). The revenue growth

of around 16% is predominantly driven by the acquisition of MPS,

which delivered revenues of circa GBP115m.

The Group is expected to report a closing net debt of circa

GBP52m (2018: GBP65.9m) which reflects conversion of EBITDA to

operating cash in excess of 100%. Average daily net debt during

2019 was GBP114m, which was impacted by the working capital

absorbed during the mobilisation of the Asylum Accommodation and

Support Contract ('AASC').

The Group continues to target a pre-IFRS 16 average net debt to

EBITDA of 1x.

The order book, adjusted to reflect continuing activities only,

stands at GBP2.5bn (2018 adjusted: GBP3.0bn) which is lower due to

the timing of existing contracts coming up for renewal.

Asylum Accommodation and Support Contract

The Board is pleased to report that the AASC mobilisation has

been executed successfully and is now fully operational. The

contract has delivered revenues in the year of approximately

GBP45m, with annualised revenues expected to be in excess of

GBP100m. Mears made substantial changes to the contract's property

portfolio during the fourth quarter which better positions the

Group to improve returns whilst delivering a high quality service.

The Company is well placed to deliver further improvements in

2020.

Housing Development

As previously advised, the Group intends to reduce its exposure

to Development. The Company continues to withdraw from this

activity through a controlled unwinding of revenue whilst keeping

working capital under tight control.

Also, as previously indicated, the property acquisition

facility, which was introduced in 2017 to enable the Group to

acquire and build portfolios of properties prior to their disposal

to long term funding partners, was paid down and has been

cancelled.

Planned disposal of standalone Domiciliary Care activities

As indicated previously, the Group has considered opportunities

to accelerate an exit from standalone care. The Group has continued

to progress this since indicating this intention within the 2019

half year statement.

The Group announces that it is at an advanced stage in the sale

of the England and Wales Domiciliary Care business. These

activities generated revenues of circa GBP36.0m and a profit

contribution, after an allocation of support costs, of circa GBP1.7

million in 2019. The disposal will result in around 1,500 employees

leaving the Group across 18 branches.

In addition, during the fourth quarter of 2019, the Group

completed the closure of a small number of England-based branches,

delivering annual revenues of circa GBP21.0m and a low profit

contribution, which were not subject to the sale.

The Board expects to complete the disposal of its Scotland

Domiciliary Care business during 2020. The Scottish business

generated revenues of circa GBP22m and a profit contribution, after

an allocation of support costs, of circa GBP0.9m in 2019. It

employs around 1,000 people across 16 branches.

The standalone Domiciliary Care activities as a whole will be

reported as discontinuing in the 2019 results and the associated

intangible asset will be written down to reflect this. This

impairment review will be concluded before the 2019 results are

reported but it is estimated that the goodwill impairment will be

approximately GBP85.0m before other costs relating to the closure,

including the impairment of fixed assets and transaction related

legal costs. Full provision will be made for the closure and

disposal in the 2019 results. The impairment of goodwill and fixed

assets are non-cash items.

Importantly, as a result of the Domiciliary Care disposal, a

number of personnel from a range of support functions also transfer

with the business. This will provide the Group an opportunity to

further rationalise its support functions in due course.

The Extra Care and Supported Living activities remain core to

the Group's Housing with Care strategy and will be retained. In the

year ended 31 December 2019, revenues from these activities were

approximately GBP20m with an operating margin in excess of 5.0%.

They will be reported within the Housing segment and continuing

activities. The retention of these capabilities provide the Group

with a demonstrable competence in the management of vulnerable

people, and is expected to facilitate other value generating

opportunities in the future.

Capital Markets Event and Notice of Results

The Group is today hosting a number of institutional investors

with a presentation on the Asylum Accommodation and Support

Contract. The presentation will be made available on the Company's

website.

Mears will issue its full year results for FY2019 on Tuesday 24

March 2020.

The numbers in this update remain subject to final close

procedures and the full year audit.

David Miles, Chief Executive Officer of the Group,

commented:

"2019 was a very busy year for Mears. A significant amount of

time and focused effort has been directed towards the integration

of MPS and the mobilisation of the asylum housing contract. I am

confident that we are well placed to benefit from this upfront

investment in our core business.

"Our exit from standalone Domiciliary Care will enable us to

focus our efforts where we can deliver superior returns for

shareholders. In line with this, we also continue to make progress

unwinding our exposure to Development activities.

"We continue to see a good pipeline of opportunities providing

Housing with Care, in the majority of cases to provide, manage and

maintain accommodation and to care for the service users.

"Our deep understanding of the challenges faced by service users

and proven ability to support vulnerable customers, many of whom

have a care requirement, has been central to our success in

Housing, and most recently in securing the asylum housing contract.

This bespoke skillset is key to our future success."

For further information, contact:

Mears Group PLC

David Miles, Chief Executive Tel: +44(0)7778 220 185

Officer

Andrew Smith, Finance Director Tel: +44(0)7712 866 461

Alan Long, Executive Director Tel: +44(0)7979 966 453

www.mearsgroup.co.uk

Buchanan

Mark Court/Charlotte Slater Tel: +44(0)20 7466 5000

mears@buchanan.uk.com

About Mears

Mears currently employs around 9,000 people and provides

services in every region of the UK. In partnership with our Housing

clients, we maintain, repair and upgrade the homes of hundreds of

thousands of people in communities from remote rural villages to

large inner city estates. Mears has extended its activities to

provide broader housing solutions to solve the challenge posed by

the lack of affordable housing and to provide accommodation and

support for the most vulnerable. Following the disposal of the

Group's standalone Domiciliary Care activities, the employee number

will reduce to around 6,500.

We focus on long-term outcomes for people rather than short-term

solutions, and invest in innovations that have a positive impact on

people's quality of life and on their communities' social, economic

and environmental wellbeing. Our innovative approaches and market

leading positions are intended to create value for our customers

and the people they serve while also driving sustainable financial

returns for our providers of capital, especially our

shareholders.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTKZGZMGGLGGZZ

(END) Dow Jones Newswires

January 21, 2020 02:00 ET (07:00 GMT)

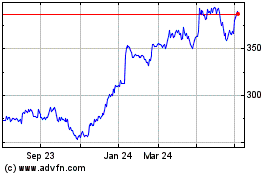

Mears (LSE:MER)

Historical Stock Chart

From Mar 2024 to Apr 2024

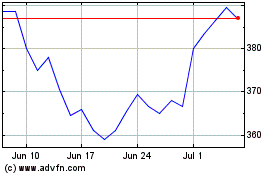

Mears (LSE:MER)

Historical Stock Chart

From Apr 2023 to Apr 2024