TIDMLFI

LONDON FINANCE & INVESTMENT GROUP P.L.C.

("Lonfin", "the Company" or "the Group")

Preliminary announcement of unaudited results for the year ended 30th June 2012

London Finance & Investment Group P.L.C. (LSE: LFI, JSE: LNF), the investment

company whose assets primarily consist of three Strategic Investments and a

General Portfolio, today announces its Preliminary Results for the year ended

30th June 2012.

Chairman's statement

Lonfin is an investment company whose target is to achieve growth in

shareholder value in real terms over the medium to long term while maintaining

a progressive dividend policy.

In the short term, the performance of the Company can be influenced by overall

stock market performance and to diversify this short term risk the Company has

a combination of Strategic Investments and a General Portfolio. Strategic

Investments are significant investments in smaller U.K. quoted companies and

these are balanced by a General Portfolio, which consists of investments in

major U.K. and European equities and provides an exposure to the equity market.

At 30th June 2012, the three Strategic Investments, in which we have Directors

in common, were our associated company Western Selection P.L.C. and MWB Group

Holdings Plc and Finsbury Food Group Plc. Detailed comments on our Strategic

Investments are given below.

- Net assets have decreased by 11.1% from 35.0p per share to 31.1p per

share

- The General Portfolio has decreased by 4.2% compared to declines of 6.3%

and 8.1% in FTSE100 and FTSE Eurofirst 300 respectively.

- The General Portfolio is yielding 3.0% (2011 - 3.1%).

- There are no net borrowings (2011 - borrowings equal to 17% of the value

of liquid stock market investments)

- Operating costs have been reduced.

Disposal of Investment Property

At the General Meeting on 21st December 2011 shareholders approved the disposal

of the Company's investment property for gross proceeds of GBP2,625,000. Net cash

proceeds after transaction costs and tax are GBP2,495,000 compared to the

estimate of GBP2,397,000, mainly due to lower tax payable. Sale proceeds were

received on 23rd December 2011 and the transaction formally completed on 27th

January 2012. The sale proceeds are being held in cash pending reinvestment in

the General Portfolio.

Results

Our net assets per share have decreased 11.1% to 31p from 35p last year

(including a valuation of GBP2,093,000 of the investment property, in place of

the book value of GBP367,000). The decrease reflects the decline in the value of

our Strategic Investments by 14%, particularly in MWB Group. The General

Portfolio decreased by 4.2%, outperforming the markets, where a decrease in the

FTSE 100 index was 6.3% and in the FTSE Eurofirst 300 index, 8.1%, over the

year.

The Group achieved a profit for the year, before tax and the fair value

adjustments of investments, of GBP2,003,000 (2011 - GBP123,000). The profit after

fair value adjustments, tax and non-controlling interest was GBP869,000 (2011 - GBP

2,118,000) giving a profit per share of 2.9p (2011 - 6.8p).

Strategic Investments

Western Selection P.L.C. ("Western")

The Group owns 7,864,412 shares, being 43.8% of the issued share capital of

Western.

On 27th September 2012, Western announced a profit before associates and tax of

GBP164,000 for its year to 30th June 2012 (2011 - GBP136,000). Including associates

and after exceptional items and tax, losses per share were 1.0p (2011 - profits

- 2.6p).

Western has paid an interim dividend of 0.80p and proposes an increased final

dividend of 0.9p (2011 - 0.85p). Western's net assets at market value were GBP

12,895,000, equivalent to 72p per share, a decrease of 14% from 84p last year.

Our share of the net assets of Western including the value of Western's

investments at market value, was GBP5.6 million (2011 - GBP6.6 million). The fair

value recorded in the statement of financial position is the market value of GBP

3,144,000 (2011 - GBP3,458,000). This represents 32% (2011 - 37%) of the net

assets of the Group.

Mr. D. C. Marshall is the Chairman of Western and Mr. Robotham and Mr. Beale,

the chief executive of our subsidiary company (City Group P.L.C.), are

non-executive Directors. Western has Strategic Investments in Creston plc,

Northbridge Industrial Services plc, Swallowfield plc and Hartim Limited. An

extract from Western's announcement of its Strategic Investments is set out

below:

Creston plc

Creston is a marketing services group whose strategy is to grow within

its sector both by organic growth and through selective acquisition to

become a substantial, diversified marketing services group. Further

information about Creston is available on their website:

www.creston.com.

The audited results for the year to 31st March 2012, show a profit after

tax of GBP10,300,000 (2011 - GBP10,400,000), equivalent to fully diluted

earnings of 12.34p per share (2011 - 12.39p).

Western maintained its holding of 3,000,000 shares in Creston, which is

4.9% of their issued share capital. The value of this investment at 30th

June 2012 was GBP1,650,000 (2011 - GBP3,390,000) being 13% (2011 - 23%) of

Western's assets.

Northbridge Industrial Services PLC

Northbridge hires and sells specialist industrial equipment to a

non-cyclical customer base. With offices or agents in the U.K., U.S.A.,

Dubai, Germany, Belgium, France, Australia, Singapore, India, Brazil,

Korea and Azerbaijan, Northbridge has a global customer base. This

includes utility companies, the oil and gas sector, shipping,

construction and the public sector. The product range includes

loadbanks, transformers, generators, compressors, loadcells and oil

tools. Further information about Northbridge is available on their

website: www.northbridgegroup.co.uk.

Northbridge announced profits of GBP2,321,000 for the year ended 31st

December 2011 (2010 - GBP3,036,000) and declared a final dividend of 3.25p

per share, making 5.0p for the year (2010 - 4.6p).

Western maintained its holding of 2,200,000 shares in Northbridge, which

is 14.3% of their issued share capital. The value of this investment at

30th June 2012 was GBP5,984,000 (2011 - GBPGBP6,094,000) being 46 % (2011 -

40%) of Western's assets.

Swallowfield plc

Swallowfield is a market leader in the development, formulation,

manufacture and supply of cosmetics, toiletries and related household

products for global brands and retailers operating in the cosmetics,

personal care and household goods market. Further information about

Swallowfield is available on their website: www.swallowfield.com.

Swallowfield announced itsannual results to June 2012 showing a profit

after tax of GBP1,263,000 compared to GBP1,082,000 (restated) for the

comparable period last year. Dividends of GBP118,000 (2011 - GBP116,000)

were received from Swallowfield during the year.

At the reporting date Western owned 1,869,149 shares which is 16.5% of

their issued share capital. The market value of this investment on 30th

June 2012 was GBP2,187,000 (2011 - GBP1,922,000), being 17% (2011 - 13%) of

Western's net assets.

Investments in Associates

Hartim Limited

Hartim is the unquoted holding company for Tudor Rose International

Limited ("TRI") which was founded in 1984. It works closely with a

number of leading UK branded fast moving consumer goods companies,

offering a complete sales, marketing and logistical service. Based in

Stroud, Gloucestershire, TRI sells into 78 countries worldwide including

USA, Spain, Portugal, Italy, Czech Republic, Russia, Turkey, South

Africa, Saudi Arabia, UAE, Malaysia, Australia and China. Hartim has

acquired out of administration its principal distributor in Australia;

to maintain and improve the service that it can offer to principals.

Losses are being incurred by this business while it is being turned

around. Hartim has also incurred an exceptional loss in a legal dispute

about the exercise of the break clause in a property lease.

Western holds 49.5% of Hartim, which has a 31st December year end and

sustained losses in 2011 of GBP220,000 after tax on turnover of GBP

27,799,000. Western's share of the consolidated loss after exceptional

items and tax for the twelve months to 30th June 2012 was GBP342,000 (2011

- profit - GBP337,000) and the book value of the investment at 30th June

2012 was GBP1,124,000 (2011 - GBP1,465,000), being 9% (2011 - 10%) of

Western's assets.

MWB Group Holdings Plc ("MWB")

MWB is a hotel, serviced offices and retail group that is in the process of

realising its assets through an orderly disposal programme. Further information

about MWB is available on its website: www.mwb.co.uk.

The Group holding in MWB was unchanged from the 2 million shares held at June

2011, representing 1.22% of MWB's issued share capital. The market value at

30th June 2012 was GBP70,000 (2011 - GBP775,000), compared with a cost of GBP

1,681,000, and represents 1% (2011 - 8%) of the net assets of the Group.

The share price of MWB has declined significantly over the recent year and we

have made an impairment provision in the subsidiary holding this investment of

GBP1,611,000 and also provided an equal amount in the parent company against the

loan to that subsidiary.

Mr. D.C. Marshall is a non-executive director of MWB.

Finsbury Food Group Plc ("Finsbury")

Finsbury is one of the largest producers and suppliers of premium cakes, bread

and morning goods in the UK. The Group currently supplies most of the UK's

major supermarket chains, including Asda, Co-op, Morrisons, Sainsbury,

Somerfield, Tesco and Waitrose. Further information about Finsbury is available

on its website: www.finsburyfoods.co.uk.

The Group holding in Finsbury remains at 8 million shares, representing 15.18%

of their share capital. The market value of the holding was GBP1,880,000 on 30th

June 2012 (cost - GBP1,893,000) and represents 19% (2011 - 18%) of the net assets

of the Group.

Mr. D.C. Marshall and Mr. Beale, the Chief Executive of our subsidiary company

City Group P.L.C., are non-executive Directors of Finsbury.

General Portfolio

The General Portfolio is well spread with material interests in Food and

Beverages, Oil, Natural Resources, Chemicals, and Tobacco. We believe that the

portfolio of quality companies we hold has the potential to outperform the

market in the medium to long term, especially in respect of our Western

European holdings.

The number of holdings in the General Portfolio has increased to 30 from 23.

The proceeds from the sale of our investment property are being reinvested in

the General Portfolio and we have increased the amount invested in the General

Portfolio over the year by GBP171,000 (2011: decreased by GBP464,000).

Operations & Employees

All of our operations and those of our associate, Western, except investment

selection, are outsourced to our subsidiary, City Group P.L.C. City Group also

provides office accommodation, company secretarial and head office finance

services to a number of other U.K. and Jersey clients. City Group has

responsibility for the initial identification and appraisal of potential new

strategic investments for the Group and the day to day monitoring of existing

strategic investments.

Dividend

The Company will be recommending a final dividend for the year ended 30th June

2012 of 0.35p and further details will be announced shortly.

Outlook

We remain concerned that the high national debts of developed countries can

only be reduced significantly through prolonged austerity and/or substantial

inflation. We remain invested in large diversified international non-financial

companies, which we think are well placed to outperform the market. We hope

that volatility in the financial markets will provide long term investors, such

as ourselves, with buying opportunities.

By Order of the Board

CITY GROUP P.L.C.

Secretaries

28th September 2012

Unaudited Consolidated Statement of Comprehensive Income

For the year ended 30th June 2012 2011

GBP000 GBP000

Dividends - Listed investments 265 251

Interest receivable 4 -

Rental and other income 70 94

(Losses)/Profits realised on sales of investments (32) 266

Management services fees 295 398

---------- ----------

Operating income 602 1,009

Administration expenses (638) (749)

---------- ----------

Operating (loss)/profit (36) 260

Unrealised changes in the carrying value of investments (1,134) 1,995

Exceptional profit on disposal of property 2,137 -

Interest payable (27) (110)

---------- ----------

Profit on ordinary activities before taxation 940 2,145

Tax on result of ordinary activities (65) (19)

---------- ----------

Profit on ordinary activities after taxation 875 2,126

Non-controlling interest (6) (8)

---------- ----------

Profit for the financial year attributable to members of 869 2,118

the holding company

Other comprehensive income - -

---------- ----------

Total comprehensive income attributable to shareholders 869 2,118

======= =======

Reconciliation of headline earnings

Basic profit per share 2.8p 6.8 p

Adjustment for the unrealised changes in the carrying 3.6p (6.4)p

value of investments, net of tax

---------- ----------

Headline profit per share 6.4p 0.4 p

====== ======

All profits and losses are on continuing activities.

Unaudited Consolidated Statement of Changes in Shareholders' Equity

Retained

Unrealised Share of realised

Ordinary Share profits/ undistributed profits Non-

Share Premium Revaluation (losses) on results of & Controlling Total

Capital account Reserve investments Subsidiaries losses Total interests equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Year ended 30th June

2011

Balances at 1st July 1,560 2,318 330 (3,747) 791 6,004 7,256 84 7,340

2011

Total comprehensive - - - 1,997 113 8 2,118 8 2,126

income

------ ------ ------ ------ ------ ------ ----- ------ ------

Shares issued - 2 - - - - 2 - 2

Dividends paid - - - - - (187) (187) - (187)

------ ------ ------ ------ ------ ------ ----- ------ ------

Total transactions - 2 - - - (187) (185) (185)

with shareholders

------ ------ ------ ------ ------ ------ ----- ------ ------

Balances at 30th 1,560 2,320 330 (1,750) 904 5,825 9,189 92 9,281

June 2011

------ ------ ------ ------ ------ ------ ----- ------ ------

Year ended 30th

June 2012

Balances at 1st 1,560 2,320 330 (1,750) 904 5,825 9,189 92 9,281

July 2011

------ ------ ------ ------ ------ ------ ------ ------ ------

Total - - - 2,086 (1,476) 259 869 6 875

comprehensive

income

------ ------ ------ ------ ------ ------ ------ ------ ------

Transfer on - - (330) - - 330 - - -

disposal

------ ------ ------ ------ ------ ------ ------ ------ ------

Dividends paid - - - - - (343) (343) - (343)

------ ------ ------ ------ ------ ------ ------ ------ ------

Total - - - - - (343) (343) - (343)

transactions

with

shareholders

------ ------ ------ ------ ------ ------ ------ ------ ------

Balances at 1,560 2,320 - 336 (572) 6,071 9,715 98 9,813

30th June 2012

------ ------ ------ ------ ------ ------ ------ ------ ------

Unaudited Consolidated Statement of Financial Position

At 30th June 2012 2011

GBP000 GBP000

Non-current Assets

Tangible assets 4 367

Investments 5,094 5,933

----------- -----------

5,098 6,300

----------- -----------

Current Assets

Listed investments 4,533 4,668

Trade and other receivables 272 260

Cash at bank 2,217 21

----------- -----------

7,022 4,949

Current Liabilities

Trade and other payables: falling due within one year (2,307) (1,968)

----------- -----------

Net Current Assets 4,715 2,981

----------- -----------

Total Assets less Current Liabilities 9,813 9,281

======= =======

Capital and Reserves

Called up share capital 1,560 1,560

Share premium account 2,320 2,320

Revaluation reserve - 330

Unrealised profits and losses on investments 336 (1,750)

Share of retained realised profits and losses of (572) 904

subsidiaries

Company's retained realised profits and losses 6,071 5,825

----------- -----------

9,715 9,189

Non-controlling equity interests 98 92

----------- -----------

9,813 9,281

======= =======

Unaudited Company Statement of Financial Position

at 30th June 2012 2011

GBP000 GBP000

Non-current Assets

Tangible assets - 367

Investments in Group companies 5,987 7,726

----------- -----------

5,987 8,093

Current Assets ----------- -----------

Listed investments 4,533 4,668

Trade and other receivables 18 38

Bank balance 2,202 -

----------- -----------

6,753 4,706

Current Liabilities

Trade and other payables: falling due within one year (2,236) (1,915)

----------- -----------

Net Current Assets 4,517 2,791

----------- -----------

Total Assets less Current Liabilities 10,504 10,884

======= =======

Capital and Reserves

Called up share capital 1,560 1,560

Share premium account 2,320 2,320

Revaluation reserve - 330

Unrealised profits and losses on investments 553 849

Realised profits and losses 6,071 5,825

----------- -----------

Equity shareholders' funds 10,504 10,884

======= =======

Unaudited Consolidated Statement of Cash Flow

For the year ended 30th June 2012 2011

GBP000 GBP000

Cash flows from operating activities

Profit before tax 940 2,145

----------- -----------

Adjustments for non-cash and non-operating activities

-

Finance expense 27 110

Profit on disposal of property (2,137) -

Depreciation charges 5 10

Unrealised changes in the fair value of investments 1,134 (1,995)

----------- -----------

(971) (1,875)

----------- -----------

Taxes paid (17) (19)

----------- -----------

Changes in working capital

Decrease in trade and other receivables (12) 34

(Decrease) in trade and other payables 158 (6)

Decrease in current asset investments (161) 285

----------- -----------

(15) 313

----------- -----------

Net cash inflow from operating activities (63) 564

----------- -----------

Cash flows from disposal of property 2,495 -

----------- -----------

Cash flows from financing

Shares issued - 2

Interest paid (27) (110)

Equity dividends paid (343) (187)

Net repayment of loan facilities 134 (265)

----------- -----------

Net cash outflow from financing (236) (560)

----------- -----------

Increase/(Decrease) in cash and cash equivalents 2,196 4

Cash and cash equivalents at the beginning of the year 21 17

----------- -----------

Cash and cash equivalents at end of the year 2,217 21

====== ======

Notes

1. Earnings per share are based on the profiton ordinary activities after

taxation andnon controllinginterests and on 31,207,479shares

(2011-31,205,694) being the weighted average of the number of shares in

issue during the year.

2. The financial information in this preliminary announcement of unaudited

group results does not constitute the company's statutory accounts for

the years ended 30th June 2012 or 30th June 2011 but is derived from

those accounts. The accounts have been prepared in accordance with

International Financial Reporting Standards (IFRS) as adopted by the

European Union and with those parts of the Companies Act 2006 applicable

to companies reporting under IFRS. The accounts are prepared on the

historical cost basis, except for certain assets and liabilities which

are measured at fair value, in accordance with IFRS and comply with IAS

34. The audited accounts of the group for the year ended 30th June 2011

were reported on with an unqualified audit report and have been

delivered to the Registrar of Companies.

Enquiries to:

London Finance & Investment Group P.L.C. 020 7448 8950

David Marshall / Edward Beale

END

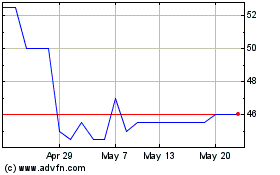

London Finance & Investm... (LSE:LFI)

Historical Stock Chart

From May 2024 to Jun 2024

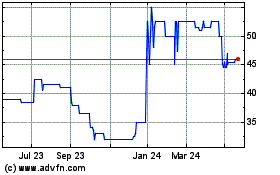

London Finance & Investm... (LSE:LFI)

Historical Stock Chart

From Jun 2023 to Jun 2024