Circ re Proposed Disposal of Investment Property

November 29 2011 - 2:00AM

UK Regulatory

TIDMLFI

29 November 2011

London Finance & Investment Group P.L.C.

("LFIG" or the "Company")

Posting of Class 1 Circular in connection with

Proposed Disposal of Investment Property

Further to the announcement made on 4 November 2011, the Company is pleased to

announce that it has posted a Class 1 Circular to Shareholders (the "Circular")

on Monday 28th November 2011 seeking Shareholder approval for the disposal of

the Company's property in Rutland Gate, Knightsbridge, London (the `Property')

for a cash consideration of GBP2.625 million (the "Disposal"). A notice of

General Meeting is set out at the end of the Circular convening a General

Meeting of the Company to be held at 30 City Road, London EC1Y 2AG at 3.30 p.m.

on 21 December 2011.

The Circular is available from the offices of the Company and from its website,

www.city-group.com.

The Circular includes the following additional disclosure in relation to the

financial effects of the Disposal and also clearly sets out the Investment

Policy.

Subject to Shareholder approval, the expected cash proceeds of the Disposal,

net of transaction costs and tax will be GBP2,397,000, representing 34.9 per

cent. of the Company's market capitalisation as at 25 November 2011, the last

practicable date prior to the publication of this Document. The cash proceeds

of the Disposal will be held on the Company's balance sheet as cash and cash

equivalents pending reinvestment in line with the Company's investment policy,

as set out below. The effect on earnings will be that the Company will no

longer receive annual rental income from the Property of GBP53,000 per annum;

this will be offset to the extent that a return can be made on new investments

and the Net Cash Proceeds pending investment.

Investment Policy

The Company's investment policy is to invest in a range of "strategic"

investments, a "general portfolio" consisting primarily of highly liquid stock

market investments, both in equity instruments and bonds, and, at the Board's

discretion, `other investments', typically property and other physical assets.

This investment policy is designed to achieve the Company's objectives of

capital growth in real terms over the medium term, while maintaining a

progressive dividend policy.

Both "strategic" and "general portfolio" investments can be in any industry

sector. "Strategic" investments are significant minority positions in UK small

cap companies which can be either quoted or unquoted; to diversify risk, the

policy is to maintain a number of such investments. Most such investments will

be in shares of companies that are publicly traded but investments can also be

made in publicly traded and untraded debt or equity instruments of companies

that are strategic investments. The "general portfolio" aims to further

diversify risk through a spread of investments and a target of between 20 and

30 holdings in some of the largest European quoted companies.

The intention is for between 30 per cent. and 70 per cent. of the overall

investment portfolio with a maximum limit of 80 per cent. to be in "strategic"

investments at the point of investment, with the balance of the portfolio, net

of "other investments", to be in the "general portfolio". "Other investments"

will be limited to 20 per cent. of the overall value of the investment

portfolio, measured at the point of investment. No one "strategic investment"

or "other investment" will represent more than 30 per cent. and 20 per cent.

respectively of the value of all investments at the time of making such

investment and no one "general portfolio" investment will represent more than

10 per cent. of the value of the "general portfolio" at the time of such

investment.

Within these parameters, changes in strategic and other investments are decided

on by the Board and changes to the general portfolio are decided on by the

Board or, between Board meetings, by an Investment Committee of the Board. The

investment guidelines within which the Investment Committee operates allow the

Investment Committee discretion within the parameters set by the Investment

Policy. The investment mix and level of borrowings are reviewed at each board

meeting.

The Company's gearing is limited at or below 70 per cent. of the total value of

investments.

Enquiries:

London Finance & Investment Group P.L.C.

Lloyd Marshall

Tel: 020 7448 8950

Beaumont Cornish Limited, Sponsor

Roland Cornish

Tel: 0207 628 3396

END

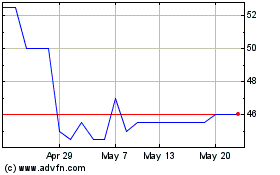

London Finance & Investm... (LSE:LFI)

Historical Stock Chart

From May 2024 to Jun 2024

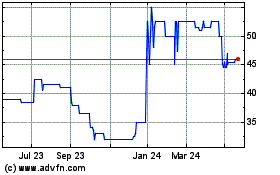

London Finance & Investm... (LSE:LFI)

Historical Stock Chart

From Jun 2023 to Jun 2024