TIDMLBE

RNS Number : 5271M

Longboat Energy PLC

22 September 2021

Longboat Energy plc

("Longboat Energy", the "Company" or "Longboat")

Interim Results to 30 June 2021

London, 22 September 2021 - Longboat Energy, the emerging

full-cycle North Sea E&P company with a portfolio of

significant, near-term, low-risk exploration assets, is pleased to

announce its unaudited interim results for the period to 30 June

2021.

Highlights

-- Secured three bilateral transactions to acquire a significant,

near-term, low-risk exploration drilling programme on the Norwegian

Continental Shelf ("NCS")

-- Seven firm wells drilling over the next 18 months

-- Net mean resource potential of 104 mmboe(1)

-- Total net upside case potential of 324 mmboe(1)

-- Completed GBP35 million equity raise and NOK 600 million (GBP50

million) Exploration Finance Facility

-- Fully funded through the seven well drilling programme(2)

-- Qualified as licence holder on the NCS

-- One of only 38 companies qualified on the NCS (versus >130

on the UKCS)

-- New status removes transaction hurdles, positioning Longboat

for further value accretive M&A

Operations

-- Drilling has already commenced on two exploration wells: Rødhette

(Longboat 20%) and Egyptian Vulture (Longboat 15%)

-- Mugnetind (Longboat 20%), expected to commence drilling by the

end of September

-- Drilling at Ginny/Hermine (Longboat 9%) expected to commence

in December

-- Rig confirmed for Kveikje (Longboat 10%) and Cambozola (Longboat

25%) wells, to be drilled in 2022

-- Copernicus well site survey to be acquired shortly, to facilitate

2022 drilling, following well commitment decision

Financial Summary

-- Cash reserves of GBP38.7 million (31 Dec-20 GBP7.0 million)

with no debt at period end

-- 2020 tax refund received of GBP0.7 million

-- Loss for the period GBP0.9 million

Helge Hammer, Chief Executive Officer of Longboat Energy,

commented:

" I am pleased that we are already under way with exploration

drilling so soon after the completion of our first transactions

last month. We expect to be drilling three wells over the next few

weeks with the Rødhette and Egyptian Vulture wells already under

way and Mugnetind expected to spud shortly, in an extremely busy

and exciting time for the Company. Drill results from these first

three wells are expected before the end of the year and have the

potential to create significant shareholder value.

"The exploration programme over the next 18 months offers

shareholders a unique opportunity to gain exposure to a drilling

portfolio of seven wells targeting net mean prospective resource

potential of 104 mmboe(1) with an additional 220 mmboe(1) of upside

which provides the potential to create a Net Asset Value of over $1

billion based on precedent transactions in the Norwegian North Sea

for development assets."

This announcement does not contain

inside information

Enquiries:

Longboat Energy via FTI

Helge Hammer, Chief Executive Officer

Jon Cooper, Chief Financial Officer

Stifel (Nomad) Tel: +44 20 7710 7600

Callum Stewart

Jason Grossman

Simon Mensley

Ashton Clanfield

FTI Consulting (PR adviser) Tel: +44 20 3727 1000

Ben Brewerton

Ntobeko Chidavaenzi longboatenergy@fticonsulting.com

Notes :

1 ERC Equipoise estimates, using a conversion factor of 5,600

scf/stb

2 Under both existing and proposed Norwegian tax legislation,

the latter assuming that the Exploration Finance Facility is

amended as described in the interim report below

Standard

Estimates of reserves and resources have been prepared in

accordance with the June 2018 Petroleum Resources Management System

("PRMS") as the standard for classification and reporting with an

effective date of 31 December 2020.

Review by Qualified Person

The technical information in this release has been reviewed by

Helge Hammer, Chief Executive Officer, who is a qualified person

for the purposes of the AIM Guidance Note for Mining, Oil and Gas

Companies. Mr Hammer is a petroleum engineer with more than 30

years' experience in the oil and gas industry. He holds a degree in

Petroleum Engineering from NTH University in Trondheim and an MSc

in Economics from the Institut Français du Pétrole in Paris.

Glossary

mmboe Millions of barrels of oil equivalent

scf Standard cubic feet

stb Stock tank barrel

CEO Introductory Statement

I am delighted that the groundwork that Longboat put in during the

period of subdued industry activity in 2020 has paid-off. In June,

the Company announced three bilaterally negotiated farm-in transactions,

which combined represent an attractive initial portfolio of seven

material, near-term, exploration wells on the Norwegian Continental

Shelf ("NCS"). Together with the substantial equity and debt financing

in support of the transactions, Longboat is poised for an active

and exciting period ahead.

Sourced through our excellent industry relationships, the vendors

of these exploration interests, Equinor, Spirit and Idemitsu, are

all leading NCS participants. Equinor, a vendor in seven out of

the eight licences, is the largest operator in Norway and has an

industry leading exploration track record. All the vendors are retaining

stakes in all-but-one of the licences, which clearly demonstrates

that the key driver for the deals were capital allocation and not

lack of attractiveness of the drilling opportunities.

By building the initial portfolio through the three farm-in transactions,

we have taken years off the timetable, compared to building the

portfolio organically through licensing rounds, and hence are delivering

firm wells in a short timeframe and reducing risk for the Company

and its shareholders.

The farm-ins provide the Company with a bespoke, material, near-term

drilling programme, including seven wells over the next 18 months

with further appraisal drilling likely on success. The prospects

are gas weighted and are all located in tie-back distance to existing

infrastructure, with an overlap between exploration partners and

infrastructure owners, providing a portfolio with a clear low-cost

route to monetisation and the potential for developments which can

contribute positively to decarbonisations, well aligned to Longboat

Energy's ESG targets.

Exploration continues to be a key value driver on the NCS, with

Norway enjoying record geological exploration success rates at c.

50% so far in in 2021. Furthermore, the Norwegian Petroleum Directorate

reports nearly US$200 billion of value creation since 2000 with

an average return on investment of 2.5 times since 2010. The Norwegian

tax regime remains supportive despite recently proposed changes

with significant tax rebates under the temporary tax regime introduced

in 2020, and the buyer pool for discoveries in Norway continues

to be strong with approximately US$1.4 billion of discovery transactions

since 2018 and an average transaction value exceeding US$4/boe.

Longboat Energy is committed to delivering energy responsibly and

strongly supports the energy transition, whilst acknowledging the

place that hydrocarbon exploration and production will continue

to have in the global markets for the foreseeable future. As part

of the Company's sustainability strategy, Longboat Energy has undertaken

to be corporate 'Net Zero' on a Scope 1 and 2 basis by 2050, with

exploration success near existing infrastructure being crucial to

reducing carbon intensity in order maximise the use of existing

facilities and pipelines. The farm-ins are well aligned to these

principles given their proximity to existing infrastructure, nature

of the licences and gas weighted resource base and the commitment

to decarbonisation on the NCS evidenced through multiple initiatives

underway, including power-from-shore, power from offshore windmills

and carbon capture and storage projects.

The Company believes that the completed farm-ins have launched Longboat

Energy as an exciting and unique new North Sea oil and gas company,

with the initially acquired assets providing a material and attractively

located licence package, significant upside potential, in a favourable

fiscal environment for exploration in Norway, and a well-managed

and balanced risk profile.

Directors Statement

The Directors are pleased to present to shareholders the interim

report and financial statements of Longboat Energy plc for the six-month

period ended 30 June 2021.

On 9 June 2021, the Company announced that it had executed farm-in

agreements, subject to certain conditions precedent, with Equinor

Energy AS and Spirit Energy Norway AS with a third transaction with

Idemitsu Petroleum Norge AS announced on 10 June 2021. The three

transactions closed on 31 August 2021 post the period end. To finance

these farm-ins the Company also announced that it had successfully

raised gross proceeds of GBP35 million by means of a share placing

and subscription of 46,666,666 new ordinary shares at a price of

75 pence each on 24 June 2021. In addition, as part of the financing

of the farm-ins, Longboat also entered into a NOK 600 million (GBP50

million) Exploration Finance Facility or EFF with SpareBank 1 SR-Bank

ASA and ING Bank N.V.

Together, the share placing and EFF enable Longboat to pursue a

significant, near-term, low-risk exploration drilling programme

on the NCS across seven wells targeting net mean prospective resource

potential of 104 MMboe (1) and an additional 220 MMboe (1) of upside

and follow-on prospectivity. The cost of the carry element of the

farm-ins is fully eligible for the Norwegian tax refund system reducing

the net cost to the Company to $7.8 million on a post-tax basis

($35 million pre-tax), however noting that a new tax was recently

proposed by the Norwegian Government where the exploration tax refund

could be replaced by a more general tax refund arrangement.

Net mean prospective resources across the licences have been estimated

by ERC Equipoise at 104 MMboe (1) with total upside potential of

324 MMboe(1) . The Company has created a portfolio with an attractive

risk and reward balance, with the chance of success for each well

in the 22 to 55 per cent range for all-but-one high-impact prospect.

All mean volumes for the Target Assets are estimated to be in excess

of Minimum Economic Field sizes, as calculated by Longboat Energy.

The Company has created a bespoke and well-balanced portfolio of

opportunities, with working interest positions ranging from 9 to

25 per cent., and prospect risk levels generally considered low

to medium for exploration wells, with the exception of the Cambozola

well, and a diverse range of resource size and upside potential

across the assets. Under the current attractive Norwegian fiscal

regime for explorers, the Company is eligible for a 78 per cent.

tax rebate on exploration spending. The expected average pre-tax

dry hole cost per well is approximately US$6 million. In the case

of success, additional costs would be expected for further formation

evaluation testing in the order of US$1 to 2 million per well, with

additional optional geological side-tracks or well tests which could

add a further US$3 to 6 million per well. The Company is currently

undertaking a review of the proposed changes to the Norwegian fiscal

regime, more detail of which can be found below. As drafted, the

changes are not anticipated to have a material impact on the post-tax

well cost.

Four of the committed wells are either in the course of drilling

or are about to commence as follows:

Rodhette Exploration Well: the drilling of the Rodhette prospect

(Company 20%), operated by Var, commenced on 13 September 2021 using

the deep water Scarabeo 8 semi-submersible drilling rig. This is

a proven Jurassic Play in the Hammerfest Basin with a potential

30km tie-back distance to the Goliat Field for early potential monetisation.

The Rodhette prospect is estimated to contain gross mean prospective

resources of 41mmboe (1) with further potential upside to bring

the total to 81 MMboe(1) . The geological chance of success associated

with this prospect is 41%(1) with the key risk being related to

fault seal and oil column thickness.

Egyptian Vulture Exploration Well: the Egyptian Vulture well (Company

15%) well operations, operated by Equinor, commenced on 20 September

using the West Hercules semi-submersible drilling rig. The well

is targeting gross mean prospective resources of 103mmboe(1) with

further potential upside to bring the total to 208 MMboe(1) . The

Geological Chance of Success associated with this prospect is 25%

(1) with the key risk being related to reservoir quality/thickness.

The well is expected to take up to four weeks to drill with a pre-carry

net cost to Longboat of c.$5 million (c.$1m post tax). Upon success,

there is the potential to provide low-CO(2) blending gas to the

nearby Equinor operated infrastructure (Åsgard) allowing for

the possibility of rapid monetisation.

Mugnetind Exploration Well: the drilling of the Mugnetind prospect

(Company 20%) is scheduled to commence in September using the Maersk

Integrator jack-up drilling rig. The Mugnetind prospect is located

in licence PL906, which lies in the Central Graben area, 11 km to

the west of the Ula Field. The prospect is up-dip from Well 7/11-6

which is a dry well with shows in the Ula Formation and is defined

as a four-way dip closure with a structural component towards the

north where there is fault seal. The Munetind prospect is estimated

to contain gross mean prospective resources of 24mmboe(1) with further

potential upside to bring the total to 47mmboe(1) . The geological

chance of success associated with the Mugnetind prospect is 51%(1)

with the key risks being reservoir presence/quality.

Ginny/Hermine Exploration Well: the drilling of the Ginny and Hermine

prospects (Company 9%) is scheduled to drill in late Q4 using the

West Hercules semi-submersible drilling rig. The Ginny prospect

is interpreted as a hanging-wall half graben adjacent to the Bremstein

High, with faults which subdivide the prospect into three segments:

Ginny North, Central and South. The Hermine prospect lies beneath

Ginny and they will both be drilled by the planned exploration well.

The Ginny/Hermine prospects are estimated to contain gross mean

prospective resources of 41mmboe(1) for Ginny and 27mmboe(1) for

Hermine with further potential upside to bring the total to 84mmboe(1)

and 45mmboe respectively. The geological chance of success associated

with the Ginny prospect is 27%(1) and for Hermine 22%(1) with the

key risks being related to faulty seal and phase risk.

There are now three further committed wells to follow including

two key wells in one of Norway's most active and prolific exploration

and production areas with Cambozola and Kveikje. These prospects

provide acreage in the most prolific hydrocarbon province in Norway,

near Statfjord, Snorre, Gullfaks and Troll with numerous recent

discoveries (Atlantis, Dugong, Equino, Basto) being made as operators

focus on infrastructure-led exploration opportunities to utilise

mature infrastructure and reduce CO(2) emissions. Multiple nearby

tie-back options exist for both Cambozola and Kveikje on either

a standalone basis or as part of wider regional developments. This

area is also expected to be key for a number of energy transition

projects. Longboat was recently informed by Equinor, the operator,

that the semi-submersible drilling rig Deepsea Stavanger has been

contracted for these two wells which are anticipated to start drilling

back-to-back in H1 2022.

Longboat was also pleased to recently announce that the parties

to the Copernicus joint venture, Equinor and PIGNiG, have also committed

to a firm well on this prospect (Company 10%). Copernicus lies on

the Utgard High in the Vøring Basin region of the Norwegian

Sea and the prospect is a combination trap with mapped stratigraphic

pinch out down-dip and a small structural component at the apex.

The Copernicus prospect is estimated to contain gross mean prospective

resources of 254mmboe(1) with further potential upside to bring

the total to 471mmboe(1) . The geological chance of success associated

with the Copernicus prospect is 25%(1) with the key risks being

reservoir presence/quality and trap

The farm-ins were classified as a reverse takeover under the AIM

Rules for Companies. On 13 August 2021 the Company was approved

by the Ministry of Petroleum and Energy as a licence holder of oil

and gas assets on the NCS and completed the farm-ins on 31 August

2021 with the reverse takeover occurring on 2 September 2021.

Norwegian Fiscal Stimulus and potential Norwegian tax changes

The Company is currently benefiting from the Norwegian government

temporary tax reforms introduced in June last year to mitigate the

effect of the Covid pandemic for the offshore oil and gas industry

whereby tax losses incurred during 2021 are paid out early by way

of negative instalment tax payments "terminskatt". During the period,

the Company received GBP705,857 in negative tax instalments with

a receivable of GBP1,089,367 at 30 June 2021. The company amended

its estimates of expenditure for 2021 following the agreement to

acquire the exploration licences and therefore will receive higher

negative tax instalments in the second half of 2021.

On 30 August 2021 the Government and the Ministry of Finance announced

proposals for potential changes to the Norwegian petroleum taxation

system from 2022 onwards. The feedback on the consultation proposal

is due by 3 December 2021 with the final changes anticipated to

be enacted during the spring of 2022.

The key element of these proposals is the immediate expensing of

investments with the intention of improving the neutrality of the

tax system between the government and the industry by aligning the

pre-versus-post-tax economics.

The proposals can be summarised as follows: -- The total marginal tax rate remains the same at 78 per cent;

-- The Special Petroleum Tax ("SPT") will increase to 71.8 per

cent (from 56 per cent) but Corporation Tax (22 per cent) will

become fully deductible from the SPT and the uplift on investments

will be removed;

-- The current exploration refund at 78% will cease to exist and

the Company will instead receive the tax value of losses (including

exploration costs) refunded in cash at the revised SPT (71.8

per cent) in the year after incurrence (to the extent these

generate tax losses);

-- The remaining corporation tax element (6.2 per cent) will be

carried forward to be set off against future profits from production;

and

-- There are no changes proposed to the temporary tax regime introduced

in 2020 and effective until the end of 2021

Based on the consultation feedback, and explicit statements made

by the Norwegian Government, the authorities will consider including

a system for pledging tax loss settlements to the lending banks

in a similar arrangement as is currently in place for the exploration

tax cost refund scheme.

The Company has made a preliminary assessment of the impact of the

proposed tax changes, which effectively increase the equity funding

requirement of exploration costs from 22 to 28.2 per cent, and believes

the Company remains funded for its exploration programme. In reaching

this conclusion, the Company has assumed that the Exploration Finance

Facility shall be amended to reflect the proposed new tax regime

enabling the Company to borrow against the proposed tax refund in

the same ratio as the existing exploration tax refund, and to pledge

the same in favour of the lenders.

Financial Results

The share issue to fund the farm-ins raised GBP32.4 million net

of fees, resulting in a period end cash position of GBP38.7 million,

with no debt (30 June 2020: GBP8.1 million). The loss for the period

was GBP0.9 million after receiving a 2020 tax refund in Norway of

GBP0.7 million in the period. GBP2.6 million of costs relating directly

to the sale of shares was charged to the share premium reserve.

A NOK600 million Exploration Finance Facility was secured to finance

the Norwegian Government's tax rebate, and the arrangement fee of

GBP579 k was debited to pre-payments in the balance sheet and will

be released over the term of the funding.

Salaries and pension costs in the six month period were GBP516k

(30 June 2020 GBP402 k). Other significant costs were those associated

with the analysis and review of the farm-in transactions, such as

technical consultant costs of GBP477 k (30 June 2020 GBP273 k) which

were capitalised against the exploration licences acquired. Legal

and professional fees of GBP242 k (30 June 2020 GBP161k) and outsourced

accounting fees were GBP50 k (30 June 2020 GBP69 k). The IFRS2 non-cash

charge for the period in relation to the Founders' Incentive Plan

and the Long Term Incentive Plan was GBP47 k (30 June 2020 GBP52

k).

Outlook

We are excited to be drilling our first exploration wells and can

now look forward to a busy period of almost continuous drilling

and frequent value catalysts during the next 18 months with a combined

upside value potential in excess of $1 billion.

Exploration activity in Norway is picking up and during the first

six months of 2021, a total of 14 exploration and appraisal wells

have been completed, resulting in 9 discoveries. With four wells

anticipated to be drilled by Longboat during the second half of

2021, a discovery at any one of the wells would add contingent resources

and give the Company significant monetisation opportunities.

Our plan remains to build Longboat in to a full-cycle, North Sea

E&P company. We believe the momentum built by the initial acquisitions

will enable us to take advantage of the increasing number of opportunities

we are seeing in the market.

On behalf of the board

..............................

Helge Ansgar Hammer

Director

.........................

1. ERC Equipoise estimates

The latest set of principal risks facing the Company were set

out in the Company's Re-admission document of 1 June 2021. Although

no new risks have emerged, now that the Company is operational

the 'risks relating to the oil and gas industry' are of greater

significance and in addition, following the announcement of the

proposed chances to the Norwegian petroleum taxation system, the

risks associated with 'fiscal risks relating to tax rebates in

Norway', are of particular relevance.

On behalf of the board

..............................

Helge Ansgar Hammer

Director

21 September 2021

The directors are responsible for preparing the interim report

in accordance with applicable law and regulations.

The directors have elected to prepare the financial statements

in accordance with International Financial Reporting Standards

(IFRSs) as adopted by the United Kingdom. The directors must not

approve the financial statements unless they are satisfied that

they give a true and fair view of the state of affairs of the

Group and of the profit or loss of the Group for that period.

The directors are also required to prepare the financial statements

in accordance with the rules of the London Stock Exchange for

companies trading securities on AIM.

In preparing these financial statements, the directors are required

to: -- select suitable accounting policies and then apply them consistently;

-- make judgements and accounting estimates that are reasonable

and prudent;

-- state whether they have been prepared in accordance with IFRSs

as adopted by the United Kingdom, subject to any material departures

disclosed and explained in the financial statements; and

-- prepare the financial statements on the going concern basis

unless it is inappropriate to presume that the company will

continue in business.

The directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the company's

transactions and disclose with reasonable accuracy at any time

the financial position of the company. They are also responsible

for safeguarding the assets of the company and hence for taking

reasonable steps for the prevention and detection of fraud and

other irregularities.

Website publication

The directors are responsible for ensuring the annual and interim

reports and financial statements are made available on a website.

Financial statements are published on the company's website in

accordance with legislation in the United Kingdom governing the

preparation and dissemination of financial statements, which may

vary from legislation in other jurisdictions. The maintenance

and integrity of the company's website is the responsibility of

the directors. The directors' responsibility also extends to the

ongoing integrity of the financial statements contained therein.

Introduction

We have been engaged by the Company to review the condensed set

of financial statements in the half-yearly financial report for

the six months ended 30 June 2021 which comprises the consolidated

statement of comprehensive income, consolidated statement of financial

position, consolidated statement of changes in equity, consolidated

statement of cash flows and notes to the consolidated interim financial

information.

We have read the other information contained in the half-yearly

financial report and considered whether it contains any apparent

misstatements or material inconsistencies with the information in

the condensed set of financial statements.

Directors responsibilities

The interim report, including the financial information contained

therein, is the responsibility of and has been approved by the directors.

The directors are responsible for preparing the interim report in

accordance with the rules of the London Stock Exchange for companies

trading securities on AIM which require that the half-yearly report

be presented and prepared in a form consistent with that which will

be adopted in the Company's annual accounts having regard to the

accounting standards applicable to such annual accounts.

Our responsibility

Our responsibility is to express to the Company a conclusion on

the condensed set of financial statements in the half-yearly financial

report based on our review.

Scope of review

We conducted our review in accordance with International Standard

on Review Engagements (UK and Ireland) 2410, "Review of Interim

Financial Information Performed by the Independent Auditor of the

Entity", issued by the Financial Reporting Council for use in the

United Kingdom. A review of interim financial information consists

of making enquiries, primarily of persons responsible for financial

and accounting matters, and applying analytical and other review

procedures. A review is substantially less in scope than an audit

conducted in accordance with International Standards on Auditing

(UK) and consequently does not enable us to obtain assurance that

we would become aware of all significant matters that might be identified

in an audit. Accordingly, we do not express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that causes

us to believe that the condensed set of financial statements in

the half-yearly financial report for the six months ended 30 June

2021 is not prepared, in all material respects, in accordance with

the rules of the London Stock Exchange for companies trading securities

on AIM.

Material uncertainty related to going concern

We draw attention to note 1.2 to the half-yearly financial report

which indicates the Directors considerations concerning the Group's

ability to continue as a going concern. The matters explained in

note 1.2 highlights that the continued availability of suitable

Exploration Finance facility or an amended facility cannot be guaranteed

given the proposed revisions to the Norwegian tax regime. As stated

in note 1.2, these events or conditions, along with other matters

as set out in note 1.2, indicates that a material uncertainty exists

which may cast significant doubt over the Group's ability to continue

as a going concern. Our conclusion is not modified in respect of

this matter.

Use of our report

This report is made solely to the Board of Directors, as a body.

Our audit work has been undertaken so that we might state to the

Board those matters we are required to state to them in an auditor's

report and for no other purpose. To the fullest extent permitted

by law, we do not accept or assume responsibility to anyone other

than the Company and the Company's Board as a body, for our audit

work, for this report, or for the opinions we have formed.

BDO LLP

Chartered Accountants

London

21 September 2021

BDO LLP is a limited liability partnership registered in England

and Wales (with registered number OC305127).

6 months 6 months

ended 30 ended to Year to

June 30 June 31 December

2021 2020 2020

unaudited audited audited

Notes GBP GBP GBP

Administrative expenses (1,513,958) (1,118,850) (2,399,204)

Operating loss 6 (1,513,958) (1,118,850) (2,399,204)

Investment revenues 5 3,963 10,719 18,736

Loss before taxation (1,509,995) (1,108,131) (2,380,468)

Income tax income 8 645,117 - 754,289

Loss for the period (864,878) (1,108,131) (1,626,179)

Items that may be reclassified to profit

or loss

Currency translation differences (11,731) (3,440) 524

Total items that may be reclassified to

profit or loss (11,731) (3,440) 524

Total comprehensive loss (876,609) (1,111,571) (1,625,655)

Loss per share 9

Basic and diluted (7.70) (11.08) (16.26)

Loss per share is expressed in pence per share.

The income statement has been prepared on the basis that all operations

are continuing operations.

30 June 30 June 31 December

2021 2020 2020

unaudited audited audited

Notes GBP GBP GBP

Non-current assets

Property, plant and equipment 10 25,685 8,545 11,798

Current assets

Trade and other receivables 11 1,368,540 74,383 75,807

Current tax recoverable 12 1,089,367 - 777,823

Cash and cash equivalents 38,729,643 8,123,612 7,021,105

41,187,550 8,197,995 7,874,735

Total assets 41,213,235 8,206,540 7,886,533

Current liabilities

Trade and other payables 15 1,707,404 203,542 351,610

Net current assets 39,480,146 7,994,453 7,523,125

Non-current liabilities

Deferred tax liabilities 16 372,709 - 431

Total liabilities 2,080,113 203,542 352,041

Net assets 39,133,122 8,002,998 7,534,492

Equity

Called up share capital 13 5,666,665 1,000,000 1,000,000

Share premium account 14 35,570,410 7,808,660 7,808,660

Other reserves 14 450,000 450,000 450,000

Currency translation reserve 14 (11,182) (3,415) 549

Share based payment reserve 144,587 52,185 97,763

Retained earnings (2,687,358) (1,304,432) (1,822,480)

Total equity 39,133,122 8,002,998 7,534,492

The financial statements were approved by the board of directors

and authorised for issue on ......................... and are signed

on its behalf by:

..............................

Helge Ansgar Hammer

Director

Company Registration No. 12020297

Share Share Currency Share Other Retained Total

capital premium translation based reserves earnings

account reserve payment

reserve

Notes GBP GBP GBP GBP GBP GBP GBP

Balance at 1 January

2020 1,000,000 7,808,660 25 - 450,000 (196,301) 9,062,384

Period ended

30 June 2020

Loss and total

comprehensive income

for

the period - - - - - (1,108,131) (1,108,131)

Credit to equity for

equity settled

share-based

payments - - - 52,185 - - 52,185

Other

comprehensive

income:

Currency translation

differences (3,440)

Balance at 30 June

2020 1,000,000 7,808,660 (3,415) 52,185 450,000 (1,304,432) 8,002,998

Period ended

31 December

2020

Loss for the period - - - - - (518,048) (518,048)

Credit to equity for

equity settled

share-based

payments - - - 45,578 - - 45,578

Other

comprehensive

income:

Currency translation

differences - - 3,964 - - - 3,964

Total comprehensive

income for the period - - 3,964 45,578 - (518,048) (468,506)

Other

comprehensive

income:

Balance at 31 December

2020 1,000,000 7,808,660 549 97,763 450,000 (1,822,480) 7,534,492

Share Share Currency Share Other Retained Total

capital premium translation based reserves earnings

account reserve payment

reserve

Notes GBP GBP GBP GBP GBP GBP GBP

Balance at 1 January

2021 1,000,000 7,808,660 549 97,763 450,000 (1,822,480) 7,534,492

Period ended

30 June 2021:

Loss and total

comprehensive income

for

the period - - - - - (864,878) (864,878)

Issue of share capital 4,666,665 27,761,750 - - - - 32,428,415

Share issue costs - (2,571,584) - - - - (2,571,584)

Credit to equity for

equity settled

share-based

payments - - - 46,824 - - 46,824

Other comprehensive

losses:

Currency translation

differences - - (11,731) - - - (11,731)

Balance at 30 June

2021 5,666,665 35,570,410 (11,182) 144,587 450,000 (2,687,358) 39,133,122

30 June 31 December

30 June 2021 2020 2020

unaudited audited audited

Notes GBP GBP GBP

Cash flows from operating activities

Cash absorbed by operations 19 (919,329) (1,081,261) (2,164,648)

Tax refunded/(paid) 12 705,850 - (23,533)

Net cash outflow from operating

activities (213,479) (1,081,261) (2,188,181)

Investing activities

Purchase of property, plant

and equipment 10 (17,331) (7,254) (12,359)

Purchase of investments in

exploration assets (477,015) - -

Interest received 5 3,963 10,719 18,736

Net cash (used in)/generated

from investing activities (490,383) (3,465) 6,377

Financing activities

Proceeds from issue of shares

(gross of issue costs) 34,999,999 - -

Share issue costs (charged

to Share premium reserve) (2,571,584) - -

Net cash generated from/(used

in) financing activities 32,428,415 - -

Net increase/(decrease) in cash

and cash equivalents 31,724,553 (1,077,796) (2,181,804)

Cash and cash equivalents at beginning

of period 7,016,199 9,204,257 9,197,479

Effect of foreign exchange

rates (11,733) (3,440) 524

Cash and cash equivalents

at end of period 38,729,019 8,123,021 7,016,199

Relating to:

Bank balances and short term

deposits 38,729,643 8,123,612 7,021,105

Bank overdrafts and credit

cards (624) (591) (4,906)

1 Accounting policies

Company information

Longboat Energy plc is a public company limited by shares incorporated

in England and Wales. The registered office is 5th Floor, One

New Change, London, EC4M 9AF. The Company's principal activities

and nature of its operations are disclosed in the directors'

report.

1.1 Accounting convention

The consolidated interim financial statements have been prepared

in accordance with International Financial Reporting Standards

(IFRS) as adopted for use in the United Kingdom.

The same accounting policies, presentation and methods of computation

are followed in the interim consolidated financial information

as were applied in the Group's latest annual audited financial

statements except for those that relate to new standards and

interpretations effective for the first time for periods beginning

on (or after) 1 January 2021, and will be adopted in the 2021

annual financial statements.

This interim financial information does not constitute statutory

accounts within the meaning of section 434 and of the Companies

Act 2006. The information for the year ended 31 December 2020

included in this report was derived from the statutory accounts

for that year, which were prepared in accordance with International

Financial Reporting Standards ('IFRSs') issued by the International

Accounting Standards Board ('IASB') and interpretations issued

by the International Financial Reporting Interpretations Committee

('IFRIC') of the IASB, as adopted by the EU up to 31 December

2020, a copy of which has been delivered to the Registrar of

Companies. The report of the auditors on those accounts was unqualified,

included a material uncertainty paragraph in respect of going

concern and did not contain a statement under 498(2) 498(3) of

the Companies Act 2006.

The financial statements are prepared in sterling, which is the

functional currency of the company. Monetary amounts in these

financial statements are rounded to the nearest GBP.

The financial statements have been prepared under the historical

cost convention.

The Group interim financial statements consolidate the financial

statements of the parent company and its subsidiary undertakings

drawn up to 30 June 2021. The results of subsidiaries acquired

or sold are consolidated for periods from or to the date on which

control passed.

1 Accounting policies

1.2 Going concern

The Directors have completed the going concern assessment, including

a review of cash flow forecasts to December 2022, to assess whether

the Group is a going concern. The base case, which included conservative

scenarios in terms of well success rates, contingencies and associated

costs, demonstrates sufficient liquidity headroom. The forecasts

have been further subject to stress testing, focused on further

increased exploration cost levels, which demonstrated headroom

under the current facilities.

The Company notes the proposed changes to the Norwegian tax regime

announced on 31 August 2021 which remain subject to public consultation

and approval by parliament anticipated during the first half

of 2022. The directors have reviewed the potential impact based

on the information available and believes the Company will remain

fully funded for its planned exploration programme should these

changes be adopted into law.

However, the proposed changes would require certain amendments

to the Company's Exploration Finance Facility ("EFF") in order

to reflect both changes to the tax rate calculation methodology

and security structure in favour of the lenders. Based on explicit

statements made by the Norwegian Government on seeking to protect

the security structure of the tax refunds the Board believes

that the EFF will be amended satisfactorily.

As we are in the early stages of both the consultation process

and discussions with our lenders and given the uncertainty surrounding

the timing and nature of any changes to the tax regime, which

impacts the industry as a whole, the ability to secure any necessary

amendment to the EFF or otherwise secure alternative appropriate

facilities cannot be guaranteed. This circumstance represents

a material uncertainty that may cast significant doubt on the

Company's ability to continue as a going concern. The financial

statements do not include any adjustments that would result from

the basis of preparation being inappropriate.

2 Adoption of new and revised standards and changes in accounting

policies

The accounting policies adopted in the preparation of the consolidated

financial statements are consistent with those followed in the

preparation of the Group's annual consolidated financial statements

for the year ended 31 December 2020, except for the adoption of

new standards effective as of 1 January 2021. The Group has not

early adopted any standard, interpretation or amendment that has

been issued but is not yet effective.

Several amendments and interpretations apply for the first time

in 2021, but do not have an impact on the interim financial statements

of the Group.

3 Critical accounting estimates and judgements

In the application of the Group's accounting policies, the directors

are required to make judgements, estimates and assumptions about

the carrying amount of assets and liabilities that are not readily

apparent from other sources. The estimates and associated assumptions

are based on historical experience and other factors that are

considered to be relevant. Actual results may differ from these

estimates.

The estimates and underlying assumptions are reviewed on an ongoing

basis. Revisions to accounting estimates are recognised in the

period in which the estimate is revised, if the revision affects

only that period, or in the period of the revision and future

periods if the revision affects both current and future periods.

Shared based payments

Estimation was required in determining inputs to the share based

payment calculations including share price volatility as detailed

in the annual accounts for the year to 31 December 2020.

Under the Founder Incentive Plan, judgment was required in determining

the point at which the Company and recipients had a shared mutual

understanding of the terms of the awards. Whilst the awards were

legally granted in July 2020, the Board consider that the IPO

Admission Document provided such a shared mutual understanding

given the detailed disclosure of the terms of the scheme. Accordingly,

the estimated fair value of the awards was determined in FY 20

has been spread over the vesting period which commenced at IPO.

A charge of GBP44,091 has been recorded in the period.

Under the Long Term Incentive Plan, judgement was required in

determining the fair value of the shares awarded. The Board has

taken advice from external parties and has determined the fair

value per share in FY 20, which results in a charge of GBP2,733

in the period.

4 Employees

The average monthly number of persons (including directors) employed

by the Group during the period was:

Six month Six month

period ended period ended Year ended

30 June 30 June 31 Dec

2021 2020 2020

Number Number Number

Executive Directors 2 2 2

Non-Executive Directors 4 4 4

Staff 2 1 2

Total 8 7 8

4 Employees

Their aggregate remuneration comprised:

Six month Six month

period ended period ended Year ended

30 June 30 June 31 Dec

2021 2020 2020

GBP GBP GBP

Wages and salaries 391,440 298,814 646,485

Share based payment 46,824 52,185 97,763

Social security costs 51,753 33,160 82,826

Pension costs 25,510 17,655 41,782

515,527 401,814 868,856

The Executive Directors entered into service agreements with

the Company on 28 November 2019, the date of Admission to AIM.

Nick Ingrassia joined the Board on 1 June 2021 and entered into

an updated service agreement on 9 June 2021.

Pursuant to letters of appointment dated 28 November 2019, the

Non-executive Directors of the Company were appointed as of that

date and on an ongoing basis. Each Non-executive Director is

entitled to an annual fee, including in respect of any service

on any Board committee.

In accordance with the statement made at the time of Admission

to AIM in November 2019, in parallel to the Company's first acquisitions

entered into on 9 and 10 June 2021, the Remuneration Committee

undertook a benchmarked review of executive remuneration and

made adjustments accordingly as disclosed in the Re-admission

document of 10 June 2021. These adjustments came into effect

following the approval of these acquisitions by shareholders

on 28 June 2021 but were subject to their completion, which occurred

after the period end on 31 August 2021.

5 Investment Income

Six month Six month

period ended period ended Year ended

30 June 30 June to 31 Dec

2021 2020 2020

GBP GBP GBP

Interest income

Bank deposits 3,963 10,719 18,736

Total interest income for financial assets that are not held at

fair value through profit or loss is GBP3,963 (2020: GBP10,719).

6 Operating loss

Six month Six month

period ended period ended Year ended

30 June 30 June 31 Dec

2021 2020 2020

GBP GBP GBP

Operating profit/(loss) for the period is stated after charging/(crediting):

Exchange losses 47,249 74,120 28,037

Fees payable to the company's auditor

for the audit of the company's financial

statements - 16,000 16,000

Depreciation of property, plant and

equipment 3,483 954 2,807

Share-based payments 46,824 52,185 97,763

7 Auditor's remuneration

Six month Six month

period ended period ended Year ended

30 June 30 June 31 Dec

2021 2020 2020

Fees payable to the company's auditor GBP GBP GBP

and associates:

For audit services

Audit of the financial statements of

the company - 16,000 32,000

Audit of the financial statements of

the company's subsidiaries - - 4,170

- 16,000 36,170

For non-audit services

Interim review 16,000 - -

Other services 110,000 - -

Total non-audit fees 126,000 - -

During the period the auditor provided non-audit services of

GBP110,000 in their role as Reporting Accountant in relation

to work carried out for a working capital model, and also undertook

a review of the interim accounts. There were no non-audit services

provided in the six months to 30 June 2020. In the year to 31

December 2020, they provided additional services for the audit

of the interim financial statements.

8 Income tax expense

Six month Six month

period ended period ended Year ended

30 June 30 June 31 Dec

2021 2020 2020

GBP GBP GBP

Current tax

UK corporation tax on

profits for the

current period - - -

Foreign taxes and

reliefs (1,017,401) - (754,289)

(1,017,401) - (754,289)

Deferred tax

Origination and

reversal of temporary

differences 372,284 - -

Total tax (credit) (645,117) - -

No deferred tax asset has been recognised in the UK because there

is uncertainty of the timing of suitable future profits against

which they can be recovered. The Company has losses carried forward

of GBP2,003,236 (June 2020: GBP345,870). A deferred tax asset

has been recognised relating to Norway, further details of which

can be found in Note 16.

Longboat Energy Norge AS received a tax refund under the temporary

tax measures introduced in Norway for the tax year 2020 & 2021.

9 Loss per share 30 June 30 June 31 Dec

2021 2020 2020

GBP GBP GBP

Number of shares

Weighted average number

of ordinary

shares for basic loss

per share 11,229,050 10,000,000 10,000,000

Losses

Continuing operations

Loss for the period from

continued

operations (864,878) (1,108,131) (1,625,179)

Loss for basic and

diluted loss per

share being net losses

attributable

to equity shareholders

of the company

for continued

operations (864,878) (1,108,131) (1,625,179)

Basic and diluted loss

per share (7.70) (11.08) (16.26)

Loss per share is expressed in pence per share.

10 Property, plant and equipment

Computers

GBP

Cost

At 1 January 2020 2,245

Additions 7,254

At 30 June 2020 9,499

Additions 5,106

At 31 December 2020 14,605

Additions 17,331

At 30 June 2021 31,936

Accumulated depreciation and impairment

Charge for the Six Month Period 954

At 30 June 2020 954

Charge for the Six Month Period 1,853

At 31 December 2020 2,807

Charge for the Six Month Period 3,483

Foreign currency adjustments (39)

At 30 June 2021 6,251

Carrying amount

At 30 June 2021 25,685

At 30 June 2020 8,545

At 31 December 2020 11,798

11 Trade and other receivables

30 June 30 June 31 Dec

2021 2020 2020

GBP GBP GBP

VAT recoverable 144,305 8,295 22,161

Prepayments and other receivables 1,224,235 66,088 53,646

1,368,540 74,383 75,807

12 Current tax receivable

30 June 30 June 31 Dec

2021 2020 2020

GBP GBP GBP

Current tax receivable 1,089,367 - 777,823

The temporary tax rules in Norway allow oil and gas companies

to reclaim 78% of their tax losses for the financial years 2020

and 2021. At the period end the current tax receivable was GBP1,089,367,

GBP1,017,401 relating to 2021 losses with GBP71,966 of a true

up element due for the tax year 2020.

13 Share Capital

GBP

Balance at 1 January 2020 1,000,000

Balance at 30 June and 31 December 2020 1,000,000

Additions 4,666,665

Balance at 30 June 2021 5,666,665

On 10 June 2021 46,666,665 Ordinary Shares were allotted at

a premium of 75p per Ordinary Share. This brought the total

share capital to 56,666,665 ordinary shares.

14 Other reserves

Other reserves Currency translation Share Premium

reserve

GBP GBP GBP

Balance at 1 January 2020 450,000 25 -

Additions - (3,440) -

Issue of share capital - - 270,000

Share buy-back and

cancellation of share

premium - - (270,000)

Initial Public Offering - - 8,550,000

Costs of share issue - - (741,340)

Balance at 30 June

2020 450,000 (3,415) 7,808,660

Additions - 3,964 -

Balance at 31 December

2020 450,000 549 7,808,660

Additions - (11,731) -

Initial Public Offering - - 30,333,334

Costs of share issue - - (2,571,584)

Balance at 30 June

2021 450,000 (11,182) 35,570,410

15 Trade and other payables

30 June 30 June 31 Dec

2021 2020 2020

GBP GBP GBP

Trade payables 823,780 50,275 129,713

Accruals 830,971 114,691 115,309

Social security and other taxation 48,946 36,552 94,850

Other payables 3,707 2,024 11,738

1,707,404 203,542 351,610

16 Deferred taxation

The following are the major deferred tax liabilities and assets

recognised by the company and movements thereon during the current

and prior reporting period.

GBP

Deferred tax liability at 1 January 2020 and 30 June 2020 -

Deferred tax movements

Differences in tax basis for depreciation in Norway 431

Deferred tax liability at 31 December 2020 431

Deferred tax movements

Differences in tax basis for depreciation in Norway 372,278

Deferred tax liability at 30 June 2021 372,709

Deferred tax assets and liabilities are offset in the financial

statements only where the company has a legally enforceable right

to do so. In Norway, deferred tax assets and liabilities occur

mainly because of prepayment of Exploration spend. Exploration

spend is fully tax deductible refundable when incurred.

17 Other leasing information

Lessee

Amounts recognised in profit or loss as an expense during the

period in respect of lease arrangements are as follows:

Six month Six month

period ended period ended Year ended

30 June 30 June

2021 2020 31 Dec 2020

GBP GBP GBP

Expense relating to short-term leases 47,048 47,744 96,519

18 Related party transactions

Remuneration of key management personnel

Members of the Board of Directors are deemed to be key management

personnel. Key management personnel compensation for the financial

period is the same as the Director remuneration set out in note

5 to the accounts.

Other information

Directors' and PDMR interests in the shares of the Company in

the period, including family interests, were as follows:

Ordinary shares

Helge Hammer 680,000

Jonathan Cooper 275,000

Graham Stewart 300,000

Jorunn Saetre 45,000

Nick Ingrassia 120,000

Julian Riddick (PDMR) 220,000

In addition, the following conditional awards have been made

to the Executive Directors and Company Secretary under the FIP

which are expressed as a percentage of the total maximum potential

award, being 10% of the Company's issued share capital:

Founder Percentage Maximum percentage

entitlement entitlement of Maximum percentage

of Initial growth in value of issued share

Award pool from IPO capital

% % %

Helge Hammer 23.50% 3.53% 2.35%

Graham Stewart 19.75% 2.96% 1.98%

Jonathan Cooper 19.13% 2.87% 1.91%

Julian Riddick 18.50% 2.78% 1.85%

The Group does not have one controlling party.

19 Cash used by operations

30 June 30 June 31 Dec

2021 2020 2020

GBP GBP GBP

Loss for the Six Month Period after

tax (864,878) (1,108,131) (1,626,179)

Adjustments for:

Net taxation credited (645,117) - (753,858)

Investment income (3,963) (10,719) (18,736)

Depreciation and impairment of property,

plant and equipment 3,483 954 2,807

Equity settled share based payment

expense 46,824 52,185 97,763

Movements in working capital:

(Increase)/decrease in trade and other

receivables (815,712) 8,721 7,192

Increase in trade and other payables 1,360,034 (24,271) 126,363

Cash absorbed by operations (919,329) 1,081,261 (2,164,648)

20 Events after the reporting date

Longboat Energy was established as a closed-ended investment

company on 28 May 2019 with the objective of creating a new mid-cap

independent oil and gas company. From its admission to trading

on AIM on 28 November 2019, the Company was an "investing company"

for the purposes of the AIM Rules for Companies.

On 31 August 2021, the Company's wholly-owned subsidiary, Longboat

Energy Norge AS, completed the acquisition of interests in seven

exploration wells derived from three Farm-in Agreements with

Equinor Energy AS, Spirit Energy (Norge) AS and Idemitsu Petroleum

Norge AS.

The Farm-ins constituted a reverse takeover under the AIM Rules

and following completion of the farm-ins on 31 August 2021 the

Company ceased to be an investing company, for the purposes of

the AIM Rules, and become an operating company.

21 Other information

A copy of this interim report and financial statements is available

on the Company's website www.longboatenergy.com.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FFFFLAAILFIL

(END) Dow Jones Newswires

September 22, 2021 02:00 ET (06:00 GMT)

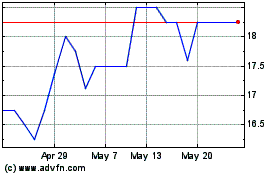

Longboat Energy (LSE:LBE)

Historical Stock Chart

From May 2024 to Jun 2024

Longboat Energy (LSE:LBE)

Historical Stock Chart

From Jun 2023 to Jun 2024