Longboat Energy PLC Spud of Egyptian Vulture Exploration Well (3779M)

September 21 2021 - 2:00AM

UK Regulatory

TIDMLBE

RNS Number : 3779M

Longboat Energy PLC

21 September 2021

21 September 2021

Longboat Energy plc

("Longboat Energy", "Longboat" or the "Company")

Spud of Egyptian Vulture Exploration Well

Longboat Energy, the emerging full-cycle North Sea E&P

company with a portfolio of significant, near-term, low-risk

exploration assets, is pleased to announce the commencement of

drilling operations on the Egyptian Vulture exploration well

(Company 15%).

The drilling of the Egyptian Vulture prospect is being

undertaken by the West Hercules semi-submersible drilling rig. The

Egyptian Vulture well is targeting gross mean prospective resources

of 103 mmboe with further potential upside to bring the total to

208 mmboe on a gross basis. The chance of success associated with

this prospect is 25% with the key risk being related to reservoir

quality and thickness.

The well, operated by Equinor, is expected to take up to seven

weeks to drill with an estimated pre-carry net cost to Longboat of

c.$5 million (c.$1.1 million post tax).

A further announcement will be made when drilling operations

have been completed.

Helge Hammer, Chief Executive of Longboat, commented:

"I am pleased that we have now commenced drilling operations on

our second exploration well in our short term three well programme

following the commencement of the Rødhette well last week. It is no

overstatement to say that the next few weeks will be an extremely

busy and exciting time for Longboat with each of these wells having

the potential to create significant shareholder value.

"The exploration programme over the next 18 months offers

shareholders a unique opportunity to gain exposure to a drilling

portfolio of seven wells targeting net mean prospective resource

potential of 104MMboe (1) with an additional 220 MMboe (1) of

upside which provides the potential to create a Net Asset Value of

over $1 billion based on precedent transactions in the Norwegian

North Sea for development assets."

The information contained within this announcement is not

considered to be inside information prior to its release.

Notes :

1. All resource figures and chance of success estimates are from

the ERC Equipoise Competent Person Report and using a gas-to-barrel

of oil equivalent conversion factor of 5,600 scf/stb

Ends

Enquiries:

Longboat Energy

Helge Hammer, Chief Executive Officer via FTI

Jon Cooper, Chief Financial Officer

Nick Ingrassia, Corporate Development

Director

Stifel Nicolaus Europe Limited (Nominated Adviser and Broker)

Callum Stewart Tel: +44 20 7710 7600

Jason Grossman

Simon Mensley

Ashton Clanfield

FTI Consulting (PR adviser)

Ben Brewerton Tel: +44 20 3727 1000

Ntobeko Chidavaenzi longboatenergy@fticonsulting.com

Background Longboat Energy was established by the ex-Faroe

Petroleum plc ("Faroe") management team to create a full-cycle

North Sea E&P company through value accretive M&A and

low-risk, near-field exploration. The management team has a proven

track record of delivering value to shareholders through

exploration success, accretive acquisitions and farm-ins, and a

demonstrated ability to monetise discoveries through sales and

asset swaps. At Faroe, the team grew reserves from 19 MMboe to 98

MMboe between 2013 and 2018, a compounded annual growth rate of

approximately 39%. The team monetised numerous assets through

development and active portfolio management, including asset swaps

and sell downs. Faroe Petroleum was sold to DNO ASA in January

2019, providing a Total Shareholder Return of 129% to investors

from the previous equity fundraise.

The Company has created a hand-picked portfolio and material

drilling programme, including seven attractive exploration wells

over the next 18 months and further appraisal drilling likely on

success.

Standard

Estimates of reserves and resources have been prepared in

accordance with the June 2018 Petroleum Resources Management System

("PRMS") as the standard for classification and reporting with an

effective date of 31 December 2020.

Review by Qualified Person

The technical information in this release has been reviewed by

Helge Hammer, Chief Executive Officer, who is a qualified person

for the purposes of the AIM Guidance Note for Mining, Oil and Gas

Companies. Mr Hammer is a petroleum engineer with more than 30

years' experience in the oil and gas industry. He holds a degree in

Petroleum Engineering from NTH University in Trondheim and an MSc

in Economics from the Institut Français du Pétrole in Paris.

Glossary

"mmboe" Million barrels of oil equivalent

"NCS" Norwegian Continental Shelf

"Prospective Resources" those quantities of petroleum which are

estimated, on a given date, to be potentially

recoverable from undiscovered accumulations

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DRLURAWRARUKUAR

(END) Dow Jones Newswires

September 21, 2021 02:00 ET (06:00 GMT)

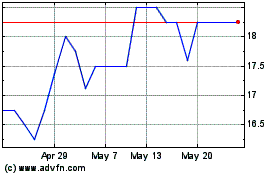

Longboat Energy (LSE:LBE)

Historical Stock Chart

From May 2024 to Jun 2024

Longboat Energy (LSE:LBE)

Historical Stock Chart

From Jun 2023 to Jun 2024