TIDMLBE

RNS Number : 7804L

Longboat Energy PLC

15 September 2021

15 September 2021

Longboat Energy plc

("Longboat Energy", "Longboat" or the "Company")

Spud of Rødhette Exploration Well and Operational Update

Longboat Energy, the emerging full-cycle North Sea E&P

company with a portfolio of significant, near-term, low-risk

exploration assets, is pleased to announce the spudding of the

Rødhette exploration well and to provide a further operational

update.

Highlights

-- Drilling commenced at Rødhette (Company 20%), Longboat's

first exploration well

-- Further two wells, Egyptian Vulture (Company 15%) and Mugnetind

(Company 20%), expected to commence drilling by the end of

September

-- Drilling at Ginny/Hermine (Company 9%) expected to commence

in December

-- Rig confirmed for Kveikje and Cambozola wells, to be drilled

in 2022

-- Copernicus well site survey to be acquired shortly, to facilitate

2022 drilling, following well commitment decision

-- Executive team further strengthened through additional ex-Faroe

appointment of Hilde Salthe as Managing Director, Norway

Rødhette exploration well spud

The drilling of the Rødhette prospect (Company 20%) has

commenced using the deep water Scarabeo 8 semi-submersible drilling

rig . This is a proven Jurassic play in the Hammerfest Basin with

the potential for early monetisation through a 30km tie-back to the

Goliat Field.

The well, operated by Vår Energi, is expected to take up to six

weeks to drill with an estimated pre-carry net cost to Longboat of

c.$7 million (c.$1.5 million post tax).

The Rødhette prospect is estimated to contain gross mean

prospective resources of 41 mmboe with further potential upside to

bring the total to 81 mmboe. The chance of success associated with

this prospect is 41% with the key risk being related to fault seal

and oil column thickness.

Drilling schedule 2021

The following three additional near-term wells are scheduled for

drilling in 2021:

Drilling of the Egyptian Vulture prospect (Company 15%) is

expected to commence towards the end of September using the West

Hercules semi-submersible drilling rig, which is on a long-term

contract with the operator, Equinor. The Egyptian Vulture well is

targeting gross mean prospective resources of 103 mmboe with

further potential upside to bring the total to 208 mmboe on a gross

basis. The chance of success associated with this prospect is 25%

with the key risk being related to reservoir quality and

thickness.

Drilling of the Mugnetind prospect (Company 20%) is also

scheduled to commence at the end of September using the Maersk

Integrator jack-up drilling rig. The Mugnetind prospect, operated

by AkerBP, is estimated to contain gross mean prospective resources

of 24 mmboe with further potential upside estimated at 47 mmboe on

a gross basis. The chance of success associated with the Mugnetind

prospect is 51% with the key risks being reservoir

presence/quality.

Drilling of the dual-target Ginny and Hermine prospects (Company

9%) is now scheduled to commence in December 2021, u sing the West

Hercules semi-submersible drilling rig operated by Equinor. These

prospects have a combined target gross mean prospective resource of

68 mmboe with further potential upside estimated at 129 mmboe on a

gross basis. The chance of success associated with these prospects

are 27% and 22%, respectively, with the key risk being related to

fault seal and phase risk.

2022 Drilling Programme

Longboat is pleased to confirm further details of its 2022

exploration drilling programme which will see the Company

participate in three additional wells.

The Company has recently been informed by Equinor, the operator,

that the Deep Sea Stavanger semi-submersible drilling rig has been

contracted to drill the Kveikje (Company 10%) and Cambozola

(Company 25%) exploration wells in H1 2022.

Kveikje is a low-risk, Paleocene injectite play located near the

Fram infrastructure offering opportunities for rapid

commercialisation. Cambozola is a significant, play-opening well

located near some of the largest fields on the Norwegian

Continental Shelf. Further details about both wells, including size

and chance of success, can be found on the Company's website.

Additionally, following the well commitment made on Copernicus

(Company 10%) at the end of August, the acquisition of a site

survey is anticipated to be acquired shortly which will facilitate

the drilling of an exploration well during 2022 by operator

PGNiG.

Appointment of Managing Director Norway

Longboat is pleased to announce that Ms Hilde Salthe will be

joining the Company as Managing Director Norway on 1 October 2021,

further strengthening the Company's executive team as it

transitions to a full-cycle E&P business. Ms Salthe, a

petroleum geologist by background, has over 20 years' industry

experience with Shell, Statoil (Equinor), Talisman and Paladin. Ms

Salthe was a key member of the Faroe technical team from 2008 until

2019 when the business was acquired by DNO ASA. Most recently, Ms

Salthe was the Subsurface Manager of DNO's North Sea Business Unit.

Ms Salthe has a Masters Degree from Norwegian University of Science

and Technology, Trondheim.

The full list of the licenses, working interests and resource

estimates are set out in the background notes below.

The Company will release further announcements as and when

appropriate. More details on Longboat's seven well exploration

drilling programme can be found on the Company's newly updated

website: www.longboatenergy.com .

Helge Hammer, Chief Executive of Longboat, commented:

"Following the successful completion of our first transactions

at the end of last month, I am pleased that we are already under

way with exploration drilling. Rødhette is the first of three

wells, which we expect will begin drilling over the next few weeks

in an extremely busy and exciting time for the Company. The wells

have the potential to create significant shareholder value.

"The exploration programme over the next 18 months offers

shareholders a unique opportunity to gain exposure to a drilling

portfolio of seven wells targeting net mean prospective resource

potential of 104MMboe (1) with an additional 220 MMboe (1) of

upside which provides the potential to create a Net Asset Value of

over $1 billion based on precedent transactions in the Norwegian

North Sea for development assets."

The information contained within this announcement is not

considered to be inside information prior to its release.

Notes :

All resource figures and chance of success estimates are from

the ERC Equipoise Competent Person Report and using a gas-to-barrel

of oil equivalent conversion factor of 5,600 scf/stb

Ends

Enquiries:

Longboat Energy

Helge Hammer, Chief Executive Officer via FTI

Jon Cooper, Chief Financial Officer

Nick Ingrassia, Corporate Development

Director

Stifel Nicolaus Europe Limited (Nominated Adviser and Broker)

Callum Stewart Tel: +44 20 7710 7600

Jason Grossman

Simon Mensley

Ashton Clanfield

FTI Consulting (PR adviser)

Ben Brewerton Tel: +44 20 3727 1000

Ntobeko Chidavaenzi longboatenergy@fticonsulting.com

Background

Longboat Energy was established by the ex-Faroe Petroleum plc

("Faroe") management team to create a full-cycle North Sea E&P

company through value accretive M&A and low-risk, near-field

exploration. The management team has a proven track record of

delivering value to shareholders through exploration success,

accretive acquisitions and farm-ins, and a demonstrated ability to

monetise discoveries through sales and asset swaps. At Faroe, the

team grew reserves from 19 MMboe to 98 MMboe between 2013 and 2018,

a compounded annual growth rate of approximately 39%. The team

monetised numerous assets through development and active portfolio

management, including asset swaps and sell downs. Faroe Petroleum

was sold to DNO ASA in January 2019, providing a Total Shareholder

Return of 129% to investors from the previous equity fundraise.

The Company has created a hand-picked portfolio and material

drilling programme, including seven attractive exploration wells

over the next 18 months and further appraisal drilling likely on

success.

The full list of the licences, working interests and resource

estimates are detailed below:

Licence Prospect Longboat Gross Attributable Geological Expected

Working Prospective Chance Pre-tax Drilling

Interest Resources of Success(2) Well Cost Date(3)

(MMboe)(1) Gross/Net

($million)(3)

--------------- --------- ------------------- -------------- ---------------

Equinor

Egyptian

PL939 Vulture 15 % 103 25% $31/5 Aug-21

---------- --------------- --------- ------------------- -------------- --------------- ----------

PL901 Rødhette 20 % 41 41% $35/7 Sep-21

---------- --------------- --------- ------------------- -------------- --------------- ----------

PL1060 Ginny 9 % 41 27% $25/2 Q3-21

---------- --------------- --------- ------------------- -------------- --------------- ----------

PL1060 Hermine 9% 27 22% incl above Q3-21

---------- --------------- --------- ------------------- -------------- --------------- ----------

PL906 Mugnetind 20 % 24 51% $33/7 Q4-21

---------- --------------- --------- ------------------- -------------- --------------- ----------

PL1049(4) Cambozola 5 % 159 15% $64/16 Q2-22

---------- --------------- --------- ------------------- -------------- --------------- ----------

PL1017 Copernicus 10% 254 26% $38/4 Q2/3-22

---------- --------------- --------- ------------------- -------------- --------------- ----------

Spirit

PL1049(4) Cambozola 20 % 159 15% $64/16 Q2-22

---------- --------------- --------- ------------------- -------------- --------------- ----------

Idemitsu

PL293B Kveikje 10% 36 55% $31/3 Q4-21

---------- --------------- --------- ------------------- -------------- --------------- ----------

Source: ERC Equipoise Competent Persons Report. The geological

chance of success (GCOS) is an estimate of the probability that

drilling the prospect would result in a discovery as defined

under SPE PRMS. In the case of Prospective Resources, there is

no certainty that hydrocarbons will be discovered, nor if discovered

will it be commercially viable to produce any portion of the

resources.

Notes :

1 ERC Equipoise estimates, using a conversion factor of 5,600

scf/stb

2 ERC Equipoise estimates

3 Longboat management/operator estimates

4 Transaction also includes the extension licence PL1049B

Standard

Estimates of reserves and resources have been prepared in

accordance with the June 2018 Petroleum Resources Management System

("PRMS") as the standard for classification and reporting with an

effective date of 31 December 2020.

Review by Qualified Person

The technical information in this release has been reviewed by

Helge Hammer, Chief Executive Officer, who is a qualified person

for the purposes of the AIM Guidance Note for Mining, Oil and Gas

Companies. Mr Hammer is a petroleum engineer with more than 30

years' experience in the oil and gas industry. He holds a degree in

Petroleum Engineering from NTH University in Trondheim and an MSc

in Economics from the Institut Français du Pétrole in Paris.

Glossary

"mmboe" Million barrels of oil equivalent

"NCS" Norwegian Continental Shelf

"Prospective Resources" those quantities of petroleum which are

estimated, on a given date, to be potentially

recoverable from undiscovered accumulations

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDGZGMLRDLGMZM

(END) Dow Jones Newswires

September 15, 2021 02:00 ET (06:00 GMT)

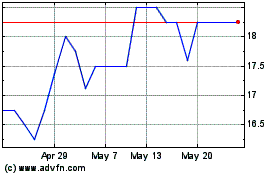

Longboat Energy (LSE:LBE)

Historical Stock Chart

From May 2024 to Jun 2024

Longboat Energy (LSE:LBE)

Historical Stock Chart

From Jun 2023 to Jun 2024