AIM Schedule One update - Longboat Energy Plc (2860K)

September 01 2021 - 3:00AM

UK Regulatory

TIDMLBE

RNS Number : 2860K

AIM

01 September 2021

ANNOUNCEMENT TO BE MADE BY THE AIM APPLICANT PRIOR TO ADMISSION

IN ACCORDANCE WITH RULE 2 OF THE AIM RULES FOR COMPANIES ("AIM

RULES")

COMPANY NAME:

Longboat Energy plc

COMPANY REGISTERED OFFICE ADDRESS AND IF DIFFERENT, COMPANY

TRADING ADDRESS (INCLUDING POSTCODES) :

5th Floor

One New Change

London EC4M 9AF

United Kingdom

COUNTRY OF INCORPORATION:

England and Wales

COMPANY WEBSITE ADDRESS CONTAINING ALL INFORMATION REQUIRED

BY AIM RULE 26:

www.longboatenergy.com

COMPANY BUSINESS (INCLUDING MAIN COUNTRY OF OPERATION) OR,

IN THE CASE OF AN INVESTING COMPANY, DETAILS OF ITS INVESTING

POLICY). IF THE ADMISSION IS SOUGHT AS A RESULT OF A REVERSE

TAKE-OVER UNDER RULE 14, THIS SHOULD BE STATED:

Longboat Energy was established in mid-2019 by the former Faroe

Petroleum management team to create a new mid cap independent

oil and gas company. The Company is currently an "investing

company" for the purposes of the AIM Rules for Companies. The

Company's ordinary shares were admitted to trading on AIM on

28 November 2019. The investment objective of Longboat Energy

is to create a full-cycle North Sea E&P company in order to

deliver value to investors.

Longboat has secured three bilateral transactions to acquire

a significant, near term, low risk exploration drilling programme

in the Norwegian Continental Shelf. These agreements will provide

Longboat Energy with a working interest in up to seven near

term exploration wells.

The farm-in agreements will constitute a reverse takeover for

the purpose of Rule 14 of the AIM Rules. Following completion

of the farm-in agreements and subsequent re-admission to AIM,

the Company will no longer be deemed to be an investing company.

DETAILS OF SECURITIES TO BE ADMITTED INCLUDING ANY RESTRICTIONS

AS TO TRANSFER OF THE SECURITIES (i.e. where known, number

and type of shares, nominal value and issue price to which

it seeks admission and the number and type to be held as treasury

shares):

Number of securities to be admitted: 56,666,666

Type and nominal value of securities: Ordinary shares of GBP0.10

nominal value

Shares to be held in treasury: None

1,953,334 shares are subject to lock-ins for 12 months from

the date of Re Admission, pursuant to AIM rule 7 of the AIM

Rules for Companies

CAPITAL TO BE RAISED ON ADMISSION (AND/OR SECONDARY OFFERING)

AND ANTICIPATED MARKET CAPITALISATION ON ADMISSION:

Capital raised on Admission: GBP35 million by way of a placing

and subscription for Ordinary shares of GBP0.10 was raised

before Re-Admission. The placing and subscription shares were

admitted to trading on 30 June at which point the funds were

raised. The fundraising proceeds will be used to complete the

farm-ins and fund future related capital activities but are

not conditional on the completion of the farm-ins.

The market capitalisation of the Company on Re-Admission is

expected to be equal to approximately GBP40 million.

PERCENTAGE OF AIM SECURITIES NOT IN PUBLIC HANDS AT ADMISSION:

18.82%

DETAILS OF ANY OTHER EXCHANGE OR TRADING PLATFORM TO WHICH

THE AIM SECURITIES (OR OTHER SECURITIES OF THE COMPANY) ARE

OR WILL BE ADMITTED OR TRADED:

None.

FULL NAMES AND FUNCTIONS OF DIRECTORS AND PROPOSED DIRECTORS

(underlining the first name by which each is known or including

any other name by which each is known):

Helge Ansgar Hammer - Chief Executive Officer

Jonathan ("Jon") Robert Cooper - Chief Financial Officer

Nicholas ("Nick") Andrew Ingrassia - Corporate Development

Director

Graham Duncan Stewart - Non-Executive Chairman

Brent Cheshire - Senior Independent Non-Executive Director

Jorunn Johanne Saetre - Independent Non-Executive Director

Katherine Louise Margiad Roe - Independent Non-Executive Director

FULL NAMES AND HOLDINGS OF SIGNIFICANT SHAREHOLDERS EXPRESSED

AS A PERCENTAGE OF THE ISSUED SHARE CAPITAL, BEFORE AND AFTER

ADMISSION (underlining the first name by which each is known

or including any other name by which each is known):

Before Admission After Admission

Blackrock Investment Management 13.8% 14.8%

----------------- ----------------

Fidelity International 10.0% 9.8%

----------------- ----------------

AXA Framlington Investment Managers 5.0% 9.2%

----------------- ----------------

SVM Asset Management 5.0% 7.4%

----------------- ----------------

Janus Henderson N/A 5.3%

----------------- ----------------

Smith & Williamson Investment

Management N/A 4.7%

----------------- ----------------

Chelverton Asset Management

Limited N/A 4.7%

----------------- ----------------

Canaccord Genuity Wealth Management 10.0% 4.1%

----------------- ----------------

Pentwater Capital Management 4.50% <3%

----------------- ----------------

Stonehage Fleming 3.50% <3%

----------------- ----------------

Helge Hammer(1) 3.00% <3%

----------------- ----------------

1. Helge Hammer shares held indirectly via Hammer Investering

AS

NAMES OF ALL PERSONS TO BE DISCLOSED IN ACCORDANCE WITH SCHEDULE

2, PARAGRAPH (H) OF THE AIM RULES:

None.

(i) ANTICIPATED ACCOUNTING REFERENCE DATE

(ii) DATE TO WHICH THE MAIN FINANCIAL INFORMATION IN THE ADMISSION

DOCUMENT HAS BEEN PREPARED (this may be represented by unaudited

interim financial information)

(iii) DATES BY WHICH IT MUST PUBLISH ITS FIRST THREE REPORTS

PURSUANT TO AIM RULES 18 AND 19:

i) 31 December

ii) 31 December 2020

iii) 30 September 2021, 30 June 2022, 30 September 2022

EXPECTED ADMISSION DATE:

2 September 2021

NAME AND ADDRESS OF NOMINATED ADVISER:

Stifel Nicolaus Europe Limited

150 Cheapside

London

EC2V 6ET

NAME AND ADDRESS OF BROKER:

Stifel Nicolaus Europe Limited

150 Cheapside

London

EC2V 6ET

OTHER THAN IN THE CASE OF A QUOTED APPLICANT, DETAILS OF WHERE

(POSTAL OR INTERNET ADDRESS) THE ADMISSION DOCUMENT WILL BE

AVAILABLE FROM, WITH A STATEMENT THAT THIS WILL CONTAIN FULL

DETAILS ABOUT THE APPLICANT AND THE ADMISSION OF ITS SECURITIES:

The admission document, which will contain full details about

the Company and Admission, will be available free of charge

at the registered office address of the Company during normal

business hours on any day (except Saturdays, Sundays and public

holidays) for a period of one month from the date of Admission.

The admission document will also be available for download

from the Company's website at www.longboatenergy.com .

THE CORPORATE GOVERNANCE CODE THE APPLICANT HAS DECIDED TO

APPLY

QCA Corporate Governance Code

DATE OF NOTIFICATION:

1 September 2021

NEW/ UPDATE:

Update

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

AIMFLFLRTAILVIL

(END) Dow Jones Newswires

September 01, 2021 03:00 ET (07:00 GMT)

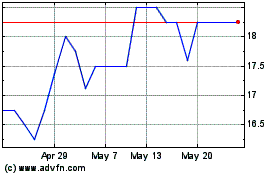

Longboat Energy (LSE:LBE)

Historical Stock Chart

From May 2024 to Jun 2024

Longboat Energy (LSE:LBE)

Historical Stock Chart

From Jun 2023 to Jun 2024