TIDMLBE

RNS Number : 1285C

Longboat Energy PLC

06 February 2020

6 February 2020

Longboat Energy plc

("Longboat Energy", "the Company" or "Longboat")

Final Results for the Year ended 31 December 2019

Longboat Energy, established by the former management team of

Faroe Petroleum plc to build a significant North Sea-focused

E&P business, announces its preliminary results for the period

from incorporation on 28 May 2019 to 31 December 2019.

Operational and strategy update

Since Longboat was admitted to AIM on 28 November 2019, the

Directors' time and resources have been fully deployed in meeting

the Company's investment objective to create a full-cycle North Sea

E&P company in order to deliver value to shareholders.

The Company's Board of Directors has excellent relationships

across the North Sea oil and gas industry, which the Company

intends to use in order to access attractive bi-lateral deal

opportunities.

The Company is targeting an initial acquisition that will

deliver near term cashflow as well as provide an appropriate

platform upon which to achieve the Company's investment objectives.

Initial acquisition targets are expected to be:

-- located offshore Norway and the UK or the wider EEA region;

-- producing and/or near producing assets, providing cash flows

to fund organic growth with robust economics, sustainable in a low

oil price environment;

-- assets with identifiable upsides via organic growth through

further field investment (infill drilling etc.), potential

near-field exploration and with follow on opportunities to deliver

a hub strategy;

-- assets with aligned partnerships where the Company can influence and optimise operations; and

-- assets where the management team's experience is valued by

the other licence partners and the authorities and can be exploited

to add value.

The North Sea oil and gas industry has been experiencing an

extended period of significant consolidation and the assets that

are being targeted are typically non-core to existing large E&P

companies, and where the Directors believe that the investment

objectives of the Company to create significant value can be met.

The Company's investment objectives are intended to be

achieved:

-- through geological expertise, technical knowledge and

understanding in addition to deep experience across the E&P

life cycle;

-- through cost reductions and targeted investments in the assets to be acquired; and

-- by focusing on assets that have the potential to provide material upside to Longboat Energy.

The Company aims to deliver value by applying the business model

of growing production and reserves through value creative M&A

combined with exploration. Longboat will focus on 'near field'

exploration with access to infrastructure and de-risking through

nearby discoveries.

The Company's Annual Report & Accounts to 31 December 2019

will be posted to shareholders in due course.

Helge Hammer, Chief Executive of Longboat Energy, said:

"We are currently evaluating a number of deal opportunities

which may prove to be suitable acquisition candidates. A key

objective for any acquisition will be a focus on investments where

we believe we can facilitate growth and unlock inherent value.

"We look forward to updating the market on this process at the

appropriate time."

Enquiries:

Longboat Energy via FTI

Helge Hammer, Chief Executive Officer

Jon Cooper, Chief Financial Officer

Stifel (Nomad) Tel: +44 20 7710 7600

Callum Stewart

Jason Grossman

Nicholas Rhodes

Ashton Clanfield

FTI Consulting (PR adviser) Tel: +44 20 3727 1000

Ben Brewerton

Sara Powell longboatenergy@fticonsulting.com

Results

The Company's loss after taxation for the period from

incorporation to 31 December 2019 was GBP196,301. In the period to

31 December 2019, the Company recorded no revenue and incurred

GBP198,051 of administrative and operating expenses. During the

period the Company raised GBP10m (before transaction costs) by way

of share issues, including GBP9.5m through the Company's Initial

Public Offering as detailed in note 16 to the financial statements.

Transaction costs associated with share issues totalled GBP741,340.

At the period end the Company held a cash balance of

GBP9,201,692.

Dividends

It is the Board's policy that the Company should seek to

generate capital growth for its shareholders but may recommend

distributions at some future date when the investment portfolio

matures, and production revenues are established and when it

becomes commercially prudent to do so

Statement of going concern

The financial statements of Longboat Energy plc have been

prepared on a going concern basis.

Outlook

The initial focus of the Directors is to identify, secure and

finance a first acquisition that will deliver asset(s) that are

able to meet the Company's investment criteria (including near term

cashflow) as well as provide an appropriate basis to build on the

Company's investment objectives. In parallel, the Board will

continue to focus on seeking additional opportunities for

generating shareholder returns in the medium and long-term beyond

the first acquisition.

Statement of losses

for the Period 28 May 2019 to 31 December 2019

Notes Period

28 May 19

to 31 Dec

19

GBP

CONTINUING OPERATIONS -

Revenue

Administrative expenses (198,051)

Other operating expenses -

----------

OPERATING LOSS (198,051)

Finance income 7 1,750

----------

LOSS BEFORE INCOME TAX 8 (196,301)

----------

Income tax 10 -

----------

LOSS FOR THE PERIOD (196,301)

----------

Loss per share expressed in pence per

share:

Basic 11 (9.52)

Diluted (9.52)

All profits and losses arise from continuing activities.

There were no items of other comprehensive income in the period

therefore no statement of comprehensive income has been

prepared.

Statement of financial position

As at 31 December 2019

Notes 31 Dec 19

GBP

ASSETS

NON-CURRENT ASSETS

Property, plant and equipment 12 2,245

Investments 13 2,540

---------

4,785

---------

CURRENT ASSETS

Trade and other receivables 15 83,104

Cash and cash equivalents 9,201,692

---------

9,284,796

---------

TOTAL ASSETS 9,289,581

---------

EQUITY

SHAREHOLDERS' EQUITY

Called up share capital 16 1,000,000

Share premium 17 7,808,660

Other reserves 17 450,000

Retained earnings 17 (196,301)

---------

TOTAL EQUITY 9,062,359

---------

LIABILITIES

CURRENT LIABILITIES

Trade and other payables 18 227,222

---------

TOTAL LIABILITIES 227,222

---------

TOTAL EQUITY AND LIABILITIES 9,289,581

---------

The financial statements were approved by the board of directors

and authorised for issue on 5 February 2020 and are signed on its

behalf by:

Helge Hammer Director

5 February 2020

Statement of changes in equity

for the Period 28 May 2019 to 31 December 2019

Called up share Share Other Retained Total equity

capital premium reserves earnings

-------------------

GBP GBP GBP GBP GBP

------------------- ------------------------- ------------------ ------------------ ---------------- ------------

On incorporation 1 - - - 1

Issue of share

capital 229,999 270,000 - - 499,999

Share buy-back

and cancellation

of share premium (180,000) (270,000) 450,000 - -

Initial Public

Offering 950,000 8,550,000 - - 9,500,000

Costs of share

issue - (741,340) - (741,340)

Total

comprehensive

expense - - - (196,301) (196,301)

------------------------- ------------------ ------------------ ---------------- ------------

Balance at 31

December

2019 1,000,000 7,808,660 450,000 (196,301) 9,062,359

------------------------- ------------------ ------------------ ---------------- ------------

Statement of cash flows

for the Period 28 May 2019 to 31 December 2019

Notes Period 28 May

19

to 31 Dec 19

GBP

Loss before income tax (196,301)

Finance income 7 (1,750)

Increase in trade and other receivables 15 (83,104)

Increase in trade and other payables 18 220,444

-----------------------------

Cash absorbed by operations (60,711)

Cash flows from investing activities

Purchase of tangible fixed assets 12 (2,245)

Purchase of fixed asset investments 13 (2,540)

Intercompany Loan -

Interest received 1,750

-----------------------------

Net cash used in investing activities (3,035)

Cash flows from financing activities

Share issue (net of issue costs) 17 9,258,660

-----------------------------

Net cash from financing activities 9,258,660

-----------------------------

Increase in cash and cash equivalents 9,194,914

Cash and cash equivalents at beginning -

of period

-----------------------------

Cash and cash equivalents at end

of period 9,194,914

-----------------------------

Relating to:

Bank balances and short-term deposits 9,201,692

Bank overdrafts (6,778)

-----------------------------

9,194,914

-----------------------------

Notes to the financial statements

for the Period 28 May 2019 to 31 December 2019

1. Statutory information

Longboat Energy plc is a public limited company, limited by

shares, registered in England and Wales. The company's registered

number is 12020297 and registered office address 5(th) Floor, One

New Change, London, England, EC4M 9AF

2. Accounting policies Basis of preparation

The financial statements of Longboat Energy plc and the Company

have been prepared in accordance with International Financial

Reporting Standards (IFRS) adopted for use in the European Union

and in accordance with the Companies Act 2006.

The financial information for the year ended 31 December 2019

set out in this announcement does not constitute the Company's

statutory financial statements for the year ended 31 December 2019

but is extracted from the audited financial statements. The

statutory financial statements for 2019 will be delivered to the

Registrar of Companies in due course.

The auditors have reported on the financial statements for the

year ended 31 December 2019 and their report was unqualified. The

report did not contain statements under section 498 (2) or (3) of

the Companies Act 2006.

While the financial information included in this preliminary

announcement has been prepared in accordance with the recognition

and measurement criteria of International Financial Reporting

Standards (IFRSs and IFRIC interpretations) issued by the

International Accounting Standards Board and as endorsed for use in

the European Union, and with those parts of the Companies Act 2006

applicable to companies preparing their accounting under IFRS, this

announcement does not itself contain sufficient information to

comply with IFRSs.

The principal accounting policies adopted in the preparation of

the financial information in this announcement are set out in the

Company's full financial statements for the year ended 31 December

2019.

The financial statements have been prepared on the historical

cost basis.

Going concern

The directors, having made due and careful enquiry and preparing

forecasts, are of the opinion that the company has adequate working

capital to execute its operation over the next 12 months. The

directors, therefore, have made an informed judgement, at the time

of approving the financial statements, that there is a reasonable

expectation that the company has adequate resources to continue in

operational existence for the foreseeable future. As a result, the

directors have continued to adopt the going concern basis of

accounting in preparing the annual financial statements.

Property, plant and equipment

Depreciation is provided at the following annual rates in order

to write off the cost less estimated residual value of each asset

over its estimated useful life.

Computer Equipment 33.33% straight line

Financial instruments

A financial instrument is a contract that gives rise to a

financial asset of one entity and a financial liability or equity

instrument of another entity. Financial assets and liabilities

comprise non-derivative and derivative receivables and

payables.

Classification: Financial assets

The Company classifies financial assets in the following

measurement categories:

-- financial assets subsequently measured at fair value (either

through other comprehensive income or through profit or loss),

and

-- financial assets measured at amortised cost.

The Company has no financial assets subsequently measured at

fair value through other comprehensive income or through profit or

loss.

Classification depends on the business model used for managing

financial assets and on the characteristics of the contractual cash

flows involved.

All financial assets held by the Company, have contractual cash

flows representing solely the payment of principal and interest.

The Company holds all these assets to collect the contractual cash

flows. These assets are classified as held at amortised cost.

Classification: Financial liabilities

Financial liabilities other than derivatives are classified as

measured at amortised cost. The Company has no derivatives.

Measurement on initial recognition

A financial asset or financial liability is initially measured

at its fair value, plus, in the case of a financial asset or

financial liability not subsequently measured at fair value through

profit or loss, the transaction costs directly attributable to the

acquisition of the asset or issuing of the liability.

Transaction costs of financial assets measured at fair value

through profit or loss are recognised as an expense in the income

statement.

The fair value is defined as the amount for which an asset could

be exchanged, or a liability settled, between knowledgeable,

willing parties in an arm's length transaction.

Subsequent measurement

The subsequent measurement of debt instruments depends on the

classification of the financial asset or liability, described

above.

Financial assets and liabilities measured at amortised cost are

accounted for using the effective interest rate method. Interest

income and expense is reported as financial income and expense.

Gains or losses arising on the derecognition of the financial asset

or liability are recognised directly in profit or loss as other

operating income/expense together with foreign currency gains and

losses.

Impairment

Trade receivables and other receivables are measured and carried

at amortised cost using the effective interest method, less any

impairment.

The carrying amount is reduced by the expected lifetime losses.

The Company does not hold other financial assets for which an

expected credit loss would be material to record.

Taxation

Taxation, comprised of current and deferred tax, is charged or

credited to the income statement unless it relates to items

recognised in other comprehensive income or directly in equity. In

such cases, the related tax is also recognised in other

comprehensive income or directly in equity.

Current tax liabilities are measured at the amount expected to

be paid, based on tax rates and laws that are enacted or

substantively enacted at the balance sheet date.

Deferred tax is accounted for using the balance sheet liability

method and is calculated using rates of taxation enacted or

substantively enacted at the balance sheet date which are expected

to apply when the asset or liability is settled.

Deferred tax liabilities are generally recognised for all

taxable temporary differences. Deferred tax assets are only

recognised to the extent that it is probable that taxable profits

will be available against which deductible temporary differences

can be utilised. Deferred tax is not recognised in respect of

investments in subsidiaries and associates where the reversal of

any taxable temporary differences can be controlled and are

unlikely to reverse in the foreseeable future. Deferred tax assets

and liabilities are offset when there is a legally enforceable

right to offset and there is an intention to settle the balances on

a net basis.

Tax provisions are recognised when there is a potential exposure

under changes to International tax legislation.

Foreign currencies

Assets and liabilities in foreign currencies are translated into

sterling at the rates of exchange ruling at the statement of

financial position date. Transactions in foreign currencies are

translated into sterling at the rate of exchange ruling at the date

of transaction. Exchange differences are taken into account in

arriving at the operating result.

Leases

All leases are accounted for by recognising a right-of-use asset

and a lease liability except for:

- Leases of low value assets; and

- Leases with a duration of 12 months or less.

Lease liabilities are measured at the present value of the

contractual payments due to the lessor over the lease term, with

the discount rate determined by reference to the rate inherent in

the lease unless (as is typically the case) this is not readily

determinable, in which case the Company's incremental borrowing

rate on commencement of the lease is used. Variable lease payments

are only included in the measurement of the lease liability if they

depend on an index or rate. In such cases, the initial measurement

of the lease liability assumes the variable element will remain

unchanged throughout the lease term. Other variable lease payments

are expensed in the period to which they relate.

On initial recognition, the carrying value of the lease

liability also includes:

- amounts expected to be payable under any residual value

guarantee;

- the exercise price of any purchase option granted in favour of

the group if it is reasonable certain to assess that option;

- any penalties payable for terminating the lease, if the term

of the lease has been estimated on the basis of termination option

being exercised.

Right of use assets are initially measured at the amount of the

lease liability, reduced for any lease incentives received, and

increased for:

- lease payments made at or before commencement of the

lease;

- initial direct costs incurred; and

- the amount of any provision recognised where the Company is

contractually required to dismantle, remove or restore the leased

asset.

Subsequent to initial measurement lease liabilities increase as

a result of interest charged at a constant rate on the balance

outstanding and are reduced for lease payments made. Right-of-use

assets are amortised on a straight-line basis over the remaining

term of the lease or over the remaining economic life of the asset

if, rarely, this is judged to be shorter than the lease term.

Reserves

A description of each of the reserves follows:

Share capital

Share capital represents the nominal value of shares issued less

the nominal value of shares repurchased and cancelled.

Share Premium

This reserve represents the difference between the issue price

and the nominal value of shares at the date of issue, net of

related issue costs and share premium cancelled.

Retained Earnings

Net revenue profits and losses of the Company which are revenue

in nature are dealt with in this reserve.

Other reserve

Other reserves relate to the nominal value of share capital

repurchased and cancelled.

3. Adoption of new and revised standards and changes in

accounting policies

Standards issued but not yet effective

At the date of authorisation of these financial statements, the

Company has not applied the following standards that have been

issued but are not yet effective. The Company has not adopted any

new or amended standards early.

Effective

date:

IFRS 17 Insurance Contracts 1 January

2021

IFRS 10 and IAS Sale or Contribution of Assets between No date set

28 (Amendments) an Investors and its Associate or

Joint Venture

IFRS 3 (Amendments) Definition of a business 1 January

2020

IAS 1 and IAS Definition of material 1 January

8 (Amendments) 2020

Conceptual Framework Amendments to References to the Conceptual 1 January

Framework in IFRS Standards 2020

In October 2018, the International Accounting Standards Board

(Board) issued Definition of a Business (Amendments to IFRS 3) to

make it easier for companies to decide whether activities and

assets they acquire are a business or merely a group of assets. The

amendments:

-- confirmed that a business must include inputs and a process, and clarified that:

- the process must be substantive; and

- the inputs and process must together significantly contribute to creating outputs.

-- narrowed the definitions of a business by focusing the

definition of outputs on goods and services provided to customers

and other income from ordinary activities, rather than on providing

dividends or other economic benefits directly to investors or

lowering costs; and

-- added a test that makes it easier to conclude that a company

has acquired a group of assets, rather than a business, if the

value of the assets acquired is substantially all concentrated in a

single asset or group of similar assets.

The amendment is effective for periods beginning on or after 1

January 2020. It has yet to be endorsed for application in the

European Union. Given the acquisition strategy of the Company these

amendments may have a significant impact on the accounting

treatment for future acquisitions.

Other changes to standards, interpretations and amendments

issued but not yet effective are not expected to have a material

impact on the Company financial statements.

4. Critical accounting estimates

In the application of the company's accounting policies, the

directors are required to make judgements, estimates and

assumptions about the carrying amount of assets and liabilities

that are not readily apparent from other sources. The estimates and

associated assumptions are based on historical experience and other

factors that are considered to be relevant. Actual results may

differ from these estimates.

The estimates and underlying assumptions are reviewed on an

ongoing basis. Revisions to accounting estimates are recognised in

the period in which the estimate is revised, if the revision

affects only that period, or in the period of the revision and

future periods if the revision affects both current and future

periods.

Cost allocation

In accordance with IFRS the costs of the IPO that involves both

issuing new shares and a stock market listing was accounted for as

follows:

-- Incremental costs that are directly attributable to issuing

new shares should be deducted from equity (net of any income tax

benefit)

-- Costs that relate to the stock market listing, or are

otherwise not incremental and directly attributable to issuing new

shares, have been recorded as an expense in the statement of

comprehensive income.

Judgment was required in assessing the nature of certain costs

such as legal and professional fees to determine the extent to

which such costs were attributable to the new shares issued or the

listing and management assessed the underlying nature of the

services in assessing the allocation.

5. Employees and directors

GBP

------------------------ --------

Wages and salaries 52,163

Social security costs 6,504

Other pension costs 3,447

--------

62,114

--------

The average number of employees during the period was as

follows:

Number

-------------------------- --------

Executive Directors 2

Non-Executive Directors 4

Staff 1

--------

7

--------

6. Directors remuneration

The emoluments of the individual Directors for the period are

included in wages and salaries and were as follows:

Salary Pension Total

GBP GBP GBP

Executive Directors

Helge Hammer 12,575 1,397 13,972

Jonathan Cooper 10,060 1,118 11,178

Non-executive Directors

Brent Cheshire 5,216 - 5,216

Katherine Roe 4,471 - 4,471

Jorunn Saetre 3,726 - 3,726

Graham Stewart 7,732 - 7,732

Total 43,780 2,515 46,295

The Executive Directors entered into service agreements with the

Company on 28 November 2019, the date of Admission to AIM.

Pursuant to letters of appointment dated 28 November 2019, the

Non-executive Directors of the Company were appointed as of that

date and on an ongoing basis. Each Non-executive Director is

entitled to an annual fee, including in respect of any service on

any Board committee.

As stated at the time of Admission to AIM, the Remuneration

Committee will, at the time of making the first acquisition,

undertake an executive salary benchmarking exercise for the

purposes of determining what shall constitute a competitive market

salary and pension contribution for the Executive Directors.

7. Net finance income

GBP

-------------------------- -----

Finance Income

Deposit account interest 1,750

-----

8. Loss before income tax

The loss before income tax is state after charging:

GBP

------------------------------------- ------

Administrative expenses

Auditor remuneration 8,000

Executive Director's remuneration 22,635

Wages 8,383

Pensions 3,447

Social security 6,504

Operating leases 9,500

Non-Executive Director remuneration 21,145

9. Auditors' remuneration

GBP

---------------------------------------------------------- -----

Fees payable to the Company's auditors for the audit

of the Company's accounts 8,000

During the period the auditor provided non-audit services of

GBP15,000 in their role as Reporting Accountant in relation

to the Company's Admission to AIM.

10. Income tax

Analysis of tax expense

No liability to UK corporation tax arose for the period.

Unused tax losses on which no deferred tax has been recognised

as at 31 December 2019 was GBP299,105 and the potential tax benefit

will be GBP56,830. Deferred tax assets, including those arising

from temporary differences, are recognised only when it is

considered more likely than not that they will be recovered, which

is dependent on the generation of future assessable income of a

nature and of an amount sufficient to enable the benefits to be

utilised.

Reconciliation of tax charge

Loss on ordinary activities before taxation (196,301)

Tax on loss on ordinary activities at standard

CT rate of 19.00% (37,297)

Effects of:

Expenses not deductible for tax purposes 8,321

Adjust closing mainstream unrecognized deferred

tax to average rate of 19.00% 363

Adjust closing ring fence unrecognized deferred

tax to average rate of 19.00% (28,217)

Deferred tax not recognised 56,830

----------

Tax charge/(credit) for the period -

----------

11. Loss per share

Basic loss per share is calculated by dividing the loss

attributable to ordinary shareholders by the weighted average

number of ordinary shares outstanding during the period.

Diluted loss per share is calculated using the weighted average

number of shares adjusted to assume the conversion of all dilutive

potential ordinary shares of which there are currently none in

issue.

Reconciliations are set out below.

Weighted

average Per share

Loss number of amount

GBP shares p

Basic and diluted LPS

Loss attributable to ordinary shareholders (196,301) 2,062,213 (9.52)

12. Property, plant and equipment

Computer

equipment

GBP

COST

Additions 2,245

At 31 December 2019 2,245

--------------

NET BOOK VALUE

At 31 December 2019 2,245

--------------

No depreciation was charged in the period ended 31 December 2019

due to assets being purchased part way through December 2019.

Depreciation will be charged from the first full month of ownership.

13. Investments

Shares in company

undertakings

GBP

COST

Additions 2,540

At 31 December 2019 2,540

-----------------

NET BOOK VALUE

At 31 December 2019 2,540

-----------------

The Company or the company's investments at the Statement of

Financial Position date in the share capital of companies include

the following:

Subsidiary

Longboat Energy Norge AS (company number 924 186 720), with a

registered office at c/o Kluge Advokatfirma, Laberget 24, 4020,

Stavanger, Norway. The company was incorporated on 5 December

2019.

Holding

----------------------------------------------------

%

---------------------------------------------------- --------------------

Class of shares:

Ordinary 100.00

The company has taken advantage of the exemption under the Companies

Act 2006 s405 not to consolidate this subsidiary as it has been

dormant from the date of incorporation and is not material for

the point of giving a true and fair view.

14. Financial risk management

The Company is exposed to financial risks through its various

business activities. In particular, changes in interest rates

exchange rates can have an effect on the capital, financial and

revenue situation of the Company. In addition, the Company is

subject to credit risks.

The Company has adopted internal guidelines, which concern risk

control processes and which regulate the use of financial

instruments and thus provide a clear separation of the roles

relating to operational financial activities, their implementation

and accounting, and the auditing of financial instruments. The

guidelines on which the Company's risk management processes are

based are designed to ensure that the risks are identified and

analysed across the Company. They also aim for a suitable

limitation and control of the risks involved, as well as their

monitoring.

The Company controls and monitors these risks primarily through

its operational business and financing activities.

Credit Risks

The credit risk describes the risk from an economic loss that

arises because a contracting party fails to fulfil their

contractual payment obligations. The credit risk includes both the

immediate default risk and the risk of credit deterioration,

connected with the risk of the concentration of individual risks.

For the Company, credit and default risks are concentrated in the

financial institutions in which it places cash deposits.

The Company's policy is to place its cash with reputable

clearing banks. The Company's cash is deposited with one bank with

a credit rating of AA-.

Notwithstanding existing collateral, the amount of financial

assets indicates the maximum default risk in the event that

counterparties are unable to meet their contractual payment

obligations. The maximum credit default risk amounted to

GBP9,254,796 at the balance sheet date, of which GBP9,201,692 was

cash on deposit at banks.

Liquidity Risks

Liquidity risk is defined as the risk that a company may not be

able to fulfil its financial obligations. The Company manages its

liquidity by maintaining cash and cash equivalents sufficient to

meet its expected cash requirements to implement its investment

policy. In the event that there is a risk that the cash required to

follow the investment policy is greater than the Company's liquid

resources, the Company would seek confirmation of the continuation

of the policy and the raising of further financing at a shareholder

general meeting.

At 31 December 2019, the Company has cash on deposit of

GBP9,201,692.

Market Risks

Interest Rate Risks

Interest rate risks exist due to potential changes in market

interest rates and can lead to a change in the fair value of

fixed-interest bearing instruments, and to fluctuations in interest

payment for variable interest rate financial instruments.

The Company is exposed to interest rate risk on cash held on

deposit at banks. Interest income for the period to 31 December

2019 was GBP1,750. These accounts are maintained for liquidity

rather than investment, and the interest rate risk is not

considered material to the Company.

Currency Risks

The Company operates in the UK, incurs expenses predominantly in

sterling and NOK, and holds cash in sterling and NOK. The Company

incurs some expenditure in foreign currency when the investment

policy requires services to be obtained overseas and when its NOK

balances are retranslated into GBP at period ends. The foreign

exchange risk on these costs is not considered material to the

Company.

15. Trade and other receivables

GBP

----------------- ------

VAT recoverable 45,060

Prepayments 38,044

83,104

------

The directors consider that the carrying amount of trade and

other receivables approximates to their fair value.

16. Called up share capital

Allotted and issued ordinary shares of ten pence each ('Ordinary

Shares'):

Number Class Nominal value GBP

------------ ---------- ------------- -----------

10,000,000 Ordinary GBP0.10 1,000,000

Share capital history over the period:

-- On incorporation on 28 May 2019, one subscriber share with a

nominal value of GBP1.00 was issued

-- On 3 September 2019 the subscriber share of GBP1.00 was

subdivided into 10 Ordinary Shares and a further 999,990 Ordinary

Shares were issued at par

-- On 23 October 2019 1,000,000 Ordinary Shares were issued at par

-- On 25 November 2019 300,000 Ordinary Shares were issued at a

premium of 90p per Ordinary Share and from the total Ordinary

Shares in issue (2,300,000 Ordinary Shares), 1,800,000 Ordinary

Shares were repurchased, cancelled and transferred to other

reserves leaving 500,000 Ordinary Shares in issue with total

subscription monies of GBP500,000 (which was carried out in order

to ensure that the founders' subscription price for Ordinary Shares

was equal to the price paid by the new subscribers in the initial

public offering i.e. GBP1.00 per share).

-- On 25 November 2019 a capital reduction was undertaken to

convert GBP270,000 of share premium to other reserves.

-- On 28 November 2019 9,500,000 Ordinary Shares were allotted

to the new subscribers at a premium of 90p per Ordinary Share

17. Reserves

Company Retained Share premium Other reserves Total

earnings GBP GBP GBP

GBP

------------------ ---------- -------------- --------------- ----------

Deficit for the

period (196,301) - - (196,301)

Cash share issue

/ IPO - 8,550,000 450,000 9,000,000

Costs of share

issue - (741,340) - (741,340)

---------- -------------- --------------- ----------

(196,301) 7,808,660 450,000 8,062,359

---------- -------------- --------------- ----------

18. Trade and other payables

GBP

-------------------------------------------------------- ------------

Current:

Trade creditors 94,452

Social security and other taxes 6,504

Other creditors 62,389

Accrued expenses 63,877

227,222

------------

The directors consider that the carrying amount of trade payables

approximates to their fair value

19. Leasing agreements

Minimum lease payments fall due as follows:

Company Non-cancellable operating

leases

GBP

Within one year 45,600

The leases have a term of less than 12 months.

20. Related party transactions

Members of the Board of Directors are deemed to be key

management personnel. Key management personnel compensation for the

financial period is the same as the Director remuneration set out

in note 6 to the accounts.

Directors' and the Company Secretary's interests in the shares

of the Company, including family interests, were as follows:

Ordinary shares

Helge Hammer 300,000

Jonathan Cooper 125,000

Graham Stewart 150,000

Jorunn Saetre 25,000

Julian Riddick 100,000

There were no other transactions or balances with related

parties in the period.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR UPUUGPUPUPGA

(END) Dow Jones Newswires

February 06, 2020 02:00 ET (07:00 GMT)

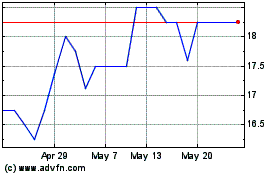

Longboat Energy (LSE:LBE)

Historical Stock Chart

From May 2024 to Jun 2024

Longboat Energy (LSE:LBE)

Historical Stock Chart

From Jun 2023 to Jun 2024