Further re possible offer for Liberty PLC

May 18 2010 - 2:01AM

UK Regulatory

TIDMMWB TIDMLBE

RNS Number : 0978M

Pyrrho Investment Limited

18 May 2010

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN PART, IN, INTO OR

FROM ANY JURISDICTION WHERE TO DO THE SAME WOULD CONSTITUTE A VIOLATION OF THE

RELEVANT LAWS OF SUCH JURISDICTION

FOR IMMEDIATE RELEASE

18 May 2010

Liberty Plc ("Liberty")

RESPONSE TO LIBERTY'S ANNOUNCEMENT

Pyrrho Investments Limited ("Pyrrho") notes the announcements made by Liberty on

14 May and 17 May in response to Pyrrho's announcement that it has made a

proposal to Liberty's board that it wishes to make an offer for the entire

issued and to be issued share capital of Liberty at a higher aggregate price

than the possible offer by BlueGem Capital Partners LLP ("BlueGem") that was

announced on 7 May.

For the benefit of the shareholders of MWB Group Holdings plc ("MWB") and

Liberty, Pyrrho wishes to respond to and clarify a number of assertions that

were made in the announcements by Liberty:

1. Pyrrho's initial proposal to Liberty on 4 May was not "highly

conditional"

As stated in Pyrrho's announcement on 14 May, this initial proposal was subject

to standard due diligence pre-conditions. These were discussed in a meeting

between Arbuthnot Securities Limited ("Arbuthnot"), Pyrrho's advisers, and

Panmure Gordon ("Panmure"), MWB's advisers, in the morning of 5 May. During

this meeting, Arbuthnot represented that these due diligence pre-conditions were

capable of being addressed in a very short timescale, primarily by arranging a

meeting between the respective parties.

2. The risk to Liberty of BlueGem's possible proposed offer falling away

was not material

On 6 May, Pyrrho made an approach to Liberty with a revised proposal which was

not subject to any due diligence pre-conditions. Pyrrho subsequently discovered

that this revised proposal was only 1p per Liberty share less than BlueGem's

revised proposed offer of 186p.

If Liberty had agreed to negotiate with Pyrrho, even if BlueGem's revised

proposed offer had fallen away, the downside to Liberty shareholders was only

approximately GBP230,000, a difference of 0.5% in a transaction of over

GBP43million. Pyrrho's revised proposal at 185p was open for the Liberty board's

acceptance until 5pm on 7 May.

Pyrrho believes that it remains in Liberty shareholders' interests for the

Liberty board to explore a possible offer from Pyrrho.

3. a) Pyrrho was never told that a higher offer existed

On 3 May Pyrrho was informed that BlueGem had made an offer for Liberty (the

"Original BlueGem Offer"). On 6 May Pyrrho made an unconditional offer at a

higher price than the Original BlueGem Offer. At no time did Panmure or

Liberty's advisers Cavendish Corporate Finance ("Cavendish") inform Pyrrho that

Liberty had received an offer higher than Pyrrho's 185p unconditional offer.

Pyrrho naturally assumed that it remained the highest bidder, and therefore saw

no reason to raise its offer. Pyrrho was only aware of the higher offer when an

email was sent to Arbuthnot 13 minutes prior to the publication of the

announcement at 7am on 7 May that Liberty had received an offer of 186p from

BlueGem.

b) 185p was not Pyrrho's highest offer

In the early afternoon of 6 May, Panmure telephoned Arbuthnot to ask if 185p was

Pyrrho's highest offer. Unaware that BlueGem had made or were intending to make

a higher offer, Arbuthnot replied that "this (i.e.185p) is an offer that we are

able to deliver on today", leaving the door open for further negotiation.

At no time did Arbuthnot state that 185p was Pyrrho's highest offer.

This brief statement by Arbuthnot should not have been construed or interpreted

by Panmure (particularly without having sought clarification from Pyrrho or its

advisers) as confirmation that "Pyrrho was not prepared to increase that offer

on an unconditional basis above 185 pence" as was stated in Liberty's

announcement on 14 May.

Subsequent to the aforementioned telephone conversation between Panmure and

Arbuthnot, between 4 pm and 8 pm on 6 May, Arbuthnot chased Panmure and

Cavendish several times, via e-mails and telephone messages, in an earnest

attempt to obtain an update on the status of Liberty board's decision-making

process, and to try to ascertain if there was a higher offer.

It must have been obvious to Cavendish, Liberty's advisers, that the numerous

attempts that Arbuthnot made to discuss the proposed Pyrrho offer with them

during the afternoon of 6 May indicated that they were in a position to provide

further information to Liberty and its advisers, which could have benefited

Liberty and MWB's shareholders.

4. The Liberty and MWB boards did not sufficiently consider the Pyrrho

Offer

Pyrrho is surprised that, since it first indicated its interest in making a

possible offer for Liberty on 4 May, neither MWB nor Liberty made any attempt to

contact Pyrrho to discuss this or to arrange a meeting. In addition, MWB's

advisers and Liberty's advisers made no proactive attempt to enter into any

discussions with Pyrrho's advisers.

We understand that some time after receipt by Liberty of the higher 185p per

share offer from Pyrrho on 6 May, BlueGem restructured its bid (i.e. materially

enlarging the Liberty special dividend and shrinking BlueGem's cash offer

component, compared to BlueGem's original bid), culminating in a revised BlueGem

bid that is, in the aggregate, a mere 1p per share above Pyrrho's unconditional

offer.

Pyrrho was given no opportunity to respond to BlueGem's revised offer, a

privilege afforded to BlueGem in response to Pyrrho's unconditional offer of

185p. Pyrrho cannot understand, in light of the incremental difference between

Pyrrho's unconditional offer of 185p and BlueGem's revised offer of 186p being

so small, why the Liberty Board and its advisers did not invite competing

potential acquirers to bid against each other in another competitive round in

order to achieve a higher final offer price.

Pyrrho believes that this was an inappropriate manner in which to consider a

matter as important as a potential offer for Liberty.

5. Liberty's advisers did indicate to Pyrrho's advisers that they would

update them on any developments in this matter

This assertion was made both verbally and in an email by Cavendish at 3.20pm on

6 May to Arbuthnot.

6. Pyrrho showed interest in a bid for Liberty once it became aware of

potential terms

Pyrrho has watched the efforts of the Liberty management team and MWB to elicit

offers for Liberty since its strategic review was announced in July 2009. Pyrrho

would have put forward this proposal earlier had it been aware of the level of

offer that Liberty's board and MWB were willing to recommend and accept. Pyrrho

made its initial approach to Liberty on 4 May one day after becoming aware of

this information.

Improved Proposal

Further to its announcement on 14 May, Pyrrho reiterates that it has made a

revised proposal to Liberty's board that it wishes to make an offer for the

entire issued and to be issued share capital of Liberty at a higher aggregate

price than BlueGem's aggregate 186p per share offer.

For further information, please contact:

Arbuthnot Securities Limited

Nick Tulloch

Tel: +44 (0) 207 012 2000

Ben Wells

Ed Gay

Hogarth PR

Reg Hoare

Tel: +44 (0) 7884 494112

Katie Hunt

+44 (0) 207 357 9477

Ian Payne

Copies of this announcement are available on the London Stock Exchange website

www.londonstockexchange.com

Disclosure requirements of the Takeover Code (the "Code")

Under Rule 8.3(a) of the Code, any person who is interested in 1% or more of any

class of relevant securities of an offeree company or of any paper offeror

(being any offeror other than an offeror in respect of which it has been

announced that its offer is, or is likely to be, solely in cash) must make an

Opening Position Disclosure following the commencement of the offer period and,

if later, following the announcement in which any paper offeror is first

identified. An Opening Position Disclosure must contain details of the person's

interests and short positions in, and rights to subscribe for, any relevant

securities of each of (i) the offeree company and (ii) any paper offeror(s). An

Opening Position Disclosure by a person to whom Rule 8.3(a) applies must be made

by no later than 3.30 pm (London time) on the 10th business day following the

commencement of the offer period and, if appropriate, by no later than 3.30 pm

(London time) on the 10th business day following the announcement in which any

paper offeror is first identified. Relevant persons who deal in the relevant

securities of the offeree company or of a paper offeror prior to the deadline

for making an Opening Position Disclosure must instead make a Dealing

Disclosure.

Under Rule 8.3(b) of the Code, any person who is, or becomes, interested in 1%

or more of any class of relevant securities of the offeree company or of any

paper offeror, must make a Dealing Disclosure if the person deals in any

relevant securities of the offeree company or of any paper offeror. A Dealing

Disclosure must contain details of the dealing concerned and of the person's

interests and short positions in, and rights to subscribe for, any relevant

securities of each of (i) the offeree company and (ii) any paper offeror, save

to the extent that these details have previously been disclosed under Rule 8. A

Dealing Disclosure by a person to whom Rule 8.3(b) applies must be made by no

later than 3.30 pm (London time) on the business day following the date of the

relevant dealing.

If two or more persons act together pursuant to an agreement or understanding,

whether formal or informal, to acquire or control an interest in relevant

securities of an offeree company or a paper offeror, they will be deemed to be a

single person for the purpose of Rule 8.3.

Opening Position Disclosures must also be made by the offeree company and by any

offeror and Dealing Disclosures must also be made by the offeree company, by any

offeror and by any persons acting in concert with any of them (see Rules 8.1,

8.2 and 8.4). Details of the offeree and offeror companies in respect of whose

relevant securities Opening Position Disclosures and Dealing Disclosures must be

made can be found in the Disclosure Table on the Takeover Panel's website at

www.thetakeoverpanel.org.uk, including details of the number of relevant

securities in issue, when the offer period commenced and when any offeror was

first identified. If you are in any doubt as to whether you are required to make

an Opening Position Disclosure or a Dealing Disclosure, you should contact the

Panel's Market Surveillance Unit on +44 (0)20 7638 0129.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FURGGUWWAUPUUAR

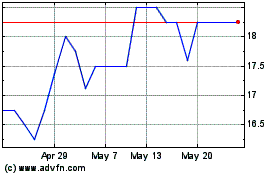

Longboat Energy (LSE:LBE)

Historical Stock Chart

From May 2024 to Jun 2024

Longboat Energy (LSE:LBE)

Historical Stock Chart

From Jun 2023 to Jun 2024