Statement re. Press Comment

May 17 2010 - 2:01AM

UK Regulatory

TIDMLBE TIDMMWB

RNS Number : 0015M

Liberty PLC

17 May 2010

FOR IMMEDIATE RELEASE

17 May 2010

LIBERTY PLC

("LIBERTY" OR "THE COMPANY")

STATEMENT RE: PRESS COMMENT

The Board of Liberty, the iconic British brand and Regent street emporium, notes

the weekend press comment that states a potential bidder for the Company was

"frozen out" of the bidding process and was prevented from making a higher

offer.

Liberty and its advisors reiterate that Pyrrho Investments Ltd ("Pyrrho") had

ample opportunity to increase its proposed 185p a share offer for the Company

but refused to do so on an unconditional basis. At the same time Liberty

received a proposed 186p per share offer from BlueGem (the "BlueGem Proposed

Offer") that was unconditional and had received hard irrevocables to vote in

favour of the BlueGem Proposed Offer from shareholders owning 86.3% of Liberty's

Ordinary shares.

Pyrrho claimed that it would have made a higher offer for the Company on or

before 7 May 2010, but when offered the opportunity to make a higher bid it

declined to do so. Yet comments attributed to Pyrrho in the weekend's press

claimed it had informed the Liberty Board before 7 May 2010 that it was prepared

to make a higher bid than 186p a share.

Neither the Liberty Board nor the Company's shareholders received an increased

offer from Pyrrho before 7 May 2010.

Pyrrho's argument that the Liberty Board's acceptance of BlueGem's unconditional

186p a share offer is materially to the detriment of Liberty shareholders is

totally without foundation. Liberty's shareholders have the benefit of a

proposed offer of 186p a share that is supported by four months of due diligence

and financial backing.

In contrast Pyrrho, which as a 21% shareholder in MWB Group Holdings Plc, the

majority shareholder in Liberty, has been aware of the possibility that Liberty

could be sold since the end of July 2009. Yet its earliest indication of

interest was 4 May 2010 when Pyrrho said it was considering a bid for Liberty of

between 190-200p a share. But two days later it proposed a lower offer of only

185p a share and Liberty was informed by Pyrrho's advisors that it was not

prepared to increase the offer on an unconditional basis over 185p.

The Board of Liberty made an informed choice based on the submitted proposals it

had received on 6 May 2010. This was the correct way to proceed and the Board

acted properly and in the best interests of the Liberty shareholders.

Ends.

For further information, please contact:

Liberty Plc

Richard Balfour-Lynn, Chairman +44

(0) 20 7706 2121

Baron Phillips Associates (Financial PR Adviser)

Baron Phillips

+44 (0) 20 7920 3161

Seymour Pierce Limited

Nicola Marrin

+44 (0) 207 107 8000

Jonathan Wright

This information is provided by RNS

The company news service from the London Stock Exchange

END

SPCGGUBGAUPUGMQ

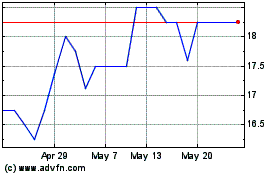

Longboat Energy (LSE:LBE)

Historical Stock Chart

From May 2024 to Jun 2024

Longboat Energy (LSE:LBE)

Historical Stock Chart

From Jun 2023 to Jun 2024