Rule 2.4 announcement

May 07 2010 - 2:00AM

UK Regulatory

TIDMLBE TIDMMWB

RNS Number : 5055L

Liberty PLC

07 May 2010

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN PART, IN, INTO OR

FROM ANY JURISDICTION WHERE TO DO THE SAME WOULD CONSTITUTE A VIOLATION OF THE

RELEVANT LAWS OF SUCH JURISDICTION

PRESS ANNOUNCEMENT

FOR IMMEDIATE RELEASE

7 May 2010

Liberty Plc ("Liberty")

ANNOUNCEMENT OF A POSSIBLE OFFER UNDER RULE 2.4 OF THE TAKEOVER CODE

This announcement does not amount to a firm intention to make an offer and,

accordingly, there can be no certainty that any offer will be made even if the

pre-conditions set out below are satisfied or waived.

BlueGem Capital Partners LLP, on behalf of BlueGem L.P. ("BlueGem"), announces

that it is in discussions with the Board of Liberty about the possibility of

making an offer for the ordinary share capital of Liberty (the "Proposed

Offer").

On 15 March 2010, Liberty announced that it had exchanged contracts for the sale

of the freehold interest in its 125,000 sq ft flagship store on Great

Marlborough Street, London, W1, for GBP41.5 million to Sirosa Liberty Limited

(the "Property Sale").

The Property Sale is conditional on approval by the shareholders of MWB Group

Holdings Plc ("MWB"), Liberty's 68.3% shareholder. On 16 April 2010 MWB posted a

circular to its shareholders seeking such approval at a general meeting to be

held on 10 May 2010. The directors of MWB have recommended that shareholders of

MWB approve the Property Sale. Furthermore, the directors of MWB and other

shareholders, representing in aggregate 71.3% of the ordinary shares in MWB,

have granted hard irrevocable undertakings to vote in favour of the resolution

to approve the Property Sale.

Immediately prior to the completion of the Property Sale, Liberty will lease

back the store and continue to operate from the building. Liberty will take an

institutional 30-year lease on the building at an initial annual rent of GBP2.1

million, with five yearly fixed upward rent reviews during the remaining period

of the lease.

In addition to the Property Sale, Liberty has been holding discussions with

BlueGem about the possibility of BlueGem making the Proposed Offer. The Proposed

Offer by BlueGem for each Liberty ordinary share is 141.8 pence per share in

cash (the "Offer Price"), valuing the existing issued ordinary share capital of

Liberty at approximately GBP32.0 million. Any offer will only be made following

completion of the Property Sale.

Following the announcement of the Proposed Offer (if any), the board of Liberty

intends to declare a special dividend (the "Special Dividend"), the payment of

which is conditional upon the Proposed Offer being declared wholly

unconditional. The Special Dividend to be declared in conjunction with the

Proposed Offer would be 44.2 pence per Liberty ordinary share (approximately

GBP10.0 million in total based on the existing issued ordinary share capital of

Liberty) (the Proposed Offer and the Special Dividend together referred to as

the "Transaction"). The Special Dividend would be paid to Liberty ordinary

shareholders within seven days of the date on which the Proposed Offer becomes

or is declared wholly unconditional. The record date for the Special Dividend

would be announced at the time that the Special Dividend is declared.

The Transaction would result in a total payment to the holders of Liberty

ordinary shares who are on the share register as at the record date of 186.0

pence per Liberty ordinary share (approximately GBP42.0 million in aggregate).

This aggregate amount reflects both the benefit of the anticipated surplus cash

in Liberty following the Property Sale, as well as the value placed by BlueGem

on the Liberty business. For the avoidance of doubt, the Special Dividend will

not be payable to ordinary shareholders unless the Proposed Offer is declared

unconditional in all respects.

On 6 May 2010, MWB and certain of its wholly owned subsidiaries entered into

hard irrevocable undertakings to accept the Proposed Offer ("MWB Irrevocables")

in relation to their combined holding of 15,447,409 Liberty ordinary shares (the

"Relevant Liberty Shares") at the Offer Price, subject to the making of the

Proposed Offer by BlueGem.

In addition Principle Capital Investments Limited and Cartesian Partners LP have

entered into hard irrevocable undertakings to accept the Proposed Offer in

relation to their holdings of Liberty ordinary shares (1,693,541 and 2,359,177

respectively) at the Offer Price, subject to the making of the Proposed Offer by

BlueGem.

In total, the hard irrevocable undertakings entered into by holders of ordinary

shares in Liberty (the "Liberty Offer Irrevocables") represent 86.3% of the

existing issued ordinary share capital of Liberty.

The directors of Liberty have resolved, subject to the making of the Proposed

Offer by BlueGem, to recommend the Proposed Offer to shareholders of Liberty in

the proposed Offer Document to be sent to Liberty shareholders. BlueGem has

confirmed that it will declare the Proposed Offer (if made) unconditional as to

acceptances if, at the first closing date of the Proposed Offer (or any

subsequent closing date), acceptances in respect of not less than 86.3% of the

ordinary share capital of Liberty have been received.

The MWB Irrevocables are conditional upon shareholders of MWB approving the

proposed sale by MWB of the Relevant Liberty Shares pursuant to the Proposed

Offer at a general meeting of the shareholders of MWB. A circular seeking

approval of the sale by MWB of the Relevant Liberty Shares pursuant to the

Proposed Offer will be posted to shareholders of MWB if the Proposed Offer is

formally announced. The directors of MWB have undertaken to convene a general

meeting to consider approval of the sale by MWB of the Relevant Liberty Shares

pursuant to the Proposed Offer, to recommend the resolution to shareholders of

MWB, to vote in favour of such resolution in respect of their respective

shareholdings in MWB totalling 25,880,014 ordinary shares in MWB, representing

15.8% of MWB's issued share capital and to vote against any resolution which

might conflict in any way with the passing of such resolution. Shareholders in

MWB accounting for a further 57,876,326 ordinary shares in MWB, representing

35.3% of MWB's issued voting share capital, have entered into hard irrevocable

undertakings to vote in favour of the sale by MWB of the Relevant Liberty Shares

pursuant to the Proposed Offer if it is considered at a general meeting of the

shareholders of MWB and to vote against any resolution which might conflict in

any way with the passing of such resolution.

In total, the hard irrevocable undertakings entered into by holders of ordinary

shares in MWB represent 51.1% of the ordinary share capital of MWB.

The principal terms of the Liberty Offer Irrevocables granted by Liberty

shareholders are set out in the appendix to this announcement.

This announcement does not amount to a firm intention to make an offer and,

accordingly, there can be no certainty that any offer will be made even if the

conditions set out above are satisfied or waived.

A further announcement will be made in due course.

For further information, please contact:

Seymour Pierce Limited

+44 (0) 207 107 8000

Nicola Marrin

Jonathan Wright

APPENDIX

Summary of principal terms of Liberty Offer Irrevocables

Each person who has entered into an irrevocable undertaking has undertaken (on

its own behalf and on behalf of its associates) inter alia not to (i) sell,

transfer, charge, encumber, grant any option over or otherwise dispose of any

interest in any ordinary shares such person holds in Liberty; (ii) accept any

other offer in respect of its ordinary shares in Liberty; (iii) purchase, sell

or otherwise deal in ordinary shares in Liberty or any interest therein; (iv)

requisition any shareholder meeting of Liberty; or (v) agree to do any of the

things described in (i) or (ii) above.

Such persons have further undertaken inter alia to accept or procure the

acceptance of the Proposed Offer in respect of their ordinary shares in Liberty

and not to withdraw or procure the withdrawal of such acceptance.

From the time that a Proposed Offer is announced to the time that a Proposed

Offer becomes wholly unconditional, lapses or is withdrawn, such persons have

undertaken to exercise votes (and or any other rights) attaching to their

ordinary shares in Liberty in accordance with BlueGem's directions in relation

to the passing or proposal of any resolution necessary to implement the Proposed

Offer or which, if passed, might result in any condition of the Proposed Offer

not being fulfilled or which might impede or frustrate the Proposed Offer.

The undertakings provided by MWB and MWB Retail Stores Shareholder Limited are

conditional on the sale by MWB of the Relevant Liberty Shares pursuant to the

Proposed Offer being approved by shareholders of MWB at a general meeting of the

shareholders of MWB.

The undertakings shall also lapse and shall cease to be binding if the Proposed

Offer is not formally announced by 8 June 2010; or if after the Proposed Offer

is announced the Panel on Takeovers and Mergers consents to BlueGem not making

the offer or an event occurs which means that BlueGem is no longer required by

the Takeover Code to proceed with the Offer; or if the offer document and

associated form of acceptance in respect of the Proposed Offer is not posted

within 28 days of the formal announcement of the Proposed Offer; or if the

Proposed Offer once formally announced lapses or is withdrawn in accordance with

the Takeover Code.

In addition, the directors of Liberty have undertaken inter alia (i) to

recommend the Proposed Offer to the shareholders of Liberty; (ii) not to

solicit, initiate or encourage any other person to make an offer for Liberty;

and (iii) except where required by his duties as a director of Liberty or under

the Takeover Code, and in any event only in response to an unsolicited approach,

not to enter into or continue discussions or agreements with, or provide any

information to any person considering making such an offer or otherwise take any

action which might be prejudicial to the outcome of the Proposed Offer.

Copies of this announcement are available on the BlueGem's website,

http://www.bluegemcp.com/uk_site/press-releases.html

and Liberty's

website,

http://www.liberty.co.uk/fcp/content/InvestorInformation/content

Disclosure requirements of the Takeover Code (the "Code")

Under Rule 8.3(a) of the Code, any person who is interested in 1% or more of any

class of relevant securities of an offeree company or of any paper offeror

(being any offeror other than an offeror in respect of which it has been

announced that its offer is, or is likely to be, solely in cash) must make an

Opening Position Disclosure following the commencement of the offer period and,

if later, following the announcement in which any paper offeror is first

identified. An Opening Position Disclosure must contain details of the person's

interests and short positions in, and rights to subscribe for, any relevant

securities of each of (i) the offeree company and (ii) any paper offeror(s). An

Opening Position Disclosure by a person to whom Rule 8.3(a) applies must be made

by no later than 3.30 pm (London time) on the 10th business day following the

commencement of the offer period and, if appropriate, by no later than 3.30 pm

(London time) on the 10th business day following the announcement in which any

paper offeror is first identified. Relevant persons who deal in the relevant

securities of the offeree company or of a paper offeror prior to the deadline

for making an Opening Position Disclosure must instead make a Dealing

Disclosure.

Under Rule 8.3(b) of the Code, any person who is, or becomes, interested in 1%

or more of any class of relevant securities of the offeree company or of any

paper offeror, must make a Dealing Disclosure if the person deals in any

relevant securities of the offeree company or of any paper offeror. A Dealing

Disclosure must contain details of the dealing concerned and of the person's

interests and short positions in, and rights to subscribe for, any relevant

securities of each of (i) the offeree company and (ii) any paper offeror, save

to the extent that these details have previously been disclosed under Rule 8. A

Dealing Disclosure by a person to whom Rule 8.3(b) applies must be made by no

later than 3.30 pm (London time) on the business day following the date of the

relevant dealing.

If two or more persons act together pursuant to an agreement or understanding,

whether formal or informal, to acquire or control an interest in relevant

securities of an offeree company or a paper offeror, they will be deemed to be a

single person for the purpose of Rule 8.3.

Opening Position Disclosures must also be made by the offeree company and by any

offeror and Dealing Disclosures must also be made by the offeree company, by any

offeror and by any persons acting in concert with any of them (see Rules 8.1,

8.2 and 8.4). Details of the offeree and offeror companies in respect of whose

relevant securities Opening Position Disclosures and Dealing Disclosures must be

made can be found in the Disclosure Table on the Takeover Panel's website at

www.thetakeoverpanel.org.uk, including details of the number of relevant

securities in issue, when the offer period commenced and when any offeror was

first identified. If you are in any doubt as to whether you are required to make

an Opening Position Disclosure or a Dealing Disclosure, you should contact the

Panel's Market Surveillance Unit on +44 (0)20 7638 0129.

This information is provided by RNS

The company news service from the London Stock Exchange

END

OFDKKADBNBKBFPK

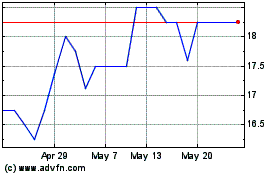

Longboat Energy (LSE:LBE)

Historical Stock Chart

From May 2024 to Jun 2024

Longboat Energy (LSE:LBE)

Historical Stock Chart

From Jun 2023 to Jun 2024