TIDMMWB TIDMLBE

RNS Number : 3317K

MWB Group Holdings PLC

16 April 2010

FOR IMMEDIATE RELEASE

16 April 2010

MWB GROUP HOLDINGS PLC ("MWB" or the "Company")

PROPOSED SALE OF THE LIBERTY TUDOR BUILDING AND NOTICE OF GENERAL MEETING

On 15 March 2010 MWB announced the proposed sale and leaseback by its 68%

subsidiary, Liberty Plc ("Liberty"), of the freehold interest in Liberty's

flagship store on Great Marlborough Street, London W1 (the "Tudor Building")

from which Liberty operates its retail business, to Sirosa Liberty Limited (the

"Sale"). A circular containing details of the Sale ("Circular") has been

published and is expected to be posted to shareholders today. A General Meeting

to approve the Sale is expected to be held at 11.00 a.m. on 10 May 2010.

Highlights

· Net Sale Price of GBP41.2m represents a surplus, before expenses, of

GBP10.95 million over the book value of the Tudor Building of GBP30.25 million

as included in the 2009 Results

· Liberty has entered into a long term lease of the Tudor Building, with

initial annual rental cost of GBP2.1 million per annum

· Irrevocable undertakings to vote in favour totalling 71.3% received

The Company has received irrevocable undertakings to vote in favour of the

ordinary resolution to be put to shareholders of the Company at the General

Meeting to approve the Sale from shareholders holding 71.3% of the Company's

issued share capital. The Directors have given irrevocable undertakings

amounting to 15.8% of the Company's issued share capital (such amount being

included in the 71.3% total above).

The Circular relating to the Sale has been approved by the UK Listing Authority

and will shortly be available for inspection at their Document Viewing Facility,

situated at The Financial Services Authority, 25 The North Colonnade, Canary

Wharf, London E14 5HS. The Circular will also be available at the registered

office of the Company and at the offices of Dechert LLP, 160 Queen Victoria

Street, London EC4V 4QQ during normal business hours on any weekday (Saturdays,

Sundays and public holidays excepted) from the date of the publication of the

Circular until the General Meeting. The circular will also be available on the

Company's website, www.mwb.co.uk

Richard Balfour-Lynn, Chief Executive of MWB, commented:

"The Sale of the Tudor Building is the latest step in fulfilling our ongoing

realisation plans. We are delighted to have realised this advantageous sale

price for the Tudor Building."

For further information, please contact:

+-----------------------------------------+---------------------+

| MWB Group Holdings Plc | +44 (0) 20 7706 |

| Richard Balfour-Lynn, Chief Executive | 2121 |

| Jag Singh, Finance Director | |

| | |

+-----------------------------------------+---------------------+

| Panmure Gordon (Financial Adviser and | +44 (0) 20 7459 |

| Broker) | 3600 |

| Hugh Morgan | |

| Adam Pollock | |

| | |

+-----------------------------------------+---------------------+

| Baron Phillips Associates (Financial PR | +44 (0) 20 7920 |

| Adviser) | 3161 |

| Baron Phillips | |

+-----------------------------------------+---------------------+

This announcement has been issued by, and is the sole responsibility of, the

Company. No representation or warranty, express or implied, is made or given by,

or on behalf of, the Company or Panmure Gordon (UK) Limited ("Panmure Gordon")

or any of their affiliates, parent undertakings, subsidiary undertakings or

subsidiaries of their parent undertakings or any of their respective directors,

officers, employees or advisers or any other person as to the accuracy or

completeness or fairness of the information or opinions contained in this

announcement and no responsibility or liability is accepted by any of them for

any such information or opinions or for any errors or omissions.

Panmure Gordon, which is authorised and regulated by the Financial Services

Authority, is acting exclusively for the Company and for no one else in

connection with the Sale and is not advising any other person and accordingly

will not be responsible to anyone other than the Company for providing the

protections afforded to the customers of Panmure Gordon or for providing advice

in relation to the contents of this announcement or any transaction, arrangement

or other matter described in this announcement.

The distribution of this announcement into jurisdictions other than the United

Kingdom may be restricted by law. Any failure to comply with these restrictions

may constitute a violation of the securities laws of any such jurisdiction.

The information in this announcement may not be forwarded or distributed to any

other person and may not be reproduced in any manner whatsoever. Any forwarding,

distribution, reproduction, or disclosure of this information in whole or in

part is unauthorised. Failure to comply with this directive may result in a

violation of applicable laws of relevant jurisdictions.

This announcement contains a number of forward looking statements relating to

MWB and Liberty with respect to, amongst others, the following: financial

conditions; results of operations; economic conditions in which MWB and Liberty

operates; the businesses of MWB and Liberty; future benefits of the Sale; and

management plans and objectives. The Company considers any statements that are

not historical facts as "forward looking statements". They relate to events and

trends that are subject to risks, uncertainties and assumptions that could cause

the actual results and financial position of MWB and Liberty to differ

materially from the information presented in the relevant forward looking

statement. When used in this announcement the words "estimate", "project",

"intend", "aim", "anticipate", "believe", "expect", "should", and similar

expressions, as they relate to MWB and Liberty or the management of either of

them, are intended to identify such forward looking statements. Readers are

cautioned not to place undue reliance on these forward looking statements which

speak only as at the date of this announcement. Neither the Company nor any

member of the Group including Liberty undertakes any obligation to update

publicly or revise any of the forward looking statements, whether as a result of

new information, future events or otherwise, save in respect of any requirement

under applicable laws and regulations, the Listing Rules, the Prospectus Rules,

and the Disclosure and Transparency Rules.

MWB GROUP HOLDINGS PLC

PROPOSED SALE OF THE LIBERTY TUDOR BUILDING AND NOTICE OF GENERAL MEETING

1. Introduction

On 1 March 2010, Liberty, MWB's 68.3 per cent. owned subsidiary, announced that

a number of parties had expressed interest in acquiring the freehold of the

Tudor Building. On 15 March 2010, the Liberty Board announced that it had agreed

terms to sell the Tudor Building to the Purchaser, Sirosa Liberty Limited. Under

the terms of the Sale, Liberty will receive the Sale Price in cash, which values

the Tudor Building at GBP41.5 million.

The Net Sale Price of GBP41.2 million, which reflects a retention of GBP0.3

million by the Purchaser in accordance with the Sale Agreement, represents a

surplus, before expenses, of GBP10.95 million over the book value of the Tudor

Building of GBP30.25 million at 31 December 2009. It is intended that Liberty

uses the proceeds to, inter alia, repay its indebtedness to its bank, BoS, and

its intercompany loan provided by MWB.

The Sale is of sufficient size relative to that of the Group to constitute a

Class 1 transaction for MWB under the Listing Rules and, as such, requires

approval of Shareholders prior to Completion.

2. Background to the Sale

In February 2009, Liberty launched its Renaissance of Liberty as the next step

in establishing itself as a popular and avant-garde British luxury brand. The

Renaissance continues to be successful, and in the year ended 31 December 2009

revenues grew by 20 per cent. compared with 2008.

In July 2009, the Liberty Board announced that it was undertaking a review with

the aim of identifying ways in which the business could be developed and

expanded. The Liberty Board has concluded that the Sale of the Tudor Building at

the Sale Price is in the best interests of Liberty. The Net Sale Price

represents a surplus, before expenses, of GBP10.95 million or 36 per cent. over

the book value of the Tudor Building of GBP30.25 million at 31 December 2009.

Following Completion, Liberty will continue to occupy and carry on its retail

operations at the Tudor Building pursuant to the Liberty Lease. In addition,

following Completion, Liberty will continue to own and operate its other

business divisions, namely Liberty Art Fabrics, which supplies fashion and

design fabrics and prints to global fashion brands and designers, Liberty of

London, Liberty's in-house studio, and Liberty's transactional website.

From an operational perspective, the Board and the Liberty Board envisage that

the day to day operations of Liberty will continue in the same manner after the

Sale as they are carried on at the date of this announcement. From a financial

perspective, the Liberty Board intends to use part of the proceeds from the Sale

to eliminate all of Liberty's interest bearing debt. As a result, interest costs

(GBP1.4 million incurred in the year ended 31 December 2009) will be eliminated

and will be replaced by the payment of rental costs under the Liberty Lease

(initially GBP2.1 million per annum). In addition, following repayment of

Liberty's interest bearing debt and the payment of accrued dividends to holders

of preference shares in Liberty, the Liberty Board anticipates there will be

approximately GBP11.6 million of surplus proceeds from the Sale. Prior to any

further distributions or payments, these surplus proceeds will be retained

within the Group.

On 12 March 2010 the Liberty Board announced that it had received approaches

which may or may not lead to an offer being made for Liberty, but that it was

too early for the Liberty Board to determine whether or not these discussions

would result in any formal offer being made for Liberty. Discussions are ongoing

and have been undertaken on the basis that any potential offer for Liberty would

be conditional on the Sale taking place and any such offer would only be made

subject to completion of the Sale. The sale of the Tudor Building is not

conditional on any such offer being made for Liberty and the Board considers

that the Sale is in the best interests of Shareholders irrespective of any

potential offer for Liberty.

Since implementation of the Cash Distribution Programme in May 2002, the Board's

strategy has been to mature and enhance the value of the Group's businesses.

Upon the businesses reaching maturity, the strategy has been to realise their

value through sales and, after repayment of debt, to return realised cash or

cash equivalents to Shareholders. These broad strategic aims remain in place

today.

The Sale will enable both Liberty and the Group to realise the inherent value in

the Tudor Building at what is considered by the Directors to be an attractive

price, in cash, and so to continue the Group's strategy of realising the value

of the Group's businesses through sales in connection with the Cash Distribution

Programme.

3. Terms of the Sale

The price negotiated with the Purchaser for the Tudor Building is GBP41.5

million pursuant to the Sale Agreement. On the assumption that the Sale

completes as planned, the Net Sale Price receivable represents a premium of

GBP10.95 million over the book value of the Tudor Building of GBP30.25 million

based on a valuation by DTZ at 31 December 2009, which is included in the

Financial Review section of the 2009 Results.

The Tudor Building comprises a Grade II* timber framed building constructed

between 1922 and 1924 in the Tudor arts and crafts style. The property is

arranged over basement, ground and five upper floors. There are five passenger

and two goods lifts serving all floors. The Tudor Building comprises gross space

of 10,168 square metres (109,452 square feet), which provides 6,938 square

metres (74,683 square feet) net of predominantly retail accommodation.

The Tudor Building, on the assumption that the Liberty Lease has been completed,

has been valued for the Group by DTZ, acting as independent property valuers at

12 March 2010, at GBP41.5 million.

A key benefit of the Sale is that the Group is able to lock-in what the

Directors consider to be an advantageous sale price for the Tudor Building. At

Completion, Liberty Lease Limited (a wholly owned subsidiary of Liberty) and

Liberty, as joint and several tenants, will enter into the Liberty Lease which

will have a term of 30 years, with an option to extend in favour of the joint

tenants for a further 15 years. This will allow Liberty to continue to carry on

its operations unaffected after Completion, thus further underpinning the

current and future value of the Group. Rental costs under the Liberty Lease will

be GBP2.1 million per annum initially, with fixed rental increases of 2.5 per

cent. per annum, compounded at five yearly intervals during the term of the

Liberty Lease.

The Purchaser is Sirosa Liberty Limited, a holding company for a European family

trust, which is incorporated in the British Virgin Islands. Although the

Purchaser's name includes the word 'Liberty', the Purchaser is not in any way

connected to the Group other than pursuant to the Sale and the Liberty Lease.

BoS, Liberty's bankers, which has the benefit of security over the Tudor

Building under the terms of the Existing BoS Debt, has given its consent to the

Sale.

4. Composition, receipt and use of proceeds derived from the Sale

Out of the proceeds of the Sale of GBP41.5 million, the Purchaser will retain

GBP0.3 million pursuant to the Sale Agreement relating to completion of remedial

works on the Tudor Building. After deduction of costs of the Sale estimated at

GBP0.7 million, Liberty will at Completion repay the Existing BoS Debt secured

on the Tudor Building which is required to be repaid on a sale of the property

under the terms of its financing arrangements with BoS. This is estimated to

amount to GBP14.0 million at Completion.

Following Completion, the Liberty Board intends to repay the Existing Group Debt

to MWB which is estimated will be GBP14.7 million at Completion, and pay accrued

dividends (which amount to GBP0.2 million) to holders of preference shares in

Liberty. These dividends have not been capable of payment by Liberty in previous

years as Liberty had a deficit on retained earnings in its own financial

statements. After payment of dividends up through the Liberty group, sourced

from the surplus realised on completion of the Sale, Liberty will have a

positive balance on retained earnings in its own financial statements,

permitting the payment of these arrears of preference dividend. Thereafter,

there is expected to be GBP11.6 million of surplus cash proceeds available in

Liberty as a result of the Sale.

The Liberty Board intends to pay a special dividend out of the surplus proceeds

from the Sale to shareholders in Liberty, which would be receivable by MWB and

minority shareholders in Liberty. In light of this potential special dividend

and ongoing discussions relating to a potential offer for Liberty, the Liberty

Board has commenced discussions with the trustees of the Liberty Pension Scheme

concerning a possible contribution to be made by Liberty to reduce the deficit

in the Liberty Pension Scheme, such contribution to be funded out of the surplus

proceeds of the Sale of GBP11.6 million referred to above. The Liberty Pension

Scheme deficit, under the basis of accounting required by International

Accounting Standard Number 19, at 31 December 2009 was GBP2.8 million as

disclosed in the 2009 Results. As these discussions have only recently

commenced, the Liberty Board is not yet in a position to determine the amount of

any contribution to the Liberty Pension Scheme nor the resulting special

dividend. The Board will make a further announcement once this position has been

finalised.

After repayment of the Existing BoS Debt and the Existing Group Debt, the

payment of accrued dividends to holders of preference shares in Liberty and

prior to any other payments referred to above, the surplus proceeds of GBP11.6

million will be retained within the Group.

5. Current operations of Liberty

Liberty, which was established by the Liberty family in 1875, is a retail

emporium whose business is principally located in the West End of London.

Liberty retails fashion, beauty and home collections from five floors of the

Tudor Building and operates a wholesale business through Liberty Art Fabrics.

MWB has a 68.3 per cent. interest in Liberty, whose shares are admitted to

trading on AIM.

The core of the Liberty strategy is the creation of a global luxury brand across

four distinct business activities, each based on a common heritage and shared

support functions.

The principal activity of Liberty is the operation of the Liberty flagship store

on Great Marlborough Street, which has in recent years undergone a period of

significant financial investment, culminating in completion of the 'Renaissance

of Liberty' which was launched in February 2009. The Liberty flagship store

carries menswear, womenswear, shoes, jewellery, accessories and home interiors

amongst other categories. The store also carries collections by renowned

designers and is positioned at the upper end of the luxury market. With the

refurbished Liberty flagship store having opened in February 2009, Operating

Revenue from the store and transactional website increased in 2009 to GBP37.3

million, an increase of 18 per cent. over the revenue of GBP31.5 million in

2008, and Liberty recorded positive EBITDA during this period. Given the current

economic climate, the Liberty Board considers this to be a strong performance

and a good barometer with which to measure the prospects going forward. In the

year ended 31 December 2009, the Liberty flagship store and the transactional

website contributed 63 per cent. to Liberty's total revenues.

In July 2008, Liberty launched its transactional website, which has developed

rapidly since then. The Liberty Board considers that there is significant

potential for this part of its business.

Liberty Art Fabrics supplies fashion and design fabrics and prints to global

fashion brands and designers, such as Nike, Balmain and Junya Watanabe. In the

year ended 31 December 2009, the Liberty Art Fabrics business contributed 36 per

cent. of Liberty's total revenues.

Liberty of London, Liberty's in-house studio, develops fashion accessories for

men and women which are sold in Liberty's three core areas of operation referred

to above. In the year ended 31 December 2009, the Liberty of London business

contributed 1 per cent. of Liberty's total revenues.

6. Financial effects of the Sale on the Group

Consolidated statement of financial condition

The Sale constitutes the sale by Retail Stores Property Holdings, a wholly owned

subsidiary of Liberty, of the Tudor Building for the Sale Price pursuant to the

Sale Agreement. DTZ, as independent professional valuers to Liberty and the

Group, have placed a market value on the Tudor Building, with the benefit of the

Liberty Lease at 12 March 2010, of GBP41.5 million, which is underpinned by the

agreed Sale Price. DTZ had previously valued the Tudor Building at GBP30.25

million at 31 December 2009 based on its then fixed internal annual rental of

GBP2 million for the remaining eight year term of the existing lease.

Taking into account the expected costs of the transaction to be incurred by MWB

of GBP0.4 million (in addition to the expected costs of the transaction to be

incurred by Liberty of GBP0.7 million), at Completion the Sale is expected to

increase net assets of the Group on the Group's consolidated statement of

financial position by the net surplus received over the market value included in

its financial statements at 31 December 2009. This amounts to GBP9.83 million,

of which GBP6.72 million is Equity Attributable to Shareholders and GBP3.11

million is attributable to minority interests.

Consolidated income statement

At Completion, the Group will enter into the Liberty Lease. Rental costs under

the Liberty Lease will be GBP2.1 million per annum initially, with fixed rental

increases of 2.5 per cent. per annum compounded at five yearly intervals.

On the assumption that the Sale completes as planned, annual rental costs in

Liberty would increase by GBP2.1 million and net finance costs would decrease to

reflect the reduction in net indebtedness arising from the net proceeds of the

disposal of the property.

Equity Attributable to Shareholders

Prior to the payment of any dividends to minority shareholders in Liberty and

the payment of any amounts to the Liberty Pension Scheme referred to above,

Equity Attributable to Shareholders, which excludes minority interests, will

increase by GBP6.72 million as a result of the sale of the Liberty Tudor

Building.

7. 2009 Results

Detailed commentary on the Group's current trading and prospects is included in

the 2009 Results which were announced on 30 March 2010.

Equity Attributable to Shareholders reduced from GBP125.9 million or 174p per

share at 31 December 2008, to GBP104.5 million or 144p per share at 31 December

2009, principally reflecting retained losses for the year and the effective

portion of changes in fair value of cash flow hedges. After taking account of

the Placing that was completed in January 2010, Equity Attributable to

Shareholders at 31 December 2009 totalled GBP129.1 million, or 79p per share,

reflecting the issue price of the New Units of 30p per Unit. The Group's

property values stabilised during the year, resulting in a reduction in values

during the year of only GBP2.1 million compared with a reduction of GBP79.2

million during 2008. The Malmaison and Hotel du Vin trading results were steady

during the year despite challenging market conditions, producing EBITDA of

GBP26.4 million, in comparison to GBP25.9 million in the previous year. Liberty

produced record levels of revenue of GBP60.8 million, being 20 per cent. Higher

than those for the year ended 31 December 2008. At Business Exchange, EBITDA

declined 46 per cent. to GBP9.8 million, reflecting lower returns at centres

acquired from the MLS group while they are brought up to Group standards, and

aggressive pricing from the conventional property market. Overall, the loss

before tax of the Group increased to GBP15.4 million from GBP9.9 million during

the year ended 31 December 2008, reflecting the above factors and high interest

costs. The latter have been reduced going forward as a result of the proceeds

received from the Placing announced by the Company in December 2009 which

improved the financial standing of the Group and would be reduced further on

completion of the Sale.

The Group's annual report and financial statements for the year ended 31

December 2009 is expected to be sent to Shareholders in early May 2010.

8. Shortening of notice period in respect of future general meetings of

the Company

Changes made to the 2006 Act by the Shareholders' Rights Regulations increased

the notice period required for general meetings of traded companies to 21 days,

unless shareholders approve a shorter notice period. Any such shorter notice

period, however, cannot be less than 14 clear days. Annual general meetings of

the Company will continue to be held on at least 21 clear days' notice under

these Regulations.

The Directors are therefore seeking approval of Shareholders at the General

Meeting to the shortening of the notice period in respect of future general

meetings of the Company (other than an annual general meeting) to 14 clear days'

notice. The Notice Period Resolution seeks approval of the Notice Period

Reduction which will be effective until the Company's 2010 annual general

meeting, when it is intended that a similar resolution will also be proposed.

The Directors intend that this shorter notice period would not be used as a

matter of routine for such meetings but only where the flexibility is merited by

the business of the meeting and is thought to be to the advantage of

Shareholders as a whole.

The changes to the 2006 Act brought about by the Shareholders' Rights

Regulations also mean that, in order for the Company to be able to call a

general meeting on less than 21 clear days' notice, the Company must provide

electronic voting to all Shareholders for that meeting. The Company will

implement this change in advance of the first general meeting at which the

shorter notice period will be operational.

9. General Meeting

Completion of the Sale is conditional upon Shareholders' approval being obtained

at the General Meeting to be held at the offices of Dechert LLP, 160 Queen

Victoria Street, London EC4V 4QQ at 11.00 a.m. on 10 May 2010. At the General

Meeting the Sale Resolution will be proposed to approve the Sale and the Notice

Period Resolution will be proposed to approve the Notice Period Reduction. To

approve the Sale, a majority of not less than 50 per cent. of those voting in

person or by proxy must vote in favour of the Sale Resolution (unless a poll is

demanded, in which case, a majority of not less than 50 per cent. of the votes

cast in person or by proxy must be in favour of the Sale Resolution).

To approve the Notice Period Reduction, a majority of not less than 75 per cent.

of those voting inperson or by proxy must vote in favour of the Notice Period

Resolution (unless a poll is demanded, in which case, a majority of at least 75

per cent. of the votes cast in person or by proxy must be in favour of the

Notice Period Resolution).

10. Irrevocable undertakings

The Directors and persons connected with them have given irrevocable

undertakings to the Company to vote in favour of the Resolutions to be proposed

at the General Meeting (and to procure that such action is taken by the relevant

registered holders) in respect of their beneficial holdings totalling 25,880,014

Units, representing 15.78 per cent. of the existing Units at the date of this

announcement.

In addition, certain other Shareholders have given irrevocable undertakings to

the Company to vote in favour of the Sale Resolution to be proposed at the

General Meeting (and to procure that such action is taken by the relevant

registered holders) in respect of their beneficial holdings totalling 91,126,201

Units, representing 55.55 per cent. of the existing Units at the date of this

announcement.

In total, therefore, the Company has received irrevocable undertakings to vote

in favour of the Sale Resolution to be proposed at the General Meeting in

respect of beneficial holdings totalling 117,006,125 Units, representing 71.33

per cent of the existing Units at the date of this announcement. The total

amount of beneficial holdings to which these irrevocable undertakings relate

exceeds the majority of not less than 50 per cent. of those voting in person or

by proxy (or if a poll is demanded a majority of not less than 50 per cent. of

the votes cast in person or by proxy) required to pass the Sale Resolution

11. Recommendation

The Board considers that the Sale and the Notice Period Reduction are in the

best interests of the Company and the Shareholders as a whole.

The Board has received financial advice from Panmure Gordon on the Sale, and in

giving its financial advice to the Board, Panmure Gordon has relied on the

Board's commercial assessment of the Sale.

Accordingly, the Board recommends that Shareholders vote in favour of the

Resolutions to be proposed at the General Meeting, as the Directors intend to do

in respect of their own holdings totalling 25,880,014 Units, representing 15.78

per cent. of the existing Units.

Appendix

DEFINITIONS AND GLOSSARY

The following definitions apply throughout this announcement, unless the context

otherwise requires:

+----------------------+--------------------------------------+

| "2006 Act" | the Companies Act 2006, as amended |

| | from time to time |

+----------------------+--------------------------------------+

| "2009 Results" | the preliminary announcement of |

| | audited results of the Group for the |

| | year ended 31 December 2009, which |

| | the Company announced on 30 March |

| | 2010 |

+----------------------+--------------------------------------+

| "AIM" | the AIM market of the London Stock |

| | Exchange |

+----------------------+--------------------------------------+

| "BoS" | the Bank of Scotland (now Bank of |

| | Scotland Plc) |

+----------------------+--------------------------------------+

| "B Shares" | the B ordinary shares of 0.01 p each |

| | in the capital of the Company |

+----------------------+--------------------------------------+

| "Cash Distribution | the programme as approved by |

| Programme" | shareholders of MWB Property at an |

| | extraordinary general meeting of MWB |

| | Property held on 24 May 2002, as |

| | extended on 17 February 2004, 17 |

| | April 2007, 10 April 2008 and 1 |

| | January 2010, pursuant to which MWB |

| | Property and, following |

| | implementation of the Scheme, MWB, |

| | proposes to realise all or |

| | substantially all of its assets in |

| | cash or cash equivalents in order to |

| | make Gross Cash Returns to |

| | Shareholders |

+----------------------+--------------------------------------+

| "Completion" | the completion of the Sale in |

| | accordance with the Sale Agreement |

| | which is scheduled to take place on |

| | 17 May 2010, subject to the passing |

| | of the Sale Resolution at the |

| | General Meeting |

+----------------------+--------------------------------------+

| "Directors" or the | the current directors of MWB whose |

| "Board" | names are set out in the Circular |

+----------------------+--------------------------------------+

| "Disclosure and | the disclosure and transparency |

| Transparency Rules" | rules of the UK Listing Authority |

| | made in accordance with section |

| | 73(A) of FSMA, as amended from time |

| | to time |

+----------------------+--------------------------------------+

| "DTZ" or the | DTZ Debenham Tie Leung Limited |

| "Valuer" | |

+----------------------+--------------------------------------+

| "EBITDA" | earnings before interest, tax, |

| | depreciation and amortisation |

+----------------------+--------------------------------------+

| "Equity Attributable | the net assets of the Group |

| to Shareholders" | attributable to Shareholders, or, |

| | prior to 3 April 2008, attributable |

| | to shareholders of MWB Property, as |

| | disclosed by the consolidated Group |

| | financial statements from time to |

| | time |

+----------------------+--------------------------------------+

| "Existing BoS Debt" | the existing debt drawn down by |

| | Liberty from BoS which is |

| | approximately GBP14.0 million at the |

| | date of this announcement and which |

| | will be repaid at Completion by |

| | Liberty out of the Sale Price |

+----------------------+--------------------------------------+

| "Existing Group | the existing short term financing |

| Debt" | provided to Liberty by MWB which is |

| | GBP14.5 million at the date of this |

| | announcement and which it is |

| | intended will be repaid following |

| | Completion by Liberty out of the |

| | Sale Price |

+----------------------+--------------------------------------+

| "FSA" | the Financial Services Authority of |

| | the United Kingdom |

+----------------------+--------------------------------------+

| "FSMA" | the Financial Services and Markets |

| | Act 2000, as amended from time to |

| | time |

+----------------------+--------------------------------------+

| "General Meeting" | the general meeting of the Company |

| | convened for 11.00 a.m. on 10 May |

| | 2010, and including any adjournment |

| | thereof |

+----------------------+--------------------------------------+

| "Gross Cash Returns | the aggregate gross distributions to |

| to Shareholders" | Shareholders by the Company in the |

| | form of cash or readily realisable |

| | assets adjusted by adding back any |

| | corporation tax payable by the |

| | Company on any disposals, and |

| | including the aggregate gross cash |

| | or cash equivalent paid to |

| | Shareholders by a third party on a |

| | takeover of the Company |

+----------------------+--------------------------------------+

| "Group" or "MWB | before 3 April 2008, MWB Property |

| Group" | and its subsidiaries, and from that |

| | date onwards, the Company and its |

| | subsidiaries including MWB Property |

+----------------------+--------------------------------------+

| "Liberty" | Liberty Plc, MWB's 68.3 per cent. |

| | owned subsidiary whose ordinary |

| | shares are admitted to trading on |

| | AIM, and including, where the |

| | context requires, its wholly owned |

| | subsidiaries |

+----------------------+--------------------------------------+

| "Liberty Board" | the board of directors of Liberty |

+----------------------+--------------------------------------+

| "Liberty Lease" | the 30 year lease (with an option in |

| | favour of the tenant to extend for a |

| | further 15 years) relating to the |

| | Tudor Building to be entered into |

| | immediately prior to Completion |

| | between Liberty Lease Limited and |

| | Liberty (as joint and several |

| | tenants) and Liberty Tudor Property |

| | Limited and Liberty Tudor Property |

| | No 2 Limited (as landlord) of which |

| | the Purchaser will, at Completion, |

| | become landlord, described in more |

| | detail in the Circular |

+----------------------+--------------------------------------+

| "Liberty Pension | the Liberty Retail Plc defined |

| Scheme" | benefit pension scheme |

+----------------------+--------------------------------------+

| "Listing Rules" | the rules and regulations made by |

| | the FSA under Part VI of FSMA, as |

| | amended from time to time |

+----------------------+--------------------------------------+

| "London Stock | London Stock Exchange Plc |

| Exchange" | |

+----------------------+--------------------------------------+

| "MWB" or "Company | MWB Group Holdings Plc |

+----------------------+--------------------------------------+

| "MWB Property" | MWB Property Limited, formerly named |

| | Marylebone Warwick Balfour Group Plc |

| | (company number 3125437), the |

| | holding company of the Group until 3 |

| | April 2008, and thereafter a wholly |

| | owned subsidiary of the Company |

+----------------------+--------------------------------------+

| "Net Sale Price" | the Sale Price less a retention by |

| | the Purchaser of GBP0.3 million in |

| | accordance with the Sale Agreement |

+----------------------+--------------------------------------+

| "Notice Period | the shortening of the notice period |

| Reduction" | in respect of general meetings of |

| | the Company (other than an annual |

| | general meeting) to not less than 14 |

| | clear days' notice |

+----------------------+--------------------------------------+

| "Notice Period | the special resolution to approve |

| Resolution" | the Notice Period Reduction to be |

| | proposed at the General Meeting |

+----------------------+--------------------------------------+

| "Operating Revenue" | revenue generated by Liberty in its |

| | retail, wholesale, online and |

| | Liberty of London operations, |

| | excluding rental and other sundry |

| | income, as disclosed in the annual |

| | financial statements and half-yearly |

| | financial reports of Liberty from |

| | time to time |

+----------------------+--------------------------------------+

| "Ordinary Shares" | the ordinary shares of 0.1p each in |

| | the capital of the Company |

+----------------------+--------------------------------------+

| "Panmure Gordon" | Panmure Gordon (UK) Limited, |

| | Moorgate Hall, 155 Moorgate, London |

| | EC2M 6XB, acting as sponsor and |

| | financial adviser to the Company |

+----------------------+--------------------------------------+

| "Prospectus Rules" | the prospectus rules of the UK |

| | Listing Authority made in accordance |

| | with section 73A of FSMA, as mended |

| | from time to time |

+----------------------+--------------------------------------+

| "Purchaser" | Sirosa Liberty Limited, a company |

| | incorporated in the British Virgin |

| | Islands (with company number |

| | 1573837) |

+----------------------+--------------------------------------+

| "Resolutions" | the Sale Resolution and the Notice |

| | Period Resolution to be proposed at |

| | the General Meeting |

+----------------------+--------------------------------------+

| "Retail Stores | Retail Stores Property Holdings |

| Property Holdings" | Limited, a wholly owned subsidiary |

| | of Liberty, and a Tudor Building |

| | Party, being the owner of the |

| | beneficial interest in the freehold |

| | of the Tudor Building |

+----------------------+--------------------------------------+

| "Sale" | the proposed sale of the Tudor |

| | Building to the Purchaser pursuant |

| | to the Sale Agreement |

+----------------------+--------------------------------------+

| "Sale Agreement" | the conditional sale and purchase |

| | agreement relating to the Tudor |

| | Building dated 12 March 2010 between |

| | (1) the Tudor Building Parties (2) |

| | MWB and (3) the Purchaser, described |

| | in more detail in the Circular |

+----------------------+--------------------------------------+

| "Sale Price" | GBP41.5 million being the price |

| | payable by the Purchaser to Retail |

| | Stores Property Holdings in cash |

| | under the Sale Agreement |

+----------------------+--------------------------------------+

| "Sale Resolution" | the ordinary resolution to approve |

| | the Sale to be proposed at the |

| | General Meeting |

+----------------------+--------------------------------------+

| "Scheme" | the scheme of arrangement pursuant |

| | to section 425 of the Companies Act |

| | 1985 as set out in more detail in |

| | the circular sent to shareholders of |

| | MWB Property dated 7 February 2008 |

| | that was approved by shareholders of |

| | MWB Property at an extraordinary |

| | general meeting of MWB Property on 4 |

| | March 2008 and which became |

| | effective on 3 April 2008 |

+----------------------+--------------------------------------+

| "Shareholders" | holders of Units, or prior to April |

| | 2008, holders of ordinary shares in |

| | MWB Property |

+----------------------+--------------------------------------+

| "Shareholders' | the Companies (Shareholders' Rights) |

| Rights Regulations" | Regulations 2009 |

+----------------------+--------------------------------------+

| "Tudor Building" | the freehold mock Tudor building and |

| | the Muji building, Great Marlborough |

| | Street, London W1 owned by the Tudor |

| | Building Parties, all wholly owned |

| | subsidiaries of Liberty |

+----------------------+--------------------------------------+

| "Tudor Building | Retail Stores Property Holdings, |

| Parties" | Liberty Tudor Property Limited, |

| | Liberty Tudor Property No 2 Limited, |

| | Liberty Properties Link Owner |

| | Limited and Liberty Properties Link |

| | Owner No 2 Limited, all wholly owned |

| | subsidiaries of Liberty and each a |

| | "Tudor Building Party" |

+----------------------+--------------------------------------+

| "UK Listing | the FSA in its capacity as the |

| Authority" or "UKLA" | competent authority for the purposes |

| | of Part VI of FSMA |

+----------------------+--------------------------------------+

| "Unit" | a unit, comprising one Ordinary |

| | Share and 20 B Shares in the capital |

| | of the Company, such Ordinary Share |

| | and B Shares being transferable only |

| | in the form of a Unit and not |

| | separately and "Units" shall be |

| | construed accordingly |

+----------------------+--------------------------------------+

| "United Kingdom" or | the United Kingdom of Great Britain |

| "UK" | and Northern Ireland |

+----------------------+--------------------------------------+

All references to "pounds", "pounds sterling", "Sterling", "GBP", "pence" and

"p" are to the lawful currency of the UK.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCXQLFFBZFXBBB

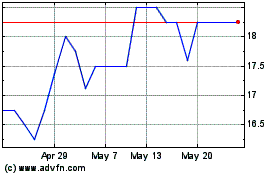

Longboat Energy (LSE:LBE)

Historical Stock Chart

From May 2024 to Jun 2024

Longboat Energy (LSE:LBE)

Historical Stock Chart

From Jun 2023 to Jun 2024