Statement re. Press Comment

March 16 2010 - 3:00AM

UK Regulatory

TIDMLBE

RNS Number : 6197I

Liberty PLC

16 March 2010

This announcement replaces RNS 4696I released at 07.00 on 12 March 2010. The

only changes are the addition of the section headed "Rule 2.10" and certain

amendments to the section headed "Dealing Disclosure Requirements". All other

text remains unchanged and the full text of the updated announcement is below.

16 March 2010

For Immediate Release

Not for release, publication or distribution in whole or in part, in or into the

United States, Canada, Australia, Japan or any other jurisdiction if to do so

would constitute a violation of the relevant laws of such jurisdiction.

LIBERTY Plc

("Liberty" or "the Company"):

DISCUSSIONS RELATING TO A POTENTIAL OFFER

Further to the recent press speculation, the Board of Liberty (the "Board")

confirms that it has received approaches which may or may not lead to an offer

being made for the Company. At this stage, it is too early for the Board to

determine whether or not these discussions will result in any formal offer being

made for the Company.

Over the past six months Liberty has been examining and assessing a range of

options and initiatives that would enable it to build upon its success since the

launch of the Renaissance of Liberty in February 2009. This has included seeking

investors who could bring capital and expertise to help develop and grow the

business both within the UK and internationally.

Also the Company has noted the press comment surrounding the possible sale and

leaseback of Liberty's Tudor building flagship store on Great Marlborough

Street, London W1, which was the subject of an announcement by the Company on 1

March

2010.

Shareholders will be updated on further developments as appropriate.

At the time of its trading statement in January 2010, the Company said overall

revenue for the year to December 2009 grew by 20% and that the flagship store

generated a 16% revenue increase during the course of 2009 compared to the

previous year. All divisions increased revenue with the on-line sales platform

enjoying a particularly strong Christmas.

Trading has continued to benefit from the Renaissance of the Regent Street

flagship store which drove footfall and market share over the remainder of the

year and has continued during 2010 to date.

Rule 2.10

In accordance with Rule 2.10 of the City Code on Takeovers and Mergers (the

"Code"), Liberty confirms that it currently has in issue 22,608,808 ordinary

shares of 25p each and 385,000 cumulative non-redeemable preference shares of

GBP1 each.

The International Securities Identification Number for the ordinary shares is

GB0007742082.

As the cumulative non-redeemable preference shares are not listed, there is no

applicable International Securities Identification Number.

Ends.

Contact:

Richard Balfour-Lynn, Chairman, Liberty. Tel: 020 7706 2121

Baron Phillips, Baron Phillips Associates. Tel: 020 7920

3161

Dealing Disclosure Requirements

Under the provisions of Rule 8.3 of the Takeover Code (the "Code"), if any

person is, or becomes, "interested" (directly or indirectly) in 1% or more of

any class of "relevant securities" of Liberty plc, all "dealings" in any

"relevant securities" of that company (including by means of an option in

respect of, or a derivative referenced to, any such "relevant securities") must

be publicly disclosed by no later than 3.30 pm (London time) on the London

business day following the date of the relevant transaction. This requirement

will continue until the date on which the offer becomes, or is declared,

unconditional as to acceptances, lapses or is otherwise withdrawn or on which

the "offer period" otherwise ends. If two or more persons act together pursuant

to an agreement or understanding, whether formal or informal, to acquire an

"interest" in "relevant securities" of Liberty plc, they will be deemed to be a

single person for the purpose of Rule 8.3.

Under the provisions of Rule 8.1 of the Code, all "dealings" in "relevant

securities" of Liberty plc by Liberty plc, or by any of its "associates", must

be disclosed by no later than 12.00 noon (London time) on the London business

day following the date of the relevant transaction.

A disclosure table, giving details of the companies in whose "relevant

securities" "dealings" should be disclosed, and the number of such securities in

issue, can be found on the Takeover Panel's website at

www.thetakeoverpanel.org.uk.

The Directors of Liberty plc accept responsibility for the information contained

in this announcement. To the best of the knowledge and belief of the Directors

of Liberty plc, who have taken all reasonable care to ensure that this is the

case, such information is in accordance with the facts and does not omit

anything likely to affect the import of such information. This announcement does

not constitute an offer or invitation to purchase or subscribe for any

securities.

Seymour Pierce Limited, which is authorised and regulated in the United Kingdom

by the Financial Services Authority, is acting exclusively for Liberty plc and

for no one else in connection with the proposed offer and is not advising any

other person or treating any other person as its client in relation thereto and

will not be responsible to anyone other than Liberty plc for providing the

protections afforded to clients of Seymour Pierce Limited, or for giving advice

to any other person in relation to the proposed offer, the contents of this

announcement or any other matter referred to herein.

Cavendish Corporate Finance LLP, which is authorised and regulated in the United

Kingdom by the Financial Services Authority, is acting exclusively for Liberty

plc and for no one else in connection with the proposed offer and is not

advising any other person or treating any other person as its client in relation

thereto and will not be responsible to

anyone other than Liberty plc for providing the protections afforded to clients

of Cavendish Corporate Finance LLP, or for giving advice to any other person in

relation to the proposed offer, the contents of this announcement or any other

matter referred to herein.

Global Leisure Partners LLP, which is authorised and regulated in the United

Kingdom by the Financial Services Authority, is acting exclusively for Liberty

plc and for no one else in connection with the proposed offer and is not

advising any other person or treating any other person as its client in relation

thereto and will not be responsible to anyone other than Liberty plc for

providing the protections afforded to clients of Global Leisure Partners LLP, or

for giving advice to any other person in relation to the proposed offer, the

contents of this announcement or any other matter referred to herein.

This information is provided by RNS

The company news service from the London Stock Exchange

END

SPCGGURGWUPUGRA

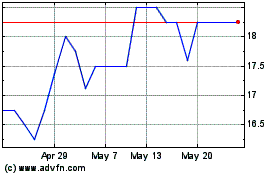

Longboat Energy (LSE:LBE)

Historical Stock Chart

From May 2024 to Jun 2024

Longboat Energy (LSE:LBE)

Historical Stock Chart

From Jun 2023 to Jun 2024