Sale of Freehold Property

March 15 2010 - 4:11AM

UK Regulatory

TIDMLBE TIDMMWB

RNS Number : 5611I

Liberty PLC

15 March 2010

FOR IMMEDIATE RELEASE

15 March 2010

LIBERTY PLC:

SALE OF FREEHOLD OF FLAGSHIP STORE FOR

GBP41.5 MILLION

Further to the announcement made on 1 March 2010, Liberty Plc ("Liberty" or "the

Company") which is 68% owned by MWB Group Holdings Plc ("MWB") today announces

that it has exchanged contracts for the sale of the freehold interest in its

125,000 sq ft flagship store on Great Marlborough Street, London W1, for GBP41.5

million to Sirosa Liberty Limited. The sale price reflects an initial yield of

4.8%.

The sale follows a six month review by Liberty of a range of options and

initiatives that would enable the Company to build upon its success since the

launch of the Renaissance of Liberty in February 2009.

On completion of the sale, Liberty will lease back the store and continue to

operate as one of London's most cutting edge, but accessible, design-led

retailers from the Tudor Building. Under the terms of the proposed deal, Liberty

will take an institutional 30-year lease on the building at an initial annual

rent of GBP2.1 million, with five yearly fixed rent reviews during the

intervening period. The funds will be used by Liberty to repay its bank and

other debt and thereafter to provide additional financial resources for the

Company.

The freehold of the flagship store was valued at GBP30.25 million at 31 December

2009, the date of Liberty's recent year end, based on an annual rental of GBP2.0

million and an eight year lease term. The sale price therefore represents a

substantial surplus over that valuation, reflecting the increased demand for

prime freehold property assets in Central London.

At the time of its trading statement in January 2010, Liberty reported overall

revenue for the year to December 2009 grew by 20% and that the flagship store

had generated a 16% revenue increase during the course of 2009 compared to the

previous year. All lines of business increased their revenue with Liberty

on-line enjoying a particularly strong Christmas.

Trading has continued to benefit from the Renaissance of the Regent Street

flagship store in February 2009 which drove footfall and market share over the

remainder of the year and has continued to do so in 2010.

The sale is conditional on approval by the shareholders of Liberty's 68%

shareholder, MWB, which is expected to be sought during April 2010. The Board

of MWB which owns 15.8% of its issued share capital of MWB has confirmed its

approval of the sale, and shareholders associated with the Board owning a

further 17.5% have also confirmed their approval to the sale.

Liberty was advised in the sale by Knight Frank while the purchaser was

represented by Savills.

Ends.

Contact:

Richard Balfour-Lynn, Chairman, Liberty. Tel:

020 7706 2121

Baron Phillips, Baron Phillips Associates. Tel:

020 7920 3161

Nicola Marrin, Seymour Pierce Tel: 020 7107

8000

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCGIGDXGBBBGGU

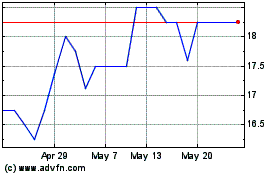

Longboat Energy (LSE:LBE)

Historical Stock Chart

From May 2024 to Jun 2024

Longboat Energy (LSE:LBE)

Historical Stock Chart

From Jun 2023 to Jun 2024