TIDMHAT

RNS Number : 8268V

H&T Group PLC

11 August 2020

INTERIM RESULTS - CORRECTION

The "UNAUDITED INTERIM CONDENSED FINANCIAL STATEMENTS"

announcement released on 11 August 2020 at 7:00am London time under

RNS No.7100V contained an error relating to dividend dates in the

note 9. The following amendments have been made.

Note 9 Dividends

On 6 August 2020, the directors approved a 2.5 pence interim

dividend (30 June 2019: 4.7 pence) which equates to a dividend

payment of GBP997,000 (30 June 2019: GBP1,866,000). The dividend

will be paid on 2 October 2020 to shareholders on the share

register at the close of business on 4 September 2020 and has not

been provided for in the 2020 interim results. The shares will be

marked ex-dividend on 3 September 2020.

All other details remain unchanged.

The full amended text is shown below.

11 August 2020

H&T Group plc

("H&T" or "the Group" or "the Company")

UNAUDITED INTERIM CONDENSED FINANCIAL STATEMENTS

FOR THE SIX MONTHSED 30 JUNE 2020

H&T Group plc today announces its interim results for the

six months ended 30 June 2020.

HIGHLIGHTS

-- Profit before tax down 26.5% to GBP5.0m (H1 2019: GBP6.8m)

-- Operating profit down 32.9% to GBP5.5m (H1 2019: GBP8.2m)

-- Diluted EPS of 10.2p (H1 2019: 15.0p)

-- Net pledge book, including accrued interest, increased

by 4.6% to GBP56.3m (30 June 2019: GBP53.8m)

-- Personal Loan book reduced 43.8% to GBP10.0m (30 June 2019:

GBP17.8m)

-- Net debt reduced to nil (30 June 2019: GBP11.6m)

-- Net assets up GBP19.3m to GBP126.9m (30 June 2019: GBP107.6m)

-- Interim dividend of 2.5p (2019 interim: 4.7p)

John Nichols, H&T chief executive, said:

"Our results reflect the impact of Covid-19 on our business and

the closure of our stores from 24 March, all of which have since

reopened. While our revenues and profits reduced in this

unprecedented environment, our focus on costs and cash generation

leaves us presently well positioned as we look to the rest of the

year and enables us to declare an interim dividend of 2.5 pence per

share.

"Pre lock-down the Group was well on track to deliver revenue

growth and increased profitability, underpinned by our diversified

income streams, increased footprint and investment in digital

initiatives. With lock-down in March we closed all stores in order

to protect colleagues and customers, and we have launched our

online payment portal. We also froze interest on pawnbroking loans

while our stores were closed and have offered payment deferral

arrangements to those lending customers impacted by the financial

implications of Covid-19.

"Having safely re-opened our stores, the Board is confident that

H&T is well-positioned to navigate the rest of 2020 and beyond.

The Group has a strong balance sheet, no debt and a good cash

position. This will enable us to build back our pawnbroking book, a

resilient secured asset in times of economic uncertainty, and

deliver our long-term growth plans which remain intact. "

Financial highlights (GBPm unless

stated)

Change

6 months ended 30 June 2020 2019 %

Gross profit 37.4 44.1 (15.2%)

EBITDA (Note 3) 9.6 11.3 (15.0%)

Operating profit 5.5 8.2 (32.9%)

Profit before tax 5.0 6.8 (26.5%)

Diluted EPS (p) 10.2 15.0 (32.0%)

Dividend per share 2.5p 4.7p (46.8%)

Key performance indicators

Net pledge book GBP56.3m GBP53.8m 4.6%

Retail gross profits GBP2.8m GBP5.4m (48.1%)

Personal loan book GBP10.0m GBP17.8m (43.8%)

Personal loan revenue less impairment GBP6.4m GBP11.6m (44.8%)

Number of stores 252 182 38.5%

Enquiries:

H&T Group plc

Tel: 0870 9022 600

John Nichols, chief executive

Richard Withers, chief financial officer

Numis Securities (broker and nominated adviser)

Tel: 020 7260 1000

Luke Bordewich, nominated adviser

Haggie Partners (financial public relations)

Damian Beeley: Tel: 020 7562 4444 (messaging service)

Caroline Klein: Mob: 07902 307333

Vivian Lai: Mob: 07795 153253

INTERIM REPORT

Introduction

We increased our store network by 70 during H2 2019 because of

the business assets added via the Money Shop and Albemarle &

Bond acquisitions. The Group's Q1 2020 trading performance exceeded

expectations with pleasing revenue growth in the new stores.

On 24 March, in the light of HM Government's introduction of

nationwide social restrictions and instructions regarding retail

operations we closed all our stores. From 12 May we commenced a

phased reopening such that all stores except two were open by 31

May, servicing essential financial services with the exclusion of

personal unsecured lending. Retail jewellery was then reintroduced

into all those stores that previously offered jewellery during the

last two weeks in June. All stores are now open.

Since reopening, all product categories have continued to build,

showing week on week growth, although business levels for most

products are yet to reach either pre closure or pre-Covid-19

expectation levels.

Re-establishing business to levels pre closure and the building

of our lending books is the primary focus for H2 2020.

COVID-19 IMPACT AND ACTIONS

In line with government guidance and in order to protect our

colleagues, customers and the communities where we operate, all

stores were closed on 24 March 2020. Stores have since

reopened.

During the temporary store closure period, we have supported and

stayed in touch with our customers by offering a dedicated call

centre operation and online chat facility, regularly updating our

website providing information and guidance, and issuing additional

SMS text and postal communications direct to customers. Pawnbroking

customers were provided with an interest holiday while our stores

were closed and offered the opportunity to defer payment, by

extending their loan. Personal lending customers, financially

impacted by Covid-19, were offered the opportunity to take payment

deferrals.

At the same time, we have finalised and implemented our online

pawnbroking payment portal, allowing customers to settle loans

remotely. To date 14,000 customers have used this service, making

payments of GBP3.5m.

Throughout the period we have continued to sell jewellery online

and have maintained our gold processing operation, smelted gold and

so benefited from the relatively high gold price.

While our stores were closed, our store colleagues were

furloughed under the Government's Job Retention Scheme. Most

colleagues have now returned to employment as we have reopened for

business. During the past three months, our colleagues across the

UK have offered support in their local communities and the Group

has provided a small charitable fund to support local, small

charities who are connected to our customers and employees.

The Group's colleagues remained internally connected during

lock-down with cross functional teams established to provide

effective customer support, to review our operating methods, to

accelerate our digital development work and to maintain risk

management including vigilance surrounding IT security during

Covid-19.

FINANCIAL RESULTS

The Group has reported profit before tax of GBP5.0m (H1 2019:

GBP6.8m), a 26.5% fall, reflecting the impact of Covid-19 and

associated store closures.

Gross profit reduced by GBP6.7m, 15.2%, to GBP37.4m (H1 2019:

GBP44.1m). Operating profit reduced by GBP2.7m, 32.9%, to GBP5.5m

(H1 2019: GBP8.2m). H&T received GBP3.5m in HM Government

support payments, included as 'other income' (see note 2) in

relation to the Job Retention and Business Rate support

schemes.

The average H1 2020 gold price has increased 29.3% to GBP1,306

per troy ounce (H1 2019: GBP1,010). As at 30 June 2020: GBP1,440

(30 June 2019: GBP1,108).

Total direct and administrative expenses reduced by GBP4.0m.

This comprises an increase in costs, primarily by increased staff

and property related costs arising from the Group's increased store

estate, offset by a GBP8.4m reduction in impairment charges as a

result of reduced lending books. While some operational and

transactional costs reduced while stores were closed, we have

incurred some additional Covid-19 related costs, associated with

ensuring colleague and customer safety. Further related expenditure

will continue in the near term. The pawnbroking and personal

lending books have reduced by GBP15.9m and GBP6.6m respectively

since 31 December 2019.

The Group's balance sheet remains strong with zero net debt (30

June 2019: GBP11.6m) leaving GBP34.0m (30 June 2019: GBP14.0m) of

the GBP35.0 RCF Lloyds facility undrawn.

The reduced borrowing is a direct consequence of the reduction

in our personal and pawnbroking lending books. The relatively high

levels of customer redemptions following the reopening of our

stores and the strong use of the customer payment portal has

resulted in the reduction in the pledge book across all stores.

H&T's decision to at least temporarily cease HCSTC lending in

October 2019 and then temporarily cease all personal lending as a

result of stores closing has seen our personal lending book

reduce.

Dividend

The Board has approved an interim dividend of 2.5 pence (2019

interim: 4.7 pence). This will be payable on 2 October 2020 to all

shareholders on the register at the close of business on 4

September 2020. It is intended that a final dividend, commensurate

with historical levels, will be declared should trading return to

pre lock-down levels by the year end.

REVEW OF OPERATIONS

Pawnbroking

Pawnbroking remains a core product for H&T and we report

that the gross pledge book increased to GBP56.3m, including accrued

interest (30 June 2019: GBP53.8m). Pledge balances in the 70 new

H&T stores at 30 June 2020 were GBP5.9m. Initial pledge books

on acquisition in these sites was GBP4.9m.

Prior to lock-down, at the end of March the pledge book across

all stores had increased to GBP72.7m, with growth in both core and

the newly acquired stores.

Interest was frozen for customers during the period stores were

closed, meaning that all customers have benefitted from at least

two months of interest holiday. The payment portal drove GBP3.5m of

online redemption payments and once stores re-opened we have seen

loan redemptions exceed new lending. This is in part because

customers reduced discretionary spending and reduced interest

charged which appears to have enabled reduced borrowing which has

resulted in the GBP16.4m reduction in pledge book compared with pre

lock-down and consequential pay down of debt.

During the period pawnbroking revenue less impairment was

unchanged at GBP16.8m (H1 2019: GBP16.8m) resulting in a

risk-adjusted margin (RAM) for the period of 24.4% (H1 2019:

35.2%). The lock-down period has resulted in a higher ageing

profile of the book, resulting in higher impairment provisioning.

Revenue less impairment from new stores was GBP3.5m, leaving core

stores at GBP13.3m, GBP3.5m, 20.8% down on H1 2019.

The reduction in like for like net revenues is a consequence of

stores being temporary closed during the Covid-19 lock down.

Pawnbroking summary:

6 months ended 30 2020 2019 Change

June: %

GBP'm GBP'm

Period-end net pledge

book(1) 56.3 53.8 4.6%

Average net pledge

book 68.9 47.7 44.4%

------------------------------ ------- ------- -------

Revenue less impairment 16.8 16.8 0.0%

Risk-adjusted margin(2) 24.4% 35.2%

------------------------------ ------- ------- -------

Notes to table

1 - Includes accrued interest

and impairment

2 - Revenue as a percentage of the average

net pledge book

------------------------------------------------ -------

Pawnbroking scrap

Pawnbroking scrap increased gross profits by GBP1.6m to GBP2.0m

(H1 2019: GBP0.4m) for the half year, on sales of GBP6.7m (H1 2019:

GBP6.0m). The margin increased from 7% to 30%. The rise in gold

price is the main reason for the gross profit uplift.

Retail

Retail sales reduced 47.0% to GBP9.8m (H1 2019: GBP18.5m) while

gross profits reduced by 48.1% to GBP2.8m (H1 2019: GBP5.4m).

Margin at 28% (H1 2019: 29%) reflects a continuation of the move

towards an increasing proportion of new sales. New sales accounted

for 17% of total retail sales (H1 2019: 12%). The Group has reduced

its retail stock holding by GBP3.3m to GBP27.3m (30 June 2019:

GBP30.6m)

Personal Loans

Net revenue reduced 20.4% to GBP4.3m (H1 2019: GBP5.4m), while

the loan book decreased 43.8% to GBP10.0m (30 June 2019: GBP17.8m).

The contraction of the loan book is a result of ceasing HCSTC

lending in October 2019 and suspending all personal lending from 24

March 2020.

The risk-adjusted margin for the period at 32.8% is relatively

unchanged (H1 2019: 32.5%). However, the cessation of HCSTC lending

has increased the proportion of the book derived from lower APR

products and consequently has resulted in lower interest yield of

48.9% (H1 2019: 69.9%). This has also significantly impacted

impairment rates, with impairment as a proportion of the average

monthly net loan book reducing to 16.0% (H1 2019: 37.3%).

Personal Loans summary:

6 months ended 30 June: 2020 2019

GBP'm GBP'm Change

%

Period-end net loan book 10.0 17.8 (43.8%)

Average monthly net loan book 13.1 16.6 (21.1%)

---------------------------------------- ----------------------------- ----------------------------- ----------

Revenue 6.4 11.6 (44.8%)

Impairment (2.1) (6.2) (66.1%)

Revenue less impairment 4.3 5.4 (20.4%)

---------------------------------------- ----------------------------- ----------------------------- ----------

Interest yield(1) 48.9% 69.9%

Impairment % of revenue 32.8% 53.4%

Impairment % of average monthly

net loan book 16.0% 37.3%

Risk-adjusted margin(2) 32.8% 32.5%

---------------------------------------- ----------------------------- ----------------------------- ----------

1 - Revenue as a percentage of average

loan book

2 - Revenue less impairment as a

percentage of average loan book

---------------------------------------- ----------------------------- ----------------------------- ----------

Gold purchasing

Gold purchasing profits increased by 1.3m to GBP2.8m (H1 2019:

GBP1.5m) on sales of GBP9.6m (H1 2019: GBP8.8m). The increased

margin from 17% to 29% is a result of gold price increase and the

main driver for the GP uplift.

Other services

Total revenues from other services reduced by GBP0.9m to GBP2.4m

(H1 2019: GBP3.3m). A GBP0.5m fall in Foreign Exchange (FX)

transaction profit and GBP0.8m reduction in buyback is partially

offset by GBP0.1m increase in cheque cashing revenue and GBP0.3m

new revenue from Western Union.

FX profit reduced by 29.0% to GBP1.3m while the value of

currency traded reduced by 53.0%. We have seen a change in the mix

between buying and selling currency, initially as a result of new

stores. This has resulted in 19% of FX transactions being buys (H1

2019: 8%) which has increased our FX margin.

Buyback product was ceased during Q1 2020 with gross profits

consequently falling to GBP0.2m in the period. Cheque cashing and

Western Union revenues were ahead primarily driven by increased

revenues from new H&T stores.

REGULATION - FCA REVIEW

Continued focus on affordability and creditworthiness in

consumer credit

On 18 November 2019 the Group announced that it was working with

the Financial Conduct Authority (FCA) to review its

creditworthiness assessments and lending processes for its

unsecured HCSTC loans. Since then the Group has been developing its

methodology for conducting a past-book review. In collaboration

with the FCA progress towards appointment of a skilled person was

postponed until Covid-19 restrictions allowed engagement. During

July we engaged with advisers and conducted interviews in order to

put forward proposals to the FCA. We anticipate a skilled person

will be selected shortly with their work commencing in

September.

STRATEGY AND OUTLOOK

We are pleased with the way our business has returned since

stores re-opened, with pawnbroking lending run rates developing so

far week on week, although we have some way still to go to reach

pre lock-down levels. Our focus is on being able to provide

short-term cash loans to customers when they need it and

consequently building our lending portfolios. This rebuilding is

supported by our strong cash generation in the first half and our

ungeared balance sheet. The opportunity to achieve uplift and

return from our newly enlarged store estate remains. We have

already demonstrated an ability to grow pawnbroking in new stores

and to leverage opportunities in Western Union, FX and cheque

cashing.

The Group will continue to focus and seek strategies to grow its

pawnbroking offering while building our other lines of business.

Further investment in digital and online capabilities to complement

our store estate will be fundamental.

Interim Condensed Financial Statements

Unaudited statement of comprehensive income

For the 6 months ended 30 June 2020

12 months

6 months 6 months ended 31

ended 30 ended 30 December

June 2020 June 2019 2019

Note Total Total Total

Unaudited Unaudited

GBP'000 GBP'000 GBP'000

Revenue 2 55,830 69,999 160,213

Cost of sales (18,478) (25,929) (58,852)

________ ________ ________

Gross profit 2 37,352 44,070 101,361

Other direct expenses (21,567) (28,513) (60,842)

Administrative expenses (10,324) (7,384) (18,031)

________ ________ ________

Operating profit 3 5,461 8,173 22,488

Finance costs 5 (446) (1,342) (2,405)

________ ________ ________

Profit before taxation 5,015 6,831 20,083

Tax on profit 6 (1,132) (1,275) (3,393)

________ ________ ________

Total comprehensive income for

the period 3,883 5,556 16,690

________ ________ ________

Pence Pence Pence

Earnings per ordinary share

- basic 7 10.21 15.00 43.88

Earnings per ordinary share

- diluted 7 10.20 14.97 43.80

All results derive from continuing operations.

Unaudited condensed consolidated statement of changes in

equity

For the 6 months ended 30 June 2020

6 months 6 months 12 months

ended ended ended

30 June 30 June 31 December

Note 2020 2019 2019

Unaudited Audited

Unaudited Restated* Restated*

GBP'000 GBP'000 GBP'000

Opening total equity 122,606 103,821 103,821

Total comprehensive income for the

period 3,883 5,556 16,690

Issue of share capital 313 328 6,130

Share option movement taken directly

to equity 102 368 328

Dividends paid 9 - (2,496) (4,363)

Closing total equity 126,904 107,577 122,606

Unaudited condensed consolidated balance sheet

At 30 June 2020

At 30 June At 30 June At 31 December

2020 2019 2019

Unaudited Unaudited

Note GBP'000 GBP'000 GBP'000

Non-current assets

Goodwill 19,330 17,643 19,580

Other intangible assets 3,264 280 3,889

Property, plant and equipment 7,595 6,497 7,739

Deferred tax assets 2,184 1,760 2,180

Right-of-use assets 18,689 18,408 21,147

51,062 44,588 54,535

Current assets

Inventories 27,306 30,653 29,157

Trade and other receivables 68,582 74,315 90,606

Other current assets 38 947 714

Cash and cash equivalents 13,938 9,501 12,003

109,864 115,416 132,480

Total assets 160,926 160,004 187,015

Current liabilities

Trade and other payables (8,842) (9,031) (10,578)

Lease liability (5,708) (4,830) (253)

Current tax liabilities (890) (722) (2,066)

(15,440) (14,583) (12,897)

Net current assets 94,424 100,833 119,583

Non-current liabilities

Borrowings 4 (773) (20,656) (25,715)

Lease liability (16,298) (15,890) (24,307)

Provisions (1,511) (1,298) (1,490)

(18,582) (37,844) (51,512)

Total liabilities (34,022) (52,427) (64,409)

Net assets 126,904 107,577 122,606

EQUITY

Share capital 8 1,993 1,891 1,987

Share premium account 33,486 27,472 33,179

Employee Benefit Trust share

reserve (35) (35) (35)

Retained earnings 91,460 78,249 87,475

Total equity attributable to

equity holders of the parent 126,904 107,577 122,606

Unaudited condensed consolidated cash flow statement

For the 6 months ended 30 June 2020

6 months 6 months 12 months

Note ended ended ended

30 June 30 June 31 December

2020 2019 2019

Unaudited Unaudited

GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Profit for the period 3,883 5,556 16,690

Adjustments for:

Finance costs 446 1,342 2,405

Increase in provisions 21 45 237

Income tax expense 1,132 1,275 3,393

Depreciation of property, plant

and equipment 1,097 1,045 2,272

Depreciation of right-of-use assets 2,239 2,004 4,604

Amortisation of intangible assets 785 71 591

Loss on disposal of property, plant

and equipment - 5 70

Loss on disposal of right-of-use

assets 92 - -

Share based payment expense 69 146 266

Operating cash flows before movements

in working capital 9,764 11,489 30,528

Decrease/(increase) in inventories 1,851 (1,391) 105

Decrease/(increase) in other current

assets 676 (70) 163

Decrease/(Increase) in receivables 22,022 (517) (5,500)

(Decrease)/increase in payables (3,734) (259) 5,347

Cash generated from operations 30,579 9,252 30,643

Income taxes paid (2,279) (1,248) (2,604)

Interest paid on loan facility (259) (314) (686)

Interest paid on lease liability (108) (892) (1,524)

Net cash generated from operating

activities 27,933 6,798 25,829

Investing activities

Purchases of intangible assets (160) - (9)

Purchases of property, plant and equipment (1,037) (1,520) (3,316)

Acquisition of right-of-use assets (365) (253) (5,592)

Acquisition of trade and assets of business 251 (419) (18,740)

Net cash used in investing activities (1,311) (2,192) (27,657)

Financing activities

Dividends paid 9 - (2,497) (4,363)

(Decrease)/increase in borrowings (25,000) (4,000) 1,000

Debt restructuring cost - (350) (350)

Proceeds on Issue of shares 313 328 6,130

Net cash (used in)/generated from financing

activities (24,687) (6,519) 2,417

Net increase/(decrease) in cash and cash

equivalents 1,935 (1,913) 589

Cash and cash equivalents at beginning

of period 12,003 11,414 11,414

Cash and cash equivalents at end of period 13,938 9,501 12,003

Unaudited notes to the condensed interim financial

statements

For the 6 months ended 30 June 2020

Note 1 Basis of preparation

The interim financial statements of the group for the six months

ended 30 June 2020, which are unaudited, have been prepared in

accordance with the International Financial Reporting Standards

('IFRS') accounting policies adopted by the group and set out in

the annual report and accounts for the year ended 31 December 2019.

The group does not anticipate any change in these accounting

policies for the year ended 31 December 2020. As permitted, this

interim report has been prepared in accordance with the AIM rules

but not in accordance with IAS 34 "Interim financial reporting".

While the financial figures included in this preliminary interim

earnings announcement have been computed in accordance with IFRSs

applicable to interim periods, this announcement does not contain

sufficient information to constitute an interim financial report as

that term is defined in IFRSs.

The financial information contained in the interim report also

does not constitute statutory accounts for the purposes of section

434 of the Companies Act 2006. The financial information for the

year ended 31 December 2019 is based on the statutory accounts for

the year ended 31 December 2019. The auditors reported on those

accounts: their report was unqualified, did not draw attention to

any matters by way of emphasis and did not contain a statement

under section 498 (2) or (3) of the Companies Act 2006.

The Board have conducted an extensive review of forecast

earnings and cash over the next twelve months, considering various

scenarios and sensitivities given the Covid--19 situation and

uncertainty around the future economic environment. The Board have

a reasonable expectation that the Company and Group have adequate

resources to continue in operational existence for the foreseeable

future. Accordingly, they continue to adopt the going concern basis

in preparing the interim condensed financial statements. Further

details of the impact of Covid--19 are set out in note 11.

Unaudited notes to the condensed interim financial

statements

For the 6 months ended 30 June 2020

Note 2 Segmental Reporting

Consolidated

for the

6 months

ended

Gold Pawnbroking Personal Other Other 30 June

2020 Pawnbroking purchasing Retail scrap Loans Services Income 2020

Revenue GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

External revenue 17,399 9,607 9,768 6,698 6,426 2,434 3,498 55,830

Total revenue 17,399 9,607 9,768 6,698 6,426 2,434 3,498 55,830

Gross profit 17,399 2,831 2,775 1,989 6,426 2,434 3,498 37,352

Impairment (642) - - - (2,147) - - (2,789)

Segment result 16,757 2,831 2,775 1,989 4,279 2,434 3,498 34,563

Other direct expenses excluding impairment (18,778)

Administrative expenses (10,324)

Operating profit 5,461

Finance costs (446)

Profit before taxation 5,015

Tax charge on profit (1,132)

Profit for the financial year and

total comprehensive income 3,883

Consolidated

for the

6 months

ended

Gold Pawnbroking Personal Other Other 30 June

2019 Pawnbroking purchasing Retail scrap Loans Services Income 2019

Revenue GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

External

revenue 21,790 8,752 18,511 6,040 11,620 3,286 - 69,999

Total revenue 21,790 8,752 18,511 6,040 11,620 3,286 - 69,999

Gross profit 21,790 1,495 5,432 447 11,620 3,286 - 44,070

Impairment (4,997) - - - (6,196) - - (11,193)

Segment result 16,793 1,495 5,432 447 5,424 3,286 - 32,877

Other direct expenses excluding

impairment (17,320)

Administrative expenses (7,384)

Operating profit 8,173

Finance costs (1,342)

Profit before taxation 6,831

Tax charge on profit (1,275)

Profit for the financial year and

total comprehensive income 5,556

Unaudited notes to the condensed interim financial statements

(continued)

For the 6 months ended 30 June 2020

Note 2 Segmental Reporting (continued)

Pawnbroking Gold Pawnbroking Personal Other Other For the year

2019 Restated* purchasing Retail scrap Loans Services Income ended 2019

Revenue GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

External

revenue 49,102 24,229 41,516 14,944 21,459 8,963 - 160,213

Total revenue 49,102 24,229 41,516 14,944 21,459 8,963 - 160,213

Gross profit 49,102 5,736 13,639 2,462 21,459 8,963 - 101,361

Impairment (10,142) - - - (10,656) - (20,798)

Segment result 38,960 5,736 13,639 2,462 10,803 8,963 80,563

Other direct expenses excluding impairment (40,044)

Administrative expenses (18,031)

Operating profit 22,488

Finance costs (2,405)

Profit before taxation 20,083

Tax charge on profit (3,393)

Profit for the financial year and

total comprehensive income 16,690

Note 3 Operating profit and EBITDA

EBITDA

The Board consider EBITDA to be a key performance measure as the

Group borrowing facility includes a number of loan covenants based

on it.

EBITDA is defined as Earnings Before Interest, Taxation,

Depreciation and Amortisation. It is calculated by adding back

depreciation and amortisation to the operating profit as

follows:

6 months ended 30 June 2020 6 months 6 months 12 months

Unaudited ended ended ended

30 June 30 June 31 December

2020 2019 2019

Unaudited Unaudited Audited

Total Total Total

GBP'000 GBP'000 GBP'000

Operating profit 5,461 8,173 22,488

Depreciation and amortisation 1,882 1,116 2,862

Depreciation of right-of-use assets 2,239 2,004 4,604

EBITDA 9,582 11,293 29,954

Unaudited notes to the condensed interim financial statements

(continued)

For the 6 months ended 30 June 2020

Note 4 Borrowings

6 months 6 months 12 months

ended ended ended

30 June 30 June 31 December

2020 2019 2019

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Long term portion of bank loan 1,000 21,000 26,000

Unamortised issue costs (227) (344) (285)

--------- --------- ------------

Amount due for settlement after more

than one year 773 20,656 25,715

========= ========= ============

Note 5 Finance costs

6 months 6 months 12 months

ended ended ended

30 June 30 June 31 December

2020 2019 2019

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Interest payable on bank loans and overdraft 280 331 693

Other interest - 1 1

Amortisation of debt issue costs 58 118 187

Interest on expense on the lease liability 108 892 1,524

Total finance costs 446 1,342 2,405

Unaudited notes to the condensed interim financial statements

(continued)

For the 6 months ended 30 June 2020

Note 6 Tax on profit

The taxation charge for the 6 months ended 30 June 2020 has been

calculated by reference to the expected effective corporation tax

and deferred tax rates for the full financial year to end on 31

December 2020. The underlying effective full year tax charge is

estimated to be 19% (six months ended 30 June 2019: 19%).

Note 7 Earnings per share

Basic earnings per share is calculated by dividing the profit

for the period attributable to equity shareholders by the weighted

average number of ordinary shares in issue during the period.

For diluted earnings per share, the weighted average number of

ordinary shares in issue is adjusted to assume conversion of all

dilutive potential ordinary shares. With respect to the group these

represent share options granted to employees where the exercise

price is less than the average market price of the company's

ordinary shares during the period.

Reconciliations of the earnings per ordinary share and weighted

average number of shares used in the calculations are set out

below:

Unaudited Unaudited

6 months ended 30 6 months ended 30 12 months ended 31

June 2020 June 2019 December 2019

Earnings Weighted Per-share Earnings Weighted Per-share Earnings Weighted Per-share

GBP'000 average amount GBP'000 average amount GBP'000 average amount

number pence number pence number pence

of shares of shares of shares

Earnings

per share

-

basic 3,883 38,039,328 10.21 5,556 37,039,443 15.00 16,690 38,039,328 43.88

Effect of

dilutive

securities

Options - 18,201 (0.01) - 70,999 (0.03) - 68,197 (0.08)

Earnings

per share

diluted 3,883 38,057,529 10.20 5,556 37,110,442 14.97 16,690 38,107,525 43.80

Unaudited notes to the condensed interim financial statements

(continued)

For the 6 months ended 30 June 2020

Note 8 Share capital

At At At

30 June 2020 30 June 2019 31 December

2019

Unaudited Unaudited Audited

Allotted, called up and fully

paid

(Ordinary Shares of GBP0.05

each)

GBP'000 Sterling 1,993 1,891 1,987

Number 39,864,077 37,827,501 39,736,476

Note 9 Dividends

On 6 August 2020, the directors approved a 2.5 pence interim

dividend (30 June 2019: 4.7 pence) which equates to a dividend

payment of GBP997,000 (30 June 2019: GBP1,866,000). The dividend

will be paid on 2 October 2020 to shareholders on the share

register at the close of business on 4 September 2020 and has not

been provided for in the 2020 interim results. The shares will be

marked ex-dividend on 3 September 2020.

Note 10 Contingent Liabilities

As set out in the market release issued by H&T Group plc on

18 November 2019, we will be working with a skilled person

appointed in conjunction with the FCA on a past-book review of our

lending since April 2014 within the High Cost Short Term unsecured

lending (HCSTC) market. A skilled person is in the course of being

appointed. At this stage, under the criteria in IAS 37 Provisions,

contingent liabilities and contingent assets it is possible that a

liability may exist, but H&T is unable to estimate the quantum

of any such possible liability.

Note 11 Covid-19 Considerations

The outbreak of Covid-19 and its impact on the global and UK

economies has resulted in financial consequences also for

H&T.

In line with HM Government Guidance and in order to protect

colleagues and customers all stores were closed on 24 March 2020.

Whilst stores were closed no interest on pawnbroking loans was

charged. During lock-down the Company's ability to operate was

impacted as stores were closed. During this period costs were

reduced and the operational impact on the business was mitigated by

developing online capabilities and continuing to scrap gold and

collect in loan receivables. Whilst stores have since re-opened,

the Group is adhering to HM Government guidance in respect of the

provision of a safe environment for colleagues and customers which

reduces store capacity.

The most significant financial impact of the Covid-19 crisis on

the Company is expected to be the extent to which the need for

short-term cash loans returns following a period immediately post

lock-down which saw high levels of pawnbroking loan redemptions.

Further, we anticipate ongoing reduced demand in the short term for

foreign currency, as overseas travel is likely to continue to be

affected, and there remains uncertainty surrounding retail footfall

which might reduce retail sales.

The impact of impairments on loan receivables is not yet clear.

Charges may increase as the Company offers payment deferrals to

customers experiencing financial difficulties as a result of events

caused by Covid-19.

The Group' has considered its position and the likely impact on

trading, including customer demand across its diversified income

streams, the impact of the current high gold price and of its cost

base. The Group has concluded that it has sufficient liquidity

within the business and existing bank facilities. After reviewing

these factors, it has determined that the preparation of these

interim financial statements on a going concern basis remains

appropriate.

A goodwill impairment review has also been carried out. The

Group further considers that store profitability will not be

significantly impacted in the medium term and therefore no change

in the assessment of the fair value of its assets, including

goodwill and intangibles, is required at this time. We will review

the position at year end.

The Board has considered the impact of risks around Covid-19,

summarised as follows:

Description of risk Examples of mitigating activities

Failure to implement social -- Risk assessments carried

distancing in stores or -- out for each location

office locations resulting 2- metre distancing rule

in colleagues or customers applied by implementing distancing

becoming ill or transmitting tape and restricting staff

the virus. -- and customers to no more

than two per store

Commercial risk leading -- Perspex applied to speech

to reduced profits and gaps in counter bays

cash pressure resulting Colleague and customer guidance

from: regarding social distancing

i) a necessity to close -- and hygiene measures communicated

stores once more again -- via posters, website and

should a new virus waive direct communications

reoccur or Home-working implemented

ii) reduced product demand -- where possible

resulting from changes Regular communication to

in consumer behaviour, -- staff regarding latest Government

e.g. less overseas travel guidelines, including self-isolation

or reduced high street and hygiene factors

footfall Awareness of the vulnerability

iii) an economic downturn -- status of colleagues who

resulting in, for example, remain shielded

higher unemployment and Online alternatives developed

a consequential change -- to service customer requirements

in customer behaviours - e.g. online pawnbroking,

which might impact loan payment portal and online

repayment and redemption -- unsecured lending channels

profiles. reviewed

Diversified product range

ensuring reduced demand in

-- one area does not overly

impact the whole

The ability to generate cash

via melting gold and collecting

in loans even where stores

are closed.

Maintaining prudent loan

underwriting and affordability

assessment criteria and conservative

loan to value percentages

for gold based secured loans.

Pawnbroking loans are secured

on valuable assets e.g. gold

and thus the Group is protected

financially if customers

are unable to redeem their

pledged items.

---- -------------------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR UASORRNUWAAR

(END) Dow Jones Newswires

August 11, 2020 09:50 ET (13:50 GMT)

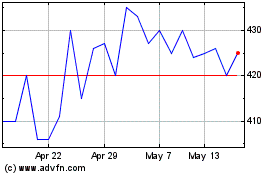

H&t (LSE:HAT)

Historical Stock Chart

From May 2024 to Jun 2024

H&t (LSE:HAT)

Historical Stock Chart

From Jun 2023 to Jun 2024