TIDMHAT

RNS Number : 7927I

H&T Group PLC

13 August 2019

13 August 2019

H&T Group plc

("H&T" or "the Group" or "the Company")

UNAUDITED INTERIM CONDENSED FINANCIAL STATEMENTS

FOR THE SIX MONTHSED 30 JUNE 2019

H&T Group plc today announces its interim results for the

six months ended 30 June 2019.

The Group financial statements have been prepared, as required,

for the first time under IFRS 16 ('Leases').

FINANCIAL HIGHLIGHTS

-- Profit before tax up GBP0.5m, 7.9% to GBP6.8m (H1 2018:

GBP6.3m)

-- Operating profit before non-recurring expenses up 16.0%,

GBP1.2m to GBP8.7m (H1 2018: GBP7.5m), after GBP0.5m transaction

expenses up 9.3%, GBP0.7m to GBP8.2m (H1 2018: GBP7.5m)

-- Basic EPS of 15.00p (H1 2018: 13.85p)

-- Net pledge book, including accrued interest, increased

by 3.8% from FY18 to GBP53.8m (30 June 2018: GBP47.8m)

-- Personal Loan book Risk Adjusted Margin increased to 54.1%

(H1 2018: 37.5%)

-- Net debt reduced by GBP2.1m from FY18 to GBP11.6m (30 June

2018: GBP16.8m)

-- Interim dividend of 4.7p (2018 interim: 4.4p)

OPERATIONAL HIGHLIGHTS

-- Growth in pawnbroking, customer lending and new customers

-- Improved personal loan net profitability due to lower impairment

and focus on store initiated new business

-- Growth of our foreign currency product, driven by improved

systems and in-store displays

-- Improved management of our customer interactions and better

conversion of our online leads via the utilisation of our

integrated CRM and digital marketing platforms

-- Planned acquisition of 65 trading stores and 46 pledge

books from the Money Shop

John Nichols, H&T chief executive, said:

"We have made a good start to the year due to the resilient

nature of our product set, our investment in people, and our

digital initiatives. A strengthening gold price is helpful to our

business. PBT is up nearly 8% to GBP6.8m, and revenue is up

GBP1.5m, primarily driven by increased pawnbroking, personal

lending and retail activity.

"Against this solid background, in July 2019 we completed the

acquisition of 65 trading stores and bought 29 pledge books from

the Money Shop, all of which have been integrated into the Group

(we had previously acquired 17 books for GBP0.4m in the period). To

facilitate this acquisition, in July we raised GBP6.0m of

additional equity funding by way of an accelerated bookbuild

placing, having renewed our GBP35.0m credit facility with Lloyds.

The total acquisition price was GBP11.0m, which included taking

possession of GBP6.0m of pledged assets, GBP1.0m of cash, a

freehold property and trading fixtures and fittings, together with

241 employees.

"We can be confident of the success of this important

transaction as a result of the investment in people and processes

made over many years. The acquired stores conduct similar business

and will geographically complement our existing store estate. With

the application of H&T's appropriate capital, staffing support

and management, and with the expansion of pledge business and the

introduction of our personal lending products the investment will

provide significant value to shareholders.

"We will further leverage this expanded store estate by

continuing to develop and invest in digital multi-channel

capability."

Enquiries:

H&T Group plc

Tel: 0870 9022 600

John Nichols, chief executive

Richard Withers, interim finance director

Numis Securities (broker and nominated adviser)

Tel: 020 7260 1000

Luke Bordewich, nominated adviser

Haggie Partners (financial public relations)

Tel: 020 7562 4444

Caroline Klein

Vivian Lai

INTERIM REPORT

Introduction

We have continued to achieve revenue growth from all core

business activities through our ongoing focus on in-store execution

excellence alongside continuing development in digital

capabilities.

In July we increased our store estate by 65 sites, bringing our

estate to 248 stores, via the acquisition of certain assets from

the Money Shop. This growth allows us to expand our online to

in-store capability.

FINANCIAL RESULTS

The Group has reported profit before tax of GBP6.8m (H1 2018:

GBP6.3m), a 7.9% increase, reflecting a good operational

performance.

Gross profit increased by GBP1.5m, 3.5%, to GBP44.1m (H1 2018:

GBP42.6m). Operating profit before non-recurring expenses increased

by GBP1.2m, 16.0%, to GBP8.7m (H1 2018: GBP7.5m). The group

incurred GBP0.5m of transaction related costs in respect of the

acquisition of certain assets of the Money Shop which have been

expensed in full.

The average H1 2019 gold price has increased 5.4% to GBP1,010

per troy ounce for H1 2019 (H1 2018: GBP958).

Total direct and administrative expenses increased by GBP0.3m,

reflecting a GBP0.2m reduction in impairment charges despite

aggregate increases in our lending books and a GBP0.5m, 3.5%

increase in wage-related costs, as a result of increases in pension

and living wage costs.

The Group's balance sheet remains strong with net debt at

GBP11.6m (30 June 2018: GBP16.8m) and a net debt to EBITDA ratio,

calculated in accordance with bank covenant arrangements, of 0.64x

(30 June 2018: 0.97x).

The reduced borrowings reflected the cash generative nature of

the Group and a relative slow-down in the growth of our personal

lending offering. The bank debt position is well within the

covenant test of 3.0x. The Group had GBP14.0m (30 June 2018:

GBP9.0m) of headroom available on its debt facility of GBP35.0m at

30 June 2019. The credit facility was renewed with Lloyds on

principally the same terms for a period of up to five years,

expiring in June 2024.

Dividend

The Board has approved an interim dividend of 4.7 pence (2018

interim: 4.4 pence). This will be payable on 4 October 2019 to all

shareholders on the register at the close of business on 6

September 2019.

IFRS 16

IFRS 16, applicable for accounting periods beginning on or after

1 January 2019 has been adopted by the Group and prior periods

restated using the fully retrospective approach. The standard

introduces the identification of lease arrangements and the impact

on the Group's financial statements is shown in detail at note

10.

As at 30 June 2019 the Group has non-cancellable operating lease

commitments of GBP22.0m (30 June 2018: GBP25.3m). The new

accounting requirement results in a reduction in retained earnings

of GBP3.1m, primarily resulting from the Group recognising a

right-of-use asset capitalised at a net book value of GBP18.4m (30

June 2018: GBP21.5m) offset by a lease liability of GBP20.7m (30

June 2018: GBP24.0m). The impact on the Group's statement of

comprehensive income for H1 2019 is GBP0.1m (H1 2018: GBP0.1m).

REVEW OF OPERATIONS

Pawnbroking

Pawnbroking remains a core product for H&T and we report

that the gross pledge book increased to GBP53.8m, including accrued

interest (30 June 2018: GBP47.8m). This growth has been achieved

due to the following factors:

-- Increase in number of customer transactions by 6.5% on

H1 2018

-- Higher carat lending, principally 14ct and 22ct, driving

a GBP0.9m increase in book value from this category on

31 December 2018

-- Improvement in the quality-watch segment of the book, with

the support of the Expert Eye system and additional specialist

valuation staff, which has seen a GBP0.5m book increase

on 31 December 2018

-- Consistently high redemption rate of 84% (H1 2018: 84%)

-- Continued growth in customer lending sourced via our appointed

introducers

Pawnbroking-revenue less impairment increased GBP0.6m to

GBP16.8m (H1 2018: GBP16.2m) resulting in an annualised

risk-adjusted margin (RAM) of 62.9% (H1 2018: 67.9%). The was a

consequence of a change in mix towards lending on higher value

(higher carat gold and premium watches) items.

Pawnbroking summary:

6 months ended 30 June: 2019 2018 Change

GBP'000 GBP'000 %

----------------------------- -------- -------- -------

Year-end net pledge book(1) 53,799 47,847 12.4%

Average monthly net pledge

book 53,422 47,665 12.1%

Revenue less impairment 16,793 16,182 3.8%

Annualised Risk-adjusted

margin(2) 62.9% 67.9%

Notes to table

1 - Includes accrued

interest

2 - Revenue less impairment as a percentage

of average pledge book

Pawnbroking scrap

Pawnbroking scrap produced gross profits of GBP0.4m (H1 2018:

GBP1.0m) for the half year, on sales of GBP5.9m (H1 2018: GBP8.0m).

The reduced margin from 13% to 7% results primarily from delay in

the realisation of diamond sales yet to be auctioned.

Retail

Retail sales increased 12.8% to GBP18.5m (H1 2018: GBP16.4m)

while gross profits reduced by 10.0% to GBP5.4m (H1 2018: GBP6.0m).

Margin at 29.2% (H1 2018: 36.6%) is reflected by an increased

proportion of lower-margin watches sold in store and online and

higher watch repair and refurbishment costs. The Group has also

reduced its stock holding of aged items, requiring higher level of

sales discounting. As a result, retail stock has reduced by GBP2.3m

to GBP31.6m (30 June 2018: GBP33.9m).

Our online retail site continues to grow, with online generated

sales reaching GBP2.0m (H1 2018: GBP1.1m). Our www.est1897.co.uk

website typically holds more than 2,000 high-end pre-owned watches

and jewellery items.

Electronic item sales are a necessary consequence of buyback fee

income. Revenue from electronic items was GBP1.9m (H1 2018:

GBP1.5m). In the period, losses from these items were GBP0.4m (H1

2018: profit GBP0.1m). Our online sales process only became

operational end H1 2019. As a result, a higher proportion of items

were disposed of at auction, as opposed to online or in-store where

we achieve a higher price, resulting in these net losses and

depressing the overall retail margin.

Personal Loans

Net revenue increased 74.2% to GBP5.4m (H1 2018: GBP3.1m), while

the loan book decreased 5.3% from 31 December 2018 to GBP19.4m (30

June 2018: GBP17.8m). Organic store lending increased 2.1% vs H1

2018.

We have improved the annualised risk-adjusted margin to 54% (H1

2018: 37%) by taking proactive action in areas identified as not

economically viable. Since the end of 2018 we have been refocusing

on the quality of our lending.

Marketing activities have been stepped up to leverage our

investment in our Customer Relations Management system so that we

can more effectively engage with and redirect loan enquiries to

local branches. The process of encouraging a potential customer

from the website to a physical branch is now an important component

of our strategy, blending a digital offering with our store

estate.

We have made further progress in delivery of the longer-term

strategy of helping our customers to rebuild their credit rating,

with more customers obtaining access to one of the two lower

interest rate and longer-term products. As a result, the proportion

of loans that fall under the definition of high-cost short-term

credit fell to 36% (H1 2018: 50%).

Personal Loans summary:

6 months ended 30 June: 2019 2018 Change

GBP'000 GBP'000 %

---------------------------- --------- -------- --------

Period-end net loan book 19,363 17,757 9.0 %

Average monthly net loan

book 20,050 16,639 20.5%

Revenue 11,620 10,566 10.0%

Impairment (6,196) (7,443) (16.8%)

Revenue less impairment 5,424 3,123 73.7%

Annualised Risk-adjusted

margin(1) 54.1% 37.5%

Notes to table

1 - Revenue less impairment as a percentage

of average loan book

Gold purchasing

Gold purchasing profits reduced to GBP1.5m (H1 2018: GBP2.1m) on

sales of GBP8.4m (H1 2018: GBP10.1m). The reduced margin from 21%

to 18% is a result of timings differences in the sales of purchased

gold together with diamonds awaiting auction as at 30 June 2019.

Gold held in stock for melting was GBP1.7m (30 June 2018:

GBP1.4m).

Other services

Total revenues from other services increased to GBP3.3m (H1

2018: GBP2.8m) with a GBP0.3m increase in Foreign Currency (FX)

transaction profit partially offset by reductions in buyback

income.

FX profit increased by 18.8% to GBP1.9m (H1 2018: GBP1.6m) while

the value of currency traded increased by 14.0% from GBP71.9m to

GBP82.0m. We continue to maintain competitive rates as we raise

customer awareness in the product. The product is still relatively

new to the business and we have seen trading uplift due to a new

system deployment that optimises currency holdings in store. We

continue to see improved customer awareness through development of

marketing and point-of-sale materials.

Buyback customer transactions were up 14.4% on H1 2018, driving

an additional GBP0.1m in fees with revenue at GBP0.9m (H1 2018:

GBP0.8m).

Cheque cashing revenue was flat at GBP0.4m (H1 2018:

GBP0.4m).

REGULATION

Continued focus on affordability and creditworthiness in

consumer credit

Our historic approach to affordability and creditworthiness

ensured we were in a positive position to be able to meet all new

requirements with minimal changes to our policies or procedures. In

November 2018 the FCA's new rules and guidance on assessing

affordability and creditworthiness in consumer credit came into

force. The Group's strategy is to evolve the Personal Loans product

to lower interest rates.

Senior Managers & Certification Regime

The FCA is extending the Senior Managers & Certification

Regime (SM&CR) to all firms from the 9(th) December 2019. The

Group has always adopted a robust approach to governance and

internal controls and is well placed to meet the additional demands

of the SM&CR.

STRATEGY AND OUTLOOK

We are excited about the opportunity to achieve uplift and

return from our newly enlarged store estate. We will continue to

focus on people development and transfer the Group's success

factors into the 65 newly acquired ex-Money Shop stores. We will

also look at opportunities where the Money shop excelled (for

example Western Union, FX, cheque cashing) and transfer knowledge

and synergies where relevant.

The demand for small-sum, short-term cash loans remains strong.

The Company continues to focus and seek strategies to grow its

pawnbroking offering while sensibly expanding its unsecured

personal lending product and retail offering by focusing on digital

and online strategies to complement its store estate.

We will continue to work towards our vision of helping our

customers to rebuild their credit history by giving them access to

more affordable lending products. We will also maintain our

relentless focus on operational effectiveness aligned with the

training, development and progression of our valuable staff.

Current trading is in line with management's expectations.

Interim Condensed Financial Statements

Unaudited statement of comprehensive income

For the 6 months ended 30 June 2019

6 months 6 months 12 months

ended 30 ended 30 ended 31 December

June 2019 June 2018 2018

Note Total Total Total

Unaudited Restated*

Unaudited Restated*

GBP'000 GBP'000 GBP'000

Revenue 2 69,999 68,486 143,025

Cost of sales (25,929) (25,915) (54,781)

________ ________ ________

Gross profit 2 44,070 42,571 88,244

Other direct expenses (28,013) (27,740) (58,736)

Administrative expenses (7,384) (7,341) (13,272)

________ ________ ________

Operating profit before non-operating

expenses 8,673 7,490 16,236

________ ________ ________

Non-recurring expenses 11 (500) - -

________ ________ ________

Operating profit 3 8,173 7,490 16,236

Investment revenues - 3 3

Finance costs 5 (1,342) (1,196) (2,468)

________ ________ ________

Profit before taxation 6,831 6,297 13,771

Tax on profit 6 (1,275) (1,197) (2,818)

________ ________ ________

Total comprehensive income for

the period 5,556 5,100 10,953

________ ________ ________

Pence Pence Pence

Earnings per ordinary share

- basic 7 15.00 13.85 29.69

Earnings per ordinary share

- diluted 7 14.97 13.78 29.59

All results derive from continuing operations.

* Certain comparative information has been restated as a result

of the initial application of IFRS 16 as set out in note 10.

Unaudited condensed consolidated statement of changes in

equity

For the 6 months ended 30 June 2019

6 months 6 months 12 months

ended ended ended

30 June 30 June 31 December

Note 2019 2018 2018

Unaudited Restated*

Unaudited Restated*

GBP'000 GBP'000 GBP'000

Opening total equity 103,821 96,404 96,404

Total comprehensive income for the

period 5,556 5,100 10,953

Issue of share capital 328 522 522

Share option movement taken directly

to equity 368 (12) (72)

Dividends paid 9 (2,496) (2,329) (3,986)

________ ________ ________

Closing total equity 107,577 99,685 103,821

________ ________ ________

Unaudited condensed consolidated balance sheet

At 30 June 2019

At 30 June At 30 June At 31 December

2019 2018 2018

Unaudited

Unaudited Restated* Restated*

Note GBP'000 GBP'000 GBP'000

Non-current assets

Goodwill 17,643 17,643 17,643

Other intangible assets 280 449 343

Property, plant and equipment 6,497 6,660 6,032

Deferred tax assets 1,760 2,015 1,683

Right-of-use assets 10 18,408 21,529 20,159

44,588 48,296 45,860

Current assets

Inventories 30,653 33,035 29,262

Trade and other receivables 74,315 67,219 73,379

Other current assets 947 841 877

Cash and cash equivalents 9,501 9,272 11,414

115,416 110,367 114,932

Total assets 160,004 158,663 160,792

Current liabilities

Lease liability 10 (4,830) (4,657) (4,779)

Trade and other payables (9,031) (7,086) (7,384)

Current tax liabilities (722) (759) (842)

(14,583) (12,502) (13,005)

Net current assets 100,833 97,865 101,927

Non-current liabilities

Borrowings 4 (20,656) (25,831) (24,888)

Lease liability 10 (15,890) (19,326) (17,825)

Provisions (1,298) (1,319) (1,253)

(37,844) (46,476) (43,966)

Total liabilities (52,427) (58,978) (56,971)

Net assets 107,577 99,685 103,821

EQUITY

Share capital 8 1,891 1,883 1,883

Share premium account 27,472 27,153 27,152

Employee Benefit Trust share

reserve (35) (35) (35)

Retained earnings 78,249 70,684 74,821

Total equity attributable to

equity holders of the parent 107,577 99,685 103,821

* Certain comparative information has been restated as a result

of the initial application of IFRS 16 as set out in note 10.

Unaudited condensed consolidated cash flow statement

For the 6 months ended 30 June 2019

6 months 6 months 12 months

Note ended ended ended

30 June 30 June 31 December

2019 2018 2018

Unaudited

Unaudited Restated* Restated*

GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Profit for the period 5,556 5,100 10,953

Adjustments for:

Investment revenues - (3) (3)

Finance costs 1,342 1,196 2,468

Increase/(decrease) in provisions 45 6 (60)

Income tax expense 1,275 1,197 2,818

Depreciation of property, plant

and equipment 1,045 1,160 2,333

Depreciation of right-of-use assets 2,004 2,092 4,188

Amortisation of intangible assets 71 72 150

Loss on disposal of property, plant

and equipment 5 81 133

Share based payment expense 146 - -

Operating cash flows before movements

in working capital 11,489 10,901 22,980

(Increase)/decrease in inventories (1,391) 1,112 4,884

Increase in other current assets (70) (176) (212)

Increase in receivables (517) (3,821) (9,947)

Decrease in payables (259) (4,264) (5,405)

Cash generated from operations 9,252 3,752 12,300

Income taxes paid (1,248) (1,511) (2,776)

Interest paid (1,206) (1,128) (2,344)

Net cash generated from operating

activities 6,798 1,113 7,180

Investing activities

Interest received - 3 3

Purchases of property, plant and equipment (1,520) (1,563) (2,101)

Acquisition of right-of-use assets (253) (548) (1,275)

Acquisition of trade and assets of business (419) (569) (575)

Net cash used in investing activities (2,192) (2,677) (3,948)

Financing activities

Dividends paid 9 (2,497) (2,329) (3,986)

(Decrease)/increase in borrowings (4,000) 4,000 3,000

Debt restructuring cost (350) (34) (31)

Proceeds on Issue of shares 328 523 523

Net cash (used in)/generated from financing

activities (6,519) 2,160 (494)

Net (decrease)/increase in cash and cash

equivalents (1,913) 596 2,738

Cash and cash equivalents at beginning

of period 11,414 8,676 8,676

Cash and cash equivalents at end of period 9,501 9,272 11,414

Unaudited notes to the condensed interim financial

statements

For the 6 months ended 30 June 2019

Note 1 Basis of preparation

The interim financial statements of the group for the six months

ended 30 June 2019, which are unaudited, have been prepared in

accordance with the International Financial Reporting Standards

('IFRS') accounting policies adopted by the group and set out in

the annual report and accounts for the year ended 31 December 2018,

except for the adoption of IFRS 16. The group does not anticipate

any change in these accounting policies for the year ended 31

December 2019. As permitted, this interim report has been prepared

in accordance with the AIM rules but not in accordance with IAS 34

"Interim financial reporting". While the financial figures included

in this preliminary interim earnings announcement have been

computed in accordance with IFRSs applicable to interim periods,

this announcement does not contain sufficient information to

constitute an interim financial report as that term is defined in

IFRSs.

The financial information contained in the interim report also

does not constitute statutory accounts for the purposes of section

434 of the Companies Act 2006. The financial information for the

year ended 31 December 2018, prior to the restatement as a result

of the adoption of IFRS 16, is based on the statutory accounts for

the year ended 31 December 2018. The auditors reported on those

accounts: their report was unqualified, did not draw attention to

any matters by way of emphasis and did not contain a statement

under section 498 (2) or (3) of the Companies Act 2006.

After conducting a further review of the group's forecasts of

earnings and cash over the next twelve months and after making

appropriate enquiries as considered necessary, the directors have a

reasonable expectation that the company and group have adequate

resources to continue in operational existence for the foreseeable

future. Accordingly, they continue to adopt the going concern basis

in preparing the half yearly condensed financial statements.

Unaudited notes to the condensed interim financial

statements

For the 6 months ended 30 June 2019

Note 2 Segmental Reporting

Consolidated

for the

6 months

ended

Gold Pawnbroking Personal Other 30 June

2019 Pawnbroking purchasing Retail scrap Loans Services 2019

Revenue GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

External

revenue 21,790 8,752 18,511 6,040 11,620 3,286 69,999

___________ __________ _______ __________ ______ __________ ___________

Total revenue 21,790 8,752 18,511 6,040 11,620 3,286 69,999

Gross profit 21,790 1,495 5,432 447 11,620 3,286 44,070

Impairment (4,997) - - - (6,196) - (11,193)

Segment result 16,793 1,495 5,432 447 5,424 3,286 32,877

Other direct expenses excluding impairment (16,820)

Administrative expenses (7,384)

Operating profit before non-recurring

expenses 8,673

Non recurring expenses (500)

Operating profit 8,173

Investment revenue -

Finance costs (1,342)

Profit before taxation 6,831

Tax charge on profit (1,275)

Profit for the period and total comprehensive

income 5,556

Consolidated

for the

6 months

ended

Gold Pawnbroking Personal Other 30 June

2018 Pawnbroking purchasing Retail scrap Loans Services 2018

Revenue GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

External revenue 20,092 10,611 16,420 7,954 10,566 2,843 68,486

Total revenue 20,092 10,611 16,420 7,954 10,566 2,843 68,486

Gross profit 20,092 2,107 5,965 998 10,566 2,843 42,571

Impairment (3,910) - - - (7,443) - (11,353)

Segment result 16,182 2,107 5,965 998 3,123 2,843 31,218

Other direct expenses excluding impairment (16,387)

Administrative expenses (7,341)

Operating profit 7,490

Investment revenue 3

Finance costs (1,196)

Profit before taxation 6,297

Tax charge on profit (1,197)

Profit for the period and total comprehensive

income 5,100

Unaudited notes to the condensed interim financial statements

(continued)

For the 6 months ended 30 June 2019

Note 2 Segmental Reporting (continued)

For the

Personal Other year

Pawnbroking Gold Pawnbroking Loans Services ended 2018

2018 Restated* purchasing Retail scrap Restated* Restated* Restated*

Revenue GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

External

revenue 41,278 20,745 38,338 14,059 22,472 6,133 143,025

Total revenue 41,278 20,745 38,338 14,059 22,472 6,133 143,025

Gross profit 41,278 3,757 13,203 1,401 22,472 6,133 88,244

Impairment (10,366) - - - (15,515) - (25,881)

Segment result 30,912 3,757 13,203 1,401 6,957 6,133 62,363

Other direct expenses excluding

impairment (32,855)

Administrative expenses (13,272)

Operating profit 16,236

Investment revenue 3

Finance costs (2,468)

Profit before taxation 13,771

Tax charge on profit (2,818)

Profit for the financial year and

total comprehensive income 10,953

Note 3 Operating profit and EBITDA

The Board consider EBITDA to be a key performance measure as the

Group borrowing facility includes a number of loan covenants based

on it.

EBITDA is defined as Earnings Before Interest, Taxation,

Depreciation and Amortisation. It is calculated by adding back

depreciation and amortisation to the operating profit as

follows:

6 months ended 30 June 2019 6 months 6 months 12 months

Unaudited ended ended ended

30 June 30 June 31 December

2019 2018 2018

Restated* Restated*

Unaudited Unaudited Audited

Total Total Total

GBP'000 GBP'000 GBP'000

Operating profit 8,173 7,490 16,236

Depreciation and amortisation 1,116 1,232 2,483

Depreciation of right-of-use assets 2,004 2,092 4,188

EBITDA 11,293 10,814 22,907

See note 10 for impact of IFRS 16 ('leases').

Unaudited notes to the condensed interim financial statements

(continued)

For the 6 months ended 30 June 2019

Note 4 Borrowings

6 months 6 months 12 months

ended ended ended

30 June 30 June 31 December

2019 2018 2018

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Long term portion of bank loan 21,000 26,000 25,000

Unamortised issue costs (344) (169) (112)

--------- --------- ------------

Amount due for settlement after more

than one year 20,656 25,831 24,888

========= ========= ============

Note 5 Finance costs

6 months 6 months 12 months

ended ended ended

30 June 30 June 31 December

2019 2018 2018

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Interest payable on bank loans and overdraft 331 294 657

Other interest 1 1 1

Amortisation of debt issue costs 118 53 109

Interest on right-of-use assets 892 848 1,701

Total finance costs 1,342 1,196 2,468

Note 6 Tax on profit

The taxation charge for the 6 months ended 30 June 2019 has been

calculated by reference to the expected effective corporation tax

and deferred tax rates for the full financial year to end on 31

December 2019. The underlying effective full year tax charge is

estimated to be 19% (six months ended 30 June 2018: 19%).

Unaudited notes to the condensed interim financial statements

(continued)

For the 6 months ended 30 June 2019

Note 7 Earnings per share

Basic earnings per share is calculated by dividing the profit

for the period attributable to equity shareholders by the weighted

average number of ordinary shares in issue during the period.

For diluted earnings per share, the weighted average number of

ordinary shares in issue is adjusted to assume conversion of all

dilutive potential ordinary shares. With respect to the group these

represent share options granted to employees where the exercise

price is less than the average market price of the company's

ordinary shares during the period.

Reconciliations of the earnings per ordinary share and weighted

average number of shares used in the calculations are set out

below:

Unaudited Unaudited (Restated*) (Restated*)

6 months ended 30 6 months ended 30 12 months ended 31

June 2019 June 2018 December 2018

Earnings Weighted Per-share Earnings Weighted Per-share Earnings Weighted Per-share

GBP'000 average amount GBP'000 average amount GBP'000 average amount

number pence number pence number pence

of shares of shares of shares

Earnings

per share

-

basic 5,556 37,039,443 15.00 5,100 36,832,563 13.85 10,953 36,895,316 29.69

Effect of

dilutive

securities

Options - 70,999 (0.03) - 165,465 (0.07) - 126,277 (0.10)

Earnings

per share

diluted 5,556 37,110,442 14.97 5,100 36,998,028 13.78 10,953 37,021,593 29.59

Note 8 Share capital

At At At

30 June 2019 30 June 2018 31 December

2018

Unaudited Unaudited Audited

Allotted, called up and fully

paid

(Ordinary Shares of GBP0.05

each)

GBP'000 Sterling 1,891 1,883 1,883

Number 37,827,501 37,658,511 37,658,511

Note 9 Dividends

On 9 August 2019, the directors approved a 4.7 pence interim

dividend (30 June 2018: 4.4 pence) which equates to a dividend

payment of GBP1,866,000 (30 June 2018: GBP1,657,000), which

incorporates additional shares issued on 4 July 2019 (see note 11).

The dividend will be paid on 4 October 2019 to shareholders on the

share register at the close of business on 6 September 2019 and has

not been provided for in the 2019 interim results. The shares will

be marked ex-dividend on 5 September 2019.

On 2 May 2019, the shareholders approved the payment of a 6.6

pence final dividend for 2018 (2017: 6.4 pence) which equates to a

dividend payment of GBP2,450,000 (2018: GBP2,329,000). The dividend

was paid on 31 May 2019.

Unaudited notes to the condensed interim financial statements

(continued)

For the 6 months ended 30 June 2019

Note 10 Explanation of adoption of IFRS 16

The table below shows the impact of adopting IFRS 16 on each

financial statement line item affected.

Impact on profit or loss, other comprehensive As at As at As at

income and total comprehensive income 30 June 30 June 31 December

2019 2018 2018

Unaudited Unaudited Unaudited

GBP'000 GBP'000 GBP'000

Decrease in Operating expenses 3,052 3,135 6,126

Increase in Depreciation (2,004) (2,092) (4,189)

Increase in Finance costs (892) (848) (1,701)

Increase in Tax charged on profit (64) (71) (112)

----------- ----------- -----------

Increase in Profit for the year 92 124 124

Impact on assets, liabilities and As at As at As at As at

equity 31 December 30 June 30 June 31 December

2017 2019 2018 2018

Unaudited Unaudited Unaudited Unaudited

GBP'000 GBP'000 GBP'000 GBP'000

Increase in Right-of-use assets (NBV) 23,073 18,408 21,529 20,159

Increase in Deferred tax assets 675 574 641 608

Decrease in Trade and other receivables (1,389) (1,269) (1,324) (1,291)

Increase in Trade and other payables (25,656) (20,720) (23,983) (22,604)

Increase in Current tax liabilities - (74) (37) (45)

------------ ------------ ------------ -----------

Total reduction in net assets (3,297) (3,081) (3,174) (3,173)

Retained earnings (3,297) (3,081) (3,174) (3,173)

Note 11 Subsequent events

On 1 July 2019 the Group completed the acquisition of 65 trading

stores and 29 pledge books from the Money Shop, all of which have

been integrated into the Group, having previously acquired 17 books

for GBP0.4m in the period. To facilitate this acquisition, the

Group raised GBP6.0m of additional equity funding by way of an

accelerated bookbuild Placing. The total acquisition price was

GBP11.0m, which included taking possession of GBP6.0m of pledged

assets, GBP1.0m of cash, a freehold property and trading fixtures

and fittings, together with 241 employees.

The group incurred GBP0.5m of transaction related costs in the

form of legal and professional fees in respect of the acquisition

of assets from the Money Shop which have been expensed in full in

the period.

Movement in share capital as a result of the Placing Allotted,

called up

and fully

paid

(Ordinary

Shares of

GBP0.05 each)

At 30 June 2019 37,827,501

Shares issued (placing priced at GBP3.16 and issued

4 July 2019) 1,882,925

------------

At 4 July 2019 39,710,426

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR UUURRKNAWAUR

(END) Dow Jones Newswires

August 13, 2019 02:00 ET (06:00 GMT)

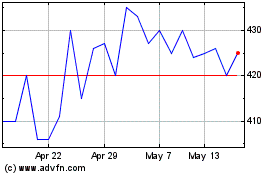

H&t (LSE:HAT)

Historical Stock Chart

From May 2024 to Jun 2024

H&t (LSE:HAT)

Historical Stock Chart

From Jun 2023 to Jun 2024