TIDMHAT

RNS Number : 4819H

H&T Group PLC

13 March 2018

Preliminary results

for the year ended 31 December 2017

H&T Group ("H&T" or the "Group") is pleased to announce

its preliminary results for the year ended

31 December 2017.

John Nichols, chief executive of H&T Group, said:

"This has been a milestone year for H&T. We have produced a

strong trading performance which is due in no small part to the

initiatives which we have implemented over the past few years. We

have sought to refine our core operations to ensure that they

produce the best possible results, while developing our credit and

online propositions. I am pleased that the impact of these efforts

is borne out in today's results.

"Personal loans and our est1897.co.uk online jewellery sales are

particular highlights, and there is significant scope to continue

to grow these aspects of the business. Over the past few years our

marketplace has changed dramatically. We have adapted to this new

environment, investing heavily in our staff, diversifying our

product suite, building out our online proposition and realigning

aspects of our business to reflect our customer base. We have also

reduced our exposure to gold price volatility. Challenges remain,

but we can look to the future with growing confidence."

Financial highlights (GBPm 2017 2016 Change

unless stated) %

Gross profit 63.8 57.1 11.7%

EBITDA 17.3 13.1 32.1%

Profit before tax 14.1 9.7 45.4%

Diluted EPS 30.94p 20.88p 48.2%

Dividend per share 10.5p 9.2p 14.1%

Key performance indicators 2017 2016 Change

%

Gross pledge book GBP46.1m GBP41.3m 11.6%

Redemption of annual lending

* 83.6% 84.3% (0.8%)

Retail gross profits GBP12.9m GBP11.2m 15.2%

Personal loan book GBP18.3m GBP9.4m 94.7%

Personal loan revenue less

impairment GBP5.7m GBP3.5m 62.9%

Number of stores 181 181 0%

* This is the actual percentage of lending in each year which

was redeemed or renewed, the 2017 figure is an estimate based on

recent trend and early performance.

Preliminary results

for the year ended 31 December 2017

Operational highlights:

-- Personal loans grew with the net loan book increasing 94.7% from GBP9.4m to GBP18.3m

-- Gross pledge book increased 11.6% to GBP46.1m (2016: GBP41.3m)

-- We increased both the concession format and lending on high-value watches for pawnbroking

-- The est1897.co.uk retail website has been significantly

improved and expanded to include more than 2,000 high-value

watches, now available to buy direct or via click-and-collect

-- We launched our lowest rate personal loan product in May 2017

Enquiries:

H&T Group plc

Tel: 020 8225 2797

John Nichols, Chief Executive

Steve Fenerty, Finance Director

Numis Securities (Broker and Nominated Adviser)

Tel: 020 7260 1000

Freddie Barnfield - Nominated Adviser

Mark Lander - Corporate Broking

Haggie Partners (Public Relations)

Tel: 020 7562 4444

Damian Beeley

Brian Norris

Chairman's statement

The Group has achieved growth in revenues from the core services

of pawnbroking, retail and personal loans. We have improved store

profitability and have also made progress in the development of our

online channel although there is still considerable work to do.

Our est1897.co.uk site for watches is a great example of how we

can successfully use the internet for retailing backed up by our

store network. The opportunity to build on this concept for our

core services is clear and will be a key part of our future

strategy.

These activities have repositioned the business within the wider

alternative credit market and allowed the Group to access a broader

customer base. The Board ensures that this growth is carefully

managed with a clear focus on the changing risks, both regulatory

and financial, that this diversification brings.

The growth in retail, FX and buyback also provide a degree of

resilience to changes in the marketplace

Financial Performance

The Group delivered profit after tax of GBP11.3m (2016: GBP7.6m)

and diluted earnings per share of 30.94 pence (2016: 20.88 pence).

Subject to shareholder approval, a final dividend of 6.2 pence per

ordinary share (2016: 5.3 pence) will be paid on 1 June 2018 to

those shareholders on the register at the close of business on 4

May 2018. This will bring the full year dividend to 10.5 pence per

ordinary share (2016: 9.2 pence).

The Group's financial position is strong with growth in the

combined personal loan and pawnbroking loan books (net) to GBP63.8m

(31 December 2016: GBP50.2m), as a result net debt increased to

GBP13.3m at 31 December 2017 (31 December 2016: GBP5.4m).

At year end the Group had available headroom of GBP8.0m on its

GBP30m borrowing facilities. I am pleased to report that in March

2018 the facility was increased by GBP5.0m.

Regulation

H&T is authorised and regulated by the Financial Conduct

Authority (FCA) for all consumer credit business. During the year

the FCA conducted a consultation on creditworthiness and is

expected to publish the results in 2018.

We engaged with the FCA through our trade associations and have

analysed the proposals contained within the consultation. The

consultation provides helpful guidance on effective

creditworthiness assessments and clarifies some of the specific

exemptions in relation to pawnbroking. Subject to the final policy

statement we do not expect it to have an adverse impact on our

business. We fully support the higher standards that the

consultation aims to deliver.

Strategy

We are developing our capabilities to address a changing market

where we see pressures both on the high street in general and the

core product of pawnbroking in particular. We are focussed on

maximising the potential from the core services while investing in

the development of new products and channels. This approach will

allow us to improve profitability in the short term; in the longer

term we can access a wider customer base and provide those

consumers with products appropriate to their needs.

We believe that our network of stores supports this development,

whether through click-and-collect from the est1897 website or by

providing a face-to-face underwriting decision for customers we

cannot serve with an online loan. This real-world presence

supported by an effective online and mobile proposition creates an

important distinction between H&T and a purely online

business.

In developing our personal loan product, we have a clear

objective to provide our customers with a route to lower interest

rate credit products as their relationship with H&T develops.

We believe that this progression is beneficial to the customer,

builds loyalty and meets the high standards required in this

regulated marketplace.

Prospects

The overall weakness in sterling following the EU referendum

result has continued to benefit the sterling gold price for much of

the year, this in turn provides an improvement in the Group's

profits while it continues. Demand for our services remains strong

and the development in our products and distribution enables us to

capture a larger share of the significant alternative credit

market.

Our thoughtful approach to growth reflects our intention to

provide our consumers with a service that maintains the highest

standards of affordability and seeks to avoid any consumer

detriment.

On behalf of the Board and our shareholders, I would like to

thank everyone at H&T for their hard work and dedication over

the past year.

Peter D McNamara

Chairman

Chief executive's review

INTRODUCTION

The Group has produced a strong trading performance and made

good progress in its strategic development. Our intention is to get

the best possible result from our core operations, develop a range

of additional credit products and expand the online channel. We

have delivered against all of those objectives in the past

year.

The Group delivered profit before tax of GBP14.1m (2016:

GBP9.7m) as a result of improved gross profits in the key segments

of pawnbroking, retail and personal loans.

THE MARKET

Our marketplace has undergone significant changes in the past

four years, experiencing peak competition, a falling gold price and

new regulation causing a number of our competitors to restructure

their businesses or exit the market. In comparison, during 2017 we

experienced far more stability allowing us to focus on developing

our proposition.

OUR STRATEGY

Our Vision: "H&T will be the premier provider of alternative

credit in the UK through a range of services that help our

customers rebuild their credit rating and return to the

mainstream."

The Group's strategy is to serve a customer base whose access to

mainstream credit is limited and for whom small-sum loans can help

to address short-term financial challenges. The Group will continue

to deliver this strategy by developing a range of lending products,

both secured and unsecured, offered in store and online. In

expanding our credit products we aim to genuinely help our

customers and have updated our vision statement to reinforce that

vital message within the business.

The development of a diversified suite of services including

retail, buyback and FX, improves returns and reduces the Group's

exposure to gold price volatility.

We continue to innovate and explore how to interact most

effectively with our customers through the development of

introducer channels, our online capability and our brand. This

development is supported by our stores that provides our online

customer with the opportunity to speak to a trained member of staff

face to face or to collect an item that they reserved online.

REVIEW OF OPERATIONS

Pawnbroking

Gross profits from pawnbroking increased 4.5% to GBP29.7m (2016:

GBP28.4m) and the gross pledge book increased 11.6% to GBP46.1m (31

December 2016: GBP41.3m) as a result of the higher gold price, the

concession format and an increase in loans on quality watches.

The risk-adjusted margin (Revenue as a percentage of the average

net pledge book) was 68.3% (2016: 72.5%). The reduction in

risk-adjusted margin is a result of the changing business mix to

higher value, lower interest rate loans. Redemption of annual

lending was marginally lower at an estimated 83.6% for lending in

2017 (2016 actual: 84.3%).

The pawnbroking segment remains challenging with limited real

growth in like-for-like stores. There is short-term opportunity as

a result of the relatively higher gold price and in the medium term

through further expansion in our concession format and lending on

high-end products.

The Group has benefitted from the expertise provided by the

Expert Eye service. This allows high quality images of assets in

store to be assessed by our team of experts which in turn improves

both the quality of decisions made and extends the range of assets

on which we can lend. This has assisted the development of watch

and diamond lending during the year.

The Group is investing in software to assist the management of

customer enquiries in respect of pawnbroking as well as the

acquisition of new partners to introduce customers to the business.

This investment will allow an expansion to the broker and online

channels in respect of pawnbroking during 2018.

Pawnbroking summary:

2017 2016 Change

GBP'000 GBP'000 %

--------------- --------- --------- --------

Year-end net

pledge book 45,549 40,806 11.6%

Average net

pledge book 43,414 39,155 10.9%

Revenue 29,670 28,384 4.5%

Risk-adjusted

margin(1) 68.3% 72.5%

Notes to table

1 - Revenue as a percentage of the average net pledge book

Retail

Retail sales increased 16% to GBP35.4m (2016: GBP30.5m), gross

profits to GBP12.9m (2016: GBP11.2m) and margin reduced to 36.3%

(2016: 36.8%).

The Group has invested in store inventories with average monthly

balances being 12% higher during 2017 than 2016. This coupled with

control over targeted discounts has resulted in the significant

improvements in gross profits despite margin pressure as a result

of increased cost of goods reflecting the higher rates on both

lending and purchasing activities.

The development of new-jewellery sales has been particularly

encouraging with sales increasing by 62% and gross profits of

GBP1.3m (2016: GBP0.9m) as we identify key segments and lines to

supplement our pre-owned offering.

The est1897 website has been enhanced during the year with

improved templates, photography and the number of items on the

site. There are now more than 2000 high-quality watches online

together with a range of high-quality jewellery. This enables us to

present store inventories to a far wider audience and equally,

through the use of tablets, we can present a far wider range of

choice to in-store customers. While in the early stages of

development we are encouraged by the results to date with almost

GBP1m in sales originating on the website being completed during

2017 (2016: GBP0.1m).

We intend to enhance the website further during 2018 with

greater integration with in-store systems, additional products

online and improved functionality for the user.

Personal Loans

The net personal loans book has increased by 94.7% to GBP18.3m

(31 December 2016: GBP9.4m). The Board considers revenue less

impairment to be an important measure of the performance of

personal loans as it represents the net profit derived directly

from our lending activities. Revenue less impairment has increased

to GBP5.7m (2016: GBP3.5m) as a result of increased customer

numbers and the expansion in our longer term, lower interest rate

loan product.

The reduction in the risk-adjusted margin (RAM) to 44.9% (2016:

55.1%) is the result of the increased proportion of new customers,

expansion in online and the introduction of our lower APR products.

Impairment as a percentage of the average monthly net loan book has

improved to 33.3% (2016: 37.0%) reflecting the increased mix of

lower yield, higher quality loans. This is in line with management

expectations for credit quality and collections performance.

In line with the strategy of providing larger loans over longer

terms at a lower interest rate we launched our 49.9% APR product in

May 2017. This product is designed to provide a "near prime" option

for our best customers.

The group now has three distinct products offered both in store

and online:

-- >100% APR loans falling into the high-cost short-term

credit (HCSTC) definition of the FCA. These loans are intended as

the starting point of the customer journey with H&T and

represent the highest volume of loans written as they tend to be

lower value and shorter term. At 31 December 2017 this segment

represented approximately 50% of the personal loan book.

-- <100% APR loans which are generally provided to customers

who have established a track record of repayment with H&T. At

31 December 2017 this segment represented approximately 46% of the

personal loan book.

-- <50% APR loans which are intended to be the final step of

the journey for our customers as they rebuild their credit rating.

At 31 December 2017 this segment represented approximately 4% of

the personal loan book.

As a result of these initiatives half of the personal loans loan

book is now non-HCSTC.

The expansion in other channels of business continues, the net

online loan book doubled in the year to GBP1.4m and remains a key

opportunity for the Group. The broker to store channel is also

beginning to show positive results as we enhance our customer

relationship management systems.

The focus for the Group is to build these alternative sources

for customers, work is underway to reduce the costs of acquisition

and processing whilst improving performance.

Personal Loans summary:

2017 2016 Change

GBP'000 GBP'000 %

----------------------------------------------- --------- --------------- -------

Year-end net loan book 18,256 9,356 95.1%

Average monthly net loan book 12,795 6,348 101.6%

Revenue 10,012 5,849 71.2%

Impairment (4,271) (2,351) 81.7%

Revenue less impairment 5,741 3,498 64.1%

Interest yield(1) 78.3% 92.1%

Impairment % of Revenue 42.7% 40.2%

Impairment % of Average monthly net loan book 33.3% 37.0%

Risk-adjusted margin(2) 44.9% 55.1%

Notes to table

1 - Revenue as a percentage of average loan book

2 - Revenue less impairment as a percentage of average loan

book

Pawnbroking scrap

Gross profits reduced to GBP1.9m (2016: GBP2.1m). The result in

2016 was enhanced as a result of the rapid increase in the sterling

gold price following the EU referendum result.

The average gold price during 2017 was GBP976 per troy ounce

(2016: GBP926), a 5.4% increase. The gold price directly impacts

the revenue received on the sales of scrapped gold.

Gold purchasing

Gross profits reduced to GBP3.4m (2016: GBP3.9m) despite a

higher volume of gold scrapped in the year.

H&T purchases gold to achieve a particular margin and it

takes around two months to process items directly to scrap. If the

gold price increases during this processing period then our margins

are enhanced, if it reduces then our margins are compressed.

During 2016, the gold price increased by 29% from January to

December, whereas during the same period in 2017 it fell by 2.2%.

Accordingly, our margins were considerably lower in 2017 vs

2016.

We estimate that the weight of fine gold purchased in 2017

increased by approximately 2.1% from 2016 to 2017.

Other services

Other services principally comprises FX, buyback, cheque cashing

and Western Union. Gross profits from this segment increased by

GBP0.3m to GBP5.9m (2016: GBP5.6m), as growth in FX and buyback was

partially offset by declines in Western Union and cheque

cashing.

The key growth components of FX and buyback improved in the year

with gross profits from FX increasing to GBP2.9m (2016: GBP2.7m)

and buyback increasing to GBP1.8m (2016: GBP1.6m).

FX is a simple transactional product which attracts a new

customer base to the business. Improvements to currency holdings in

store, point of sale materials and the expansion of click and

collect will enhance this product in the future.

Buyback enables the Group to service a customer base who may not

have appropriate assets for a pawnbroking loan. The principal

assets purchased are mobile phones, tablets and games consoles. We

have invested in system development to support the valuation and

testing of the items in store. Further work will be completed in

2018 to fully integrate those systems and support the

clicks-to-bricks customer journey.

PROSPECTS

The Group has enhanced its ability to serve a wider customer

base, both in store and online, with growth in its well-established

core products and the newer unsecured lending offering. This

diversified approach to growth reduces the risks inherent in any

individual objective and positions the Group to capture share in

this exciting market. Current trading for 2018 is in line with

management expectations.

I would also like to add my great thanks to those of the

Chairman, in recognising all of our people whose skills, commitment

and enthusiasm continue to drive our success, and who give us

confidence in the future.

John G Nichols

Chief Executive

Finance Director's Review

FINANCIAL RESULTS

For the year ended 31 December 2017 gross profit increased 11.7%

from GBP57.1m to GBP63.8m driven by growth in the core segments of

pawnbroking, retail and personal loans.

Total direct and administrative expenses increased by 4.7% from

GBP46.9m to GBP49.1m, principally as a result of investment in

staff to support business volumes in Personal Loans and new

initiatives. The Board considers the continued investment in people

and systems to be vital in repositioning the business to take

advantage of the market conditions.

Finance costs increased 20% to GBP0.6m (2016: GBP0.5m),

reflecting the higher utilisation of the facility during 2017

following expansion in the pawnbroking and personal loan books.

Profit before tax increased by GBP4.4m to GBP14.1m, up 45.4%

from GBP9.7m in 2016.

CASH FLOW

The growth in profit for the year resulted in an increase in

operating cash flows before movements in working capital of 26.5%

to GBP17.2m (2016: GBP13.6m).

The Group accelerated the growth both in personal loans and

pawnbroking during 2017 resulting in an increase in receivables of

GBP14.2m in the year (2016: GBP8.2m). This growth, partially offset

by increased profits, is the principal reason the Group produced a

cash outflow from operating activities of GBP2.4m (2016: inflow of

GBP1.3m).

BALANCE SHEET

As at 31 December 2017, the Group had net assets of GBP107.6m

(2016: GBP98.8m) with year-end net debt of GBP13.3m (2016: GBP5.4m)

delivering an increase in gearing to 12.4% (2016: 5.5%).

On 1 March 2018, the Group extended the existing facility with

Lloyds Bank plc by GBP5m allowing for maximum borrowings of

GBP35.0m, subject to covenants, at a margin of between 1.75% and

2.75% above LIBOR. At year end GBP22.0m was drawn on the facility

and the Group was well within the covenants with a net debt to

EBITDA ratio of 0.76x and an EBITDA to interest ratio of 37.15. The

facility has a termination date of 30 April 2020.

The combination of low gearing and a secure long-term credit

facility provides the Group with the ability to make selective

investments in the future while maintaining appropriate

headroom.

INVESTMENTS AND DISPOSALS

The Group acquired two pawnbroking loan books for GBP0.1m, there

have been no disposals of stores or loan books during the year.

IMPAIRMENT REVIEW

The Group performs an annual review of the expected earnings of

each acquired store and considers whether the associated goodwill

and other property, plant and equipment are impaired. There was no

impairment charge during 2017 (2016: GBPnil/none).

SHARE PRICE AND EPS

At 31 December 2017, the share price was 335p (2016: 259.75p)

and market capitalisation was GBP124.6m (2016: GBP95.5m). Basic

earnings per share were 31.07p (2016: 20.94p), diluted earnings per

share were 30.94p (2016: 20.88p).

Stephen A Fenerty

Finance Director

Group statement of comprehensive income

For the year ended 31 December 2017

2017 2016

GBP'000 (Restated*)

Continuing operations: Note GBP'000

Revenue 2 110,333 96,573

Cost of sales (46,567) (39,453)

Gross profit 2 63,766 57,120

Impairment (4,271) (2,351)

Other direct expenses excluding

impairment (32,593) (32,246)

Administrative expenses (12,233) (12,325)

Operating profit 14,669 10,198

Investment revenues - 1

Finance costs 3 (567) (479)

Profit before taxation 14,102 9,720

Tax charge on profit 4 (2,766) (2,138)

Profit for the financial year

and total comprehensive income 11,336 7,582

Earnings per share 2017 2016

Pence Pence

Basic 5 31.07 20.94

Diluted 5 30.94 20.88

(*) see note 1 Revenue Recognition

Group statement of changes in equity

For the year ended 31 December 2017

Employee

Benefit

Share Trust

Share premium shares Retained

capital account reserve earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January 2016 1,843 25,409 (35) 66,843 94,060

Profit for the financial

year - - - 7,582 7,582

Total income for

the financial year - - - 7,582 7,582

Issue of share capital 9 345 - - 354

Share option movement - - - (40) (40)

Dividends paid - - - (3,109) (3,109)

At 31 December 2016 1,852 25,754 (35) 71,276 98,847

At 1 January 2017 1,852 25,754 (35) 71,276 98,847

Profit for the financial

year - - - 11,336 11,336

Total income for

the financial year - - - 11,336 11,336

Issue of share capital 20 887 - - 907

Share option movement - - - 96 96

Dividends paid - - - (3,564) (3,564)

At 31 December 2017 1,872 26,641 (35) 79,144 107,622

Group balance sheet

As at 31 December 2017

31 December 31 December

2017 2016

GBP'000 GBP'000

Non-current assets

Goodwill 17,643 17,676

Other intangible assets 331 527

Property, plant and

equipment 6,381 6,874

Deferred tax assets 861 682

25,216 25,759

Current assets

Inventories 34,102 29,792

Trade and other receivables 73,277 59,058

Other current assets 665 848

Cash and cash equivalents 8,676 9,608

116,720 99,306

Total assets 141,936 125,065

Current liabilities

Trade and other payables (9,731) (8,887)

Current tax liabilities (1,460) (1,119)

(11,191) (10,006)

Net current assets 105,529 89,300

Non-current liabilities

Borrowings (21,810) (14,715)

Provisions (1,313) (1,497)

(23,123) (16,212)

Total liabilities (34,314) (26,218)

Net assets 107,622 98,847

Equity

Share capital 1,872 1,852

Share premium account 26,641 25,754

Employee Benefit Trust

shares reserve (35) (35)

Retained earnings 79,144 71,276

Total equity attributable

to equity holders 107,622 98,847

Group cash flow statement

For the year ended 31 December 2017

2017 2016

Note GBP'000 GBP'000

Net cash (used in) / generated

from operating activities 6 (3,493) 1,315

Investing activities

Interest received - 1

Proceeds on disposal of property,

plant and equipment 7 66

Proceeds on disposal of trade

and assets of businesses - 82

Purchases of property, plant

and equipment (1,768) (1,918)

Acquisition of trade and assets

of businesses (21) (106)

Net cash used in investing

activities (1,782) (1,875)

Financing activities

Dividends paid (3,564) (3,109)

Increase in borrowings 7,000 2,000

Issue of shares 907 354

Net cash generated from /

(used in) financing activities 4,343 (755)

Net decrease in cash and cash

equivalents (932) (1,315)

Cash and cash equivalents

at beginning of the year 9,608 10,923

Cash and cash equivalents

at end of the year 8,676 9,608

Notes to the preliminary announcement

For the year ended 31 December 2017

1. Finance information and basis of preparation

The financial information has been abridged from the audited

financial statements for the year ended 31 December 2017.

The financial information set out above does not constitute the

company's statutory accounts for the years ended 31 December 2017

or 2016, but is derived from those accounts. Statutory accounts for

2016 have been delivered to the Registrar of Companies and those

for 2017 will be filed with the Registrar in due course. The

auditors have reported on those accounts: their reports were

unqualified, did not draw attention to any matters by way of

emphasis and did not contain statements under s498 (2) or (3)

Companies Act 2006 or equivalent preceding legislation.

Whilst the financial information included in this preliminary

announcement has been prepared in accordance with International

Financial Reporting Standards (as adopted for use in the EU)

('IFRS'), this announcement does not itself contain sufficient

information to comply with IFRS. The Group will be publishing full

financial statements that comply with IFRS in April 2018.

Revenue recognition

Revenue is measured at the fair value of the consideration

received or receivable and represents amounts receivable for goods

and services and interest income provided in the normal course of

business, net of discounts, VAT and other sales-related taxes.

Revenue is recognised to the extent that it is probable that the

economic benefits will flow to the Group and the revenue can be

reliably measured. The following specific recognition criteria must

also be met before revenue is recognised:

-- Pawnbroking, or Pawn Service Charge (PSC), comprises interest

on pledge book loans, plus auction profit and loss, less any

auction commissions payable and less surplus payable to the

customer. Interest receivable on loans is recognised as interest

accrues by reference to the principal outstanding and the effective

interest rate applicable, which is the rate that discounts the

estimated future cash receipts through the expected life of the

financial asset to that asset's net carrying amount;

-- Retail comprises revenue from retail jewellery sales, with

inventory sourced from unredeemed pawn loans, newly purchased

inventory and inventory refurbished from the Group's gold

purchasing operation. All revenue is recognised at the point of

sale;

-- Pawnbroking scrap and Gold Purchasing comprises proceeds from

gold scrap sales and is recognised on full receipt of sale

proceeds;

-- Personal loans comprises income from the Company unsecured

lending activities. Personal loan revenues have historically been

recognised net of related impairment charges. In light of the

growth of the personal loans segment the Group has changed the

personal loan revenue recognition policy to better reflect the

underlying nature and substance of such revenues. From 1 January

2017 onwards, revenue has been stated before impairment, with any

impairment charge shown on a separate line in the Group statement

of comprehensive income. 2016 revenue, gross profit and other

direct expenses have been restated. The revenue and other direct

expenses as previously stated have been increased by GBP2,351,000.

There have been no changes to previously reported operating profit,

profit before tax, profit after tax, earnings per share; nor any

change to the Group balance sheet or the Group cash flow statement;

and

Notes to the preliminary announcement (continued)

For the year ended 31 December 2017

1. Finance information and basis of preparation (continued)

Revenue recognition (continued)

-- Other services comprise revenues from third party cheque

cashing, foreign exchange income, buyback and other income. The

commission receivable on cheque cashing is recognised at the time

of the transaction. Buyback revenue is recognised at the point of

sale of the item back to the customer. Foreign exchange income

represents the margin when selling or buying foreign currencies and

is recognised at the point of sale. Any other revenues are

recognised on an accruals basis.

The Group recognises interest income arising on secured and

unsecured lending within trading revenue rather than investment

revenue on the basis that this represents most accurately the

business activities of the Group.

Inventories provisioning

Where necessary provision is made for obsolete, slow moving and

damaged inventory or inventory shrinkage. The provision for

obsolete, slow moving and damaged inventory represents the

difference between the cost of the inventory and its market value.

The inventory shrinkage provision is based on an estimate of the

inventory missing at the reporting date using historical shrinkage

experience.

Impairment of goodwill and other intangibles

Determining whether goodwill is impaired requires an estimation

of the value in use of the cash-generating units to which goodwill

has been allocated. The value in use calculation requires the Group

to estimate the future cash flows expected to arise from the

cash-generating unit and a suitable discount rate in order to

calculate present value. The review is conducted annually, in the

final quarter of the year. The impairment review is conducted at

the level of each cash generating unit, which for acquisitions

represents the specific store or stores acquired.

There was no impairment loss recorded in the current year (2016:

GBPnil). The principal assumptions applied by management in

arriving at the value in use of each cash generating unit are as

follows:

The Group prepares cash flow forecasts over a five-year period

for each cash generating unit. Forecast EBITDA (used as a proxy for

cashflows) has been derived by applying the Board approved base

budget assumption to each individual stores' results for the twelve

months to September 2017. For impairment review purposes, we have

used conservative growth assumptions after 2018, even in this

scenario there is still significant headroom on each CGU. A

perpetuity formula has been applied to the cashflows i.e. we have

made the assumption that periodic cashflows will be received

indefinitely. The Group has discounted the cash flows at a pre-tax,

risk adjusted rate of 12% (2016: 9%).

While the impairment review has been conducted based on the best

available estimates at the impairment review date, the Group notes

that actual events may vary from management expectation.

Notes to the preliminary announcement (continued)

For the year ended 31 December 2017

2. Operating segments

Business segments

For reporting purposes, the Group is currently organised into

six segments - pawnbroking, gold purchasing, retail, pawnbroking

scrap, personal loans and other services.

The principal activities by segment are as follows:

Pawnbroking:

Pawnbroking is a loan secured against a collateral (the pledge).

In the case of the Group, over 99% of the collateral against which

amounts are lent comprises precious metals (predominantly gold),

diamonds and watches. The pawnbroking contract is a six-month

credit agreement bearing a monthly interest rate of between 1.99%

and 10.00%. The contract is governed by the terms of the Consumer

Credit Act 2008 (previously the Consumer Credit Act 2002). If the

customer does not redeem the goods by repaying the secured loan

before the end of the contract, the Group is required to dispose of

the goods either through public auctions if the value of the pledge

is over GBP75 (disposal proceeds being reported in this segment)

or, if the value of the pledge is GBP75 or under, through public

auctions or the Retail or Pawnbroking Scrap activities of the

Group.

Purchasing:

Jewellery is bought direct from customers through all of the

Group's stores. The transaction is simple with the store agreeing a

price with the customer and purchasing the goods for cash on the

spot. Gold purchasing revenues comprise proceeds from scrap sales

on goods sourced from the Group's purchasing operations.

Retail:

The Group's retail proposition is primarily gold and jewellery

and the majority of the retail sales are forfeited items from the

pawnbroking pledge book or refurbished items from the Group's gold

purchasing operations. The retail offering is complemented with a

small amount of new or second-hand jewellery purchased from third

parties by the Group.

Pawnbroking scrap:

Pawnbroking scrap comprises all other proceeds from gold scrap

sales other than those reported within Gold Purchasing. The items

are either damaged beyond repair, are slow moving or surplus to the

Group's requirements, and are smelted and sold at the current gold

spot price less a small commission.

Personal loans:

Personal loans comprises income from the Company unsecured

lending activities. Personal loan revenues have historically been

recognised net of related impairment charges. In light of the

growth of the personal loans segment the Group has opted to change

the personal loan revenue recognition policy to better reflect the

underlying nature and substance of such revenues. From 1 January

2017 onwards, revenue has been stated before impairment, with any

impairment charge included within other direct expenses in the

group statement of comprehensive income. 2016 revenue, gross profit

and other direct expenses have been restated accordingly. There

have been no changes to previously reported operating profit,

profit before tax, profit after tax, earnings per share; nor any

change to the group balance sheet or group cash flow statement.

Notes to the preliminary announcement (continued)

For the year ended 31 December 2017

2. Operating segments (continued)

Other Services:

This segment comprises:

-- Third party cheque encashment which is the provision of cash

in exchange for a cheque payable to our customer for a commission

fee based on the face value of the cheque.

-- Buyback which is a service where items are purchased from

customers, typically high-end electronics, and may be bought back

up to 31 days later for a fee.

-- The foreign exchange currency service where the Group earns a

margin when selling or buying foreign currencies.

-- Western Union commission earned on the Group's money transfer service.

Cheque cashing is subject to bad debt risk which is reflected in

the commissions and fees applied.

Further details on each activity are included in the chief

executive's review.

Segment information about these businesses is presented

below:

For the

year

Gold Pawnbroking Personal Other ended

2017 Pawnbroking purchasing Retail scrap loans services 2017

Revenue GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

External

revenue 29,670 17,651 35,407 11,696 10,012 5,897 110,333

Total revenue 29,670 17,651 35,407 11,696 10,012 5,897 110,333

Gross profit 29,670 3,397 12,859 1,931 10,012 5,897 63,766

Impairment - - - - (4,271) - (4,271)

Segment result 29,670 3,397 12,859 1,931 5,741 5,897 59,495

Other direct expenses excluding

impairment (32,593)

Administrative expenses (12,233)

Operating profit 14,669

Finance costs (567)

Profit before taxation 14,102

Tax charge on profit (2,766)

Profit for the financial

year and total comprehensive

income 11,336

Notes to the preliminary announcement (continued)

For the year ended 31 December 2017

2. Operating segments (continued)

For the

Personal year

ended

Gold loans Other 2016

Pawnbroking

2016 Pawnbroking purchasing Retail scrap (Restated*) services (Restated*)

Revenue GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

External

revenue 28,384 15,021 30,549 11,136 5,849 5,634 96,573

Total revenue 28,384 15,021 30,549 11,136 5,849 5,634 96,573

Gross profit 28,384 3,941 11,228 2,084 5,849 5,634 57,120

Impairment - - - - (2,351) - (2,351)

Segment result 28,384 3,941 11,228 2,084 3,498 5,634 54,769

Other direct expenses excluding

impairment (32,246)

Administrative expenses (12,325)

Operating profit 10,198

Investment revenues 1

Finance costs (479)

Profit before taxation 9,720

Tax charge on profit (2,138)

Profit for the financial

year and total comprehensive

income 7,582

As disclosed in note 2, gross profit is stated after charging

the direct costs of inventory items sold or scrapped in the period.

Other operating expenses of the stores are included in other direct

expenses. The Group is unable to meaningfully allocate the other

direct expenses of operating the stores between segments as the

activities are conducted from the same stores, utilising the same

assets and staff. The Group is also unable to meaningfully allocate

Group administrative expenses, or financing costs or income between

the segments. Accordingly, the Group is unable to meaningfully

disclose an allocation of items included in the consolidated

statement of comprehensive income below gross profit, which

represents the reported segment results.

The Group does not apply any inter-segment charges when items

are transferred between the pawnbroking activity and the retail or

pawnbroking scrap activities.

Notes to the preliminary announcement (continued)

For the year ended 31 December 2017

2. Operating segments (continued)

Unallocated For the

Pawn-broking Gold Pawn-broking Personal Other assets/ year

GBP'000 purchasing Retail scrap loans services (liabilities) ended

2017 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Other information

Capital

additions

(*) 1,980 1,980

Depreciation

and

amortisation

(*) 2,628 2,628

Balance sheet

Assets

Segment

assets 52,924 1,658 31,858 1,251 18,256 - 105,947

Unallocated

corporate

assets 31,381 31,381

Consolidated

total assets 141,936

Liabilities

Segment

liabilities - - (650) - - (100) (750)

Unallocated

corporate

liabilities (33,564) (33,564)

Consolidated

total

liabilities (34,314)

Unallocated For the

Pawn-broking Gold Pawn-broking Personal Other assets/ year

GBP'000 purchasing Retail scrap loans services (liabilities) ended

2016 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Other information

Capital

additions

(*) 1,768 1,768

Depreciation

and

amortisation

(*) 2,940 2,940

Balance sheet

Assets

Segment

assets 47,301 1,005 29,066 570 9,375 - 87,317

Unallocated

corporate

assets 33,040 33,040

Consolidated

total assets 125,065

Liabilities

Segment

liabilities - - (649) - - (260) (909)

Unallocated

corporate

liabilities (25,309) (25,309)

Consolidated

total

liabilities (26,218)

(*) The Group cannot meaningfully allocate this information by

segment due to the fact that all the

segments operate from the same stores and the assets in use are

common to all segments.

Notes to the preliminary announcement (continued)

For the year ended 31 December 2017

2. Operating segments (continued)

Geographical segments

The Group's revenue from external customers by geographical

location are detailed below:

2017 2016

GBP'000 GBP'000

United Kingdom 109,128 95,837

Other 1,205 736

110,333 96,573

The Group's non-current assets are located entirely in the

United Kingdom. Accordingly, no further geographical segments

analysis is presented.

3. Finance costs

2017 2016

GBP'000 GBP'000

Interest on bank loans 472 348

Other interest 1 1

Amortisation of debt

issue costs 94 130

Total interest expense 567 479

Notes to the preliminary announcement (continued)

For the year ended 31 December 2017

4. Tax charge on profit

(a) Tax on profit on ordinary activities

2017 2016

Current tax GBP'000 GBP'000

United Kingdom corporation tax charge

at 19.25% (2016: 20%)

based on the profit for the year 2,742 2,143

Adjustments in respect of prior

years 181 191

Total current tax 2,923 2,334

Deferred tax

Timing differences, origination

and reversal (156) (278)

Adjustments in respect of prior

years (1) 12

Effects of change in tax rate - 70

Total deferred tax (157) (196)

Tax charge on profit 2,766 2,138

(b) Factors affecting the tax charge for the year

The tax assessed for the year is higher than that resulting from

applying a blended standard rate of corporation tax in the UK of

19.25% (2016: 20%). The differences are explained below:

2017 2016

GBP'000 GBP'000

Profit before taxation 14,102 9,720

Tax charge on profit at standard

rate 2,716 1,944

Effects of:

Disallowed expenses and non-taxable

income (130) (29)

Effect of change in tax rate - 70

Movement in short-term timing differences - (50)

Adjustments to tax charge in respect

of previous periods 180 203

Tax charge on profit 2,766 2,138

In addition to the amount charged to the income statement and in

accordance with IAS 12, the excess of current and deferred tax over

and above the relative related cumulative remuneration expense

under IFRS 2 has been recognised directly in equity. This amounted

released from equity in the current period of GBP96,000 (2016:

charge of GBP56,000).

Notes to the preliminary announcement (continued)

For the year ended 31 December 2017

5. Earnings Per Share

Basic earnings per share is calculated by dividing the profit

for the year attributable to equity shareholders by the weighted

average number of ordinary shares in issue during the year.

For diluted earnings per share, the weighted average number of

ordinary shares in issue is adjusted to assume conversion of all

dilutive potential ordinary shares. With respect to the Group these

represent share options and conditional shares granted to employees

where the exercise price is less than the average market price of

the Company's ordinary shares during the year.

Reconciliations of the earnings per ordinary share and weighted

average number of shares used in the calculations are set out

below:

Year ended 31 Year ended 31

December 2017 December 2016

Earnings Weighted Per-share Earnings Weighted Per-share

GBP'000 average amount GBP'000 average amount

number pence number pence

of shares of shares

Earnings per share:

basic 11,336 36,479,426 31.07 7,582 36,212,688 20.94

Effect of dilutive

securities

Options and conditional

shares - 155,374 (0.13) - 101,947 (0.06)

Earnings per share:

diluted 11,336 36,634,800 30.94 7,582 36,314,635 20.88

Notes to the preliminary announcement (continued)

For the year ended 31 December 2017

6. Notes to the Cash Flow Statement

2017 2016

GBP'000 GBP'000

Profit for the financial year 11,336 7,582

Adjustments for:

Investment revenues - (1)

Finance costs 567 479

Movement in provisions (184) 192

Tax expense - Group Statement of

Comprehensive Income 2,766 2,138

Depreciation of property, plant and

equipment 2,429 2,686

Amortisation of intangible assets 200 256

Share-based payment expense - 16

Loss on disposal of property, plant

and equipment 68 265

Operating cash flows before movements

in working capital 17,182 13,613

Increase in inventories (4,311) (4,991)

Increase/(decrease) in other current

assets 184 (202)

Increase in receivables (14,202) (8,156)

Increase in payables 618 3,585

Cash (used in) / generated from operations (529) 3,849

Income taxes paid (2,508) (1,860)

Debt restructuring costs - (325)

Interest paid (456) (349)

Net cash (used in) / generated from

operating activities (3,493) 1,315

Cash and cash equivalents (which are presented as a single class

of assets on the face of the balance sheet) comprise cash at bank

and other short-term highly liquid investments with a maturity of

three months or less.

Notes to the preliminary announcement (continued)

For the year ended 31 December 2017

7. Earnings before interest, tax, depreciation and amortisation ("EBITDA")

EBITDA

EBITDA is defined as earnings before interest, taxation,

depreciation and amortisation. It is calculated by adding back

depreciation and amortisation to the operating profit as

follows:

2017 2016

GBP'000 GBP'000

Operating profit 14,669 10,198

Depreciation

and amortisation 2,628 2,942

EBITDA 17,297 13,140

The Board consider EBITDA to be a key performance measure as the

Group borrowing facility includes a number of loan covenants based

on it.

8. Events after the balance sheet date

The directors have proposed a final dividend for the year ended

31 December 2017 of 6.2p (2016: 5.3p).

9. IFRS 9 Financial instruments

The Group will apply IFRS 9 from 1 January 2018. The Group plans

to restate comparatives on initial application of IFRS 9. The full

impact of adopting IFRS 9 on the Group's consolidated financial

statements will depend on the financial instruments that the Group

has during 2018 as well as on economic conditions and judgements

made as at the year end. The Group has performed an assessment of

potential impact of adopting IFRS 9 based on the financial

instruments as at the date of initial application of IFRS 9 (1

January 2018).

Classification and measurement

With respect to the classification and measurement of financial

assets, the number of categories of financial assets under IFRS 9

has been reduced compared to IAS 39. Under IFRS 9 the

classification of financial assets is based both on the business

model within which the asset is held and the contractual cash flow

characteristics of the asset.

There will be no impact on the classification and measurement of

the personal loans or pawnbroking trade receivables, both are

measured on amortised cost.

There will be no change in the accounting for any financial

liabilities.

9. IFRS 9 Financial instruments (continued)

Impairment

The impairment model under IFRS 9 reflects expected credit

losses, as opposed to only incurred credit losses under IAS 39.

Under the impairment approach in IFRS 9, it is not necessary for a

credit event to have occurred before credit losses are recognised.

Instead, an entity always accounts for expected credit losses and

changes in those expected credit losses. The amount of expected

credit losses should be updated at each reporting date. Under IFRS

9 there will be a material increase in both revenue and impairment

for Pawnbroking and Personal Loans.

In respect of the personal loan receivable the Group expects to

recognise a loss allowance for 12-month expected credit losses

where the loan is not in arrears, as the loan falls into arrears

the loss allowance will be based on the lifetime expected credit

losses as there has been a significant increase in credit risk. The

Group's estimate of the loss allowance for these assets as at 1

January 2018 is GBP2.6m greater compared to IAS 39.

In respect of the pawnbroking loan receivable the short-term

nature of the agreement results in 12-month expected credit losses

being the same as lifetime expected credit losses. The Group's

estimate of the loss allowance for these assets as at 1 January

2018 is GBP5.2m greater compared to IAS 39.

At the date of initial application of IFRS 9, the estimated

impact is a decrease in receivables as at 1 January 2018 of GBP7.8m

which, net of deferred tax, results in a reduction in net assets of

GBP6.3m.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR FKBDBFBKDNND

(END) Dow Jones Newswires

March 13, 2018 03:00 ET (07:00 GMT)

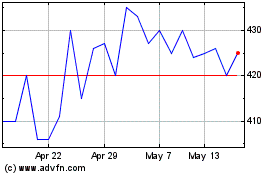

H&t (LSE:HAT)

Historical Stock Chart

From May 2024 to Jun 2024

H&t (LSE:HAT)

Historical Stock Chart

From Jun 2023 to Jun 2024