TIDMCRU

RNS Number : 8323H

Coral Products PLC

08 December 2020

CORAL PRODUCTS PLC

("Coral" or the "Group")

HALF YEARLY REPORT

Coral Products plc, a specialist in the design, manufacture and

supply of plastic products, is pleased to report its half yearly

report for the six months ended 31 October 2020.

Financial headlines Six months Six months

to to

31 October 31 October

2020 2019 % change

GBP10.65 GBP12.14

Group sales million million -12.3%

GBP4.29 GBP4.60

Gross profit million million -6.7%

Underlying operating margin* 40.3% 37.9% 6.3%

Underlying operating profit (excluding

finance expenses)* GBP994,000 GBP485,000 104.9%

Reported profit before taxation GBP541,000 GBP 25,000 2,064.0%

Underlying EBITDA* GBP1,622,000 GBP1,341,000 21.0%

Underlying basic earnings per share* 0.93p 0.26p 257.7%

Proposed interim dividend per share 0.00p 0.00p

*The financial headlines disclosed as underlying represent the

reported metrics excluding separately disclosed items (being share

based payment charges, amortisation of intangible assets and other

one-off costs in each period), see note 7.

Operational and financial highlights

- I am pleased to report that the first half of this year has

seen a return to profit. This is despite the on-going Covid-19

pandemic impact, Brexit, the China-USA trade wars, volatile

currency fluctuations and variable trading conditions.

- Ensuring that the business is Covid-19 secure for employees

and visitors is paramount. As a critical supplier our business

continued to operate under strict Covid-19 Government guidelines to

support the medical, transport, food and communication industries

through the UK lockdowns encountered this year.

- The Covid-19 pandemic caused a reduction in profitability at

Global One-Pak in the first few months of this financial period. I

am very pleased to report however that with the addition of new

Chinese suppliers in recent months profitability has returned.

- Particularly pleasing is the Group's return to profit when

considering the huge negative impact of the Covid-19 pandemic on

our customer base has meant that the new business expected from the

new and improved food packaging and the 23 litre/55 litre recycling

products have not been realised in the current period. It is

expected that both will positively impact the business in the final

quarter of this financial period.

- The business cost base was reduced via improvements in

automation, labour shift pattern changes, increasing the raw

material supplier base, utilisation of the recycling plant and the

integration of the Interpack daily operation into the Mouldings

operation.

- The extruded fire retardant click & fix product has been

developed with huge interest from both existing and potential new

customer base. It is expected that this will positively impact the

business in the final quarter of this year.

- The recycling plant is contributing to the business, and has

done throughout the pandemic to date. This exciting area of the

business is expected to become more and more integral to the

business profitability in the future.

- The recycling plant has gained re-processor status enabling

the business to mitigate the Government waste packaging levy

incurred on the business.

- The Group has retained its BRC food packaging accreditation.

- The Multi-box-recycling-system (MBRS) has now been

commissioned with positive impact on sales expected over the rest

of this financial period and beyond.

- A very strong net assets position has been maintained.

Commenting on today's results, Joe Grimmond, Coral's Chairman,

said:

"In my Chairman's statement that accompanied the release of the

2020 accounts I expressed concerns over the uncertainties

associated with the ongoing Brexit situation and coronavirus

pandemic. Despite these concerns I am encouraged with the level of

sales and profitability achieved over the period".

Enquiries

Coral Products plc Tel: 01942 272

Joe Grimmond, Non-Executive Chairman 882

Mick Wood, CEO

Nominated Adviser & Broker

Cairn Financial Advisers LLP Tel: 020 7213

Liam Murray / Sandy Jamieson / Ludovico Lazzaretti 0880

David Lawman (Corporate Broking)

Capital Markets Consultants Limited Tel: 07515 587

Richard Pearson 184

Chairman's Statement

Results and Financial Position

Trading in the first half of the current year shows that even

though revenue and gross profit are below the same period for last

year, the gross profit % has improved. Reported revenue was

GBP10,645,000 (six months to 31 October 2019: GBP12,143,000), gross

margins were 40.3% (2019: 37.9%) resulting in a gross profit of

GBP4,291,000 (2019: GBP4,601,000) in the six months to 31 October

2020. Underlying EBITDA was GBP1,622,000 (2019: GBP1,341,000).

Underlying operating profits increased to GBP994,000 (2019:

GBP485,000).

Separately disclosed expenses of GBP230,000 (2019: GBP193,000)

comprised the amortisation of intangibles acquired on acquisition,

share based payment charges over employee options and redundancy

costs.

Finance costs dropped slightly to GBP223,000 (2019: GBP267,000)

in this period due to the payment holidays taken in the first few

months of the financial period.

Profit before tax after including all the above items was

GBP541,000 (2019: GBP25,000).

The balance sheet net asset position remains strong at

GBP12,645,000 (2019: GBP12,945,000). This represents a solid asset

platform for developing the business.

The Group's net debt has decreased to GBP7,192,000 (2019:

GBP8,625,000). The Group has undrawn bank facilities of GBP2.6

million, (2019: GBP2.0 million).

Operations

Tatra-Rotalac Ltd

Now with a reduced cost base gained by a major re-organisation

and a change in shift patterns the business is back to

profitability. Upgrades on current manufacturing assets have

enabled improved efficiencies, culminating in the retention of a

multimillion-pound three-year contract for a major

telecommunications customer. New upgraded extruded click & fix

panel will contribute in the final quarter of this financial

period.

Interpack Ltd

Due to the Covid 19 pandemic the financial benefits expected of

the new and improved ice-cream packaging have yet to be realised.

It is expected that this will happen in the final quarter of this

financial period. The integration of the day-to-day activities into

the Mouldings business has enabled continuity via familiarisation

of product coupled with cost reduction.

Global One-Pak Ltd

Initially this business was financially the worst hit by the

Covid-19 pandemic in the Group. New suppliers have successfully

been sought to enable continuity of supply of triggers and plungers

from China. World-wide demand is expected to remain high for the

foreseeable future. With the new aforementioned supply chain in

place and even with the uncertainty of the current Covid-19 and

Brexit situation in the UK we believe the business can be managed

to deliver improved profitability in the rest of this financial

period.

Coral Products (Mouldings) Ltd

Turnover for the first 6 months of this financial period was

affected by the reduction in services provided by councils and

authorities as the demand for recycling products reduced due mainly

to the impact of Covid-19. This demand is now coming back on stream

and coupled with high demand for Blow moulding products (supplied

into wet wipe and sanitizing companies), high demand for

transportation and telecommunication products, along with the

resurgence of food container products the business is set to

benefit from increased turnover and profitability.

The recycling plant is fully operational and the objective of

giving the business a full 360 degree offering across the recycling

spectrum has been achieved. It has maintained its re-processor

accreditation making it a go to site for the customer base.

Focus on adding high levels of recycled material to new

containers is a major objective for the site to offset the

forecasted GBP200 per tonne plastic tax set to be implemented in

April 2022 for products made with less than 30% of recycled

content. We are pleased to report that Mouldings is well down the

road to achieving the objective in advance of the deadline.

The industry anticipated MBRS (multi-box recycling system) is

now being made. It is expected that it will contribute to

profitability during this financial period.

Capital expenditure

Total capital expenditure in the first six months was GBP315,000

(2019: GBP650,000) of which GBPnil (2019: GBP69,000) related to

Tatra-Rotalac, GBPnil (2019: GBP375,000) related to Interpack, and

the balance expended on the tools for the multi box recycling

system (MBRS) at Coral Products (Mouldings).

Dividends

Whilst there has been a marked improvement of performance in the

first half of this year, the Board has decided to defer any

decision on dividend for the current year until we see the outcome

of the coronavirus pandemic.

Brexit

With the imminent departure of the United Kingdom from the

European Union, as a business, we continue to focus on operational

cost control to enable an improved gross margin.

We know that the impact at the UK docks towards the end of

2020/early 2021 will be challenging, delays are expected. A

constant monitoring of supplies to the plants is on-going with

extra working capital used to purchase raw materials in advance.

Our focus remains that of cost control across the two manufacturing

subsidiaries. These will be supplemented increasingly by the

recycling business which we believe will leave the Group on a sound

footing both during and after the completion of the UK's departure

from the European Union.

Outlook

In my Chairman's statement that accompanied the release of the

2020 accounts I expressed concerns over the uncertainties

associated with the ongoing Brexit situation and coronavirus

pandemic. Despite these concerns I am encouraged with the level of

sales and profitability achieved over the period.

Cost reduction controls now in place, the recycling plant

delivering to overall profitability coupled with continued and

increased demand for Covid-19-related products, telecommunications,

transport, food product packaging and recycling containers gives me

great confidence for the future prospects and performance of the

Group.

Joe Grimmond

Non-Executive Chairman

8 December 2020

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the six months to 31 October 2020

Six months Six months

to to Year to

31 October 31 October 30 April

2020 2019 2020

Notes (unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

Revenue 3 10,645 12,143 22,321

Cost of sales (6,354) (7,542) (14,329)

------------- ---------------- --------------

Gross profit 4,291 4,601 7,992

Operating costs

Distribution expenses (544) (622) (1,296)

Administrative expenses

before separately disclosed

items (2,753) (3,494) (6,295)

------------- ---------------- --------------

Underlying operating profit 994 485 401

Separately disclosed items:

-------------

Share based payment credit/(charge) 2 (7) (14)

Amortisation of intangible

assets (138) (138) (277)

Reorganisation costs (94) (48) (142)

Impairment loss on goodwill - - (350)

(230) (193) (783)

Operating profit/(loss) 764 292 (382)

Finance expense (223) (267) (439)

------------- ---------------- --------------

Profit/(loss) before taxation 541 25 (821)

Taxation 4 - - -

------------- ---------------- --------------

Total comprehensive income/(loss) 541 25 (821)

------------- ---------------- --------------

Earnings per ordinary share 5

Basic and diluted (pence) 0.66 0.03 (0.99)

Underlying basic (pence) 0.93 0.26 (0.05)

------------- ---------------- --------------

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

At 31 October 2020

31 October 31 October 30 April

2020 2019 2020

(unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

Non-current assets

Goodwill 5,145 5,495 5,145

Other intangible assets 986 1,263 1,124

Property, plant and equipment 2,768 9,406 2,790

Right of use assets 4,058 835 4,365

Total non-current assets 12,957 16,999 13,424

------------- ------------- ------------

Current assets

Inventories 3,395 3,667 3,368

Trade and other receivables 4,575 5,783 4,931

Cash and cash equivalents 1,292 436 453

Total current assets 9,262 9,886 8,752

------------- ------------- ------------

Assets held for sale 2,520 - 2,520

Current liabilities

Bank overdrafts and borrowings (2,526) (4,779) (2,978)

Trade and other payables (3,212) (4,473) (3,749)

Lease liabilities (1,393) - (1,191)

Corporation tax - (43) -

Total current liabilities (7,131) (9,295) (7,918)

------------- ------------- ------------

Liabilities on assets held

for sale (1,706) - (1,765)

Non-current liabilities

Borrowings (1,000) (4,282) -

Lease liabilities (1,859) - (2,509)

Deferred taxation (398) (363) (398)

------------- ------------- ------------

Total non-current liabilities (3,257) (4,645) (2,907)

------------- ------------- ------------

Total liabilities (12,094) (13,940) (12,590)

------------- ------------- ------------

Total net assets 12,645 12,945 12,106

------------- ------------- ------------

Equity

Share capital 826 826 826

Share premium 5,288 5,288 5,288

Other reserves 1,567 1,567 1,567

Retained earnings 4,964 5,264 4,425

------------- ------------- ------------

Total equity 12,645 12,945 12,106

------------- ------------- ------------

CONSOLIDATED STATEMENT OF CHANGES IN SHAREHOLDERS' EQUITY

For the six months to 31 October 2020 (unaudited)

Share Share Other Retained Total

capital premium reserves earnings equity

GBP000 GBP000 GBP000 GBP000 GBP000

At 1 May 2020 826 5,288 1,567 4,425 12,106

Total comprehensive

income - - - 541 541

Charge for share based

payment - - - (2) (2)

Dividend paid - - - - -

----- --------- ---------- ---------- --------

At 31 October 2020 826 5,288 1,567 4,964 12,645

----- --------- ---------- ---------- --------

For the six months to 31 October 2019 (unaudited)

Share Share Other Retained Total

capital premium reserves earnings equity

GBP000 GBP000 GBP000 GBP000 GBP000

At 1 May 2019 826 5,288 1,567 5,232 12,913

Total comprehensive

income - - - 25 25

Credit for share based

payment - - - 7 7

Dividend paid - - - - -

--------- ---------------- ------------ ---------- --------

At 31 October 2019 826 5,288 1,567 5,264 12,945

--------- ---------------- ------------ ---------- --------

For the year ended 30 April 2020 (audited)

Share Share Other Retained Total

capital premium reserves earnings equity

GBP000 GBP000 GBP000 GBP000 GBP000

At 1 May 2019 826 5,288 1,567 5,232 12,913

Total comprehensive

loss - - - (821) (821)

Credit for share based

payment - - - 14 14

Dividend paid - - - - -

--------- --------- ------------ ---------- --------------

At 30 April 2020 826 5,288 1,567 4,425 12,106

--------- --------- ------------ ---------- --------------

CONSOLIDATED STATEMENT OF CASH FLOWS

For the six months to 31 October 2020

Six months Six months

to to Year to

31 October 31 October 30 April

2020 2019 2020

(unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

Cash flow from operating activities

Profit/(loss) for the period after

tax 541 25 (821)

Adjustments for:

Depreciation of property, plant

and equipment 321 733 1,032

Depreciation of right of use assets

under IFRS16 307 - 681

Goodwill impairment - - 350

Amortisation of intangible assets 138 138 277

Share based payment (credit)/charge (2) 7 14

Interest payable 223 267 439

(Increase)/decrease in inventories (27) (162) 137

Decrease/(increase) in trade and

other receivables 386 (262) 563

(Decrease)/increase in trade and

other payables (537) 639 (87)

Net cash generated from operating

activities 1,350 1,385 2,585

------------- ------------- ------------

Cash flow from investing activities

Acquisition of property, plant and

equipment (314) (17) (322)

Net cash used in investing activities (314) (17) (322)

------------- ------------- ------------

Cash flow from financing activities

Interest paid (223) (267) (135)

Interest paid on lease liabilities - - (304)

Repayments of bank borrowings (60) (93) (188)

Repayments of obligations under

lease liabilities (462) (672) (1,180)

New bank loans raised 1,000 500 500

New lease liabilities - - 58

Movements on invoice discounting

facility (452) (373) (534)

Net cash used in financing activities (197) (905) (1,783)

------------- ------------- ------------

Net increase/(decrease) in cash

and cash equivalents 839 463 480

Cash and cash equivalents at the

start of the period 453 (27) (27)

------------- ------------- ------------

Cash and cash equivalents at the

end of the period 1,292 436 453

------------- ------------- ------------

1. Basis of preparation

The financial information set out in this Interim Report does

not constitute statutory accounts as defined in Section 435 of the

Companies Act 2006.

The Group's statutory financial statements for the year ended 30

April 2020, prepared under IFRS, are in the process of being filed

with the Registrar of Companies . The auditor's report on the

statutory accounts for the year ended 30 April 2020 was qualified

with respect to inventory having a carrying value of GBP3,368,000

as the audit evidence available was limited because, given the

global Covid-19 pandemic, no inventory count was undertaken and the

auditor did not observe the physical inventory as at 30 April 2020.

In respect solely of the limitation relating to inventory, the

auditor did not obtain all the information and explanations

considered necessary for the purpose of the audit and were unable

to determine whether adequate accounting records had been kept by

the parent company.

The interim financial information has been prepared in

accordance with the recognition and measurement principles of

International Financial Reporting Standards (IFRS) and on the same

basis and using the same accounting policies as used in the

financial statements for the year ended 30 April 2020 .

The Interim Report has not been reviewed by our auditor in

accordance with the International Standard on Review Engagement

2410 issued by the Auditing Practices Board.

2. Significant accounting policies

The accounting policies applied by the Group in these condensed

consolidated interim financial statements are the same as those

applied by the Group in its consolidated financial statements for

the year ended 30 April 2020.

3. Revenue

All production is based in the United Kingdom. The geographical

analysis of revenue is shown below:

Six months Six months

to to Year to

31 October 31 October 30 April

2020 2019 2020

(unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

United Kingdom 9,676 11,433 20,882

Rest of Europe 874 648 916

Rest of the World 95 62 523

10,645 12,143 22,321

-------------- -------------- -----------

Turnover by business activity

Sale and manufacture of plastic

products 10,645 12,143 22,321

-------------- -------------- -----------

4. Taxation

The taxation charge for the six months to 31 October 2020 is

based on the effective taxation rate, which is estimated will apply

to earnings for the year ending 30 April 2021. The rate used is

below the applicable UK corporation tax rate of 19% due to the

utilisation of tax losses in the period.

5. Earnings per share

Basic and underlying earnings per ordinary share are calculated

using the weighted average number of ordinary shares in issue

during the financial period of 82,614,865 (31 October 2019:

82,614,865 and 30 April 2020: 82,614,865).

Year to

Six months Six months

to to 30 April

31 October 31 October

2020 2019 2020

(unaudited) (unaudited) (audited)

GBP000 p GBP000 p GBP000 p

Basic and diluted earnings

per ordinary share

Profit/(loss) for the period

after tax 541 0.66 25 0.03 (821) (0.99)

-------- ----- -------- ----- ------- -------

Underlying earnings per ordinary

share

Underlying profit/(loss) for

the period after tax 771 0.93 218 0.26 (38) (0.05)

-------- ----- -------- ----- ------- -------

6. Movement in Net Debt

Net debt incorporates the Group's borrowings and bank overdrafts

less cash and cash equivalents. A reconciliation of the movement in

the net debt is shown below:

Six months Six months

to to

Year to

31 October 31 October 30 April

2020 2019 2020

(unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

Net increase in cash and cash

equivalents 839 463 1,014

Decrease/(increase) in bank

and other loans 510 (9) (312)

(Decrease)/increase in lease

liabilities (551) (862) (475)

Movement in net debt in the

financial period 798 (408) 227

Net debt at beginning of period (7,990) (8,217) (8,217)

-------------- ------------- -----------

Net debt at end of period (7,192) (8,625) (7,990)

-------------- ------------- -----------

7. Underlying profit and separately disclosed items

Underlying profit before tax, underlying earnings per share,

underlying operating profit, underlying earnings before interest,

tax, depreciation and amortisation are defined as being before

share based payment charges, amortisation of intangibles recognised

on acquisition, acquisition costs, reorganisation costs,

compensation for loss of office, impairment of goodwill and

impairment loss on trade receivables. Collectively these are

referred to as separately disclosed items. In the opinion of the

directors the disclosure of these transactions should be reported

separately for a better understanding of the underlying trading

performance of the Group.

Six months Six months

to to

Year to

31 October 31 October 30 April

2020 2019 2020

(unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

Operating profit/(loss) 764 292 (382)

Separately disclosed items within

administration expenses

-------------------------------------- -------------- ------------- -----------

Share based payment (credit)/charge (2) 7 14

Amortisation of intangible assets 138 138 277

Reorganisation costs 94 48 142

Impairment of goodwill - - 350

-------------------------------------- -------------- ------------- -----------

Total separately disclosed items 230 193 783

-------------- ------------- -----------

Underlying operating profit 994 485 401

Depreciation 628 856 1,731

Underlying EBITDA 1,622 1,341 2,114

8. Forward looking statements

This announcement contains unaudited information and

forward-looking statements that are based on current expectations

or beliefs, as well as assumptions about future events. These

forward-looking statements can be identified by the fact that they

do not relate only to historical or current facts and undue

reliance should not be placed on any such statement because they

speak only as at the date of this document and are subject to known

and unknown risks and uncertainties and can be affected by other

factors that could cause actual results, and Coral's plans and

objectives, to differ materially from those expressed or implied in

the forward-looking statements. Coral undertakes no obligation to

revise or update any forward-looking statement contained within

this announcement, regardless of whether those statements are

affected as a result of new information, future events or

otherwise, save as required by law and regulations.

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014 (MAR). The Directors of the

Group take responsibility for this announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFSDFFLDIII

(END) Dow Jones Newswires

December 08, 2020 02:00 ET (07:00 GMT)

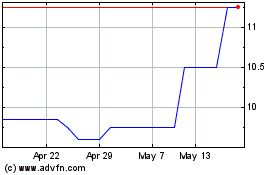

Coral Products (LSE:CRU)

Historical Stock Chart

From May 2024 to Jun 2024

Coral Products (LSE:CRU)

Historical Stock Chart

From Jun 2023 to Jun 2024