TIDMCRU

RNS Number : 8320H

Coral Products PLC

08 December 2020

8 December 2020

CORAL PRODUCTS PLC

('Coral' or the 'Company' or the 'Group')

Coral Products PLC, (the "Company" or the "Group") a specialist

in the design, manufacture and supply of injection moulded plastic

products based in Haydock, Merseyside, announces its audited final

results for the year ended 30 April 2020.

KEY FINANCIALS

2020 2019

GBP GBP

Group revenue 22,321,000 24,733,000

Underlying operating profit * 401,000 1,018,000

Goodwill impairment (350,000) -

Separately disclosed non-cash items (excluding

goodwill impairment) (291,000) (360,000)

Operating (loss)/profit (382,000) 479,000

Gross Margin 35.8% 35.9%

(Loss)/profit for the year before taxation (821,000) 41,000

Underlying EBITDA * 2,114,000 2,479,000

Underlying earnings per share (see note

3) * (0.05)p 0.75p

Dividend paid per share 0.00p 0.25p

* Underlying results are reported before separately disclosed

items, as shown in note 2. Such underlying results are not intended

to be a substitute for, or superior to, IFRS measures of

profit.

HEADLINES

Covid-19 headlines

-- The fall in Group revenues is entirely due to Covid-19, sales

during the second half of the year were expected to be higher than

2019 due to the introduction of the MBRS project and the new

upgraded ice cream tools, both of which were delayed due to the

pandemic.

-- Global One-Pak's sales were hit particularly hard due to

running out of stock as all stock is manufactured in China and

delivery after Chinese New Year did not resume until May 2020 with

deliveries getting to GOP in June 2020.

-- Underlying operating profit decreased to GBP0.4m (2019:

GBP1.0m) and underlying EBITDA decreased to GBP2.1m (2019:

GBP2.5m).

-- Multi box recycling system (MBRS). The tooling of this had

been delayed due to the pandemic. The tools arrived onsite in

September 2020 with production commencing in November 2020.

-- New improved food packaging. The tooling was ready to go for

this summer period but due to the lockdowns very little production

of ice cream tubs has occurred during this financial period.

-- Flame retardant plastic moulded roof tiles for the

construction industry. This has been put on hold by the customer

due to the pandemic.

Other headlines

-- Gross margin remained static at 35.8% (2019: 35.9%).

-- We still remain a supplier of choice for a major on-line tote

retailer with a further extension to supply into 2021/22.

-- Continuing to build on being a major supplier of recycling

crates and caddies into UK councils and local authorities.

-- End of line automation installed in blow moulding to reduce labour resources.

-- Recycling of post-industrial plastic waste increasing contribution.

-- Maximising current assets across manufacturing.

-- Strong net assets position of GBP12.1m as at the year-end (2019: GBP12.9m).

The Company's audit report contained a qualification in relation

to the carrying value of the Company's inventory as the audit

evidence available to the auditor was limited because, given the

global COVID-19 pandemic, no inventory count was undertaken and the

auditor did not observe the physical inventory as at 30 April 2020.

Further details can be found in note 1 below.

Commenting on the results, Joe Grimmond, Chairman, said:

"This current trading period has been one of the most difficult

I've ever experienced, with Brexit, the United States - China

trading wars, the general election and the covid-19 pandemic. The

net effect of all these culminated in a steep reduction in sales in

the second half from our budgeted expectations. This fall in sales

has resulted in a loss in contribution for the period. Revenue was

GBP22.3m (2019: GBP24.7m) and underlying operating profit GBP0.4m

(2019: GBP1.0m), the gross margin of 35.8% (2019: 35.9%) was

maintained which was as a result of the direct and indirect cost

reduction measures taken across the Group".

"The second half of the year was forecasted to have much higher

sales than the first half. This was expected from the long-awaited

multi-box recycling system (MBRS) project and the general uptake in

sales that occurs in the final quarter onwards. The tooling for the

MBRS was severely delayed and with the lockdown the usual uptake

did not occur and we had invested quite heavily in improved tooling

last year to meet demand which the lockdown disrupted. Global

One-Pak was hit particularly hard due to the pandemic as supplies

almost dried up".

"The Group has reported a loss before taxation for the financial

year of GBP0.8m (2019: GBP0.04m profit), this is after non cash

amortisation of GBP0.3m (2019: GBP0.3) and goodwill impairment of

GBP0.4m (2019: GBPnil). Across the Group, finance costs have

remained static at GBP0.4m (2019: GBP0.4m) and depreciation at

GBP1.7m (2019: GBP1.5m)".

"Whilst we have confidence in our development strategy and the

prospects of the Group, the very real uncertainties over Brexit and

the coronavirus pandemic are a cause for concern."

"The Group continues with its strategic progress of increasing

focus on value-added and innovative products, particularly in the

food container, recycling, telecommunications, rail industry, home

delivery totes and blow moulding areas. Our aim is to build a

significant plastic moulding business with a bias towards using

recycled materials produced by our recycling unit installed in

Haydock. The current year will benefit from the Coral Mouldings and

Tatra-Rotalac cost reductions and new business".

"Our Group is facing a crisis that is unprecedented, but we

believe that our balance sheet and margins mean that we can

mitigate the effects. The crisis will pass at some point. At that

time, it will be the work we do to move the business forward that

will determine our future success. So, our priorities being clear:

(1) to do all we can to keep our workplaces as safe as possible for

staff, (2) secure the cash resources of the business and (3)

continue to develop our product ranges throughout the next

financial period".

" We have enjoyed a strong start to our current financial year

and we look forward to a satisfactory outturn for the year given

the prevailing conditions. "

For further information, please contact:

Coral Products plc

Michael (Mick) Wood, Chief Executive Officer Tel: 07788 565

154

Nominated Adviser & Broker

Cairn Financial Advisers LLP Tel: 020 7213

Liam Murray/Sandy Jamieson/Ludovico Lazzaretti 0880

David Lawman (Corporate Broking)

Capital Markets Consultants Tel: 07515 587

Richard Pearson 184

This announcement contains inside information for the purpose of

Article 7 of the EU Regulation 596/2014.

CHAIRMAN'S STATEMENT

Coronavirus - Summary of Impact Assessment

As might be expected I will begin with a summary of the risks

that the coronavirus pandemic poses to the business and the actions

we are taking to mitigate the effects. We cannot predict how

widespread the virus will become, how long the pandemic will last

and what the medium to long term effect of this pandemic will

be.

Our priority is to do all we can to keep our workplaces as safe

as possible for staff, ensuring that we follow all government

guidelines. We have planned our business to be flexible, in all

areas, to meet fluctuating levels of demand. We have robust

financial controls that will ensure we maintain our working capital

requirements whilst meeting all our agreed parameters with our

financial partners.

We are taking measures to control costs and conserve cash within

the business which include the delay of capital expenditure, the

potential sale and leaseback of the land and building at the

Haydock site and the suspension of dividend payments.

We reacted quickly to the crisis and as early as mid-March 2020

negotiated capital repayment holidays and a CBIL loan of GBP1

million pounds, this was received on 13 May 2020, with a six-month

capital payment holiday and 12 months interest free from the Groups

existing bank Barclays. We had invested heavily in new capacity in

the last 3 years and this investment will enable us to greatly

reduce capital expenditure over the next 2 financial periods.

Our manufacturing sites at Haydock and Wythenshawe were deemed

as key suppliers during the first wave of the pandemic allowing

both sites to continue manufacturing throughout.

There will be many challenges to our working practices as the

pandemic develops and we are putting plans in place to protect our

most vulnerable employees, comply with differing levels of

Government restrictions and cope with illness throughout the

business. In particular, we have adapted our technology for greater

home working and seeking to segregate critical operational teams so

as to keep all our vital operations and projects on track.

The actions taken by your board give us confidence that we will

come through this current crisis and will be in a position to take

advantage of any economic upturn.

Trading

This current trading period has been one of the most difficult

I've ever experienced, with Brexit, the United States - China

trading wars, the general election and the covid-19 pandemic. The

net effect of all these culminated in a steep reduction in sales in

the second half from our budgeted expectations. This fall in sales

has resulted in a loss in contribution for the period. Revenue was

GBP22.3m (2019: GBP24.7m) and underlying operating profit GBP0.4m

(2019: GBP1.0m), the gross margin of 35.8% (2019: 35.9%) was

maintained which was as a result of the direct and indirect cost

reduction measures taken across the Group.

The second half of the year was forecasted to have much higher

sales than the first half. This was expected from the long-awaited

multi-box recycling system (MBRS) project and the general uptake in

sales that occurs in the final quarter onwards. The tooling for the

MBRS was severely delayed and with the lockdown the usual uptake

did not occur and we had invested quite heavily in improved tooling

last year to meet demand which the lockdown disrupted. Global

One-Pak was hit particularly hard due to the pandemic as supplies

almost dried up.

The Group has continued with its strategic progress of

increasing focus on value-added and innovative products. The focus

is to build a significant plastic moulding business with a bias

towards using recycled materials and with the new Recycling unit

now installed and operational at Haydock, we remain confident in

our ability to do so.

The Group has reported a loss before taxation for the financial

year of GBP0.8m (2019: GBP0.04m profit), this is after non cash

amortisation of GBP0.3m (2019: GBP0.3) and goodwill impairment of

GBP0.4m (2019: GBPnil). Across the Group, finance costs have

remained static at GBP0.4m (2019: GBP0.4m) and depreciation at

GBP1.7m (2019: GBP1.5m).

Interpack's profit before tax is GBP0.4m (2019: GBP0.7m), Global

One-Pak's GBP0.1m (2019: GBP0.2m) and Tatra-Rotalac's GBP0.1m

(2019: GBP0.2m loss). The delay in the launch of the MBRS and drop

in sales following the pandemic at Coral Products (Mouldings) has

resulted in a loss of GBP0.8m (2019: GBP0.4m loss). These results

are before amortisation of intangibles arising on consolidation of

GBP0.3m (2019: GBP0.3m) and the goodwill impairment of Tatra

Rotalac of GBP0.4m (2019: GBPnil).

Performance of the Group is monitored principally through

adjusted profit measures which exclude GBP0.8m of adjusted items

(2019: GBP0.5m). Such items include the amortisation of intangibles

arising on the acquisitions of Global One-Pak and Tatra-Rotalac,

due-diligence costs, share based payment charges, compensation for

loss of office of senior management, reorganisation costs and

goodwill impairment.

Dividends

The Board remains committed to its long-term progressive

dividend policy, which takes account of the underlying growth,

whilst acknowledging the requirement for continuing investment and

short-term fluctuations in profit.

Due to the uncertainty surrounding UK Brexit and the Coronavirus

pandemic the Board believe it is prudent to suspend dividend

payments in the short term. Therefore, the Board will not be

recommending the payment of a dividend for this financial

period.

Board Changes

There were no board changes during the year.

Chairman's Corporate Governance Statement

As Non-executive Chairman of the board, my role is to set the

strategy for the company, monitor the ongoing performance of the

companies within the Group to ensure that they are meeting our

requirements and also identify potential acquisition targets.

In addition, my role also encompasses overseeing the functioning

of the board and its effectiveness and ensuring sound corporate

governance practices are followed.

All the Directors of Coral believe strongly in the importance of

good corporate governance for the creation of shareholder value

over the medium to long-term and to engender trust and support

amongst the Group's wider stakeholders.

I work with key executives throughout the organisation to instil

good corporate governance practices in accordance with the

Code.

In accordance with the changes to AIM Rule 26 the Company is now

applying the revised QCA Corporate Governance Code published

earlier in 2018.

The board monitors our corporate governance practices and will

always implement improvements which further enhance performance

and/or benefit stakeholders.

Strategy

Our Board continuously reviews business performance alongside

market conditions to make sure that we take the correct strategic

decisions for each of our businesses. The Board recognises fully

that it has been tasked with delivering enhanced shareholder value.

The challenges facing the Board relate to managing the continued

growth of the Group through the uncertainty and timelines

surrounding UK Brexit and the coronavirus pandemic.

People

We are reliant on the expertise, professionalism and commitment

of our people and thank them for their continued contribution to

the business during a challenging year.

Future Developments

The following projects were delayed due to the coronavirus

pandemic. We expect these to now be introduced during the latter

part of the current financial year:

-- The multi box recycling system (MBRS).

-- Conservatory and outbuildings rooftiles.

Outlook

Whilst we have confidence in our development strategy and the

prospects of the Group, the very real uncertainties over Brexit and

the coronavirus pandemic are a cause for concern.

The Group continues with its strategic progress of increasing

focus on value-added and innovative products, particularly in the

food container, recycling, telecommunications, rail industry, home

delivery totes and blow moulding areas. Our aim is to build a

significant plastic moulding business with a bias towards using

recycled materials produced by our recycling unit installed in

Haydock. The current year will benefit from the Coral Mouldings and

Tatra-Rotalac cost reductions and new business.

Our Group is facing a crisis that is unprecedented, but we

believe that our balance sheet and margins mean that we can

mitigate the effects. The crisis will pass at some point. At that

time, it will be the work we do to move the business forward that

will determine our future success. So, our priorities being clear:

(1) to do all we can to keep our workplaces as safe as possible for

staff, (2) secure the cash resources of the business and (3)

continue to develop our product ranges throughout the next

financial period.

We have enjoyed a strong start to our current financial year and

we look forward to a satisfactory outturn for the year given the

prevailing conditions.

Joe Grimmond

Chairman

8 December 2020

Group Income Statement

for the year ended 30 April 2020

2020 2019

GBP'000 GBP'000

--------------------------------------------------- --------- ---------

Revenue 22,321 24,733

Cost of sales (14,329) (15,861)

--------- ---------

Gross profit 7,992 8,872

Operating costs

Distribution expenses (1,296) (1,246)

------------------------------------------------------ --------- ---------

Administrative expenses before impairment

and separately disclosed items (6,295) (6,608)

Other separately disclosed items (433) (539)

Goodwill impairment (350) -

---------

Administrative expenses (7,078) (7,147)

Operating (loss)/profit (382) 479

Finance costs (439) (438)

--------- ---------

(Loss)/profit for the financial year before

taxation (821) 41

Taxation - 43

--------- ---------

(Loss)/profit for the financial year attributable

to the equity holders of the parent (821) 84

--------- ---------

Earnings per share attributable to the

equity holders of the parent

Basic and diluted (loss)/profit per ordinary

share (0.99)p 0.10p

Group Statement of Comprehensive Income

for the year ended 30 April 2020

2020 2019

GBP'000 GBP'000

------------------------------------------------------------- ---------- ----------

(Loss)/profit for the financial

year (821) 84

---------- ----------

Total other comprehensive income - -

---------- ----------

Total comprehensive (loss)/income for the year attributable

to equity holders of the parent (821) 84

---------- ----------

Balance Sheet

as at 30 April 2020

As at As at

30 April 30 April

2020 2019

GBP'000 GBP'000

------------------------------- ---------- ----------

ASSETS

Non-current assets

Goodwill 5,145 5,495

Other intangible assets 1,124 1,401

Property, plant and equipment 2,790 9,411

Right of use assets 4,365 -

---------- ----------

Total non-current assets 13,424 16,307

---------- ----------

Current assets

Inventories 3,368 3,505

Trade and other receivables 4,931 5,521

Cash and cash equivalents 453 -

Total current assets 8,752 9,026

---------- ----------

Assets held for sale 2,520 -

---------- ----------

LIABILITIES

Current liabilities

Term loan - 150

Other borrowings 2,978 4,800

Lease liabilities 1,191 -

Trade and other payables 3,749 3,834

---------- ----------

Total current liabilities 7,918 8,784

---------- ----------

Liabilities on assets held 1,765 -

for sale

---------- ----------

Net current assets 1,589 242

---------- ----------

Non-current liabilities

Term loan - 1,303

Other borrowings - 1,965

Lease liabilities 2,509 -

Deferred tax 398 368

---------- ----------

Total non-current liabilities 2,907 3,636

---------- ----------

NET ASSETS 12,106 12,913

---------- ----------

SHAREHOLDERS' EQUITY

Share capital 826 826

Share premium 5,288 5,288

Other reserves 1,567 1,567

Retained earnings 4,425 5,232

---------- ----------

TOTAL SHAREHOLDERS' EQUITY 12,106 12,913

---------- ----------

Statement of Changes in Shareholders' Equity

for the year ended 30 April 2020

Called Share

Up Premium Other Retained Total

Share Reserve Reserves Earnings Equity

Capital GBP'000 GBP'000 GBP'000 GBP'000

GBP'000

----------------------------- --------- --------- ----------- ----------- ----------

Group

At 1 May 2018 826 5,288 1,567 5,490 13,171

Profit for the year - - - 84 84

Other comprehensive - - - - -

income

--------- --------- ----------- ----------- ----------

Total comprehensive

income - - - 84 84

--------- --------- ----------- ----------- ----------

Contributions by

and distributions

to owners

Credit to equity

for equity settled

share-based payments - - - 71 71

Dividend paid - - - (413) (413)

--------- --------- ----------- ----------- ----------

At 1 May 2019 826 5,288 1,567 5,232 12,913

Loss for the year - - - (821) (821)

Total comprehensive

loss - - - (821) (821)

--------- --------- ----------- ----------- ----------

Contributions by

and distributions

to owners

Credit to equity for

equity settled share-based

payments - - - 14 14

Dividend paid - - - - -

At 30 April 2020 826 5,288 1,567 4,425 12,106

--------- --------- ----------- ----------- ----------

Cash Flow Statement

for the year ended 30 April 2020

Group

2020 2019

GBP'000 GBP'000

---------------------------------------------- --------- ---------

Cash flows from operating activities

(Loss)/profit for the year (821) 84

Adjustments for:

Depreciation of property, plant and

equipment 1,032 1,461

Depreciation on right of use assets 681 -

under IFRS16

(Profit)/loss on disposal of tangible

assets - (23)

Goodwill impairment 350 -

Amortisation of intangible assets 277 289

Share based payment charge 14 71

Interest payable 439 438

Taxation charge/(credit) - (43)

--------- ---------

Operating cash flows before movements

in working capital 1,972 2,277

Decrease/(increase) in inventories 137 (641)

Decrease/(increase) in trade and

other receivables 563 (69)

(Decrease)/increase in trade and

other payables (87) (75)

--------- ---------

Cash generated by operations 2,585 1,492

UK corporation tax received - 2

--------- ---------

Net cash generated from operating activities 2,585 1,494

--------- ---------

Cash flows from investing activities

Proceeds from disposal of property,

plant and equipment - 33

Acquisition of property, plant

and equipment (322) (690)

Net cash used in investing activities (322) (657)

--------- ---------

Cash flows from financing activities

New bank loans raised 500 -

Dividends paid - (413)

New lease liabilities 58 350

Interest paid on borrowings (135) (438)

Interest paid on lease liabilities (304) -

Repayments of bank borrowings (188) (151)

Repayments of obligations under lease

liabilities (1,180) (801)

Movements on invoice discounting facility (534) 118

Net cash used in financing activities (1,783) (1,335)

--------- ---------

Net increase/(decrease) in cash

and cash equivalents 480 (498)

Cash and cash equivalents at 1

May (27) 471

--------- ---------

Cash and cash equivalents at 30

April 453 (27)

--------- ---------

Notes

for the year ended 30 April 2020

1. Basis of preparation

The financial information set out above does not constitute the

Group's statutory accounts for the years ended 30 April 2020 or

2019 within the meaning of Section 434 of the Companies Act 2006,

but is derived from those accounts. Statutory accounts for 2019

have been delivered to the Registrar of Companies and those for

2020 will be delivered following the company's Annual General

Meeting. The auditors' report on the statutory accounts for the

year ended 30 April 2019 was unqualified, did not draw attention to

any matters by way of emphasis, and did not contain statements

under s498 (2) or s498 (3) of the Companies Act 2006. The auditor's

report on the statutory accounts for the year ended 30 April 2020

was qualified with respect to inventory having a carrying value of

GBP3,368,000 as the audit evidence available was limited because,

given the global COVID-19 pandemic, no inventory count was

undertaken and the auditor did not observe the physical inventory

as at 30 April 2020. In respect solely of the limitation relating

to inventory, the auditor did not obtain all the information and

explanations considered necessary for the purpose of the

audit and were unable to determine whether adequate accounting

records had been kept by the parent company.

This financial information has been prepared in accordance with

International Financial Reporting Standards ("IFRSs") and

International Financial Reporting Interpretations Committee (IFRIC)

interpretations as adopted by the European Union and with those

parts of the Companies Act 2006 applicable to companies reporting

under IFRS.

2. Underlying operating profit and separately disclosed

items

Underlying profit - the Company believes that underlying profit

and underlying earnings provide additional useful information for

shareholders. The term underlying earnings is not a defined term

under IFRS and may not therefore be comparable with similarly

titled profit measurements reported by other companies.

2020 2019

GBP'000 GBP'000

---------------------------------------------------- --------- ---------

Operating (loss)/profit (382) 479

Separately disclosed items within administrative

expenses

---------------------------------------------------- --------- ---------

Share based payment charge 14 71

Amortisation of intangible assets (customer

relationships and brands) 277 289

Reorganisation costs 142 179

Goodwill impairment 350 -

---------------------------------------------------- --------- ---------

Total separately disclosed items 783 539

--------- ---------

Underlying operating profit 401 1,018

Depreciation 1,713 1,461

--------- ---------

Underlying EBITDA 2,114 2,479

Separately disclosed items (excluding amortisation

and impairment) (156) (250)

--------- ---------

EBITDA 1,958 2,229

3. Earnings per share

Basic and underlying earnings per share

The basic earnings per share is calculated by dividing the

earnings attributable to ordinary shareholders for the financial

period by the weighted average number of shares in issue during the

financial period of 82,614,865 (2019: 82,614,865).

Underlying earnings per share is also shown calculated by

reference to earnings before separately disclosed items. The

directors consider that this gives a useful indication of

underlying performance.

2020 2019

GBP'000 EPS (p) GBP'000 EPS (p)

(Loss)/profit for the

financial period (821) (0.99) 84 0.10

Separately disclosed

items (note 2) 783 539

Underlying (loss)/profit

for the period (38) (0.05) 623 0.75

------------------ -------------------- ---------------- -----------------

4. Dividends

A dividend for the year ended 30 April 2019 of 0.25p per share

was paid on 28 March 2019. This dividend amounted to

GBP206,537.

Due to the effects the coronavirus pandemic is having on the

business; the Board will not be recommending a payment of a final

dividend payment for the year ended 30 April 2020.

5. Group reconciliation of net cash flow to movement in net

debt

2020 2019

GBP'000 GBP'000

-------------------------------------------- --------- ---------

Net increase/(decrease) in cash and

cash equivalents 480 (498)

Decrease/(increase) on invoice discounting

facility 534 (118)

(Increase)/decrease in bank loans

and other loans (312) 151

(Decrease)/increase in lease liabilities (475) (441)

--------- ---------

Movement in net debt for the period 227 (906)

Net debt at beginning of period (8,217) (7,311)

--------- ---------

Net debt at end of period (7,990) (8,217)

--------- ---------

6. Post Balance Sheet Event

A coronavirus business interruption loan (CBIL) of GBP1 million

was received from Barclays Bank on 13 May 2020. This is on a 3-year

term interest free for the first 12 months and repayment holiday

for the first 6 months. The interest rate is 4.61% over base. The

only covenant in place is that capital expenditure cannot be higher

than GBP400,000 and during the term of the loan no dividend

payments can be made.

The invoice factoring facility with Barclays was reviewed in

June 2020 and renewed for a further twelve months.

7. Publication of Annual Report

A copy of the 2020 Report & Accounts will be sent to all

shareholders on or before 18 December 2020. Further copies will be

available to the public at the company's registered address at

North Florida Road, Haydock Industrial Estate, Haydock, Merseyside

WA11 9TP and on the Company's website at www.coralproducts.com.

8. Forward looking statements

This announcement contains unaudited information and

forward-looking statements that are based on current expectations

or beliefs, as well as assumptions about future events. These

forward-looking statements can be identified by the fact that they

do not relate only to historical or current facts and undue

reliance should not be placed on any such statement because they

speak only as at the date of this document and are subject to known

and unknown risks and uncertainties and can be affected by other

factors that could cause actual results, and Corals plans and

objectives, to differ materially from those expressed or implied in

the forward-looking statements. Coral undertakes no obligation to

revise or update any forward-looking statement contained within

this announcement, regardless of whether those statements are

affected as a result of new information, future events or

otherwise, save as required by law and regulations.

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014 (MAR). The Directors of the

Group take responsibility for this announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR UBSBRRRUURAA

(END) Dow Jones Newswires

December 08, 2020 02:00 ET (07:00 GMT)

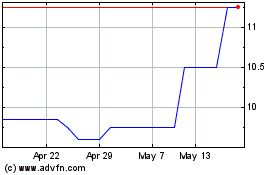

Coral Products (LSE:CRU)

Historical Stock Chart

From May 2024 to Jun 2024

Coral Products (LSE:CRU)

Historical Stock Chart

From Jun 2023 to Jun 2024