TIDMCRU

RNS Number : 0790I

Coral Products PLC

25 August 2016

25 August 2016

CORAL PRODUCTS PLC

('Coral' or the 'Company' or the 'Group')

FINAL RESULTS

Coral Products PLC, (the "Company" or the "Group") a specialist

in the design, manufacture and supply of injection moulded plastic

products based in Haydock, Merseyside, announces its final results

for the year ended 30 April 2016.

KEY FINANCIALS

2016 2015 Change

GBP GBP

Group revenue 18,714,000 17,425,000 7.4%

Operating profit 938,000 375,000 150.1%

Underlying operating profit * 1,649,000 1,349,000 22.2%

Profit for the year before taxation 758,000 191,000 296.9%

Underlying profit before taxation* 1,469,000 1,165,000 26.1%

Underlying EBITDA* 2,342,000 1,912,000 22.5%

Underlying earnings per share

* 2.2p 2.1p

Dividend payable per share 1.0p 0.7p

* "Underlying" results are reported before separately disclosed

items, as shown in note 2, as the Directors are of the opinion that

these give a more accurate picture of underlying performance

HEADLINES

-- Group revenue increase of 7.4%.

-- Significant underlying operating profit rise to GBP1.65m (GBP1.35m in 2015).

-- Sales of packaging containers continue to offset fall in media sales.

-- Underlying EBITDA increased by 22.5% to GBP2.3m maintaining

an improvement in operating cash flow.

-- Successful integration of business and assets from Neiman Packaging Limited in June 2015.

-- Revenues from non-media products increased to GBP17.9m

(GBP14.5m in 2015) representing 95% of total revenues (2015:

83%).

-- Purchase of Rotalac assets in January 2016.

-- Acquisition of Global One-Pak Limited ("GOP") completed in February 2016.

-- Progressive dividend policy maintained with 43% increase in

total dividend for the year of 1.0p (2015: 0.7p).

-- Commenced strategic reorganisation and restructuring of Group

into more focussed units with benefits from economies of scale.

Commenting on the results, Joe Grimmond, Chairman, said:

"I am pleased to record a further year of progress for the Group

with revenue up by 7.4% to GBP18.7 million and underlying profit up

by 22.2% to GBP1.6 million.

The Group continues with its strategic progress of increasing

focus on value-added and innovative products, particularly in the

food container, telecommunications and rail industry markets. Our

aim continues to be to build a significant plastic moulding

business and we remain confident in our ability to make further

progress by improving business performance and increasing our

market share to drive forward financial results over the medium

term.

We look forward with confidence to further progress in the

coming year."

For further information, please contact:

Coral Products plc

Joe Grimmond, Chairman Tel: 07703 518

Roberto Zandona, Group Chief Executive 148

Tel: 01942 272

882

Nominated Adviser Tel: 020 7148

Cairn Financial Advisers LLP 7900

Tony Rawlinson, Liam Murray, Rebecca Anderson

Broker

Daniel Stewart & Co plc Tel: 020 7776

David Lawman 6550

Capital Markets Consultants Tel: 07515 587

Richard Pearson 184

Chairman's Statement

Trading

It is pleasing to record a further year of progress for the

Group with revenue up by 7% to GBP18.7m and underlying operating

profit up by 22% to GBP1.6m. I am pleased that we are both

delivering increased profits to our shareholders and putting in

place the levels of investment and planning needed to secure

Coral's long term future as a leading player in our chosen

markets.

Following the Five Year Plan that was adopted in 2015 the Group

made a number of acquisitions this year aimed at substantially

increasing Group revenue and profitability from our specialist

plastic products manufacturing and distribution activities. In June

2015, we took our first step along this plan when we acquired

certain plant and machinery from Neiman Packaging Limited

('Neiman'). This acquisition introduces two new manufacturing

processes, injection blow moulding and extrusion blow moulding,

enhancing our range of manufacturing capability. This was followed

in January 2016 with the purchase of the fixed assets, stock and

business of Rotalac Plastics Limited ('Rotalac') from its

administrators. Rotalac provides thermoplastic extrusion and

moulding solutions across a number of industries worldwide,

including aerospace, medical and automotive and is a leader in

shutter system design and manufacture. This addition further

enabled the broadening of the Group's product range. Finally, in

February 2016 the Group acquired Global One-Pak Holdings Limited

('GOP') which designs, manufactures and supplies lotion pumps and

trigger sprayers to a broad range of customers worldwide, including

a number of global brands, across a wide range of markets,

including household and garden, automotive, personal care and pet

grooming. This business expanded further the market coverage and

product range with the supply of a number of high added value

components. These businesses have all been successfully integrated

into the Group and enable us to promote a more diverse range of

products and manufacturing methods the benefits of which are

already being seen.

Two of our subsidiaries at Interpack Limited ('Interpack') and

Tatra Plastics Manufacturing Limited ('Tatra') had further years of

improvement with continued improvements to profit and contribution.

Interpack's turnover stayed roughly constant but its margins were

improved from weaker overseas currencies whilst it also benefitted

from reduced overheads following the closure of its Dunstable site

with all operations moved to Haydock. Food container sales continue

to improve as the markets grow for foodstuffs to be contained

within hygienic, tamper-proof packaging and this looks set to

continue further. Tatra continued to report both significant

increases in both turnover and profit as demand from key suppliers

of infrastructure and communications increased. The Company

relocated from Halifax to Wythenshawe in July 2016 and, combined

with the existing Rotalac business already in situ there, is

confidently expected to maintain this progression and further

increase its contribution to Group performance. Tatra has been

renamed Tatra Rotalac Limited post year end, with the acquired

Rotalac trade hived into the now combined entity in

Wythenshawe.

At our freehold manufacturing site at Haydock within the

subsidiary Coral Products (Mouldings) Limited ('Mouldings') we have

made substantial investment in infrastructure, plant capacity and

management control. The improvement on operational efficiency,

whilst slower than anticipated, is nevertheless marked. We continue

to improve this facility and believe this will benefit our renewed

sales drive at Haydock.

Sales of on-line totes and recycling crates contributed GBP2.4m

from GBP1.2m in 2015 which helped to offset the further fall in

media sales to GBP0.9m in 2016 from GBP2.9m in 2015. We are

delighted to announce the receipt of a letter of intent from our

customer for a further supply of up to 300,000 totes for a new

on-line fulfilment centre with delivery late 2016 through 2018.

Trade moulding sales were below expectations with revenue falling

to GBP1.2m from GBP2.9m in 2015. There remained challenging market

conditions as local authorities continued not to commit resources

in the present atmosphere of austerity. Waste management will

continue to be a significant area of future spending and we are

determined to offer products and partnerships that will assist in

its management.

The significant fall in the relative value of sterling against

the dollar and the euro since the beginning of the year, together

with the prevailing uncertainty, could have a negative effect on

our business. We are taking steps across the Group to mitigate

these.

Performance of the Group is monitored principally through

adjusted profit measures which exclude GBP0.7m of underlying items.

Such items include the costs for the reorganisation involved in

merging the two businesses of Tatra and Rotalac during 2016,

together with the expenses in rationalising and improving the site

at Haydock. In addition, acquisition costs and amortisation of

intangibles arising on acquisition, written-off under accounting

practices, are also treated as underlying, as are share based

payment charges, compensation for loss of office of senior

management, and losses on sale of tangible assets.

The Group has reduced net debt by GBP0.7m in the year and

gearing has decreased to 23.9%. Given the continued pressure on raw

material prices and credit availability we continued to focus on

minimising our inventory and reducing our debtor days. Overall the

Group was able to report a net cash inflow of GBP1.3m.

Results

Group revenue improved for the year to GBP18.7m (2015:

GBP17.4m). Gross margin showed a significant increase to 33.1%

(2015: 29.6%) resulting from the continued addition of better added

value products along with decreases in the cost of raw materials.

Underlying earnings before interest, tax, depreciation and

amortisation for the Group remained strong at GBP2.3m (2015:

GBP1.9m). Administrative expenses in the Group increased to GBP4.4m

(2015: GBP4.1m) in line with the increase in Group activity. This

resulted in an underlying operating profit of GBP1.6m (2015:

GBP1.3m).

Separately disclosed underlying items totalled GBP0.7m (2015:

GBP1.0m) of which GBP0.4m resulted from the reorganisation costs of

Haydock and Wythenshawe to improve the facilities and rationalise

the businesses. Finance costs amounted to GBP0.2m (2015: GBP0.2m).

The underlying profit for the financial year before taxation was

GBP1.5m (2015: GBP1.2m). Earnings per share were 1.12 pence (2015:

0.35 pence), underlying earnings per share were 2.20 pence (2015:

2.12 pence).

Net debt at 30 April 2016 was GBP3.3m (2015: GBP4m) giving

reduced gearing of 23.9% (2015: 43.7 %). Interest cover before

underlying costs was 9.2 times (2015: 7.3 times). Net assets per

share were 16.6p (2015: 15.8p).

Dividends

The board remains committed to its long-term progressive

dividend policy, which takes account of the underlying growth in

earnings, whilst acknowledging the requirement for continuing

investment and short-term fluctuations in profit.

Having considered the results for the year, the outlook for the

new financial year and the ongoing requirements of the business,

the board has recommended the total dividend be increased to 1.0

pence per share. The final payment of 0.7 pence per share will have

an ex-dividend date of 8 September 2016 and record date of 9

September 2016. This final dividend will be paid on 14 October

2016.

Board Changes

In June 2016 Roberto (Rob) Zandona was appointed as Group Chief

Executive and at the same time Joe Grimmond became Non-executive

Chairman having previously acted as executive Chairman. Rob has

over 35 years of experience in the manufacturing and project

moulding sectors.

Strategy

Our board continuously reviews business performance alongside

market conditions to make sure that we take the correct strategic

decisions for each of our businesses. The board recognises fully

that it has been tasked with delivering enhanced shareholder value

in accordance with the strategy that we outlined in March 2015. The

challenges facing the board relate to managing the continued growth

of the Group whilst preserving the strengths of the business.

People

We are reliant on the expertise, professionalism and commitment

of our people and their contribution to the business during a

challenging year.

Outlook

The Group continues with its strategic progress of increasing

focus on value-added and innovative products, particularly in the

food container, telecommunications and rail industry markets. Our

aim continues to be to build a significant plastic moulding

business and we remain confident in our ability to make further

progress by improving business performance and increasing our

market share to drive forward financial results over the medium

term.

We look forward with confidence to further progress in the

coming year.

Joe Grimmond

Chairman

25 August 2016

Group Income Statement

for the year ended 30 April 2016

2016 2015

GBP'000 GBP'000

--------------------------------------------- ----------- -----------

Continuing operations

Revenue 18,714 17,425

Cost of sales (12,512) (12,268)

----------- -----------

Gross profit 6,202 5,157

Operating costs

Distribution expenses (863) (716)

------------------------------------------------ ----------- -----------

Administrative expenses before separately

disclosed items (3,690) (3,092)

Separately disclosed items (711) (974)

Administrative expenses (4,401) (4,066)

Operating profit 938 375

Finance costs (180) (184)

----------- -----------

Profit for the financial year before

taxation 758 191

Taxation (15) -

----------- -----------

Profit for the financial year attributable

to the equity holders 743 191

----------- -----------

Earnings per share

Basic (2015: basic and dilutive)

earnings per ordinary share 1.12p 0.35p

Dilutive earnings per ordinary share 1.12p 0.35p

Group Statement of Comprehensive Income

for the year ended 30 April 2016

2016 2015

GBP'000 GBP'000

------------------------------------------------------- ----------- -----------

Profit for the financial year 743 191

----------- -----------

Total comprehensive income for the year attributable

to equity holders 743 191

----------- -----------

Balance Sheets

as at 30 April 2016

As at As at

30 April 30 April

2016 2015

GBP'000 GBP'000

-------------------------------- ----------- -----------

ASSETS

Non-current assets

Goodwill 5,495 4,768

Other intangible assets 2,390 246

Property, plant and equipment 6,517 5,556

Investments in subsidiaries - -

----------- -----------

Total non-current assets 14,402 10,570

----------- -----------

Current assets

Inventories 1,843 1,404

Trade and other receivables 5,279 3,854

Cash and cash equivalents 910 67

Total current assets 8,032 5,325

----------- -----------

LIABILITIES

Current liabilities

Borrowings 2,062 2,349

Trade and other payables 4,054 2,659

----------- -----------

Total current liabilities 6,116 5,008

----------- -----------

Net current assets 1,916 317

----------- -----------

Non-current liabilities

Borrowings 2,122 1,704

Deferred tax 508 62

----------- -----------

Total non-current liabilities 2,630 1,766

----------- -----------

NET ASSETS 13,688 9,121

----------- -----------

SHAREHOLDERS' EQUITY

Share capital 826 579

Share premium 5,288 1,862

Other reserves 1,061 443

Retained earnings 6,513 6,237

----------- -----------

TOTAL SHAREHOLDERS' EQUITY 13,688 9,121

----------- -----------

Statement of Changes in Shareholders' Equity

for the year ended 30 April 2016

Called Share

Up Premium Other Retained Total

Share Reserve reserves Earnings Equity

Capital GBP'000 GBP'000 GBP'000 GBP'000

GBP'000

------------------------ ---------- ---------- ------------ ------------ -----------

Group

At 1 May 2014 419 409 - 6,439 7,267

Profit for the

year - - - 191 191

---------- ---------- ------------ ------------ -----------

Total comprehensive

income - - - 191 191

---------- ---------- ------------ ------------ -----------

Transactions with

owners

Issue of share

capital 160 1,453 443 - 2,056

Credit to equity

for equity settled

share based payments - - - 12 12

Dividend paid - - - (405) (405)

---------- ---------- ------------ ------------ -----------

At 1 May 2015 579 1,862 443 6,237 9,121

Profit for the

year - - - 743 743

---------- ---------- ------------ ------------ -----------

Total comprehensive

income - - - 743 743

---------- ---------- ------------ ------------ -----------

Transactions with

owners

Issue of share

capital 247 3,426 618 - 4,291

Credit to equity for

equity settled share

based payments - - - 28 28

Dividend paid - - - (495) (495)

At 30 April 2016 826 5,288 1,061 6,513 13,688

---------- ---------- ------------ ------------ -----------

Cash Flow Statements

for the year ended 30 April 2016

Group

2016 2015

GBP'000 GBP'000

----------------------------------------------- ----------- -----------

Cash flows from operating activities

Profit/(loss) for the year 743 191

Adjustments for:

Depreciation of property, plant and

equipment 678 533

Loss/(profit) on disposal of tangible

assets 50 (33)

Amortisation of intangible assets 133 136

Share based payment charge 28 12

Interest payable 180 184

Taxation charge 15 -

----------- -----------

Operating cash flows before movements

in working capital 1,827 1,023

(Increase)/decrease in inventories (174) 801

(Increase)/decrease in trade and

other receivables (455) 1,108

Increase/(decrease) in trade and

other payables 658 (1,361)

----------- -----------

Cash generated by operations 1,856 1,571

UK corporation tax paid (40) -

----------- -----------

Net cash generated from operating activities 1,816 1,571

----------- -----------

Cash flows from investing activities

Acquisition of subsidiary, net

of cash acquired (2,402) (1,998)

Acquisition of property, plant

and equipment (1,668) (440)

Proceeds from disposal of fixed

assets - 42

Acquisition of intangible assets - (7)

----------- -----------

Net cash used in investing activities (4,070) (2,403)

----------- -----------

Cash flows from financing activities

Proceeds of issue of share capital 3,641 1,605

New bank loans raised 1,150 500

New director's loan raised - 200

Dividends paid (495) (405)

New asset finance raised 463 237

Interest paid on borrowings (180) (184)

Repayments of bank borrowings (666) (297)

Repayment of director's loan (200) (146)

Repayments of obligations under finance

lease (205) (226)

Net cash used in financing activities 3,508 1,284

----------- -----------

Net increase in cash and cash

equivalents 1,254 452

Cash and cash equivalents at 1

May 2015 (1,747) (2,199)

----------- -----------

Cash and cash equivalents at 30

April 2016 (493) (1,747)

----------- -----------

Cash 910 67

Invoice discounting facility (1,403) (1,814)

----------- -----------

Cash and cash equivalents at 30

April 2016 (493) (1,747)

----------- -----------

Notes to the Financial Statements

for the year ended 30 April 2016

1. Basis of preparation

The financial information set out above does not constitute the

Group's statutory accounts for the years ended 30 April 2016 or

2015 within the meaning of Section 434 of the Companies Act 2006,

but is derived from those accounts. Statutory accounts for 2015

have been delivered to the Registrar of Companies and those for

2016 will be delivered following the company's Annual General

Meeting. The auditors' report on the statutory accounts for the

year ended 30 April 2015 was unqualified and does not contain

statements under s498 (2) or (3) Companies Act 2006.

This financial information has been prepared in accordance with

International Financial Reporting Standards ("IFRSs") and

International Financial Reporting Interpretations Committee (IFRIC)

interpretations as adopted by the European Union and with those

parts of the Companies Act 2006 applicable to companies reporting

under IFRS.

Underlying profit - the Company believes that underlying profit

and underlying earnings provide additional useful information for

shareholders. The term underlying earnings is not a defined term

under IFRS and may not therefore be comparable with similarly

titled profit measurements reported by other companies.

2. Underlying operating profit and separately disclosed

items

2016 2015

GBP'000 GBP'000

Underlying operating profit 1,649 1,349

Separately disclosed items in administrative

expenses:

Share based payment charge (28) (12)

Intangible amortisation (118) (106)

Costs of acquisition (67) (106)

Retirement costs of former directors (30) (414)

Reorganisation costs (418) -

Loss on disposal of tangible fixed assets (50) -

Impairment loss recognised on trade receivables - (336)

--------------------------- ----------------------

Operating profit 938 375

--------------------------- ----------------------

3. Earnings per share

Basic and underlying earnings per share

The basic earnings per share is calculated by dividing the

earnings attributable to ordinary shareholders for the financial

period by the weighted average number of shares in issue during the

financial period of 66,238,090 (2015: 54,894,513).

Underlying earnings per share is also shown calculated by

reference to earnings before exceptional items. The directors

consider that this gives a useful indication of underlying

performance.

Unaudited Audited

2016 2015

GBP'000 EPS (p) GBP'000 EPS (p)

Profit for the financial

period 743 1.12 191 0.35

Separately disclosed

items 711 1.08 974 1.77

-------------------- ------------------- ------------------- ------------------

Underlying profit for

the period 1,454 2.20 1,165 2.12

-------------------- ------------------- ------------------- ------------------

Diluted earnings per share

The diluted earnings per share is based on the weighted average

number of ordinary shares in issue ranking for dividend during the

year, adjusted for the effect of all dilutive potential ordinary

shares. The number of shares used to calculate the earnings per

share were 66,548,090 (2015: 54,894,513). This resulted in diluted

earnings per share of 1.12p (2015: 0.35p).

4. Dividends

A final dividend for the year ended 30 April 2015 of 0.5p per

share was paid on 30 October 2015 to shareholders on the register

on 7 August 2015. This dividend amounted to GBP289,308.

In respect of the current year an interim dividend of 0.3p per

share was paid on 1 March 2016 to shareholders on the register on

21 January 2016. This dividend amounted to GBP196,844.

A final dividend of 0.7p per share is to be paid on 14 October

2016 to shareholders on the register on 9 September 2016. The

ex-dividend date will be 8 September 2016. The dividend is subject

to approval by the shareholders of the company at the Annual

General Meeting. This dividend equates to GBP578,304 and has not

been included as a liability at 30 April 2016.

5. Group reconciliation of net cash flow to movement in net

debt

2016 2015

GBP'000 GBP'000

Increase in cash and cash equivalents 1,254 452

Increase in bank loans and other

loans (284) (257)

Increase in asset finance (258) 213

--------------------------- ---------------------

Movement in net debt in the period 712 (18)

Net debt at start of the period (3,986) (3,968)

--------------------------- ---------------------

Net debt at end of the period (3,274) (3,986)

--------------------------- ---------------------

6. Publication of Annual Report and Notice of Annual General

Meeting

A copy of the 2016 Report & Accounts, together with a notice

of the Annual General Meeting to be held at Tatra Rotalac Limited,

Southmoor Road, Roundthorn Industrial Estate, Wythenshawe,

Manchester M23 9DU on 28 September 2016 at 12:00 p.m., will be sent

to all shareholders on 5 September 2016. Further copies will be

available to the public at the company's registered address at

North Florida Road, Haydock Industrial Estate, Haydock, Merseyside

WA11 9TP and on the Company's website at www.coralproducts.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR USOWRNOAWUAR

(END) Dow Jones Newswires

August 25, 2016 02:01 ET (06:01 GMT)

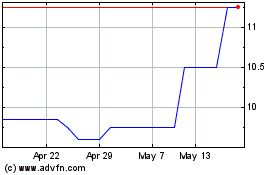

Coral Products (LSE:CRU)

Historical Stock Chart

From May 2024 to Jun 2024

Coral Products (LSE:CRU)

Historical Stock Chart

From Jun 2023 to Jun 2024