RNS Number : 6812J

Accsys Technologies PLC

08 December 2008

8th December 2008

AIM: AXS

NYSE Euronext Amsterdam: AXS

ACCSYS TECHNOLOGIES PLC ("Accsys" or "the Company")

INTERIM RESULTS FOR THE SIX MONTHS ENDED 30 SEPTEMBER 2008

Highlights

* Revenue of EUR17.9 million (2007: EUR3.8 million) and a pre-tax profit of EUR0.24 million (2007: loss of EUR5.0 million) in the

period

* Dividend of EUR1.55 million (EUR0.01 per share) paid in respect of the year ended 31 March 2008

* Net cash position of EUR30 million with no existing debt at 30 September 2008

* Accoya� wood sales volumes produced at the Group's production facility in Arnhem, increased by 200% compared to the same period

last year

* Diamond Wood China Limited extended its exclusivity in China with a licence option for an additional 250,000m3

* Accsys selected to join the elite Cleantech Index

* Accsys named in the World's Top 20 Sustainable Stocks

Post period Highlights

* Distribution agreement with UCS Forest Products, in Canada and the United States of America.

* Agreement with PEG Resources to develop licensing infrastructure on the African continent.

Willy Paterson-Brown, Executive Chairman of Accsys, commented, "Accsys continues to make positive progress despite the very challenging

conditions in the marketplace. I am pleased to note that the results for the first half of the year are broadly in line with the Directors'

expectations."

For further information, please contact:

Accsys Technologies PLC William + 44 20 8114 2510

www.accsysplc.com Paterson-Brown + 44 20 8150 8838

Executive Chairman

Collins Stewart Europe Ltd. Hugh Field/Piers + 44 20 7523 8000

Coombs/Michael

O'Brien

Parkgreen Communications Paul McManus / Leah + 44 20 7933 8780

Kramer + 44 77 9324 4055

Leah.kramer@ + 44 79 8057 5893

parkgreenmedia.com

Paul.mcmanus@

parkgreenmedia.com

Citigate First Financial B.V. Wouter van de Putte + 31 20 5754 080

/ Laurens Goverse

Introduction

The period covered by this report has seen good progress for your Company. The focus has been on increasing sales of Accoya� wood

produced in our Arnhem facility; working with Diamond Wood China Limited ("Diamond Wood") and Al Rajhi Holdings WLL ("Al Rajhi") on the

detailed planning and design phases for each of their production facilities and on progressing discussions with potential licensees.

Accoya� Wood

The volume of sales of Accoya� wood produced at our Arnhem facility increased by 200% compared to the same period last year on the back

of expansion into additional territories. Our first shipments of Accoya� were made to China during the period as Diamond Wood builds up its

resources to develop the Accoya� brand in China.

We have also started to ship product to North America and recently announced a distribution agreement with UCS Forest Products ("UCS")

which will allow us to introduce Accoya� extensively in Canada and the United States of America. UCS is one of North America's premier

speciality wood products distributors servicing an estimated $35 billion market and this relationship will allow us to help establish

Accoya� in one of our biggest target markets.

Considerable time and resource has been devoted to the testing of additional wood species for potential licensees, and all staff at our

Arnhem facility have been working hard not only to produce Accoya� wood and explore the acetylation potential of new wood species but also

to welcome, train, and demonstrate our technologies' capabilities to existing and potential licensees. This means that the Arnhem facility

does not always operate at optimal performance levels, something we continue to emphasise, as it is primarily a demonstration facility. Our

focus is on building a strong brand in the form of Accoya� wood and licensing our technology for production around the world.

We continue to see Accoya� wood being well received wherever it is presented. However we do also see that the general market sectors

associated with our products are subject to challenging conditions, particularly in Europe. We hope that, by spreading our geographical

influence across the world, we will be able to mitigate some of the effect of such market sensitivities.

Progress with licensing activity

During the period covered by this report, a significant amount of effort has been devoted to supporting our two licensees, Diamond Wood

and Al Rajhi, in China and the Middle East respectively, through the detailed planning and design phases for each of their facilities.

The China facility has now received local approvals and consents and Diamond Wood expects to commission its first plant in the first

half of 2010. During the period under review, Diamond Wood also acquired an option for an additional 250,000m3 (which takes their agreements

and options to 750,000m3 in total) and extended its exclusivity for the Chinese market to 2015 and potentially beyond.

We are actively discussing a number of further licensing opportunities in various countries and regions. We announced our distribution

agreement with UCS and are in active discussions with them regarding licensing rights. North American licensing is one of our priorities and

we continue to put significant efforts behind working closely with a number of potential partners.

More recently we announced our agreement with PEG Re Resources SA ("PEG"), in respect of the rights to develop a licensing

infrastructure to manufacture Accoya� wood in the African continent. The importance of PEG's experience with civil engineering projects and

their close governmental

relationships since 1965 not only gives a significant endorsement to Accoya� wood and our technology but should allow us to accelerate

the ability to penetrate significant sized new markets.

We currently have licence agreements in place for 650,000m3, licence options for 350,000m3 and are in discussions in several countries,

and on every continent, for licence agreements that we believe will lead to total licence agreement potential of approximately 4 million m3

within a two year period. All of our licence deals agreed and being discussed are based on both licence fees and royalties.

Environmental Credentials Endorsed

During the period under review we were selected by the Cleantech Group to join its prestigious Cleantech Index. This index, which

comprises 75 publicly traded companies, offers investors an effective way to track and invest in the leading companies from sectors

including advanced materials, agriculture, manufacturing, renewable and water.

We were also included in the Sustainable Business 20 (SB20) list of the World's top sustainable stocks, where we were listed as the

World's sixth most sustainable business.

These were further endorsements of the enormous global potential for our high performance Accoya� wood technology, and recognition that

the sustainability focussed investment community has Accsys in their sights, something that we believe will pay healthy dividends as and

when the financial markets start to recover.

Continuing to build our resources

We have continued to increase our team of skilled people, with staff numbers increasing from 75 at 31 March 2008 to 117 at 30 September

2008. This is slightly higher than originally anticipated at this point in time primarily due to increased demand for our business and

expectations of support for existing and future licensees. In particular, we have increased our technical and engineering resources to

further develop our solid wood technology, to accelerate the development of our fibreboard technology and to support licensees during the

design and build phases for their facilities.

We are particularly pleased with the steps we have taken to progress our fibreboard, panel products division, which gives us a whole new

market on which to focus with additional products. We set ourselves very high targets and consider that we are well ahead of our own

expectations in terms of the speed of development of this division. Our indications are that the panel products (fibreboard, MDF, OSB, chip

board) business opportunity on a global basis has the potential to match volumes achieved in the solid wood market and as of today we do not

believe this value has been considered by analysts in valuing our business in the public markets.

Results and Liquidity

Results for the six months ended 30 September 2008 show revenue of EUR17.9 million (EUR2007: EUR3.8 million) and a pre-tax profit of

EUR0.24 million (2007: loss of EUR5.0 million).

Revenue comprises sales of Accoya� wood produced at our Arnhem facility, and technology fees and option fees from licensees. Sales

volumes of Accoya� have increased by 200% compared to the same period last year. Technology fees from the licences with Diamond Wood and Al

Rajhi are being recognised over the course of each project based on an assessment of the level of work done.

At 30 September 2008, the group held cash balances of approximately EUR30 million and no debt. During the period there was a cash

outflow of EUR16.7 million which included the dividend payment of EUR1.6 million, investment in the business and therefore additional

capital expenditure on the Arnhem facility of EUR6.0 million and working capital and other movements of EUR9.1 million.

Dividends

The dividend in respect of the year ended 31 March 2008, of EUR0.01 per share, was approved and paid in August 2008. The directors will

consider the recommendation of a dividend in respect of the current financial year at the time of the full year results.

Market Capitalisation

The Company has a current market capitalisation of approximately EUR210 million. Whilst 2008 has not been an easy year in the public

markets, and the Company's share price has fallen by almost 60% since the 1 January 2008, it has performed in line or slightly better than

the overall market index for its relevant listings on FTSE AIM 50 in London and NYSE Euronext Amsterdam. Although the shares have seen good

liquidity, we believe that they also may have been subject to significant 'short selling' in the period, perhaps due to their better

liquidity than other AIM stocks. The management is focussed on delivering results for the business and believe that in doing so the share

price should take care of itself. It is therefore the positive business developments on which we maintain our focus.

Principal risks and uncertainties

The principal risks and uncertainties set out in the Annual Report and Financial Statements for the year ended 31 March 2008 remain the

same for the Interim financial statements and the remaining half year. Those risks and uncertainties comprise: economic and market

conditions; regulatory, legislative and reputational risks; employees and intellectual property.

Summary

Accsys continues to make positive progress despite the very challenging conditions in the marketplace. Results for the first half of the

year are broadly in line with the Directors' expectations. I would like to thank you for your continued support during these turbulent

times, which, on some days seem challenging and others offer interesting opportunities. We remain excited by the prospects ahead both in the

second half of the year and beyond, and look forward to being able to make additional announcements regarding our development and

partnerships.

Willy Paterson-Brown

Executive Chairman

8 December 2008

Unaudited Unaudited Audited

6 months ended 6 months ended Year ended

30 Sept 2008 30 Sept 2007 31 March 2008

Notes EUR'000 EUR'000 EUR'000

Revenue 17,867 3,841 27,328

Cost of Sales (10,902) (2,880) (11,761)

Gross Profit 6,965 961 15,567

Administration expenses (7,420) (6,088) (11,450)

Profit / (Loss) from operations (455) (5,127) 4,117

Finance income 690 158 1,328

Profit / (Loss) before tax 235 (4,969) 5,445

Tax expense (106) - (1,364)

Profit / (Loss) after taxation attributable to equity 129 (4,969) 4,081

holders

Earnings / (Loss) per share

Basic and diluted 3 EUR 0.00 EUR (0.03) EUR 0.03

All amounts relate to continuing activities

The notes set out on pages 9 to 13 form part of these interim financial statements

Unaudited Unaudited Audited

6 months ended 6 months ended Year ended

30 Sept 2008 30 Sept 2007 31 March 2008

EUR'000 EUR'000 EUR'000

NET ASSETS

Non-current assets

Intangible assets 7,984 8,248 8,116

Property, plant and equipment 27,226 22,146 27,169

Available for sale investments 6,000 - 6,000

41,210 30,394 41,285

Current assets

Inventories 6,838 2,089 4,932

Trade and other receivables 46,938 1,242 5,100

Cash and cash equivalents 29,580 58,966 46,239

83,356 62,297 56,271

Current liabilities

Deferred income (17,925) (8,000) -

Trade and other payables (18,639) (7,133) (8,731)

Corporation tax (1,470) - (1,364)

(38,034) (15,133) (10,095)

Net current assets 45,322 47,164 46,176

Total net assets 86,532 77,558 87,461

EQUITY

Equity and reserves

Share capital - Ordinary 1,556 1,552 1,553

shares

Share capital - Deferred - 148 148

shares

Capital redemption reserve 148 - -

Share premium account 78,191 78,020 78,076

Other reserves 106,707 106,707 106,707

Retained earnings (100,070) (108,869) (99,023)

Equity attributable to equity 86,532 77,558 87,461

holders of the parent

The notes set out on pages 9 to 13 form part of these interim financial statements

Share capital Share premium Capital Redemption Other Reserves Retained Earnings Total

Reserves

EUR000 EUR000 EUR000 EUR000 EUR000 EUR000

Balance at 1 April 2007 1,554 35,689 - 106,707 (104,241) 39,709

Loss and total recognised - - - - (4,969) (4,969)

income and expense for the

period

Share based payments - - - - 341 341

Shares issued in the period 131 - - - - 131

Share options exercised 15 - - - - 15

Premium on shares issued - 43,095 - - - 43,095

Share issue costs - (764) - - - (764)

Balance at 30 September 2007 1,700 78,020 - 106,707 108,869) 77,558

Balance at 1 April 2007 1,554 35,689 - 106,707 (104,241) 39,709

Profit and total recognised - - - - 4,081 4,081

income and expense for the

period

Share based payments - - - - 1,137 1,137

Shares issued in the period 131 - - - - 131

Share options exercised 16 - - - - 16

Premium on shares issued - 43,152 - - - 43,152

Share issue costs - (765) - - - (765)

Balance at 31 March 2008 1,701 78,076 - 106,707 (99,023) 87,461

Profit and total recognised - - - - 129 129

income and expense for the

period

Share based payments - - - - 380 380

Share options exercised 3 - - - - 3

Premium on shares issued - 115 - - - 115

Buyback of deferred shares (148) - 148 - (3) (3)

Dividend paid - - - - (1,553) (1,553)

Balance at 30 September 2008 1,556 78,191 148 106,707 (100,070) 86,532

The notes set out on pages 9 to 13 form part of these interim financial statements

Unaudited Unaudited Audited

6 months ended 6 months ended Year ended

30 Sept 2008 30 Sept 2007 31 March 2008

EUR'000 EUR'000 EUR'000

Cash flows from operating

activities

Profit / (Loss) for the period 129 (4,969) 5,445

Adjustments for:

Amortisation of intangible 132 132 264

assets

Depreciation of property, 728 714 1,447

plant and equipment

Finance income (690) (158) (1,328)

Equity-settled share-based 380 342 1,137

payment expenses

Cash flows from operating 679 (3,939) 6,965

activities before changes in

working capital

(Increase)/decrease in trade (41,838) (157) (4,015)

and other receivables

Increase in deferred income 17,925 8,000 -

(Increase) in inventories (1,906) (1,179) (4,022)

Increase in trade and other 15,275 4,031 369

payables

Cash (absorbed by)/generated (9,865) 6,756 (703)

from operating activities

Cash flows from investing

activities

Interest received 690 158 1,328

Purchase of available for sale - - (6,000)

investments

Purchase of property, plant (6,046) (1,249) (1,745)

and equipment

Net cash from investing (5,356) (1,091) (6,417)

activities

Cash flows from financing

activities

Dividends paid (1,553) - -

Proceeds from issue of share 115 43,241 43,299

capital

Share issue costs - (765) (765)

Net cash from financing (1,438) 42,476 42,534

activities

Net (decrease)/increase in (16,659) 48,141 35,414

cash and cash equivalents

Net (decrease)/increase in (16,659) 48,141 35,414

cash and cash equivalents

Opening cash and cash 46,239 10,825 10,825

equivalents

Closing cash and cash 29,580 58,966 46,239

equivalents

The notes set out on pages 9 to 13 form part of these interim financial statements

1. Accounting policies

Basis of preparation

The Group's financial statements have been prepared in accordance with International Financial Reporting Standards (IFRS) issued by the

International Accounting Standards Board as endorsed by the European Union.

The comparatives figures for the period to 31 March 2008 are not the Group's full statutory accounts for that financial year. Those

accounts have been reported on by the Company's auditors and delivered to the Registrar of Companies. The report of the auditors was

unqualified, did not include reference to any matter to which the auditors drew attention by way of emphasis without qualifying their

report, and did not contain statements under section 237(2) or (3) of the Companies Act 1985. The financial information in this document

does not constitute statutory financial statements within the meaning of section 240 of the Companies Act 1985. The financial information

for the six months ended 30 September 2008 has been prepared using accounting policies expected to apply in the full financial statements

for the year ended 31 March 2009, which are consistent with IFRS and endorsed for use in the European Union. These accounting policies are

unchanged from the audited financial statements for the year ended 31 March 2008.

The interim financial statements for the period ended 30 September 2008 have been prepared in accordance with IAS34 "Interim Financial

Reporting" as adopted by the European Union.

2. Segmental reporting

The Group operates in one business segment - the development and commercialisation of proprietary technology for the manufacture of

Accoya� branded acetylated wood and related process technologies with potential applications in the wood and chemical industries.

Accordingly, no segmental analysis is required for the primary segment.

The secondary segment analysis is presented on a geographical basis:

Unaudited Unaudited Audited

6 months ended 6 months ended Year ended

30 Sept 2008 30 Sept 2007 31 March 2008

EUR'000 EUR'000 EUR'000

Europe 4,035 1,341 4,210

Asia 13,832 2,500 23,118

17,867 3,841 27,328

Segment revenue is based on location of the customer. The segmental assets in the current period and the prior year were predominantly

held in Europe. Additions to property, plant and equipment in the current period and the previous year were mostly incurred in Europe.

3. Earnings/(loss) per share

Basic earnings/(loss) per 6 months ended 30 6 months ended 30 Year ended 31 March

share Sept 2008 Sept 2007 2008

EUR'000 EUR'000 EUR'000

Weighted average number of 155,378 147,991 151,112

Ordinary shares in issue

('000)

Earnings/(loss) for the year 129 (4,969) 4,081

(EUR'000)

Basic earnings/(loss) per EUR 0.00 EUR (0.03) EUR 0.03

share

Diluted earnings/(loss) per

share

Weighted average number of 157,543 147,991 155,070

Ordinary shares in issue

('000)

Earnings/(loss) for the year 129 (4,969) 4,081

(EUR'000)

Diluted earnings/(loss) per EUR 0.00 EUR (0.03) EUR 0.03

share

4. Related party transactions

Mr William Paterson-Brown is a director of Khalidiya Investments SA. During the six months to 30 September 2008, the Group paid

Khalidiya Investments SA EUR151,200 (September 2007: EUR251,643) in respect of directors services, EUR518,634 (September 2007: EUR95,055) in

respect of travel expenses for a number of employees, and EUR149,100 (September 2007: EUR0) in respect of office costs related to Geneva. In

addition, Mr William Paterson-Brown is a director of Zica SA. During the six months to 30 September 2008, the Group paid Zica SA EUR177,294

(September 2007: EUR140,242) in respect of office and related costs in Geneva and Dallas.

At the 30 September 2008 there were balances outstanding in respect of Khalidiya Investments SA of EUR114,135 (2007: EUR116,201) and

Zica SA of EUR27,423 (2007 EUR67,466).

5. Property, plant and equipment

Freehold land Plant and machinery Office equipment Total

EUR'000 EUR'000 EUR'000 EUR'000

Cost or valuation

At 31 March 2007 1,279 28,130 153 29,562

Additions 225 998 27 1,250

At 30 September 2007 1,504 29,128 180 30,812

Additions 5,261 414 81 5,756

At 31 March 2008 6,765 29,542 261 36,568

Additions - 686 99 785

At 30 September 2008 6,765 30,228 360 37,353

Depreciation

At 31 March 2007 - 7,887 65 7,952

Charge for the period - 676 38 714

At 30 September 2007 - 8,563 103 8,666

Charge for the period - 683 50 733

At 31 March 2008 - 9,246 153 9,399

Charge for the period - 672 56 728

At 30 September 2008 - 9,918 209 10,127

Net book value

At 30 September 2007 1,504 20,565 77 22,146

At 31 March 2008 6,765 20,296 108 27,169

At 30 September 2008 6,765 20,310 151 27,226

INDEPENDENT REVIEW REPORT TO ACCSYS TECHNOLOGIES PLC

Introduction

We have been engaged by the company to review the condensed set of financial statements in the half-yearly financial report for the six

months ended 30 September 2008 which comprises the consolidated income statement, the consolidated balance sheet, the consolidated statement

of changes in equity, the consolidated cash flow statement and the related notes. We have read the other information contained in the

half-yearly financial report and considered whether it contains any apparent misstatements or material inconsistencies with the information

in the condensed set of financial statements.

Directors' responsibilities

The interim report, including the financial information contained therein, is the responsibility of and has been approved by the

directors. The directors are responsible for preparing the interim report in accordance with the rules of both the London Stock Exchange for

companies trading securities on the Alternative Investment Market and Euronext Amsterdam by NYSE Euronext which require that the half-yearly

report be presented and prepared in a form consistent with that which will be adopted in the company's annual accounts having regard to the

accounting standards applicable to such annual accounts.

Our responsibility

Our responsibility is to express to the company a conclusion on the condensed set of financial statements in the half-yearly financial

report based on our review. Our report has been prepared in accordance with the terms of our engagement to assist the company in meeting the

requirements of the rules of both the London Stock Exchange for companies trading securities on the Alternative Investment Market and

Euronext Amsterdam by NYSE Euronext and for no other purpose. No person is entitled to rely on this report unless such a person is a person

entitled to rely upon this report by virtue of and for the purpose of our terms of engagement or has been expressly authorised to do so by

our prior written consent. Save as above, we do not accept responsibility for this report to any other person or for any other purpose and

we hereby expressly disclaim any and all such liability.

Scope of review

We conducted our review in accordance with International Standard on Review Engagements (UK and Ireland) 2410, ''Review of Interim

Financial Information Performed by the Independent Auditor of the Entity'', issued by the Auditing Practices Board for use in the United

Kingdom. A review of interim financial information consists of making enquiries, primarily of persons responsible for financial and

accounting matters, and applying analytical and other review procedures. A review is substantially less in scope than an audit conducted in

accordance with International Standards on Auditing (UK and Ireland) and consequently does not enable us to obtain assurance that we would

become aware of all significant matters that might be identified in an audit. Accordingly, we do not express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that causes us to believe that the condensed set of financial statements in the

half-yearly financial report for the six months ended 30 September 2008 is not prepared, in all material respects, in accordance with the

rules of both the London Stock Exchange for companies trading securities on the Alternative Investment Market and Euronext Amsterdam by NYSE

Euronext.

BDO STOY HAYWARD LLP

Chartered Accountants

London, 8 December 2008

www.accsysplc.com www.titanwood.com www.accoya.info

Accsys Technologies PLC is listed on the London Stock Exchange AIM market and Euronext Amsterdam by

NYSE Euronext under the symbol 'AXS'.

ACCOYA and the Trimarque Device are registered trademarks owned by Titan Wood Limited, part of the

Accsys Technologies PLC group of companies, and may not be used or reproduced without written permission.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR ILFIRFELDIIT

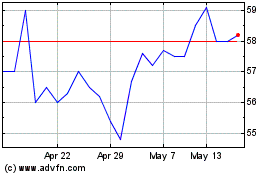

Accsys Technologies (LSE:AXS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Accsys Technologies (LSE:AXS)

Historical Stock Chart

From Jul 2023 to Jul 2024