TIDMAJB

RNS Number : 4778D

AJ Bell PLC

20 October 2022

20 October 2022

AJ Bell plc

Year-end trading update

AJ Bell plc ("AJ Bell" or the "Company"), one of the UK's

largest investment platforms, today issues a trading update in

respect of its financial year ended 30 September 2022.

Performance overview

Platform business

-- Customer numbers increased by 57,687 to close at 425,652, up

16% in the year, as the Company's dual-channel model continued

to deliver strong organic growth in both advised and D2C customers

o Total advised customers increased by 18,451 to close at 145,371,

up 15% in the year

o Total D2C customers increased by 39,236 to close at 280,281,

up 16% in the year

-- AUA closed the year down 2% at GBP64.1 billion, with strong

net inflows in the year offset by adverse market movements

of 11%. During the year the FTSE All-Share Index fell by 7%,

whilst the FTSE 250 Index fell by 25% (1)

-- Gross and net inflows were resilient against a volatile market

backdrop. Whilst being lower than the very strong prior year

comparatives, gross inflows were 36% higher and net inflows

were 18% higher than those achieved two years ago in FY20

o Gross inflows in the year of GBP10.1 billion (FY21: GBP10.9

billion; FY20: GBP7.4 billion)

o Net inflows in the year of GBP5.8 billion (FY21: GBP7.0 billion;

FY20: GBP4.9 billion)

AJ Bell Investments

-- Assets under management ("AUM") increased by 27% in the

year to close at GBP2.8 billion (FY21: GBP2.2 billion)

-- Underlying net inflows in the year were GBP1.05 billion,

an increase of 14% versus the prior year (FY21: GBP922

million)

-- All of AJ Bell's multi-asset funds have outperformed

their Investment Association sector benchmark over one,

three and five years to 30 September 2022

Non-platform business

-- Customer numbers increased by 1%, closing at 14,937

-- Net outflows in the year were GBP2.0 billion (FY21: GBP0.6

billion) following the previously reported closure of AJ Bell's

institutional stockbroking business

(1) Relevant benchmark indices considered for comparison

purposes

MSCI World

Benchmark FTSE All-Share FTSE 100 FTSE 250 (GBP)

Performance

(Year to 30 September

2022) (7%) (3%) (25%) (2%)

--------------- --------- --------- -----------

Michael Summersgill, Chief Executive Officer at AJ Bell,

commented:

"I am incredibly proud to have succeeded Andy as AJ Bell's CEO

and am pleased to update on another very successful year for the

Company.

"Organic customer growth of 16% and net inflows of GBP5.8

billion over the year, with GBP1.2 billion of net inflows in the

last quarter alone, once again demonstrates the strength of our

dual-channel platform, with both advised and D2C channels

performing very well.

"Advised platform inflows were strong throughout the year and

customer numbers grew 15% as advisers helped their clients to

navigate significant market volatility. Net inflows for the final

quarter of GBP0.9 billion were in line with the previous two

quarters, with advisers continuing to utilise the breadth of our

product offering and growing suite of investment solutions to meet

a wide range of client needs.

"In the D2C market our customer base grew by 16% as our

easy-to-use platform continued to attract retail investors looking

for a trusted provider to help them on their investment journey.

Net inflows for the year were strong at GBP2.5 billion and remained

resilient during the traditionally quieter summer months, with

GBP0.3 billion of net inflows in Q4 despite a slowdown in new

contributions from customers impacted by the rising cost of living.

Dodl, our new investing app, has been well received by customers

looking for a simpler way to invest and we have recently launched

some new features with the addition of US equities to the

investment range and the enabling of account transfers from other

providers.

"Our investments business delivered significant growth in assets

under management, driven by underlying net inflows of over GBP1

billion across our multi-asset funds and managed portfolio service.

Our asset allocation approach has delivered for our customers with

all our multi-asset funds outperforming their benchmarks over the

last 12 months and all but one delivering top quartile returns.

"Despite the challenging economic backdrop, our business model

continues to perform exceptionally well. We have a talented and

experienced management team in place that is focused on achieving

our growth ambitions in the investment platform market. Together we

are extremely excited about the long-term prospects for AJ

Bell."

Investor Site Visit

AJ Bell is hosting a site visit for institutional investors and

analysts at the Company's head office in Manchester this afternoon.

No new material information will be provided. A copy of the slides

and Q&A transcript will be made available at

ajbell.co.uk/investor-relations after the event.

Year ended Advised D2C Platform Total Non-platform

30 September 2022 Platform Platform Total

Opening customers 126,920 241,045 367,965 14,789 382,754

Closing customers 145,371 280,281 425,652 14,937 440,589

AUA and AUM (GBPbillion)

------------------------------- ---------- ------------- ---------- ------------- --------

Opening AUA 45.8 19.5 65.3 7.5 72.8

------------------------------- ---------- ------------- ---------- ------------- --------

Inflows(1) 6.2 3.9 10.1 0.2 10.3

Outflows(2) (2.9) (1.4) (4.3) (2.2) (6.5)

------------------------------- ---------- ------------- ---------- ------------- --------

Net inflows/(outflows) 3.3 2.5 5.8 (2.0) 3.8

------------------------------- ---------- ------------- ---------- ------------- --------

Market and other movements(3) (4.3) (2.7) (7.0) (0.4) (7.4)

------------------------------- ---------- ------------- ---------- ------------- --------

Closing AUA 44.8 19.3 64.1 5.1 69.2

------------------------------- ---------- ------------- ---------- ------------- --------

Closing AUM 1.7 1.0 2.7 (4) 0.1 (5) 2.8

Year ended Advised D2C Platform Total Non-platform

30 September 2021 Platform Platform Total

Opening customers 108,911 172,183 281,094 14,211 295,305

Closing customers 126,920 241,045 367,965 14,789 382,754

AUA and AUM (GBPbillion)

------------------------------- ---------- ------------- ---------- ------------- --------

Opening AUA 36.3 13.4 49.7 6.8 56.5

------------------------------- ---------- ------------- ---------- ------------- --------

Inflows(1) 6.3 4.6 10.9 0.2 11.1

Outflows(2) (2.5) (1.4) (3.9) (0.8) (4.7)

------------------------------- ---------- ------------- ---------- ------------- --------

Net inflows/(outflows) 3.8 3.2 7.0 (0.6) 6.4

------------------------------- ---------- ------------- ---------- ------------- --------

Market and other movements(3) 5.7 2.9 8.6 1.3 9.9

------------------------------- ---------- ------------- ---------- ------------- --------

Closing AUA 45.8 19.5 65.3 7.5 72.8

------------------------------- ---------- ------------- ---------- ------------- --------

Closing AUM 1.3 0.8 2.1 (4) 0.1 (5) 2.2

(1) Transfers-in, subscriptions, contributions and tax

relief

(2) Transfers-out, cash withdrawals, benefits and tax

payments

(3) Total investment returns and revaluations, net of charges

and taxes

(4) Platform AUA which is held in AJ Bell's Funds or Managed

Portfolio Service

(5) Assets which are held in AJ Bell's Funds or Managed

Portfolio Service via third-party platforms

Contacts:

AJ Bell

Shaun Yates, Investor Relations

-- Director +44 (0) 7522 235 898

Charlie Musson, Brand and PR

-- Director +44 (0) 7834 499 554

Historical customer numbers, AUA and AUM by quarter

Advised Platform Qtr to Qtr to Qtr to Qtr to Qtr to

30 31 31 30 30

September December March June September

2021 2021 2022 2022 2022

Customers 126,920 131,610 137,201 141,856 145,371

AUA and AUM

(GBPbillion)

------------------ ----------- ---------- -------- -------- -----------

Opening AUA 44.2 45.8 47.5 46.5 44.3

------------------ ----------- ---------- -------- -------- -----------

Inflows(1) 1.7 1.6 1.6 1.5 1.5

Outflows(2) (0.7) (1.0) (0.7) (0.6) (0.6)

------------------ ----------- ---------- -------- -------- -----------

Net inflows 1.0 0.6 0.9 0.9 0.9

------------------ ----------- ---------- -------- -------- -----------

Market and other

movements(3) 0.6 1.1 (1.9) (3.1) (0.4)

Closing AUA 45.8 47.5 46.5 44.3 44.8

----------- ---------- -------- --------

Closing AUM(4) 1.3 1.2 1.4 1.4 1.7

D2C Platform Qtr to Qtr to Qtr to Qtr to Qtr to

30 31 31 30 30

September December March June September

2021 2021 2022 2022 2022

Customers 241,045 251,664 266,182 275,647 280,281

AUA and AUM

(GBPbillion)

------------------ ----------- ---------- -------- -------- -----------

Opening AUA 18.9 19.5 20.6 20.4 19.2

------------------ ----------- ---------- -------- -------- -----------

Inflows(1) 1.0 1.1 1.1 1.1 0.6

Outflows(2) (0.4) (0.3) (0.4) (0.4) (0.3)

------------------ ----------- ---------- -------- -------- -----------

Net inflows 0.6 0.8 0.7 0.7 0.3

------------------ ----------- ---------- -------- -------- -----------

Market and other

movements(3) - 0.3 (0.9) (1.9) (0.2)

------------------ ----------- ---------- -------- -------- -----------

Closing AUA 19.5 20.6 20.4 19.2 19.3

------------------ ----------- ---------- -------- -------- -----------

Closing AUM(4) 0.8 0.9 0.9 1.0 1.0

Non-platform Qtr to Qtr to Qtr to Qtr to Qtr to

30 31 31 30 30

September December March June September

2021 2021 2022 2022 2022

Customers 14,789 14,792 14,926 14,947 14,937

AUA and AUM

(GBPbillion)

------------------ ----------- ---------- -------- -------- -----------

Opening AUA 7.3 7.5 7.5 7.2 5.2

------------------ ----------- ---------- -------- -------- -----------

Inflows(1) - 0.1 - 0.1 -

Outflows(2) (0.1) (0.2) (0.1) (1.8) (0.1)

------------------ ----------- ---------- -------- -------- -----------

Net outflows (0.1) (0.1) (0.1) (1.7) (0.1)

------------------ ----------- ---------- -------- -------- -----------

Market and other

movements(3) 0.3 0.1 (0.2) (0.3) -

------------------ ----------- ---------- -------- -------- -----------

Closing AUA 7.5 7.5 7.2 5.2 5.1

------------------ ----------- ---------- -------- -------- -----------

Closing AUM(5) 0.1 - - 0.1 0.1

Total closing

AUA 72.8 75.6 74.1 68.7 69.2

------------------ ----------- ---------- -------- -------- -----------

Total closing

AUM 2.2 2.1 2.3 2.5 2.8

------------------ ----------- ---------- -------- -------- -----------

(1) Transfers-in, subscriptions, contributions and tax

relief

(2) Transfers-out, cash withdrawals, benefits and tax

payments

(3) Total investment returns and revaluations, net of charges

and taxes

(4) Platform AUA which is held in AJ Bell's Funds or Managed

Portfolio Service

(5) Assets which are held in AJ Bell's Funds or Managed

Portfolio Service via third-party platforms

About AJ Bell:

Established in 1995, AJ Bell is one of the largest investment

platforms in the UK, operating at scale in both the advised and

direct-to-consumer markets.

Our purpose is to help people invest by providing them with

easy-to-use online services and information to help them build and

manage their portfolios.

We do that via our three platform propositions - AJ Bell

Investcentre in the advised market and AJ Bell Youinvest and Dodl

by AJ Bell in the direct-to-consumer market, which all give

investors access to Pensions, ISAs and General Investment / Dealing

Accounts.

AJ Bell Investcentre and AJ Bell Youinvest provide access to a

broad investment range including shares and other instruments

traded on the major stock exchanges around the world, as well as

all mainstream collective investments available in the UK and our

own range of AJ Bell funds.

Dodl by AJ Bell offers a simplified investment range to make it

easier for customers to choose investments and buy and sell them

without paying any commission.

We also offer a Cash savings hub via AJ Bell Youinvest which

provides access to a range of competitive savings accounts to help

people manage their cash savings.

AJ Bell is headquartered in Manchester, UK, with offices in

London and Bristol.

Forward-looking statements

This announcement contains forward-looking statements that

involve substantial risks and uncertainties, and actual results and

developments may differ materially from those expressed or implied

by these statements. These forward-looking statements are

statements regarding AJ Bell's intentions, beliefs or current

expectations concerning, among other things, its results of

operations, financial condition, prospects, growth, strategies, and

the industry in which it operates. By their nature, forward-looking

statements involve risks and uncertainties because they relate to

events and depend on circumstances that may or may not occur in the

future. These forward-looking statements speak only as of the date

of this announcement and AJ Bell does not undertake any obligation

to publicly release any revisions to these forward-looking

statements to reflect events or circumstances after the date of

this announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFLFEDIRLALIF

(END) Dow Jones Newswires

October 20, 2022 02:00 ET (06:00 GMT)

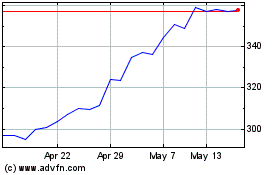

Aj Bell (LSE:AJB)

Historical Stock Chart

From May 2024 to Jun 2024

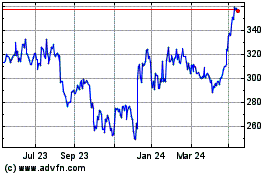

Aj Bell (LSE:AJB)

Historical Stock Chart

From Jun 2023 to Jun 2024