TIDMAJB

RNS Number : 8153M

AJ Bell PLC

26 May 2022

26 May 2022

AJ Bell plc

Interim results for the six months ended 31 March 2022

AJ Bell plc ('AJ Bell' or the 'Company'), one of the UK's

largest investment platforms, today announces its interim results

for the six-month period ended 31 March 2022.

Highlights

-- Solid performance delivered across all metrics against very

strong prior year comparatives

-- Investment in new propositions has progressed in line with

expectations, with Dodl by AJ Bell launched in April 2022

and Touch by AJ Bell on track to soft launch later in the

year

-- Continued organic growth driven by platform propositions,

with total customers up by 35,555 to 418,309, net inflows

of GBP2.8 billion and assets under administration (AUA) closing

at GBP74.1 billion

-- Customer retention rate up to 95.4% (FY21: 95.0%)

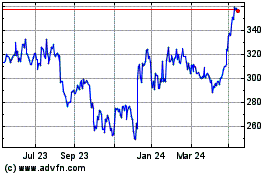

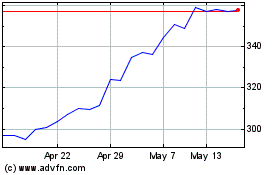

-- Revenue up to GBP75.5 million (HY21: GBP73.9 million), profit

before tax of GBP26.1 million (HY21: GBP31.6 million) and

a PBT margin of 34.6% (HY21: 42.8%)

-- Diluted earnings per share of 5.08 pence (HY21: 6.26 pence)

-- Interim dividend of 2.78 pence per share in line with stated

dividend policy

-- Revenue and profit margins are expected to increase in the

second half, with PBT margin guidance for FY22 raised to

c.35% (previous guidance 32-33%) and further improvement

anticipated in FY23

Andy Bell, Chief Executive Officer at AJ Bell, commented:

"I'm pleased to announce another solid set of results for the

first half of the year. Our dual-channel platform continues to

attract and retain long-term customers in both the advised and

direct-to-consumer markets, with our platform retention rate of

95.4% evidencing the quality of our propositions and our high

customer service levels.

"The organic growth in customers and AUA helped to deliver an

increase in revenue to GBP75.5 million and we remained highly

profitable, with profit before tax of GBP26.1 million and a PBT

margin of 34.6%. This is a very good result against a significantly

more challenging market backdrop to that experienced in the first

half of last year, when retail investor engagement and dealing

activity was exceptionally high particularly in the

direct-to-consumer market.

"The impact of normalised customer dealing activity and lower

interest rates compared to the same period last year resulted in a

lower revenue margin in this period. However, our diversified

revenue model positions us well across all market conditions and we

are now seeing the positive impact of recent interest rate rises on

our revenue margins.

"Our secure and scalable platform has been designed to both

facilitate growth and drive operational gearing, enabling us to

once again exercise strong control over our operational costs. We

have also continued to invest in new customer propositions to

broaden our reach in both the advised and direct-to-consumer

markets. In April we launched Dodl by AJ Bell, a new

commission-free investing app which we believe will appeal

particularly to people who want an easy, low-cost way to get

started with investing. We plan to follow this with Touch by AJ

Bell, a simplified, mobile-led platform proposition for the advised

market, which is on track to soft launch later this year.

"As our business grows we are committed to sharing efficiency

gains with our customers, whilst continuing to invest in new

products and services for them. At a time when people are seeking

to manage the impact of rising living costs, we have announced a

number of reductions to our platform charges across both our

advised and direct-to-consumer propositions which will deliver

total annualised savings to our customers of around GBP5

million.

"This follows consistent reductions to the charges on our AJ

Bell funds as assets under management have grown. The annual

charges on the first five multi-asset funds we launched five years

ago have nearly halved from 0.50% to 0.31% during that time, again

delivering significant savings to customers.

"Our strong financial position and the Board's confidence in the

long-term prospects for the business support continuing returns to

shareholders alongside ongoing investment in our customer

propositions. We remain committed to our stated dividend policy and

the Board has declared an interim dividend of 2.78 pence per

share.

"The long-term structural drivers of growth in the UK investment

platform market remain strong with around two-thirds of our

estimated GBP3 trillion target market not yet on a platform. We

continue to see customers moving onto investment platforms to

benefit from increased flexibility and lower costs and we are well

positioned to attract an increasing market share with our leading

propositions and established brand in both the advised and

direct-to-consumer segments.

"Whilst market uncertainty is likely to persist in the

short-term, our business model ensures we can continue to invest in

our customer propositions whilst delivering strong financial

performance and we expect profit before tax for the full year to be

at least in line with consensus market expectations."

Financial highlights

Six months Six months

ended 31 March ended 31 March

2022 2021 Change

Revenue GBP75.5m GBP73.9m 2%

---------------- ---------------- ----------

Revenue per GBPAUA* 20.3bps 24.0bps (3.7bps)

---------------- ---------------- ----------

PBT GBP26.1m GBP31.6m (17%)

---------------- ---------------- ----------

PBT margin 34.6% 42.8% (8.2ppts)

---------------- ---------------- ----------

Diluted earnings per

share 5.08p 6.26p (19%)

---------------- ---------------- ----------

Interim dividend per

share 2.78p 2.46p 13%

---------------- ---------------- ----------

Non-financial highlights

Six months Year ended

ended 31 March 30 September

2022 2021 Change

Number of retail customers 418,309 382,754 9%

---------------- -------------- --------

- Platform 403,383 367,965 10%

---------------- -------------- --------

- Non-platform 14,926 14,789 1%

---------------- -------------- --------

AUA* GBP74.1bn GBP72.8bn 2%

---------------- -------------- --------

- Platform GBP66.9bn GBP65.3bn 2%

---------------- -------------- --------

- Non-platform GBP7.2bn GBP7.5bn (4%)

---------------- -------------- --------

AUM* GBP2.3bn GBP2.2bn 5%

---------------- -------------- --------

Customer retention rate 95.4% 95.0% 0.4ppts

---------------- -------------- --------

*see Alternative Performance Measures below

Contacts:

AJ Bell

Shaun Yates, Investor Relations

-- Director +44 (0) 7522 235 898

Charlie Musson, Brand and PR

-- Director +44 (0) 7834 499 554

Results presentation details

A pre-recorded video with Andy Bell (CEO) and Michael

Summersgill (Deputy CEO and CFO) discussing these results will be

available on our website (ajbell.co.uk/investor-relations) along

with an accompanying investor presentation from 07.00 BST today.

Management will be hosting a meeting for sell-side analysts at

08.15 BST today. Attendance is by invitation only.

Management will also be hosting a group call for investors at

15.30 BST on Wednesday 1 June. Please contact Camilla Crowe at

c.crowe@numis.com for registration details.

Forward-looking statements

The interim results contain forward-looking statements that

involve substantial risks and uncertainties, and actual results and

developments may differ materially from those expressed or implied

by these statements. These forward-looking statements are

statements regarding AJ Bell's intentions, beliefs or current

expectations concerning, among other things, its results of

operations, financial condition, prospects, growth, strategies, and

the industry in which it operates. By their nature, forward-looking

statements involve risks and uncertainties because they relate to

events and depend on circumstances that may or may not occur in the

future. These forward-looking statements speak only as of the date

of these interim results and AJ Bell does not undertake any

obligation to publicly release any revisions to these

forward-looking statements to reflect events or circumstances after

the date of the interim results.

Chief Executive Officer's report

Our dual-channel platform, serving the growing advised and D2C

platform markets, continues to attract new customers with

significant net inflows delivered during the first half of the

financial year. We remain focused on our core purpose; to help

people invest, by providing the easiest platform to use.

Overview

We delivered strong net AUA inflows of GBP2.8 billion with total

AUA closing at GBP74.1 billion (FY21: GBP72.8 billion). This

performance was achieved against a very different market backdrop

to that seen in the prior year with adverse market movements of

GBP1.5 billion since the year end.

Retail customers grew by 35,555 during the period to 418,309

(FY21: 382,754), with our retention rate increasing to 95.4% (FY21:

95.0%), testament to our high-quality propositions and customer

service levels. We continue to see strong demand for our platform

propositions with our advised customers growing by 8% and our D2C

customers by 10% in the period.

The UK investment platform market, measured by AUA, has grown by

13% per annum since 2012, with the advised and D2C market segments

growing at a similar rate. During that period, we have continued to

increase our market share, growing our advised assets by 21% per

annum and our D2C by 36% per annum. Our dual-channel platform

enables us to benefit from operating in both segments of this

growing platform market.

We recorded a solid financial performance in the first half of

the year, with revenue up to GBP75.5 million (HY21: GBP73.9

million). Revenue margin on AUA was lower than the comparative

period as expected, due to the normalisation of dealing activity

and lower interest rates earned on customer assets. The reduction

in PBT, from GBP31.6 million to GBP26.1 million, represents the

lower revenue margin earned on assets coupled with increased

investment in our brand, technology and propositions to support our

long-term growth strategy. Revenue margin is expected to increase

in the second half of the year as a result of the higher interest

rate environment.

Following the period-end we launched an exciting new investing

app, Dodl by AJ Bell (Dodl), which expands our offering in the D2C

market. We believe there is a significant and underserved market

for Dodl. It is estimated that 8.6 million adults in the UK hold

more than GBP10,000 of investible assets in cash, equating to at

least GBP86 billion of excess cash savings which are being eroded

in real terms by high inflation and low interest rates. Our own

research suggests that many of these people don't know where to

start investing and are deterred by too much choice and complexity.

Dodl's ease of use, simplified investment range and low charges

make it an ideal solution for this type of customer. The

combination of Dodl and AJ Bell Youinvest means we have one of the

most comprehensive customer offerings in the D2C platform market,

ensuring we remain in a very strong position to deliver long-term

growth.

The operational gearing inherent within the business model

allows us to share efficiency gains with our customers, whilst

continuing to invest in the long-term growth of the business. At a

time where customers are seeking to reduce their living costs, we

will be reducing charges across our AJ Bell Investcentre and AJ

Bell Youinvest platform propositions in the second half of the

year. We remain committed to providing high quality, low-cost

investment platform propositions that cater for all investors.

Strategic update

Investing for all

At AJ Bell, we believe in making investing accessible to all,

whether investing directly or with the help of a financial adviser,

irrespective of age, wealth and investment approach. Our aim is to

broaden our customer reach and promote a better understanding and

awareness of investment choices that ultimately deliver good

outcomes for our customers. Our latest national TV advertising

campaign 'investing for all' reflects this belief and we continue

to invest in our brand as part of raising awareness of investing

and how we can help people to invest.

Our new simplified propositions, Dodl and Touch by AJ Bell

(Touch) will help to broaden our reach to a new generation of

investors across both the D2C and advised segments. Dodl is aimed

at younger, less experienced investors, offering a simplified

investment range and will be amongst the best value investment

platforms in the market. Touch, which is on track to soft launch

later in the year, will be a mobile-focused platform service that

will broaden our offering to financial advisers and help them serve

a wider base of clients.

Our research shows that, on average, women in the UK have half

the level of savings and investments that men do, a statistic that

we want to help change. The launch of AJ Bell Money Matters in

November 2021 has seen us roll out a range of initiatives focused

on encouraging women to engage with investing, in order to help

close the gender investment gap. This includes dedicated website

content, a regular podcast, monthly newsletters, webinars, live

events and social media interaction.

Advised propositions

The advised market continues to demonstrate steady year-on-year

growth and we delivered strong net inflows of GBP1.5 billion in the

period. This was partially offset by GBP0.8 billion of adverse

market movements, resulting in closing AUA of GBP46.5 billion

(FY21: GBP45.8 billion). Customer numbers increased by 10,281

during the period to 137,201 (FY21: 126,920); an increase of

8%.

We continued to improve our AJ Bell Investcentre proposition for

the benefit of our customers and their advisers, making several

enhancements with a focus on ease of use. We also launched our

flexible ISA, allowing temporary withdrawals during the tax year

without affecting annual ISA subscription limits.

We aim to share the benefits of operating at scale with our

customers, an example of this is through regularly reviewing our

charges to ensure they position us well to support advisers and

their clients. From 10 June, we will remove our charge for SIPP

establishment, where the process is initiated online. We will also

remove our charge for transferring pensions to SIPPs in cash and

some of our dealing charges.

The development of Touch, our simplified, mobile-led platform

proposition is progressing well, ahead of its planned soft launch

later this year.

Investival, our flagship adviser conference, was held in a

hybrid format in November 2021 having been entirely online in 2020.

More than 400 finance professionals attended in person with over

300 joining virtually, making it the most popular one yet. The

event was very well received and is now recognised as one of the

largest investment conferences for advisers in the UK. We have also

continued to deliver our 'On the Road' seminars alongside monthly

'Off the Road' webinars following positive feedback and ongoing

demand. The success of our ongoing engagement with advisers

highlights the value they see in us as a trusted partner.

D2C propositions

We delivered strong net inflows of GBP1.5 billion in the period.

This was partially offset by GBP0.6 billion of adverse market

movements, resulting in closing AUA of GBP20.4 billion (FY21:

GBP19.5 billion). Customer numbers continued to grow, increasing by

25,137 during the period to 266,182 (FY21: 241,045), an increase of

10%.

We have continued to develop AJ Bell Youinvest, with multiple

enhancements focused on ease of use delivered during the

period.

Our efficient operating model and robust cost control allows us

to reduce charges for our customers to ensure we continue to

provide excellent value for money. Last year, we commenced a review

of our trading model following the higher levels of dealing

activity experienced during the pandemic, in order to reduce the

costs for customers. As a result, I am pleased to announce that we

will be reducing our foreign exchange commission rates on 1 July,

whilst also reducing the cap on funds custody charges, removing

charges for in-specie transfers out and simplifying our dividend

re-investment charge.

Dodl launched on 19 April 2022 and sits alongside our existing

D2C platform proposition AJ Bell Youinvest. Together they provide

great value investment platform options for retail investors,

catering for all levels of experience and investment needs. Dodl

offers ISAs, LISAs, pensions and GIAs with an annual charge of just

0.15% and no commission for buying or selling investments. The

proposition's simplified investment range offers customers 30 funds

catering for different themes and risk appetites. It also features

50 popular shares in UK-listed companies for those who like to

invest in their favourite brands, with US shares coming later in

the year.

AJ Bell Investments

Our range of investment solutions continue to be a popular

choice with investors, with total AUM up to GBP2.3 billion (FY21:

GBP2.2 billion).

The first five AJ Bell multi-asset funds launched in 2017 have

recently passed their fifth anniversary, an important performance

milestone particularly for advisers. Performance of all five funds

was in the top 30% when compared against their peer groups, with

four being in the top quintile. Since launching these funds we have

shared the benefits of our increasing scale with customers,

reducing the Ongoing Charges Figure (OCF), by nearly half from

0.50% to 0.31% during that time. In February this year we also

implemented a new simplified pricing structure, setting a single

OCF for all of our multi-asset growth funds, making it easier for

customers and advisers to understand.

Customer services and technology

Our dual-channel single operating model ensures we can

efficiently service our customers whilst maintaining our

high-quality customer service levels. In a period of continued

customer growth, our operational performance indicators have shown

excellent levels of customer service as demonstrated by our high

4.5-star Trustpilot score, rated by our retail customers. The

strength of our customer service and proposition is also reflected

in our platform customer retention rate, which is in excess of

95%.

Our secure and scalable platform has been designed to both

facilitate growth and drive operational gearing. In the period we

continued to invest in our technology, enhancing our existing

propositions alongside the development of Dodl and Touch. Our

hybrid technology model serves us well, allowing us to build

adaptable, easy-to-use interfaces and minimise the cost impact of

ongoing regulatory compliance.

We have embedded the FCA's new regulatory requirements on

operational resilience, effective from 31 March 2022, into our

operating framework and processes. These rules are designed to

ensure regulated firms are better able to prevent, adapt to,

respond to, recover from and learn from operational

disruptions.

We continue to drive improvements and invest for the future to

ensure that we provide a high-quality service to our customers.

People and culture

Our new hybrid working model came into effect from 1 January

2022 and is working well in balancing the needs of our people and

business operations. As the Government removed restrictions during

the period, we have gradually increased office numbers and were

pleased to see the return of our programme of social activities and

events in-person to enhance engagement.

We run a wide programme of activities and events to facilitate

engagement between the Board, senior management and the wider

workforce. Following the appointment of Helena Morrissey as our

designated Non-Executive Director for employee engagement, we

hosted the first Employee Voice Forum of the year at our head

office in March 2022. I look forward to hearing feedback from the

forum as we progress through the year.

It was pleasing to see more events and opportunities to support

our local communities as COVID-19 restrictions were lifted. Our

people have taken part in a number of charitable initiatives and

fundraising events during the first half of the year, continuing to

support a range of local charities including Fare Share, Wood

Street Mission and City of Trees. We have also launched an

initiative to support education in our communities by refurbishing

IT kit that we no longer need, and then donating it to local

schools.

Regulatory developments

There are a number of significant regulatory developments

underway that will shape the market we operate in.

The FCA Consumer Investments Strategy recently identified that

nearly 8.6 million people in the UK have more than GBP10,000 of

investible assets held predominantly in cash. The FCA's stated aim

is to reduce this number of people by 20%, on the basis they would

be better off in a risk-based investment. We believe Dodl is

ideally placed to benefit from this drive by the regulator as it

gives investors an easy, low-cost way to start investing.

Another key output from the Consumer Investments Strategy is the

new Consumer Duty. This is a major regulatory development which

puts the onus on providers to ensure good customer outcomes. We

support the intention here, even though most regulated firms would

argue that this is already well embedded. Any concerns we have are

centred around making sure that providers understand what this

means at a practical level.

Investment pathways were an example of the challenges caused by

micro-regulation. What is right for an insured personal pension may

not be right for a platform pension. The regulatory solution to a

failure in administration and oversight by insured pension

providers - customers inadvertently remaining invested in cash -

created significant pain for platform pension providers with little

discernible customer benefit.

More recent regulatory proposals to introduce default funds for

non-workplace pensions, which includes platform pensions, again

demonstrates a desire for the regulator to micro-manage the

solution. Lifestyle funds are the proposed default fund solution.

These funds, which shift from equities to bonds as the pension

saver reaches their retirement age, are from a bygone era.

Retirement is no longer defined by a single date, with income

drawdown now the main delivery mechanism for taking an income in

retirement, rather than buying an annuity. We support the idea of a

default fund but with a focus on creating good outcomes for

consumers, we urge the regulator to let providers decide what type

of default fund best suits their customers.

Another aim of both the Consumer Investments Strategy and the

new Consumer Duty is to make it easier for firms to help consumers

access and identify investments that suit their circumstances and

attitude to risk. Investment platforms are ideally placed to

provide this guidance to customers but the current regulatory

guidance around what constitutes financial advice (as opposed to

investment guidance) makes it difficult for execution-only

providers to offer services - such as risk profiling or information

on specific investments held by customers - which could help them

improve their investment strategy.

The FCA's proposal for pensions dashboards is another

significant development that aims to help customers build a better

picture of their retirement savings, allowing them to see all of

their pensions in one place and get an impression of the income

they could expect from each in retirement. Statutory Money Purchase

Illustrations (SMPI) have been around for nearly twenty years and

it is fair to say that these have been routinely ignored by pension

savers. Going forward they will be the foundation on which pensions

dashboards will deliver estimates of pension income to pension

savers. We are at the early stages of the consultation being led by

the Financial Reporting Council (FRC), on behalf of the DWP, to

determine the underlying actuarial basis for these projections.

Once again, despite platform pensions dominating the market, the

proposals are being driven by what works for insured pensions and

are unworkable for platform pensions. I have urged the FCA and the

FRC to get together and agree a simple and consistent basis so that

the pension projected at the point of sale is consistent with the

pension projections during the lifetime of the pension.

Dividend

Our strong balance sheet, robust liquidity position and future

prospects for the business support both ongoing investment in the

business and continuing returns to shareholders. The Board has

therefore declared an interim dividend of 2.78 pence per share in

line with our stated dividend policy, to which we remain

committed.

Outlook

The long-term structural drivers of growth in the UK investment

platform market remain strong with around two-thirds of our

estimated GBP3 trillion target addressable market not yet on a

platform. We continue to see a structural shift from non-platform

providers to platforms, where assets already in the financial

system are migrated onto platforms to increase flexibility and

reduce costs for customers. We expect this to continue to be a

driver of significant inflows in the platform market and are well

positioned to attract an increasing share with our leading

propositions and established brand in both the advised and D2C

segments.

The macro-economic environment is uncertain as high inflation in

the UK has led to interest rate rises and the growing

cost-of-living crisis has been further exacerbated by the ongoing

war in Ukraine. The rising cost of living is likely to impact

investable income across the economy with the savings ratio falling

back towards pre-pandemic levels. This presents a potential

short-term headwind for inflows, particularly in the D2C market and

the likelihood of increased administrative expenses. Our

diversified revenue model provides inflation protection, ensuring

we are well-equipped to succeed in different macro-economic

conditions. A higher interest rate environment will provide a

significant benefit, with higher revenue and profit margins

expected both in the second half of the financial year and

FY23.

In a high-inflation environment where consumers are increasingly

looking for low-cost solutions, we are reducing a number of charges

across our existing propositions as we look to share our economies

of scale with our customers. Our existing propositions,

complemented by our two new app-based, simplified, low-cost

platform propositions, ensure we are well placed to support the

next generation of investors and to capitalise on future growth

opportunities.

Our secure and scalable platform propositions and established

brand position us well to deliver further organic growth and

capture an increasing share of the market.

Andy Bell

Chief Executive Officer

Financial review

The Group delivered a solid financial performance in the first

half of the year, with revenue up to GBP75.5 million and PBT of

GBP26.1 million. We have invested in our brand, technology and

platform propositions as part of our growth strategy to capitalise

on the opportunities created in the UK platform market, that

continues to benefit from long-term structural growth drivers.

Business performance

Customers

Customer numbers increased by 35,555 during the period to a

total of 418,309. This growth has been driven by our platform

propositions, with our D2C platform delivering a 10% increase in

customers to 266,182 and our advised platform customers up by 8% to

137,201. In addition, our platform customer retention rate remained

high at 95.4% (FY21: 95.0%).

Six months ended Six months ended Year ended

31 March 31 March 30 September

2022 2021 2021

Platform 403,383 332,276 367,965

Non-platform 14,926 14,521 14,789

------------- ----------------------- ---------------- ------------

Total 418,309 346,797 382,754

------------- ----------------------- ---------------- ------------

Assets Under Administration

Six months ended 31 March 2022

Advised D2C Total

platform platform platform Non-platform Total

GBPbn GBPbn GBPbn GBPbn GBPbn

--------------------------- -------- -------- -------- ------------ -----

As at 1 October 2021 45.8 19.5 65.3 7.5 72.8

--------------------------- -------- -------- -------- ------------ -----

Inflows 3.2 2.2 5.4 0.1 5.5

Outflows (1.7) (0.7) (2.4) (0.3) (2.7)

--------------------------- -------- -------- -------- ------------ -----

Net inflows/(outflows) 1.5 1.5 3.0 (0.2) 2.8

--------------------------- -------- -------- -------- ------------ -----

Market and other movements (0.8) (0.6) (1.4) (0.1) (1.5)

--------------------------- -------- -------- -------- ------------ -----

As at 31 March 2022 46.5 20.4 66.9 7.2 74.1

--------------------------- -------- -------- -------- ------------ -----

Six months ended 31 March 2021

Advised D2C Total

platform platform platform Non-platform Total

GBPbn GBPbn GBPbn GBPbn GBPbn

--------------------------- -------- -------- -------- ------------ -----

As at 1 October 2020 36.3 13.4 49.7 6.8 56.5

--------------------------- -------- -------- -------- ------------ -----

Inflows 2.8 2.2 5.0 0.1 5.1

Outflows (1.1) (0.6) (1.7) (0.3) (2.0)

--------------------------- -------- -------- -------- ------------ -----

Net inflows/(outflows) 1.7 1.6 3.3 (0.2) 3.1

--------------------------- -------- -------- -------- ------------ -----

Market and other movements 3.1 1.9 5.0 0.6 5.6

--------------------------- -------- -------- -------- ------------ -----

As at 31 March 2021 41.1 16.9 58.0 7.2 65.2

--------------------------- -------- -------- -------- ------------ -----

We continued to see strong AUA inflows, driven by our platform

propositions. Gross inflows in the period were GBP5.5 billion, up

8% compared to the previous year (HY21: GBP5.1 billion).

Outflows increased by GBP0.7 billion to GBP2.7 billion versus

the comparative period. This increase was driven partly by an

exceptional bulk annuity purchase by an adviser firm which resulted

in a one-off outflow of GBP0.2 billion from both advised platform

AUA and AJ Bell Investments AUM. We also saw GBP0.3 billion of

non-platform outflows in the period following our decision to close

our institutional stockbroking service during the first half. The

final non-platform outflows relating to this closure, totalling

approximately GBP1.8 billion, are expected to complete in the

second half of the financial year.

The uncertainty across global markets driven by inflationary

pressure on the cost of living and the war in Ukraine contributed a

GBP1.5 billion adverse movement on asset values. This compares to

favourable market movements of GBP5.6 billion in the comparative

period last year. AUA closed at GBP74.1 billion, an increase of

GBP1.3 billion in the period.

Financial performance

Revenue

Unaudited Unaudited Audited

Six months ended Six months ended Year ended

31 March 31 March 30 September

2022 2021 2021

GBP000 GBP000 GBP000

--------------------- ----------------- --------------------------------- ------------

Recurring fixed 14,982 14,050 28,598

Recurring ad valorem 42,365 37,917 77,955

Transactional 18,181 21,930 39,273

--------------------- ----------------- --------------------------------- ------------

Total 75,528 73,897 145,826

--------------------- ----------------- --------------------------------- ------------

Revenue increased by 2% to GBP75.5 million (HY21: GBP73.9

million).

Revenue from recurring fixed fees increased by 7% to GBP15.0

million (HY21: GBP14.1 million), primarily due to higher pension

administration revenue from our advised platform customers.

Recurring ad valorem revenue grew by 12% to GBP42.4 million

(HY21: GBP37.9 million). The key driver of this growth was the

increase in average AUA in the period. This was partially offset by

a lower average interest rate earned on customer cash balances than

in the comparative period last year.

Revenue from transactional fees decreased by 17% to GBP18.2

million (HY21: GBP21.9 million). This decrease was due to a

normalisation of dealing activity levels in the current period

following the significantly elevated levels seen in the first half

of the prior year.

Our overall revenue margin of 20.3bps (HY21: 24.0bps) in the

period reflects the reduced transactional revenues and lower

average interest rate earned on cash as noted above.

Since the start of the financial year, the Bank of England base

rate has increased from 0.1% to 1.0%. This higher interest rate

environment will deliver a gradual increase in recurring ad valorem

revenue across our platform. Whilst allowing for the impact of our

planned price reductions for AJ Bell Investcentre and AJ Bell

Youinvest, our consolidated revenue margin for FY22 is currently

expected to be higher than the 20.3bps reported in the first half,

with a further improvement anticipated in FY23.

Administrative expenses

Unaudited Unaudited Audited

Six months ended Six months ended Year ended

31 March 31 March 30 September

2022 2021 2021

GBP000 GBP000 GBP000

------------------------ ----------------- ----------------- ------------

Distribution 7,592 5,402 11,095

Technology 14,771 11,482 25,765

Operational and support 26,681 24,978 53,115

------------------------ ----------------- ----------------- ------------

Total 49,044 41,862 89,975

------------------------ ----------------- ----------------- ------------

Administrative expenses increased by 17% to GBP49.0 million

(HY21: GBP41.9 million).

Distribution costs increased by 41% to GBP7.6 million (HY21:

GBP5.4 million) as we continued to invest in our brand to help

deliver long-term growth. In February we launched a new national TV

advertising campaign and we also increased D2C marketing activity

in the period. The year-on-year increase is also partly reflective

of a lower than normal spend in the prior year, when both

advertising and sponsorship opportunities were limited by COVID-19

restrictions. We expect the rate of increase in distribution costs

to moderate over the course of the full year as planned, following

the higher activity undertaken in the first half in the lead-up to

the tax year end.

Technology costs increased by 29% to GBP14.8 million (HY21:

GBP11.5 million). This increase reflects the continued investment

in growing the size of our technology team, enabling us to deliver

change initiatives to support our continued growth whilst also

developing our new propositions, Dodl and Touch. A significant

proportion of the increase in technology costs related to the

Adalpha acquisition in March 2021. Excluding Adalpha-related costs

in the period of GBP1.7 million (HY21: GBP0.3 million), underlying

technology costs increased by 17% year-on-year.

Operational and support costs increased by 7% to GBP26.7 million

(HY21: GBP25.0 million) as the business continued to scale

efficiently. The higher costs were driven by an increase in the

average number of employees to support our continued growth,

partially offset by lower costs resulting from the reduced customer

dealing activity during the period. Excluding the impact of

dealing-related costs, underlying operational and support costs

increased by 10% year-on-year.

Profit and earnings

PBT of GBP26.1 million (HY21: GBP31.6 million) and PBT margin of

34.6% (HY21: 42.8%) reflect the lower revenue margin in the period

and planned investment in our brand, technology and product

propositions to drive long term growth. PBT margin for the full

year is expected to increase, driven by the higher revenue margin

that is more than offsetting increases in administrative

expenses.

The effective rate of tax for the period was 20.0% (HY21:

18.7%), slightly higher than the standard rate of UK Corporation

Tax of 19.0%, as a result of disallowable charges relating to the

Adalpha earn-out arrangement.

Basic earnings per share fell by 19% to 5.10p (HY21: 6.29p).

Diluted earnings per share (DEPS), which accounts for the dilutive

impact of outstanding share awards, decreased by 19% to 5.08p

(HY21: 6.26p).

Financial position

Capital and liquidity

The Group's financial position remains strong, with net assets

totalling GBP115.9 million (HY21: GBP117.9 million) at 31 March

2022 and a return on assets of 18% (HY21: 22%).

We operate a highly cash-generative business, with a short

working capital cycle that ensures profits are quickly converted

into cash. Our period end balance sheet included cash balances of

GBP73.2 million.

We have continued to maintain a healthy surplus over our

regulatory capital requirement throughout the period. The

Investment Firm Prudential Regime (IFPR) came into effect from 1

January 2022, focusing prudential requirements on the potential

harm the firm can pose to its customers, markets and itself whilst

introducing a basic liquidity requirement for all investment firms.

We are currently undertaking our first Internal Capital and Risk

Assessment (ICARA) process as required by the new regime; this is

not expected to have a material impact on our capital

requirements.

Dividend

The Board has declared an interim dividend of 2.78 pence per

share (HY21: 2.46 pence per share), representing 40% of the FY21

total ordinary dividend of 6.96 pence per share, in line with our

dividend policy.

The interim dividend declared reflects the financial strength of

the business, as evidenced by our well-capitalised, profitable and

highly cash-generative business model.

Michael Summersgill

Deputy Chief Executive Officer and Chief Financial Officer

Responsibility statement

Directors' responsibility statement

We confirm that to the best of our knowledge:

(a) the condensed set of financial statements has been prepared

in accordance with IAS 34 Interim Financial Reporting as issued by

the IASB and adopted for use in the UK; and

(b) the Interim management report includes a fair review of the information required by:

(i) DTR 4.2.7R of the Disclosure Guidance and Transparency

Rules, being an indication of important events that have occurred

during the first six months of the financial year and their impact

on the condensed set of financial statements; and a description of

the principal risks and uncertainties facing the Group for the

remaining six months of the financial year; and

(ii) DTR 4.2.8R of the Disclosure Guidance and Transparency

Rules, being related-party transactions that have taken place in

the first six months of the current financial year and that have

materially affected the financial position or performance of the

Group during that period; and any changes in the related-party

transactions described in the last annual report that could do

so.

By order of the Board:

Christopher Bruce Robinson

Company Secretary

25 May 2022

Independent review report to AJ Bell plc

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 31

March 2022 is not prepared, in all material respects, in accordance

with UK adopted International Accounting Standard 34 and the

Disclosure Guidance and Transparency Rules of the United Kingdom's

Financial Conduct Authority.

We have been engaged by the Company to review the condensed set

of financial statements in the half-yearly financial report for the

six months ended 31 March 2022 which comprises the condensed

consolidated income statement, the condensed consolidated statement

of financial position, the condensed consolidated statement of

changes in equity, the condensed consolidated statement of cash

flows and the related explanatory notes.

Basis for conclusion

We conducted our review in accordance with International

Standard on Review Engagements (UK) 2410, "Review of Interim

Financial Information Performed by the Independent Auditor of the

Entity" ("ISRE (UK) 2410"). A review of interim financial

information consists of making enquiries, primarily of persons

responsible for financial and accounting matters, and applying

analytical and other review procedures. A review is substantially

less in scope than an audit conducted in accordance with

International Standards on Auditing (UK) and consequently does not

enable us to obtain assurance that we would become aware of all

significant matters that might be identified in an audit.

Accordingly, we do not express an audit opinion.

As disclosed in note 2, the annual financial statements of the

Group are prepared in accordance with UK adopted international

accounting standards. The condensed set of financial statements

included in this half-yearly financial report has been prepared in

accordance with UK adopted International Accounting Standard 34,

"Interim Financial Reporting".

Conclusions relating to going concern

Based on our review procedures, which are less extensive than

those performed in an audit as described in the Basis for

conclusion section of this report, nothing has come to our

attention to suggest that the Directors have inappropriately

adopted the going concern basis of accounting or that the Directors

have identified material uncertainties relating to going concern

that are not appropriately disclosed.

This conclusion is based on the review procedures performed in

accordance with ISRE (UK) 2410, however future events or conditions

may cause the Group to cease to continue as a going concern.

Responsibilities of Directors

The Directors are responsible for preparing the half-yearly

financial report in accordance with the

Disclosure Guidance and Transparency Rules of the United

Kingdom's Financial Conduct Authority.

In preparing the half-yearly financial report, the Directors are

responsible for assessing the Company's ability to continue as a

going concern, disclosing, as applicable, matters related to going

concern and using the going concern basis of accounting unless the

Directors either intend to liquidate the Company or to cease

operations, or have no realistic alternative but to do so.

Auditor's responsibilities for the review of the financial

information

In reviewing the half-yearly report, we are responsible for

expressing to the Company a conclusion on the condensed set of

financial statements in the half-yearly financial report. Our

conclusion, including our Conclusions Relating to Going Concern,

are based on procedures that are less extensive than audit

procedures, as described in the Basis for Conclusion paragraph of

this report.

Use of our report

Our report has been prepared in accordance with the terms of our

engagement to assist the Company in meeting the requirements of the

Disclosure Guidance and Transparency Rules of the United Kingdom's

Financial Conduct Authority and for no other purpose. No person is

entitled to rely on this report unless such a person is a person

entitled to rely upon this report by virtue of and for the purpose

of our terms of engagement or has been expressly authorised to do

so by our prior written consent. Save as above, we do not accept

responsibility for this report to any other person or for any other

purpose and we hereby expressly disclaim any and all such

liability.

BDO LLP

Chartered Accountants

London, UK

25 May 2022

BDO LLP is a limited liability partnership registered in England

and Wales (with registered number OC305127).

Condensed consolidated income statement

For the six months ended 31 March 2022

Audited

Unaudited Unaudited Year ended

Six months Six months 30 September

ended 31 March ended 31 March 2021

Notes 2021 GBP000 2021 GBP000 GBP000

Revenue 75,528 73,897 145,826

Administrative expenses (49,044) (41,862) (89,975)

---------------- ---------------- --------------

Operating profit 26,484 32,035 55,851

Investment income 13 6 23

Finance costs (381) (398) (790)

---------------- ---------------- --------------

Profit before tax 26,116 31,643 55,084

================ ================ ==============

Tax expense 7 (5,216) (5,926) (11,262)

---------------- ---------------- --------------

Profit for the period

attributable to:

Equity holders of the

parent company 20,900 25,717 43,822

---------------- ---------------- --------------

Earnings per ordinary

share:

Basic (pence) 8 5.10 6.29 10.71

Diluted (pence) 8 5.08 6.26 10.67

All revenue, profit and earnings are in respect of continuing

operations.

There were no other components of recognised income or expense

in any of the periods presented and consequently no statement of

other comprehensive income has been presented.

Condensed consolidated statement of financial position

As at 31 March 2022

Notes Audited

Unaudited Unaudited 30 September

Assets 31 March 31 March 2021

Non-current assets 2022 GBP000 2021 GBP000 GBP000

Goodwill 6,991 6,991 6,991

Other intangible assets 9 7,716 4,350 6,014

Property, plant and equipment 9 3,501 3,426 3,351

Right-of-use assets 9 12,531 13,650 13,325

Deferred tax asset 598 797 940

------------ ------------ -------------

31,337 29,214 30,621

------------ ------------ -------------

Current assets

Trade and other receivables 39,921 39,727 34,408

Current tax receivable 673 - 51

Cash and cash equivalents 73,205 80,596 97,062

------------ ------------ -------------

113,799 120,323 131,521

------------ ------------ -------------

Total assets 145,136 149,537 162,142

------------ ------------ -------------

Liabilities

Current liabilities

Trade and other payables (11,555) (11,577) (12,765)

Current tax liabilities - (1,200) -

Lease liabilities (1,658) (1,404) (1,708)

Provisions 10 (1,466) (1,570) (1,526)

------------ ------------ -------------

(14,679) (15,751) (15,999)

------------ ------------ -------------

Non-current liabilities

Lease liabilities (13,058) (14,292) (13,886)

Provisions 10 (1,549) (1,549) (1,549)

------------ ------------ -------------

(14,607) (15,841) (15,435)

------------ ------------ -------------

Total liabilities (29,286) (31,592) (31,434)

------------ ------------ -------------

Net assets 115,850 117,945 130,708

============ ============ =============

Equity

Share capital 11 51 51 51

Share premium 8,917 8,647 8,658

Own shares (488) (1,037) (740)

Retained earnings 107,370 110,284 122,739

------------ ------------ -------------

Total equity 115,850 117,945 130,708

------------ ------------ -------------

Condensed consolidated statement of changes in equity

For the six months ended 31 March 2022

Share Share Own Retained Total

capital premium shares earnings equity

GBP000 GBP000 GBP000 GBP000 GBP000

------------------ ------------------ ------------------ ------------------ ------------------- -----------------

Balance at 1

October 2021 51 8,658 (740) 122,739 130,708

------------------ ------------------ ------------------ ------------------ ------------------- -----------------

Total

comprehensive

income for the

period:

Profit for the

period - - - 20,900 20,900

Transactions with

owners, recorded

directly

in equity:

Issue of shares - 259 - - 259

Dividends paid - - - (38,971) (38,971)

Equity-settled

share-based

payment

transactions - - - 3,016 3,016

Deferred tax

effect of

share-based

payment

transactions - - - (224) (224)

Tax relief on

exercise of share

options - - - 162 162

Share transfer

relating to EIP - - 252 (252) -

------------------ ------------------ ------------------ ------------------ ------------------- -----------------

Total transactions

with owners - 259 252 (36,269) (35,758)

------------------ ------------------ ------------------ ------------------ ------------------- -----------------

Balance at 31

March 2022 51 8,917 (488) 107,370 115,850

------------------ ------------------ ------------------ ------------------ ------------------- -----------------

Share Share Own Retained Total

capital premium shares earnings equity

GBP000 GBP000 GBP000 GBP000 GBP000

------------------ ------------------ ------------------ ------------------ ------------------- -----------------

Balance at 1

October 2020 51 8,459 (1,147) 102,103 109,466

------------------ ------------------ ------------------ ------------------ ------------------- -----------------

Total

comprehensive

income for the

period:

Profit for the

period - - - 25,717 25,717

Transactions with

owners, recorded

directly

in equity:

Issue of shares - 188 - - 188

Dividends paid - - - (19,070) (19,070)

Equity-settled

share-based

payment

transactions - - - 1,656 1,656

Deferred tax

effect of

share-based

payment

transactions - - - (228) (228)

Tax relief on

exercise of share

options - - - 216 216

Share transfer

relating to EIP - - 110 (110) -

------------------ ------------------ ------------------ ------------------ ------------------- -----------------

Total transactions

with owners - 188 110 (17,536) (17,238)

------------------ ------------------ ------------------ ------------------ ------------------- -----------------

Balance at 31

March 2021 51 8,647 (1,037) 110,284 117,945

------------------ ------------------ ------------------ ------------------ ------------------- -----------------

Condensed consolidated statement of cash flows

For the six months ended 31 March 2022

Unaudited Audited

Unaudited Six Six months Year ended

months ended ended 31 30 September

31 March 2022 March 2021 2021

Cash flows from operating activities Notes GBP000 GBP000 GBP000

Profit for the period 20,900 25,717 43,822

Adjustments for:

Investment income (13) (6) (23)

Finance costs 381 398 790

Income Tax expense 5,216 5,926 11,262

Depreciation and amortisation 1,741 2,035 3,623

Share-based payment expense 2,193 1,277 4,952

Decrease in provisions and other

payables (60) (25) (69)

Loss on disposal of property,

plant and equipment 5 - 13

Profit on disposal of right-use-assets - (3) (3)

Increase in trade and other receivables (5,513) (9,154) (3,835)

Decrease in trade and other payables (1,210) (2,535) (1,347)

-------------- ----------- -------------

Cash generated from operations 23,640 23,630 59,185

Income Tax paid (5,558) (4,766) (11,455)

Interest expense paid - (1) (1)

-------------- ----------- -------------

Net cash flows from operating

activities 18,082 18,863 47,729

-------------- ----------- -------------

Cash flows from investing activities

Additions to other intangible

assets 9 (1,317) (1,413) (2,370)

Purchase of property, plant and

equipment 9 (664) (732) (1,174)

Acquisition of subsidiary, net

of cash acquired - (2,561) (2,561)

Interest received 13 6 23

-------------- ----------- -------------

Net cash used in investing activities (1,968) (4,700) (6,082)

-------------- ----------- -------------

Cash flows from financing activities

Payments of principal in relation

to lease liabilities (878) (672) (1,241)

Payments of interest on lease

liabilities (381) (397) (789)

Proceeds from issue of share

capital 11 259 188 199

Dividends paid 12 (38,971) (19,070) (29,138)

-------------- ----------- -------------

Net cash used in financing activities (39,971) (19,951) (30,969)

-------------- ----------- -------------

Net (decrease)/increase in cash

and cash equivalents (23,857) (5,788) 10,678

Cash and cash equivalents at

beginning of period 97,062 86,384 86,384

-------------- ----------- -------------

Cash and cash equivalents at

end of period 73,205 80,596 97,062

-------------- ----------- -------------

Notes to the condensed consolidated financial statements

For the six months ended 31 March 2022

1 General information

AJ Bell plc ('the Company') is the Parent Company of the AJ Bell

group of companies (together 'the Group'). The Group provides

investment administration, dealing and custody services. The

Company is a public limited company which is listed on the Main

Market of the London Stock Exchange and incorporated and domiciled

in the United Kingdom. The Company's number is 04503206 and the

registered office is 4 Exchange Quay, Salford Quays, Manchester, M5

3EE.

2 Basis of preparation

The condensed consolidated interim financial statements

('interim financial statements') have been prepared in accordance

with IAS 34 'Interim Financial Reporting' as issued by the IASB and

adopted for use in the UK. They do not include all of the

information and disclosures required for full annual financial

statements and therefore should be read in conjunction with the AJ

Bell plc Annual Report and Financial Statements for the year ended

30 September 2021, which were prepared under International

Financial Reporting Standards (IFRSs) as adopted pursuant to

Regulation (EC) No 1606/2002 as it applies in the European Union

and in accordance with the requirements of the Companies Act 2006.

The change from EU adopted IFRS to UK adopted international

accounting standards did not result in any changes to the

accounting policies applied.

The interim financial statements have been prepared on the

historical cost basis and are presented in pounds sterling, which

is the currency of the primary economic environment in which the

Group operates. All amounts have been rounded to the nearest

thousand, unless otherwise stated.

The financial information contained in the interim financial

statements does not constitute statutory accounts within the

meaning of section 434 of the Companies Act 2006. The financial

information for the year ended 30 September 2021 has been derived

from the audited financial statements of AJ Bell plc for that year,

which have been reported on by the Company's auditor and delivered

to the registrar of companies. The report of the auditor was:

(i) Unqualified; and

(ii) did not include a reference to any matters to which the

auditors drew attention by way of emphasis without qualifying their

report; and

(iii) did not contain a statement under section 498 (2) or (3)

of the Companies Act 2006.

The consolidated financial statements of the Group for the year

ended 30 September 2021 are available to view online at

ajbell.co.uk/investor-relations.

Going concern

The Group's forecasts and objectives, considering a number of

potential changes in trading conditions, show that the Group should

be able to operate at adequate levels of both liquidity and capital

for at least 12 months from the date of signing this report. The

Directors have performed a number of stress tests, covering a

significant reduction in equity market values and a reduction in

interest income with a further Group-specific, idiosyncratic stress

relating to a scenario whereby prolonged IT issues cause a

reduction in customers. These provide assurance that the Group has

sufficient capital and liquidity to operate under stressed

conditions.

Consequently, after making reasonable enquiries, the Directors

are satisfied that the Group has sufficient financial resources to

continue in business for at least 12 months from the date of

signing the interim report and therefore have continued to adopt

the going concern basis in preparing the interim financial

statements.

Significant accounting policies

The accounting policies adopted by the Group in these interim

financial statements are consistent with those applied by the Group

in its consolidated financial statements for the year ended 30

September 2021.

The following amendments and interpretations became effective

during the year. Their adoption has not had any significant impact

on the Group.

Effective

from

IFRS 9, IAS Interest Rate Benchmark Reform - 1 January 2021

39, IFRS 7, Phase 2 (Amendments)

IFRS 4 and

IFRS 16

IFRS 16 Covid-19-Related Rent Concessions 1 April 2021

beyond 30 June 2021 (Amendments)

The Group has not early adopted any other standard,

interpretation or amendment that has been issued but is not yet

effective.

3 Critical accounting judgements and key sources of estimation

uncertainty

In the preparation of the interim financial statements, the

Directors are required to make judgements, estimates and

assumptions to determine the carrying amounts of certain assets and

liabilities. The estimates and associated assumptions are based on

the Group's historical experience and other relevant factors.

Actual results may differ from the estimates applied.

Estimates and underlying assumptions are reviewed on an ongoing

basis. Revisions to accounting estimates are recognised in the

period in which the estimate is revised if the revision affects

only that period, or in the period of the revision and future

periods if the revision affects both current and future

periods.

There are no judgements made, in applying the accounting

policies, about the future, or any other major sources of

estimation uncertainty at the end of the reporting period, that

have a significant risk of resulting in a material adjustment to

the carrying amounts of assets and liabilities within the next

financial year.

4 Seasonality of operations

There is a peak in the Group's operational activity around the

tax year end. This impacts the financial results primarily in March

and April, either side of the interim period end. As such, no

significant seasonal fluctuations affect the first or second half

of the Group's financial year in isolation.

5 Segmental reporting

It is the view of the Directors that the Group has a single

operating segment: investment services in the advised and D2C space

administering investments in SIPPs, ISAs and General

Investment/Dealing Accounts. Details of the Group's revenue,

results and assets and liabilities for the reportable segment are

shown within the condensed consolidated income statement and

condensed consolidated statement of financial position.

The Group operates in one geographical segment, being the

UK.

Due to the nature of its activities, the Group is not reliant on

any one customer or group of customers for the generation of

revenues.

6 Revenue

The analysis of the consolidated revenue is disclosed within the

Financial Review. The total revenue for the Group has been derived

from its principal activities undertaken in the UK.

7 Taxation

Tax charged in the condensed consolidated income statement:

Unaudited Unaudited

Six months Six months Audited Year

ended 31 March ended 31 March ended 30 September

2022 2021 2021

GBP000 GBP000 GBP000

Current taxation

UK Corporation Tax 5,098 6,167 11,629

Adjustment to current tax in respect

of prior periods - - (11)

--------------- --------------- -------------------

5,098 6,167 11,618

--------------- --------------- -------------------

Deferred taxation

Origination and reversal of temporary

differences 266 (249) (328)

Adjustment in respect of prior

periods - 8 12

Effect of changes in tax rates (148) - (40)

--------------- --------------- -------------------

118 (241) (356)

--------------- --------------- -------------------

Total tax expense 5,216 5,926 11,262

--------------- --------------- -------------------

Corporation Tax for the six months ended 31 March 2022 has been

calculated at 19% (six months ended 31 March 2021: 19%; year ended

30 September 2021: 19%), representing the average annual effective

tax rate expected for the full year, applied to the estimated

assessable profit for the six-month period.

In addition to the amount charged to the income statement,

certain tax amounts have been recognised directly in equity as

follows:

Unaudited Unaudited

Six months Six months Audited Year

ended 31 March ended 31 March ended 30 September

2022 2021 2021

GBP000 GBP000 GBP000

Deferred tax relating to share-based

payments 224 228 202

Current tax relief on exercise

of share options (162) (216) (231)

--------------- --------------- -------------------

62 12 (29)

--------------- --------------- -------------------

The charge for the period can be reconciled to the profit per

the condensed consolidated income statement as follows:

Unaudited Unaudited

Six months Six months Audited Year

ended 31 March ended 31 March ended 30 September

2022 2021 2021

GBP000 GBP000 GBP000

Profit before tax 26,116 31,643 55,084

UK Corporation Tax at 19% (six months

ended

31 March 2021: 19%; year ended 30

--------------- --------------- -------------------

September 2021: 19%) 4,962 6,012 10,466

--------------- --------------- -------------------

Tax effects of:

Expenses not deductible for tax

purposes 399 (98) 709

Change in recognised deductible

temporary differences 3 4 126

Effect of tax rate changes to deferred

tax (148) - (40)

Adjustments in respect of prior

periods - 8 1

--------------- --------------- -------------------

Total tax expense 5,216 5,926 11,262

--------------- --------------- -------------------

Effective tax rate 20.0% 18.7% 20.4%

Deferred tax has been recognised at 25% being the rate expected

to be in force at the time of the reversal of the temporary

difference (six months ended 31 March 2021: 19%; year ended 30

September 2021: 19% or 25%). A deferred tax asset in respect of

future share option deductions has been recognised based on the

Company's share price at 31 March 2022.

8 Earnings per share

Basic earnings per share (EPS) is calculated by dividing the

profit attributable to the owners of the parent company by the

weighted average number of ordinary shares, excluding own shares,

in issue during the period.

Diluted earnings per share is calculated by adjusting the

weighted average number of shares to assume exercise of all

potentially dilutive share options.

The calculation of basic and diluted earnings per share is based

on the following data:

Unaudited

Six months Unaudited Six Audited Year

ended 31 months ended ended 30 September

March 2022 31 March 2021 2021

GBP000 GBP000 GBP000

Earnings

Earnings for the purposes of basic

and diluted EPS being profit attributable

to equity holders of the parent

company 20,900 25,717 43,822

Number Number Number

Number of shares

Weighted average number of ordinary

shares for the purposes of basic

EPS in issue during the period 410,008,946 409,058,991 409,249,186

Effect of potentially dilutive

share options 1,602,638 1,685,073 1,643,911

-------------- -------------- -------------------

Weighted average number of ordinary

shares for the purposes of fully

diluted EPS 411,611,584 410,744,064 410,893,097

============== ============== ===================

Unaudited Six Unaudited Six Audited Year

months ended months ended ended 30 September

31 March 2022 31 March 2021 2021

GBP000 GBP000 GBP000

Earnings per share

Basic (pence) 5.10 6.29 10.71

============== ============== ===================

Diluted (pence) 5.08 6.26 10.67

============== ============== ===================

9 Changes in capital expenditure

During the six months ended 31 March 2022, the Group acquired

plant and equipment with a cost of GBP664,000 (six months ended 31

March 2021: GBP732,000; year ended 30 September 2021:

GBP1,174,000).

During the six months ended 31 March 2022, the Group acquired

intangible assets with a cost of GBP2,140,000 (six months ended 31

March 2021: GBP2,934,000; year ended 30 September 2021:

GBP4,890,000). Prior year additions include GBP1,142,000 of

intangible assets arising on acquisition of Adalpha on 18 March

2021.

Additions to intangible assets include an amount of GBP2,098,000

relating to internally generated assets for the period ended 31

March 2022 (six months ended 31 March 2021: GBP379,000; year ended

30 September 2021: GBP2,289,000), of which GBP823,000 relates to

capitalised share-based payment expenses (six months ended 31 March

2021: GBP379,000; year ended 30 September 2021: GBP1,378,000).

Additions to the cost of right-of-use assets were GBPnil in the

six months ended 31 March 2022 (six months ended 31 March 2021:

GBP36,000; year ended 30 September 2021: GBP460,000).

10 Provisions

Office Other

dilapidations provisions Total

GBP000 GBP000 GBP000

As at 1 October 2020 1,549 1,595 3,144

Additional provisions - 8 8

Provisions used - (33) (33)

As at 31 March 2021 1,549 1,570 3,119

---------------- -------------- ----------------

Additional provisions - 7 7

Provisions used - (14) (14)

Unused provision reversed - (37) (37)

---------------- -------------- ----------------

As at 1 October 2021 1,549 1,526 3,075

---------------- -------------- ----------------

Provisions used - (60) (60)

As at 31 March 2022 1,549 1,466 3,015

================ ============== ================

Current liabilities - 1,466 1,466

Non-current liabilities 1,549 - 1,549

Office dilapidations

The Group is contractually obliged to reinstate its leased

properties to their original state and layout at the end of the

lease terms. The office dilapidations provision represents

management's best estimate of the present value of costs which will

ultimately be incurred in settling these obligations.

Other provisions

The other provisions relate to the settlement of an operational

tax dispute and the costs associated with defending a legal case.

There is some uncertainty regarding the amount and timing of the

outflows required to settle the obligations; therefore, a best

estimate has been made by assessing a number of different outcomes

considering the potential areas and time periods at risk and any

associated interest. The timings of the outflows are uncertain, but

the Group expects that settlement will be within the next 12

months.

11 Share capital

Audited

Unaudited Unaudited Year ended

Six months Six months 30 September

ended 31 ended 31 2021

March 2022 March 2021 GBP000

Issued, fully-called and paid:

Ordinary shares of 0.0125p each 51,382 51,308 51,311

Issued, fully-called and paid: Number Number Number

Number of ordinary shares of 0.0125p

each 411,053,142 410,471,093 410,491,708

============ ============ ==================

All ordinary shares have full voting and dividend rights.

The following share transactions have taken place during the

period:

Transaction type Share class Number Share premium

of shares GBP000

Ordinary shares of 0.0125p

Exercise of CSOP options each 251,387 259

Exercise of EIP options Ordinary shares of 0.0125p

each 154,073 -

Earn-out issue Ordinary shares of 0.0125p

each 155,974 -

561,434 259

=========== ===================

Own shares

As at 31 March 2022, the Group held 584,877 own shares in the AJ

Bell Employee Benefit Trust (31 March 2021: 1,238,733; 30 September

2021: 885,701). During the period 300,824 EIP options were

exercised and issued from the AJ Bell Employee Benefit Trust.

12 Dividends

The following dividends were declared and paid by the Company

during the period:

Unaudited Unaudited

Six months Six months Audited Year

ended 31 March ended 31 March ended 30 September

2022 2021 2021

GBP000 GBP000 GBP000

Final dividend for the year ended

30

September 2020 of 4.66p per share - 19,070 19,070

Interim dividend for the year

ended 30

September 2021 of 2.46p per share - - 10,068

Final dividend for the year ended

30

September 2021 of 4.50p per share 18,460 - -

Special dividend for the year

ended 30

September 2021 of 5.00p per share 20,511 - -

--------------- --------------- -------------------

Ordinary dividends paid on equity

shares 38,971 19,070 29,138

--------------- --------------- -------------------

An interim dividend of 2.78 pence per share was approved by the

Board on 24 May 2022 and is payable on 1 July 2022 to shareholders

on the register at the close of business on 10 June 2022. The

ex-dividend date will be 9 June 2022. This dividend has not been

included as a liability as at 31 March 2022.

AJ Bell Employee Benefit Trust, which held 584,877 ordinary

shares (31 March 2021: 1,238,733; 30 September 2021: 885,701) in AJ

Bell plc at 31 March 2022, has agreed to waive all dividends.

13 Share-based payments

During the period the Group recognised a total share-based

payment expense in the income statement of GBP2,193,000 (six months

ended 31 March 2021: GBP1,277,000; year ended 30 September 2021:

GBP4,952,000) and capitalised GBP823,000 (six months ended 31 March

2021: GBP379,000; year ended 30 September 2021: GBP1,378,000)

within the statement of financial position.

14 Principal risks and uncertainties

We continually review the principal risks and uncertainties

facing the Group that could pose a threat to the delivery of our

strategic objectives. The Board believes that the nature of the

principal risks and uncertainties that may have a material effect

on the Group's performance over the remainder of the financial year

remain unchanged from those presented within the 2021 annual report

and accounts.

The Group has reviewed the impact of the recent Russian invasion

of Ukraine and concluded that whilst the level of inherent risk for

some of Group's principal risks and uncertainties has increased,

e.g. information security / cyber-attacks, the Group's controls

continue to mitigate this increase in risk. The Group will continue

to monitor and respond to any new developments from the war in

Ukraine that may impact the Group.

15 Related-party transactions

The Group has a related-party relationship with its Directors

and members of the Executive Management Board ('the key management

personnel'). There were no changes to the related-party

relationships or significant transactions during the financial

period that would materially affect the financial position or

performance of the Group. All other transactions are consistent in

nature with the disclosure in note 29 of the consolidated financial

statements for the year ended 30 September 2021.

16 Subsequent events

There have been no material events occurring between the

reporting date and the date of approval of these interim financial

statements.

17 Cautionary statement

The interim results for the six months ended 31 March 2022

contain forward-looking statements that involve substantial risks

and uncertainties, and actual results and developments may differ

materially from those expressed or implied by these statements.

These forward-looking statements are statements regarding AJ Bell's

intentions, beliefs or current expectations concerning, among other

things, its results of operations, financial condition, prospects,

growth, strategies, and the industry in which it operates. By their

nature, forward-looking statements involve risks and uncertainties

because they relate to events and depend on circumstances that may

or may not occur in the future. These forward-looking statements

speak only as of the date of these interim results and AJ Bell does

not undertake any obligation to publicly release any revisions to

these forward-looking statements to reflect events or circumstances

after the date of these interim results.

Alternative performance measures

Within the interim report and condensed financial statements,

various Alternative Performance Measures (APM) are referred to.

APMs are not defined by International Financial Reporting Standards

and should be considered together with the Group's IFRS

measurements of performance. We believe APMs assist in providing

greater insight into the underlying performance of the Group and

enhance comparability of information between reporting periods. The

table below states those which have been used, how they have been

calculated and why they have been used.

APMs How have they been calculated Why they have been used

Assets Under AUA is the value of assets AUA is a measurement of

Administration for which AJ Bell provides the growth of the business

(AUA) either an administrative, and is the primary driver

custodial, or transactional of ad valorem revenue, which

service. is the largest component

of Group revenue.