TIDMAJB

RNS Number : 8147I

AJ Bell PLC

21 April 2022

21 April 2022

AJ Bell plc

Q2 trading update

AJ Bell plc ("AJ Bell" or the "Company"), one of the UK's

largest investment platforms, today issues a trading update in

respect of the three months ended 31 March 2022.

Performance overview

Total customer numbers increased to 418,309, up 21% over the

last year and 5% in the quarter, with total net inflows in the

quarter of GBP1.5 billion.

Total assets under administration ("AUA") closed at GBP74.1

billion, up 14% over the last year but down 2% in the quarter due

to adverse market and other movements of 4%. During the quarter the

FTSE All-Share Index fell by 0.5% whilst the MSCI World Index fell

by 5.5%.

The customer growth and net inflows delivered in Q2 once again

evidence the resilience of the AJ Bell business model across

different market conditions. The comparative quarter last year was

exceptionally strong as consumers invested excess cash savings

built up during Covid lockdowns, whereas this year they have been

faced with increased market uncertainty caused by factors including

inflationary pressure on the cost of living and the war in

Ukraine.

Despite the challenging market backdrop, the AJ Bell platform

has continued to attract and retain high quality customers, with

over three-quarters of new accounts being tax-advantaged pensions

or ISAs and platform customer retention remaining high at 95%.

Platform business

-- Customer numbers increased by 20,109 in the quarter to close

at 403,383, up 21% in the last year and 5% in the quarter

o Advised customers of 137,201, up 16% in the last year and

4% in the quarter

o D2C customers of 266,182, up 25% in the last year and 6%

in the quarter

-- AUA closed at GBP66.9 billion, up 15% in the last year and

down 2% in the quarter

-- Gross inflows in the quarter of GBP2.7 billion (2021: GBP2.8

billion)

-- Net inflows in the quarter of GBP1.6 billion (2021: GBP1.8

billion)

AJ Bell Investments

-- Assets under management ("AUM") closed at GBP2.3 billion,

up 64% over the last year and up 10% in the quarter

-- Net inflows in the quarter were GBP223 million (2021: GBP311

million)

Andy Bell, Chief Executive Officer at AJ Bell, commented:

"Our dual-channel platform, serving the growing advised and D2C

platform markets, attracted over 20,000 new customers and

significant net inflows during Q2 despite weakened investor

sentiment. In the last year we have grown platform customer numbers

by 21% and platform AUA by 15%, demonstrating the strength of our

business model across different market conditions.

"Although our D2C customers invested slightly less via our

platform than in the comparative period as they assess the impact

of the rising cost of living, net inflows to our advised platform

remained on par with last year, which was a strong comparative. Net

platform inflows of GBP1.6 billion is an encouraging result given

the uncertain market backdrop.

"Our in-house investment solutions remain popular across our

platform propositions and continued to perform strongly, delivering

net inflows of GBP223 million during the quarter. Our first five

multi-asset funds recently passed their fifth anniversary, an

important performance milestone particularly for advisers.

Performance of all five funds was in the top 30% when compared

against their peer groups, with four being in the top quintile.

Since launching these funds in 2017 we have shared the benefits of

our increasing scale with customers, reducing the Ongoing Charges

Figure from 50bps to 31bps during that time.

"This week we launched a new investing app called Dodl by AJ

Bell which expands our offering to DIY investors. It offers all the

main tax wrappers and a simplified investment range to help people

select funds and shares for their portfolio. With an annual charge

of just 0.15% and no commission for buying or selling investments,

Dodl is a low-cost proposition perfectly suited to individuals who

want an easy way to invest for their future. We believe it will be

particularly attractive to the 8.6m adults in the UK who hold more

than GBP10,000 of investible assets in cash, especially in the

current climate of rising inflation where cash savings are being

eroded in real terms due to the low interest rates available.

"The launch of Dodl in the consumer market will be complemented

by the launch of Touch by AJ Bell, our simplified platform

currently being developed for the advised market. These

developments will broaden our reach in both the advised and D2C

segments, keeping us at the forefront of the platform market and

positioning us well to continue gaining market share."

Notice of interim results

AJ Bell expects to announce its full results for the six months

ended 31 March 2022 on Thursday 26 May 2022.

Three months ended Advised D2C Platform Total Non-platform Total

31 March 2022 Platform Platform

Opening customers 131,610 251,664 383,274 14,792 398,066

Closing customers 137,201 266,182 403,383 14,926 418,309

AUA and AUM (GBPbillion)

------------------------------- ---------- ------------- ---------- ------------- --------

Opening AUA 47.5 20.6 68.1 7.5 75.6

------------------------------- ---------- ------------- ---------- ------------- --------

Inflows(1) 1.6 1.1 2.7 - 2.7

Outflows(2) (0.7) (0.4) (1.1) (0.1) (1.2)

------------------------------- ---------- ------------- ---------- ------------- --------

Net inflows/(outflows) 0.9 0.7 1.6 (0.1) 1.5

------------------------------- ---------- ------------- ---------- ------------- --------

Market and other movements(3) (1.9) (0.9) (2.8) (0.2) (3.0)

------------------------------- ---------- ------------- ---------- ------------- --------

Closing AUA 46.5 20.4 66.9 7.2 74.1

------------------------------- ---------- ------------- ---------- ------------- --------

Closing AUM 1.4 0.9 2.3 (4) - 2.3

Three months ended Advised D2C Platform Total Non-platform Total

31 March 2021 Platform Platform

Opening customers 112,308 185,745 298,053 14,256 312,309

Closing customers 118,509 213,767 332,276 14,521 346,797

AUA and AUM (GBPbillion)

------------------------------- ---------- ------------- ---------- ------------- --------

Opening AUA 39.7 15.5 55.2 7.3 62.5

------------------------------- ---------- ------------- ---------- ------------- --------

Inflows(1) 1.5 1.3 2.8 - 2.8

Outflows(2) (0.6) (0.4) (1.0) (0.3) (1.3)

------------------------------- ---------- ------------- ---------- ------------- --------

Net inflows/(outflows) 0.9 0.9 1.8 (0.3) 1.5

------------------------------- ---------- ------------- ---------- ------------- --------

Market and other movements(3) 0.5 0.5 1.0 0.2 1.2

------------------------------- ---------- ------------- ---------- ------------- --------

Closing AUA 41.1 16.9 58.0 7.2 65.2

------------------------------- ---------- ------------- ---------- ------------- --------

Closing AUM 0.8 0.6 1.4 (4) - 1.4

(1) Transfers-in, subscriptions, contributions and tax

relief

(2) T (ransfers-out, cash withdrawals, benefits and tax

payments)

(3) Total i (nvestment returns and revaluations, net of charges

and taxes)

(4) Platform AUA which is held in AJ Bell's Funds or Managed

Portfolio Service

Contacts:

AJ Bell

Shaun Yates, Investor Relations

-- Director +44 (0) 7522 235 898

Charlie Musson, Brand and PR

-- Director +44 (0) 7834 499 554

Historical customer numbers, AUA and AUM by quarter

Advised Platform Qtr to Qtr to Qtr to Qtr to Qtr to

31 30 30 31 31

March June September December March

2021 2021 2021 2021 2022

Customers 118,509 122,757 126,920 131,610 137,201

AUA and AUM (GBPbillion)

-------------------------- -------- -------- ----------- ---------- --------

Opening AUA 39.7 41.1 44.2 45.8 47.5

-------------------------- -------- -------- ----------- ---------- --------

Inflows(1) 1.5 1.8 1.7 1.6 1.6

Outflows(2) (0.6) (0.7) (0.7) (1.0) (0.7)

-------------------------- -------- -------- ----------- ---------- --------

Net inflows 0.9 1.1 1.0 0.6 0.9

-------------------------- -------- -------- ----------- ---------- --------

Market and other

movements(3) 0.5 2.0 0.6 1.1 (1.9)

Closing AUA 41.1 44.2 45.8 47.5 46.5

-------- -------- ----------- ----------

Closing AUM(4) 0.8 1.2 1.3 1.2 1.4

D2C Platform Qtr to Qtr to Qtr to Qtr to Qtr to

31 30 30 31 31

March June September December March

2021 2021 2021 2021 2022

Customers 213,767 230,542 241,045 251,664 266,182

AUA and AUM (GBPbillion)

-------------------------- -------- -------- ----------- ---------- --------

Opening AUA 15.5 16.9 18.9 19.5 20.6

-------------------------- -------- -------- ----------- ---------- --------

Inflows(1) 1.3 1.4 1.0 1.1 1.1

Outflows(2) (0.4) (0.4) (0.4) (0.3) (0.4)

-------------------------- -------- -------- ----------- ---------- --------

Net inflows 0.9 1.0 0.6 0.8 0.7

-------------------------- -------- -------- ----------- ---------- --------

Market and other

movements(3) 0.5 1.0 - 0.3 (0.9)

-------------------------- -------- -------- ----------- ---------- --------

Closing AUA 16.9 18.9 19.5 20.6 20.4

-------------------------- -------- -------- ----------- ---------- --------

Closing AUM(4) 0.6 0.7 0.8 0.9 0.9

Non-platform Qtr to Qtr to Qtr to Qtr to Qtr to

31 30 30 31 31

March June September December March

2021 2021 2021 2021 2022

Customers 14,521 14,734 14,789 14,792 14,926

AUA and AUM (GBPbillion)

-------------------------- ------- ------- ----------- ---------- --------

Opening AUA 7.3 7.2 7.3 7.5 7.5

-------------------------- ------- ------- ----------- ---------- --------

Inflows(1) - 0.1 - 0.1 -

Outflows(2) (0.3) (0.4) (0.1) (0.2) (0.1)

-------------------------- ------- ------- ----------- ---------- --------

Net inflows/(outflows) (0.3) (0.3) (0.1) (0.1) (0.1)

-------------------------- ------- ------- ----------- ---------- --------

Market and other

movements(3) 0.2 0.4 0.3 0.1 (0.2)

-------------------------- ------- ------- ----------- ---------- --------

Closing AUA 7.2 7.3 7.5 7.5 7.2

-------------------------- ------- ------- ----------- ---------- --------

Closing AUM(5) - 0.1 0.1 - -

Total closing

AUA 65.2 70.4 72.8 75.6 74.1

-------------------------- ------- ------- ----------- ---------- --------

Total closing

AUM 1.4 2.0 2.2 2.1 2.3

-------------------------- ------- ------- ----------- ---------- --------

(1) Transfers-in, subscriptions, contributions and tax

relief

(2) T (ransfers-out, cash withdrawals, benefits and tax

payments)

(3) Total i (nvestment returns and revaluations, net of charges

and taxes)

(4) Platform AUA which is held in AJ Bell's Funds or Managed

Portfolio Service

(5) Assets which are held in AJ Bell's Funds or Managed

Portfolio Service via third-party platforms

About AJ Bell:

Established in 1995, AJ Bell is one of the largest investment

platforms in the UK, operating at scale in both the advised and

direct-to-consumer markets.

Our purpose is to help people invest by providing them with

easy-to-use online services and information to help them build and

manage their portfolios.

We do that via our three platform propositions - AJ Bell

Investcentre in the advised market and AJ Bell Youinvest and Dodl

by AJ Bell in the direct-to-consumer market, which all give

investors access to Pensions, ISAs and General Investment / Dealing

Accounts.

AJ Bell Investcentre and AJ Bell Youinvest provide access to a

broad investment range including shares and other instruments

traded on the major stock exchanges around the world, as well as

all mainstream collective investments available in the UK and our

own range of AJ Bell funds.

Dodl by AJ Bell offers a simplified investment range to make it

easier for customers to choose investments and buy and sell them

without paying any commission.

We also offer a Cash savings hub via AJ Bell Youinvest which

provides access to a range of competitive savings accounts to help

people manage their cash savings.

AJ Bell is headquartered in Manchester, UK, with offices in

London and Bristol.

Forward-looking statements

This announcement contains forward-looking statements that

involve substantial risks and uncertainties, and actual results and

developments may differ materially from those expressed or implied

by these statements. These forward-looking statements are

statements regarding AJ Bell's intentions, beliefs or current

expectations concerning, among other things, its results of

operations, financial condition, prospects, growth, strategies, and

the industry in which it operates. By their nature, forward-looking

statements involve risks and uncertainties because they relate to

events and depend on circumstances that may or may not occur in the

future. These forward-looking statements speak only as of the date

of this announcement and AJ Bell does not undertake any obligation

to publicly release any revisions to these forward-looking

statements to reflect events or circumstances after the date of

this announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTPPUWGCUPPGMU

(END) Dow Jones Newswires

April 21, 2022 02:00 ET (06:00 GMT)

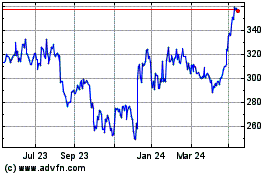

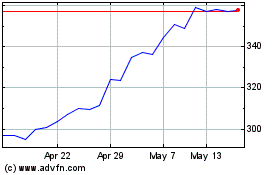

Aj Bell (LSE:AJB)

Historical Stock Chart

From May 2024 to Jun 2024

Aj Bell (LSE:AJB)

Historical Stock Chart

From Jun 2023 to Jun 2024