TIDMAJB

RNS Number : 7977T

AJ Bell PLC

23 July 2020

23 July 2020

AJ Bell plc

Q3 trading update

AJ Bell plc ("AJ Bell" or the "Company"), one of the UK's

largest investment platforms, today issues a trading update in

respect of the three months ended 30 June 2020.

Performance overview

Total customer numbers increased to 282,619, up 26% over the

last 12 months and 8% in the quarter, with total net inflows in the

quarter of GBP1.2 billion (2019: GBP1.2 billion).

Total assets under administration (AUA) increased to GBP54.3

billion, up 7% over the last 12 months and 12% in the quarter. The

FTSE All-Share increased by 10% over the quarter.

AJ Bell's customer growth and strong net inflows during the

quarter were driven by the platform business:

-- Platform customer numbers increased organically by 20,370

-- Total platform customers closed at 268,444, up 27% year-on-year

and 8% in the quarter

o Advised customers of 106,335, up 11% over the last year

and 2% in the quarter

o D2C customers of 162,109, up 41% over the last year

and 12% in the quarter

-- Platform underlying net inflows, representing organic

growth in the quarter, increased by 30% over the prior

year to GBP1.3 billion (2019: GBP1.0 billion)

o Advised underlying net inflows of GBP0.5 billion, in

line with the prior year

o D2C underlying net inflows of GBP0.8 billion, up 60%

on the prior year

-- Platform AUA closed at GBP47.7 billion, up 10% over the

last year and 14% in the quarter

Customer dealing activity and financial outlook

As reported in the Company's interim results for the six months

ended 31 March 2020, stock market volatility drove record levels of

dealing activity by D2C customers in the first half of the

financial year, generating increased transactional revenue.

Although trading volumes have now fallen from the peak levels seen

earlier in the COVID-19 crisis, the number of trades placed by D2C

customers in the quarter more than doubled compared to the same

quarter in 2019, exceeding management's expectations.

As a result, management currently expects profit before tax for

the year ending 30 September 2020 to be at least GBP2.5 million

above current market consensus(1) .

Customer dealing activity is expected to normalise in Q4 of the

current financial year and therefore management reiterates its

previous guidance in respect of the year ending 30 September

2021.

(1) As at 20 July 2020, Company compiled consensus for profit

before tax was GBP43.4 million. Further details are available at

ajbell.co.uk/investor-relations/analyst-consensus

Launch of AJ Bell Cash savings hub

The Company is preparing to move into the GBP1.5 trillion(2)

retail cash savings market with the launch of the AJ Bell Cash

savings hub via its D2C platform.

As part of the Company's commitment to make it easy for people

to invest, the AJ Bell Cash savings hub will enable customers to

access a range of competitive notice and fixed-term savings

accounts from a range of UK authorised banks. They will be able to

apply for multiple accounts quickly and easily, with no paperwork,

and manage their cash savings via one online account that sits

alongside their existing AJ Bell Youinvest accounts. It will also

give them peace of mind that the savings accounts they have within

the Cash savings hub will be covered by the Financial Services

Compensation Scheme (FSCS), up to the limit of GBP85,000 per

bank.

AJ Bell will begin testing the Cash savings hub with a small

group of existing customers before the end of July and expects to

launch it to all AJ Bell Youinvest customers by the end of the

calendar year.

(2) Source: Bank of England UK households' deposits statistics,

May 2020

Andy Bell, Chief Executive Officer at AJ Bell, commented:

"Markets have rebounded from the lows seen in the previous

quarter but remain volatile and this has helped increase the value

of assets under administration and customer trading volumes. Our

focus throughout the COVID-19 crisis has been on ensuring we are

here for customers and advisers when they need us and this has

translated into strong net inflows onto the platform and continued

strong organic growth in new customers.

"With interest rates so low, it is increasingly important that

people regularly check the rates they are earning on their cash

savings and consider switching accounts if they want to ensure they

get a better return, but most people don't have the time or

inclination to do that. Our new AJ Bell Cash savings hub will

enable customers to manage their cash savings more effectively

without having to go through lengthy, paper-based application

processes each time they open a new account, whilst ensuring they

benefit from FSCS protection.

"The quality and commitment of our staff has enabled us to

operate all services on a business as usual basis throughout the

coronavirus pandemic. This operational resilience demonstrates the

strength of our business model which has been appreciated by many

customers and advisers. The long-term growth drivers of the

platform market remain undiminished and we are well positioned

within the market to benefit."

Three months ended Advised D2C Platform Total Non-platform Total

30 June 2020 Platform GBPbillion Platform GBPbillion GBPbillion

GBPbillion GBPbillion

Opening AUA 31.4 10.6 42.0 6.3 48.3

----------------------------------- ------------ ------------- ------------ ------------- -------------

Underlying inflows(1) 0.8 1.0 1.8 - 1.8

Outflows(2) (0.3) (0.2) (0.5) (0.3) (0.8)

----------------------------------- ------------ ------------- ------------ ------------- -------------

Underlying net inflows/(outflows) 0.5 0.8 1.3 (0.3) 1.0

----------------------------------- ------------ ------------- ------------ ------------- -------------

DB inflows(3) 0.2 - 0.2 - 0.2

Total net inflows/(outflows) 0.7 0.8 1.5 (0.3) 1.2

----------------------------------- ------------ ------------- ------------ ------------- -------------

Market and other movements(4) 3.1 1.1 4.2 0.6 4.8

----------------------------------- ------------ ------------- ------------ ------------- -------------

Closing AUA 35.2 12.5 47.7 6.6 54.3

----------------------------------- ------------ ------------- ------------ ------------- -------------

Opening customers 103,974 144,100 248,074 14,105 262,179

Closing customers 106,335 162,109 268,444 14,175 282,619

Three months ended Advised D2C Platform Total Non-platform Total

30 June 2019 Platform GBPbillion Platform GBPbillion GBPbillion

GBPbillion GBPbillion

Opening AUA 30.9 9.7 40.6 7.1 47.7

----------------------------------- ------------ ------------- ------------ ------------- -------------

Underlying inflows(1) 0.9 0.6 1.5 - 1.5

Outflows(2) (0.4) (0.1) (0.5) - (0.5)

----------------------------------- ------------ ------------- ------------ ------------- -------------

Underlying net inflows 0.5 0.5 1.0 - 1.0

----------------------------------- ------------ ------------- ------------ ------------- -------------

DB inflows(3) 0.2 - 0.2 - 0.2

Total net inflows 0.7 0.5 1.2 - 1.2

----------------------------------- ------------ ------------- ------------ ------------- -------------

Market and other movements(4) 1.2 0.4 1.6 0.2 1.8

----------------------------------- ------------ ------------- ------------ ------------- -------------

Closing AUA 32.8 10.6 43.4 7.3 50.7

----------------------------------- ------------ ------------- ------------ ------------- -------------

Opening customers 93,496 107,426 200,922 13,931 214,853

Closing customers 96,083 114,682 210,765 13,879 224,644

(1) Includes transfers-in, subscriptions, contributions and tax

relief, excluding inflows from DB pension transfers and bulk

migrations

(2) Includes (transfers-out, cash withdrawals, benefits and tax

payments)

(3) Inflows to the advised platform from defined benefit pension

transfers

(4) Includes (charges, taxes deducted, investment returns and

revaluations)

Contacts:

AJ Bell

-- Shaun Yates, Head of Investor Relations +44 (0) 7522 235

898

-- Charlie Musson, Head of PR +44 (0) 7834 499 554

Historical AUA and customer numbers by quarter

Advised Platform Qtr to Qtr to Qtr to Qtr to Qtr to

30 30 31 31 30

AUA (GBPbillion) June September December March June

2019 2019 2019 2020 2020

Opening AUA 30.9 32.8 33.8 35.2 31.4

----------------------- ------- ----------- ---------- -------- --------

Underlying inflows(1) 0.9 0.9 0.8 1.2 0.8

Outflows(2) (0.4) (0.4) (0.4) (0.5) (0.3)

----------------------- ------- ----------- ---------- -------- --------

Underlying net

inflows 0.5 0.5 0.4 0.7 0.5

----------------------- ------- ----------- ---------- -------- --------

DB inflows(3) 0.2 0.2 0.2 0.2 0.2

Total net inflows 0.7 0.7 0.6 0.9 0.7

----------------------- ------- ----------- ---------- -------- --------

Market and other

movements(4) 1.2 0.3 0.8 (4.7) 3.1

Closing AUA 32.8 33.8 35.2 31.4 35.2

------- ----------- ---------- --------

Customers 96,083 98,056 100,170 103,974 106,335

D2C Platform Qtr to Qtr to Qtr to Qtr to Qtr to

30 30 31 31 30

AUA (GBPbillion) June September December March June

2019 2019 2019 2020 2020

Opening AUA 9.7 10.6 11.1 12.0 10.6

------------------- -------- ----------- ---------- -------- --------

Inflows(1) 0.6 0.5 0.5 0.9 1.0

Outflows(2) (0.1) (0.2) (0.2) (0.2) (0.2)

------------------- -------- ----------- ---------- -------- --------

Net inflows 0.5 0.3 0.3 0.7 0.8

------------------- -------- ----------- ---------- -------- --------

Market and other

movements(4) 0.4 0.2 0.6 (2.1) 1.1

------------------- -------- ----------- ---------- -------- --------

Closing AUA 10.6 11.1 12.0 10.6 12.5

------------------- -------- ----------- ---------- -------- --------

Customers 114,682 120,113 127,032 144,100 162,109

Non-platform Qtr to Qtr to Qtr to Qtr to Qtr to

30 30 31 31 30

AUA (GBPbillion) June September December March June

2019 2019 2019 2020 2020

Opening AUA 7.1 7.3 7.4 7.5 6.3

------------------- ------- ----------- ---------- -------- -------

Inflows(1) - - - - -

Outflows(2) - (0.1) (0.1) (0.3) (0.3)

------------------- ------- ----------- ---------- -------- -------

Net outflows - (0.1) (0.1) (0.3) (0.3)

------------------- ------- ----------- ---------- -------- -------

Market and other

movements(4) 0.2 0.2 0.2 (0.9) 0.6

------------------- ------- ----------- ---------- -------- -------

Closing AUA 7.3 7.4 7.5 6.3 6.6

------------------- ------- ----------- ---------- -------- -------

Customers 13,879 13,897 13,950 14,105 14,175

Total closing

AUA 50.7 52.3 54.7 48.3 54.3

------------------- ------- ----------- ---------- -------- -------

(1) Includes transfers-in, subscriptions, contributions and tax

relief, excluding inflows from DB pension transfers and bulk

migrations

(2) Includes (transfers-out, cash withdrawals, benefits and tax

payments)

(3) Inflows to the advised platform from defined benefit pension

transfers

(4) Includes (charges, taxes deducted, investment returns and

revaluations)

About AJ Bell:

Established in 1995, AJ Bell is one of the largest investment

platforms in the UK.

We operate in both the advised and direct to consumer segments

of the platform market and our flagship platform propositions are

AJ Bell Investcentre (adviser) and AJ Bell Youinvest

(direct-to-consumer).

We offer SIPPs, ISAs and General Investment / Dealing Accounts.

We aim to make it easy for our customers to invest by providing

them with additional support in the form of various investment

solutions and information. We offer a broad investment range

including shares and other instruments traded on the major stock

exchanges around the world, as well as all mainstream collective

investments available in the UK and our own range of AJ Bell

funds.

AJ Bell is headquartered in Manchester, UK.

Forward-looking statements

This announcement contains forward-looking statements that

involve substantial risks and uncertainties, and actual results and

developments may differ materially from those expressed or implied

by these statements. These forward-looking statements are

statements regarding AJ Bell's intentions, beliefs or current

expectations concerning, among other things, its results of

operations, financial condition, prospects, growth, strategies and

the industry in which it operates. By their nature, forward-looking

statements involve risks and uncertainties because they relate to

events and depend on circumstances that may or may not occur in the

future. These forward-looking statements speak only as of the date

of this announcement and AJ Bell does not undertake any obligation

to publicly release any revisions to these forward-looking

statements to reflect events or circumstances after the date of

this announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTPPURWMUPUGCP

(END) Dow Jones Newswires

July 23, 2020 02:00 ET (06:00 GMT)

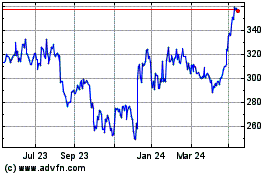

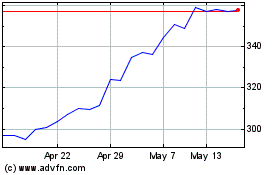

Aj Bell (LSE:AJB)

Historical Stock Chart

From May 2024 to Jun 2024

Aj Bell (LSE:AJB)

Historical Stock Chart

From Jun 2023 to Jun 2024