AEW UK REIT PLC Acquisition of high-yielding retail warehouse unit (2225U)

March 27 2023 - 2:00AM

UK Regulatory

TIDMAEWU

RNS Number : 2225U

AEW UK REIT PLC

27 March 2023

27 March 2023

AEW UK REIT plc

Acquisition of high yielding retail warehousing unit in

Preston

AEW UK REIT plc (LSE: AEWU) ("AEWU" or the "Company") is pleased

to announce that it has completed the purchase of a freehold solus

retail warehousing unit in Bamber Bridge, Preston for GBP6,450,000,

reflecting a low capital value of GBP110 per sq ft and an

attractive net initial yield of 9.5%.

The 58,696 sq ft unit is single-let to Matalan Retail Limited

and has another 9.2 years left on the lease. Matalan is known to

trade strongly from the location, with the store being one of its

top 10 performers, as well as being the retailer's first ever store

in the U.K. The lease benefits from a 2027 rent review to the

higher of open market value, or 2.5% per annum compounded,

resulting in a minimum reversionary yield of 10.7%.

The site totals 4.39 acres, providing a low site cover of 30%.

It is well located on Cuerden Way which connects to the A6, half a

mile from Junction 1 of the M65. Neighbouring tenants include Aldi

and Sainsburys to the south, with predominantly industrial uses to

the north. There is the potential to repurpose the unit for trade

counter or industrial use, and to extend the accommodation, subject

to planning, if required in future.

In January, Matalan announced the completion of a refinancing,

reducing its gross debt by 43% from GBP593 million to GBP336

million. The new debt facility will mature in 2027. The refinancing

also provides GBP100 million for business growth over the next

three years, with a return to profitability anticipated in FY

2024.

Commenting on the purchase, Laura Elkin, Portfolio Manager of

AEW UK REIT said : "We are pleased to have purchased this retail

warehousing unit that provides a very attractive day one yield that

is set to increase at review in the future. Our due diligence has

shown that Matalan trades well from the location, giving us

confidence in its continued occupation, and in the stability of the

income stream. As we look to return the portfolio to full

investment, we continue to analyse an interesting pipeline of

potential acquisitions, and expect to make further purchase

announcements in the coming months."

ENDS

Enquiries

AEW UK

Laura Elkin laura.elkin@eu.aew.com

+44(0) 7917 058 337

Henry Butt henry.butt@eu.aew.com

+44(0) 7920 499 076

Nicki Gladstone nicki.gladstone-ext@eu.aew.com

+44(0) 7711 401 021

Company Secretary

Link Company Matters Limited aewu.cosec@linkgroup.co.uk

+44(0) 7548773155

TB Cardew AEW@tbcardew.com

Ed Orlebar +44 (0) 7738 724 630

Tania Wild +44 (0) 7425 536 903

Henry Crane +44 (0)7918 207157

Liberum Capital

Darren Vickers / Owen Matthews +44 (0) 20 3100 2222

Notes to Editors

About AEW UK REIT

AEW UK REIT plc (LSE: AEWU) aims to deliver an attractive total

return to shareholders by investing predominantly in smaller

commercial properties (typically less than GBP15 million), on

shorter occupational leases in strong commercial locations across

the United Kingdom. The Company is currently invested in office,

retail, industrial and leisure assets, with a focus on active asset

management, repositioning the properties and improving the quality

of income streams. AEWU is currently paying an annualised dividend

of 8p per share.

The Company was listed on the Official List of the Financial

Conduct Authority and admitted to trading on the

Main Market of the London Stock Exchange on 12 May 2015. www.aewukreit.com

LEI: 21380073LDXHV2LP5K50

About AEW UK Investment Management LLP

AEW UK Investment Management LLP employs a well-resourced team

comprising 29 individuals covering investment, asset management,

operations and strategy. It is part of AEW Group, one of the

world's largest real estate managers, with EUR84.9bn of assets

under management as at 31 December 2022. AEW Group comprises AEW SA

and AEW Capital Management L.P., a U.S. registered investment

manager and their respective subsidiaries. In Europe, as at 31

December 2022, AEW Group managed EUR38.5bn of real estate assets on

behalf of a number of funds and separate accounts with over 470

staff located in 10 locations.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQVZLFLXXLXBBL

(END) Dow Jones Newswires

March 27, 2023 02:00 ET (06:00 GMT)

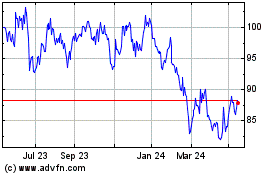

Aew Uk Reit (LSE:AEWU)

Historical Stock Chart

From May 2024 to Jun 2024

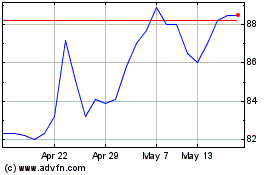

Aew Uk Reit (LSE:AEWU)

Historical Stock Chart

From Jun 2023 to Jun 2024