Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10/A

GENERAL FORM FOR REGISTRATION OF SECURITIES

Pursuant to Section 12(b) or (g) of The Securities

Exchange Act of 1934

|

WORLDWIDE STRATEGIES

INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

|

41-0946897

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

1961

NW 150 Avenue

Suite

205

Pembroke

Pines, Florida

|

|

33028

|

|

(Address of principal executive office)

|

|

(Zip Code)

|

Registrant’s telephone number including area

code: 844-500-9974

Securities to be registered pursuant to Section

12(b) of the Act:

|

None

|

|

None

|

|

(Title of class)

|

|

Name of each exchange on which each class is to be registered

|

Securities to be registered pursuant to Section

12(g) of the Act:

|

Common Stock, par value $0.001 per share

|

|

None

|

|

(Title of class)

|

|

Name of each exchange on which each class is to be registered

|

Indicate by check mark whether the

registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging

growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting

company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

☐

|

Accelerated filer

|

☐

|

|

Non-accelerated filer

|

☒

|

Smaller reporting company

|

☒

|

|

|

|

Emerging growth company

|

☐

|

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

TABLE OF CONTENTS

EXPLANATORY NOTE

Worldwide Strategies Inc. is filing this General

Form for Registration of Securities on Form 10, or this “registration statement,” to register its common stock, par value

$0.001 per share (“Common Stock”), pursuant to Section 12(g) of the Securities Exchange Act of 1934. Unless otherwise mentioned

or unless the context requires otherwise, when used in this registration statement, the terms “Company,” “we,”

“us,” “our” and “WWSG” refer to Worldwide Strategies Inc.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This following information

specifies certain forward-looking statements of management of our Company. Forward-looking statements are statements that estimate the

happening of future events and are not based on historical fact. Forward-looking statements may be identified by the use of forward-looking

terminology, such as may, shall, could, expect, estimate, anticipate, predict, probable, possible, should, continue, or similar terms,

variations of those terms, or the negative of those terms. The forward-looking statements specified in the following information have

been compiled by our management on the basis of assumptions made by management and considered by management to be reasonable. Our future

operating results, however, are impossible to predict and no representation, guaranty, or warranty is to be inferred from those forward-looking

statements.

The assumptions used for purposes

of the forward-looking statements specified in the following information represent estimates of future events and are subject to uncertainty

as to possible changes in economic, legislative, industry, and other circumstances. As a result, the identification and interpretation

of data and other information and their use in developing and selecting assumptions from and among reasonable alternatives require the

exercise of judgment. To the extent that the assumed events do not occur, the outcome may vary substantially from anticipated or projected

results, and, accordingly, no opinion is expressed on the achievability of those forward-looking statements.

The market data and other

statistical information contained in this registration statement are based on internal Company estimates of our past experience in the

industry, general market data, and public information which was not commissioned by us for this filing.

ITEM 1. BUSINESS

Overview

We are a science based direct

to consumer (DTC) health company offering products and services focused on aging biology wellness and longevity. Our program is based

on the book the Kaufmann Protocol® authored by our co-founder Dr. Sandra Kaufmann, M.D., and on identifying and offering individual

specific services, recommendations and treatments designed to improve our customers’ lifespan and health-span. Whereas lifespan

represents the total number of years we live, and health-span is

how many of those years we remain healthy, active, energetic and free from disease. Our goal is to use science and technology, current

and emerging treatments, for our customers to lengthen lifespan and maximize health-span.

We

operate a DTC sales model, which means we market our products directly to our target consumers. We currently sell our book, the Kaufmann

Protocol online, we offer, the Kaufmann Protocol, a mobile application on the iOS platform, and plan to commercialize and market a line

of products, including our own branded molecular agents, health and wellness testing kits and services, as well as published and multimedia

content.

Kaufmann Protocol

In the book The Kaufmann

Protocol, Dr. Kaufmann explores the multifactorial causes of aging and presents strategies where aging is curtailed, these strategies

are hereinafter referred to as the “Protocol”.

At the most basic level organisms

age because their component cells age, the Protocol addresses the seven known theories, or the “Kaufmann Seven Tenets” of

cellular aging into tenets, which are: Information Systems (DNA), Cellular Energy, Cellular Pathways, Quality Control, Immune System,

Individual Cells and Waste Management.

|

|

1.

|

Information Systems (DNA). DNA is our information depot. Issues with aging in this category include

epigenetic modification, accumulation of DNA damage, and telomeric integrity. Epigenetic modification encompasses changes to the “packaging”

of the DNA, including methylation, histone modification and the like. Telomeres, the caps or ends of DNA, are known to shorten over time

and are broadly correlated to the length of a life.

|

|

|

2.

|

Cellular Energy. Mitochondria, cellular organelles, serve as our energy source. These organelles

are rate limiting over time as their output declines, second to either damage from free radicals or simply declining availability of raw

materials.

|

|

|

3.

|

Cellular Pathways. The pathways are our aging or anti-aging pathways, such as the AMP Kinase, the

Sirtuin or the mTOR pathways. These are like enzymatic dominoes that can either direct your cells and tissues to age or not age.

|

|

|

4.

|

Quality Control. This category includes the DNA and Protein Repair mechanisms, which are key to

repairing the ongoing damage inside your cells. As you get older and the damage becomes more extensive, these mechanisms get a bit stressed.

This category also includes intracellular autophagy, a mechanism for cellular recycling.

|

|

|

5.

|

Immune System. The cells that compose the immune system constitute your security system. Over time,

unfortunately, this system becomes problematic and causes the body to be in a state of chronic and systemic inflammation. In addition,

the failing immune system causes an increase in infection and cancer.

|

|

|

6.

|

Individual Cells. Depending on the lifespan of particular cells, some live for days while some

last a life time, their particular needs can be specialized. Some require an increased pool of nutrients, while others have more issues

with trash accumulation.

|

|

|

7.

|

Waste Management. Every cell has requirements for living, such as oxygen and glucose. Unfortunately,

these can lead to increased aging. As an example, glucose forms molecular complexes called Advanced Glycation Endproducts (AGEs), which

are very destructive. As well, longer lived cells produce cellular waste, called lipofuscin, that accumulates and eventually causes space

issues.

|

Our Products

Based on the Seven Tenets,

the Protocol has identified a series of molecular agents, certain of which are dietary supplements and or prescription medications that

can be used to combat aging and improve health-span. Many of the molecular agents we recommend have been used in eastern medicine for

thousands of years based on their curative effects, and are generally available, none of which are proprietary to us. We do however identify

and present individualized and in certain instances dosage specific individualized recommendations, based on algorithmic outputs of our

software, based on individual biology, diet, lifestyle and desired outcomes. Three generalized, and our most popular regimens are:

|

|

·

|

The Panacea; The General Strategy

|

|

|

·

|

The Sweet Tooth; The Anti-Glycation Strategy

|

|

|

·

|

The Ache Remedy; The Anti-Inflammatory Strategy

|

We do not currently offer the molecular

agents that makeup our Strategies. Our designed strategies, include a regimen of molecular agents, which currently must be sourced from

third parties, however it is our plan to source and market the products which make up our proprietary strategies under our own brand,

the Kaufmann Protocol, which we plan to offer through our website and mobile application.

Our Mobile Application

The mobile application guides

users through a specific set of questions relating to your age and aging concerns and will use our proprietary algorithm to design a regimen

scientifically calculated to achieve optimum results addressing your needs, based on the users’ responses. We expect our mobile

and web applications will serve as a sales tool, for initial sales, reorders and as a means to connect with our customers to track their

progress, deliver relevant and meaningful content and serve as a platform for future growth and expansion of our DTC product offerings.

Market for our Products and Sales Strategy

Our target market spans “Baby

Boomers” (71.2 million, US Census 2019), “Generation X” (65.2

million, US Census 2019) and the “Silent Generation” (23

million US Census 2019). We expect that our target market, within our customer cohort skews towards college, post graduate with significant

disposable income and are actively seeking health & wellness solutions with a view towards maximizing quality of life, elongating

lifespan and maximizing health-span.

We believe that there is

a large audience of people who are interested in a science-based approach to healthy aging and lifespan enhancing strategies. Since it

was published, the Kaufmann Protocol book has sold approximately ten thousand copies with no marketing or advertising spend, Dr. Kaufmann

has participated in approximately 40 podcasts, and is consistently asked to speak and has spoken at leading anti-aging industry conferences.

We have not generated revenues from the sales of the book which predate our license agreement, we expect to generate revenues from

book sales which occur after the effective date of our license agreement.

We plan to source and market

the molecular agents that make up our primary protocols, the Panacea, the Sweet Tooth and the Anti-Inflammatory and

sell those products on our website, through our mobile application and on

third party ecommerce platforms, specifically on Amazon through the Fulfillment by Amazon program, if we are accepted. Moreover, we intend

to sell personalized protocols directly to users based on the results of our personalized evaluations which users will be able to access

through our mobile application, and eventually through our website. We plan

to drive traffic to our sales channels through paid advertising campaigns, content we generate and distribute directly through our own

social media channels and in partnership with influencers who we may seek to engage. We expect that Dr. Kaufmann’s continued appearance

on podcasts, as a speaker at industry conferences and in content we develop and distribute through our own distribution channels and on

social media, will be effective at driving awareness of our products and as a result drive sales.

Competition.

We operate in the health &

wellness industry and plan to generate revenues through the sale of nutritional supplements and health & wellness related content.

Both the health & wellness and nutritional supplement industries are highly fragmented, and intensely competitive. We are an early-stage

company and most of our competitors have longer operating histories, established customer bases with greater marketing reach and visibility,

they have more operating experience and greater financial resources than we do. Nutritional supplements are available through mass-market

retailers, drug stores, supermarkets, discount stores, health food stores, mail order companies, and direct sales organizations. We will

also compete with, bio-hackers, authors and other content providers who have written books on anti-aging, specialized anti-aging companies,

medical doctors and practices specializing in longevity medicine, and med-spas and facilities which offer anti-aging treatments, each

of whom have longer operating histories, may be more capitalized and better positioned than we are. We expect that in each category named

above there are formidable competitors and competition is intense.

Sources and Availability of Raw Materials and

the Names of Principal Suppliers.

We

have no present commitments or agreements with respect to the purchase of any raw materials needed for the production of our molecular

agent and or dietary supplement-based products; however, management believes that there is an adequate available supply of these materials

from various suppliers and there is and will be no constraint on us in sourcing the raw materials we need to make our finished products.

We may have to purchase raw materials based on certain minimum quantities; however, we believe that purchasing said quantities and any

supply agreements that require minimum purchase commitments will be available to us at reasonable and commercial terms. We plan to enter

exclusive supply agreements and manufacturing agreements to protect our products, regulate product costs, and help ensure quality control

standards.

Intellectual Property

We

do not currently own any patents, trademarks or copyrights, however we may in the future seek intellectual property protection on certain

works which we may invent author or otherwise create, and or which may be direct and or derivative works or enhancements of the Kaufmann

License.

We

have entered into a pre-paid, irrevocable worldwide license for the Kaufmann Protocol which is the first comprehensive approach to aging

that tackles why we age, and then recommends a strategic, scientific approach to decelerate the aging process (the Kaufmann License”),

with the Kaufmann Anti-Aging Institute LLC, (the Licensor”) who owns or controls certain, know-how, trade secrets, common law copyrights

and other intellectual property rights including the Licensor’s Apple iOS and Android applications and associated source codes,

the kaufmannprotocol.com domain name, and other assets, social media accounts, related to the Kaufman Protocol. The license extends to

any copyrights, patents and or trademarks which may be awarded in the future, including existing works which may be trademarked or copyrighted

under applicable laws. The domain name lifeextensions.com is owned by our CEO, and has been made available to us at no expense for an

indefinite period of time, our access to this domain name is terminable at will by our CEO.

Government Regulations

The FDA regulates the formulation,

manufacturing, packaging, storage, labeling, promotion, distribution, and sale of foods, dietary supplements, over-the-counter drugs,

medical devices, and pharmaceuticals. In January 2000, the FDA issued a final rule called “Statements Made for Dietary Supplements

Concerning the Effect of the Product on the Structure or Function of the Body”. In the rule and its preamble, the FDA distinguished

between permitted claims under the Federal Food, Drug and Cosmetic Act (the “FFDC Act”) relating to the effect of dietary

supplements on the structure or functions of the body, and impermissible direct or implied claims of the effect of dietary supplements

on any disease. In June 2007, the FDA issued a rule, as authorized under the FFDC Act, that defined current Good Manufacturing Practices

in the manufacture and holding of dietary supplements. Effective January 1, 2006, legislation required specific disclosures in labeling

where a food, including a dietary supplement, contains an ingredient derived from any of eight named allergens. Legislation passed at

the end of 2006 requires the reporting to the FDA any reports of “serious adverse events” associated with the use of a dietary

supplement or an over-the-counter drug that is not covered by new drug approval reporting. The FDA created the Office of Dietary Supplements

(“ODSP”) on December 21, 2015. The creation of this new office elevates the FDA’s program from its previous status as

a division under the Office of Nutrition and Dietary Supplements. ODSP will continue to monitor the safety of dietary supplements.

The Dietary Supplement Health

and Education Act of 1994, referred to as DSHEA, revised the provisions of the FFDC Act concerning the composition and labeling of dietary

supplements and statutorily created a new class entitled “dietary supplements.” Dietary supplements include vitamins, minerals,

herbs, amino acids, and other dietary substances used to supplement diets. A majority of our products are considered dietary supplements

as outlined in the FFDC Act, which requires us to maintain evidence that a dietary supplement is reasonably safe. A manufacturer of dietary

supplements may make statements concerning the effect of a supplement or a dietary ingredient on the structure or any function of the

body, in accordance with the regulations described above. As a result, we will be required to make such statements with respect to any

of the products we offer or may offer in the future. In some cases, such statements must be accompanied by a statutory statement that

the claim has not been evaluated by the FDA and that the product is not intended to treat, cure, mitigate, or prevent any disease, and

the FDA must be notified of such claim within 30 days of first use.

The FDA oversees product safety,

manufacturing, and product information, such as claims on a company's website, product’s label, package inserts, and accompanying

literature. The FDA has promulgated regulations governing the labeling and marketing of dietary and nutritional supplement products. The

regulations include:

|

|

·

|

the identification of dietary or nutritional supplements and their nutrition and ingredient labeling;

|

|

|

·

|

requirements related to the wording used for claims about nutrients, health claims, and statements of

nutritional support;

|

|

|

·

|

labeling requirements for dietary or nutritional supplements for which “high potency,” “antioxidant,”

and “trans-fatty acids” claims are made;

|

|

|

·

|

notification procedures for statements on dietary and nutritional supplements; and

|

|

|

·

|

pre-market notification procedures for new dietary ingredients in nutritional supplements.

|

In certain markets, including

the United States, specific claims made with respect to a product may change the regulatory status of a product. For example, a product

sold as a dietary supplement but marketed as a treatment, prevention, or cure for a specific disease or condition would likely be considered

by the FDA or other regulatory bodies as unapproved and thus an illegal drug. To maintain a product’s status as a dietary supplement,

its labeling and marketing must comply with the provisions in DSHEA and the FDA’s extensive regulations.

Dietary supplements are also

subject to the Nutrition, Labeling and Education Act and various other acts that regulate health claims, ingredient labeling, and nutrient

content claims that characterize the level of nutrients in a product. These acts prohibit the use of any specific health claim for dietary

supplements unless the health claim is supported by significant scientific research and is pre-approved by the FDA.

The FTC and other regulators

regulate marketing practices and advertising of a company and its products. Regulators have instituted and continue to bring enforcement

actions against numerous dietary supplement companies for false and/or misleading marketing practices, as well as misleading advertising

of products. These enforcement actions have resulted in consent decrees and significant monetary judgments against the companies and/or

individuals involved. Regulators require a company to convey product claims clearly and accurately and further require marketers to maintain

adequate substantiation for their claims. More specifically, the FTC requires such substantiation to be competent and reliable scientific

evidence and requires a company to have a reasonable basis for the expressed and implied product claim before it disseminates an advertisement.

A reasonable basis is determined based on the claims made, how the claims are presented in the context of the entire advertisement, and

how the claims are qualified. The FTC’s standard for evaluating substantiation is designed to ensure that consumers are protected

from false and/or misleading claims by requiring scientific substantiation of product claims at the time such claims are first made. The

failure to have this substantiation violates the Federal Trade Commission Act.

Due to the diverse scope of

regulations applicable to our planned products and the various regulators enforcing these requirements, determining how to conform to

all requirements is often open to interpretation and debate. However, our policy is and will continue to be, to fully cooperate with any

regulatory agency in connection with any inquiries or other investigations.

We can make no assurances that regulators will not question our actions in the future, even though we continue to make efforts to comply

with all applicable regulations, inquiries, and investigations.

History of Our Company

Worldwide Strategies Incorporated

("we", "us", or "our") was originally incorporated in the State of Nevada on April 6, 1998 as Boyd Energy

Corporation, on July 17, 2001 the corporation’s name was changed to Barnett Energy Corporation and on June 15, 2005, pursuant to

a business combination with Worldwide Business Solutions Incorporated, a Colorado corporation ("WBSI"), WBSI became a wholly-owned

subsidiary of the company and the corporation’s name was changed to Worldwide Strategies Inc. On July 31, 2007, we acquired 100%

of the issued and outstanding shares of Centric Rx, Inc., a Nevada corporation which was merged out of existence in connection with the

share exchange. We subsequently ceased operations in 2015 and the Company has fully impaired all assets since the shutdown of its operations

in 2015 and recorded the effects of this impairment as part of its discontinued operations. As a result of our discontinuation of operations,

on August 1, 2017 and January 2, 2018, respectively our two subsidiaries were dissolved for non-payment of annual fees. Therefore, Worldwide

Business Solutions Incorporated, a Colorado corporation and Worldwide Business Solutions Limited, a United Kingdom corporation, a subsidiary

of Worldwide Business Solutions Incorporated, are no longer subsidiaries of the Company.

On May 7, 2019, the Eighth

Judicial District Court of Nevada appointed Small Cap Compliance, LLC (“Custodian”) as custodian for Worldwide Strategies

Inc., and on May 8, 2019, the Custodian appointed an executive officer and board member, who on July 10, 2019, filed a certificate of

reinstatement of WWSG with the state of Nevada. On October 16, 2019, the Eighth Judicial

District Court of Nevada discharged Small Cap Compliance, LLC as custodian for Worldwide Strategies Inc. On

July 10, 2019 the Custodian appointed board member and sole executive officer, appointed a new member to the board of directors and subsequently

resigned from the board and as the company’s sole executive officer. The board of directors subsequently appointed the current management

team, who are reorganizing the business as a health technology company.

Employees

As of June 21, 2021, we had

two employees, our CEO and CFO, each of whom are part-time employees and each of whom are our founders.

ITEM

1A. RISK FACTORS.

RISK FACTORS

Risks Relating to Our Business and Industry.

We Have a limited Operating History Within

this Industry, and we may not Succeed.

We have limited specific operating

history or experience in procuring, marketing and selling anti-aging products and as such, within this industry we may not succeed. Moreover,

we are subject to all risks inherent in a developing a new business enterprise. Our likelihood of success must be considered in light

of the problems, expenses, difficulties, complications, and delays frequently encountered in connection with establishing a new business

and the competitive environment in which we operate. For example, we will need to develop supply chains for our molecular agents, develop

systems and processes for fulfillment, logistics and customer service and we will need to develop and execute effective communications,

marketing and sales campaigns.

You should further consider,

among other factors, our prospects for success in light of the risks and uncertainties encountered by companies that, like us, are in

their early stages. For example, unanticipated expenses, delays and or complications with sourcing raw materials and managing time-sensitive

inventories. We may not successfully address these risks and uncertainties or successfully implement our operating strategies. If we fail

to do so, it could materially harm our business to the point of having to cease operations and could impair the value of our common stock

to the point our investors may lose their entire investment

We have not yet commenced operations which

will generate revenue for the company.

We plan to generate revenue

through the commercialization of the Protocol described in the book the Kaufmann Protocol, which includes driving sales of the book and

the molecular agents identified in Dr. Kaufmann’s book. While we believe that our products will benefit our customers, and we believe

that our fundraising efforts will enable us to execute our business plan, there are no assurances when we will begin generating revenue,

how much revenue we will generate and if the revenues we generate will be sufficient to cover our operations, or if we will generate revenues

at all. If we are unable to generate revenues from the sale of Protocol related products and content, we would be hard pressed to identify

a new business model within the anti-aging space that would generate revenues in a reasonable amount of time, if at all.

We are smaller and less diversified than

many of our competitors.

Many of the producers of anti-aging,

health & wellness and longevity products with which we compete are part of large diversified corporate groups with a variety of other

operations, more extensive product lines, which provide stable sources of earnings that may allow them to better offset fluctuations in

the financial performance of their operations. In addition, larger media and health & wellness companies have more resources with

which to compete for customers. The resources of larger companies may also give them an advantage in scaling marketing campaigns, procuring

lower prices for raw materials as well as finished products.

We depend upon key personnel, the loss of

which could seriously harm our business.

Our operating performance

is substantially dependent on the continued services of our executive officers, Mr. Pavan Charan, Mr. Adam Laufer, who also serve on our

Board of Directors, as well as our board member, Dr. Sandra Kaufmann. We believe our executives collective knowledge and experience would

be difficult to replicate. We have not entered into an employment agreement with either Messrs. Charan, Laufer or Dr. Kaufmann and, although

we are considering doing so. We have not secured any key-person life insurance on our officers or directors. The unexpected loss of the

services of Dr. Kaufmann, Messrs. Charan or Laufer could have a material adverse effect on our business, operations, financial condition

and operating results, as well as the value of our common stock.

If we are unable to obtain and maintain

intellectual property protection for our technology, content and products, or if the scope of the intellectual property protection obtained

is not sufficiently broad, our competitors could develop and commercialize technology, content and products similar or identical to ours,

and our ability to successfully commercialize our existing intellectual property and any intellectual property we may develop in the future,

may be adversely affected.

Our commercial success will

depend in large part on our ability to obtain and maintain appropriate intellectual property protections, including but not limited to

patent, trademark, trade secret and other intellectual property protection of our content, products and other technology including our

protocols, and methods of treatment, as well as successfully defending our patent and other intellectual property rights against third-party

challenges. It is difficult and costly to protect our technology and products, and we may not be able to ensure their protection. Our

ability to stop unauthorized third parties from making, using, selling, offering to sell, importing or otherwise commercializing our products

or products similar or indistinguishable from ours is dependent upon the extent to which we have rights under valid and enforceable patents

or trade secrets that cover these assets could have a material adverse effect on our competitive

position, business, financial conditions, results of operations, and prospects.

Any significant disruption in the computer

systems of third parties that we utilize in our operations could result in a loss or degradation of service and could adversely impact

our business.

Our reputation and ability

to sell our products and serve our customers through our websites and applications is dependent upon the reliable performance of the computer

systems of third parties that we utilize in our operations. These systems may be subject to damage or interruption from earthquakes, adverse

weather conditions, other natural disasters, terrorist attacks, power loss, telecommunications failures, computer viruses, computer denial

of service attacks or other attempts to harm these systems. Interruptions in these systems or to the internet in general, could make our

services unavailable or impair our ability to sell our products and or serve our customers.

If we violate governmental regulations or

fail to obtain necessary regulatory approvals, our operations could be adversely affected.

Our operation is subject to

extensive laws, governmental regulations, administrative determinations, court decisions, and similar constraints at the federal, state,

and local levels in our domestic and foreign markets. These regulations primarily involve the following:

|

|

·

|

the formulation, manufacturing, packaging, labeling, distribution, importation, sale, and storage of our

products;

|

|

|

·

|

the health and safety of dietary supplements;

|

|

|

·

|

our product claims and advertising;

|

|

|

·

|

the assessment of customs duties;

|

|

|

·

|

further taxation of our independent associates, which may obligate us to collect additional taxes and

maintain additional records; and

|

|

|

·

|

export and import restrictions.

|

Any unexpected new regulations

or changes in existing regulations could significantly restrict our ability to continue operations, which could adversely affect our business.

For example, changes regarding health and safety and food and drug regulations for our nutritional products could require us to reformulate

our products to comply with such regulations.

Increased regulatory scrutiny of nutritional

supplements as well as new regulations that are being adopted in some of our markets with respect to nutritional supplements could result

in more restrictive regulations and harm our results if our supplements or advertising activities are found to violate existing or new

regulations or if we are not able to effect necessary changes to our products in a timely and efficient manner to respond to new regulations.

There has been an increasing

movement in the United States and other markets to increase the regulation of dietary supplements, which could impose additional restrictions

or requirements on us and increase the cost of doing business. On February 11, 2019, the FDA issued a statement from FDA Commissioner,

Dr. Scott Gottlieb, regarding the agency's efforts to strengthen the regulation of dietary supplements. The FDA will be prioritizing and

focusing resources on misbranded products bearing unproven claims to treat, cure, or mitigate disease. Commissioner Gottlieb established

a Dietary Supplement Working Group tasked with reviewing the agency's organizational structure, process, procedures, and practices to

identify opportunities to modernize the oversight of dietary supplements. Additionally, on December 21, 2015, the FDA created the Office

of Dietary Supplements (“ODSP”). The creation of this new office elevates the FDA’s program from its previous status

as a division under the Office of Nutrition and Dietary Supplements. ODSP will continue to monitor the safety of dietary supplements.

In markets outside of the United States, prior to commencing operations or marketing new products, we may be required to obtain approvals,

registrations, licenses, or certifications from an agency comparable to the FDA for the specific market. Approvals or registration may

require reformulation of our products or may be unavailable to us with respect to certain products or ingredients. We must also comply

with product labeling regulations, which vary by jurisdiction.

In August 2016, the FDA published

its revised draft guidance on Dietary Supplements: New Dietary Ingredient Notifications and Related Issues. If a company sells a dietary

supplement containing an ingredient that FDA considers either not a dietary ingredient or a new dietary ingredient (“NDI”)

that needs an NDI notification, the agency may threaten or initiate enforcement against the Company. For example, it might send a warning

letter that can trigger consumer lawsuits, demand a product recall, or even work with the Department of Justice to bring a criminal action.

Our operations could be harmed if new guidance or regulations require us to reformulate products or effect new registrations, if regulatory

authorities make determinations that any of our products do not comply with applicable regulatory requirements, if the cost of complying

with regulatory requirements increases materially, or if we are not able to effect necessary changes to our products in a timely and efficient

manner to respond to new regulations. In addition, our operations could be harmed if governmental laws or regulations are enacted that

restrict the ability of companies to market or distribute nutritional supplements or impose additional burdens or requirements on nutritional

supplement companies.

If our outside suppliers and manufacturers

fail to supply products in sufficient quantities and in a timely fashion, our business could suffer.

Outside manufacturers will

make all of our products. We will be dependent on outside suppliers and manufacturers to supply us with products in a timely and cost-efficient

manner. We believe there are dependable suppliers for all of the ingredients we require for the products we plan to sell, however if we

are unable to find and retain suppliers and or our suppliers are unable to perform and we are unable to find replacement suppliers, our

business operations would be adversely affected.

The loss of suppliers or shortages of raw

materials could have an adverse effect on our business, financial condition, or results of operations.

We will depend on outside

suppliers for raw materials. We expect that some if not all of our contract manufacturers will acquire the raw materials for manufacturing

our products from third-party suppliers. In the event we were to lose any significant suppliers and have trouble in finding or transitioning

to alternative suppliers, it could result in product shortages or product back orders, which could harm our business. There can

be no assurance that suppliers will be able to provide our contract manufacturers the raw materials in the quantities and at the appropriate

level of quality that we request or at a price that we are willing to pay. We are also subject to delays caused by any interruption

in the production of these materials including weather, disease, crop conditions, climate change, transportation interruptions and natural

disasters or other catastrophic events. For example, in December 2019, COVID-19 was first identified in Wuhan, Hubei Province, China.

While initially the outbreak was largely concentrated in China and caused significant disruptions to its economy, it has now spread to

several other countries and infections have been reported globally. The extent to which COVID-19 impacts our operations will depend on

future developments, which are highly uncertain and cannot be predicted with confidence, including the duration of the outbreak, new information

which may emerge concerning the severity of COVID-19 and the actions to contain COVID-19 or treat its impact, among others. In particular,

the continued spread of COVID-19 globally could adversely impact our operations, including among others, our manufacturing and supply

chain, sales and marketing and clinical trial operations and could have an adverse impact on our business and our financial results.

The occurrence of natural or man-made disasters

could result in declines in business that could adversely affect our financial condition, results of operations and cash flows.

We are exposed to various

risks arising out of natural disasters, including earthquakes, hurricanes, fires, floods, landslides, tornadoes, typhoons, tsunamis, hailstorms,

explosions, climate events or weather patterns and pandemic health events (such as the recent pandemic spread of the novel corona virus

known as COVID-19 virus, duration and full effects of which are still uncertain), as well as man-made disasters, including acts of terrorism,

military actions, cyber-terrorism, explosions and biological, chemical or radiological events. The continued threat of terrorism and ongoing

military actions may cause significant volatility in global financial markets, and a natural or man-made disaster could trigger an economic

downturn in the areas directly or indirectly affected by the disaster. These consequences could, among other things, result in a decline

in business. Disasters also could disrupt public and private infrastructure, including communications and financial services, which could

disrupt our normal business operations. A natural or man-made disaster also could disrupt the operations of our partners and counterparties

or result in increased prices for the products and services they provide to us.

If we are exposed to product liability claims,

we may be liable for damages and expenses, which could affect our overall financial condition.

We could face financial liability

from product liability claims if the use of our products results in significant loss or injury. We can make no assurances that we will

not be exposed to any substantial future product liability claims. Such claims may include claims that our products contain contaminants,

that we provide consumers with inadequate instructions regarding product use, or that we provide inadequate warnings concerning side effects

or interactions of our products with other substances. We believe that, our suppliers, and our manufacturers maintain adequate product

liability insurance coverage, and we believe that product liability insurance will be available to us at reasonable terms. However, a

substantial future product liability claim could exceed the amount of insurance coverage or could be excluded under the terms of an existing

insurance policy, which could adversely affect our overall future financial condition.

In recent years, a discovery

of Bovine Spongiform Encephalopathy (“BSE”), which is commonly referred to as “Mad Cow Disease”, has caused concern

among the general public. As a result, some countries have banned the importation or sale of products that contain bovine materials sourced

from locations where BSE has been identified, if a vegetable base is not available or practical for use, certifications are required

to ensure the capsule material is BSE-free. The higher costs could affect our financial condition, results of operations, and our cash

flows.

The global nutrition and skin care industries

are intensely competitive and the strengthening of any of our competitors could harm our business.

The global nutrition and skin

care industries are intensely fragmented and competitive. We compete with other global nutrition and skin care industries. Many of our

competitors have greater name recognition and financial resources, which may give them a competitive advantage. Our competitors may also

be able to devote greater resources to marketing, promotional, and pricing campaigns to lead customers to buy products from competitors

rather than from us. Such competition could adversely affect our business.

A downturn in the economy, including as

a result of COVID-19, could affect consumer purchases of discretionary items such as the health and wellness products that we offer, which

could have an adverse effect on our business, financial condition, profitability, and cash flows.

A downturn in the economy,

including as a result of COVID-19, could adversely impact consumer purchases of discretionary items such as health and wellness products.

The United States and global economies may slow dramatically as a result of a variety of problems, including turmoil in the credit and

financial markets, concerns regarding the stability and viability of major financial institutions, the state of the housing markets, and

volatility in worldwide stock markets. In the event of such economic downturn, the U.S. and global economies could become significantly

challenged in a recessionary state for an indeterminate period of time. These economic conditions could negatively affect demand for our

products for some time, which in turn could harm our business by adversely affecting our revenues, results of operations, cash flows and

financial condition. We cannot predict these economic conditions or the impact they would have on our consumers or business.

Adverse or negative publicity could cause

our business to suffer.

Our business depends, in part,

on the public’s perception of our integrity and the safety and quality of our products. Any adverse publicity could negatively affect

the public’s perception about our industry, our products, or our reputation and could result in a significant decline in our operations.

Specifically, we are susceptible to adverse or negative publicity regarding:

|

|

·

|

the nutritional supplements industry;

|

|

|

·

|

skeptical consumers;

|

|

|

·

|

competitors;

|

|

|

·

|

the safety and quality of our products and/or our ingredients;

|

|

|

·

|

regulatory investigations of our products or our competitors’ products;

|

If our information technology system fails

or if the implementation of new information technology systems is not executed efficiently and effectively, our business, financial position,

and operating results could be adversely affected.

Like many companies, our business

is heavily dependent upon our information technology infrastructure to effectively manage and operate many of our key business functions,

including:

|

|

·

|

order processing;

|

|

|

·

|

supply chain management;

|

|

|

·

|

customer service;

|

|

|

·

|

product distribution;

|

|

|

·

|

cash receipts and payments; and

|

|

|

·

|

financial reporting.

|

These systems and operations

are vulnerable to damage and interruption from fires, earthquakes, telecommunications failures, and other events. They are also subject

to break-ins, sabotage, intentional acts of vandalism and similar misconduct. Although we maintain an extensive security system and business

continuity program that was developed under the guidelines published by the National Institute of Standards of Technology, a long-term

failure or impairment of any of our information technology systems could adversely affect our ability to conduct day-to-day business.

Occasionally information technology

systems must be upgraded or replaced and if this system implementation is not executed efficiently and effectively, the implementation

may cause interruptions in our primary management information systems, which may make our website or services unavailable thereby preventing

us from processing transactions, which would adversely affect our financial position or operating results.

The regulatory climate for

data privacy and protection continues to grow in scope and complexity both domestically and in the international markets in which we operate.

Although there is no single federal law in the United States imposing a cross-sectoral data breach notification obligation, virtually

every state has enacted breach notification requirements. Additionally, many of the international countries in which we operate have proposed

or enacted laws or regulations on the appropriate use and disclosure of financial and personal data. The European Union (“EU”)

adopted the General Data Protection Regulation (“GDPR”) on April 27, 2016. The GDPR went into effect on May 25, 2018. The

GDPR applies to organizations based in the EU and organizations based outside of the EU that offer products or services to individuals

in the EU or that otherwise monitor individuals in the EU. While U.S. state laws generally cover specific categories of sensitive personal

data (e.g., social security numbers, bank account numbers, and credit card numbers), the GDPR notification requirements will apply to

incidents involving any personal data, meaning any data related to an identified person. In Canada, the Personal Information Protection

and Electronic Documents Act (“PIPEDA”) went into effect on November 1, 2018. PIPEDA applies to foreign organizations with

a real and substantial link to Canada that collect, use, or disclose the personal information of Canadians in the course of their commercial

activities. Under PIPEDA, an organization must notify individuals of any breach of the security of safeguards involving their personal

information if it is reasonable to believe that the breach creates a “real risk of significant harm.” Concurrently, the organization

must also report to the Privacy Commissioner of Canada. As noted above, many states have enacted data protection requirements. Most recently,

the California Consumer Privacy Act ("CCPA"), a state statute signed into law on June 28, 2018 and effective on January 1, 2020,

provides enhanced data privacy protections to California residents. The CCPA applies to companies with annual gross revenues in excess

of $25 million. Our failure or inability to comply with data protection regimes domestically and in foreign countries could result in

fines, penalties, injunctions, or material litigation expenditures.

With increased frequency in

recent years, cyber-attacks against companies have resulted in breaches of data security. Our business requires the storage and transmission

of suppliers’ data and customers’ personal, credit card, and other confidential information. Our information technology systems

are susceptible to a growing and evolving threat of cybersecurity risk. Any substantial compromise of our data security, whether externally

or internally, or misuse of associate, customer, or employee data, could cause considerable damage to our reputation, cause the public

disclosure of confidential information, and result in lost sales, significant costs, and litigation, which would negatively affect our

financial position and results of operations. We currently do not have insurance to protect us from claims surrounding the protection

of sensitive data, and we have no assurances that we will be able to insure against these risks, and if we are if the cost of insurance

will be available at reasonable terms and if such coverage would be adequate, and there can be no assurances that we will not be subject

to such claims in the future.

There is no established market for

our stock and our common stock is not listed on a stock exchange; as a result, stockholders may not be able to resell their shares at

or above the price paid for them.

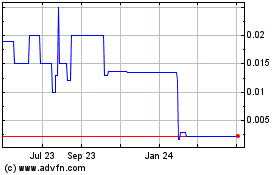

There is not an established

market for our common stock. Our common stock is listed on the OTC market under ticker symbol WWSG; stocks which trade on the OTC markets

tend to be illiquid and volatile and could be subject to significant fluctuations due to changes in sentiment in the market regarding

our operations or business prospects, among other factors. Further, our common stock is not listed on a stock exchange, nor do we currently

intend to list the common stock on a stock exchange. There are no assurances that an active public market for our common stock will develop.

Therefore, stockholders may not be able to sell their shares at or above the price they paid for them.

Other factors that could affect

our stock price are:

|

|

·

|

broad market fluctuations and general economic conditions;

|

|

|

·

|

fluctuations in our financial results;

|

|

|

·

|

future securities offerings;

|

|

|

·

|

changes in the market’s perception of our products or our business, including false or negative

publicity;

|

|

|

·

|

governmental regulatory actions;

|

|

|

·

|

the outcome of any lawsuits;

|

|

|

·

|

financial and business announcements made by us or our competitors;

|

|

|

·

|

the demand and daily trading volume of our shares;

|

|

|

·

|

the general condition of the industry; and

|

|

|

·

|

the sale of large amounts of stock by insiders.

|

In addition, the stock market

has experienced extreme price and volume fluctuations in recent years that have significantly affected the quoted prices of the securities

of many companies. The changes sometimes appear to occur without regard to specific operating performance. The price of our common stock

in the open market could fluctuate based on factors that have little or nothing to do with us or that are outside of our control. For

example, general economic conditions, such as recession or interest rate or currency rate fluctuations in the United States or abroad,

could negatively affect the market price of our common stock in the future.

Our management controls a large block of

our common stock that will allow them to control us.

As of June 21, 2021, while

members of our management team and affiliates beneficially don’t own any of our outstanding common stock, they do own shares of

our preferred stock, which are convertible to 90.92% of our common stock. As such, management owns approximately 90.92% of our voting

power and controls the Company. As a result, management has the ability to control substantially all matters submitted to our stockholders

for approval including:

|

|

·

|

election of our board of directors;

|

|

|

·

|

removal of any of our directors;

|

|

|

·

|

removal of any of our directors;

|

|

|

·

|

amendment of our articles of incorporation or bylaws; and

|

|

|

·

|

adoption of measures that could delay or prevent a change in control or impede a merger, takeover or other

business combination involving us.

|

In addition, management's

stock ownership may discourage a potential acquirer from making a tender offer or otherwise attempting to obtain control of us, which

in turn could reduce our stock price or prevent our stockholders from realizing a premium over our stock price.

Sales by our stockholders of a substantial

number of shares of our common stock in the public market could adversely affect the market price of our common stock.

A substantial portion of our

total outstanding shares of common stock may be sold into the market by our principal stockholders, who are also executive officers, and

while we believe that such holders have no current intention to sell a significant number of shares of our stock, if our principal stockholders

were to decide to sell large amounts of stock over a short period of time such sales could cause the market price of our common stock

to drop significantly, even if our business is doing well.

Further, the market price

of our common stock could decline as a result of the perception that such sales could occur. These sales, or the possibility that these

sales may occur, also might make it more difficult for us to sell equity securities in the future at a time and price that we deem appropriate.

We currently have 19,830,679 shares of common stock outstanding, 3,106,228 of which are freely tradable without restriction under

the Securities Act.

We are not required to pay dividends, and

our Board of Directors may decide not to declare dividends in the future.

The declaration of dividends

on our common stock is solely within the discretion of our Board of Directors, subject to limitations under Texas law stipulating that

dividends may not be paid if payment therefore would cause the corporation to be insolvent or if the amount of the dividend would exceed

the surplus of the corporation. Our Board of Directors may decide not to declare dividends or we could be prevented from declaring a dividend

because of legal or contractual restrictions. The failure to pay dividends could reduce our stock price.

Going concern report of independent certified

public accountants.

Our limited history of operations

and our absence of revenues to date raise substantial doubt about our ability to continue as a going concern. In this regard, see the

Report of Independent Certified Public Accountants accompanying our audited financial statements appearing elsewhere herein which cites

substantial doubt about our ability to continue as a going concern. There can be no assurance that we will achieve profitability or generate

positive cash flow in the future. As a result of these and other factors, there can be no assurance that our proposed activities will

be successful or that the Company will be able to achieve or maintain profitable operations. If we fail to achieve profitability, our

growth strategies could be materially and adversely affected.

In the event that we do not generate adequate

cash flow from operations, we will need to raise money through a debt or equity financing, if available, or curtail operations.

If we are unsuccessful in

generating positive cash flow from operations, we could exhaust whatever cash resources we may have on hand, if any, and be required to

secure additional funding through a debt or equity financing, significantly scale back our operations, and/or discontinue many of our

activities, which could negatively affect our business and prospects. Additional funding may not be available or may only be available

on unfavorable terms.

If we experience rapid growth, we may not

manage our growth effectively, execute our business plan as proposed or adequately address competitive challenges.

If we are successful in executing

our business plan and grow at an accelerated rate beyond our expectation, such growth could place a significant strain on our management,

administrative, operational and financial infrastructure. Our long-term success will depend, in part, on our ability to manage this growth

effectively, grow our internal resources as required, including management and staff personnel. To manage the expected growth of our operations

and personnel, we also will need to increase our internal operational, financial and management controls, and our reporting systems and

procedures. Failure to effectively manage growth could result in an ability to meet customer orders in a timely manner, if at all, and

possibly damaging our reputation, resulting in the loss of existing and or potential customers, wasting of financial resources, and realizing

lost opportunities. Any of these difficulties could adversely impact our business financial condition, operating results, liquidity and

prospects.

To be successful, we need to attract and

retain qualified personnel.

Our success will depend to

a significant extent on our ability to identify, attract, hire, train and retain qualified professional and managerial personnel. Competition

for qualified employees is significant. We cannot assure you that we will be successful in identifying, attracting, hiring, training and

retaining such personnel in the future. If we were unable to hire, assimilate and retain qualified personnel in the future, such inability

could have a material adverse effect on our business, financial condition, operating results, liquidity and prospects.

The spread of COVID-19 underscores certain

risks we face, and the rapid development and fluidity of this situation precludes any prediction as to the ultimate adverse impact to

us of COVID-19.

In December 2019, COVID-19

was reported to have surfaced in Wuhan, China. COVID-19 has since spread to over 100 countries, including every state in the

United States. On March 11, 2020 the World Health Organization declared COVID-19 a pandemic, and on March 13, 2020 the United

States declared a national emergency with respect to COVID-19. The spread of COVID-19 underscores certain risks we face

in our business that are described in this disclosure document. Governmental and non-governmental organizations may not effectively combat

the spread and severity of COVID-19, which could adversely impact our profitability. The adverse economic effects of COVID-19 may

materially decrease demand for our products based on changes in consumer behavior or the restrictions in place by governments trying to

curb the outbreak. For example, we have rescheduled corporate sponsored events, and in some cases, our associates have canceled sales

meetings. This could lead to adverse impacts on our sales in fiscal year 2020 and our overall liquidity.

The spread of COVID-19,

or actions taken to mitigate this spread, could have material and adverse effects on our ability to operate effectively, including as

a result of the complete or partial closure of certain businesses and the inability of our associates to market our products as a result

of “shelter-in-place” and similar policies that may be implemented in an effort to mitigate the spread of COVID-19. Furthermore,

the outbreak of COVID-19 has severely impacted global economic activity, and caused significant volatility and negative pressure

in the financial markets. We have started to experience challenges in getting raw materials and ingredients to our contract manufacturers

and finished products to our distribution centers resulting from reductions in global transportation capacity.

The rapid development and fluidity

of this situation precludes any prediction as to the ultimate adverse impact to us of COVID-19. We are continuing to monitor the

spread of COVID-19 and related risks. The magnitude and duration of the pandemic and its impact on our business, results of

operations, financial position, and cash flows is uncertain as this continues to evolve globally. However, if the spread continues on

its current trajectory, such impact could grow and our business, results of operations, financial position, and cash flows could be materially

adversely affected.

Having no independent directors on our board

limits our ability to establish effective independent corporate governance procedures.

We do not have any independent

directors on our board of directors nor do we maintain a standing audit committee, compensation committee or nominating and governance

committee. Accordingly, without independent directors, we cannot establish effective standing board committees to oversee functions such

as audit, compensation and corporate governance. In addition, our executive officers are also directors. This structure gives our executive

officers significant control over all corporate issues.

Unless and until we have a

larger board of directors that would include a majority of independent members, there will be limited oversight of our executive officers'

decisions and activities and little ability for you to challenge or reverse those activities and decisions, even if they are not in your

best interests.

If we fail to maintain an

effective system of internal control over financial reporting, we may not be able to accurately report our financial results. As a result,

we could become subject to sanctions or investigations by regulatory authorities and/or stockholder litigation, which could harm our business

and have an adverse effect on our stock price.

As a public reporting company,

we are required to comply with the Sarbanes-Oxley Act of 2002 and the related rules and regulations of the SEC, including periodic reports,

disclosures and more complex accounting rules. As directed by Section 404 of Sarbanes-Oxley, the SEC adopted rules requiring public

companies to include a report of management on a company's internal control over financial reporting in their Annual Report on Form 10-K.

Based on current rules, we are required to report under Section 404(a) of Sarbanes-Oxley regarding the effectiveness of our internal control

over financial reporting.

Requirements associated with being a reporting

public company will require significant company resources and management attention.

Subsequent to effectiveness

of this registration statement, we will be required to comply with the reporting requirements as promulgated under the Securities Exchange

Act of 1934 which will require that we retain legal, accounting and financial advisors to ensure adequate disclosure and control systems

to manage our growth and our obligations as a company that files reports with the SEC. These areas include corporate governance, internal

control, internal audit, disclosure controls and procedures and financial reporting and accounting systems. However, we cannot assure

you that these and other measures we may take will be sufficient to allow us to satisfy our obligations as an SEC reporting company on

a timely basis.

In addition, compliance with

reporting and other requirements applicable to SEC reporting companies will create additional costs for us, will require the time and

attention of management and will require the hiring of additional personnel and legal, audit and other professionals. We cannot predict

or estimate the amount of the additional costs we may incur, the timing of such costs or the impact that our management's attention to

these matters will have on our business.

Our officers and directors have limited

liability, and we are required in certain instances to indemnify our officers and directors for breaches of their fiduciary duties.

We have adopted provisions

in our Articles of Incorporation and Bylaws, which limit the liability of our officers and directors and provide for indemnification by

us of our officers and directors to the full extent permitted by Nevada corporate law. Our articles generally provide that our officers

and directors shall have no personal liability to us or our shareholders for monetary damages for breaches of their fiduciary duties as

directors, except for breaches of their duties of loyalty, acts or omissions not in good faith or which involve intentional misconduct

or knowing violation of law, acts involving unlawful payment of dividends or unlawful stock purchases or redemptions, or any transaction

from which a director derives an improper personal benefit. Such provisions substantially limit our shareholders' ability to hold officers

and directors liable for breaches of fiduciary duty, and may require us to indemnify our officers and directors.

No audit or compensation committee

Because we do not have an

audit or compensation committee, stockholders will have to rely on our entire Board of Directors, none of which are independent, to perform

these functions. We do not have an audit or compensation committee comprised of independent directors. Indeed, we do not have any audit

or compensation committee. These functions are performed by our Board of Directors as a whole. No members of our Board of Directors are

independent directors. Thus, there is a potential conflict in that Board members who are also part of management will participate in discussions

concerning management compensation and audit issues that may affect management decisions.

If we fail to establish and maintain proper

and effective internal control over financial reporting, our operating results and our ability to operate our business could be harmed.

Ensuring that we have adequate

internal financial and accounting controls and procedures in place so that we can produce accurate financial statements on a timely basis

is a costly and time-consuming effort that needs to be re-evaluated frequently. Our internal control over financial reporting

is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial

statements in accordance with generally accepted accounting principles. Currently we do not have appropriate controls in place, due in

part to our size and lack of resources, however as soon as practicable, we intend to begin the process of documenting, reviewing and improving

our internal controls and procedures for compliance with Section 404 of the Sarbanes-Oxley Act of 2002, or SOX, which will require

annual management assessment of the effectiveness of our internal control over financial reporting.

Implementing any appropriate

changes to our internal controls may distract our officers and employees, entail substantial costs to modify our existing processes and

take significant time to complete. These changes may not, however, be effective in maintaining the adequacy of our internal controls,

and any failure to maintain that adequacy, or consequent inability to produce accurate financial statements on a timely basis, could increase

our operating costs and harm our business. In addition, investors’ perceptions that our internal controls are inadequate or that

we are unable to produce accurate financial statements on a timely basis may harm our common share price and have an adverse effect on

how we are perceived by customers, current and potential investors.

Any future litigation could have a material

adverse impact on our results of operations, financial condition and liquidity, particularly since we do not currently have director and

officer insurance. Our lack of D&O insurance may also make it difficult for us to retain and attract talented and skilled directors

and officers.

From time to time, we may

be subject to litigation, including potential stockholder derivative actions. Risks associated with legal liability are difficult to assess

and quantify, and their existence and magnitude can remain unknown for significant periods of time. To date we have not procured directors

and officers liability ("D&O") insurance to cover such risk exposure for our directors and officers. Such insurance generally

pays the expenses (including amounts paid to plaintiffs, fines, and expenses including attorneys' fees) of officers and directors who

are the subject of a lawsuit as a result of their service to the Company. While we are currently seeking such insurance, there can be

no assurance that we will be able to do so at reasonable rates or at all, or in amounts adequate to cover such expenses should such a

lawsuit occur. While neither Nevada law nor our articles of incorporation or bylaws require us to indemnify or advance expenses to our

officers and directors involved in such a legal action, we expect that we would do so to the extent permitted by Nevada law. Without D&O

insurance, the amounts we would pay to indemnify our officers and directors should they be subject to legal action based on their service

to the Company could have a material adverse effect on our financial condition, results of operations and liquidity. Further, our lack

of D&O insurance may make it difficult for us to retain and attract talented and skilled directors and officers, which could adversely

affect our business.

The Concentration of Our Stock Ownership

Limits Our Stockholders’ Ability to Influence Corporate Matters.

Our Convertible Series

A preferred stock has 6.25 votes per share and our Convertible Series B preferred stock has 1,000 votes per share, while our common stock

has one vote per share. As of August 9, 2021, Messrs. Charan, Laufer and Dr. Kaufmann, beneficially owned 100% of our outstanding Convertible

Series B preferred stock and 70.16% of our Convertible Series A preferred stock, which represented approximately 90.92% of the voting

power of our outstanding capital stock. Messrs. Charan, Laufer and Dr. Kaufmann therefore have the voting power over all matters requiring

stockholder approval, including the election of directors and significant corporate transactions, such as a merger or other sale of our

company or our assets, for the foreseeable future.

This concentrated control

limits or severely restricts our stockholders’ ability to influence corporate matters and, as a result, we may take actions that

our stockholders do not view as beneficial. As a result, the market price of our common stock could be adversely affected.

Risks Related to the Market for our Stock

The reduced disclosure requirements applicable

to us as a "smaller reporting company" may make our common stock less attractive to investors.

We are a "smaller reporting

company" as defined in Rule 12b-2 of the Exchange Act. As a smaller reporting company, we prepare and file SEC forms similar to other

SEC reporting companies; however, the information disclosed may differ and be less comprehensive. If some investors find our common stock

less attractive as a result of less comprehensive information we may disclose pursuant to the exemptions available to us as a smaller

reporting company, there may be a less active trading market for our common stock and our stock price may be more volatile than that of

an otherwise comparable company that does not avail itself of the same or similar exemptions.

Circumstances and conditions

may change. Accordingly, additional risks and uncertainties not currently known, or that we currently deem not material, may also adversely

affect our business operations.

The OTC and share value

Our Common Stock trades over

the counter, which may deprive stockholders of the full value of their shares. Our stock is quoted via the Over-The-Counter (“OTC”)

Pink Sheets. Therefore, our Common Stock is expected to have fewer market makers, lower trading volumes, and larger spreads between bid

and asked prices than securities listed on an exchange such as the New York Stock Exchange or the NASDAQ Stock Market. These factors may

result in higher price volatility and less market liquidity for our Common Stock.

Volatility in our common stock price may

subject us to securities litigation.

The market for our common

stock is characterized by significant price volatility when compared to seasoned issuers, and we expect that our share price will continue

to be more volatile than a seasoned issuer for the indefinite future. In the past, plaintiffs have often initiated securities class action

litigation against a company following periods of volatility in the market price of its securities. We may, in the future, be the target

of similar litigation. Securities litigation could result in substantial costs and liabilities to us and could divert our management's

attention and resources from managing our operations and business.

Low market price

A low market price would severely

limit the potential market for our Common Stock. Our Common Stock may trade at a price below $5.00 per share, subjecting trading in the

stock to certain Commission rules requiring additional disclosures by broker-dealers. These rules generally apply to any non-NASDAQ equity

security that has a market price share of less than $5.00 per share, subject to certain exceptions (a “penny stock”). Such

rules require the delivery, prior to any penny stock transaction, of a disclosure schedule explaining the penny stock market and the risks

associated therewith and impose various sales practice requirements on broker-dealers who sell penny stocks to persons other than established

customers and institutional or wealthy investors. For these types of transactions, the broker-dealer must make a special suitability determination

for the purchaser and have received the purchaser’s written consent to the transaction prior to the sale. The broker-dealer also

must disclose the commissions payable to the broker-dealer, current bid and offer quotations for the penny stock and, if the broker-dealer