Current Report Filing (8-k)

February 13 2019 - 4:46PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT

REPORT

pursuant

to Section 13 or 15(d) of The Securities Act of 1934

Date of Report

(Date of earliest event reported): 02/13/19

Turner

Valley Oil & Gas, Inc.

(Exact name

of Registrant as specified in its charter)

Commission

File Number: 0-30891

|

Nevada

|

|

91-1980526

|

|

(Jurisdiction

of Incorporation)

|

|

(I.R.S. Employer

Identification No.)

|

1600

West Loop South, Suite 600, Houston, Texas 77027

(Address

of principal executive offices) (Zip Code)

Registrant's

telephone number, including area code:

1-713-588-9453

INTRODUCTION

This Registrant (Reporting Company)

has elected to refer to itself, whenever possible, by normal English pronouns, such as "We", "Us" and "Our".

This Form 8-K may contain forward-looking statements. Such statements include statements concerning plans, objectives, goals,

strategies, future events, results or performances, and underlying assumptions that are not statements of historical fact. This

document and any other written or oral statements made by us or on our behalf may include forward-looking statements which reflect

our current views, with respect to future events or results and future financial performance. Certain words indicate forward-looking

statements, words like "believe", "expect", "anticipate", "intends", "estimates",

"forecast", "projects", and similar expressions.

|

Item

1.01

|

|

Entry

into a Material Definitive Agreement

|

Turner

entered into an acquisition agreement with (“American”) with terms as follows:

1. Trade:

|

|

1.1.

|

|

APC shall have a closing valuation of $2,500,000.00

upon closing estimated to be approximately 5x EBITDA trailing twelve months 2019.

|

|

|

1.2.

|

|

TVOG will issue Preferred Stock of the TVOG for

50% and cash and debt assumed for 50% to APC in exchange for 100% of the equity of

O&S Builders, Inc.,

and

OSET, LLC

.

|

|

|

1.3.

|

|

Preferred Stock shall be initially valued at

the estimated Valuation herein or $1,250,000.00.

|

|

|

1.4.

|

|

TVOG shall pay off all SBA loans equal to approximately

$500,000.00 at closing or alternatively adjust the cash portion of the purchase by the same amount TVOG decides

to assume or refinance the debts. Any other outstanding debt will be paid from the remaining balance of the

$500,000.00 should any exist.

|

|

|

1.5.

|

|

The Preferred Stock shall be convertible to common

stock at a fixed price per share of $0.01 and have a 2.5% yield payable in cash or in kind every 12 months

after effective date.

|

|

|

1.6.

|

|

The Preferred Stock conversion price shall be

guaranteed for 12 months, whereas a lower price per share at the end of the period for an average of the last

10 trading days of the period shall result in a one-time lowering of the conversion price to that average.

For discussion purposes only, the following numbers would be calculated as allocated between Cash, Debt Assumed

(or paid off) and Equity Retained; at closing .

|

|

|

1.7.

|

|

APC will have a one time option at closing,to

retain additional Preferred Stock in instead of the $750,000.00 paid at closing for all or part.

|

|

|

|

%

|

|

Cash

|

$750,000.00

|

30%

|

|

Debt

Assumed

|

$500,000.00

|

20%

|

|

Equity

Retained

|

$1,250,000.00

|

50%

|

|

Total

|

$2,500,000.00

|

100%

|

2. Acquisition and Capital Structure:

|

|

2.1.

|

|

The MOA as summarized herein is valid to be signed

and approved by the seller until Friday, February 15, 2019 Midnight time CST. If not approved by then, it will

need to be revised by the buyer again.

|

|

|

2.2.

|

|

APC will provide a period of exclusivity to TVOG

to close the deal which will continue until the established closing date when PSA (Purchasing and Sales Agreement)

is signed. APC will not negotiate or speak to other parties during this period.

|

|

|

2.3.

|

|

TVOG will acquire APC as per the terms herein

as a wholly-owned subsidiary in which APC will continue to operate as is and under the current brand for a

minimum period of one (1) year.

|

|

|

2.4.

|

|

TVOG proposed a stock sale versus asset sale

subject to tax review by both parties and unforeseen liability protection.

|

|

|

2.5.

|

|

The Accounts Receivable and Payable will be retained

as per the financial statements at the time of the closing date..

|

|

|

2.6.

|

|

APC shall have Long-Term Liabilities notes approximating

to $723,643.46 for O&S Builders, Inc and $85,880.11 for OSET, LLC as of December 31, 2018.

|

|

|

2.7.

|

|

TVOG will retain current

Working Capital which will be calculated using a seasonally adjusted trailing average for the last 12 months

period prior to close. TVOG acknowledges that APC has, historically, maintained a large asset balance in the

business that was not related to working capital needs.

|

3. Investment & Growth Plan:

|

|

3.1.

|

|

TVOG will invest up to

$500,000.00

into

APC for capital equipment discussed, as necessary, after closing to handle work upcoming in 2019 through a

mutually agreeable, detailed use of proceeds and business plan.

|

|

|

3.2.

|

|

As results are reflected in line with the forecasts,

TVOG anticipates making an additional investment for an amount to be determined.

|

|

|

3.3.

|

|

Such capital expenditures will go toward additional

equipment, expansion of staff, marketing and development or as TVOG Executive Leadership deems necessary.

|

|

|

3.4.

|

|

TVOG management will, at the appropriate time,

take over responsibilities for non-customer facing back office work. Where both efficient and practical, certain

day to day operations, and some sales and development work may be transferred to a TVOG managed office to consolidate

efforts from multiple locations.

|

|

|

3.5.

|

|

Current management person(s) stays on to manage

all day-to-day operations, including sales, marketing and administration.

|

|

|

3.6.

|

|

Current management person(s) works full-time

or as required to maintain current business run-rate and to meet forecasted growth expectations as established

by TVOG.

|

|

|

3.7.

|

|

APC management shall

have an opportunity, at a later date when determined not to be detrimental to the continuing operations of

APC, to participate in Management Preferred Stock and expand roles into TVOG leadership whereas earn-in and

back-in stock and cash compensation shall be available.

|

4. Summary Terms:

|

|

4.1.

|

|

These are subject to finalize valuation, structure

of deal and for discussion purposes only and available for counter proposal.

|

|

|

4.2.1.

|

|

Preferred Stock valued at

$1,250,000.00

to the 50%.

|

|

|

4.2.2.

|

|

Paid in cash to pay off approximately

$500,000.00

in APC debt or if assumed valuation adjusted for the same amount equal to 20% of the valuation.

|

|

|

4.2.3.

|

|

Paid in cash unless option is exercised in all

or in part, to retain additional Preferred Stock at time of closing for face value of up to

$750,000.00

.

|

|

|

4.2.4.

|

|

Current management person(s) will receive a W-2

salary amount of

$175,000.00

a year for 3 years. Management for APC are identified as:

|

|

|

4.2.4.1.

|

|

William

O’Connor

|

|

|

4.2.4.2.

|

|

Jereme

Sonnenfeld

|

|

|

4.2.5.

|

|

Expansion capital of

$500,000.00+

is to

be invested into the business.

|

Item

7.01. Regulation FD Disclosure.

The

Company intends to issue a press release on 02/14/19 to provide investors with updates regarding this acquisition. The update

is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

Item

9.01 Financial Statements and Exhibits

(d)

Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, this Form 8-K has been signed below by the following person(s) on behalf of the Registrant

and in the capacity and on the date indicated.

Dated: 02/13/19

Turner

Valley Oil and Gas, Inc.

By:

/s/

Steve Helm

Steve Helm,

President/CEO/Director

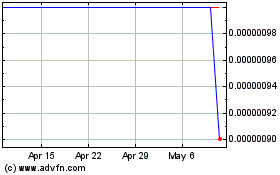

Turner Valley Oil and Gas (CE) (USOTC:TVOG)

Historical Stock Chart

From Mar 2024 to Apr 2024

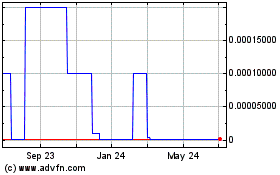

Turner Valley Oil and Gas (CE) (USOTC:TVOG)

Historical Stock Chart

From Apr 2023 to Apr 2024