UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 1-SA

SEMIANNUAL REPORT PURSUANT TO REGULATION

A

For the semiannual period ended June 30, 2021

StartEngine Crowdfunding, Inc.

(Exact name of issuer as specified in its charter)

|

Delaware

|

|

46-5371570

|

|

(State or other jurisdiction of

|

|

(IRS Employer

|

|

incorporation or organization)

|

|

Identification No.)

|

3900 WEST ALAMEDA AVENUE, SUITE 1200,

BURBANK, CALIFORNIA 91505

(Full mailing address of principal executive offices)

(800) 317-2200

Issuer’s telephone number, including area

code

STARTENGINE CROWDFUNDING, INC.

FOR THE SIX MONTHS ENDED JUNE 30, 2021 AND 2020

(unaudited)

TABLE

OF CONTENTS

ITEM 1. MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

In this report, the term “StartEngine”,

“we”, “us”, “our”, or “the company” refers to StartEngine Crowdfunding, Inc. and our subsidiaries

on a consolidated basis. The terms “StartEngine Capital” or “our funding portal” refer to StartEngine Capital

LLC, the terms “StartEngine Secure” or “our transfer agent” refer to StartEngine Secure LLC, and the terms “StartEngine

Primary” or “our broker-dealer” refer to StartEngine Primary LLC. “StartEngine Secondary” refers to

the Alternative Trading System operated by StartEngine Primary. The following discussion of our financial condition and results of operations

should be read in conjunction with our financial statements and the related notes included in this semi-annual report. The following discussion

contains forward-looking statements that reflect our plans, estimates, and beliefs. Our actual results could differ materially from those

discussed in the forward-looking statements.

Forward-Looking Statements

The following information contains certain forward-looking

statements. Forward-looking statements are statements that estimate the happening of future events and are not based on historical fact.

Forward-looking statements may be identified by the use of forward-looking terminology, such as “may,” “could,”

“expect,” “estimate,” “anticipate,” “plan,” “predict,” “probable,”

“possible,” “should,” “continue,” or similar terms, variations of those terms or the negative of those

terms. The forward-looking statements specified in the following information have been compiled by our management on the basis of assumptions

made by management and considered by management to be reasonable. Our future operating results, however, are impossible to predict and

no representation, guaranty, or warranty is to be inferred from those forward-looking statements.

The following discussion of our financial condition and results of

operations should be read in conjunction with our financial statements and the related notes included in Item 3 of this report. The following

discussion contains forward-looking statements that reflect our plans, estimates, and beliefs. Our actual results could differ materially

from those discussed in the forward-looking statements. Unless otherwise indicated, the latest results discussed below are as of June 30,

2021. The financial statements included in this filing as of and for the six months ended June 30, 2021 are unaudited, and may not

include year-end adjustments necessary to make those financial statements comparable to audited results, although in the opinion of management

all adjustments necessary to make interim statements of operations not misleading have been included.

Operating Results

StartEngine Crowdfunding, Inc. was incorporated

on March 19, 2014 in the State of Delaware. The company was originally incorporated as StartEngine Crowdsourcing, Inc., but

changed to the current name on May 8, 2014. The company’s revenue-producing activities commenced in 2015 with the effectiveness

of the amendments to Regulation A under the Securities Act adopted in response to Title IV of the JOBS Act. Operations expanded in 2016,

as Regulation Crowdfunding, adopted in response to Title III of the JOBS Act, went into effect. On June 10, 2019, our subsidiary,

StartEngine Primary LLC, was approved for membership as a broker-dealer with FINRA.

For Regulation A offerings, our broker-dealer

subsidiary is permitted to charge commissions to the companies that raise funds on our platform. Regulation A offerings are subject to

a commission ranging between 4% and 7% and usually include warrants to purchase shares of the company or the securities that are the subject

of the offering. The amount of commission is based on the risks and other factors associated with the offering. Since StartEngine Primary

became a broker-dealer, we have also been permitted to charge commissions on Regulation D offerings hosted on our platform. We received

a minimal amount of revenues from services related to Regulation D offerings in the periods under discussion. In Regulation Crowdfunding

offerings, our funding portal subsidiary is permitted to charge commissions to the companies that raise funds on our platform. We typically

charge 6% to 10% under Regulation Crowdfunding offerings for our platform fees. In addition, we charge additional fees to allow investors

to use credit cards. We also generate revenue from services, which include a consulting package called StartEngine Premium priced at $10,000

to help companies who raise capital with Regulation Crowdfunding, digital advertising services branded under the name StartEngine Promote

for an additional fee, as well as transfer agent services marketed as StartEngine Secure. We additionally charge a $1,000 fee for certain

amendments we file on behalf of companies raising capital with Regulation Crowdfunding as well as fees to run the required bad actor checks

for companies utilizing our services. The company also receives revenues from other programs such as the StartEngine OWNers bonus program

and StartEngine Secondary. In October 2020, we started selling annual memberships for the StartEngine OWNers bonus program for $275 per

year. We launched StartEngine Secondary on May 18, 2020 and generate revenues by charging trade commissions to the sellers of the shares.

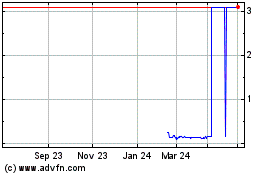

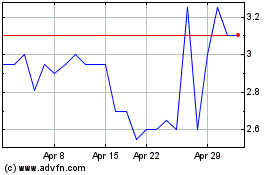

To date, StartEngine Secondary has a limited operating history. In the first half of 2021, the company itself was the only one quoted

on this platform. Additional companies were quoted on the platform beginning in August 2021.

Results of Operations for Six Months Ended June 30, 2021 Compared

with the Six Months Ended June 30, 2020

The following summarized the results of our operations

for the six months ended June 30, 2021 as compared to the six months ended June 30, 2020.

|

|

|

Six Months Ended June 30,

|

|

|

|

|

|

|

|

2021

|

|

|

2020

|

|

|

$ Change

|

|

|

Revenues

|

|

$

|

13,358,914

|

|

|

$

|

5,422,592

|

|

|

$

|

7,936,322

|

|

|

Cost of revenues

|

|

|

2,168,073

|

|

|

|

1,519,307

|

|

|

|

648,766

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit

|

|

|

11,190,841

|

|

|

|

3,903,285

|

|

|

|

7,287,556

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative

|

|

|

3,990,321

|

|

|

|

1,538,126

|

|

|

|

2,452,195

|

|

|

Sales and marketing

|

|

|

3,493,497

|

|

|

|

2,147,394

|

|

|

|

1,346,103

|

|

|

Research and development

|

|

|

1,137,591

|

|

|

|

482,835

|

|

|

|

654,756

|

|

|

Change in fair value of warrants received for fees

|

|

|

129,357

|

|

|

|

29,010

|

|

|

|

100,347

|

|

|

Impairment in value of shares received for fees

|

|

|

314,261

|

|

|

|

13,387

|

|

|

|

300,874

|

|

|

Total operating expenses

|

|

|

9,065,027

|

|

|

|

4,210,752

|

|

|

|

4,854,275

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income (loss)

|

|

|

2,125,814

|

|

|

|

(307,467

|

)

|

|

|

2,433,281

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other expense (income), net:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other expense (income), net

|

|

|

356

|

|

|

|

70,623

|

|

|

|

(70,267

|

)

|

|

Total other expense (income), net

|

|

|

356

|

|

|

|

70,623

|

|

|

|

(70,267

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before provision for income taxes

|

|

|

2,125,458

|

|

|

|

(378,090

|

)

|

|

|

2,503,548

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for income taxes

|

|

|

32,825

|

|

|

|

12,612

|

|

|

|

20,213

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss)

|

|

$

|

2,092,633

|

|

|

$

|

(390,702

|

)

|

|

$

|

2,483,335

|

|

|

Less: net income (loss) attributable to noncontrolling interest

|

|

|

-

|

|

|

|

(22,456

|

)

|

|

|

22,456

|

|

|

Net income (loss) attributable to stockholders

|

|

$

|

2,092,633

|

|

|

$

|

(368,246

|

)

|

|

$

|

2,460,879

|

|

Revenues

Our revenues during the six months ended June

30, 2021 were $13,358,914, which represented an increase of $7,936,322, or 146%, from revenues in the same period in 2020. The following

are the major components of our revenues during the six months ended June 30, 2021 and 2020:

|

|

|

Six Months Ended June 30,

|

|

|

|

|

|

|

|

2021

|

|

|

2020

|

|

|

$ Change

|

|

|

Regulation Crowdfunding platform fees

|

|

$

|

6,938,893

|

|

|

$

|

2,741,734

|

|

|

$

|

4,197,159

|

|

|

Regulation A commissions

|

|

|

3,575,336

|

|

|

|

980,190

|

|

|

|

2,595,146

|

|

|

StartEngine Premium

|

|

|

742,500

|

|

|

|

1,145,275

|

|

|

|

(402,775

|

)

|

|

StartEngine Secure

|

|

|

313,427

|

|

|

|

131,430

|

|

|

|

181,997

|

|

|

StartEngine Promote

|

|

|

227,045

|

|

|

|

221,412

|

|

|

|

5,633

|

|

|

Other service revenue

|

|

|

1,561,713

|

|

|

|

202,551

|

|

|

|

1,359,162

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenues

|

|

$

|

13,358,914

|

|

|

$

|

5,422,592

|

|

|

$

|

7,936,322

|

|

The increase in total revenues in the six months

ended June 30, 2021 as compared to the same period in 2020 is primarily due to the following:

|

|

●

|

Increase in Regulation Crowdfunding platform fees of $4,197,159, due primarily to higher average amounts raised by issuers in Regulation Crowdfunding offerings. We believe the increase in the amounts was partially driven by the increase in Regulation CF’s cap to $5 million instituted

|

|

|

●

|

Increase in Regulation A commissions of $2,595,146, due primarily to higher average amounts raised by issuers in Regulation A offerings.

|

|

|

●

|

Increase in revenues of $181,997 from StartEngine

Secure, primarily due to a higher volume of issuers using our services.

|

|

|

|

|

|

|

●

|

Increase in other service revenue of $1,359,162, related to sales

of annual membership in our StartEngine OWNers bonus program and from revenues from StartEngine Secondary.

|

Offsetting

these increases, there was a decrease in StartEngine Premium revenue reported of $402,775; this was primarily due to the company’s

changing its business practice to invoice for these services upon an issuer’s launching a campaign, as opposed to invoicing in advance

and recognizing revenue based on the expected launch date. Under the previous practice, much of the revenue recognized was written off

in end of the year adjustments. We believe this practice will give us better transparency related to these fees.

Cost of Revenues

Our cost of revenues during the six months ended

June 30, 2021 was $ 2,168,073, which represented an increase of $648,766, or 43%, from the amounts during the same period in 2020. Overall,

cost of revenues increased due to the increase in the underlying revenue activity. Our gross margin in 2021 improved to 84% compared to

72% in 2020. This margin improvement is due an increase in revenue from services with high margins, including Regulation CF platform fees,

Regulation A fees, and StartEngine Premium, while at the same time we were able to negotiate lower rates for some of our variable cost

of revenues.

Operating Expenses

Our total operating expenses during the six months

ended June 30, 2021 amounted to $9,065,027, which represented an increase of $4,854,275 from the expenses in the same period in 2020.

The increase in operating expenses is primarily due to an increase in general and administrative expenses of $2,452,195, an increase in

sales and marketing expenses of $1,346,103 and an increase in research and development expenses of $654,756. General and administrative

expenses increased primarily due to increased payroll and bonus expenses of approximately $2,795,364. Sales and marketing expenses increased

primarily due to increased payroll and bonus expenses of approximately $1,074,775 due to increased headcount and the payment of bonuses

related to the improved operating results during 2021, and higher advertising costs for corporate branding of $1,375,301. Research and

development expenses increased due to increased payroll and bonus expenses of approximately $1,024,551 due to increased headcount as the

company focused on enhancing its platform and technology.

Other Expenses, net

Our other expenses, net during the six months

ended June 30, 2021 amounted to $356, which represented interest and dividend income of $356. During the same period in 2020 our other

income, net was $16,702 which represented a gain of $8,927 on marketable securities and interest and dividend income of $7,775.

Net Income (Loss)

As a result of the foregoing, we had net income

attributable to stockholders of 2,092,633 for the six months ended June 30, 2021 compared to a net loss attributable to stockholders of

$368,246 for the six months ended June 30, 2020.

Liquidity and Capital Resources

The following table summarizes, for the periods

indicated, selected items in our condensed Statements of Cash Flows:

|

|

|

Six Months Ended June 30,

|

|

|

|

|

|

|

|

2021

|

|

|

2020

|

|

|

$ Change

|

|

|

Net cash (used in) provided by operating activities

|

|

$

|

3,337,359

|

|

|

$

|

(693,531

|

)

|

|

$

|

2,643,828

|

|

|

Net cash (used in) provided by investing activities

|

|

$

|

3,073

|

|

|

$

|

(5,816,442

|

)

|

|

$

|

5,819,515

|

|

|

Net cash provided by financing activities

|

|

$

|

119,082

|

|

|

$

|

6,040,813

|

|

|

$

|

(5,921,731

|

)

|

Cash provided by operating activities for the

six months ended June 30, 2021 was $3,337,359, as compared to cash used of $693,531 in the same period in 2020. The increase in cash provided

by operating activities in 2021 was primarily due to the company having a net income in 2021 as compared to a net loss in 2020. Our net

income during the six months ended June 30, 2021 was $2,092,633, as compared to a net loss of $390,702 during the same period in 2020.

Cash used in investing activities for the six

months ended June 30, 2021 was $3,073, as compared to cash provided by investing activities of $5,816,442 during the same period in 2020.

Cash provided by financing activities was $119,082

for the six months ended June 30, 2021, as compared to $6,040,463 for the same period in 2020. The company did not have an open Regulation

A offering during 2021, while the company had an open Regulation A offering during the same period in 2020. During 2021, our cash provided

by financing activities was the result of proceeds from the sale of Common Stock of $383,028 and proceeds from the exercise of stock options

of $6,715, offset by offering costs of $238,423. During 2020, our cash provided by financing activities was the result of proceeds from

the sale of Common Stock of $6,667,140 and proceeds from the exercise of stock options of $7,920, offset by offering costs of $634,247.

We do not currently have any significant loans

or available credit facilities. As of June 30, 2021, the company’s current assets were $29,642,543. To date, our activities have

been funded from investments from our founders, the previous sale of Series Seed Preferred Shares, Series A Preferred Shares, Series T

Preferred Shares, our Regulation A and Regulation CF offerings and our revenues.

We have no off-balance sheet arrangements, including

arrangements that would affect the liquidity, capital resources, market risk support, and credit risk support or other benefits.

The company currently has no material commitments

for capital expenditures.

During the six months ended June 30, 2021, we

closed on 93,096 shares of Common Stock and received $383,028 in net proceeds (including offering costs) from shares that were still going

through the due diligence process from the Regulation A offering.

We believe we have the cash, marketable securities

through our open Regulation A offering, other current assets available, revenues, and access to funding that will be sufficient to fund

operations until the company starts generating positive cash flows from normal operations.

Trend Information

We are operating in a relatively new industry

and there is a level of uncertainty about how fast the volume of activity will increase and how future regulatory requirements may change

the landscape. We continue to innovate and introducing new products to include in our current mix as well as continuing to improve our

current services such as providing liquidity for our investors and issuers.

On

June 10, 2019, our subsidiary, StartEngine Primary LLC, was approved for membership as a broker-dealer with FINRA. In the second

half of 2020 and during the first half of 2021, we experienced increased costs for payroll and training that will increase relative to

our revenue. We anticipate that this trend will continue for the second half of 2021. In addition, in April 2020 we received approval

to operate an alternative trading system (“ATS”). StartEngine Primary launched its ATS, branded as “StartEngine Secondary”

on May 18, 2020. To date, StartEngine Secondary has a limited operating history, and as of June 30, 2021 the company itself was the only

company whose shares have been quoted on this platform . In August 2021, four additional issuers have been quoted on the platform.

Currently, for StartEngine Secondary, we generate revenues by charging trade commissions to the sellers of the shares and we intend to

generate revenues by charging initial and annual quotation fees. We expect increased costs due to technology and operations related to

the operation of our ATS. We anticipate operating the ATS will initially increase our overall expenses by $50,000 per month. Further,

we anticipate receiving increased revenue related to offerings under Regulation A.

We are intending to register our shares under

the Securities and Exchange Act of 1934, as amended. In preparing to become a reporting company and once we become a reporting, we anticipate

higher internal costs related the increased administrative burden as well as higher professional fees.

|

ITEM 2.

|

OTHER INFORMATION

|

None.

|

ITEM 3.

|

FINANCIAL STATEMENTS

|

STARTENGINE CROWDFUNDING, INC.

CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

|

|

|

June 30,

|

|

|

December 31,

|

|

|

|

|

2021

|

|

|

2020

|

|

|

|

|

(Unaudited)

|

|

|

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

Cash

|

|

$

|

21,998,898

|

|

|

$

|

18,539,384

|

|

|

Marketable securities

|

|

|

4,038,855

|

|

|

|

4,054,542

|

|

|

Accounts receivable, net of allowance

|

|

|

1,117,268

|

|

|

|

751,633

|

|

|

Other current assets

|

|

|

2,487,522

|

|

|

|

395,462

|

|

|

Total current assets

|

|

|

29,642,543

|

|

|

|

23,741,021

|

|

|

|

|

|

|

|

|

|

|

|

|

Property and equipment, net

|

|

|

20,600

|

|

|

|

7,986

|

|

|

Investments - warrants

|

|

|

301,833

|

|

|

|

431,190

|

|

|

Investments - other

|

|

|

1,685,462

|

|

|

|

1,047,537

|

|

|

Intangible assets

|

|

|

20,000

|

|

|

|

20,000

|

|

|

Other assets

|

|

|

43,200

|

|

|

|

43,200

|

|

|

Total assets

|

|

$

|

31,713,638

|

|

|

$

|

25,290,934

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders' Equity

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$

|

508,700

|

|

|

$

|

346,145

|

|

|

Accrued liabilities

|

|

|

2,817,221

|

|

|

|

1,216,417

|

|

|

Deferred revenue

|

|

|

3,002,824

|

|

|

|

757,750

|

|

|

Total current liabilities

|

|

|

6,328,745

|

|

|

|

2,320,312

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities

|

|

|

6,328,745

|

|

|

|

2,320,312

|

|

|

|

|

|

|

|

|

|

|

|

|

Commitments and contingencies

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders' equity:

|

|

|

|

|

|

|

|

|

|

Series A Preferred Stock, par value $0.00001, 10,350,000 shares authorized, 9,762,783 issued and outstanding at June 30, 2021 and December 31, 2020, liquidation preference of $5,591,471 at June 30, 2021 and December 31, 2020.

|

|

|

5,566,473

|

|

|

|

5,566,473

|

|

|

Series T Preferred Stock, par value $0.00001, 4,950,000 shares authorized, 497,439 and 429,939 shares issued and outstanding at June 30, 2021 and December 31, 2020, respectively, liquidation preference of $1,459,154 and $1,459,154 at June 30, 2021 and December 31, 2020, respectively.

|

|

|

1,014,922

|

|

|

|

1,014,922

|

|

|

Series Seed Preferred Stock, par value $0.00001, 10,650,000 shares authorized, 10,650,000 shares issued and outstanding at June 30, 2021 and December 31, 2020, liquidation preference of $1,775,000 at June 30, 2021 and December 31, 2020.

|

|

|

1,775,000

|

|

|

|

1,775,000

|

|

|

Common stock, par value $0.00001, 75,000,000 shares authorized, 30,508,476 and 24,016,413 shares issued and outstanding at June 30, 2021 and December 31, 2020, respectively

|

|

|

306

|

|

|

|

305

|

|

|

Additional paid-in capital

|

|

|

32,877,857

|

|

|

|

32,526,503

|

|

|

Noncontrolling interest

|

|

|

(72,279

|

)

|

|

|

(40,041

|

)

|

|

Accumulated deficit

|

|

|

(15,777,386

|

)

|

|

|

(17,872,540

|

)

|

|

Total stockholders' equity

|

|

|

25,384,893

|

|

|

|

22,970,622

|

|

|

Total liabilities and stockholders' equity

|

|

$

|

31,713,638

|

|

|

$

|

25,290,934

|

|

See accompanying notes to unaudited consolidated

financial statements

STARTENGINE CROWDFUNDING, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE

LOSS

(UNAUDITED)

|

|

|

Six Months Ended June 30,

|

|

|

|

|

2021

|

|

|

2020

|

|

|

Revenues

|

|

$

|

13,358,914

|

|

|

$

|

5,422,592

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenues

|

|

|

2,168,073

|

|

|

|

1,519,307

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit

|

|

|

11,190,841

|

|

|

|

3,903,285

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

General and administrative

|

|

|

3,990,321

|

|

|

|

1,538,126

|

|

|

Sales and marketing

|

|

|

3,493,497

|

|

|

|

2,147,394

|

|

|

Research and development

|

|

|

1,137,591

|

|

|

|

482,835

|

|

|

Change in fair value of warrants received for fees

|

|

|

129,357

|

|

|

|

29,010

|

|

|

Impairment in value of shares received for fees

|

|

|

314,261

|

|

|

|

13,387

|

|

|

Total operating expenses

|

|

|

9,065,027

|

|

|

|

4,210,752

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income (loss)

|

|

|

2,125,814

|

|

|

|

(307,467

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Other expense (income), net:

|

|

|

|

|

|

|

|

|

|

Other expense (income), net

|

|

|

356

|

|

|

|

70,623

|

|

|

Total other expense (income), net

|

|

|

356

|

|

|

|

70,623

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) before provision for income taxes

|

|

|

2,125,458

|

|

|

|

(378,090

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Provision for income taxes

|

|

|

32,825

|

|

|

|

12,612

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss)

|

|

|

2,092,633

|

|

|

|

(390,702

|

)

|

|

Less: net income (loss) attributable to noncontrolling interest

|

|

|

-

|

|

|

|

(22,456

|

)

|

|

Net income (loss) attributable to stockholders

|

|

$

|

2,092,633

|

|

|

$

|

(368,246

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average income (loss) per share - basic and diluted

|

|

$

|

0.07

|

|

|

$

|

(0.04

|

)

|

|

Weighted average shares outstanding - basic and diluted

|

|

|

30,508,476

|

|

|

|

8,459,874

|

|

In the opinion of management all adjustments necessary in order

to make the interim financial statements not misleading have been included.

See accompanying notes to unaudited consolidated

financial statements

STARTENGINE CROWDFUNDING, INC.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’

EQUITY

(UNAUDITED)

|

|

|

Series

A Preferred Stock

|

|

|

Series

T Preferred Stock

|

|

|

Series

Seed Preferred Stock

|

|

|

Common

Stock

|

|

|

Additional

Paid-in

|

|

|

Subscription

|

|

|

Accumulated Other Comprehensive

|

|

|

Noncontrolling

|

|

|

Accumulated

|

|

|

|

|

|

|

|

Shares

|

|

|

Amount

|

|

|

Shares

|

|

|

Amount

|

|

|

Shares

|

|

|

Amount

|

|

|

Shares

|

|

|

Amount

|

|

|

Capital

|

|

|

Receivable

|

|

|

Loss

|

|

|

Interest

|

|

|

Deficit

|

|

|

Total

|

|

|

Balance at December 31, 2019

|

|

|

9,762,783

|

|

|

$

|

5,566,473

|

|

|

|

429,939

|

|

|

$

|

814,922

|

|

|

|

10,650,000

|

|

|

$

|

1,775,000

|

|

|

|

24,016,413

|

|

|

$

|

240

|

|

|

$

|

9,740,266

|

|

|

$

|

(59,672

|

)

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

(15,288,180

|

)

|

|

$

|

2,549,049

|

|

|

Sale of common

stock

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

6,444,147

|

|

|

|

64

|

|

|

|

22,313,539

|

|

|

|

59,672

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

22,373,275

|

|

|

Offering costs

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(1,691,713

|

)

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(1,691,713

|

)

|

|

Exercise of stock options

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

47,916

|

|

|

|

1

|

|

|

|

12,638

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

12,639

|

|

|

Sale of preferred

stock

|

|

|

-

|

|

|

|

-

|

|

|

|

67,500

|

|

|

|

200,000

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

200,000

|

|

|

Stock compensation

expense

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

2,151,773

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

2,151,773

|

|

|

Noncontrolling

interest

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(40,041

|

)

|

|

|

40,041

|

|

|

|

-

|

|

|

Net

loss

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(2,624,401

|

)

|

|

|

(2,624,401

|

)

|

|

Balance at December 31, 2020

|

|

|

9,762,783

|

|

|

$

|

5,566,473

|

|

|

|

497,439

|

|

|

$

|

1,014,922

|

|

|

|

10,650,000

|

|

|

$

|

1,775,000

|

|

|

|

30,508,476

|

|

|

$

|

305

|

|

|

$

|

32,526,503

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

(40,041.00

|

)

|

|

$

|

(17,872,540

|

)

|

|

|

22,970,622

|

|

|

Sale of common

stock

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

93,096

|

|

|

|

1

|

|

|

|

383,028

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

383,029

|

|

|

Offering costs

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(238,423

|

)

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(238,423

|

)

|

|

Exercise of stock options

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

30,000

|

|

|

|

-

|

|

|

|

6,715

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

6,715

|

|

|

Sale of preferred

stock

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

Stock compensation

expense

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

200,034

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

200,034

|

|

|

Noncontrolling

interest

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(32,238

|

)

|

|

|

2,521

|

|

|

|

(29,717

|

)

|

|

Net

loss

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

2,092,633

|

|

|

|

2,092,633

|

|

|

Balance at June 30,

2021

|

|

|

9,762,783

|

|

|

$

|

5,566,473

|

|

|

|

497,439

|

|

|

$

|

1,014,922

|

|

|

|

10,650,000

|

|

|

$

|

1,775,000

|

|

|

|

30,631,572

|

|

|

$

|

306

|

|

|

$

|

32,877,857

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

(72,279

|

)

|

|

$

|

(15,777,386

|

)

|

|

$

|

25,384,892

|

|

See accompanying notes to unaudited consolidated

financial statements

STARTENGINE CROWDFUNDING, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

|

|

|

Six Months Ended June 30,

|

|

|

|

|

2021

|

|

|

2020

|

|

|

Cash flows from operating activities:

|

|

|

|

|

|

|

|

|

|

Net income (loss)

|

|

$

|

2,092,633

|

|

|

$

|

(390,702

|

)

|

|

Adjustments to reconcile net loss to net cash used in operating activities:

|

|

|

|

|

|

|

|

|

|

Depreciation

|

|

|

1,705

|

|

|

|

1,708

|

|

|

Bad debt expense

|

|

|

-

|

|

|

|

863

|

|

|

Fair value of warrants received for fees

|

|

|

-

|

|

|

|

(10,429

|

)

|

|

Fair value of investments - other received for fees

|

|

|

(951,370

|

)

|

|

|

(378,347

|

)

|

|

Change in fair value of warrant investments

|

|

|

129,357

|

|

|

|

29,010

|

|

|

Impairment of investments - other received for fees

|

|

|

314,261

|

|

|

|

13,387

|

|

|

(Gain) loss on marketable securities

|

|

|

-

|

|

|

|

76,991

|

|

|

Stock-based compensation

|

|

|

200,034

|

|

|

|

681,783

|

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts receivable

|

|

|

(365,635

|

)

|

|

|

(647,021

|

)

|

|

Other current assets

|

|

|

(2,092,060

|

)

|

|

|

117,904

|

|

|

Accounts payable

|

|

|

162,555

|

|

|

|

163,299

|

|

|

Accrued liabilities

|

|

|

1,600,804

|

|

|

|

(96,224

|

)

|

|

Deferred revenue

|

|

|

2,245,074

|

|

|

|

(255,753

|

)

|

|

Net cash (used in) provided by operating activities

|

|

|

3,337,359

|

|

|

|

(693,531

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from investing activities:

|

|

|

|

|

|

|

|

|

|

Purchase of marketable securities

|

|

|

-

|

|

|

|

(6,006,368

|

)

|

|

Sale of marketable securities

|

|

|

15,687

|

|

|

|

200,000

|

|

|

Purchase of property and equipment

|

|

|

(12,614

|

)

|

|

|

(10,074

|

)

|

|

Net cash (used in) provided by investing activities

|

|

|

3,073

|

|

|

|

(5,816,442

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from financing activities:

|

|

|

|

|

|

|

|

|

|

Proceeds from sale of common stock

|

|

|

383,028

|

|

|

|

6,667,140

|

|

|

Proceeds from sale of preferred stock

|

|

|

-

|

|

|

|

-

|

|

|

Offering costs

|

|

|

(238,423

|

)

|

|

|

(634,247

|

)

|

Noncontrolling interest

|

|

|

(32,238

|

)

|

|

|

-

|

|

|

Proceeds from exercise of employee stock options

|

|

|

6,715

|

|

|

|

7,920

|

|

|

Net cash provided by financing activities

|

|

|

119,082

|

|

|

|

6,040,813

|

|

|

|

|

|

|

|

|

|

|

|

|

(Decrease) increase in cash and restricted cash

|

|

|

3,459,514

|

|

|

|

(469,160

|

|

|

Cash and restricted cash, beginning of period

|

|

|

18,539,384

|

|

|

|

2,200,337

|

|

|

Cash and restricted cash, end of period

|

|

$

|

21,998,898

|

|

|

$

|

1,731,177

|

|

See accompanying notes to unaudited consolidated

financial statements

STARTENGINE CROWDFUNDING, INC.

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1 – NATURE OF OPERATIONS

StartEngine Crowdfunding, Inc. was formed

on March 19, 2014 (“Inception”) in the State of Delaware. The Company was originally incorporated as StartEngine Crowdsourcing, Inc.

and changed to the current name on May 8, 2014. The consolidated financial statements of StartEngine Crowdfunding, Inc. (which

may be referred to as the "Company," "we," "us," or "our") are prepared in accordance with accounting

principles generally accepted in the United States of America (“U.S. GAAP”). The Company’s headquarters are located

in West Hollywood, California.

The Company aims to revolutionize the startup financing model by helping both accredited and non-accredited investors invest in private

companies on a public platform. StartEngine Crowdfunding, Inc. operates under Title IV of the Jumpstart our Business Startups Act

(“JOBS Act”), allowing private companies to advertise the sale of stock to both accredited and non-accredited investors. StartEngine

Crowdfunding Inc. has wholly-owned subsidiaries, StartEngine Capital LLC, StartEngine Secure LLC, StartEngine Assets LLC and StartEngine

Primary LLC. StartEngine Capital LLC, a funding portal registered with the US Securities and Exchange Commission (SEC) and a member of

the Financial Industry Regulatory Authority (FINRA), operates under Title III of the JOBS Act. StartEngine Secure LLC is a transfer agent

registered with the SEC. StartEngine Assets LLC was formed in 2020 to buy, hold and manage assets in various asset classes such as real

estate, automobiles, luxury goods and royalty-producing intangible assets. StartEngine Primary LLC was formed in October 2017 and

received approval to operate as a registered broker-dealer in July 2019. On April 16, 2020, StartEngine Primary LLC received

approval to operate as an alternative trading system. The Company’s mission is to empower thousands of companies to raise capital

and create significant amounts of jobs over the coming years.

Stock Split

On July 7, 2021, StartEngine Crowdfunding Inc.

split its designated “Common Stock” and “Preferred Stock on a 3 for 1 basis. The total number of shares of Common Stock

that the Corporation is authorized to issue was increased to 75,000,000 shares after the split. The total number of shares of Preferred

Stock that the Corporation is authorized to issue was increased to 25,950,000 after the split. Accordingly, all share and per share amounts

for all periods presented in the consolidated financial statements and notes thereto have been adjusted retroactively, where applicable,

to reflect this stock split.

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The accompanying consolidated financial statements

are prepared in accordance with accounting principles generally accepted in the United States of America.

Principles of Consolidation

The consolidated financial statements include

the accounts of StartEngine Crowdfunding, Inc.’s wholly-owned subsidiaries, StartEngine Capital LLC, StartEngine Secure LLC,

and StartEngine Primary LLC and StartEngine Assets LLC. All significant intercompany balances and transactions have been eliminated in

consolidation.

Financial Statement Reclassifications

Certain prior year accounts have been reclassified

to conform with the current year presentation.

Use of Estimates

The preparation of financial statements in conformity

with U.S. GAAP requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities,

and the reported amount of expenses during the reporting periods. Significant estimates include the value of marketable securities, the

value of stock and warrants received as compensation and collectability of accounts receivable. Actual results could materially differ

from these estimates. It is reasonably possible that changes in estimates will occur in the near term.

Fair Value of Financial Instruments

Fair value is defined as the exchange price that

would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset

or liability in an orderly transaction between market participants as of the measurement date. Applicable accounting guidance provides

an established hierarchy for inputs used in measuring fair value that maximizes the use of observable inputs and minimizes the use of

unobservable inputs by requiring that the most observable inputs be used when available. Observable inputs are inputs that market participants

would use in valuing the asset or liability and are developed based on market data obtained from sources independent of the Company. Unobservable

inputs are inputs that reflect the Company’s assumptions about the factors that market participants would use in valuing the asset

or liability. There are three levels of inputs that may be used to measure fair value:

Level 1- Observable

inputs that reflect quoted prices (unadjusted) for identical assets or liabilities in active markets.

Level 2- Include

other inputs that are directly or indirectly observable in the marketplace.

Level 3- Unobservable

inputs which are supported by little or no market activity.

The fair value hierarchy

also requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value.

Fair value estimates

discussed herein are based upon certain market assumptions and pertinent information available to management as of December 31, 2020.

The respective carrying value of certain on-balance-sheet financial instruments approximated their fair values. The following are level

1, 2 and 3 assets.

Level 1

Investments: Marketable

securities are made up of mutual funds and shares of common stock that are valued based on quoted prices in active markets

Level 2

Investments - warrants

(public portfolio): Fair value measurements of warrants of publicly traded portfolio companies are valued based on the Black-Scholes

option pricing model. The model uses the price of publicly traded companies (underlying stock price), stated strike prices, warrant expiration

dates, the risk-free interest rate and market-observable volatility assumptions based on comparable public company.

Level 3

Investments – stock:

The fair value of investments in stock of private companies is based on the cash selling price of the stock sold to third parties. As

the stock is not actively traded, the Company considers this financial instrument a Level 3 instrument.

Investments - warrants

(private portfolio): Fair value measurements of warrants of private portfolio companies are priced based on a modified Black-Scholes

option pricing model to estimate the asset value by using stated strike prices, warrant expiration dates modified to account for estimates

to actual life relative to stated expiration, risk-free interest rates, and volatility assumptions based on comparable public companies.

Option volatility assumptions used in the modified Black-Scholes model are based on public companies who operate in similar industries

as companies in our private company portfolio. For these warrants, the fair value of the underlying stock may be estimated based on recent

raises or based on information received from the portfolio company. Certain adjustments may be applied as determined appropriate by management

for lack of liquidity.

The following fair value hierarchy table presents

information about our assets and liabilities that are measured at fair value on a recurring basis as of June 30, 2021:

|

|

|

Level 1

|

|

|

Level 2

|

|

|

Level 3

|

|

|

Total

|

|

|

Cash and cash equivalents

|

|

$

|

21,998,898

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

21,998,898

|

|

|

Marketable securities

|

|

|

4,038,855

|

|

|

|

-

|

|

|

|

-

|

|

|

|

4,038,855

|

|

|

Investments - warrants

|

|

|

-

|

|

|

|

-

|

|

|

|

301,833

|

|

|

|

301,833

|

|

|

|

|

$

|

26,037,753

|

|

|

$

|

-

|

|

|

$

|

301,833

|

|

|

$

|

26,339,586

|

|

The following fair value hierarchy table presents

information about our assets and liabilities that are measured at fair value on a recurring basis as of December 31, 2020:

|

|

|

Level 1

|

|

|

Level 2

|

|

|

Level 3

|

|

|

Total

|

|

|

Cash

|

|

$

|

18,539,384

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

18,539,384

|

|

|

Marketable securities

|

|

|

4,054,542

|

|

|

|

-

|

|

|

|

-

|

|

|

|

4,054,542

|

|

|

Investments - Warrants

|

|

|

-

|

|

|

|

-

|

|

|

|

431,190

|

|

|

|

431,190

|

|

|

|

|

$

|

22,593,926

|

|

|

$

|

-

|

|

|

$

|

431,190

|

|

|

$

|

23,025,116

|

|

The following table presents

additional information about transfers in and out of Level 3 assets measured at fair value on a recurring basis for the six months ended

June 30, 2021 and 2020:

|

|

|

Investments-

|

|

|

|

|

Warrants

|

|

|

Fair value at December 31, 2019

|

|

$

|

61,927

|

|

|

Receipt of warrants/stock

|

|

|

398,273

|

|

|

Change in fair value of warrants

|

|

|

(29,010

|

)

|

|

Fair value at December 31, 2020

|

|

|

431,190

|

|

|

Receipt of warrants/stock

|

|

|

0

|

|

|

Change in fair value of warrants/stock

|

|

|

(129,357

|

)

|

|

Fair value at June 30, 2021

|

|

$

|

301,833

|

|

The following range of

variables were used in valuing Level 3 assets during the six months ended June 30, 2021 and 2020:

|

|

|

2021

|

|

|

2020

|

|

|

Expected life (years)

|

|

|

1 - 2.5

|

|

|

|

1 - 2.5

|

|

|

Risk-free interest rate

|

|

|

0.1% - 0.9%

|

|

|

|

0.1% - 0.9%

|

|

|

Expected volatility

|

|

|

30% - 225%

|

|

|

|

30% - 225%

|

|

|

Annual dividend yield

|

|

|

0

|

%

|

|

|

0

|

%

|

Accounts Receivable

Accounts receivable are recorded at the invoiced

amount and are non-interest-bearing. The Company maintains an allowance for doubtful accounts to reserve for potential uncollectible receivables.

The allowance for doubtful accounts as of June 30, 2021 and December 31, 2020 was $90,691and $90,691, respectively. Bad debt expense for

the six months ended June 30, 2021 and 2020 was $0 and $863, respectively. The Company provides an allowance for doubtful accounts at

the point when collection is considered doubtful. Once all collection efforts have been exhausted, the Company charges-off the receivable

with the allowance for doubtful accounts. Receivables charged-off against the allowance for doubtful accounts for the six months ended

June 30, 2021 and 2020 were $0 and $45,000, respectively. The Company’s accounts receivable are all trade receivables resulting

from the sale of services and are expected to be collected in the near term.

Investment Securities

Marketable Securities

Our marketable securities consist primarily of

mutual funds, as well as common stock equities that are tradable in an active market (See Note 3). Beginning on January 1, 2020 with the

adoption of Account Standards Update (“ASU”) 2016-01, unrealized gains and losses on marketable securities, net of applicable

taxes, are reported as a component of other income, net in the accompanying consolidated statements of operations. Previous to this, unrealized

gains and losses on marketable securities were reported as a component of accumulated other comprehensive income, which was a separate

component of the Company’s stockholders' equity, until realized.

Non-Marketable and Other Securities

Non-marketable and other securities include investments

in non-public equities. Our accounting for investments in non-marketable and other securities depends on several factors, including the

level of ownership, power to control and the legal structure of the subsidiary making the investment. As further described below, we base

our accounting for such securities on: (i) fair value accounting, (ii) equity method accounting, and (iii) cost method accounting.

Investments – Warrants

In connection with negotiated platform fee agreements,

we may obtain warrants giving us the right to acquire stock in companies undergoing Regulation A offerings. We hold these assets for prospective

investment gains. We do not use them to hedge any economic risks nor do we use other derivative instruments to hedge economic risks stemming

from these warrants.

We account for warrants in certain private and

public (or publicly traded under the provisions of Regulation A) client companies as derivatives when they contain net settlement terms

and other qualifying criteria under Accounting Standards Codification (“ASC”) 815, Derivatives and Hedging. In general,

the warrants entitle us to buy a specific number of shares of stock at a specific price within a specific time period. Certain warrants

contain contingent provisions, which adjust the underlying number of shares or purchase price upon the occurrence of certain future events.

Our warrant agreements typically contain net share settlement provisions, which permit us to receive at exercise a share count equal to

the intrinsic value of the warrant divided by the share price (otherwise known as a “cashless” exercise). These warrants are

recorded at fair value and are classified as Investments - warrants on our consolidated balance sheet at the time they are obtained.

The grant date fair values of warrants received

in connection with services performed are deemed to be revenue and recognized upon receipt.

Any changes in fair value from the grant date

fair value of warrants will be recognized as increases or decreases to investments on our consolidated balance sheets and as a component

of operating expenses on our consolidated statements of operations.

In the event of an exercise for shares, the basis

or value in the securities is reclassified from Investment - warrants to marketable securities or non-marketable securities, as described

below, on the consolidated balance sheet on the latter of the exercise date or corporate action date. The shares in public companies,

or companies that trade over-the-counter as allowed by Regulation A, are classified as marketable securities (provided they do not have

a significant restriction from sale). Changes in fair value of securities designated as marketable, after applicable taxes, are reported

in other income, which is a separate component of stockholders' equity. The shares in private companies without an active trading market

are classified as non-marketable securities. Typically, we account for these securities at cost less any impairment.

The fair value of the warrant portfolio is a critical

accounting estimate and is reviewed semi-annually. We value our warrants using a modified Black-Scholes option pricing model, which incorporates

the following significant inputs, in addition to certain adjustments for general lack of liquidity:

|

|

∙

|

An underlying asset value, which is estimated based on current information available in valuation reports, including any information regarding subsequent rounds of funding or performance of a company.

|

|

|

∙

|

Stated strike price, which can be adjusted for certain warrants upon the occurrence of subsequent funding rounds or other future events.

|

|

|

∙

|

Price volatility or risk associated with possible changes in the warrant price. The volatility assumption is based on historical price volatility of publicly traded companies within indices or companies similar in nature to the underlying client companies issuing the warrant.

|

|

|

∙

|

The expected remaining life of the warrants in each financial reporting period.

|

|

|

∙

|

The risk-free interest rate is derived from the Treasury yield curve and is calculated based on the risk-free interest rates that correspond closest to the expected remaining life of the warrant on the date of assessment.

|

Investments – Other

In

connection with negotiated platform fee agreements, the Company obtains shares of stock in its customers. As the stock received from customers

have no readily determinable fair value, the Company accounts for this stock received using the cost method, less adjustments for impairment.

During the six months ended June 30, 2021 and 2020, the Company received stock with a cost of $ $1,326,761 and $378,347, respectively,

as payment for fees. At each reporting period, management reviews the list of stock held to identify any customers which are no longer

in business, or had campaigns that were not able to raise significant amounts compared to target maximums indicating the future benefit

from the related stock is remote. Any amounts identified are deemed impaired. During the six months ended June 30, 2021 and 2020, impairment

expense related to shares received amounted to $0 and $13,387, respectively.

Property and Equipment

Property and equipment are stated at cost. The

Company’s fixed assets are depreciated using the straight-line method over the estimated useful life of three (3) to five (5) years.

At the time of retirement or other disposition of property and equipment, the cost and accumulated depreciation are removed from the accounts

and any resulting gain or loss is reflected in operations.

Intangible Assets

Intangible assets are amortized over their respective

estimated lives, unless the lives are determined to be indefinite and reviewed for impairment whenever events or other changes in circumstances

indicate that the carrying amount may not be recoverable. The impairment testing compares carrying values to fair values and, when appropriate,

the carrying value of these assets is reduced to fair value. Impairment charges, if any, are recorded in the period in which the impairment

is determined.

Restricted Cash

The Company has restricted cash as a result of

an agreement with one its clearing firms, which requires a collateral balance of $50,000 be maintained in an escrow account throughout

the duration of the agreement through April 2022. The Company’s restricted cash balance as of June 30, 2021 and December 31, 2020

amounted to $0 and $50,000, respectively. During the six months ended June 30, 2021 and 2020, the Company had restricted cash balances

of $0 and $50,000, respectively, included as a component of total cash and restricted cash presented on the accompanying unaudited consolidated

statement of cash flows.

Impairment of Long-Lived Assets

The Company continually monitors events and changes

in circumstances that could indicate carrying amounts of long-lived assets may not be recoverable. When such events or changes in circumstances

are present, the Company assesses the recoverability of long-lived assets by determining whether the carrying value of such assets will

be recovered through undiscounted expected future cash flows. If the total of the future cash flows is less than the carrying amount of

those assets, the Company recognizes an impairment loss based on the excess of the carrying amount over the fair value of the assets.

Assets to be disposed of are reported at the lower of the carrying amount or the fair value less costs to sell.

Preferred Stock

ASC 480, Distinguishing Liabilities from Equity,

includes standards for how an issuer of equity (including equity shares issued by consolidated entities) classifies and measures on its

balance sheet certain financial instruments with characteristics of both liabilities and equity.

Management is required to determine the presentation

for the preferred stock as a result of the liquidation and conversion provisions, among other provisions in the agreement. Specifically,

management is required to determine whether the embedded conversion feature in the preferred stock is clearly and closely related to the

host instrument, and whether the bifurcation of the conversion feature is required and whether the conversion feature should be accounted

for as a derivative instrument. If the host instrument and conversion feature are determined to be clearly and closely related (both more

akin to equity), derivative liability accounting under ASC 815, Derivatives and Hedging, is not required. Management determined that the

host contract of the preferred stock is more akin to equity, and accordingly, derivative liability accounting is not required by the Company.

Costs incurred directly for the issuance of the

preferred stock are recorded as a reduction of gross proceeds received by the Company, resulting in a discount to the preferred stock.

Dividends which are required to be paid upon redemption

are accrued and recorded within preferred stock and accumulated deficit.

Equity Offering Costs

The Company accounts for offering costs in accordance

with ASC 340, Other Assets and Deferred Costs. Prior to the completion of an offering, offering costs will be capitalized as deferred

offering costs on the balance sheet. The deferred offering costs will be charged to stockholders’ equity upon the completion of

an offering or to expense if the offering is not completed. Offering costs of $238,423 and $634,247 for the Company’s equity offerings

were charged to stockholders’ equity during the six months ended June 30, 2021 and 2020, respectively.

Revenue Recognition

Effective January 1, 2018, the Company adopted