UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

(Mark

One)

|

|

þ

|

ANNUAL REPORT PURSUANT TO SECTION

13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For the

fiscal year ended December 31, 2008

|

|

¨

|

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

Commission

File number 0-8157

THE

RESERVE PETROLEUM COMPANY

(Exact

Name of Registrant As Specified In Its Charter)

|

DELAWARE

|

73-0237060

|

|

(State

or Other Jurisdiction of Incorporation or Organization)

|

(I.R.S.

Employer Identification No.)

|

|

|

|

|

|

|

|

6801

N. BROADWAY, SUITE 300

OKLAHOMA

CITY, OKLAHOMA

73116-9092

(405)

848-7551

|

|

(Address

and telephone number, including area code, of registrant’s principal

executive offices)

|

Securities

registered under Section 12(b) of the Exchange Act:

NONE

Securities

registered under Section 12(g) of the Exchange Act:

COMMON

STOCK ($0.50 PAR VALUE)

(Title of

Class)

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. Yes

o

No

þ

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Exchange Act. Yes

o

No

þ

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90 days. Yes

þ

No

o

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the best

of registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K.

þ

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,”

“accelerated filer” and “smaller reporting company” in Rule 12b-2 of the

Exchange Act (Check one):

|

Large

accelerated filer

o

|

Accelerated

filer Yes

o

|

Non

accelerated filer

o

|

Smaller

reporting company

þ

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act). Yes

o

No

þ

The

aggregate market value of the voting and non-voting common stock of the

registrant held by non-affiliates of the registrant was $26,110,000, as computed

by reference to the last reported sale which was on March 24, 2009.

As of

March 25, 2009, there were 162,151.64 shares of the registrant’s common stock

outstanding.

DOCUMENTS

INCORPORATED BY REFERENCE

Portions

of the definitive proxy statement relating to the registrant’s Annual Meeting of

Shareholders to be held on May 19, 2009, which will be filed within 120 days of

the end of the registrant’s fiscal year ended December 31, 2008 (the “Proxy

Statement”) are incorporated by reference into Part III of this Form 10-K to the

extent described therein.

|

TABLE

OF

CONTENTS

|

|

|

|

|

Page

|

|

|

|

|

|

|

Forward

Looking Statements

|

3

|

|

|

|

PART

I

|

|

|

Item

1.

|

|

|

3

|

|

Item

1A.

|

|

|

6

|

|

Item

1B.

|

|

|

6

|

|

Item

2.

|

|

|

6

|

|

Item

3.

|

|

|

7

|

|

Item

4.

|

|

|

7

|

|

|

|

PART

II

|

|

|

Item

5.

|

|

|

8

|

|

Item

6.

|

|

|

9

|

|

Item

7.

|

|

|

9

|

|

|

|

|

|

|

Item

7A.

|

|

|

23

|

|

Item

8.

|

|

|

23

|

|

Item

9.

|

|

|

49

|

|

|

|

|

|

|

Item

9A.(T).

|

|

|

49

|

|

Item

9B.

|

|

|

50

|

|

|

|

PART

III

|

|

|

Item

10.

|

|

|

50

|

|

Item

11.

|

|

|

50

|

|

Item

12.

|

|

|

50

|

|

Item

13.

|

|

|

50

|

|

Item

14.

|

|

|

51

|

|

|

|

PART

IV

|

|

|

Item

15.

|

|

|

51

|

Forward-Looking

Statements

This

Report on Form 10-K contains forward-looking statements. Actual

events and/or future results of operations may differ materially from those

contemplated by such forward-looking statements. See Item 7,

“Management’s Discussion and Analysis of Financial Condition and Results of

Operations” for a summation of some of the risks and uncertainties inherent in

forward-looking statements. Readers should consider the risks and uncertainties

described in connection with any forward-looking statements that may be made in

this Form 10-K. Readers should carefully review this Form 10-K in its

entirety, including but not limited to the Company's financial statements and

the notes thereto and the risks and uncertainties described

herein. Forward-looking statements contained in this Form 10-K speak

only as of the date of this Form 10-K. The Company does not undertake

to update its forward-looking statements.

PART

I

Overview

The

Reserve Petroleum Company (the “Company”) is engaged principally in managing its

owned mineral properties and the exploration for and the development of oil and

natural gas properties. Other business segments are not significant

factors in the Company’s operations. The Company is a corporation

organized under the laws of the State of Delaware in 1931.

Oil

and Natural Gas Properties

For a

summary of certain data relating to the Company’s oil and gas properties

including production, undeveloped acreage, producing and dry wells drilled and

recent activity, see Item 2, “Properties”. For a discussion and

analysis of current and prior years’ revenue and related costs of oil and gas

operations, and a discussion of liquidity and capital resource requirements, see

Item 7, “Management’s Discussion and Analysis of Financial Condition and Results

of Operations”.

Owned

Mineral Property Management

The

Company owns non-producing mineral interests in approximately 262,063 gross

acres equivalent to 90,327 net acres. These mineral interests are

located in nine different states in the north and south central United

States. A total of 64,763 net acres are located in the States of

Oklahoma, South Dakota and Texas, the areas of concentration for the Company in

its present exploration and development programs.

The

Company has several options relating to the exploration and/or development of

these owned mineral interests. Management continually reviews various industry

reports and other sources for activity (leasing, drilling, significant

discoveries, etc.) in areas where the Company has mineral

ownership. Based on its analysis of any activity and assessment of

the potential risk relative to the particular area, management may negotiate a

lease or farmout agreement and accept a royalty interest or it may choose to

participate as a working interest owner and pay its proportionate share of any

exploration or development drilling costs.

A

substantial amount of the Company’s oil and gas revenue has resulted from its

owned mineral property management. In 2008, $10,406,544 (53%) of oil

and gas sales was from royalty interests as compared to $7,563,107 (54%) in

2007. As a result of its mineral ownership, the Company had royalty

interests in 33 gross (1.13 net) wells which were drilled and completed as

producing wells in 2008. This resulted in an average royalty

interest of about 3.4% for these 33 new wells. The Company has very

little control over the timing or extent of the operations conducted on its

royalty interest properties. See the following paragraphs for a

discussion of mineral interests in which the Company chooses to participate as a

working interest owner.

Development

Program

Development

drilling by the Company is usually initiated in one of three

ways. The Company may participate as a working interest owner with a

third party operator in the development of non-producing mineral interests which

it owns; along with a joint interest operator, it may participate in drilling

additional wells on its producing leaseholds; or if its exploration program

discussed below results in a successful exploratory well, it may participate in

the development of additional wells on the exploratory prospect. In

2008, the Company participated in the drilling of nineteen development wells

with twelve wells (1.85 net) completed as producers and seven (1.14 net) in

progress. The five wells (.835 net) that were in progress at the end of 2007

were all completed as producers.

Exploration

Program

The

Company’s exploration program is normally conducted by purchasing interests in

prospects developed by independent third parties, participating in third party

exploration of Company-owned non-producing minerals, developing its own

exploratory prospects, or a combination of the above.

The

Company normally acquires interests in exploratory prospects from someone in the

industry with whom management has conducted business in the past and/or if

management has confidence in the quality of the geological and geophysical

information presented for evaluation by Company personnel. If

evaluation indicates the prospect is within the Company’s risk limits, the

Company may negotiate to acquire an interest in the prospect and participate in

a non-operating capacity.

The

Company develops exploratory drilling prospects by identification of an area of

interest, development of geological and geophysical information and purchase of

leaseholds in the area. The Company may then attempt to sell an interest in the

prospect to one or more companies in the petroleum industry with one of the

purchasing companies functioning as operator. In 2008 the Company

participated in the drilling of seventeen exploration wells with seven wells

(1.07) completed as producers, one (.11 net) completed as a dry hole and nine

(.99 net) in progress. The one well (.16 net) still drilling at the end of 2007

was completed as a producer.

For a

summation of exploratory and development wells drilled in 2008 or planned for in

2009, see Item 7, “Management’s Discussion and Analysis of Financial Condition

and Results of Operations,” subheading, “Update of Oil and Gas Exploration and

Development Activity from December 31, 2007.”

Customers

In 2008,

the Company had four customers whose total purchases were greater than 10% of

revenues from oil and gas sales. Redland Resources, Inc. purchases

were $3,923,381 or 20% of total oil and gas sales. ConocoPhillips Company

purchases were $3,820,151 or 19% of total oil and gas sales. Encana

Oil and

Gas, Inc. purchases were $2,634,748 or 13% of total oil and gas sales. Luff

Exploration Company purchases were $2,295,254 or 12% of total oil and gas

sales. The Company sells most of its oil and gas under short-term

sales contracts that are based on the spot market price. A minor

amount of oil and gas sales are made under fixed price contracts having terms of

more than one year.

Competition

The oil

and gas industry is highly competitive in all of its phases. There

are numerous circumstances within the industry and related market place that are

out of the Company’s control such as cost and availability of alternative fuels,

the level of consumer demand, the extent of other domestic production of oil and

gas, the price and extent of importation of foreign oil and gas, the cost of and

proximity of pipelines and other transportation facilities, the cost and

availability of drilling rigs, regulation by state and Federal authorities and

the cost of complying with applicable environmental regulations.

The

Company is a very minor factor in the industry and must compete with other

persons and companies having far greater financial and other

resources. The Company’s ability to participate in and/or develop

viable prospects, and secure the financial participation of other persons or

companies in exploratory drilling on these prospects is limited.

Regulation

The

Company’s operations are affected in varying degrees by political developments

and Federal and state laws and regulations. Although released from

Federal price controls, interstate sales of natural gas are subject to

regulation by the Federal Energy Regulatory Commission (FERC). Oil

and gas operations are affected by environmental laws and other laws relating to

the petroleum industry and both are affected by constantly changing

administrative regulations. Rates of production of oil and gas have

for many years been subject to a variety of conservation laws and regulations,

and the petroleum industry is frequently affected by changes in the Federal tax

laws.

Generally,

the respective state regulatory agencies supervise various aspects of oil and

gas operations within the state and transportation of oil and gas sold

intrastate.

Environmental

Protection

The

operation of the various producing properties in which the Company has an

interest is subject to Federal, state and local provisions regulating discharge

of materials into the environment, the storage of oil and gas products and the

contamination of subsurface formations. The Company’s lease

operations and exploratory activity have been and will continue to be affected

by regulation in future periods. However, the known effect to date

has not been material as to capital expenditures, earnings or industry

competitive position, nor are estimated expenditures for environmental

compliance expected to be material in the coming year. Such

expenditures produce no increase in productive capacity or revenue and require

more of management’s time and attention, a cost which cannot be estimated with

any assurance of certainty.

Other

Business

See Item

7, “Management’s Discussion and Analysis of Financial Condition and Results of

Operations”, subheading, “Equity Investments” and Item 8, Notes 2 and 7 to the

accompanying financial statements for a discussion of other business including

guarantees.

Employees

At

December 31, 2008, the Company had eight employees, including

officers. See the Proxy Statement for additional

information. During 2008, all the Company’s employees devoted a

portion of their time to duties with affiliated companies and the Company was

reimbursed for the affiliates’ share of compensation directly from those

companies. See Item 7, “Management’s Discussion and Analysis of

Financial Condition and Results of Operations”, subheading “Certain

Relationships and Related Transactions” and Item 8, Note 12 to the accompanying

financial statements for additional information.

Smaller

reporting companies are not required to provide the information required by this

Item.

|

ITEM

1B.

|

UNRESOLVED

COMMENTS.

|

Smaller

reporting companies are not required to provide the information required by this

Item.

The

Company’s principal properties are oil and natural gas

properties. The Company has interests in approximately 565

producing properties, with one-third of them being working interest properties

and the remaining two-thirds being royalty interest properties. About

89% of these properties are located in Oklahoma and Texas and account for

approximately 82.4% of the Company’s annual oil and gas sales. About

5% of the properties are located in Kansas and South Dakota and account for

approximately 16.3% of the Company’s annual oil and gas sales. The

remaining 6% of these properties are located in Colorado, Arkansas and Montana

and account for about 1.3% of the Company’s annual oil and gas

sales. No individual property provides more than 8% of the Company’s

annual oil and gas sales. See discussion of revenues from Robertson

County, Texas royalty interest properties in Item 7, “Operating Revenues” for

additional information about significant properties.

Oil

and Natural Gas Operations

Oil

and Gas Reserves

Reference

is made to the Unaudited Supplemental Financial Information beginning on Page 44

for working interest reserve quantity information.

Since

January 1, 2008, the Company has not filed any reports with any Federal

authority or agency which included estimates of total proved net oil or gas

reserves, except for its 2007 annual report on Form 10-K and Federal income tax

return for the year ended December 31, 2007. Those reserve estimates

were identical.

Production

The

average sales price of oil and gas produced and, for the Company’s working

interests, the average production cost (lifting cost) per equivalent thousand

cubic feet (MCF) of gas production is presented in the table below for the years

ended December 31, 2008, 2007 and 2006. Equivalent MCF was developed

using approximate relative energy content.

|

|

|

Royalties

|

|

|

Working Interests

|

|

|

|

|

Sales Price

|

|

|

Sales Price

|

|

|

Average

Production

|

|

|

|

|

Oil

|

|

|

Gas

|

|

|

Oil

|

|

|

Gas

|

|

|

Cost

per

|

|

|

|

|

Per Bbl

|

|

|

Per MCF

|

|

|

Per Bbl

|

|

|

Per MCF

|

|

|

Equivalent MCF

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2008

|

|

$96.80

|

|

|

$8.41

|

|

|

$91.10

|

|

|

$7.95

|

|

|

$2.10

|

|

|

2007

|

|

$67.35

|

|

|

$6.19

|

|

|

$65.71

|

|

|

$6.63

|

|

|

$1.65

|

|

|

2006

|

|

$62.72

|

|

|

$6.06

|

|

|

$59.68

|

|

|

$6.63

|

|

|

$1.65

|

|

At

December 31, 2008, the Company had working interests in 130 gross (15.49 net)

wells producing primarily gas and had working interests in 103 gross (9.10 net)

wells producing primarily oil. These interests were in 51,002 gross

(6,302 net) producing acres. These wells include 42 gross (.41 net)

wells associated with secondary recovery projects.

Seven

percent or 5,907 barrels of the Company’s oil production during 2008 was derived

from royalty interests in mature West Texas water-floods.

Undeveloped

Acreage

The

Company’s undeveloped acreage consists of non-producing mineral interests and

undeveloped leaseholds. The following table summarizes the Company’s

gross and net acres in each at December 31, 2008.

|

|

|

Acreage

|

|

|

|

|

Gross

|

|

|

Net

|

|

|

Non-producing

Mineral Interests

|

|

262,063

|

|

|

90,327

|

|

|

Undeveloped

Leaseholds

|

|

45,583

|

|

|

6,398

|

|

Net

Productive and Dry Wells Drilled

The

following table summarizes the net wells drilled in which the Company had a

working interest for the years ended December 31, 2006 and thereafter, as to net

productive and dry exploratory wells drilled and net productive and dry

development wells drilled. Net productive exploratory and development totals for

2008 include the six wells still drilling at the end of 2007. As indicated in

the “Development Program” and “Exploration Program” on page 4, seven development

wells and nine exploratory wells were still in process at the time of this Form

10-K.

|

|

|

Number of Net Working Interest Wells

Drilled

|

|

|

|

|

Exploratory

|

|

|

Development

|

|

|

|

|

Productive

|

|

|

Dry

|

|

|

Productive

|

|

|

Dry

|

|

|

2008

|

|

1.23

|

|

|

.11

|

|

|

2.69

|

|

|

---

|

|

|

2007

|

|

---

|

|

|

.20

|

|

|

1.95

|

|

|

---

|

|

|

2006

|

|

.22

|

|

|

.33

|

|

|

2.02

|

|

|

.10

|

|

Recent

Activities

See Item

7, under the subheading, “Update of Oil and Gas Exploration and Development

Activity from December 31, 2007” for a summary of recent activities related to

oil and natural gas operations.

|

ITEM

3.

|

LEGAL

PROCEEDINGS.

|

There are

no material pending legal proceedings affecting the Company or any of its

properties.

|

ITEM

4.

|

SUBMISSION OF MATTERS TO A VOTE

OF SECURITY HOLDERS

.

|

None.

PART

II

|

ITEM

5.

|

MARKET FOR REGISTRANT’S

COMMON EQUITY, RELATED STOCKHOLDER

M

ATTERS AND ISSUER

PURCHASES OF EQUITY SECURITIES

.

|

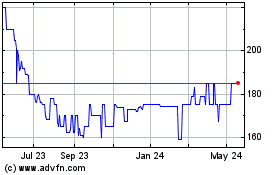

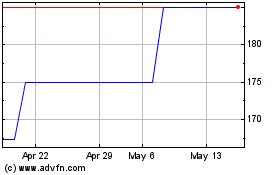

The

Company’s stock is dually traded in the Pink Sheet Electronic Quotation Service

and the OTC Bulletin Board under the symbol “RSRV”. The following

high and low bid information was quoted on the Pink Sheets OTC Market Report.

Prices reflect inter-dealer prices without retail markup, markdown or commission

and may not reflect actual transactions.

|

|

|

Quarterly Ranges

|

|

|

Quarter Ending

|

|

High Bid

|

|

|

Low Bid

|

|

|

|

|

|

|

|

|

|

|

03/31/07

|

|

170.00

|

|

|

145.00

|

|

|

06/30/07

|

|

200.00

|

|

|

155.00

|

|

|

09/30/07

|

|

257.00

|

|

|

191.25

|

|

|

12/31/07

|

|

300.00

|

|

|

255.00

|

|

|

03/31/08

|

|

325.00

|

|

|

260.00

|

|

|

06/30/08

|

|

440.00

|

|

|

315.00

|

|

|

09/30/08

|

|

412.00

|

|

|

330.00

|

|

|

12/31/08

|

|

360.00

|

|

|

225.00

|

|

There was

limited public trading in the Company’s common stock in 2008 and

2007. In 2008 there were 36 brokered trades appearing in the

Company’s transfer ledger, versus 14 in 2007.

At March

25, 2009, the Company had approximately 1,438 record holders of its common

stock. The Company paid dividends on its common stock in the amount

of $10.00 per share in the second quarter and $30.00 per share in the third

quarter of 2008 and $6.00 per share in 2007. See the “Financing Activities”

section of Item 7. below for more information about the 2008 dividend.

Management will review the amount of the annual dividend to be paid in 2009 with

the Board of Directors for its approval.

ISSUER

PURCHASES OF EQUITY SECURITIES

|

Period

|

|

Total

Number of Shares Purchased

|

|

|

Average

Price Paid Per Share

|

|

|

Total

Number of Shares Purchased as Part of Publicly Announced Plans or Programs

(1)

|

|

|

Approximate

Dollar Value of Shares that May Yet Be Purchased Under the Plans or

Programs (1)

|

|

|

Oct 1,

2008 to Oct 31, 2008

|

|

88

|

|

|

$250.00

|

|

|

-

|

|

|

-

|

|

|

Nov

1, 2008 to Nov 30, 2008

|

|

-

|

|

|

-

|

|

|

-

|

|

|

-

|

|

|

Dec

1, 2008 to Dec 31, 2008

|

|

4

|

|

|

$250.00

|

|

|

-

|

|

|

-

|

|

|

Total

|

|

92

|

|

|

$250.00

|

|

|

-

|

|

|

-

|

|

|

(1)

|

The

Company has no formal equity security purchase program or

plan. The Company acts as its own transfer agent and most

purchases result from requests made by shareholders receiving small odd

lot share quantities as the result of probate

transfers.

|

|

ITEM

6.

|

SELECTED

FINANCIAL DATA

|

Smaller

reporting companies are not required to provide the information required by this

Item.

|

ITEM

7.

|

MANAGEMENT’S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS.

|

Please

refer to the financial statements and related notes in Item 8 of this Form 10-K

to supplement this discussion and analysis.

Forward-Looking

Statements

In

addition to historical information, from time to time the Company may publish

forward-looking statements within the meaning of Section 27A of the Securities

Act of 1933 and Section 21E of the Securities Exchange Act of

1934. Forward-looking statements provide the reader with management’s

current expectations of future events. They include statements

relating to such matters as anticipated financial performance, business

prospects such as drilling of oil and gas wells, technological development and

similar matters.

Although

management believes that the expectations reflected in such forward-looking

statements are based on reasonable assumptions, a variety of factors could cause

the Company’s actual results and experience to differ materially from the

anticipated results or other expectations expressed in the Company’s

forward-looking statements. The risks and uncertainties that may

affect the operations, performance, development and results of the Company’s

business include, but are not limited to, the following:

The

Company’s future operating results will depend upon management’s ability to

employ and retain quality employees, generate revenues and control

expenses. Any decline in operating revenues without corresponding

reduction in operating expenses could have a material adverse effect on the

Company’s business, results of operations and financial condition.

Estimates

of future revenues from oil and gas sales are derived from a combination of

factors which are subject to significant fluctuation over any given period of

time. Reserve estimates by their nature are subject to revision in

the short-term. The evaluating engineer considers production

performance data, reservoir data and geological data available to the Company,

as well as makes estimates of production costs, sale prices and the time period

the property can be produced at a profit. A change in any of the

above factors can significantly change the timing and amount of net revenues

from a property. The Company’s producing properties are composed of many small

working interest and royalty interest properties. As a non-operating

owner, the Company has limited access to the underlying data from which working

interest reserve estimates are calculated, and estimates of royalty interest

reserves are not made because the information required for the estimation is not

available.

The

Company has no significant long-term sales contracts for either oil or

gas. For the most part, the price the Company receives for its

product is based upon the spot market price which in the past has experienced

significant fluctuations. Management anticipates such price

fluctuations will continue in the future, making any attempt at estimating

future prices subject to significant uncertainty.

Exploration

costs have been a significant component of the Company’s capital expenditures in

the past and are expected to remain so, to a somewhat lesser degree in the near

term. Under the successful efforts method of accounting for oil and

gas properties, which the Company uses, these costs are capitalized if the

prospect is successful, or charged to operating costs and expenses if

unsuccessful. Estimating the amount of such future costs which may

relate to successful or unsuccessful prospects is extremely imprecise, at

best.

The

provisions for depreciation, depletion and amortization of oil and gas

properties constitute a particularly sensitive accounting

estimate. Non-producing leaseholds are amortized over the life of the

leasehold using a straight line method; however, when leaseholds are impaired or

condemned, an appropriate adjustment to the provision is made at that time.

Forward-looking estimates of such adjustments are very imprecise. The

provision for impairment of long-lived assets is determined by review of the

estimated future cash flows from the individual properties. A

significant unforeseen downward adjustment in future prices and/or potential

reserves could result in a material change in estimated long-lived assets

impairment. Depletion and depreciation of oil and gas properties are computed

using the units-of-production method. A significant unanticipated

change in volume of production or estimated reserves would result in a material

unexpected change in the estimated depletion and depreciation

provisions.

The

Company has significant obligations to remove tangible equipment and facilities

associated with oil and gas wells and to restore land at the end of oil and gas

production operations. Removal and restoration obligations are most

often associated with plugging and abandoning wells. Estimating the

future restoration and removal costs is difficult and requires estimates and

judgments because most of the removal obligations will take effect in the

future. Additionally, these operations are subject to private

contracts and government regulations that often have vague descriptions of what

is required. Asset removal technologies and costs are constantly

changing, as are regulatory, political, environmental and safety

considerations. Inherent in the present value calculations are

numerous assumptions and judgments including the ultimate removal cost amounts,

inflation factors,

Income

from available for sale securities and trading securities has made substantial

contributions to net income in certain prior periods. Available for

sale securities and trading securities are used to invest funds until needed in

the Company’s capital investing and financing activities. Net

income has been materially affected in past years and could be in the future

years by utilization of those funds in operations as well as significant

fluctuation in the interest rates and/or quoted market values applicable to the

Company’s available for sale securities and trading securities.

The

Company’s trading securities consist primarily of equity

securities. These securities are carried at fair value with

unrealized gains and losses included in earnings. The equity

securities are traded on various stock exchanges and/or the NASDAQ and over the

counter markets. Therefore, these securities are market-risk

sensitive instruments. The stock market is subject to wide price

swings in short periods of time.

The

Company has equity investments in organizations over which the Company has

limited or no control. These equity investments have in the past made

substantial contributions to the Company’s net income. The management

of these entities could at any time make decisions in their own best interests

which could materially affect the Company’s net income, or the value of the

Company’s investments. See “Equity Investments”, below, in this Item

7 for information regarding these equity investments.

The

Company does not undertake any obligation to publicly revise forward-looking

statements to reflect events or circumstances that arise after the date

hereof. Readers should carefully review the information described in

other documents the Company files from time to time with the Securities and

Exchange Commission, including the Quarterly Reports on Form 10-Q to be filed by

the Company in 2009 and any Current Reports on Form 8-K filed by the

Company.

Certain

Relationships and Related Transactions

The

Company is affiliated by common management and ownership with Mesquite Minerals,

Inc., (Mesquite), Mid-American Oil Company (Mid-American), Lochbuie Limited

Partnership (LLTD) and Lochbuie Holding Company (LHC). The Company also owns

interests in certain producing and non-producing oil and gas properties as

tenants in common with Mesquite, Mid-American and LLTD.

Mason

McLain, an officer and director of the Company, is an officer and director of

Mesquite and Mid-American. Robert T. McLain and Jerry Crow, Directors of the

Company, are directors of Mesquite and Mid-American. Kyle McLain and

Cameron R. McLain are sons of Mason McLain, who is a more than 5% owner of the

Company, and are officers and directors of the Company. Kyle McLain

and Cameron McLain are officers and directors of Mesquite and Mid-American.

Mason McLain and Robert T. McLain, who are brothers, each own an approximate 32%

limited partner interest in LLTD, and Mason McLain is president of LHC, the

general partner of LLTD. Robert T. McLain is not an employee of any of the above

entities, and devotes only a small amount of time conducting their

business.

The above

named officers, directors and employees as a group beneficially own

approximately 29% of the common stock of the Company, approximately 32% of the

common stock of Mesquite, and approximately 17% of the common stock of

Mid-American. These three corporations each have only one class of

stock outstanding. See Item 8, Note 12 to the accompanying financial

statements for additional disclosures regarding these

relationships.

Equity

Investments

For most

of 2008 the Company had investments in four entities which it accounted for on

the equity method. In using the equity method, the Company records

the original investment in an entity as an asset and adjusts the asset balance

for the Company’s share of any income or loss as well as any additional

contributions to or distributions from the entity. In June 2008 the Company

purchased a 10% ownership in Bailey Hilltop Pipeline, LLC. The

remaining three entities include one Oklahoma limited partnership and two

Oklahoma limited liability companies. The Company does not have

actual or effective control of any of the entities. The management of

these entities could at any time make decisions in their own best interests that

could materially affect the Company’s net income, or the value of the Company’s

investments.

The

remaining entities are Broadway Sixty-Eight, Ltd. (33% limited partnership

interest), OKC Industrial Properties, LLC (10% ownership) and JAR Investments,

LLC (25% ownership). These entities collectively and/or individually have had a

significant effect, both positively, and negatively, on the Company’s net income

in the past and are expected to in the future. Two of these entities

have guarantee arrangements under which the Company is contingently

liable. Item 8, Note 7 to the accompanying financial statements

includes related disclosures and additional information regarding these

entities.

Liquidity

and Capital Resources

To

supplement the following discussion, please refer to the Balance Sheets and the

Statements of Cash Flows included in this Form 10-K.

In 2008,

as in prior years, the Company funded its business activity through the use of

internal sources of capital. For the most part, these internal

sources are cash flows from operations, cash, cash equivalents and available for

sale securities. When cash flows from operating activities are in

excess of those needed for other business activities, the remaining balance is

used to increase cash, cash equivalents and/or available for sale

securities. When cash flows from operating activities are not

adequate to fund other business activities, withdrawals are made from cash, cash

equivalents and/or available for sale securities. Cash equivalents

are highly liquid debt instruments purchased with a maturity of three months or

less. Available for sale securities are US Treasury

Bills.

In 2008,

net cash provided by operating activities was $13,543,730. Sales, net of

production, exploration, general and administrative costs and income taxes paid

were $12,214,609, which accounted for 90% of the operations net cash

flow. The remaining components provided $1,329,121 or 10% of cash

flow. In 2008, net cash applied to investing activities was

$7,416,157. Net purchases of available for sale securities discussed below and

capitalized property additions (net of disposals) accounted for $7,246,166 of

the total net cash applied to investing activities. Maturing available for sale

securities provided $26,632,838 of gross cash flow due to their six month

maturities. However, these funds plus $2,675,042 of excess cash from

operations were re-invested in the same type of securities.

In 2008,

cash utilized for capitalized property additions (net of disposals) was

$4,571,124. Dividend payments and treasury stock purchases totaled $5,929,117

and accounted for all of the cash applied to financing activities.

Other

than cash, cash equivalents and available for sale securities, other significant

changes in working capital include the following:

Trading

securities decreased $118,973 (35%) to $218,228 in 2008 from $337,201 in 2007.

All of the decrease is due to a $164,318 increase in unrealized losses which

represent the change in the market value of the securities from their original

cost. The losses were offset by $45,345 which represents the earnings from the

securities plus the net realized gains for the year. All earnings and

net realized gains are reinvested in additional securities.

Receivables

decreased $573,467 (25%) to $1,738,856 in 2008 from $2,312,323 in

2007. The decrease was mostly due to lower average monthly sales in

the fourth quarter of 2008 versus 2007. Average monthly oil and

natural gas sales for the fourth quarter of 2008 were about $950,000 compared to

about $1,340,000 for the fourth quarter of 2007. The receivables

balance at December 31, 2008 includes about 1.6 months of oil and natural gas

sales accruals. See the discussion of revenues under subheading

“Operating Revenues”, below for more information about the sales of oil and

natural gas, including the wells in Robertson County, Texas and the lower

product prices experienced at December 31, 2008.

Refundable

income taxes were $999,573 in 2008 versus a $153,094 payable balance in

2007. This was due to timing and an overpayment of the fourth quarter

estimated tax payments in 2008 versus an underpayment in 2007.

Prepaid

expenses of $103,373 in 2007 were prepaid seismic expenses on the Harper County,

Kansas prospect discussed in the “Update of Oil and Gas Exploration and

Development Activity from December 31, 2007” in the “Results of Operations”

section below. The seismic survey work was completed in September, 2008 and

there were no similar prepaid expenses at December 31, 2008.

Accounts

payable decreased $95,801 (31%) to $208,487 in 2008 from $304,288 in

2007. This decrease was primarily due to decreased drilling activity

at year end 2008 versus 2007. See the discussion of this activity

under “Update of Oil and Gas Exploration and Development Activity from December

31, 2007” in the “Results of Operations” section below.

Deferred

income taxes and other, decreased $158,566 (42%) to $221,266 in 2008 from

$379,832 in 2007. Deferred income taxes decreased $167,286 because of the tax

effect of decreased sales accruals and the unrealized losses on trading

securities. This decrease was offset by an increase of $10,000 in the

accrual for some delayed ad valorem tax bills on several Robertson County, Texas

gas wells.

The

following is a discussion of material changes in cash flow by activity between

the years ending December 31, 2008 and 2007. Also see the discussion

of changes in operating results under “Results of Operations” below in this Item

7.

Operating

Activities

As noted

above, net cash flows provided by operating activities in 2008 were $13,543,730,

which when compared to the $9,488,931 provided in 2007, represents an increase

of $4,054,799 or 43%. The increase resulted because of an increase in

oil and gas sales cash flows of $6,213,997, an increase in lease bonuses and

coal royalties of $505,322 and a decrease in exploration costs of $328,947.

Those increases in cash flows were partially offset by increased production

costs of $574,364, an increase in general, administrative, taxes and other

expenses of $114,432, an increase in income taxes paid of $2,209,126 and a

decrease in interest income of $96,956. Additional discussion of the more

significant items follows.

Discussion

of Selected Material Line Items Resulting in an Increase in Cash

Flows.

The $6,213,997 (44%) increase in cash received from oil

and gas sales to $20,457,619 in 2008 from $14,243,622 in 2007 was the result of

an increase in both the average oil and gas prices and the volume of oil and gas

sales. See “Results of Operations” below for a price/volume analysis

and the related discussion of oil and gas sales.

Cash

received for lease bonuses and coal royalties increased $505,322 (117%) to

$936,685 in 2008 from $431,363 in 2007. Most of the increase is due to an

increase in cash received for lease bonuses of about $534,000 in 2008 versus

2007. This increase was offset by a decline in the cash received for coal

royalties of $29,068 to $191,960 in 2008 from $221,028 in 2007.

Cash flow

increased due to a decrease in cash paid for exploration expenses of $328,947

(96%) to $12,046 in 2008 from $340,993 in 2007. About $97,000 of the

decrease was due to lower geological and geophysical expense in 2008 versus 2007

due mostly to the prepaid seismic balance at 2007 year end. The remaining

decrease of about $232,000 was due to lower dry hole costs in 2008 versus

2007.

Discussion

of Selected Material Line Items Resulting in a Decrease in Cash

Flows.

Cash paid for production costs increased $574,364 (34%)

to $2,248,936 in 2008 from $1,674,572 in 2007. Most of the increase

was due to a $248,199 increase in lease operating expenses and handling expenses

and an increase of $326,165 in production taxes in 2008 versus

2007. Most of the lease operating expense increase was attributable

to wells which first produced in 2008 and late 2007. The increase in

production taxes was due to increased sales in 2008 versus

2007.

Cash paid

for general suppliers, employees and taxes other than income taxes increased

$114,432 (9%) to $1,456,691 in 2008 from $1,342,259 in 2007. Most of this

increase is due to an increase in salaries and employee benefits of about

$114,000 to $764,000 paid in 2008 versus $650,000 paid in 2007.

Cash

received for interest earned on cash equivalents and available for sale

securities decreased $96,956 (20%) to $390,206 in 2008 from $487,162 in

2007. The decrease was the result of a decrease in the average rate

of return to 2.41% in 2008 from 4.29% in 2007 offset by an increase in the

average balance of cash equivalents and available for sale securities

outstanding to $16,219,149 in 2008 from $11,351,296 in 2007.

Income

taxes paid increased $2,209,126 (95%) to $4,525,337 in 2008 from $2,316,211 in

2007 due to increased income tax expense and estimated tax payments discussed

above and below in “Results of Operations”.

Investing

Activities

Net cash

applied to investing activities decreased $1,151,853 (13%) to $7,416,157 in 2008

from $8,568,010 in 2007. In 2008, net cash applied to available for

sale securities decreased $2,297,237 from $4,972,279 in 2007 to $2,675,042 in

2008. This decline was a result of utilizing a larger portion of the operations

cash flow for financing activities in 2008 as discussed below. Cash

flows related to property acquisitions resulted in an increase in cash

applications to investing activities in 2008 versus 2007. Cash applied to

property acquisitions increased $1,284,671 (33%) to $5,163,043 in 2008 from

$3,878,372 in 2007 due primarily to increased exploration and development

drilling activity. See the “Update of Oil and Gas Exploration and

Development Activity from December 31, 2007” under the “Results of Operations”

heading below for more information regarding expenditures related to this

drilling activity. Cash flow from property dispositions increased $567,903 to

$591,919 in 2008 from $24,016 in 2007 resulting in a decrease of the cash

applications to investing activities. Property dispositions in 2008 included

proceeds of about $592,000 from the sale of the Company’s ownership interest in

a group of Seminole County, Oklahoma producing properties with no similar sales

in 2007. The increases in cash applications for investing activities also

included a decrease in cash distributions from equity investments of $252,075

(97%) to $6,550 in 2008 from $258,625 in 2007. This decrease is due to a

$225,000 distribution in 2007 from Millennium Golf Properties, LLC representing

the proceeds from the sale of our 9% ownership interest to the remaining owners

in the limited liability company. There were no similar sales or distributions

in 2008.

Financing

Activities

Cash

applied to financing activities increased $4,918,865 (487%) to $5,929,117 in

2008 from $1,010,252 in 2007. Cash flows applied to financing

activities consist of cash dividends on common stock and cash used for the

purchase of treasury stock. In 2008, cash dividends paid on common

stock amounted to $5,857,097 as compared to $883,052 in

2007. The increase was the result of an increase in the 2008

dividends per share to $40.00 from $6.00 in 2007. The increase was necessary to

distribute to the Company’s shareholders a portion of the funds from operating

activities cash flow that was in excess of the funds needed for investing

activities. The cash applied to the purchase of treasury stock was

$72,020 in 2008 as compared to $127,200 in 2007. The decrease in

treasury stock purchases in 2008 from 2007 is due to a combination of fewer

shares purchased in 2008 (347 shares) versus 2007 (795 shares) and a higher

average price paid in 2008 of $208 per share versus $160 per share in

2007. For additional information about treasury stock

purchases, see Note (1) at the end of Item 5 "Market for Registrant’s Common

Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities”

above.

Forward-Looking

Summary

Despite

the current depressed prices being received for crude oil and natural gas sales,

the latest estimate of business to be done in 2009 and beyond indicates the

projected activity can be funded from cash flow from operations and other

internal sources including net working capital. See additional

discussion of 2009 operating income estimates below at the end of the “Operating

Revenues” section. The Company is engaged in exploratory drilling. If

this drilling is successful, substantial development drilling may

result. Also, should other exploration projects which fit the

Company’s risk parameters become available, or other investment opportunities

become known, capital requirements may be more than the Company has

available. If so, external sources of financing could be

required.

Results

of Operations

As

disclosed in the Statements of Operations in Item 8 of this Form 10-K, in 2008

the Company had net income of $9,647,693 as compared to a net income of

$7,527,876 in 2007. Net income per share, basic and diluted was

$59.43 in 2008, an increase of $13.18 per share from $46.25 in

2007. Material line item changes in the Statements of Operations will

be discussed in the following paragraphs.

Operating

Revenues

Operating

revenues increased $6,373,292 (44%) to $20,706,010 in 2008 from $14,332,718 in

2007. Oil and gas sales increased $5,801,876 (42%) to $19,717,442 in 2008 from

$13,915,566 in 2007. Lease bonuses and other revenues increased

$571,416 (137%) to $988,568 in 2008 from $417,152 in 2007. This increase was the

result of an increase in lease bonuses of $532,946 due to increased bonuses from

East Texas, Oklahoma and Colorado leases. In addition, coal royalties

from North Dakota leases increased $38,470 (19%) to $245,287 in 2008 from

$206,817 in 2007. The Company does not anticipate that coal royalties will have

a significant impact on its future results of operations. The

increase in oil and gas sales will be discussed in the following

paragraphs.

The

$5,801,876 increase in oil and gas sales was the net result of a $3,229,778

increase in gas sales plus a $2,446,578 increase in oil sales and a $125,520

increase in miscellaneous oil and gas product sales. The following price and

volume analysis is presented to help explain the changes in oil and gas sales

from 2007 to 2008. Miscellaneous oil and gas product sales of

$289,763 in 2008 and $164,243 in 2007 are not included in the

analysis.

|

|

|

|

|

|

Variance

|

|

|

|

|

|

Production

|

|

2008

|

|

|

Price

|

|

|

Volume

|

|

|

2007

|

|

|

Gas

–

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MCF

(000 omitted)

|

|

1,452

|

|

|

|

|

|

55

|

|

|

1,397

|

|

|

$(000

omitted)

|

|

$12,029

|

|

|

$2,882

|

|

|

$348

|

|

|

$8,799

|

|

|

Unit

Price

|

|

$8.28

|

|

|

$1.98

|

|

|

|

|

|

$6.30

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oil

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bbls

(000 omitted)

|

|

80

|

|

|

|

|

|

5

|

|

|

75

|

|

|

$(000

omitted)

|

|

$7,399

|

|

|

$2,097

|

|

|

$350

|

|

|

$4,952

|

|

|

Unit

Price

|

|

$92.09

|

|

|

$26.09

|

|

|

|

|

|

$66.00

|

|

The

$3,229,778 (37%) increase in natural gas sales to $12,029,060 in 2008 from

$8,799,282 in 2007 was the result of an increase in both the average price

received per thousand cubic feet (MCF) and gas sales volumes. The

average price per MCF of natural gas sales increased $1.98 per MCF to $8.28 in

2008 from $6.30 in 2007 resulting in a positive gas price variance of

$2,881,974. A positive volume variance of $347,803 was the result of

an increase in natural gas volumes sold of 55,207 MCF to 1,452,368 MCF in 2008

from 1,397,161 MCF in 2007. The increase in the volume of gas

production was the net result of new 2008 production of about 411,800 MCF offset

by declines of 356,593 MCF. These declines are a combination of about 202,500

MCF of normal decline in production from mature producing properties and a

positive sales adjustment of 154,056 MCF included in the 2007 volumes. This

adjustment was for 2005 and 2006 volumes and sales from two Robertson County,

Texas wells received and recorded in September, 2007. The purchaser had

originally suspended the revenues due to a potential title problem and the

Company had not accrued these sales for that reason. This adjustment and the

reasons for it were discussed in the Company’s Form 10-QSB for the period ended

September 30, 2007. This adjustment slightly distorted the variance between 2007

and 2008 natural gas production and accounts for part of the variance

above. As disclosed in Supplemental Schedule 1 of the Unaudited

Supplemental Financial Information included in Item 8, below, working interests

in natural gas extensions and discoveries were not adequate to replace working

interest reserves produced in 2008 or 2007.

The gas

production for 2007 and 2008 includes production from several royalty interest

properties drilled by various operators in Robertson County,

Texas. The first of these wells began producing in late March, 2005

and the most recent one began producing in December, 2008. These

properties accounted for approximately 817,000 MCF and $5,105,000 of the 2007

gas sales and approximately 845,000 MCF and $7,279,000 of the 2008 gas

sales. While the operators are currently drilling and plan more

drilling in the future on the acreage in which the Company holds mineral

interests, the Company has no control over the timing of such

activity.

The

$2,446,578 (49%) increase in crude oil sales to $7,398,619 in 2008 from

$4,952,041 in 2007 was the result of an increase in both the average price per

barrel (Bbl) and oil sales volumes. The average price received per Bbl of oil

increased $26.09 to $92.09 in 2008 from $66.00 in 2007, resulting in a positive

oil price variance of $2,096,491. An increase in oil sales volumes of

5,304 Bbls to 80,337 Bbls in 2008 from 75,033 Bbls in 2007 resulted in a

positive volume variance of $350,087. The increase in the oil volume production

was the net result of new 2008 production of about 15,900 Bbls offset by about

10,600 Bbls of normal decline in production from mature producing

properties.

Of the

new 2008 production approximately 9,900 Bbls (62%) was from Woods County,

Oklahoma. Of the remaining new production, about 3,500 Bbls (22%) was from new

working interest wells in Kansas and Oklahoma (in counties other than Woods) and

about 2,500 Bbls was from new royalty interest wells in Texas and Oklahoma. As

disclosed in Supplemental Schedule 1 of the Unaudited Supplemental Financial

Information included below in Item 8, working interests in oil extensions and

discoveries were adequate to replace working interest reserves produced in 2007

but not in 2008.

For both

oil and gas sales, the price change was mostly the result of a change in the

spot market prices upon which most of the Company’s oil and gas sales are

based. These spot market prices have had significant fluctuations in

the past and these fluctuations are expected to continue.

Spot market prices in 2008

provided an excellent example of the fluctuations that can and do

occur.

Spot

market prices for crude oil in 2008 started the year at about $100/Bbl, peaked

above $145/Bbl in July and then rapidly declined to less than $35/Bbl in early

2009. Crude oil spot prices are about $50/Bbl at the time of this

Form 10-K, so wellhead oil prices are less than one-half of the $92.06/Bbl

average sales price the Company received for its 2008 oil

production.

Spot

market prices for natural gas in 2008 started the year at about $7/MMBTU

(million British thermal units), peaked above $13/MMBTU in July and then

declined to less than $4/MMBTU in early 2009. Natural gas spot market prices are

about $4/MMBTU at the time of this Form 10-K, so wellhead gas prices are also

less than one-half of the $8.28/MCF average sales price the Company received for

its 2008 natural gas production.

These

depressed prices, if they continue for the remainder of the year, will result in

substantially lower sales and operating results in 2009 compared to

2008.

Operating

Costs and Expenses

Operating costs and expenses increased

$3,490,566 (74%) to $8,177,531 in 2008 from $4,686,965 in 2007, primarily due to

increases in production costs and depreciation, depletion and

amortization. The material components of operating costs and expenses

will

be discussed

below

.

Production

Costs.

Production costs increased $599,648 (36%) to $2,272,224

in 2008 from $1,672,576 in 2007. The increase was the net result of a $351,945

(64%) increase in gross production tax (net of production tax refunds) to

$903,224 in 2008, from $551,279 in 2007, plus an increase in lease operating and

handling expense of $247,702 (22%) to $1,369,000 in 2008 from $1,121,298 in

2007. Most of the increase in lease operating and handling expense was due to an

increase in lease operating expenses of $223,585 (30%) to $962,107 in 2008 from

$738,522 in 2007 with about $165,000 of the increase related to new 2008 wells

or wells that began producing in late 2007. Most of the remaining increase in

lease operating expense was due to required repairs on two salt water disposal

(“SWD”) wells that were part of a group of wells sold in June, 2008. See the

“Other Income (Loss), Net” discussion below for more information regarding this

sale of properties. Handling expense increased $24,117 (6%) to $406,893 in 2007

from $382,776 in 2007. Handling expense is comprised of gas gathering, treating,

transportation and compression costs. Gross production taxes are state taxes

which are calculated as a percentage of gross proceeds from the sale of products

from each producing oil and gas property; therefore, they fluctuate with the

change in the dollar amount of revenues from oil and gas sales. Most

of the gross production tax refunds relate to the Robertson County, Texas

properties and are due to a Texas program used as an incentive to encourage

operators to drill deep or tight sands gas wells. These refunds are

not permanent but are for a limited number of months of production.

Exploration

and Development Costs.

Under the successful

efforts method of accounting used by the Company, geological and geophysical

costs are expensed as incurred, as are the costs of unsuccessful exploratory

drilling. The costs of successful exploratory drilling and all

development costs are capitalized. Total costs of exploration and

development, inclusive of geological and geophysical costs were $5,189,037 in

2008 and $4,272,382 in 2007. See Item 8, Note 8 to the accompanying

financial statements for additional information regarding a breakdown of these

costs. Costs charged to operations were $142,550 in 2008 and $237,507 in 2007

inclusive of geological and geophysical costs of $120,446 in 2008 and $10,805 in

2007

.

Update

of Oil

and Gas Exploration and Development Activity from December 31,

2008.

For the twelve months ended December 31, 2008, the

Company participated in the drilling of seventeen gross exploratory and nineteen

gross development working interest wells with working interests ranging from a

high of 21.5% to a low of 2.75%. Of the seventeen exploratory wells,

seven were completed as producers and one as dry hole, and nine were in

progress. Of the nineteen development wells, twelve were completed as

producers and seven were in progress. In management’s opinion, the

exploratory drilling summarized above has produced some possible development

drilling opportunities.

The

following is a summary as of March 17, 2009, updating both exploration and

development activity from December 31, 2007.

The

Company participated with its 18% working interest in the drilling of two

step-out wells on a Barber County, Kansas prospect. Both wells were

started in January 2008 and completed in March 2008 as commercial oil and gas

producers. Two additional step-out wells will be drilled in

2009. Capitalized costs were $217,438 for the year ended December 31,

2008.

The

Company participated with its 18% working interest in the drilling of five

step-out wells on a Barber County, Kansas prospect which adjoins the previous

prospect. The first well was started in August 2008 and the second

and third wells in September 2008. The third well was a re-entry and

washdown of an old dry hole. All three wells were completed in

December 2008, the first as a commercial oil and gas producer and the other two

as marginal oil and gas producers. The fourth and fifth wells were

started in November 2008 and completion attempts of both are currently in

progress. Capitalized costs were $525,546 for the period ended December 31,

2008, including $115,968 in prepaid drilling costs.

The

Company participated with its 4.3% interest in the drilling of a horizontal

development well in a Harding County, South Dakota waterflood

unit. The well was started in June 2008 and completed in September

2008 as a commercial oil producer. Another unit well was converted

from an oil producer to a water injection well, with injection commencing in

December 2008. Costs for the year at December 31, 2008 were

$137,459.

The

Company participated with working interests of 18%, 18%, 17.4%, 18% and 17.9% in

the drilling of five development wells on a Woods County, Oklahoma

prospect. The first well was started in January 2008 and the second

in February 2008. Both were completed in March 2008 as commercial oil

and gas wells; however, the second well has since declined to marginal

status. The third well was started in March 2008 and completed in

April 2008 as a commercial oil and gas producer. The fourth and fifth

wells were started in October 2008 and completed in December 2008 as commercial

oil and gas producers. Capitalized costs totaled $653,274 as of

December 31, 2008, including $79,783 in prepaid drilling costs.

In 2007

the Company participated in the drilling and completion of an exploratory well

on a Grady County, Oklahoma prospect in which it has a 10%

interest. Sales commenced in April 2008 following the construction of

a pipeline, with gas and condensate flowing at a commercial rate. The

Company participated in the drilling of four additional exploratory wells on

this prospect in 2008. The first well was started in February 2008

and completed in May 2008 as a commercial gas and condensate

producer. The second well was started in July 2008 and completed in

March 2009. Preliminary flow rates indicate a commercial gas and

condensate producer. The third well was started in August 2008 and

casing was set in September 2008. A completion attempt is currently

in progress. The fourth well, a re-entry and sidetrack of a 2007

exploratory dry hole, was started in December 2008 and completed in January 2009

as a dry hole. Total capitalized costs for the period ended December

31, 2008 were $750,930, including $72,130 in prepaid drilling costs. Dry hole

costs of $13,365 were expensed as of December 31, 2008.

The

Company participated in the drilling of three development wells on a Woods

County, Oklahoma prospect. The first well (Company working interest

12%) was started in December 2007 and completed in January 2008. The

second well (14% interest) was started in May 2008 and completed in July

2008. The third well (16% interest) was started in July 2008 and

completed in September 2008. All three are commercial oil and gas

wells. Two additional development wells (12% and 14% interests) will

be drilled starting in May 2009. Total costs for these wells at

December 31, 2008 were $340,307, including $13,066 in prepaid drilling

costs.

In 2007

the Company participated with a 16% interest in the drilling and completion of

an exploratory well on a Woods County, Oklahoma prospect. Sales

commenced in February 2008 with oil and gas flowing at a commercial

rate. The Company participated with an 8% working interest in the

drilling of another exploratory well which was started in March 2008 and

completed in April 2008 as a commercial oil and gas producer. Two

step-out wells (11.75% and 16% interests) were started in September 2008 and

completed in December 2008 as oil and gas producers, the first commercial and

the second marginal. Capitalized costs for the period ended December 31, 2008

were $283,333, including $9,460 in prepaid drilling costs.

The

Company participated with an 18% interest in the development of nine prospects

along a trend in Comanche and Kiowa Counties, Kansas. An exploratory

well (Company working interest 18%) was started in April 2008 and completed in

August 2008 as a marginal oil producer. A second exploratory well

(16.2% interest) was started in April 2008 and completed in June 2008 as a

commercial gas well. Two additional exploratory wells (18% and 16.2%

interests) were started in November 2008. The first was completed in

February 2009 and is currently being tested. A completion is in

progress on the second. Five additional exploratory wells are planned

for 2009, the first to start in March. Total capitalized costs at

December 31, 2008 were $516,888, including $139,822 in prepaid drilling costs,

and $217,890 in leasehold costs.

A 3-D

seismic survey was started in February 2008 on a Harper County, Kansas prospect

in which the Company has a 16% interest. Weather delays forced the

suspension of the survey prior to completion; however, data was acquired over

most of the prospect acreage. Two potential structures were

identified. Two exploratory wells were started in July

2008. One was completed in November 2008 as a commercial oil and gas

well and then shut in to await the construction of a pipeline. It

started producing again in March 2009. A completion attempt of the

other was unsuccessful in one zone. It is currently being evaluated

for a completion attempt in another zone. The seismic survey was

completed in September 2008. At least two additional wells are

planned for 2009. At December 31, 2008, capitalized well costs were

$215,417, and $120,446 was expensed for seismic costs.

In March

2008 the Company participated with its 18% interest in the drilling of an

exploratory well on a Logan County, Oklahoma prospect. The well was

completed in June 2008 as a marginal oil and gas

producer. Capitalized costs for the period ended December 31, 2008

were $109,944.

The

Company participated with its 16% working interest in the drilling of two

development wells on a Woods County, Oklahoma prospect. Both were

started in November 2007 and completed in February 2008 as commercial oil and

gas wells. Total costs for these wells at December 31, 2008 were

$223,943.

The

Company participated with a 21.5% working interest in the drilling of a step-out

well on a Woods County, Oklahoma prospect. The well was started in

November 2007 and completed in February 2008 as a commercial gas

producer. It also makes some oil. An additional step-out

well was started in July 2008 and completed in September 2008 as a commercial

oil and gas producer. Total costs for these wells at December 31,

2008 were $294,928, including $7,054 in prepaid drilling costs.

In March

2008 the Company purchased a 21% interest in 637.5 net acres of leasehold on a

Lincoln County, Oklahoma prospect for $13,388. A step-out dual

lateral horizontal well was started in March 2008. Drilling

difficulties were encountered and neither lateral reached its planned total

depth. Completion efforts so far have been unsuccessful, and the well

is currently non-commercial. An impairment expense of $566,027 was

charged to the well for the year ended December 31, 2008.

In April

2008 the Company purchased a 2.75% interest in 2,064 net acres of leasehold on a

Garvin County, Oklahoma prospect for $14,795, including $3,300 for

seismic. An exploratory well was started in May 2008, drilled to

total depth and then temporarily abandoned in August 2008. A test of

the target formation in November 2008 indicated that it was non-productive, and

the well is currently being evaluated for conversion to a disposal

well. Total costs at December 31, 2008, were $71,806.

The

Company participated with an 18% interest in the development of a McClain

County, Oklahoma prospect. Acreage has been acquired and it is likely

that an exploratory well will be drilled in 2009. Leasehold costs at

December 31, 2008 were $10,571.

The

Company participated with a 50% interest in the development of another McClain

County, Oklahoma prospect. Acreage has been acquired and a deal has

been made to obtain access to a 3-D seismic survey which covered the prospect

area. The Company will retain a 16% interest in the prospect

acreage. Decisions about drilling will be made after the seismic has

been evaluated. Leasehold costs at December 31, 2008 were

$65,942.

In August

2008 the Company purchased a 5% interest in a Garvin County, Oklahoma prospect

for $15,000. An exploratory well was started in September 2008 and

reached total depth in October 2008. The lower part of the hole has

been plugged; however, a completion will be attempted in a shallow zone that is

behind the intermediate casing.

In

November 2008 the Company purchased a 10.5% interest in 803.5 net acres of

leasehold on a Woods County, Oklahoma prospect for $21,093. Two

exploratory wells were drilled starting in November 2008. One

was completed in March 2009 and is currently being tested. The other

is shut in awaiting tank battery construction. Capitalized costs were

$202,549 for the year ended December 31, 2008.

The

Company participated with its 8% working interest in the drilling of a step-out

well on a Woods County, Oklahoma prospect. The well was started in

December 2008 and completed in March 2009 as a commercial oil and gas producer.

Capitalized costs were $56,800 at December 31, 2008, including $31,987 in

prepaid drilling costs.

In

January 2009 the Company purchased a 16% interest in 18,343 net acres of

leasehold on a Ford County, Kansas prospect for $176,094 and paid $259,413 in

estimated seismic costs. A 3-D seismic survey has been completed and

an exploratory well is planned for May 2009.

In March

2009 the Company purchased a 7% interest in 3,262 net acres of leasehold on a

Williams and Defiance Counties, Ohio prospect for $15,702. Two

exploratory wells will be drilled starting in April 2009.

Depreciation,

Depletion, Amortization and Valuation Provisions

(DD&A).

Major components are the provision for impairment

of undeveloped leaseholds, provision for impairment of long-lived assets,

depletion of producing leaseholds and depreciation of tangible and intangible

lease and well costs. Undeveloped leaseholds are amortized over the life of the

leasehold (most are 3 years) using a straight line method except when the

leasehold is impaired or condemned by drilling and/or geological interpretation

of seismic data; if so, an adjustment to the provision is made at the time of

impairment. The provision for impairment of undeveloped leaseholds