Initial Resource Estimate for Novo’s Beatons Creek Gold Project, Western Australia

May 01 2013 - 11:34AM

OTC Markets

Novo Resources Corp.

Suite

1980 – 1075 West Georgia Street

Vancouver,

BC V6E 3C9

Initial Resource Estimate for Novo’s Beatons

Creek Gold Project, Western Australia

VANCOUVER,

May

1, 2013 -

Novo

Resources Corp.

(the “Company”) (CNSX: NVO; OTCQX: NSRPF)

is

pleased to announce

the first ever National Instrument (NI) 43-101 compliant resource

estimate for

its Beatons Creek Gold Project, Western Australia. This resource

estimate is

based on 16,107 meters of reverse circulation (RC) drilling and 478

meters of

diamond core drilling completed in 2011-12.

The effective date of this resource estimate is April 30,

2013.

Highlights:

-

Inferred resource of 421,000 troy ounces gold contained

in 8.9 million tonnes at a grade of 1.47 grams gold per

tonne.

-

This inferred resource was defined by 16,107 meters of

vertical RC drilling. Specific gravity measurements were taken from

core

samples from eight recently completed diamond drill holes totaling

478

meters. Costs related to drilling total approximately $2.5 million

making

the cost of discovery about $6/troy ounce gold.

-

Most of this resource is contained within two shallow,

sub-horizontal gold-bearing conglomerate horizons (reefs)

displaying

strong lateral continuity.

-

Mineralization remains open to the north, west and

south into the basin. There is a good potential for expanding

this

resource through further drilling given the strong sub-surface

continuity of

these reefs as demonstrated by drilling coupled with the Company’s

recent

success in tracing their surface expression along the northern

and

northwestern perimeter of the basin (see

news release dated January 24, 2013).

-

This inferred resource enables undertaking of a

preliminary economic assessment planned for later this year. It

is

expected that upgrading this resource to the indicated category can

be

accomplished by drilling approximately 3,710 meters more infill RC

holes.

Doing so would enable advancement toward a prefeasibility

study.

"We

are very proud that in a few short months, and for a modest budget,

we have

advanced Beatons Creek from a conceptual target to a sizeable

inferred gold

resource," commented Dr. Quinton Hennigh, President, CEO and

Director of

Novo Resources. “We are off to a strong start, and from here, we

see a straightforward

path toward upgrading and expanding this resource as well as

commencing a

preliminary economic assessment.”

Beatons

Creek NI 43-101 resource estimate is summarized

below:

Classification

|

Au Cut-off

(grams per tonne)

|

Tonnage

(million metric tonnes)

|

Au Grade

(grams per tonne)

|

Contained Au

(troy ounces)

|

Inferred

|

0.20

|

9.2

|

1.44

|

424,000

|

0.30

|

9.2

|

1.44

|

424,000

|

0.50

|

8.9

|

1.47

|

421,000

|

0.60

|

8.6

|

1.5

|

415,000

|

0.80

|

7.1

|

1.67

|

381,000

|

1.00

|

5.5

|

1.89

|

334,000

|

1.50

|

3.0

|

2.43

|

236,000

|

2.00

|

1.6

|

3.02

|

160,000

|

2.50

|

0.9

|

3.71

|

106,000

|

3.00

|

0.6

|

4.22

|

78,000

|

1

troy ounce = 31.1035 grams

Resource

Modeling

Mineral

resources were estimated by Ordinary Kriging (OK), Inverse Distance

Squared

(ID2) and Nearest Neighbor (NN) methods.

The OK estimation was selected as the preferred method and a

cut-off

grade of 0.5 g/t Au was applied.

Mineralization is currently defined in 3 domains containing 23

individual mineralised bodies, all of which are considered to be

primary in

origin, despite the shallow weathering profile.

The

majority

of assays used for the estimate were determined using LeachWELL®

methodology,

which was statistically determined to be the most reliable method

for the

nuggety gold distribution in this deposit.

Acceptable statistical verification and comparisons of LeachWELL®

assays

with equivalent Screen Fire Assays and Fire Assays supported this

assessment. Assays were not capped but higher values were

given a restricted search range. All resource

blocks in the block model were estimated in one pass with any

blocks that were

estimated flagged as Inferred Resources, based on the variography

and Quantitative

Kriging Neighborhood Analyses.

Mineral

resources that are not mineral reserves do not have demonstrated

economic

viability. The estimate of mineral resources may be materially

affected by

environmental, permitting, legal, title, taxation, sociopolitical,

marketing,

or other relevant issues. The quantity and grade of reported

inferred resources

in this estimation are uncertain in nature and there has been

insufficient

exploration to define these inferred resources as an indicated or

measured

mineral resource and it is uncertain if further exploration will

result in

upgrading them to an indicated or measured mineral resource

category. The

mineral resources in this news release were estimated using current

Canadian

Institute of Mining, Metallurgy and Petroleum (CIM) standards,

definitions and

guidelines.

Patrick

Huxtable of Tetra Tech, Perth, Australia, has prepared the Mineral

Resource

Estimate for the Beatons Creek Gold Project, and is independent of

Novo

Resources Corporation for purposes of National Instrument 43-101

- Standards

of Disclosure for Mineral Projects ("NI

43-101"). Mr. Huxtable (RPGeo MAIG) is a Qualified

Person

as defined by NI 43-101.

Mr.

Huxtable is preparing a NI 43-101 compliant technical report in

respect of the

resource estimate discussed in this news release, which the Company

is

obligated under NI 43-101 to file on SEDAR within 45 days of the

date this news

release was disseminated.

Quinton

Hennigh (Ph.D., P.Geo.) is the Qualified Person pursuant to

National Instrument

43-101 responsible for, and having reviewed and approved, the

technical

information contained in this news release. Dr. Hennigh is

President, CEO and

Director of Novo Resources Corporation.

About Beatons

Creek

The

Beatons Creek Tenements

cover extensive exposures of the Beatons Creek conglomerates, a

series of

Archaean age pyritic conglomerates hosting gold mineralization

similar to that

of the Witwatersrand Basin in the Republic of South

Africa.

Shallow

gold reefs were first identified and

mined in this area beginning in the late 1800’s.

Novo

Resources’ current drill program is the

first modern, systematic exploration on the property. Tenements

comprising the

Beatons Creek Gold project include three mining leases in which

Novo Resources

is earning a 70% interest from Millennium Minerals Ltd., 560 square

kilometers

of prospecting and exploration tenements in which Novo Resources is

earning a

70% interest from the Creasy Group Pty. Ltd. and three prospecting

tenements in

which Novo Resources holds a 100% interest.

About Novo Resources Corp.

Novo’s focus is to evaluate, acquire and

explore gold properties. The Company presently has joint ventures

earning a 70%

interest two exploration properties, Beatons Creek and Marble Bar,

situated in

Western Australia. For more information, please contact Leo

Karabelas at (416)

543-3120 or e-mail

leo@novoresources.com

Forward-looking information

Some statements in this news release contain forward-looking

information (within the meaning of Canadian securities

legislation), including

without limitation statements as to the

potential, through further drilling, to

expand and upgrade to the indicated category the inferred resource

described in

this news release, and that a preliminary economic assessment will

be

undertaken later this year.

These statements address future events and

conditions and, as such, involve known and unknown risks,

uncertainties and

other factors which may cause the actual results, performance or

achievements

to be materially different from any future results, performance or

achievements

expressed or implied by the statements.

Such factors include, without limitation, the ability to complete

the

drilling program as currently contemplated, the receipt of

successful results

as drilling proceeds, customary risks of the mineral resource

exploration

industry as well as Novo Resources having sufficient cash to fund

the planned

drilling and other activities.

Cautionary Note to U.S. Readers Regarding Estimates

of Inferred Resources

This news release uses the term "inferred

resources." We advise U.S. investors that while this term is

recognized

and required by Canadian regulations, it is not recognized by the

U.S.

Securities and Exchange Commission. "Inferred resources" have a

great

amount of uncertainty as to their existence, and great uncertainty

as to their

economic and legal feasibility. It cannot be assumed that all or

any part of an

"inferred mineral resource" will ever be upgraded to a higher

category. Under Canadian rules, estimates of "inferred mineral

resources" may not form the basis of a feasibility study or

prefeasibility

studies. U.S. investors are cautioned not to assume

that any part or

all of an inferred resource exists or is economically or legally

mineable.

On Behalf of the Board of Directors,

Novo Resources Corp.

“Quinton

Hennigh”

Quinton Hennigh

CEO and President

The Canadian National Stock Exchange has not

reviewed and does not accept responsibility for the adequacy or

accuracy of the

content of this news release.

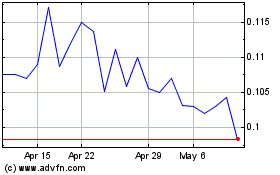

Novo Res (QX) (USOTC:NSRPF)

Historical Stock Chart

From May 2024 to Jun 2024

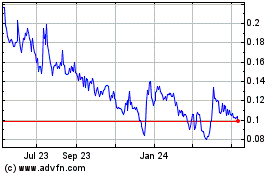

Novo Res (QX) (USOTC:NSRPF)

Historical Stock Chart

From Jun 2023 to Jun 2024