UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-8

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES

ACT OF 1933

NEWHYDROGEN,

INC.

(Exact

name of Registrant as specified in its charter)

| Nevada |

|

20-4754291 |

| (State

or other jurisdiction of |

|

(I.R.S.

Employer |

| incorporation

or organization) |

|

Identification

Number) |

27936

Lost Canyon Road, Suite 202

Santa

Clarita, CA 91387

(661) 251-0001

(Address,

including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

NewHydrogen,

Inc. 2022 Equity Incentive Plan

(Full

title of the plans)

David

Lee

Chief Executive Officer

NewHydrogen, Inc.

27936 Lost Canyon Road, Suite 202

Santa Clarita, CA 91387

(661) 251-0001

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Please

send copies of all communications to:

Gregory

Sichenzia, Esq.

Marcelle

S. Balcombe, Esq.

Sichenzia

Ross Ference LLP

1185

Avenue of the Americas, 31st Floor

New

York, NY 10036

(212)

930-9700

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer ☐ |

|

Accelerated

filer ☐ |

| Non-accelerated

filer ☒ |

|

Smaller

reporting company ☒ |

| |

|

Emerging

growth company ☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

EXPLANATORY

NOTE

This

Registration Statement on Form S-8 (this “Registration Statement”) is being filed by NewHydrogen, Inc., a Nevada corporation

(the “Company” or the “Registrant”) relating to 500,000,000 shares of common stock, $0.001 par

value per share (the “Common Stock”), issuable under NewHydrogen, Inc.’s 2022 Equity Incentive Plan (the “2022

Plan”).

This

Registration Statement also includes a prospectus (the “Reoffer Prospectus”) prepared in accordance with General Instruction

C of Form S-8 and in accordance with the requirements of Part I of Form S-3. This Reoffer Prospectus may be used for the reoffer and

resale of shares of Common Stock on a continuous or delayed basis that may be deemed to be “restricted securities” and/or

“control securities” within the meaning of the Securities Act of 1933, as amended (the “Securities Act”),

and the rules and regulations promulgated thereunder, that are issuable to certain of our executive officers, employees, consultants

and directors identified in the Reoffer Prospectus. The number of shares of Common Stock included in the Reoffer Prospectus represents

shares of Common Stock issuable to the selling stockholders pursuant to equity awards, including stock options and restricted stock grants,

granted to the selling stockholders and does not necessarily represent a present intention to sell any or all such shares of Common Stock.

As

specified in General Instruction C of Form S-8, until such time as we meet the registrant requirements for use of Form S-3, the number

of shares of Common Stock to be offered by means of this reoffer prospectus, by each of the selling security holders, and any other person

with whom he or she is acting in concert for the purpose of selling our shares of Common Stock, may not exceed, during any three month

period, the amount specified in Rule 144(e) of the Securities Act.

Part

I

INFORMATION

REQUIRED IN THE SECTION 10(a) PROSPECTUS

Item

1. Plan Information.

The

Company will provide each recipient of a grant under the 2022 Plan (the “Recipients”) with documents that contain

information related to the 2022 Plan, and other information including, but not limited to, the disclosure required by Item 1 of Form

S-8, which information is not required to be and is not being filed as a part of this Registration Statement on Form S-8 (the “Registration

Statement”) or as prospectuses or prospectus supplements pursuant to Rule 424 under the Securities Act. The foregoing information

and the documents incorporated by reference in response to Item 3 of Part II of this Registration Statement, taken together, constitute

a prospectus that meets the requirements of Section 10(a) of the Securities Act. A Section 10(a) prospectus will be given to each Recipient

who receives shares of Common Stock covered by this Registration Statement, in accordance with Rule 428(b)(1) under the Securities Act.

Item

2. Registrant Information and Employee Plan Annual Information.

The

documents containing the information specified in Part I of this Registration Statement will be sent or given to participants in the

2022 Plan, as specified by Rule 428(b)(1) promulgated under the Securities Act. Such documents need not be filed with the Securities

and Exchange Commission (the “Commission”) either as part of this Registration Statement or as prospectuses or prospectus

supplements pursuant to Rule 424 promulgated under the Securities Act. These documents and the documents incorporated by reference in

this Registration Statement pursuant to Item 3 of Part II of this Registration Statement, taken together, constitute a prospectus that

meets the requirement of Section 10(a) of the Securities Act.

David

Lee

Chief

Executive Officer

NewHydrogen,

Inc.

27936

Lost Canyon Road, Suite 202

Santa

Clarita, CA 91387

REOFFER

PROSPECTUS

NEWHYDROGEN,

INC.

Up

to 450,000,000 Shares of Common Stock

Issuable

under certain grants under

The

2022 Plan

This

reoffer prospectus relates to the public resale, from time to time, of an aggregate of 450,000,000 shares (the “Shares”)

of our common stock, $0.001 par value per share (the “Common Stock”) by certain security holders identified herein

in the section entitled “Selling Securityholders”. Such shares may be acquired in connection with common stock underlying

options issued under the Plans. You should read this prospectus carefully before you invest in our Common Stock.

Such

resales shall take place on the OTC Pink, or such other stock market or exchange on which our Common Stock may be listed or quoted, in

negotiated transactions or otherwise, at market prices prevailing at the time of the sale or at prices otherwise negotiated (see “Plan

of Distribution” starting on page 4 of this prospectus). We will receive no part of the proceeds from sales made under this reoffer

prospectus. The Selling Securityholders will bear all sales commissions and similar expenses. Any other expenses incurred by us in connection

with the registration and offering and not borne by the Selling Securityholders will be borne by us.

This

reoffer prospectus has been prepared for the purposes of registering our shares of Common Stock under the Securities Act to allow for

future sales by Selling Securityholders on a continuous or delayed basis to the public without restriction, provided that the amount

of shares of Common Stock to be offered or resold under this Reoffer Prospectus by each Selling Securityholder or other person with whom

he or she is acting in concert for the purpose of selling shares of Common Stock, may not exceed, during any three-month period, the

amount specified in Rule 144(e) under the Securities Act. We have not entered into any underwriting arrangements in connection with the

sale of the shares covered by this reoffer prospectus. The Selling Securityholders identified in this reoffer prospectus, or their pledgees,

donees, transferees or other successors-in-interest, may offer the shares covered by this reoffer prospectus from time to time through

public or private transactions at prevailing market prices, at prices related to prevailing market prices or at privately negotiated

prices.

Investing

in our Common Stock involves risks. See “Risk Factors” beginning on page 2 of this reoffer prospectus. These are speculative

securities.

Our

Common Stock is quoted on the OTC Pink under the symbol “NEWH” and the last reported sale price of our Common Stock on April

11, 2022 was $0.0210 per share.

NEITHER

THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED

IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The

date of this prospectus is April 12, 2022

NEWHYDROGEN,

INC.

TABLE

OF CONTENTS

Except

where the context otherwise requires, the terms, “we,” “us,” “our” or

“the Company,” refer to the business of NewHydrogen, Inc., a Nevada corporation.

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus and the documents and information incorporated by reference in this prospectus include forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act

of 1934, as amended, or the Exchange Act. These statements are based on our management’s beliefs and assumptions and on information

currently available to our management. Such forward-looking statements include those that express plans, anticipation, intent, contingency,

goals, targets or future development and/or otherwise are not statements of historical fact.

All

statements in this prospectus and the documents and information incorporated by reference in this prospectus that are not historical

facts are forward-looking statements. We may, in some cases, use terms such as “anticipates,” “believes,” “could,”

“estimates,” “expects,” “intends,” “may,” “plans,” “potential,”

“predicts,” “projects,” “should,” “will,” “would” or similar expressions

or the negative of such items that convey uncertainty of future events or outcomes to identify forward-looking statements.

Forward-looking

statements are made based on management’s beliefs, estimates and opinions on the date the statements are made and we undertake

no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except

as may be required by applicable law. Although we believe that the expectations reflected in the forward-looking statements are reasonable,

we cannot guarantee future results, levels of activity, performance or achievements.

We

caution you therefore that you should not rely on any of these forward-looking statements as statements of historical fact or as guarantees

or assurances of future performance.

Information

regarding market and industry statistics contained in this prospectus, including the documents that we incorporate by reference, is included

based on information available to us that we believe is accurate. It is generally based on academic and other publications that are not

produced for purposes of securities offerings or economic analysis. Forecasts and other forward-looking information obtained from these

sources are subject to the same qualifications and the additional uncertainties accompanying any estimates of future market size, revenue

and market acceptance of products and services. Except as required by U.S. federal securities laws, we have no obligation to update forward-looking

information to reflect actual results or changes in assumptions or other factors that could affect those statements.

PROSPECTUS

SUMMARY

The

Commission allows us to ‘‘incorporate by reference’’ certain information that we file with the

Commission, which means that we can disclose important information to you by referring you to those documents. The information incorporated

by reference is considered to be part of this prospectus, and information that we file later with the Commission will update automatically,

supplement and/or supersede the information disclosed in this prospectus. Any statement contained in a document incorporated or deemed

to be incorporated by reference in this prospectus shall be deemed to be modified or superseded for purposes of this prospectus to the

extent that a statement contained in this prospectus or in any other document that also is or is deemed to be incorporated by reference

in this prospectus modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as

so modified or superseded, to constitute a part of this prospectus. You should read the following summary together with the more detailed

information regarding our company, our Common Stock and our financial statements and notes to those statements appearing elsewhere in

this prospectus or incorporated herein by reference.

Our

Company

We

are a developer of clean energy technologies. Our current focus is on developing an electrolyzer technology to lower the cost of Green

Hydrogen production.

Hydrogen

is the cleanest and most abundant fuel in the universe. It is zero-emission and only produces water vapor when used. However, hydrogen

does not exist in its pure form on Earth so it must be extracted. For centuries, scientists have known how to use electricity to split

water into hydrogen and oxygen using a device called an electrolyzer. Electrolyzers installed behind a solar farm or wind farm can use

renewable electricity to split water, thereby producing Green Hydrogen. However, modern electrolyzers still cost too much. The chemical

catalysts that enable the water-splitting reactions are currently made from platinum and iridium – both are very expensive precious

metals. These catalysts account for nearly 50% of the cost of the electrolyzer.

We

are developing technologies to significantly reduce or replace rare materials with inexpensive earth abundant materials in electrolyzers

to help usher in a Green Hydrogen economy. In a 2020 report, Goldman Sachs estimates that Green Hydrogen will be a $12 trillion market

opportunity by 2050.

Corporate

Information

The

Company was originally incorporated in the State of Nevada on April 24, 2006, under the name BioSolar Labs Inc. Our name was changed

to BioSolar, Inc. on June 8, 2006, and to NewHydrogen, Inc. on April 30, 2021.

Our

principal business address is 27936 Lost Canyon Road, Suite 202, Santa Clarita, California 91387. We maintain our corporate website at

https://newhydrogen.com. The reference to our website is an inactive textual reference only. The information that can be accessed

through our website is not part of this reoffer prospectus.

THE

OFFERING

| Outstanding

Common Stock: |

|

715,496,051

shares of our Common Stock are outstanding as of April 12, 2022. |

| |

|

|

| Common

Stock Offered: |

|

Up

to 450,000,000 shares of Common Stock for sale by the selling securityholders (which include our executive officers and directors)

for their own account pursuant to the Plans. |

| |

|

|

| Selling

Securityholders: |

|

The

selling securityholders are set forth in the section entitled “Selling Securityholders” of this reoffer prospectus on

page 2. The amount of securities to be offered or resold by means of the reoffer prospectus by the designated selling securityholders

may not exceed, during any three month period, the amount specified in Rule 144(e). |

| |

|

|

| Use

of proceeds: |

|

We

will not receive any proceeds from the sale of our Common Stock by the selling securityholders. We would, however, receive proceeds

upon the exercise of the stock options by those who receive options under the Plans and exercise such options for cash. Any cash

proceeds will be used by us for general corporate purposes. |

| |

|

|

| Risk

Factors: |

|

The

securities offered hereby involve a high degree of risk. See “Risk Factors.” |

| |

|

|

| OTC

Pink trading symbol: |

|

NEWH |

RISK

FACTORS

An

investment in shares of our Common Stock is highly speculative and involves a high degree of risk. We face a variety of risks that may

affect our operations or financial results and many of those risks are driven by factors that we cannot control or predict. Before investing

in our Common Stock, you should carefully consider the risks below and set forth under the caption “Risk Factors”

in our Annual Report on Form 10-K for the year ended December 31, 2021, filed with the Securities and Exchange Commission on March

31, 2022, which are incorporated by reference herein, and subsequent reports filed with the SEC, together with the financial and other

information contained or incorporated by reference in this prospectus. If any of these risks actually occurs, our business, prospects,

financial condition and results of operations could be materially adversely affected. In that case, the trading price of our Common Stock

would likely decline and you may lose all or a part of your investment. Only those investors who can bear the risk of loss of their entire

investment should invest in our Common Stock.

USE

OF PROCEEDS

The

shares which may be sold under this reoffer prospectus will be sold for the respective accounts of each of the Selling Securityholders

listed herein (which includes our executive officers and directors). Accordingly, we will not realize any proceeds from the sale of the

shares of our Common Stock. We will receive proceeds from the exercise of the options; however, no assurance can be given as to when

or if any or all of the options will be exercised. If any options are exercised, the proceeds derived therefrom will be used for working

capital and general corporate purposes. All expenses of the registration of the shares will be paid by us. See “Selling Securityholders”

and “Plan of Distribution.”

SELLING

SECURITYHOLDERS

We

are registering for resale the shares covered by this prospectus to permit the Selling Securityholders identified below and their pledgees,

donees, transferees and other successors-in-interest that receive their securities from a Selling Securityholder as a gift, partnership

distribution or other non-sale related transfer after the date of this prospectus to resell the shares when and as they deem appropriate.

The Selling Securityholders acquired, or may acquire, these shares from us pursuant to the Plans. The shares may not be sold or otherwise

transferred by the Selling Securityholders unless and until the applicable awards vest and are exercised, as applicable, in accordance

with the terms and conditions of the Plans.

The

following table sets forth:

| |

● |

the

name of each Selling Securityholder; |

| |

|

|

| |

● |

the

position(s) or office of each Selling Securityholder; |

| |

|

|

| |

● |

the

number and percentage of shares of our Common Stock that each Selling Securityholder beneficially owned as of April 12, 2022 prior

to the offering for resale of the shares under this prospectus; |

| |

|

|

| |

● |

the

number of shares of our Common Stock that may be offered for resale for the account of each Selling Securityholder under this prospectus;

and |

| |

|

|

| |

● |

the

number and percentage of shares of our Common Stock to be beneficially owned by each Selling Securityholder after the offering of

the resale shares (assuming all of the offered resale shares are sold by such Selling Securityholder). |

Information

with respect to beneficial ownership is based upon information obtained from the Selling Securityholders. Because the Selling Securityholders

may offer all or part of the shares of Common Stock, which they own pursuant to the offering contemplated by this reoffer prospectus,

and because its offering is not being underwritten on a firm commitment basis, no estimate can be given as to the amount of shares that

will be held upon termination of this offering.

The

number of shares in the column ‘‘Number of Shares Being Offered’’ represents all of the shares of our Common

Stock that each Selling Securityholder may offer under this prospectus. We do not know how long the Selling Securityholders will hold

the shares before selling them or how many shares they will sell. The shares of our Common Stock offered by this prospectus may be offered

from time to time by the Selling Securityholders listed below. We cannot assure you that any of the Selling Securityholders will offer

for sale or sell any or all of the shares of Common Stock offered by them by this prospectus.

| | |

Number of Shares Beneficially Owned Prior to Offering (1) | | |

Number of Shares Being | | |

Number of Shares Beneficially Owned After Offering (2) | |

| Securityholders | |

Number | | |

Percent

(%) | | |

Offered | | |

Number | | |

Percent (%) | |

| David Lee (Chief Executive Officer, Acting Chief Financial Officer and Director) | |

| 341,769,285 | (3) | |

| 32.5 | % | |

| 400,000,000 | (3) | |

| 4,769,290 | | |

| * | |

| Spencer Hall (Chief Operating Officer and Director) | |

| 20,833,335 | (4) | |

| 2.8 | % | |

| 50,000,000 | (4) | |

| 0 | | |

| * | |

| (1) |

The

number and percentage of shares beneficially owned is determined in accordance with Rule 13d-3 of the Securities Exchange Act of

1934, as amended, and the information is not necessarily indicative of beneficial ownership for any other purpose. Under such rule,

beneficial ownership includes any shares as to which the Selling Securityholder has sole or shared voting power or investment power

and also any shares which the Selling Securityholder has the right to acquire within 60 days. Applicable percentage ownership is

based on 715,496,051 shares of Common Stock outstanding as of April 12, 2022. |

| |

|

| (2) |

Assumes

that all shares of Common Stock to be offered, as set forth above, are sold pursuant to this offering and that no other shares of

Common Stock are acquired or disposed of by the Selling Securityholders prior to the termination of this offering. Because the Selling

Securityholders may sell all, some or none of their shares of Common Stock or may acquire or dispose of other shares of Common Stock,

no reliable estimate can be made of the aggregate number of shares of Common Stock that will be sold pursuant to this offering or

the number or percentage of shares of Common Stock that each Selling Securityholder will own upon completion of this offering. |

| |

|

| (3) |

Represents

4,769,290 shares of common stock and 336,999,995 shares of common stock underlying options that are fully vested and that will vest

within 60 days of the date of this offering. |

| |

|

| (4) |

Represents

20,833,335 shares of common stock underlying options that are fully vested and that will vest within 60 days of the date of this

offering. |

PLAN

OF DISTRIBUTION

We

are registering the Shares covered by this prospectus to permit the Selling Stockholders to conduct public secondary trading of these

Shares from time to time after the date of this prospectus. We will not receive any of the proceeds of the sale of the Shares offered

by this prospectus. The aggregate proceeds to the Selling Stockholders from the sale of the Shares will be the purchase price of the

Shares less any discounts and commissions. We will not pay any brokers’ or underwriters’ discounts and commissions in connection

with the registration and sale of the Shares covered by this prospectus. The Selling Stockholders reserve the right to accept and, together

with their respective agents, to reject, any proposed purchases of Shares to be made directly or through agents.

The

Shares offered by this prospectus may be sold from time to time to purchasers:

| |

● |

directly

by the Selling Stockholders, or |

| |

● |

through

underwriters, broker-dealers or agents, who may receive compensation in the form of discounts, commissions or agent’s commissions

from the Selling Stockholders or the purchasers of the Shares. |

Any

underwriters, broker-dealers or agents who participate in the sale or distribution of the Shares may be deemed to be “underwriters”

within the meaning of the Securities Act. As a result, any discounts, commissions or concessions received by any such broker-dealer or

agents who are deemed to be underwriters will be deemed to be underwriting discounts and commissions under the Securities Act. Underwriters

are subject to the prospectus delivery requirements of the Securities Act and may be subject to certain statutory liabilities under the

Securities Act and the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We will make copies of this

prospectus available to the Selling Stockholders for the purpose of satisfying the prospectus delivery requirements of the Securities

Act. To our knowledge, there are currently no plans, arrangements or understandings between the Selling Stockholders and any underwriter,

broker-dealer or agent regarding the sale of the Shares by the Selling Stockholders.

The

Shares may be sold in one or more transactions at:

| |

● |

prevailing

market prices at the time of sale; |

| |

● |

prices

related to such prevailing market prices; |

| |

● |

varying

prices determined at the time of sale; or |

These

sales may be effected in one or more transactions:

| |

● |

on

any national securities exchange or quotation service on which the Shares may be listed or quoted at the time of sale; |

| |

● |

in

the over-the-counter market, including OTC Pink; |

| |

● |

in

transactions otherwise than on such exchanges or services or in the over-the-counter market; |

| |

● |

any

other method permitted by applicable law; or |

| |

● |

through

any combination of the foregoing. |

These

transactions may include block transactions or crosses. Crosses are transactions in which the same broker acts as an agent on both sides

of the trade.

At

the time a particular offering of the Shares is made, a prospectus supplement, if required, will be distributed, which will set forth

the name of the Selling Stockholders, the aggregate amount of Shares being offered and the terms of the offering, including, to the extent

required, (1) the name or names of any underwriters, broker-dealers or agents, (2) any discounts, commissions and other terms constituting

compensation from the Selling Stockholders and (3) any discounts, commissions or concessions allowed or reallowed to be paid to broker-dealers.

The

Selling Stockholders will act independently of us in making decisions with respect to the timing, manner, and size of each resale or

other transfer. There can be no assurance that the Selling Stockholders will sell any or all of the Shares under this prospectus. Further,

we cannot assure you that the Selling Stockholders will not transfer, distribute, devise or gift the Shares by other means not described

in this prospectus. In addition, any Shares covered by this prospectus that qualify for sale under Rule 144 of the Securities Act may

be sold under Rule 144 rather than under this prospectus. The Shares may be sold in some states only through registered or licensed brokers

or dealers. In addition, in some states the Shares may not be sold unless they have been registered or qualified for sale or an exemption

from registration or qualification is available and complied with.

The

Selling Stockholders and any other person participating in the sale of the Shares will be subject to the Exchange Act. The Exchange Act

rules include, without limitation, Regulation M, which may limit the timing of purchases and sales of any of the Shares by the Selling

Stockholders and any other person. In addition, Regulation M may restrict the ability of any person engaged in the distribution of the

Shares to engage in market-making activities with respect to the particular Shares being distributed. This may affect the marketability

of the Shares and the ability of any person or entity to engage in market-making activities with respect to the Shares.

The

Selling Stockholders may indemnify any broker or underwriter that participates in transactions involving the sale of the Shares against

certain liabilities, including liabilities arising under the Securities Act.

LEGAL

MATTERS

The

validity of the issuance of the securities offered by this prospectus will be passed upon for us by Sichenzia Ross Ference LLP, New York,

New York.

EXPERTS

The

financial statements of NewHydrogen, Inc. as of December 31, 2021 and 2020, and for the years then ended, included in our Annual Report

on Form 10-K for the year ended December 31, 2021, filed on March 31, 2022, which is incorporated herein by reference, have been audited

by M&K CPAs, PLLC, independent registered public accounting firm, as set forth in their report thereon, which is incorporated herein

by reference given on the authority of such firm as experts in accounting and auditing.

INCORPORATION

OF CERTAIN DOCUMENTS BY REFERENCE

The

following documents filed with the SEC are hereby incorporated by reference in this prospectus:

| |

a) |

Our

Annual Report on Form 10-K for the fiscal year ended December 31, 2021, and filed with the SEC on March 31, 2022; |

| |

b) |

All

other reports filed pursuant to Section 13(a) or 15(d) of the Exchange Act since the end of the fiscal year covered by the Registrant’s

latest annual report referred to in (a) above; |

| |

c) |

The

description of the Registrant’s common stock which is contained in the Registrant’s registration statement on Form 8-A

(File No. 000-54819) filed October 5, 2012, including any amendment or report filed for the purpose of updating such description;

and |

| |

d) |

All

other reports and documents subsequently filed by the Registrant pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange

Act (other than Current Reports furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits furnished on such form that relate

to such items) on or after the date of this Registration Statement and prior to the filing of a post-effective amendment to this

Registration Statement which indicates that all securities offered have been sold or which deregisters all securities then remaining

unsold, shall be deemed to be incorporated by reference herein and to be a part of this Registration Statement from the date of the

filing of such reports and documents. Any statement contained in a document incorporated or deemed to be incorporated by reference

herein shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained

herein or in any subsequently filed document that also is deemed to be incorporated by reference herein modifies or supersedes such

statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a

part of this Registration Statement. |

DISCLOSURE

OF COMMISSION POSITION ON INDEMNIFICATION

FOR

SECURITIES ACT LIABILITIES

Insofar

as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling the

registrant, the registrant has been informed that in the opinion of the Commission such indemnification is against public policy as expressed

in the Securities Act and is therefore unenforceable.

WHERE

YOU CAN FIND MORE INFORMATION

We

file annual, quarterly and other reports, proxy statements and other information with the SEC. Our SEC filings are available to the public

over the Internet at the SEC’s website at http://www.sec.gov. Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and

Current Reports on Form 8-K, including any amendments to those reports, and other information that we file with or furnish to the SEC

pursuant to Section 13(a) or 15(d) of the Exchange Act can also be accessed free of charge by linking directly from our website at thecoretecgroup.com.

These filings will be available as soon as reasonably practicable after we electronically file such material with, or furnish it to,

the SEC. Information contained on our website is not part of this prospectus.

The

Registrant hereby undertakes to provide without charge to each person, including any beneficial owner, to whom a copy of this prospectus

is delivered, upon written or oral request of any such person, a copy of any and all of the information that has been incorporated by

reference in this prospectus but not delivered with the prospectus other than the exhibits to those documents, unless the exhibits are

specifically incorporated by reference into the information that this prospectus incorporates. Requests for documents should be directed

to NewHydrogen, Inc., Attention: Investor Relations, 27936 Lost Canyon Road, Suite 202, Santa Clarita, CA 91387, (661) 251-0001.

NEWHYDROGEN,

INC.

UP

TO 450,000,000 SHARES OF COMMON STOCK

REOFFER

PROSPECTUS

APRIL

12, 2022

Part

II

INFORMATION

REQUIRED IN THE REGISTRATION STATEMENT

Item

3. Incorporation of Documents by Reference.

The

following documents filed by the Registrant with the Securities and Exchange Commission (the “SEC”) are incorporated

by reference into this Registration Statement:

(a)

Our Annual Report on Form 10-K for the fiscal year ended December 31, 2021, and filed with the SEC on March 31, 2022;

(b)

All other reports filed pursuant to Section 13(a) or 15(d) of the Exchange Act since the end of the fiscal year covered by the Registrant’s

latest annual report or prospectus referred to in (a) above;

(c)

The description of the Registrant’s common stock which is contained in the Registrant’s registration statement on Form

8-A (File No. 000-54819), filed by the registrant with the SEC under Section 12(g) of the Exchange Act on October 5, 2012, including

any amendment or report filed for the purpose of updating such description.

(d)

All other reports and documents subsequently filed by the Registrant pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange

Act (other than Current Reports furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits furnished on such form that relate to

such items) on or after the date of this Registration Statement and prior to the filing of a post-effective amendment to this Registration

Statement which indicates that all securities offered have been sold or which deregisters all securities then remaining unsold, shall

be deemed to be incorporated by reference herein and to be a part of this Registration Statement from the date of the filing of such

reports and documents. Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed

to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained herein or in any subsequently

filed document that also is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so

modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

ITEM

4. DESCRIPTION OF SECURITIES

Not

applicable.

ITEM

5. INTERESTS OF NAMES EXPERTS AND COUNSEL

Not

applicable.

ITEM

6. INDEMNIFICATION OF DIRECTORS AND OFFICERS

The

Nevada Revised Statutes (NRS) empower us to indemnify our directors and officers against expenses relating to certain actions, suits

or proceedings as provided for therein. In order for such indemnification to be available, the applicable director or officer must not

have acted in a manner that constituted a breach of his or her fiduciary duties and involved intentional misconduct, fraud or a knowing

violation of law, or must have acted in good faith and reasonably believed that his or her conduct was in, or not opposed to, our best

interests. In the event of a criminal action, the applicable director or officer must not have had reasonable cause to believe his or

her conduct was unlawful.

Under

the Nevada General Corporation Law and our Bylaws, our directors will have no personal liability to us or our stockholders for monetary

damages incurred as the result of the breach or alleged breach by a director of his “duty of care.” This provision does not

apply to the directors’ (i) acts or omissions that involve intentional misconduct or a knowing and culpable violation of law, (ii)

acts or omissions that a director believes to be contrary to the best interests of the corporation or its stockholders or that involve

the absence of good faith on the part of the director, (iii) approval of any transaction from which a director derives an improper personal

benefit, (iv) acts or omissions that show a reckless disregard for the director’s duty to the corporation or its stockholders in

circumstances in which the director was aware, or should have been aware, in the ordinary course of performing a director’s duties,

of a risk of serious injury to the corporation or its stockholders, (v) acts or omissions that constituted an unexcused pattern of inattention

that amounts to an abdication of the director’s duty to the corporation or its stockholders, or (vi) approval of an unlawful dividend,

distribution, stock repurchase or redemption. This provision would generally absolve directors of personal liability for negligence in

the performance of duties, including gross negligence.

The

effect of this provision in our Bylaws is to eliminate the rights of our Company and our stockholders (through stockholder’s derivative

suits on behalf of our Company) to recover monetary damages against a director for breach of his fiduciary duty of care as a director

(including breaches resulting from negligent or grossly negligent behavior) except in the situations described in clauses (i) through

(vi) above. This provision does not limit nor eliminate the rights of our Company or any stockholder to seek non-monetary relief such

as an injunction or rescission in the event of a breach of a director’s duty of care. In addition, our Bylaws provide that if the

Nevada General Corporation Law is amended to authorize the future elimination or limitation of the liability of a director, then the

liability of the directors will be eliminated or limited to the fullest extent permitted by the law, as amended. The Nevada General Corporation

Law grants corporations the right to indemnify their directors, officers, employees and agents in accordance with applicable law.

Disclosure

of Commission Position on Indemnification for Securities Act Liabilities

Insofar

as indemnification for liabilities under the Securities Act may be permitted to officers, directors or persons controlling the Company

pursuant to the foregoing provisions, the Company has been informed that is it is the opinion of the SEC that such indemnification is

against public policy as expressed in such Securities Act and is, therefore, unenforceable.

ITEM

7. EXEMPTION FROM REGISTRATION CLAIMED

Not

applicable.

ITEM

8. EXHIBITS

ITEM

9. UNDERTAKINGS

| 1. |

The

undersigned Registrant hereby undertakes: |

| |

(a) |

To

file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement: |

| |

(i) |

To

include any prospectus required by Section 10(a)(3) of the Securities Act; |

| |

(ii) |

To

reflect in the prospectus any facts or events arising after the effective date of the Registration Statement (or the most recent

post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set

forth in the Registration Statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if

the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end

of the estimated maximum offering range may be reflected in the form of prospectus filed with the Securities and Exchange Commission

pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum

aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective Registration Statement. |

| |

(iii) |

To

include any material information with respect to the plan of distribution not previously disclosed in the Registration Statement

or any material change to such information in the Registration Statement; |

Provided,

however, that paragraphs (a)(i) and (a)(ii) do not apply if the information required to be included in a post-effective amendment

by those paragraphs is contained in reports filed with or furnished to the Securities and Exchange Commission by the Registrant pursuant

to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in the Registration Statement.

| |

(b) |

That,

for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a

new Registration Statement relating to the securities offered herein, and the offering of such securities at that time shall be deemed

to be the initial bona fide offering thereof. |

| |

(c) |

To

remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the

termination of the offering. |

| 2. |

The

undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of

the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each

filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference

in the Registration Statement shall be deemed to be a new Registration Statement relating to the securities offered herein, and the

offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. |

| 3. |

Insofar

as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons

of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the

Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore,

unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of

expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action,

suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered,

the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court

of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities

Act and will be governed by the final adjudication of such issue. |

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, as amended, the Registrant certifies that it has reasonable grounds to believe that

it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by

the undersigned, thereunto duly authorized, in Santa Clarita, CA, on this 12th day of April, 2022.

| |

NEWHYDROGEN,

INC. |

| |

|

| |

By: |

/s/

David Lee |

| |

|

David

Lee |

| |

|

Chief

Executive Officer |

POWER

OF ATTORNEY

KNOW

ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints David Lee, as his or her true

and lawful attorneys-in-fact and agents, with full power of substitution and resubstitution, for him or her and in their name, place

and stead, in any and all capacities, to sign any and all amendments (including post-effective amendments) to this Registration Statement,

and to file the same, with all exhibits thereto and other documents in connection therewith, with the Securities and Exchange Commission,

granting unto said attorneys-in-fact and agents, and each of them, full power and authority to do and perform each and every act and

thing requisite and necessary to be done in connection therewith, as fully to all intents and purposes as he or she might or could do

in person, hereby ratifying and confirming all that said attorneys-in-fact and agents or any of them, or his or her substitute or substitutes,

may lawfully do or cause to be done by virtue hereof.

Pursuant

to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities

and on the dates indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/

David Lee |

|

Chief

Executive Officer (Principal Executive Officer), |

|

April

12, 2022 |

| David

Lee |

|

Acting

Chief Financial Officer (Principal Accounting and Financial Officer) and Chairman of the Board of Directors |

|

|

| |

|

|

|

|

| /s/

Spencer Hall |

|

Chief

Operating Officer |

|

April

12, 2022 |

| Spencer

Hall |

|

and

Director |

|

|

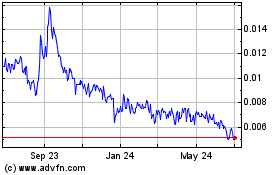

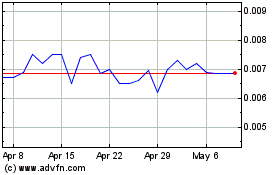

NewHydrogen (PK) (USOTC:NEWH)

Historical Stock Chart

From Mar 2024 to Apr 2024

NewHydrogen (PK) (USOTC:NEWH)

Historical Stock Chart

From Apr 2023 to Apr 2024