Glencore Profits Soar Amid Commodities Rally -- Commodity Comment

August 05 2021 - 3:15AM

Dow Jones News

By Jaime Llinares Taboada

Glencore PLC on Thursday reported record high earnings for the

first half of the year. Here's what the natural resources mining

and trading company had to say:

On market conditions:

"Following Covid-19's severe global impacts in early 2020, the

subsequent economic recovery has seen prices of most of our

commodities surging to multi-year highs amid accelerating demand

and lingering supply constraints."

"Fiscal and monetary stimulus, successful vaccine roll-outs and

increasing momentum in relation to decarbonisation of energy

systems should continue to underpin sector sentiment going

forward."

On the marketing business:

"Our marketing business excelled in this environment, recording

Adjusted EBIT of $1.8 billion."

"In contrast to the outsized oil earnings that dominated last

year's record first-half results, strong trading performances were

delivered by all key commodity teams during this year."

On the industrial business:

"In the Industrial business, Adjusted EBITDA of $6.6 billion was

up 152%, benefiting from strong metals prices and expanded mining

margins."

"While our coal business was impacted by relatively weak pricing

and lower volumes earlier in the year, we anticipate a

significantly improved finish to 2021, buoyed by the strong

recovery in both thermal and coking coal prices from Q2."

Write to Jaime Llinares Taboada at jaime.llinares@wsj.com;

@JaimeLlinaresT

(END) Dow Jones Newswires

August 05, 2021 03:04 ET (07:04 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

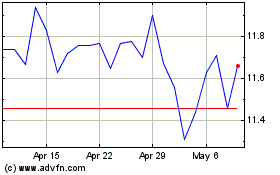

Glencore (PK) (USOTC:GLNCY)

Historical Stock Chart

From Jul 2024 to Aug 2024

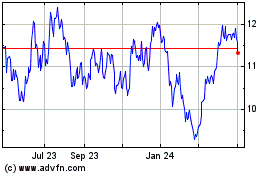

Glencore (PK) (USOTC:GLNCY)

Historical Stock Chart

From Aug 2023 to Aug 2024