Abacus Provides Update on Feasibility Study Progress

October 20 2011 - 8:00AM

Marketwired Canada

Abacus Mining & Exploration Corporation (TSX VENTURE:AME) ("Abacus") is pleased

to provide an update on the progress of the Feasibility Study (the "FS") on its

jointly owned Ajax copper-gold project.

The majority of the project inputs have now been received from a team of widely

recognized consultants led by Wardrop Engineering as the project's general QP.

Comprehensive trade-off studies have been incorporated to maximize operations

over the life of mine and enhance project value, over the original Preliminary

Economic Assessment (PEA) of June 22, 2009. These studies include the use of

high pressure grinding rolls vs SAG mill technology for reduced costs and

improved recoveries, in-pit crushing and conveying of both ore and waste vs

truck and shovel operations, and high density tailings deposition vs

conventional tailings storage to improve location logistics and reduce the

environmental footprint. A new reserve and resource estimate will also be

reported following the extensive delineation and infill diamond drilling

programs undertaken by Abacus since the PEA to further define and upgrade

resources. The results of the studies are being incorporated into the FS which

is anticipated in the fourth quarter of 2011.

Once the FS is delivered to joint venture partner KGHM Polska Miedz SA, KGHM

will have a maximum of 90 days from the date of delivery of the FS to acquire a

further 29% in the joint venture company for a cash consideration equal to 29%

of the Proven and Probable copper equivalent reserve in the FS, to a maximum of

US$35 million. Thereafter, KGHM will arrange the financing for its (80%)

proportionate interest in the project capex, and Abacus has the option to

arrange its own financing for its (20%) proportionate interest or elect to have

KGHM do so on commercially reasonable terms.

In the event that KGHM chooses not to increase its interest in the Joint

Venture, Abacus has the right to purchase KGHM's 51% interest within a period of

90 days following the above timeframe for a total consideration of US$37

million. Should KGHM choose not to increase its interest and Abacus does not

purchase KGHM's interest in its entirety, Abacus' interest in the Joint Venture

can be increased to 51% for a consideration of approximately US$1.5 million

payable to KGHM.

On Behalf of the Board,

ABACUS MINING AND EXPLORATION CORPORATION

James D. Excell, President & CEO

Donna Yoshimatsu, Director, Investor Relations

About Abacus

Abacus Mining is an exploration and mine development company focused on the

development of the Ajax copper-gold project located near Kamloops, B.C. through

the KGHM Ajax Joint Venture with KGHM Polska Miedz SA. The project has a

positive preliminary economic assessment report (June 22, 2009) that

contemplates a 60,000 tonne per day operation producing an average of

approximately 110 million pounds of copper (approx. 50,000 tonnes) and 100,000

ounces of gold in concentrate annually. A Feasibility Study is anticipated in

the fourth quarter of 2011. The environmental review and permitting process was

initiated in January of this year with the submission of the Project

Description, a copy of which is available on the Company's website and

www.eao.gov.bc.ca.

Forward-Looking Information

This release includes certain statements that may be deemed "forward-looking

statements". All statements in this release, other than statements of historical

facts, that address events or developments that Abacus Mining and Exploration

Corp. (the "Company") expects to occur, are forward-looking statements.

Forward-looking statements are statements that are not historical facts and are

generally, but not always, identified by the words "expects", "plans",

"anticipates", "believes", "intends", "estimates", "projects", "potential" and

similar expressions, or that events or conditions "will", "would", "may",

"could" or "should" occur. Although the Company believes the expectations

expressed in such forward-looking statements are based on reasonable

assumptions, such statements are not guarantees of future performance and actual

results may differ materially from those in the forward-looking statements.

Factors that could cause the actual results to differ materially from those in

forward-looking statements include market prices, exploitation and exploration

successes, and continued availability of capital and financing, and general

economic, market or business conditions. Investors are cautioned that any such

statements are not guarantees of future performance and actual results or

developments may differ materially from those projected in the forward-looking

statements. Forward-looking statements are based on the beliefs, estimates and

opinions of the Company's management on the date the statements are made. Except

as required by applicable securities laws, the Company undertakes no obligation

to update these forward-looking statements in the event that management's

beliefs, estimates or opinions, or other factors, should change.

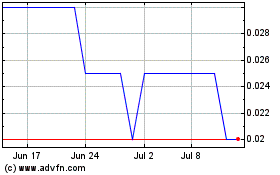

Abacus Mining and Explor... (TSXV:AME)

Historical Stock Chart

From May 2024 to Jun 2024

Abacus Mining and Explor... (TSXV:AME)

Historical Stock Chart

From Jun 2023 to Jun 2024