Abacus Completes Asset Purchase Agreement with Teck

April 08 2011 - 9:00PM

Marketwired Canada

Abacus Mining & Exploration Corporation (TSX VENTURE:AME) ("Abacus") is pleased

to announce that it has completed the acquisitions contemplated under the Asset

Purchase Agreement dated November 25, 2005, as amended (the "APA") with Teck

Resources Limited ("Teck") pursuant to which certain assets of Teck's former

Afton mine, and most notably the Iron Mask and Rainbow back-in rights, were

acquired.

The APA provided for the sale by Teck to Abacus of the Iron Mask and Rainbow

back-in rights that Teck held to certain Afton-Ajax mineral claims, as well as

the tailings pond, mill, workshop and office buildings of the former Afton mine

and the land upon which such buildings are situated. Such assets were valued at

$29,250,000, which was payable by cash payments totaling $10,750,000 (previously

paid) and the issuance of 18,500,000 common shares (previously issued). The

closing of this transaction provided for the issuance to Teck of an additional

20,751,176 common shares in Abacus to satisfy the last of the share payments

owing under the APA.

As a result of this transaction, Teck now owns 39,251,176 shares of the

Corporation representing 19.9% of the issued and outstanding shares of Abacus.

Pursuant to the provisions of the previously announced Joint Venture

Shareholders' Agreement dated October 12, 2010, these assets have been

transferred to the joint venture company, KGHM Ajax Mining Inc. ("KGHM Ajax"),

49% of which is owned by Abacus and 51% of which is owned by Abacus' joint

venture partner, KGHM Polska Miedz S.A. ("KGHM"). A remaining final cash payment

to Teck of $5 million required under the APA is to be made on or before October

8, 2012. The payment will be assumed by KGHM Ajax, provided that KGHM exercises

its option to increase its ownership position in KGHM Ajax to 80%, which Abacus

expects to occur later this year. KGHM currently owns 15,000,000 shares of

Abacus, representing 7.6% of the total shares issued and outstanding.

Jim Excell, President & CEO of Abacus, commented on the transaction, "Concluding

the APA with Teck brings to a close a chapter that has long been outstanding.

Abacus effectively has two major shareholders and industry leaders in Teck and

KGHM, and a clean slate to build significant value and cashflow growth under a

world class mining team with the Ajax project as its cornerstone."

Work continues to progress on the Feasibility Study of the Ajax Mine expected to

be finalized in the fall of this year with environmental permitting now

underway.

About Abacus

Abacus is an exploration and mine development company focused on the development

of the Ajax copper-gold project located 10 km southwest of Kamloops, B.C. With

major copper producer and joint venture partner, KGHM Polska Miedz S.A., Abacus,

as operator, is currently completing the feasibility study on the Ajax project,

which is expected to be completed in the fall of 2011. The study follows from

the previously released Preliminary Economic Assessment (the "PEA") of June 22,

2009 by Wardrop Engineering Inc., which contemplates annual production of 110

million pounds of copper and 100,000 ounces of gold in concentrate at a

processing rate of 60,000 tonnes per day. The PEA indicates a NPV of US$1,147

Mil (discounted at 8%) on a 23-year mine life based on 3-year average prices of

US$2.99/lb Cu and US$773/oz Au; and a base case NPV of US$193 Mil using

US$2.00/lb Cu and US$700/oz Au. Please refer to the Company's website for

further information at www.amemining.com.

On Behalf of the Board,

ABACUS MINING AND EXPLORATION CORPORATION

James D. Excell, President & CEO

Donna Yoshimatsu, Director, Investor Relations

Forward-Looking Information

This release includes certain statements that may be deemed "forward-looking

statements". All statements in this release, other than statements of historical

facts, that address events or developments that Abacus Mining & Exploration

Corporation (the "Company") expects to occur, are forward-looking statements.

Forward-looking statements are statements that are not historical facts and are

generally, but not always, identified by the words "expects", "plans",

"anticipates", "believes", "intends", "estimates", "projects", "potential" and

similar expressions, or that events or conditions "will", "would", "may",

"could" or "should" occur. Forward looking statements in this news release

include, but are not limited to, Abacus' expectation that KGHM will exercise its

option to increase its ownership of KGHM Ajax to 80% later this year, and that a

Feasibility Study of the proposed Ajax Mine will be completed in the fall of

2011. Although the Company believes the expectations expressed in such

forward-looking statements are based on reasonable assumptions, such statements

are not guarantees of future performance and actual results may differ

materially from those in the forward-looking statements. Factors that could

cause the actual results to differ materially from those in forward-looking

statements include market prices, exploitation and exploration successes, and

continued availability of capital and financing, and general economic, market or

business conditions. Investors are cautioned that any such statements are not

guarantees of future performance and actual results or developments may differ

materially from those projected in the forward-looking statements.

Forward-looking statements are based on the beliefs, estimates and opinions of

the Company's management on the date the statements are made. Except as required

by applicable securities laws, the Company undertakes no obligation to update

these forward-looking statements in the event that management's beliefs,

estimates or opinions, or other factors, should change.

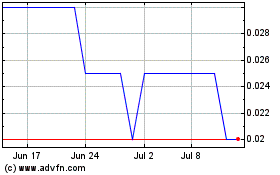

Abacus Mining and Explor... (TSXV:AME)

Historical Stock Chart

From May 2024 to Jun 2024

Abacus Mining and Explor... (TSXV:AME)

Historical Stock Chart

From Jun 2023 to Jun 2024