(all amounts are expressed in millions of U.S.

dollars, excluding per share amounts and unless otherwise

stated)

Real Matters Inc. (TSX: REAL) (“Real Matters” or the “Company”),

a leading network management services platform for the mortgage and

insurance industries, today announced its financial results for the

first quarter ended December 31, 2020.

“We reported solid first quarter results driven by strong

year-over-year growth in our U.S. Title segment. Consolidated Net

Revenue(A) increased 24.8% to $44.0 million and consolidated

Adjusted EBITDA(A) increased 19.7% to $17.4 million,” said Real

Matters Chief Executive Officer Brian Lang. “The U.S. mortgage

market remained strong in the first quarter due to sustained

strength in refinance volumes. We estimate that refinance market

volume was up 60%; by comparison, our centralized title revenues

increased 93%. Our U.S. Appraisal origination revenues increased

over 9% compared with an estimated flat addressable mortgage

origination market volumes. Our Canadian segment posted strong

results in the first quarter, principally as a result of market

share gains and stronger market volumes. Canadian revenues were up

40.7%, while Net Revenue(A) and Adjusted EBITDA(A) increased 25.1%

and 67.8%, respectively. We were active in our normal course issuer

bid in the first quarter this year, purchasing 1.2 million shares

at a cost of $18.9 million.”

Q1 2021 Key Performance Indicators

(year-over-year)

U.S. Appraisal

U.S. Title

Consolidated

Revenues

$69.6 million

$39.9 million

$120.3 million

Revenue Growth

3.2%

39.0%

15.9%

Net Revenue(A) Growth

1.4%

44.4%

24.8%

Adjusted EBITDA(A) Margin

56.3%

43.5%

39.6%

Q1 2021 Highlights

- Launched one new Tier 2 lender in two channels in U.S.

Appraisal

- Launched two new lenders in U.S. Title (including one Tier 2

lender)

- Purchased 1.2 million shares under our normal course issuer bid

at a cost of $18.9 million

Financial and Operational Summary

(millions of dollars)

Three months ended December

31

2020

Margin

2019

Margin

$ Change

% Change

Revenues

U.S. Appraisal

$

69.6

$

67.4

$

2.2

3.2%

U.S. Title

39.9

28.7

11.2

39.0%

Canada

10.8

7.7

3.1

40.7%

Consolidated revenues

$

120.3

$

103.8

$

16.5

15.9%

Net Revenue(A)

U.S. Appraisal

$

15.7

22.6%

$

15.5

23.0%

$

0.2

1.4%

U.S. Title

26.6

66.8%

18.5

64.3%

8.1

44.4%

Canada

1.7

15.3%

1.3

17.2%

0.4

25.1%

Consolidated Net Revenue(A)

$

44.0

36.6%

$

35.3

34.0%

$

8.7

24.8%

Adjusted EBITDA(A)

U.S. Appraisal

$

8.8

56.3%

$

8.8

57.2%

$

-

-0.2%

U.S. Title

11.6

43.5%

8.4

45.7%

3.2

37.5%

Canada

1.2

73.7%

0.7

55.0%

0.5

67.8%

Corporate

(4.2)

(3.4)

(0.8)

-22.4%

Consolidated Adjusted EBITDA(A)

$

17.4

39.6%

$

14.5

41.2%

$

2.9

19.7%

Net income

Net income

$

7.1

$

5.1

$

2.0

Net income per diluted share

$

0.08

$

0.06

$

0.02

Adjusted Net Income(A)

Adjusted Net Income(A)

$

12.0

$

9.2

$

2.8

Adjusted Net Income(A) per diluted

share

$

0.14

$

0.10

$

0.04

Conference Call and Webcast

A conference call to review the results will take place at 10:00

a.m. (ET) on Thursday, January 28, 2021, hosted by Chief Executive

Officer Brian Lang and Chief Financial Officer Bill Herman. An

accompanying slide presentation will be posted to the Investors

section of our website shortly before the call.

To access the call:

- Participant Toll Free Dial-In Number: (833) 968-2239

- Participant International Dial-In Number: (825) 312-2065

- Conference ID: 2239576

To listen to the live webcast of the call:

- Go to:

https://event.on24.com/wcc/r/2927942/B990CDAB1E056B71D8FE61B4D4BF1CA4

The webcast will be archived and a transcript of the call will

be available in the Investors section of our website following the

call.

(A) Non-GAAP Measures The non-GAAP measures used in this

Press Release, including Net Revenue, Adjusted EBITDA and Adjusted

Net Income do not have a standardized meaning prescribed by

International Financial Reporting Standards and are therefore

unlikely to be comparable to similar measures presented by other

issuers. These non-GAAP measures are more fully defined and

discussed in the Company’s MD&A for the three months ended

December 31, 2020 available on SEDAR at www.sedar.com.

Real Matters financial results for the three months ended

December 31, 2020 are included in the unaudited condensed

consolidated financial statements and the accompanying MD&A,

each of which are available on SEDAR at www.sedar.com. In addition, supplemental

information is available on our website at www.realmatters.com.

Forward-Looking Information

This Press Release contains “forward-looking information” within

the meaning of applicable Canadian securities laws. Words such as

“could”, “forecast”, “target”, “may”, “will”, “would”, “expect”,

“anticipate”, “estimate”, “intend”, “plan”, “seek”, “believe”,

“likely” and “predict” and variations of such words and similar

expressions are intended to identify such forward-looking

information, although not all forward-looking information contains

these identifying words.

The forward-looking information in this Press Release includes

statements which reflect the current expectations of management

with respect to our business and the industry in which we operate

and is based on management’s experience and perception of

historical trends, current conditions and expected future

developments, as well as other factors that management believes

appropriate and reasonable in the circumstances. The

forward-looking information reflects management’s beliefs based on

information currently available to management, including

information obtained from third party sources, and should not be

read as a guarantee of the occurrence or timing of any future

events, performance or results.

The forward-looking information in this Press Release is subject

to risks, uncertainties and other factors that are difficult to

predict and that could cause actual results to differ materially

from historical results or results anticipated by the

forward-looking information. A comprehensive discussion of the

factors which could cause results or events to differ from current

expectations can be found in the “Risk Factors” section of our

Annual Information Form for the year ended September 30, 2020 and

under the heading “Important Factors Affecting our Results from

Operations”, which is available on SEDAR at www.sedar.com.

Readers are cautioned not to place undue reliance on the

forward-looking information, which reflect our expectations only as

of the date of this Press Release. Except as required by law, we do

not undertake to update or revise any forward-looking information,

whether as a result of new information, future events or

otherwise.

About Real Matters

Real Matters is a leading network management services provider

for the mortgage lending and insurance industries. Real Matters’

platform combines its proprietary technology and network management

capabilities with tens of thousands of independent qualified field

professionals to create an efficient marketplace for the provision

of mortgage lending and insurance industry services. Our clients

include the majority of the top 100 mortgage lenders in the U.S.

and some of the largest insurance companies in North America. We

are a leading independent provider of residential real estate

appraisals to the mortgage market and a leading independent

provider of title and mortgage closing services in the U.S.

Established in 2004, Real Matters’ principal offices include

Buffalo (NY), Denver (CO), Middletown (RI), and Markham (ON). Real

Matters is listed on the Toronto Stock Exchange under the symbol

REAL. For more information, visit www.realmatters.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210128005246/en/

For more information: Lyne Beauregard Vice President,

Investor Relations and Marketing Real Matters

lbeauregard@realmatters.com 416.994.5930

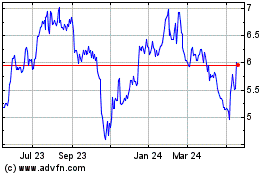

Real Matters (TSX:REAL)

Historical Stock Chart

From Jun 2024 to Jul 2024

Real Matters (TSX:REAL)

Historical Stock Chart

From Jul 2023 to Jul 2024