Real Matters Inc. (“Real Matters” or the “Company”) (TSX: REAL),

today shared the latest mortgage market data and provided an update

on its operations.

Today, the Mortgage Bankers Association (“MBA”) announced that

mortgage applications were up 0.1% week-over-week, and up 70.0%

year-over-year. Purchase applications were up 3.2% week-over-week

and down 31.1% year-over-year. Refinance applications were down

0.8% week-over-week and up 225.3% year-over-year.

Real Matters continues to receive strong U.S. Appraisal and U.S.

Title volume, higher than any week in 2019.

Long-Term and Near-Term Market Opportunity

We estimate that at least 14.5 million mortgage holders are

incentivized to refinance with 30-year mortgage rates at 3.0% to

3.25%, and that it would take approximately two to three years to

cycle through this volume. This estimate assumes that the U.S.

mortgage industry has purchase and refinance underwriting capacity

of approximately 2.0 to 2.5 million mortgages per quarter (based on

pre COVID-19 levels), and that this capacity can increase by 20%

annually starting in 2021. The 14.5 million estimate is based on

30-year mortgage holders who are current on their loans, who have

credit scores of 720 or higher, hold at least 20% equity in their

homes and who could reduce their current interest rate by at least

0.75% via a refinance. The two to three year time frame for cycling

through the refinance market opportunity also accounts for the

lender underwriting capacity that will be required to service a

return to more normalized purchase mortgage activity in 2021.

Over the next two quarters, we believe that even with

potentially higher unemployment, increased forbearance rates,

constraints on non-conforming mortgage product availability and

reduced property values, higher demand from eligible refinance

candidates will continue to fill lender underwriting capacity. We

believe that the ability of lenders to increase their underwriting

capacity during COVID-19 remains the single biggest hurdle to

industry growth.

Highly Engaged Field Professional Network

Real Matters’ field professional networks continue to be highly

engaged – delivering interior appraisals and closing mortgages

across the United States while following social distancing

principles.

“While we are taking additional precautions by wearing personal

protective equipment, limiting surface contact by asking that all

doors be opened and lights turned on prior to the inspection

appointment, the reality is that appraisers don’t need to come into

contact with homeowners,” said New York City-based licensed

appraiser, David Roberts. “This crisis has demonstrated how

critical the role of the appraiser is in performing full interior

inspections to determine the value of a property – as most lenders

are still requiring them. It’s also emphasizing the importance of

having a local market expert to analyze market conditions which is

key to developing an accurate opinion of value.”

“Our job is about helping people navigate through one of the

most impactful financial transactions of their lives,” said

Charlotte, N.C.-based notary signing agent, Alexis Little. “Even

under normal circumstances, this can be a very stressful life

event. In today’s environment, we’re helping families find some

stability during turbulent times. While we may be interacting with

borrowers in new ways to ensure we’re keeping everyone healthy and

safe, from porches to driveways, we are playing a crucial role when

people need us most.”

Safe Space Appraisals and Closings

Several weeks ago, Real Matters launched Safe Space Appraisals

and Safe Space Closings to support the field professionals on our

network and to align with guidance provided by world health

organizations as well as state and local authorities.

Safe Space Appraisals take extra precautions during interior

inspections and use social distancing principles for the safety of

all. These precautions include the use of personal protective

equipment, limiting surface contact, physical distancing and

eliminating face-to-face interactions.

Safe Space Closings are the same as mobile signings, except they

use social distancing principles for the safety of all. These

principles include employing physical distancing and taking extra

precautions for document handling, document verification and visual

confirmation.

About Real Matters

Real Matters is a leading network management services provider

for the mortgage lending and insurance industries. Real Matters’

platform combines its proprietary technology and network management

capabilities with tens of thousands of independent qualified field

professionals to create an efficient marketplace for the provision

of mortgage lending and insurance industry services. Our clients

include the majority of the top 100 mortgage lenders in the U.S.

and some of the largest insurance companies in North America. We

are a leading independent provider of residential real estate

appraisals to the mortgage market and a leading independent

provider of title and mortgage closing services in the U.S.

Established in 2004, Real Matters has offices in Buffalo (NY),

Denver (CO), Middletown (RI), and Markham (ON). Real Matters is

listed on the Toronto Stock Exchange under the symbol REAL. For

more information, visit www.realmatters.com.

FORWARD-LOOKING INFORMATION

This press release contains “forward-looking information” within

the meaning of applicable Canadian securities laws. Words such as

“could”, “forecast”, “target”, “may”, “will”, “would”, “expect”,

“anticipate”, “estimate”, “intend”, “plan”, “seek”, “believe”,

“likely” and “predict” and variations of such words and similar

expressions are intended to identify such forward-looking

information, although not all forward-looking information contains

these identifying words.

The forward-looking information in this press release includes

statements which reflect the current expectations of management

with respect to our business and the industry in which we operate

and is based on management’s experience and perception of

historical trends, current conditions and expected future

developments, as well as other factors that management believes

appropriate and reasonable in the circumstances. The

forward-looking information reflects management’s beliefs based on

information currently available to management, including

information obtained from third party sources, and should not be

read as a guarantee of the occurrence or timing of any future

events, performance or results.

The forward-looking information in this press release is subject

to risks, uncertainties and other factors that are difficult to

predict and that could cause actual results to differ materially

from historical results or results anticipated by the

forward-looking information. A comprehensive discussion of the

factors which could cause results or events to differ from current

expectations can be found in the “Risk Factors” section of our

Annual Information Form for the year ended September 30, 2019,

which is available on SEDAR at www.sedar.com.

Readers are cautioned not to place undue reliance on the

forward-looking information, which reflect our expectations only as

of the date of this press release. Except as required by law, we do

not undertake to update or revise any forward-looking information,

whether as a result of new information, future events or

otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200422005665/en/

Lyne Beauregard Fisher Vice President, Investor Relations and

Marketing Real Matters lfisher@realmatters.com 416.994.5930

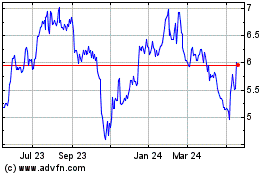

Real Matters (TSX:REAL)

Historical Stock Chart

From Jun 2024 to Jul 2024

Real Matters (TSX:REAL)

Historical Stock Chart

From Jul 2023 to Jul 2024