Gran Tierra Energy Inc.

(“Gran Tierra” or

the “Company”) (NYSE American:GTE)(TSX:GTE)(LSE:GTE) today

announced the Company’s financial and operating results for the

quarter ended March 31, 2024 (“

the

Quarter”). All dollar amounts are in United States

dollars, and production amounts are on an average working interest

(“

WI”) before royalties basis unless otherwise

indicated. Per barrel (“

bbl”) and bbl per day

(“

BOPD”) amounts are based on WI sales before

royalties. For per bbl amounts based on net after royalty

(“

NAR”) production, see Gran Tierra’s Quarterly

Report on Form 10-Q filed May 1, 2024.

Message to Shareholders

Gary Guidry, President and Chief Executive

Officer of Gran Tierra, commented: “During the Quarter we made

significant progress in our development drilling programs. We are

very pleased about the successful drilling program in Costayaco

that confirmed the Company’s reservoir interpretation and extended

the field both to the north and the south. In a field that was

originally discovered in 2007, our 2024 program increased

production to the highest level since 2017, helping to ensure the

Company is well on track to meet its previously announced guidance

for 2024.

In addition, we are having excellent results in

our core assets under waterflood, the balance sheet is strong, and

we are very excited about the initial drilling and open-hole

logging results of the Arawana exploration well in the Chanangue

block in Ecuador. The analog for the Arawana exploration well is

the Company’s Cohembi field 20 kilometers to the north. Arawana is

drilling 1.5 km across a fault from the recent Bocachico-1 well.

Bocachico-1 had initial 90-day production rates in the Basal Tena

(N-Sand geologic equivalent to Cohembi) of greater than 1,100 BOPD

and continues to produce at approximately 850 BOPD, 20 degree API

oil, has less than 1 percent water cut and has recovered over

330,000 barrels since drilled.

Our mapped area of closure, and the rock

properties observed in the Arawana-1 well compares to the Cohembi

field. As of the end of 2023, the Cohembi field has produced 28

million barrels of oil equivalent (“MMBOE”) and has remaining

reserves of 25 MMBOE proved, 54 MMBOE proved plus probable and 95

MMBOE proved plus probable plus possible.

We are very excited to get this well cased and

start testing Arawana-1 in May.”

Key Highlights of the

Quarter:

-

Production: Gran Tierra’s total average WI

production was 32,242 BOPD, an increase of 3% compared to the

fourth quarter 2023 (“the Prior Quarter”) and up

2% from the first quarter 2023. During the Quarter we had deferred

production of approximately 1,000 BOPD as a result of social

disruptions in the Acordionero field. Post disruption the field is

back to expected production levels of over 17,000 BOPD.

- Net Income: Gran

Tierra incurred a net loss of $0.1 million, compared to net income

of $8 million in the Prior Quarter and a net loss of $10 million in

the first quarter of 2023.

- Adjusted

EBITDA(2): Adjusted EBITDA(2) was $95

million compared to $93 million in the Prior Quarter and $90

million in the first quarter of 2023. Twelve month trailing Net

Debt(2) to Adjusted EBITDA(2) was 1.3 times and is expected to be

less than 1.0x by year end 2024.

- Funds

Flow from Operations(2):

Funds flow from operations(2) was $74 million ($2.34 basic per

share), down 12% from the Prior Quarter and up 24% from the first

quarter of 2023.

- Free

Cash Flow(2): During the

Quarter, the Company generated free cash flow of approximately $19

million.

- Cash and

Debt: As of March 31, 2024, the Company had a cash

balance of $127 million, total debt(2) of $637 million and net

debt(2) of $510 million. During the Quarter, the Company issued an

additional $100 million of 9.50% Senior Notes due October 2029, and

received cash proceeds of $88 million.

- Credit

Facility: During the Quarter, Gran Tierra fully re-paid

the outstanding balance on Company’s credit facility of $36 million

and the facility was terminated.

- Share

Buybacks: Gran Tierra purchased approximately 0.9 million

shares during the Quarter. Since January 1, 2023 the Company has

repurchased approximately 3.3 million shares, or 10% of shares

issued and outstanding at January 1, 2023, from free cash

flow.

- Return

on Average Capital

Employed(2): Achieved

return on average capital employed(2) of 14% during the Quarter and

16% over the trailing twelve months.

Additional Key Financial

Metrics:

- Capital

Expenditures: Capital expenditures of $55 million were

higher than the $39 million in the Prior Quarter due to higher

drilling activity during the Quarter and down from $71 million

compared to the first quarter of 2023 due to cost optimization of

the 2024 drilling program. During the Quarter, Gran Tierra

completed its development program in Acordionero and the majority

of the program in Costayaco.

- Oil

Sales: Gran Tierra generated oil sales of $158 million, up

2% from the Prior Quarter and 9% from the first quarter of 2023.

Oil sales increased compared to the Prior Quarter primarily due to

a 5% increase in sales volumes resulting from the sale of inventory

in Ecuador and a decrease in the Castilla differential, offset by

higher Vasconia and Oriente differentials. Compared to the first

quarter of 2023, oil sales increased due to lower Castilla,

Vasconia and Oriente differentials.

- Quality

and Transportation Discounts: The Company’s quality and

transportation discounts per bbl were consistent during the Quarter

at $15.36, compared to $15.34 in the Prior Quarter and down from

$18.45 in the first quarter of 2023. The Castilla oil differential

per bbl narrowed to $8.82 from $9.68 in the Prior Quarter and from

$15.17 in the first quarter of 2023 (Castilla is the benchmark for

the Company’s Middle Magdalena Valley Basin oil production). The

Vasconia differential per bbl widened to $5.05 from $4.58 in the

Prior Quarter, and narrowed from $7.87 in the first quarter of

2023. Finally, the Ecuadorian benchmark, Oriente, per bbl was

$8.02, up from $7.07 in the Prior Quarter, and down from $13.43 one

year ago. The current(1) Castilla differential is approximately

$7.60 per bbl, the Vasconia differential is approximately $3.70 per

bbl and the Oriente differential is approximately $7.60 per

bbl.

-

Operating Expenses: Gran Tierra’s operating

expenses increased by 2% to $48 million, compared to the Prior

Quarter primarily due to higher workovers offset by lower lifting

costs primarily related to power generation optimizations in

Costayaco, Acordionero and Cohembi fields. Compared to the first

quarter of 2023, operating expenses increased by 12% on a per bbl

basis due to higher workovers and lifting costs associated with

preventative maintenance activities, which were partially offset by

lower environmental and equipment rental expenses.

-

Transportation Expenses: The Company’s

transportation expenses increased by 16% to $4.6 million, compared

to the Prior Quarter of $3.9 million and increased by 50% or $3.1

million when compared to the first quarter of 2023. During the

Quarter, Gran Tierra utilized longer distance delivery points due

to low river levels in Colombia caused by El Niño preventing,

resulting in higher transportation costs.

-

Operating

Netback(2)(3): The

Company’s operating netback(2)(3) was $35.37 per bbl, a decrease of

2% from the Prior Quarter and up 1% from the first quarter of

2023.

- General

and Administrative (“G&A”) Expenses: G&A expenses

before stock-based compensation were $3.22 per bbl, down from $3.86

per bbl in the Prior Quarter due to lower legal expenses and lower

headcount and down from $3.95 per barrel, when compared to the

first quarter of 2023 due to lower legal fees and information

technology expenses.

- Cash

Netback(2): Cash netback(2) per bbl was

$25.13, compared to $29.53 in the Prior Quarter primarily as a

result of current tax expenses of $1.33 per bbl compared to a

recovery of $2.80 per bbl in the Prior Quarter. Compared to one

year ago, cash netback per bbl increased by $3.97 to $25.13 per bbl

as a result of lower current taxes in the Quarter.

Development Campaign:

- Costayaco

- Since December

2023, Gran Tierra has drilled seven wells of which six are oil

producers and one is a water injector.

- The aggregate

IP30 rates from the four wells drilled in the north was 5,707 BOPD,

unstimulated and on a jet pump. Starting in May 2024, the recently

drilled wells will undergo stimulation and installation of

optimized artificial lift systems such as Electric Submersible

Pumps. This will allow for higher total fluid rates, allowing the

wells to produce at full potential for the remainder of the

year.

- Acordionero

- An eleven well

development drilling program was started in December 2023. All

eleven wells have been drilled to date including nine producers and

two water injection wells. All wells are on production and

injection. The results from the campaign are consistent with budget

while continuing to add material free cash flow for the

Company.

- Upon completion

of the program the drilling rig was mobilized and transported to

Ecuador to begin the exploration campaign.

Gran Tierra’s Commitment to Go “Beyond

Compliance” in Environmental, Social and Governance

-

Safety:

- 2023 was the

safest year in Company history, with over 19 million work hours

without any incidents causing lost time since June 9, 2022.

-

Environment:

- Through all of

Gran Tierra’s reforestation efforts, the Company has planted over

1.6 million trees and has conserved, preserved, or reforested

approximately 4,500 hectares of land since 2018.

- Reducing

Greenhouse Gas (“GHG”) Emissions:

- Gran Tierra is

reducing GHG emissions at its facilities through gas-to-power

projects that conserve excess natural gas that would otherwise be

flared, using the gas instead for power generation. In 2023, Gran

Tierra’s gas-to-power projects generated 68% of the total energy

used in all of the Company’s operations.

- Social

& Human Rights:

- Over 350,000

people participated in and benefited from Gran Tierra’s voluntary

social investment programs over the past six years in Colombia and

Ecuador.

- Gran Tierra has

been accepted by the Voluntary Principles Initiative (VPI) as an

official member of the Voluntary Principles for Security and Human

Rights world-wide initiative.

- Installed

residential water filters to approximately 150 households in Campo

Alegre, Colombia providing clean drinking water to a local

community and their two schools.

- Gran Tierra’s

flagship social program in Ecuador, Sucumbíos Sostenible, provided

training and delivered approximately 59,000 cacao plants and over

600 cattle to local community members near our operations in

2023.

Financial and Operational Highlights

(all amounts in $000s, except per share and bbl

amounts)

| |

Three Months Ended March 31, |

|

Three Months Ended December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

|

2023 |

|

| |

|

|

|

|

| Net (Loss)

Income |

$ |

(78 |

) |

$ |

(9,700 |

) |

|

$ |

7,711 |

|

|

Per Share - Basic(4) |

$ |

— |

|

$ |

(0.28 |

) |

|

$ |

0.24 |

|

|

Per Share - Diluted(4) |

$ |

— |

|

$ |

(0.28 |

) |

|

$ |

0.23 |

|

| |

|

|

|

|

| Oil

Sales |

$ |

157,577 |

|

$ |

144,190 |

|

|

$ |

154,944 |

|

| Operating

Expenses |

|

(48,466 |

) |

|

(41,369 |

) |

|

|

(47,637 |

) |

| Transportation

Expenses |

|

(4,584 |

) |

|

(3,066 |

) |

|

|

(3,947 |

) |

| Operating

Netback(2)(3) |

$ |

104,527 |

|

$ |

99,755 |

|

|

$ |

103,360 |

|

| |

|

|

|

|

| G&A Expenses

Before Stock-Based Compensation |

$ |

9,516 |

|

$ |

11,196 |

|

|

$ |

11,072 |

|

| G&A Stock-Based

Compensation Expense |

|

3,361 |

|

|

1,500 |

|

|

|

1,974 |

|

| G&A Expenses,

Including Stock Based Compensation |

$ |

12,877 |

|

$ |

12,696 |

|

|

$ |

13,046 |

|

| |

|

|

|

|

| Adjusted

EBITDA(2) |

$ |

94,792 |

|

$ |

89,865 |

|

|

$ |

92,964 |

|

| |

|

|

|

|

|

EBITDA(2) |

$ |

91,891 |

|

$ |

87,215 |

|

|

$ |

83,634 |

|

| |

|

|

|

|

| Net Cash Provided by

Operating Activities |

$ |

60,827 |

|

$ |

49,253 |

|

|

$ |

70,481 |

|

| |

|

|

|

|

| Funds Flow from

Operations(2) |

$ |

74,307 |

|

$ |

60,016 |

|

|

$ |

84,663 |

|

| |

|

|

|

|

| Capital

Expenditures |

$ |

55,331 |

|

$ |

71,062 |

|

|

$ |

39,175 |

|

| |

|

|

|

|

| Free Cash

Flow(2) |

$ |

18,976 |

|

$ |

(11,046 |

) |

|

$ |

45,488 |

|

| |

|

|

|

|

|

Average Daily Volumes (BOPD) |

|

|

|

|

|

WI Production Before Royalties |

|

32,242 |

|

|

31,611 |

|

|

|

31,309 |

|

|

Royalties |

|

(6,397 |

) |

|

(6,085 |

) |

|

|

(6,417 |

) |

| Production

NAR |

|

25,845 |

|

|

25,526 |

|

|

|

24,892 |

|

| Decrease (Increase) in

Inventory |

|

235 |

|

|

(355 |

) |

|

|

57 |

|

| Sales |

|

26,080 |

|

|

25,171 |

|

|

|

24,949 |

|

| Royalties, % of WI

Production Before Royalties |

|

20 |

% |

|

19 |

% |

|

|

20 |

% |

| |

|

|

|

|

|

Per bbl |

|

|

|

|

|

Brent |

$ |

81.76 |

|

$ |

82.10 |

|

|

$ |

82.85 |

|

| Quality and

Transportation Discount |

|

(15.36 |

) |

|

(18.45 |

) |

|

|

(15.34 |

) |

|

Royalties |

|

(13.08 |

) |

|

(12.80 |

) |

|

|

(13.47 |

) |

| Average Realized

Price |

|

53.32 |

|

|

50.85 |

|

|

|

54.04 |

|

| Transportation

Expenses |

|

(1.55 |

) |

|

(1.08 |

) |

|

|

(1.38 |

) |

| Average Realized Price

Net of Transportation Expenses |

|

51.77 |

|

|

49.77 |

|

|

|

52.66 |

|

| Operating

Expenses |

|

(16.40 |

) |

|

(14.59 |

) |

|

|

(16.61 |

) |

| Operating

Netback(2)(3) |

|

35.37 |

|

|

35.18 |

|

|

|

36.05 |

|

| G&A Expenses

Before Stock-Based Compensation |

|

(3.22 |

) |

|

(3.95 |

) |

|

|

(3.86 |

) |

| Severance

Expenses |

|

(0.43 |

) |

|

— |

|

|

|

— |

|

| Realized Foreign

Exchange Loss |

|

(0.49 |

) |

|

(0.42 |

) |

|

|

(0.34 |

) |

| Interest Expense,

Excluding Amortization of Debt Issuance Costs |

|

(5.12 |

) |

|

(3.90 |

) |

|

|

(5.35 |

) |

| Interest

Income |

|

0.23 |

|

|

0.27 |

|

|

|

0.10 |

|

| Net Lease

Payments |

|

0.12 |

|

|

0.19 |

|

|

|

0.13 |

|

| Current Income Tax

Expense (Recovery) |

|

(1.33 |

) |

|

(6.21 |

) |

|

|

2.80 |

|

| Cash

Netback(2) |

$ |

25.13 |

|

$ |

21.16 |

|

|

$ |

29.53 |

|

| |

|

|

|

|

|

Share Information (000s) |

|

|

|

|

|

Common Stock Outstanding, End of

Period(4) |

|

31,401 |

|

|

33,307 |

|

|

|

32,247 |

|

| Weighted Average

Number of Shares of Common Stock Outstanding -

Basic(4) |

|

31,813 |

|

|

34,451 |

|

|

|

32,861 |

|

| Weighted Average

Number of Shares of Common Stock Outstanding -

Diluted(4) |

|

31,813 |

|

|

34,451 |

|

|

|

32,921 |

|

(1) Gran Tierra’s total current average production for second

quarter-to-date 2024 is the period of April 1 to April 29, 2024.

Gran Tierra’s second quarter-to-date 2024 total average

differentials are for the period from April 1 to April 29, 2024

(2) Funds flow from operations, operating

netback, net debt, cash netback, return on average capital

employed, earnings before interest, taxes and depletion,

depreciation and accretion (“DD&A”)

(“EBITDA”) and

EBITDA adjusted for non-cash lease expense, lease payments, foreign

exchange gains or losses, stock-based compensation expense,

unrealized derivative instruments gains or losses, and other

financial instruments gains or losses (“Adjusted

EBITDA”), cash flow, free cash flow and net debt are

non-GAAP measures and do not have standardized meanings under

generally accepted accounting principles in the United States of

America (“GAAP”). Cash flow refers to funds flow

from operations. Free cash flow refers to funds flow from

operations less capital expenditures. Refer to “Non-GAAP Measures”

in this press release for descriptions of these non-GAAP measures

and, where applicable, reconciliations to the most directly

comparable measures calculated and presented in accordance with

GAAP.(3) Operating netback as presented is defined as oil sales

less operating and transportation expenses. See the table titled

Financial and Operational Highlights above for the components of

consolidated operating netback and corresponding reconciliation.(4)

Reflects our 1-for-10 reverse stock split that became effective

May 5, 2023.

Conference Call

Information:

Gran Tierra will host its first quarter 2024

results conference call on Wednesday, May 2, 2024, at 9:00 a.m.

Mountain Time, 11:00 a.m. Eastern Time. Interested parties may

access the conference call by registering at the following link:

https://register.vevent.com/register/BI3642d81e05184759a47d21a0fddda043.

The call will also be available via webcast at

www.grantierra.com.

Corporate Presentation:

Gran Tierra’s Corporate Presentation has been

updated and is available on the Company website at

www.grantierra.com.

Contact Information

For investor and media inquiries please contact:

Gary Guidry President & Chief Executive Officer

Ryan Ellson Executive Vice President & Chief Financial

Officer

+1-403-265-3221

info@grantierra.com

About Gran Tierra Energy

Inc.Gran Tierra Energy Inc. together with its subsidiaries

is an independent international energy company currently focused on

oil and natural gas exploration and production in Colombia and

Ecuador. The Company is currently developing its existing portfolio

of assets in Colombia and Ecuador and will continue to pursue

additional new growth opportunities that would further strengthen

the Company’s portfolio. The Company’s common stock trades on the

NYSE American, the Toronto Stock Exchange and the London Stock

Exchange under the ticker symbol GTE. Additional information

concerning Gran Tierra is available at www.grantierra.com. Except

to the extent expressly stated otherwise, information on the

Company’s website or accessible from our website or any other

website is not incorporated by reference into and should not be

considered part of this press release. Investor inquiries may be

directed to info@grantierra.com or (403) 265-3221.

Gran Tierra’s Securities and Exchange Commission (the “SEC”)

filings are available on the SEC website at http://www.sec.gov. The

Company’s Canadian securities regulatory filings are available on

SEDAR+ at http://www.sedarplus.ca and UK regulatory filings are

available on the National Storage Mechanism website at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism.

Forward Looking Statements and Legal

Advisories:This press release contains opinions,

forecasts, projections, and other statements about future events or

results that constitute forward-looking statements within the

meaning of the United States Private Securities Litigation Reform

Act of 1995, Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended,

and financial outlook and forward looking information within the

meaning of applicable Canadian securities laws (collectively,

“forward-looking statements”). All statements other than statements

of historical facts included in this press release regarding our

business strategy, plans and objectives of our management for

future operations, capital spending plans and benefits of the

changes in our capital program or expenditures, our expected

financial condition, leverage ratio target, and those statements

preceded by, followed by or that otherwise include the words

“expect,” “plan,” “can,” “will,” “should,” “guidance,” “forecast,”

“budget,” “estimate,” “signal,” “progress” and “believes,”

derivations thereof and similar terms identify forward-looking

statements. In particular, but without limiting the foregoing, this

press release contains forward-looking statements regarding: the

Company’s expected future production, capital expenditures and free

cash flow, the Company’s targeted cash balance and uses of excess

free cash flow, including the repayment of borrowings under its

credit facility, the Company’s plans regarding strategic

investments, acquisitions and growth, the Company’s drilling

program and the Company’s expectations of commodity prices and its

positioning for 2024. The forward-looking statements contained in

this press release reflect several material factors and

expectations and assumptions of Gran Tierra including, without

limitation, that Gran Tierra will continue to conduct its

operations in a manner consistent with its current expectations,

pricing and cost estimates (including with respect to commodity

pricing and exchange rates), and the general continuance of assumed

operational, regulatory and industry conditions in Colombia and

Ecuador, and the ability of Gran Tierra to execute its business and

operational plans in the manner currently planned.

Among the important factors that could cause our actual results

to differ materially from the forward-looking statements in this

press release include, but are not limited to: our operations are

located in South America and unexpected problems can arise due to

guerilla activity, strikes, local blockades or protests; technical

difficulties and operational difficulties may arise which impact

the production, transport or sale of our products; other

disruptions to local operations; global health events; global and

regional changes in the demand, supply, prices, differentials or

other market conditions affecting oil and gas, including inflation

and changes resulting from a global health crisis, geopolitical

events, including the conflicts in Ukraine and the Gaza region, or

from the imposition or lifting of crude oil production quotas or

other actions that might be imposed by OPEC and other producing

countries and the resulting company or third-party actions in

response to such changes; changes in commodity prices, including

volatility or a prolonged decline in these prices relative to

historical or future expected levels; the risk that current global

economic and credit conditions may impact oil prices and oil

consumption more than we currently predict. which could cause

further modification of our strategy and capital spending program;

prices and markets for oil and natural gas are unpredictable and

volatile; the effect of hedges; the accuracy of productive capacity

of any particular field; geographic, political and weather

conditions can impact the production, transport or sale of our

products; our ability to execute our business plan and realize

expected benefits from current initiatives; the risk that

unexpected delays and difficulties in developing currently owned

properties may occur; the ability to replace reserves and

production and develop and manage reserves on an economically

viable basis; the accuracy of testing and production results and

seismic data, pricing and cost estimates (including with respect to

commodity pricing and exchange rates); the risk profile of planned

exploration activities; the effects of drilling down-dip; the

effects of waterflood and multi-stage fracture stimulation

operations; the extent and effect of delivery disruptions,

equipment performance and costs; actions by third parties; the

timely receipt of regulatory or other required approvals for our

operating activities; the failure of exploratory drilling to result

in commercial wells; unexpected delays due to the limited

availability of drilling equipment and personnel; volatility or

declines in the trading price of our common stock or bonds; the

risk that we do not receive the anticipated benefits of government

programs, including government tax refunds; our ability to comply

with financial covenants in our indentures and make borrowings

under any future credit agreement; and the risk factors detailed

from time to time in Gran Tierra’s periodic reports filed with the

Securities and Exchange Commission, including, without limitation,

under the caption “Risk Factors” in Gran Tierra’s Annual Report on

Form 10-K for the year ended December 31, 2023 filed February 20,

2024 and its other filings with the SEC. These filings are

available on the SEC website at http://www.sec.gov and on SEDAR+ at

www.sedarplus.ca.

The forward-looking statements contained in this press release

are based on certain assumptions made by Gran Tierra based on

management’s experience and other factors believed to be

appropriate. Gran Tierra believes these assumptions to be

reasonable at this time, but the forward-looking statements are

subject to risk and uncertainties, many of which are beyond Gran

Tierra’s control, which may cause actual results to differ

materially from those implied or expressed by the forward looking

statements. The risk that the assumptions on which the 2024 outlook

are based prove incorrect may increase the later the period to

which the outlook relates. All forward-looking statements are made

as of the date of this press release and the fact that this press

release remains available does not constitute a representation by

Gran Tierra that Gran Tierra believes these forward-looking

statements continue to be true as of any subsequent date. Actual

results may vary materially from the expected results expressed in

forward-looking statements. Gran Tierra disclaims any intention or

obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise,

except as expressly required by applicable law. In addition,

historical, current and forward-looking sustainability-related

statements may be based on standards for measuring progress that

are still developing, internal controls and processes that continue

to evolve, and assumptions that are subject to change in the

future.

The estimates of future financial performance set forth in this

press release may be considered to be future-oriented financial

information or a financial outlook for purposes of applicable

Canadian securities laws. Financial outlook and future-oriented

financial information contained in this press release about the

Company’s prospective budget, financial objectives, Net Debt to

Adjusted EBITDA ratio, financial performance, financial position or

cash flows are provided to give the reader a better understanding

of the potential future performance of the Company in certain areas

and are based on assumptions about future events, including

economic conditions and proposed courses of action, based on

management’s assessment of the relevant information currently

available, and to become available in the future. In particular,

this press release contains projected operational and financial

information for 2024 to allow readers to assess the Company’s

ability to fund its programs. These projections contain

forward-looking statements and are based on a number of material

assumptions and factors set out above. Actual results may differ

significantly from the projections presented herein. The actual

results of Gran Tierra’s operations for any period could vary from

the amounts set forth in these projections, and such variations may

be material. See above for a discussion of the risks that could

cause actual results to vary. The future-oriented financial

information and financial outlooks contained in this press release

have been approved by management as of the date of this press

release. Readers are cautioned that any such financial outlook and

future-oriented financial information contained herein should not

be used for purposes other than those for which it is disclosed

herein. The Company and its management believe that the prospective

financial information has been prepared on a reasonable basis,

reflecting management’s best estimates and judgments, and

represent, to the best of management’s knowledge and opinion, the

Company’s expected course of action. However, because this

information is highly subjective, it should not be relied on as

necessarily indicative of future results.

Non-GAAP Measures

This press release includes non-GAAP financial

measures as further described herein. These non-GAAP measures do

not have a standardized meaning under GAAP. Investors are cautioned

that these measures should not be construed as alternatives to net

income or loss, cash flow from operating activities or other

measures of financial performance as determined in accordance with

GAAP. Gran Tierra’s method of calculating these measures may differ

from other companies and, accordingly, they may not be comparable

to similar measures used by other companies. Each non-GAAP

financial measure is presented along with the corresponding GAAP

measure so as to not imply that more emphasis should be placed on

the non-GAAP measure.

Operating netback as presented is defined as oil

sales less operating and transportation expenses. See the table

entitled Financial and Operational Highlights above for the

components of consolidated operating netback and corresponding

reconciliation.

Return on average capital employed as presented

is defined as earnings before interest and taxes

("EBIT"; annualized, if the period is other than

one year) divided by average capital employed (total assets minus

cash and current liabilities; average of the opening and closing

balances for the period).

| |

|

Three Months Ended March 31, |

|

Twelve Month Trailing March

31, |

|

As at March 31, |

|

Return on Average Capital Employed - (Non-GAAP) Measure

($000s) |

|

|

2024 |

|

|

|

2024 |

|

|

|

2024 |

| Net (Loss)

Income |

|

$ |

(78 |

) |

|

$ |

3,335 |

|

|

|

| Adjustments to

reconcile net (loss) income to EBIT: |

|

|

|

|

|

|

|

Interest Expense |

|

|

18,424 |

|

|

|

62,394 |

|

|

|

|

Income Tax Expense |

|

|

17,395 |

|

|

|

96,959 |

|

|

|

| Earnings before

interest and income tax |

|

$ |

35,741 |

|

|

$ |

162,688 |

|

|

|

| |

|

|

|

|

|

|

|

Total Assets |

|

|

|

|

|

$ |

1,402,410 |

|

Less Current Liabilities |

|

|

|

|

|

|

257,721 |

|

Less Cash and Cash Equivalents |

|

|

|

|

|

|

126,618 |

| Capital

Employed |

|

|

|

|

|

$ |

1,018,071 |

| |

|

|

|

|

|

|

|

Annualized EBIT* |

|

$ |

142,964 |

|

|

|

|

|

|

Divided by Average Capital Employed |

|

|

1,018,071 |

|

|

|

1,018,071 |

|

|

|

| Return on Average

Capital Employed |

|

|

14 |

% |

|

|

16 |

% |

|

|

*Annualized EBIT was calculated for the three

months ended March 31, 2024, by multiplying the quarter-to-date

EBIT by 4.

Cash netback as presented is defined as net

income or loss adjusted for DD&A expenses, deferred tax expense

or recovery, stock-based compensation expense or recovery,

amortization of debt issuance costs, non-cash lease expense, lease

payments, unrealized foreign exchange gain or loss, unrealized

derivative instruments gain or loss, other gain or loss and

financial instruments gain or loss. Management believes that

operating netback and cash netback are useful supplemental measures

for investors to analyze financial performance and provide an

indication of the results generated by Gran Tierra’s principal

business activities prior to the consideration of other income and

expenses. A reconciliation from net income or loss to cash netback

is as follows:

| |

Three Months Ended March 31, |

|

Three Months Ended December 31, |

|

Cash Netback - (Non-GAAP) Measure ($000s) |

|

2024 |

|

|

2023 |

|

|

|

2023 |

|

| Net (loss)

income |

$ |

(78 |

) |

$ |

(9,700 |

) |

|

$ |

7,711 |

|

| Adjustments to

reconcile net (loss) income to cash netback |

|

|

|

|

|

DD&A expenses |

|

56,150 |

|

|

52,196 |

|

|

|

52,635 |

|

|

Deferred tax expense |

|

13,479 |

|

|

15,277 |

|

|

|

13,517 |

|

|

Stock-based compensation expense |

|

3,361 |

|

|

1,500 |

|

|

|

1,974 |

|

|

Amortization of debt issuance costs |

|

3,306 |

|

|

781 |

|

|

|

2,437 |

|

|

Non-cash lease expense |

|

1,413 |

|

|

1,144 |

|

|

|

1,479 |

|

|

Lease payments |

|

(1,058 |

) |

|

(606 |

) |

|

|

(1,100 |

) |

|

Unrealized foreign exchange (gain) loss |

|

(2,266 |

) |

|

514 |

|

|

|

2,729 |

|

|

Other (gain) loss |

|

— |

|

|

(1,090 |

) |

|

|

3,266 |

|

|

Financial instruments loss |

|

— |

|

|

— |

|

|

|

15 |

|

| Cash

netback |

$ |

74,307 |

|

$ |

60,016 |

|

|

$ |

84,663 |

|

EBITDA, as presented, is defined as net income

or loss adjusted for DD&A expenses, interest expense and income

tax expense or recovery. Adjusted EBITDA, as presented, is defined

as EBITDA adjusted for non-cash lease expense, lease payments,

foreign exchange gain or loss, stock-based compensation expense or

recovery, other gain or loss and financial instruments loss.

Management uses this supplemental measure to analyze performance

and income generated by our principal business activities prior to

the consideration of how non-cash items affect that income, and

believes that this financial measure is useful supplemental

information for investors to analyze our performance and our

financial results. A reconciliation from net income or loss to

EBITDA and adjusted EBITDA is as follows:

| |

Three Months Ended March 31, |

|

Three Months Ended December 31, |

|

Twelve Month Trailing March

31, |

|

EBITDA - (Non-GAAP) Measure ($000s) |

|

2024 |

|

|

2023 |

|

|

|

2023 |

|

|

|

2024 |

|

| Net (loss)

income |

$ |

(78 |

) |

$ |

(9,700 |

) |

|

$ |

7,711 |

|

|

$ |

3,335 |

|

| Adjustments to

reconcile net (loss) income to EBITDA and Adjusted

EBITDA |

|

|

|

|

|

|

|

DD&A expenses |

|

56,150 |

|

|

52,196 |

|

|

|

52,635 |

|

|

|

219,538 |

|

|

Interest expense |

|

18,424 |

|

|

11,836 |

|

|

|

17,789 |

|

|

|

62,394 |

|

|

Income tax expense |

|

17,395 |

|

|

32,883 |

|

|

|

5,499 |

|

|

|

96,959 |

|

| EBITDA |

$ |

91,891 |

|

$ |

87,215 |

|

|

$ |

83,634 |

|

|

$ |

382,226 |

|

|

Non-cash lease expense |

|

1,413 |

|

|

1,144 |

|

|

|

1,479 |

|

|

|

5,236 |

|

|

Lease payments |

|

(1,058 |

) |

|

(606 |

) |

|

|

(1,100 |

) |

|

|

(3,470 |

) |

|

Foreign exchange (gain) loss |

|

(815 |

) |

|

1,702 |

|

|

|

3,696 |

|

|

|

9,305 |

|

|

Stock-based compensation expense |

|

3,361 |

|

|

1,500 |

|

|

|

1,974 |

|

|

|

7,583 |

|

|

Other (gain) loss |

|

— |

|

|

(1,090 |

) |

|

|

3,266 |

|

|

|

3,387 |

|

|

Financial instruments loss |

|

— |

|

|

— |

|

|

|

15 |

|

|

|

15 |

|

| Adjusted

EBITDA |

$ |

94,792 |

|

$ |

89,865 |

|

|

$ |

92,964 |

|

|

$ |

404,282 |

|

Funds flow from operations, as presented, is

defined as net income or loss adjusted for DD&A expenses,

deferred tax expense or recovery, stock-based compensation expense

or recovery, amortization of debt issuance costs, non-cash lease

expense, lease payments, unrealized foreign exchange gain or loss,

other gain or loss and financial instruments loss. Management uses

this financial measure to analyze performance and income or loss

generated by our principal business activities prior to the

consideration of how non-cash items affect that income or loss, and

believes that this financial measure is also useful supplemental

information for investors to analyze performance and our financial

results. Free cash flow, as presented, is defined as funds flow

from operations adjusted for capital expenditures. Management uses

this financial measure to analyze cash flow generated by our

principal business activities after capital requirements and

believes that this financial measure is also useful supplemental

information for investors to analyze performance and our financial

results. A reconciliation from net income or loss to both funds

flow from operations and free cash flow is as follows:

| |

Three Months Ended March 31, |

|

Three Months Ended December 31, |

|

Twelve Month Trailing March 31, |

|

Funds Flow From Operations - (Non-GAAP)

Measure ($000s) |

|

2024 |

|

|

2023 |

|

|

|

2023 |

|

|

|

2024 |

|

| Net (loss)

income |

$ |

(78 |

) |

$ |

(9,700 |

) |

|

$ |

7,711 |

|

|

$ |

3,335 |

|

| Adjustments to

reconcile net (loss) income to funds flow from

operations |

|

|

|

|

|

|

|

DD&A expenses |

|

56,150 |

|

|

52,196 |

|

|

|

52,635 |

|

|

|

219,538 |

|

|

Deferred tax expense |

|

13,479 |

|

|

15,277 |

|

|

|

13,517 |

|

|

|

54,961 |

|

|

Stock-based compensation expense |

|

3,361 |

|

|

1,500 |

|

|

|

1,974 |

|

|

|

7,583 |

|

|

Amortization of debt issuance costs |

|

3,306 |

|

|

781 |

|

|

|

2,437 |

|

|

|

8,356 |

|

|

Non-cash lease expense |

|

1,413 |

|

|

1,144 |

|

|

|

1,479 |

|

|

|

5,236 |

|

|

Lease payments |

|

(1,058 |

) |

|

(606 |

) |

|

|

(1,100 |

) |

|

|

(3,470 |

) |

|

Unrealized foreign exchange (gain) loss |

|

(2,266 |

) |

|

514 |

|

|

|

2,729 |

|

|

|

(7,865 |

) |

|

Other (gain) loss |

|

— |

|

|

(1,090 |

) |

|

|

3,266 |

|

|

|

3,387 |

|

|

Financial instruments loss |

|

— |

|

|

— |

|

|

|

15 |

|

|

|

15 |

|

| Funds flow from

operations |

$ |

74,307 |

|

$ |

60,016 |

|

|

$ |

84,663 |

|

|

$ |

291,076 |

|

|

Capital expenditures |

$ |

55,331 |

|

$ |

71,062 |

|

|

$ |

39,175 |

|

|

$ |

203,151 |

|

| Free cash

flow |

$ |

18,976 |

|

$ |

(11,046 |

) |

|

$ |

45,488 |

|

|

$ |

87,925 |

|

Net debt as of March 31, 2024, was $510

million, calculated using the sum of 6.25% Senior Notes, 7.75%

Senior Notes, and 9.50% Senior Notes excluding deferred financing

fees totaling $637 million, less cash and cash equivalents of $127

million.

Presentation of Oil and Gas

Information

All reserves value and ancillary information

contained in this press release have been prepared by the Company's

independent qualified reserves evaluator McDaniel & Associates

Consultants Ltd. (“McDaniel”) in a report with an effective date of

December 31, 2023 (the “GTE McDaniel Reserves Report”) and

calculated in compliance with Canadian National Instrument 51-101 –

Standards of Disclosure for Oil and Gas Activities (“NI 51-101”)

and the Canadian Oil and Gas Evaluation Handbook (“COGEH”), unless

otherwise expressly stated.

Estimates of net present value and future net

revenue contained herein do not necessarily represent fair market

value. Estimates of reserves and future net revenue for individual

properties may not reflect the same level of confidence as

estimates of reserves and future net revenue for all properties,

due to the effect of aggregation. There is no assurance that the

forecast price and cost assumptions applied by McDaniel in

evaluating Gran Tierra’s reserves will be attained and variances

could be material. All reserves assigned in the GTE McDaniel

Reserves Report are located in Colombia and Ecuador and presented

on a consolidated basis by foreign geographic area. There are

numerous uncertainties inherent in estimating quantities of crude

oil reserves. The reserve information set forth in the GTE McDaniel

Reserves Report are estimates only and there is no guarantee that

the estimated reserves will be recovered. Actual reserves may be

greater than or less than the estimates provided therein.

Proved reserves are those reserves that can be

estimated with a high degree of certainty to be recoverable. It is

likely that the actual remaining quantities recovered will exceed

the estimated proved reserves. Probable reserves are those

additional reserves that are less certain to be recovered than

proved reserves. It is equally likely that the actual remaining

quantities recovered will be greater or less than the sum of the

estimated proved plus probable reserves. Possible reserves are

those additional reserves that are less certain to be recovered

than Probable reserves. There is a 10% probability that the

quantities actually recovered will equal or exceed the sum of

Proved plus Probable plus Possible reserves.

References to a formation where evidence of

hydrocarbons has been encountered is not necessarily an indicator

that hydrocarbons will be recoverable in commercial quantities or

in any estimated volume. Gran Tierra’s reported production is a mix

of light crude oil and medium and heavy crude oil for which there

is not a precise breakdown since the Company’s oil sales volumes

typically represent blends of more than one type of crude oil. Well

test results should be considered as preliminary and not

necessarily indicative of long-term performance or of ultimate

recovery. Well log interpretations indicating oil and gas

accumulations are not necessarily indicative of future production

or ultimate recovery. If it is indicated that a pressure transient

analysis or well-test interpretation has not been carried out, any

data disclosed in that respect should be considered preliminary

until such analysis has been completed. References to thickness of

“oil pay” or of a formation where evidence of hydrocarbons has been

encountered is not necessarily an indicator that hydrocarbons will

be recoverable in commercial quantities or in any estimated

volume.

This press release contains certain oil and gas

metrics, including operating netback and cash netback, which do not

have standardized meanings or standard methods of calculation and

therefore such measures may not be comparable to similar measures

used by other companies and should not be used to make comparisons.

These metrics are calculated as described in this press release and

management believes that they are useful supplemental measures for

the reasons described in this press release.

Such metrics have been included herein to

provide readers with additional measures to evaluate the Company’s

performance; however, such measures are not reliable indicators of

the future performance of the Company and future performance may

not compare to the performance in previous periods.

Disclosure of Reserve Information and

Cautionary Note to U.S. Investors

Unless expressly stated otherwise, all estimates

of proved, probable and possible reserves and related future net

revenue disclosed in this press release have been prepared in

accordance with NI 51-101. Estimates of reserves and future net

revenue made in accordance with NI 51-101 will differ from

corresponding GAAP standardized measure prepared in accordance with

applicable SEC rules and disclosure requirements of the U.S.

Financial Accounting Standards Board (“FASB”), and those

differences may be material. NI 51-101, for example, requires

disclosure of reserves and related future net revenue estimates

based on forecast prices and costs, whereas SEC and FASB standards

require that reserves and related future net revenue be estimated

using average prices for the previous 12 months and that the

standardized measure reflect discounted future net income taxes

related to the Company’s operations. In addition, NI 51-101 permits

the presentation of reserves estimates on a “company gross” basis,

representing Gran Tierra’s working interest share before deduction

of royalties, whereas SEC and FASB standards require the

presentation of net reserve estimates after the deduction of

royalties and similar payments. There are also differences in the

technical reserves estimation standards applicable under NI 51-101

and, pursuant thereto, the COGEH, and those applicable under SEC

and FASB requirements. In addition to being a reporting issuer in

certain Canadian jurisdictions, Gran Tierra is a registrant with

the SEC and subject to domestic issuer reporting requirements under

U.S. federal securities law, including with respect to the

disclosure of reserves and other oil and gas information in

accordance with U.S. federal securities law and applicable SEC

rules and regulations (collectively, “SEC requirements”).

Disclosure of such information in accordance with SEC requirements

is included in the Company’s Annual Report on Form 10-K and in

other reports and materials filed with or furnished to the SEC and,

as applicable, Canadian securities regulatory authorities. The SEC

permits oil and gas companies that are subject to domestic issuer

reporting requirements under U.S. federal securities law, in their

filings with the SEC, to disclose only estimated proved, probable

and possible reserves that meet the SEC’s definitions of such

terms. Gran Tierra has disclosed estimated proved, probable and

possible reserves in its filings with the SEC. In addition, Gran

Tierra prepares its financial statements in accordance with United

States generally accepted accounting principles, which require that

the notes to its annual financial statements include supplementary

disclosure in respect of the Company’s oil and gas activities,

including estimates of its proved oil and gas reserves and a

standardized measure of discounted future net cash flows relating

to proved oil and gas reserve quantities. This supplementary

financial statement disclosure is presented in accordance with FASB

requirements, which align with corresponding SEC requirements

concerning reserves estimation and reporting.

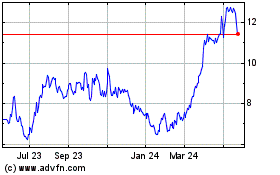

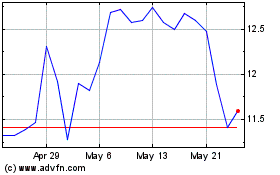

Gran Tierra Energy (TSX:GTE)

Historical Stock Chart

From Oct 2024 to Nov 2024

Gran Tierra Energy (TSX:GTE)

Historical Stock Chart

From Nov 2023 to Nov 2024