Canadian Banc Recovery Corp. Class A Share Rebalancing

January 12 2012 - 3:50PM

Marketwired Canada

Canadian Banc Recovery Corp. ("Canadian Banc") announces a Class A share

subdivision for all Class A shareholders of record on January 17, 2012 that will

increase the number of shares held by each shareholder. The purpose of the share

subdivision is to maintain an equal number of Class A shares and Preferred

shares outstanding.

As a result of the successful vote to extend the termination date of Canadian

Banc to December 1, 2018 at the recent Special Meeting of Shareholders held on

November 3, 2011, both Class A shareholders and Preferred shareholders were

given a special retraction right. This special retraction right allowed both

classes of shareholders to tender one or both classes of shares and receive a

retraction price based on the December 30, 2011 net asset value per Unit ($10

per Preferred Share, $10.68 per Class A Share and $20.68 per Unit, as

applicable). In aggregate, there were more Class A shares tendered for

retraction than Preferred shares. Since Canadian Banc is required to maintain an

equal number of shares outstanding for each Class as per the prospectus, the

Company must increase the Class A shares to match the number of Preferred

shares.

Immediately after the special retraction payment on January 16, 2012, there will

be 6,772,453 Preferred shares and 5,737,131 Class A shares outstanding. In order

to restore an equal amount of shares outstanding for each Class, Class A

shareholders on record as at January 17, 2012 will receive approximately

1.180459885 Class A shares for each Class A share outstanding. The increase in

shares (subdivision) is a non taxable event.

In addition, the monthly Class A share dividend target formula will be adjusted

in order to approximately maintain the same pre subdivision dividend formula.

This will result in shareholders maintaining their current level of dividend

income per month. The new formula will be adjusted to provide Class A shares

with regular floating rate monthly distributions targeted to be at a rate per

annum equal to the prime rate plus 1.25% with a minimum targeted annual rate of

return of 4.25% and a maximum annual rate of return of 8.50% based on the

original issue price of $15 per Class A share. The current Class A share

dividend yield based on the January 11, 2012 closing market price was 7.14%.

The intrinsic value of each investor's holdings in Class A shares will be the

same after the adjustment. The increase in the number of shares would be

proportionate to the reduction in the net assets attributable to the Class A

shares.

The table below is an illustrative example of the effects of the subdivision

with all numbers rounded.

---------------------------------------------------------------------------

Before After

Subdivision Subdivision

---------------------------------------------------------------------------

Class A shares owned (A) 1,000 (A) 1,180

---------------------------------------------------------------------------

Net asset value per Unit as at December 31,

2011 $ 20.68 $ 19.05

---------------------------------------------------------------------------

Par value of Preferred share $ 10.00 $ 10.00

---------------------------------------------------------------------------

Net asset value per Unit attributable to

Class A share (B) $ 10.68 (B) $ 9.05

---------------------------------------------------------------------------

Total net asset value attributable to Class

A shareholder (A x B) $10,680 $ 10,680

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Class A share current dividend rate per

floating rate formula $ 0.75 $ 0.6375

---------------------------------------------------------------------------

Class A share annual dividend payment $ 750 $ 752

---------------------------------------------------------------------------

(all numbers rounded)

---------------------------------------------------------------------------

The impact of the Class A share subdivision will be reflected in the next

reported net asset value per unit as at January 31, 2012. Net assets of Canadian

Banc after the retractions payments will be approximately $135 million.

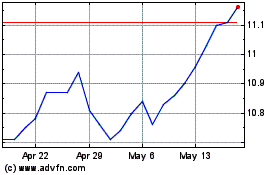

Canadian Banc (TSX:BK)

Historical Stock Chart

From May 2024 to Jun 2024

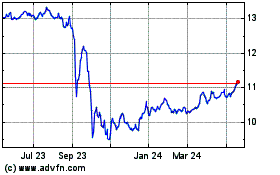

Canadian Banc (TSX:BK)

Historical Stock Chart

From Jun 2023 to Jun 2024