0001549346false00015493462023-10-312023-10-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

| | | | | |

| FORM | 8-K |

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934 |

| Date of Report (Date of earliest event reported): | October 31, 2023 |

| Shutterstock, Inc. |

| (Exact name of registrant as specified in its charter) |

| | | | | | | | | | | | | | |

| Delaware | | 001-35669 | | 80-0812659 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

350 Fifth Avenue, 20th Floor

New York, NY 10118

(Address of principal executive offices, including zip code)

(646) 710-3417

(Registrant’s telephone number, including area code)

Not applicable

(Former name, former address and former fiscal year, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | Trading symbol | Name of each exchange on which registered |

| Common Stock, $0.01 par value per share | SSTK | New York Stock Exchange |

| | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

| |

| ☐ | Emerging growth company |

| |

☐

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. |

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition. |

On October 31, 2023, Shutterstock, Inc. (the “Company”) issued a press release announcing its financial results for the fiscal period ended September 30, 2023. A copy of the press release is furnished as Exhibit 99.1 to this current report and is incorporated herein by reference.

In accordance with General Instruction B.2 of Form 8-K, the information in this Current Report on Form 8-K, including Exhibit 99.1 attached hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

| | | | | |

| Item 7.01 | Regulation FD Disclosure. |

The information provided above in “Item 2.02 Results of Operations and Financial Condition” is incorporated by reference in this Item 7.01.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

99.1Press release entitled “Shutterstock Reports Third Quarter 2023 Financial Results” dated October 31, 2023

104Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document.

EXHIBIT INDEX | | | | | | | | |

| Exhibit No. | | Exhibit Description |

| | | |

| | |

| | |

| 99.1 | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| 104 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. | | | | | | | | |

| | SHUTTERSTOCK, INC. |

| |

| | |

| Dated: October 31, 2023 | By: | /s/ Jarrod Yahes |

| | Jarrod Yahes |

| | | Chief Financial Officer |

EXHIBIT 99.1

Shutterstock Reports Third Quarter 2023 Financial Results

New York, NY - October 31, 2023 - Shutterstock, Inc. (NYSE: SSTK) (the “Company”), a leading global creative platform offering high-quality creative content for transformative brands, digital media and marketing companies, today announced financial results for the third quarter ended September 30, 2023.

Commenting on the Company’s performance, Paul Hennessy, the Company’s Chief Executive Officer, said, “In the third quarter, Shutterstock’s data and creative engines fueled faster growth and furthered the transformation of our business. Enterprise demand picked up, and we expect a further acceleration in the fourth quarter. We are seeing stabilization and expect a recovery in E-commerce over the next several quarters supported by marketing and product innovation. Based on our strong year to date performance, and improved confidence and visibility in our business, we are again raising both revenue and EBITDA guidance for 2023.”

Third Quarter 2023 highlights as compared to third quarter 2022:

Financial Highlights

•Revenue increased 14% to $233.2 million.

•Income from operations decreased 40% to $17.2 million.

•Net income increased 23% to $28.4 million.

•Adjusted EBITDA increased 15% to $64.7 million.

•Net income per diluted share increased $0.15 to $0.79.

•Adjusted net income per diluted share increased $0.26 to $1.26.

•Operating cash flows decreased $27.7 million to $10.0 million.

•Free cash flow decreased $8.7 million to $12.7 million.

Key Operating Metrics

•Subscribers decreased to 551,000.

•Subscriber revenue increased to $88.3 million.

•Average revenue per customer increased to $401.

•Paid downloads decreased to 36.4 million.

•Revenue per download increased to $4.76.

•Image collection expanded to 757 million images.

•Footage collection expanded to 52 million clips.

THIRD QUARTER RESULTS

Revenue

Third quarter revenue of $233.2 million increased $29.2 million or 14% as compared to the third quarter of 2022. Revenue generated from our Enterprise sales channel increased 60% as compared to the third quarter of 2022, to $127.2 million, and represented 55% of third quarter revenue in 2023. The increase in Enterprise revenues was primarily driven by growth in our computer vision data partnerships which generated $45.5 million during the third quarter, compared to $1.5 million in the third quarter of 2022. Revenue from our E-commerce sales channel decreased 15% as compared to the third quarter of 2022, to $106.0 million, and represented 45% of total revenue in the third quarter of 2023. The decline in E-commerce revenue was primarily driven by weakness in new customer acquisition.

On a constant currency basis, revenue increased 12% in the third quarter of 2023 as compared to the third quarter of 2022. On a constant currency basis, Enterprise revenues increased by 57%, and E-commerce revenue decreased by 16% in the third quarter of 2023, as compared to 2022.

Net income and net income per diluted share

Net income of $28.4 million increased $5.4 million as compared to $23.0 million for the third quarter in 2022. Net income per diluted share was $0.79, as compared to $0.64 for the same period in 2022.

Third quarter 2023 net income was favorably impacted by a non-taxable bargain purchase gain of $9.9 million associated with the our acquisition of Giphy which occurred in the second quarter. Third quarter 2023 net income was also favorably impacted our growth in revenue and unfavorably impacted by expenses associated with reimbursable costs paid to the Giphy workforce.

Adjusted net income per diluted share was $1.26 as compared to $1.00 for the third quarter of 2022, an increase of $0.26 per diluted share.

Adjusted EBITDA

Adjusted EBITDA of $64.7 million for the third quarter of 2023 increased by $8.7 million, or 15%, as compared to the third quarter of 2022, due primarily to revenue growth partially offset by higher operating expenses. The adjusted EBITDA margin of 27.7% for third quarter of 2023 increased by 28 basis points, as compared to 27.5% in the third quarter of 2022.

THIRD QUARTER LIQUIDITY

Our cash and cash equivalents decreased by $11.9 million to $75.2 million at September 30, 2023, as compared with $87.1 million as of June 30, 2023. This decrease was driven by $25.3 million of net cash used in financing activities, partially offset by $10.0 million of net cash provided by our operating activities and $4.2 million of net cash provided by investing activities.

Net cash provided by our operating activities was driven by our operating income, in addition to changes in the timing of cash collections from our customers and payments pertaining to operating expenses. Operating cash flows were unfavorably impacted by payments made to the Giphy workforce, the reimbursement of which is reflected in Investing Activities.

Cash provided by investing activities primarily consists of $19.0 million related to the receipt of the Giphy Retention Compensation, as reimbursed by the Giphy seller, partially offset by $16.3 million related to capital expenditures and content acquisition.

Cash used in financing activities primarily consists of $15.0 million paid for the repurchase of common stock under our share repurchase program, $9.6 million related to the payment of the quarterly cash dividend and $0.7 million paid in settlement of tax withholding obligations related to employee stock-based compensation awards.

Free cash flow was $12.7 million for the third quarter of 2023, a decrease of $8.7 million from the third quarter of 2022.

QUARTERLY CASH DIVIDEND

During the three months ended September 30, 2023, the Company declared and paid a cash dividend of $0.27 per common share or $9.6 million.

On October 23, 2023, the Board of Directors declared a dividend of $0.27 per share of outstanding common stock, payable on December 14, 2023 to stockholders of record at the close of business on November 30, 2023.

KEY OPERATING METRICS | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | | 2023 | | 2022 | | 2023 | | 2022 |

| | | |

Subscribers (end of period)(1) | | 551,000 | | | 607,000 | | | 551,000 | | | 607,000 | |

Subscriber revenue (in millions)(2) | | $ | 88.3 | | | $ | 87.7 | | | $ | 266.3 | | | $ | 257.8 | |

| | | | | | | | |

| | | | | | | | |

Average revenue per customer (last twelve months)(3) | | $ | 401 | | | $ | 329 | | | $ | 401 | | | $ | 329 | |

Paid downloads (in millions)(4) | | 36.4 | | | 42.8 | | | 117.6 | | | 130.8 | |

Revenue per download(5) | | $ | 4.76 | | | $ | 4.43 | | | $ | 4.63 | | | $ | 4.37 | |

Content in our collection (end of period, in millions)(6): | | | | | | | | |

| Images | | 757 | | | 527 | | | 757 | | | 527 | |

| | | | | | | | |

| | | | | | | | |

| Footage clips | | 52 | | | 28 | | | 52 | | | 28 | |

_______________________________________________________________________________________________________________________

Subscribers, Subscriber Revenue and Average Revenue Per Customer from acquisitions are included in these metrics beginning twelve months after the closing of the respective business combination. Accordingly, the metrics include Subscribers, Subscriber revenue, and Average revenue per customer from TurboSquid beginning February 2022, from PicMonkey beginning September 2022, and from Pond5 and Splash News beginning May 2023. These metrics exclude the respective counts and revenues from Giphy.

(1) Subscribers is defined as those customers who purchase one or more of our monthly recurring products for a continuous period of at least three months, measured as of the end of the reporting period.

(2) Subscriber revenue is defined as the revenue generated from subscribers during the period.

(3) Average revenue per customer is calculated by dividing total revenue for the last twelve-month period by customers. Customers is defined as total active, paying customers that contributed to total revenue over the last twelve-month period.

(4) Paid downloads is the number of downloads that our customers make in a given period of our content. Paid downloads exclude content related to our Studios business, downloads of content that are offered to customers for no charge, including our free trials and downloads associated with our computer vision offering.

(5) Revenue per download is the amount of revenue recognized in a given period divided by the number of paid downloads in that period excluding revenue from our Studios business, revenue that is not derived from or associated with content licenses and revenue associated with our computer vision offering.

(6) Content in our collection represents approved images (photographs, vectors and illustrations) and footage (in number of clips) in our library at the end of the period. This metric excludes content that is not uploaded directly to our site but is available for license by our customers through an application program interface, content from our Studios business and AI generated content. Prior to December 31, 2022, this metric only included approved images and footage clips in our library on shutterstock.com at the end of the period.

2023 GUIDANCE

The Company increased its guidance for the full year 2023, to the following:

•Revenue of $869 million to $886 million, representing annual growth of 5% to 7%.

•Adjusted EBITDA of between $240 million to $245 million.

•Adjusted net income per diluted share of between $4.18 to $4.30.

NON-GAAP FINANCIAL MEASURES

To supplement Shutterstock’s consolidated financial statements presented in accordance with the accounting principles generally accepted in the United States, or GAAP, Shutterstock’s management considers certain financial measures that are not prepared in accordance with GAAP, collectively referred to as non-GAAP financial measures, including adjusted EBITDA, adjusted EBITDA margin, adjusted net income, adjusted net income per diluted share, revenue growth (including by distribution channel) on a constant currency basis (expressed as a percentage), billings and free cash flow.

Shutterstock defines adjusted EBITDA as net income adjusted for depreciation and amortization, non-cash equity-based compensation, bargain purchase gain related to the acquisition of Giphy, Giphy Retention Compensation Expense - non-recurring, foreign currency transaction gains and losses, severance costs associated with strategic workforce optimizations, interest income and expense and income taxes; adjusted EBITDA margin as the ratio of adjusted EBITDA to revenue; adjusted net income as net income adjusted for the impact of non-cash equity-based compensation, amortization of acquisition-related intangible assets, bargain purchase gain related to the acquisition of Giphy, Giphy Retention Compensation Expense - non-recurring, severance costs associated with strategic workforce optimizations and the estimated tax impact of such adjustments; adjusted net income per diluted share as adjusted net income divided by weighted average diluted shares; revenue growth (including by distribution channel) on a constant currency basis (expressed as a percentage) as the increase in current period revenues over prior period revenues, utilizing fixed exchange rates for translating foreign currency revenues for all periods in the comparison; billings as revenue adjusted for the change in deferred revenue, excluding deferred revenue acquired through business combinations; and free cash flow as cash provided by operating activities, adjusted for capital expenditures, content acquisition and cash received related to Giphy Retention Compensation in connection with the acquisition of Giphy.

The expense associated with the Giphy Retention Compensation related to (i) the one-time employment inducement bonuses and (ii) the vesting of the cash value of unvested Meta equity awards held by the employees prior to closing, which are reflected in operating expenses (together, the “Giphy Retention Compensation Expense - non-recurring”), are required payments in accordance with the terms of the acquisition. Meta’s sale of Giphy was directed by the CMA and accordingly, the terms of the acquisition were subject to CMA preapproval. Management considers the operating expense associated with these required payments to be unusual and non-recurring in nature. The Giphy Retention Compensation Expense - non-recurring is not considered an ongoing expense necessary to operate the Company’s business. Therefore, such expenses have been included in the below adjustments for calculating adjusted EBITDA, adjusted EBITDA margin, adjusted net income and adjusted net income per diluted common share. For the three months ended September 30, 2023, the Company also incurred $6.5 million of Giphy Retention Compensation expense related to recurring employee costs, which is included in operating expenses, and are not included in the below adjustments for calculating adjusted EBITDA, adjusted EBITDA margin, adjusted net income and adjusted net income per diluted common share.

These figures have not been calculated in accordance with GAAP and should be considered only in addition to results prepared in accordance with GAAP and should not be considered as a substitute for, or superior to, GAAP results. Shutterstock cautions investors that non-GAAP financial measures are not based on any standardized methodology prescribed by GAAP and are not necessarily comparable to similarly-titled measures presented by other companies.

Shutterstock’s management believes that adjusted EBITDA, adjusted EBITDA margin, adjusted net income, adjusted net income per diluted share, revenue growth (including by distribution channel) on a constant currency basis (expressed as a percentage), billings and free cash flow are useful to investors because these measures enable investors to analyze Shutterstock’s operating results on the same basis as that used by management. Additionally, management believes that adjusted EBITDA, adjusted EBITDA margin, adjusted net income and adjusted net income per diluted share provide useful information to investors about the performance of the Company’s overall business because such measures eliminate the effects of unusual or other infrequent charges that are not directly attributable to Shutterstock’s underlying operating performance; and revenue growth (including by distribution channel) on a constant currency basis (expressed as a percentage) provides useful information to investors by eliminating the effect of foreign currency fluctuations that are not directly attributable to Shutterstock’s operating performance. Management also believes that providing these non-GAAP financial measures enhances the comparability for investors in assessing Shutterstock’s financial reporting. Shutterstock’s management believes that free cash flow is useful for investors because it provides them with an important perspective on the cash available for strategic measures, after making necessary capital investments in internal-use software and website development costs to support the Company’s ongoing business operations and provides them with the same measures that management uses as the basis for making resource allocation decisions.

Shutterstock’s management also uses the non-GAAP financial measures adjusted EBITDA, adjusted EBITDA margin, adjusted net income, adjusted net income per diluted share, revenue growth (including by distribution channel) on a constant currency basis (expressed as a percentage), billings and free cash flow, in conjunction with GAAP financial measures, as an integral part of managing the business and to, among other things: (i) monitor and evaluate the performance of Shutterstock’s business operations, financial performance and overall liquidity; (ii) facilitate management’s internal comparisons of the historical operating performance of its business operations; (iii) facilitate management’s external comparisons of the results of its overall business to the historical operating performance of other companies that may have different capital structures and debt levels; (iv) review and assess the operating performance of Shutterstock’s management team and, together with other operational objectives, as a measure in evaluating employee compensation and bonuses; (v) analyze and evaluate financial and strategic planning decisions regarding future operating investments; and (vi) plan for and prepare future annual operating budgets and determine appropriate levels of operating investments.

Reconciliations of the differences between adjusted EBITDA, adjusted EBITDA margin, adjusted net income, adjusted net income per diluted share, revenue growth (including by distribution channel) on a constant currency basis (expressed as a percentage), billings, free cash flow, and the most comparable financial measures calculated and presented in accordance with GAAP, are presented under the headings “Reconciliation of Non-GAAP Financial Information to GAAP” and “Supplemental Financial Data” immediately following the Consolidated Balance Sheets.

We do not provide a reconciliation of adjusted EBITDA guidance to net income guidance or a reconciliation of adjusted net income per diluted share guidance to net income per diluted share guidance, because we are unable to calculate with reasonable certainty the impact of potential future transactions, including, but not limited to, capital structure transactions, restructuring, acquisitions, divestitures or other events and asset impairments, without unreasonable effort. These amounts depend on various factors and could have a material impact on net income and net income per diluted share, but may be excluded from adjusted EBITDA and adjusted net income per diluted share. In addition, we believe such reconciliations would imply a degree of precision that would be confusing or misleading to investors. For the same reasons, the Company is unable to address the probable significance of the unavailable information.

EARNINGS TELECONFERENCE INFORMATION

The Company will discuss its third quarter and full year financial results during a teleconference today, October 31, 2023, at 8:30 AM Eastern Time. The conference call is being webcast live at the Company's website at http://investor.shutterstock.com/. The webcast is listen-only. Those interested in participating in the question-and-answer session should register using the link below.

Participants may register for the call here (https://edge.media-server.com/mmc/p/cmuiaecy). It is recommended that you join 10 minutes prior to the event start (although you may register and join at any time during the call).

A webcast replay of the call will be available on the Company's website beginning on October 31, 2023 at approximately 10:30 AM Eastern Time.

ABOUT SHUTTERSTOCK

Shutterstock, Inc. (NYSE: SSTK) is a leading global creative platform offering high-quality creative content for transformative brands, digital media and marketing companies. Fueled by millions of creators around the world, a growing data engine and a dedication to product innovation, Shutterstock is the leading global platform for licensing from the most extensive and diverse collection of high-quality 3D models, videos, music, photographs, vectors and illustrations. From the world's largest content marketplace, to breaking news and A-list entertainment editorial access, to all-in-one content editing platform and studio production service—all using the latest in innovative technology—Shutterstock offers the most comprehensive selection of resources to bring storytelling to life.

Learn more at www.shutterstock.com and follow us on LinkedIn, Instagram, Twitter, Facebook and YouTube.

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, particularly in the discussion under the caption “2023 Guidance.” All statements other than statements of historical fact are forward-looking. Examples of forward-looking statements include, but are not limited to, statements regarding guidance, industry prospects, future business, future results of operations or financial condition, new or planned features, products or services, management strategies and our competitive position. You can identify forward-looking statements by words such as “may,” “will,” “would,” “should,” “could,” “expect,” “aim,” “anticipate,” “believe,” “estimate,” “intend,” “plan,” “predict,” “project,” “seek,” “potential,” “opportunities” and other similar expressions and the negatives of such expressions. However, not all forward-looking statements contain these words. Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that could cause our actual results to differ materially from those expressed or implied by the forward-looking statements contained herein. Such risks and uncertainties include, among others, risks related to the Giphy, Inc. transaction, such as potential litigation; potential business disruption; the impact of transaction costs; our ability to achieve the benefits of the transaction, including monetization; our ability to effectively integrate the acquired operations into our operations; our ability to retain and hire key target personnel; and the effects of any unknown liabilities; as well as those risks discussed under the caption “Risk Factors” in our most recent Annual Report on Form 10-K, as well as in other documents that the Company may file from time to time with the Securities and Exchange Commission. As a result of such risks, uncertainties and factors, Shutterstock’s actual results may differ materially from any future results, performance or achievements discussed in or implied by the forward-looking statements contained herein. The forward-looking statements contained in this press release are made only as of this date and Shutterstock assumes no obligation to update the information included in this press release or revise any forward-looking statements, whether as a result of new information, future developments or otherwise, except as required by law.

| | | | | |

| Investor Relations Contact | Press Contact |

| Chris Suh | Lori Rodney |

| ir@shutterstock.com | press@shutterstock.com |

| 646-257-4825 | 917-563-4991 |

Shutterstock, Inc.

Consolidated Statements of Operations

(In thousands, except for per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | |

| Revenue | | $ | 233,248 | | | $ | 204,096 | | | $ | 657,368 | | | $ | 610,100 | |

| | | | | | | | |

| Operating expenses: | | | | | | | | |

| Cost of revenue | | 94,219 | | | 79,911 | | | 256,798 | | | 226,381 | |

| Sales and marketing | | 56,165 | | | 47,777 | | | 152,084 | | | 155,335 | |

| Product development | | 28,098 | | | 17,534 | | | 72,722 | | | 48,322 | |

| General and administrative | | 37,574 | | | 30,189 | | | 109,488 | | | 94,085 | |

| | | | | | | | |

| Total operating expenses | | 216,056 | | | 175,411 | | | 591,092 | | | 524,123 | |

| Income from operations | | 17,192 | | | 28,685 | | | 66,276 | | | 85,977 | |

| Bargain purchase gain | | 9,864 | | | — | | | 51,804 | | | — | |

| | | | | | | | |

| Other income / (expense), net | | 557 | | | (1,546) | | | 2,328 | | | (3,449) | |

| Income before income taxes | | 27,613 | | | 27,139 | | | 120,408 | | | 82,528 | |

| (Benefit) / Provision for income taxes | | (806) | | | 4,099 | | | 9,133 | | | 13,471 | |

| Net income | | $ | 28,419 | | | $ | 23,040 | | | $ | 111,275 | | | $ | 69,057 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Earnings per share | | | | | | | | |

| Basic | | $ | 0.79 | | | $ | 0.64 | | | $ | 3.10 | | | $ | 1.91 | |

| Diluted | | $ | 0.79 | | | $ | 0.64 | | | $ | 3.06 | | | $ | 1.88 | |

| | | | | | | | |

| Weighted average common shares outstanding: | | | | | | | | |

| Basic | | 35,912 | | | 35,929 | | | 35,938 | | | 36,117 | |

| Diluted | | 36,081 | | | 36,269 | | | 36,352 | | | 36,681 | |

Shutterstock, Inc.

Consolidated Balance Sheets

(In thousands, except par value amount)

(unaudited)

| | | | | | | | | | | | | | |

| | | September 30, 2023 | | December 31, 2022 |

| | | | |

| ASSETS | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 75,228 | | | $ | 115,154 | |

| | | | |

| | | | |

Accounts receivable, net of allowance of $6,022 and $5,830 | | 85,406 | | | 67,249 | |

| Prepaid expenses and other current assets | | 108,831 | | | 33,268 | |

| | | | |

| | | | |

| Total current assets | | 269,465 | | | 215,671 | |

| | | | |

| Property and equipment, net | | 61,929 | | | 54,548 | |

| Right-of-use assets | | 16,229 | | | 17,593 | |

| Intangibles assets, net | | 193,785 | | | 173,087 | |

| Goodwill | | 382,166 | | | 381,920 | |

| Deferred tax assets, net | | 19,545 | | | 16,533 | |

| Other assets | | 72,801 | | | 21,832 | |

| Total assets | | $ | 1,015,920 | | | $ | 881,184 | |

| | | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | |

| Current liabilities: | | | | |

| Accounts payable | | $ | 7,147 | | | $ | 7,183 | |

| Accrued expenses | | 123,834 | | | 89,387 | |

| Contributor royalties payable | | 49,678 | | | 38,649 | |

| | | | |

| Deferred revenue | | 203,100 | | | 187,070 | |

| Debt | | 30,000 | | | 50,000 | |

| Other current liabilities | | 10,505 | | | 11,445 | |

| Total current liabilities | | 424,264 | | | 383,734 | |

| | | | |

| Deferred tax liability, net | | 4,372 | | | 4,465 | |

| | | | |

| Lease liabilities | | 31,451 | | | 35,611 | |

| Other non-current liabilities | | 23,870 | | | 9,892 | |

| Total liabilities | | 483,957 | | | 433,702 | |

| | | | |

| Commitment and contingencies | | | | |

| Stockholders’ equity: | | | | |

Common stock, $0.01 par value; 200,000 shares authorized; 39,956 and 39,605 shares issued and 35,749 and 35,829 shares outstanding as of September 30, 2023 and December 31, 2022, respectively | | 399 | | | 396 | |

Treasury stock, at cost; 4,207 and 3,776 shares as of September 30, 2023 and December 31, 2022 | | (219,012) | | | (200,008) | |

| Additional paid-in capital | | 412,861 | | | 391,482 | |

| Accumulated other comprehensive loss | | (15,588) | | | (15,439) | |

| Retained earnings | | 353,303 | | | 271,051 | |

| Total stockholders’ equity | | 531,963 | | | 447,482 | |

| Total liabilities and stockholders’ equity | | $ | 1,015,920 | | | $ | 881,184 | |

Shutterstock, Inc.

Consolidated Statements of Cash Flows

(In thousands, except par value amount) (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | | | | | | |

| Net income | | $ | 28,419 | | | $ | 23,040 | | | $ | 111,275 | | | $ | 69,057 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | | |

| Depreciation and amortization | | 21,271 | | | 18,259 | | | 59,373 | | | 49,834 | |

| | | | | | | | |

| Deferred taxes | | (20,814) | | | (3,272) | | | (20,960) | | | (6,874) | |

| Non-cash equity-based compensation | | 13,003 | | | 9,088 | | | 36,589 | | | 23,958 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Bad debt expense | | 369 | | | 373 | | | 1,394 | | | 993 | |

Bargain purchase gain | | (9,864) | | | — | | | (51,804) | | | — | |

| | | | | | | | |

| | | | | | | | |

| Changes in operating assets and liabilities: | | | | | | | | |

| | | | | | | | |

| Accounts receivable | | (24,350) | | | (4,779) | | | (18,641) | | | (5,541) | |

| Prepaid expenses and other current and non-current assets | | (12,333) | | | (1,949) | | | (42,167) | | | (3,157) | |

| | | | | | | | |

| Accounts payable and other current and non-current liabilities | | 8,037 | | | (3,947) | | | 3,893 | | | (32,927) | |

| | | | | | | | |

| Contributor royalties payable | | 9,459 | | | 1,523 | | | 11,281 | | | 5,236 | |

| | | | | | | | |

| Deferred revenue | | (3,183) | | | (621) | | | 16,370 | | | (3,290) | |

| Net cash provided by operating activities | | $ | 10,014 | | | $ | 37,715 | | | $ | 106,603 | | | $ | 97,289 | |

| | | | | | | | |

| CASH FLOWS FROM INVESTING ACTIVITIES | | | | | | | | |

| Capital expenditures | | (11,845) | | | (12,125) | | | (34,715) | | | (32,922) | |

| | | | | | | | |

| | | | | | | | |

Business combination, net of cash acquired | | — | | | 253 | | | (53,721) | | | (211,843) | |

Cash received related to Giphy Retention Compensation | | 18,955 | | | — | | | 34,707 | | | — | |

| | | | | | | | |

Asset acquisitions | | — | | | (1,517) | | | — | | | (1,667) | |

| | | | | | | | |

| | | | | | | | |

Content acquisitions | | (4,473) | | | (4,192) | | | (9,725) | | | (11,191) | |

| | | | | | | | |

Security deposit release / (payment) | | 1,576 | | | (1) | | | 1,539 | | | (282) | |

Net cash provided by / (used in) investing activities | | $ | 4,213 | | | $ | (17,582) | | | $ | (61,915) | | | $ | (257,905) | |

| | | | | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Repurchase of treasury shares | | (15,004) | | | (16,551) | | | (19,004) | | | (73,488) | |

| Proceeds from exercise of stock options | | (1) | | | 1,242 | | | 2 | | | 1,810 | |

| Cash paid related to settlement of employee taxes related to RSU vesting | | (664) | | | (938) | | | (15,209) | | | (21,976) | |

Payment of cash dividend | | (9,636) | | | (8,633) | | | (29,023) | | | (26,004) | |

Proceeds from credit facility | | — | | | — | | | 30,000 | | | 50,000 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Payment of credit facility | | — | | | — | | | (50,000) | | | — | |

Payment of debt issuance costs | | — | | | — | | | — | | | (619) | |

| | | | | | | | |

| | | | | | | | |

Net cash used in financing activities | | $ | (25,305) | | | $ | (24,880) | | | $ | (83,234) | | | $ | (70,277) | |

| | | | | | | | |

| Effect of foreign exchange rate changes on cash | | (840) | | | (3,055) | | | (1,380) | | | (6,880) | |

Net decrease in cash and cash equivalents | | (11,918) | | | (7,802) | | | (39,926) | | | (237,773) | |

| | | | | | | | |

Cash and cash equivalents, beginning of period | | 87,146 | | | 84,046 | | | 115,154 | | | 314,017 | |

Cash and cash equivalents, end of period | | $ | 75,228 | | | $ | 76,244 | | | $ | 75,228 | | | $ | 76,244 | |

| | | | | | | | |

| Supplemental Disclosure of Cash Information: | | | | | | | | |

Cash paid for income taxes | | $ | 9,175 | | | $ | 6,776 | | | $ | 15,970 | | | $ | 19,476 | |

Cash paid for interest | | 803 | | | 384 | | | 1,232 | | | 474 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Shutterstock, Inc.

Reconciliation of Non-GAAP Financial Information to GAAP

(In thousands, except per share information)

(unaudited)

Adjusted EBITDA, adjusted EBITDA margin, adjusted net income, adjusted net income per diluted share, revenue growth (including by distribution channel) on a constant currency basis (expressed as a percentage), billings and free cash flow are not financial measures prepared in accordance with United States generally accepted accounting principles (GAAP). Such non-GAAP financial measures should not be construed as alternatives to any other measures of performance determined in accordance with GAAP. Investors are cautioned that non-GAAP financial measures are not based on any standardized methodology prescribed by GAAP and are not necessarily comparable to similarly-titled measures presented by other companies.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | | 2023 | | 2022 | | 2023 | | 2022 |

| Net income | | $ | 28,419 | | | $ | 23,040 | | | $ | 111,275 | | | $ | 69,057 | |

| Add / (less) Non-GAAP adjustments: | | | | | | | | |

| Depreciation and amortization | | 21,271 | | | 18,259 | | | 59,373 | | | 49,834 | |

| Non-cash equity-based compensation | | 13,003 | | | 9,088 | | | 36,589 | | | 23,958 | |

| | | | | | | | |

| | | | | | | | |

| Bargain purchase gain | | (9,864) | | | — | | | (51,804) | | | — | |

Giphy Retention Compensation Expense - non-recurring | | 8,198 | | | — | | | 25,389 | | | — | |

Other adjustments, net (1) | | 4,469 | | | 1,547 | | | 4,554 | | | 3,449 | |

| (Benefit) / Provision for income taxes | | (806) | | | 4,099 | | | 9,133 | | | 13,471 | |

| | | | | | | | |

| Adjusted EBITDA | | $ | 64,690 | | | $ | 56,033 | | | $ | 194,509 | | | $ | 159,769 | |

| Adjusted EBITDA margin | | 27.7 | % | | 27.5 | % | | 29.6 | % | | 26.2 | % |

____________________________________________________________________________________________________________________

(1)Other adjustments, net includes unrealized foreign currency transaction gains and losses, severance costs associated with strategic workforce optimizations and interest income and expense.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | | 2023 | | 2022 | | 2023 | | 2022 |

| Net income | | $ | 28,419 | | | $ | 23,040 | | | $ | 111,275 | | | $ | 69,057 | |

| Add / (less) Non-GAAP adjustments: | | | | | | | | |

| | | | | | | | |

| Non-cash equity-based compensation | | 13,003 | | | 9,088 | | | 36,589 | | | 23,958 | |

Tax effect of non-cash equity-based compensation (2) | | (3,056) | | | (2,135) | | | (8,599) | | | (5,629) | |

Acquisition-related amortization expense (3) | | 9,052 | | | 8,069 | | | 25,580 | | | 21,224 | |

Tax effect of acquisition-related amortization expense (2) | | (2,127) | | | (1,896) | | | (6,011) | | | (4,988) | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Bargain purchase gain | | (9,864) | | | — | | | (51,804) | | | — | |

| | | | | | | | |

Giphy Retention Compensation Expense - non-recurring | | 8,198 | | | — | | | 25,389 | | | — | |

Tax effect of Giphy Retention Compensation Expense - non-recurring | | (1,927) | | | — | | | (5,967) | | | — | |

| Other | | 4,969 | | | — | | | 6,825 | | | — | |

Tax effect of other(2) | | (1,118) | | | — | | | (1,536) | | | — | |

| Adjusted net income | | $ | 45,549 | | | $ | 36,166 | | | $ | 131,741 | | | $ | 103,622 | |

| | | | | | | | |

| Net income per diluted share | | $ | 0.79 | | | $ | 0.64 | | | $ | 3.06 | | | $ | 1.88 | |

| Adjusted net income per diluted share | | $ | 1.26 | | | $ | 1.00 | | | $ | 3.62 | | | $ | 2.82 | |

| | | | | | | | |

| Weighted average diluted shares | | 36,081 | | | 36,269 | | | 36,352 | | | 36,681 | |

____________________________________________________________________________________________________________________

(2)Statutory tax rates are used to calculate the tax effect of the adjustments.

(3)Of these amounts, $8.1 million and $7.5 million are included in cost of revenue for the three months ended September 30, 2023 and 2022, respectively. The remainder of acquisition-related amortization expense is included in general and administrative expense in the Statement of Operations.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | | 2023 | | 2022 | | 2023 | | 2022 |

| Total Revenue | | $ | 233,248 | | | $ | 204,096 | | | $ | 657,368 | | | $ | 610,100 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Revenue growth | | 14 | % | | 5 | % | | 8 | % | | 7 | % |

| Revenue growth on a constant currency basis | | 12 | % | | 10 | % | | 7 | % | | 11 | % |

| | | | | | | | |

| | | | | | | | |

| E-commerce revenue | | $ | 106,037 | | | $ | 124,594 | | | $ | 337,694 | | | $ | 379,052 | |

| Revenue growth: E-commerce | | (15) | % | | 2 | % | | (11) | % | | 5 | % |

| Revenue growth: E-commerce on a constant currency basis | | (16) | % | | 6 | % | | (11) | % | | 8 | % |

| | | | | | | | |

Enterprise revenue1 | | $ | 127,211 | | | $ | 79,502 | | | $ | 319,674 | | | $ | 231,048 | |

| Revenue growth: Enterprise | | 60 | % | | 9 | % | | 38 | % | | 12 | % |

| Revenue growth: Enterprise on a constant currency basis | | 57 | % | | 15 | % | | 38 | % | | 16 | % |

1 - Enterprise revenue includes $45.5 million and $1.5 million, related to our computer vision data partnerships, for the three months ended September 30, 2023 and 2022, respectively. Enterprise revenue includes $79.5 million and $4.4 million, related to our computer vision data partnerships, for the six months ended September 30, 2023 and 2022, respectively.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | | 2023 | | 2022 | | 2023 | | 2022 |

| Net cash provided by operating activities | | $ | 10,014 | | | $ | 37,715 | | | $ | 106,603 | | | $ | 97,289 | |

| Capital expenditures | | (11,845) | | | (12,125) | | | (34,715) | | | (32,922) | |

| Content acquisitions | | (4,473) | | | (4,192) | | | (9,725) | | | (11,191) | |

Cash received related to Giphy Retention Compensation | | 18,955 | | | — | | | 34,707 | | | — | |

| | | | | | | | |

| Free cash flow | | $ | 12,651 | | | $ | 21,398 | | | $ | 96,870 | | | $ | 53,176 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, | | |

| | | 2023 | | 2022 | | 2023 | | 2022 | | |

| | |

| E-commerce revenue | | $ | 106,037 | | | $ | 124,594 | | | $ | 337,694 | | | $ | 379,052 | | | |

| Enterprise revenue | | $ | 127,211 | | | $ | 79,502 | | | $ | 319,674 | | | $ | 231,048 | | | |

| Total revenue | | $ | 233,248 | | | $ | 204,096 | | | $ | 657,368 | | | $ | 610,100 | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Change in total deferred revenue | | $ | (4,383) | | | $ | (3,969) | | | $ | 16,030 | | | $ | (10,300) | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Total billings | | $ | 228,865 | | | $ | 200,127 | | | $ | 673,398 | | | $ | 599,800 | | | |

Shutterstock, Inc.

Supplemental Financial Data

(unaudited)

Historical Operating Metrics | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended |

| | | 9/30/23 | | 6/30/23 | | 3/31/23 | | 12/31/22 | | 9/30/22 | | 6/30/22 | | 3/31/22 | | 12/31/21 | | |

| | | | | | | | | | | | | | | | | | | |

Subscribers (end of period, in thousands) (1) | | 551 | | | 556 | | | 559 | | | 586 | | | 607 | | | 368 | | | 359 | | | 343 | | | |

Subscriber revenue (in millions) (2) | | $ | 88.3 | | | $ | 87.4 | | | $ | 90.6 | | | $ | 88.8 | | | $ | 87.7 | | | $ | 84.7 | | | $ | 85.4 | | | $ | 81.4 | | | |

| | | | | | | | | | | | | | | | | | |

Average revenue per customer (last twelve months) (3) | | $ | 401 | | | $ | 374 | | | $ | 356 | | | $ | 341 | | | $ | 329 | | | $ | 359 | | | $ | 355 | | | $ | 368 | | | |

Paid downloads (in millions) (4) | | 36.4 | | | 38.5 | | | 42.7 | | | 42.5 | | | 42.8 | | | 43.4 | | | 44.6 | | | 45.0 | | | |

Revenue per download (5) | | $ | 4.76 | | | $ | 4.71 | | | $ | 4.41 | | | $ | 4.49 | | | $ | 4.43 | | | $ | 4.46 | | | $ | 4.22 | | | $ | 4.29 | | | |

Content in our collection (end of period, in millions): (6) | | | | | | | | | | | | | | | | | | |

| Images | | 757 | | | 734 | | | 731 | | | 719 | | | 527 | | | 511 | | | 471 | | | 464 | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Footage clips | | 52 | | | 50 | | | 48 | | | 47 | | | 28 | | | 27 | | | 25 | | | 24 | | | |

Subscribers, Subscriber Revenue and Average Revenue Per Customer from acquisitions are included in these metrics beginning twelve months after the closing of the respective business combination. Accordingly, the metrics include Subscribers, Subscriber revenue, and Average revenue per customer from TurboSquid beginning February 2022, from PicMonkey beginning September 2022, and from Pond5 and Splash News beginning May 2023. These metrics exclude the respective counts and revenues from Giphy.

(1) Subscribers is defined as those customers who purchase one or more of our monthly recurring products for a continuous period of at least three months, measured as of the end of the reporting period.

(2) Subscriber revenue is defined as the revenue generated from subscribers during the period.

(3) Average revenue per customer is calculated by dividing total revenue for the last twelve-month period by customers. Customers is defined as total active, paying customers that contributed to total revenue over the last twelve-month period.

(4) Paid downloads is the number of downloads that our customers make in a given period of our content. Paid downloads exclude content related to our Studios business, downloads of content that are offered to customers for no charge, including our free trials and downloads associated with our computer vision offering.

(5) Revenue per download is the amount of revenue recognized in a given period divided by the number of paid downloads in that period excluding revenue from our Studios business, revenue that is not derived from or associated with content licenses and revenue associated with our computer vision offering.

(6) Content in our collection represents approved images (photographs, vectors and illustrations) and footage (in number of clips) in our library at the end of the period. This metric excludes content that is not uploaded directly to our site but is available for license by our customers through an application program interface, content from our Studios business and AI generated content. Prior to December 31, 2022, this metric only included approved images and footage clips in our library on shutterstock.com at the end of the period.

Equity-Based Compensation by expense category

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended |

| ($ in thousands) | | 9/30/23 | | 6/30/23 | | 3/31/23 | | 12/31/22 | | 9/30/22 | | 6/30/22 | | 3/31/22 | | 12/31/21 | | |

| | | | | | | | | | | | | | | | | | | |

| Cost of revenue | | $ | 180 | | | $ | 306 | | | $ | 184 | | | $ | 160 | | | $ | 173 | | | $ | 156 | | | $ | 78 | | | $ | 54 | | | |

| Sales and marketing | | 2,067 | | | 2,487 | | | 604 | | | 1,426 | | | 1,503 | | | 1,629 | | | 928 | | | 857 | | | |

| Product development | | 3,509 | | | 4,221 | | | 2,448 | | | 3,085 | | | 2,957 | | | 2,557 | | | 1,781 | | | 2,017 | | | |

| General and administrative | | 7,247 | | | 7,929 | | | 5,407 | | | 7,111 | | | 4,455 | | | 2,702 | | | 5,039 | | | 6,612 | | | |

| Total non-cash equity-based compensation | | $ | 13,003 | | | $ | 14,943 | | | $ | 8,643 | | | $ | 11,782 | | | $ | 9,088 | | | $ | 7,044 | | | $ | 7,826 | | | $ | 9,540 | | | |

Depreciation and Amortization by expense category

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended |

| ($ in thousands) | | 9/30/23 | | 6/30/23 | | 3/31/23 | | 12/31/22 | | 9/30/22 | | 6/30/22 | | 3/31/22 | | 12/31/21 | | |

| | | | | | | | | | | | | | | | | | | |

| Cost of revenue | | $ | 19,872 | | | $ | 18,134 | | | $ | 17,866 | | | $ | 17,341 | | | $ | 16,856 | | | $ | 15,172 | | | $ | 13,759 | | | $ | 13,682 | | | |

| General and administrative | | 1,400 | | | 1,070 | | | 1,031 | | | 1,295 | | | 1,404 | | | 1,338 | | | 1,305 | | | 1,358 | | | |

| Total depreciation and amortization | | $ | 21,272 | | | $ | 19,204 | | | $ | 18,897 | | | $ | 18,636 | | | $ | 18,260 | | | $ | 16,510 | | | $ | 15,064 | | | $ | 15,040 | | | |

v3.23.3

Cover Page Document

|

Oct. 31, 2023 |

| Cover [Abstract] |

|

| Entity Central Index Key |

0001549346

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 31, 2023

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-35669

|

| Entity Tax Identification Number |

80-0812659

|

| Entity Address, Address Line One |

350 Fifth Avenue, 20th Floor

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10118

|

| City Area Code |

646

|

| Local Phone Number |

710-3417

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value per share

|

| Trading Symbol |

SSTK

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Registrant Name |

Shutterstock, Inc.

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

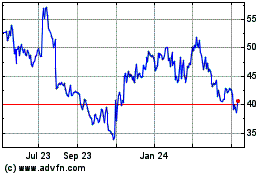

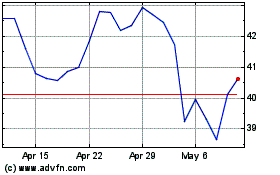

Shutterstock (NYSE:SSTK)

Historical Stock Chart

From Apr 2024 to May 2024

Shutterstock (NYSE:SSTK)

Historical Stock Chart

From May 2023 to May 2024