By Michael Wursthorn

The S&P 500 edged higher Thursday, as investors contended

with a mixed bag of corporate profit reports that offered a murky

outlook on the state of the U.S. economy.

The broad index rose in the final hours of trading to clinch a

0.2% gain after bobbing around the flatline during the busiest day

of the corporate earnings season. The tepid move obscured bigger

swings in shares of individual companies that reported quarterly

results.

On one end, shares of Twitter, 3M, Ford and eBay all suffered

steep declines after reporting disappointing earnings, weighing on

the index. On the other, shares of PayPal Holdings, Microsoft and

semiconductor company Lam Research notched solid gains after

topping Wall Street's expectations.

The problem for investors is that the latest earnings reports

did little to shore up confidence in the U.S. economy, giving them

few incentives to broadly buy stocks, analysts said. Growth is

clearly weakening, as companies including Ford and 3M deal with the

ongoing effects of the U.S.'s trade war against China.

And although most companies in the S&P 500 have topped

analysts' expectations so far, the beats haven't been that

impressive, said Larry Adam, chief investment officer at Raymond

James & Associates. Companies on average have beaten estimates

by about 2.9%, Mr. Adam said, below the near 5% average of recent

years.

"There are pockets of softness and we're seeing that," Mr. Adam

said, referring to a global manufacturing slowdown that continues

to hurt companies like 3M. "But we still have a number of bigger

names that have to report still."

A measure of business investment added to Thursday's gloomy

economic picture after the Commerce Department said orders for

long-lasting goods fell in September, snapping three straight

months of gains.

The S&P 500 added 5.77 points to 3010.29, as technology

stocks within the broad index jumped 1.5% following upbeat earnings

from that sector. The Nasdaq Composite added 66 points, or 0.8%, to

8185.80, while the Dow Jones Industrial Average continued to

underperform broader benchmarks, falling 28.42 points, or 0.1%, to

26805.53.

Shares of 3M fell $6.87, or 4.1%, to $161.89, dragging the Dow

industrials firmly lower throughout the day. The industrial

conglomerate posted lower quarterly sales in some of its core

divisions and cut its earnings forecast for the rest of the

year.

Twitter dropped $8.08, or 21%, to $30.75 after the social-media

company's third-quarter earnings fell short of expectations. Its

fourth-quarter revenue forecast also disappointed investors.

EBay fell $3.58, or 9.1%, to $35.62 after the online marketplace

forecast its first quarterly revenue decline in four years. Ford

shares dropped 61 cents, or 6.6%, to $8.60 after the car maker

lowered its profit target for the year, sparking worries that a

broad restructuring at the company isn't succeeding in driving

earnings growth.

Some of those losses were offset by companies that reported more

upbeat results.

Microsoft reported late Wednesday stronger-than-expected

earnings and revenue, in part due to the company's bet on cloud

computing. Shares jumped $2.70, or 2%, to $139.94.

PayPal, meanwhile, said results for its latest quarter topped

expectations, sending shares up $8.27, or 8.6%, to $104.91, putting

it among the S&P 500's strongest performers.

Shares of Tesla, which isn't in the S&P 500, posted a big

gain after the electric-car maker surprised investors by reporting

a profit for the third quarter, allaying fears that it was

prioritizing growth and production over profit. Shares climbed $45,

or 18%, to $299.68, their biggest single-day gain since May

2013.

About a third of the companies in the S&P 500 have reported

earnings so far, and 81% of those reports have topped expectations,

according to FactSet. But analysts still estimate the broad index

is on pace to see a quarterly earnings contraction of 4.1% from a

year earlier.

Several companies reported results after the stock market

closed, including Amazon.com, which missed analysts' earnings

forecasts and provided lower-than-expected sales guidance for the

fourth quarter. Shares were recently down 8% in after-hours

trading.

Elsewhere, the Stoxx Europe 600 index rose 0.6%, its fourth

consecutive session of gains, after the European Central Bank

decided to leave interest rates unchanged and stuck with a plan to

start buying bonds next month.

Avantika Chilkoti contributed to this article.

Write to Michael Wursthorn at Michael.Wursthorn@wsj.com

(END) Dow Jones Newswires

October 24, 2019 17:08 ET (21:08 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

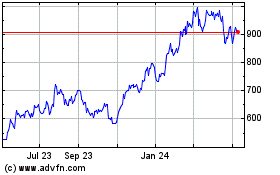

Lam Research (NASDAQ:LRCX)

Historical Stock Chart

From Mar 2024 to Apr 2024

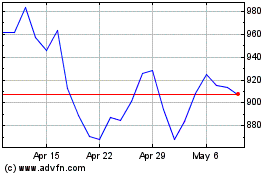

Lam Research (NASDAQ:LRCX)

Historical Stock Chart

From Apr 2023 to Apr 2024