IBEX Limited (“ibex”), a leading global provider in business

process outsourcing and end-to-end customer engagement technology

solutions, today announced financial results for its second quarter

ended December 31, 2022.

“We delivered on a tremendous second quarter of

fiscal year 2023. Driven by our strategic decision to aggressively

expand capacity in our high margin regions and exit a low margin

tenured client, our adjusted EBITDA and adjusted EBITDA margin both

soared to record levels this past quarter. Adjusted EBITDA margin

is up 450 basis points to 18%, and adjusted EBITDA is up 40% to

$25.1 million,” said Bob Dechant, CEO of ibex. “Additionally,

revenue continues to grow, fueled by an enviable client list

comprised of both elite blue-chip and leading new economy clients.

Despite trying market conditions, our powerful New Logo sales

engine continues to deliver outstanding results. Looking ahead, I

am very excited about the trajectory of our business.”

Second Quarter of Fiscal Year 2023

HighlightsBusiness Highlights

- Won 4 new logos across key

verticals in the quarter for a total of 7 new logos this fiscal

year.

- Capacity utilization increased to

62% at December 31, 2022 from 49% at June 30, 2022 enabling

significant margin improvement.

- The FinTech & HealthTech

verticals continued to increase significantly to 27.9% of total

revenue in the second quarter, compared to 22.3% of total revenue

in the prior year quarter.

Revenue

- Revenue increased 5.5% to $139.4 million, compared to $132.2

million in the prior year quarter.

- Excluding a legacy client we exited in the fourth quarter of

fiscal year 2022, revenue increased 12.6% over the prior year

quarter.

- Revenue related to our BPO 2.0 clients grew 16.9% compared to

the prior year quarter and now represents 77.3% of our quarterly

revenue.

Net Income

- Net income and net income margin

decreased to $1.9 million and 1.3%, respectively, compared to $8.5

million and 6.4%, respectively, in the prior year quarter. The

decrease was primarily the result of the revaluation of share

warrants driven by the improvement in the stock price.

- Non-GAAP adjusted net income

increased to $11.7 million, compared to $5.2 million in the prior

year quarter. Non-GAAP adjusted net income margin increased to

8.4%, compared to 3.9% in the prior year quarter (see Exhibit 1 for

reconciliation).

Adjusted EBITDA

- Non-GAAP adjusted EBITDA increased

to $25.1 million, compared to $17.8 million in the prior year

quarter (see Exhibit 2 for reconciliation).

- Non-GAAP adjusted EBITDA margin

increased to 18.0%, compared to 13.5% in the prior year quarter

(see Exhibit 2 for reconciliation).

Earnings Per Share

- IFRS fully diluted earnings per share was $0.10, compared to

$0.45 in the prior year quarter.

- Non-GAAP adjusted fully diluted earnings per share increased to

$0.62, compared to $0.27 in the prior year quarter (see Exhibit 1

for reconciliation).

Cash flow and balance sheet

-

Cash flow from operations increased to $8.3 million, compared to

$3.4 million in the prior year quarter primarily due to stronger

operating results partially offset by an increased use of working

capital.

- Capex was $7.9 million compared to

$11.8 million in the prior year quarter, as we continue to utilize

capacity built in the two prior fiscal years.

- Free cash flow for the second

quarter increased to $0.3 million, compared to ($8.4) million in

the prior year quarter.

- Cash and cash equivalents were

$38.1 million and availability on our revolving credit facilities

of $71.1 million as of December 31, 2022, compared to cash and cash

equivalents of $48.8 million and availability on our revolving

credit facilities of $50.5 million as of June 30, 2022.

- Total borrowings were $4.5 million

as of December 31, 2022, compared to total borrowings of $15.0

million as of June 30, 2022.

- DSOs were 61 days, down 1 day

compared to the prior year quarter, and up 2 days

sequentially.

Raising Fiscal Year 2023 Adjusted EBITDA

Guidance

- Fiscal year adjusted EBITDA of $82

million to $84 million with midpoint margin of 15.1%, up from $77

million to $79 million and a midpoint margin of 14.2%

previously.

Reaffirming Fiscal Year 2023 Revenue and

Capex Guidance

- Fiscal year 2023 organic revenue

between $545 million and $555 million with midpoint growth of 11.4%

versus fiscal year 2022.

- Fiscal year 2023 capex of $18

million to $22 million.

Foreign private issuer statusAs

of December 31, 2022, the last business day of our second fiscal

quarter, we determined that we will no longer qualify as a foreign

private issuer. Effective July 1, 2023, we will be required to file

periodic reports on U.S. domestic issuer forms with the SEC and to

comply with other rules as required. Our annual report for the year

ending June 30, 2023 will be filed as a domestic issuer on Form

10-K and presented in accordance with accounting principles

generally accepted in the United States (U.S. GAAP), with such

change being applied retrospectively.

Conference Call and Webcast

InformationIBEX Limited will host a conference call and

live webcast to discuss its second quarter of fiscal year 2023

financial results at 4:30 p.m. eastern time today, February 15,

2023. The conference e-call may be accessed by registering

here.

Live and archived webcasts can be accessed

at: https://investors.ibex.co/.

Financial InformationThis

announcement does not contain sufficient information to constitute

an interim financial report as defined in International Accounting

Standards 34, “Interim Financial Reporting.” The financial

information in this press release has not been audited.

Non-GAAP Financial MeasuresWe

present non-GAAP financial measures because we believe that they

and other similar measures are widely used by certain investors,

securities analysts and other interested parties as supplemental

measures of performance and liquidity. We also use these measures

internally to establish forecasts, budgets and operational goals to

manage and monitor our business, as well as evaluate our underlying

historical performance, as we believe that these non-GAAP financial

measures provide a more accurate depiction of the performance of

the business by encompassing only relevant and manageable events,

enabling us to evaluate and plan more effectively for the future.

The non-GAAP financial measures may not be comparable to other

similarly titled measures of other companies, have limitations as

analytical tools, and should not be considered in isolation or as a

substitute for analysis of our operating results as reported under

IFRS as issued by the IASB. Non-GAAP financial measures and ratios

are not measurements of our performance, financial condition or

liquidity under IFRS as issued by the IASB and should not be

considered as alternatives to operating profit or net income or as

alternatives to cash flow from operating, investing or financing

activities for the period, or any other performance measures,

derived in accordance with IFRS as issued by the IASB or any other

generally accepted accounting principles.

ibex is not providing a quantitative

reconciliation of forward-looking non-GAAP adjusted EBITDA to the

most directly comparable IFRS measure because it is unable to

predict with reasonable certainty the ultimate outcome of certain

significant items without unreasonable effort. These items include,

but are not limited to, non-recurring expenses, fair value

adjustments, and share-based compensation expense. These items are

uncertain, depend on various factors, and could have a material

impact on IFRS reported results for the guidance period.

About ibexibex helps the

world’s preeminent brands more effectively engage their customers

with services ranging from customer support, technical support,

inbound/outbound sales, business intelligence and analytics,

digital demand generation, and CX surveys and feedback

analytics.

Forward Looking StatementsIn

addition to historical information, this release contains

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995. In some cases, you can

identify forward-looking statements by terminology such as

“believe,” “may,” “will,” “estimate,” “continue,” “anticipate,”

“intend,” “should,” “plan,” “expect,” “predict,” “potential,” or

the negative of these terms or other similar expressions. These

statements include, but are not limited to, statements regarding

our future financial and operating performance, including our

outlook and guidance, and our strategies, priorities and business

plans. Our expectations and beliefs regarding these matters may not

materialize, and actual results in future periods are subject to

risks and uncertainties that could cause actual results to differ

materially from those projected. Factors that could impact our

actual results include: the effects of cyberattacks on our

information technology systems; our ability to attract new business

and retain key clients; our ability to enter into multi-year

contracts with our clients at appropriate rates; the potential for

our clients or potential clients to consolidate; our clients

deciding to enter into or further expand their insourcing

activities; our ability to manage portions of our business that

have long sales cycles and long implementation cycles that require

significant resources and working capital; our ability to manage

our international operations, particularly in the Philippines,

Jamaica, Pakistan and Nicaragua; our ability to comply with

applicable laws and regulations, including those regarding privacy,

data protection and information security; our ability to manage the

inelasticity of our labor costs relative to short-term movements in

client demand; our ability to realize the anticipated strategic and

financial benefits of our relationship with Amazon; our ability to

recruit, engage, motivate, manage and retain our global workforce;

our ability to anticipate, develop and implement information

technology solutions that keep pace with evolving industry

standards and changing client demands; our ability to maintain and

enhance our reputation and brand; developments relating to

COVID-19; and other factors discussed under the heading “Risk

Factors” in our annual report on Form 20-F filed with the

U.S. Securities and Exchange Commission on October 4, 2022 and any

other risk factors we include in subsequent reports on Form 6-K.

Because of these uncertainties, you should not make any investment

decisions based on our estimates and forward-looking statements.

Except as required by law, we undertake no obligation to publicly

update any forward-looking statements for any reason after the date

of this press release whether as a result of new information,

future events or otherwise.

IR Contact: Michael

Darwal, EVP, Deputy CFO, Investor Relations, ibex,

michael.darwal@ibex.coMedia Contact: Daniel

Burris, Senior Director PR and Communication, ibex,

daniel.burris@ibex.co

IBEX LimitedUnaudited

Consolidated Statements of Financial Position

|

|

December 31, |

|

June 30, |

| US$ in

thousands |

2022 |

|

2022 |

|

|

|

| Assets |

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

38,082 |

|

|

$ |

48,831 |

|

|

Trade and other receivables |

|

107,256 |

|

|

|

93,430 |

|

|

Due from related parties |

|

136 |

|

|

|

108 |

|

|

Warrant asset |

|

923 |

|

|

|

908 |

|

| Total current assets |

$ |

146,397 |

|

|

$ |

143,277 |

|

| |

|

|

|

|

|

| Non-current assets |

|

|

|

|

|

|

Property and equipment |

$ |

40,706 |

|

|

$ |

38,987 |

|

|

Right of use assets |

|

72,999 |

|

|

|

77,642 |

|

|

Goodwill |

|

11,832 |

|

|

|

11,832 |

|

|

Other intangible assets |

|

2,496 |

|

|

|

3,027 |

|

|

Warrant asset |

|

460 |

|

|

|

935 |

|

|

Investment in joint venture |

|

380 |

|

|

|

382 |

|

|

Deferred tax asset |

|

7,855 |

|

|

|

9,465 |

|

|

Other assets |

|

5,441 |

|

|

|

4,590 |

|

| Total non-current assets |

$ |

142,169 |

|

|

$ |

146,860 |

|

| Total assets |

$ |

288,566 |

|

|

$ |

290,137 |

|

| |

|

|

|

|

|

| Liabilities and equity |

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

Trade and other payables |

$ |

65,326 |

|

|

$ |

59,813 |

|

|

Deferred revenue |

|

7,090 |

|

|

|

8,600 |

|

|

Lease liabilities |

|

13,939 |

|

|

|

13,705 |

|

|

Borrowings |

|

4,488 |

|

|

|

14,689 |

|

|

Due to related parties |

|

2,479 |

|

|

|

2,595 |

|

|

Income tax payables |

|

2,789 |

|

|

|

2,965 |

|

| Total current liabilities |

$ |

96,111 |

|

|

$ |

102,367 |

|

| |

|

|

|

|

|

| Non-current liabilities |

|

|

|

|

|

|

Deferred revenue |

$ |

2,598 |

|

|

$ |

3,993 |

|

|

Lease liabilities |

|

72,103 |

|

|

|

76,004 |

|

|

Borrowings |

|

- |

|

|

|

338 |

|

|

Other non-current liabilities |

|

9,245 |

|

|

|

7,146 |

|

| Total non-current liabilities |

$ |

83,946 |

|

|

$ |

87,481 |

|

| Total liabilities |

$ |

180,057 |

|

|

$ |

189,848 |

|

| |

|

|

|

|

|

| Equity |

|

|

|

|

|

|

Share capital |

$ |

2 |

|

|

$ |

2 |

|

|

Additional paid-in capital |

|

155,719 |

|

|

|

154,786 |

|

|

Other reserves |

|

34,307 |

|

|

|

33,191 |

|

|

Accumulated deficit |

|

(81,519 |

) |

|

|

(87,690 |

) |

| Total equity |

$ |

108,509 |

|

|

$ |

100,289 |

|

| Total liabilities and equity |

$ |

288,566 |

|

|

$ |

290,137 |

|

| |

|

|

|

|

|

| |

|

|

|

|

|

IBEX LimitedUnaudited

Consolidated Statements of Comprehensive Income

|

|

Three months ended December 31, |

|

Six months ended December 31, |

| US$ in

thousands, except share and per share amounts |

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

Revenue |

$ |

139,390 |

|

|

$ |

132,184 |

|

|

$ |

267,266 |

|

|

$ |

240,757 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Payroll and related costs |

|

92,452 |

|

|

|

91,491 |

|

|

|

179,531 |

|

|

|

167,928 |

|

| Share-based payments |

|

1,533 |

|

|

|

144 |

|

|

|

2,655 |

|

|

|

504 |

|

| Reseller commission and lead

expenses |

|

2,479 |

|

|

|

3,489 |

|

|

|

5,663 |

|

|

|

6,681 |

|

| Depreciation and

amortization |

|

8,755 |

|

|

|

8,669 |

|

|

|

17,440 |

|

|

|

16,312 |

|

| Fair value measurement of

share warrants |

|

6,971 |

|

|

|

(4,187 |

) |

|

|

9,136 |

|

|

|

(6,987 |

) |

| Other operating costs |

|

21,185 |

|

|

|

20,463 |

|

|

|

39,561 |

|

|

|

38,487 |

|

| Income from

operations |

$ |

6,015 |

|

|

$ |

12,115 |

|

|

$ |

13,280 |

|

|

$ |

17,832 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Finance expenses |

$ |

(2,085 |

) |

|

$ |

(2,310 |

) |

|

|

(3,954 |

) |

|

|

(4,420 |

) |

| Income before

taxation |

$ |

3,930 |

|

|

$ |

9,805 |

|

|

$ |

9,326 |

|

|

$ |

13,412 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Income tax benefit /

(expense) |

$ |

(2,065 |

) |

|

$ |

(1,340 |

) |

|

|

(3,155 |

) |

|

|

(1,933 |

) |

| Net

income |

$ |

1,865 |

|

|

$ |

8,465 |

|

|

$ |

6,171 |

|

|

$ |

11,479 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Other comprehensive

income |

|

|

|

|

|

|

|

|

|

|

|

| Items that will be

subsequently reclassified to profit or loss |

|

|

|

|

|

|

|

|

|

|

|

| Foreign currency translation

adjustment |

$ |

544 |

|

|

$ |

(157 |

) |

|

$ |

(949 |

) |

|

$ |

(602 |

) |

| Cash flow hedges - changes in

fair value |

|

814 |

|

|

|

29 |

|

|

|

553 |

|

|

|

(282 |

) |

| Total other

comprehensive income |

$ |

1,358 |

|

|

$ |

(128 |

) |

|

$ |

(396 |

) |

|

$ |

(884 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Total comprehensive

income |

$ |

3,223 |

|

|

$ |

8,337 |

|

|

$ |

5,775 |

|

|

$ |

10,595 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Earnings per

share |

|

|

|

|

|

|

|

|

|

|

|

| Basic |

$ |

0.10 |

|

|

$ |

0.46 |

|

|

$ |

0.34 |

|

|

$ |

0.63 |

|

| Diluted |

$ |

0.10 |

|

|

$ |

0.45 |

|

|

$ |

0.33 |

|

|

$ |

0.61 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Weighted average

shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

18,148,954 |

|

|

|

18,294,304 |

|

|

|

18,154,402 |

|

|

|

18,270,488 |

|

|

Diluted |

|

18,859,744 |

|

|

|

18,815,099 |

|

|

|

18,753,021 |

|

|

|

18,884,220 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IBEX LimitedUnaudited

Consolidated Statements of Cash Flows

|

|

Three months ended December 31, |

|

Six months ended December 31, |

| US$ in

thousands |

2022 |

|

2021 |

|

2022 |

|

2021 |

| CASH FLOWS FROM

OPERATING ACTIVITIES |

|

|

|

|

|

|

|

|

|

|

|

|

Income before taxation |

$ |

3,930 |

|

|

$ |

9,805 |

|

|

$ |

9,326 |

|

|

$ |

13,412 |

|

|

Adjustments to reconcile income before taxation to net cash

provided by operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

8,755 |

|

|

|

8,669 |

|

|

|

17,440 |

|

|

|

16,312 |

|

|

Amortization of warrant asset |

|

244 |

|

|

|

237 |

|

|

|

460 |

|

|

|

(57 |

) |

|

Foreign currency translation gain |

|

752 |

|

|

|

16 |

|

|

|

(97 |

) |

|

|

(6 |

) |

|

Fair value measurement of share warrants |

|

6,971 |

|

|

|

(4,187 |

) |

|

|

9,136 |

|

|

|

(6,987 |

) |

|

Share-based payments |

|

1,533 |

|

|

|

144 |

|

|

|

2,655 |

|

|

|

504 |

|

|

Allowance of expected credit losses |

|

115 |

|

|

|

(99 |

) |

|

|

117 |

|

|

|

(324 |

) |

|

Share of profit from investment in joint venture |

|

(173 |

) |

|

|

(211 |

) |

|

|

(325 |

) |

|

|

(436 |

) |

|

Gain on lease terminations |

|

(1 |

) |

|

|

(5 |

) |

|

|

(367 |

) |

|

|

(7 |

) |

|

(Benefit) / provision for defined benefit scheme |

|

(99 |

) |

|

|

59 |

|

|

|

(100 |

) |

|

|

78 |

|

|

Finance expenses |

|

2,085 |

|

|

|

2,310 |

|

|

|

3,954 |

|

|

|

4,420 |

|

|

Increase in trade and other receivables |

|

(8,585 |

) |

|

|

(14,352 |

) |

|

|

(14,843 |

) |

|

|

(21,949 |

) |

|

Increase in prepayments and other assets |

|

(144 |

) |

|

|

70 |

|

|

|

(937 |

) |

|

|

(199 |

) |

|

(Decrease) / increase in trade and other payables and other

liabilities |

|

(3,810 |

) |

|

|

3,916 |

|

|

|

(3,985 |

) |

|

|

10,832 |

|

|

Cash inflow from operations |

|

11,573 |

|

|

|

6,372 |

|

|

|

22,434 |

|

|

|

15,593 |

|

|

Interest paid |

|

(2,055 |

) |

|

|

(2,310 |

) |

|

|

(3,990 |

) |

|

|

(4,420 |

) |

|

Income taxes paid |

|

(1,257 |

) |

|

|

(675 |

) |

|

|

(1,378 |

) |

|

|

(888 |

) |

|

Net cash inflow from operating activities |

$ |

8,261 |

|

|

$ |

3,387 |

|

|

$ |

17,066 |

|

|

$ |

10,285 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CASH FLOWS FROM

INVESTING ACTIVITIES |

|

|

|

|

|

|

|

|

|

|

|

|

Purchase of property and equipment |

$ |

(7,837 |

) |

|

$ |

(11,330 |

) |

|

$ |

(11,326 |

) |

|

$ |

(16,265 |

) |

|

Purchase of other intangible assets |

|

(111 |

) |

|

|

(487 |

) |

|

|

(180 |

) |

|

|

(876 |

) |

|

Dividend received from joint venture |

|

177 |

|

|

|

228 |

|

|

|

328 |

|

|

|

433 |

|

| Net cash outflow from

investing activities |

$ |

(7,771 |

) |

|

$ |

(11,589 |

) |

|

$ |

(11,178 |

) |

|

$ |

(16,708 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| CASH FLOWS FROM

FINANCING ACTIVITIES |

|

|

|

|

|

|

|

|

|

|

|

|

Proceeds from line of credit |

$ |

29,959 |

|

|

$ |

35,317 |

|

|

$ |

39,314 |

|

|

$ |

60,132 |

|

|

Repayments of line of credit |

|

(32,300 |

) |

|

|

(24,307 |

) |

|

|

(46,300 |

) |

|

|

(49,227 |

) |

|

Repayment of borrowings |

|

(838 |

) |

|

|

(1,604 |

) |

|

|

(3,524 |

) |

|

|

(3,842 |

) |

|

Exercise of options |

|

1,188 |

|

|

|

- |

|

|

|

1,209 |

|

|

|

- |

|

|

Proceeds from lease obligations |

|

331 |

|

|

|

- |

|

|

|

331 |

|

|

|

- |

|

|

Principal payments on lease obligations |

|

(3,660 |

) |

|

|

(3,524 |

) |

|

|

(7,136 |

) |

|

|

(6,547 |

) |

|

Purchase of treasury shares |

|

- |

|

|

|

(36 |

) |

|

|

(276 |

) |

|

|

(36 |

) |

| Net cash (outflow) /

inflow from financing activities |

$ |

(5,320 |

) |

|

$ |

5,846 |

|

|

$ |

(16,382 |

) |

|

$ |

480 |

|

|

Effects of exchange rate difference on cash and cash

equivalents |

|

61 |

|

|

|

(99 |

) |

|

|

(255 |

) |

|

|

(368 |

) |

|

Net decrease in cash and cash equivalents |

$ |

(4,769 |

) |

|

$ |

(2,455 |

) |

|

$ |

(10,749 |

) |

|

$ |

(6,311 |

) |

|

Cash and cash equivalents at beginning of the period |

$ |

42,851 |

|

|

$ |

53,986 |

|

|

$ |

48,831 |

|

|

$ |

57,842 |

|

| Cash and cash

equivalents at end of the period |

$ |

38,082 |

|

|

$ |

51,531 |

|

|

$ |

38,082 |

|

|

$ |

51,531 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Non-cash

items |

|

|

|

|

|

|

|

|

|

|

|

|

New leases |

|

7,633 |

|

|

|

6,656 |

|

|

|

7,987 |

|

|

|

14,406 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IBEX

LimitedReconciliation of IFRS Financial Measures

to Non-GAAP Financial Measures

EXHIBIT 1: Adjusted net income and adjusted fully

diluted earnings per share

We define “adjusted net income” as net income

before the effect of the following items: non-recurring expenses

(including severance expense, litigation and settlement expenses,

costs related to COVID-19, and listing costs, as applicable),

amortization of warrant asset, foreign currency translation gains

or losses, fair value measurement of share warrants, share-based

payments, gain or loss on disposal of fixed assets and/or lease

terminations, and impairment of intangibles, as applicable, net of

the tax impact of such adjustments. The following table provides a

reconciliation of net income to adjusted net income for the periods

presented:

|

IBEX Limited |

|

Adjusted net income |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three months ended December 31, |

Six months ended December 31, |

|

|

2022 |

|

2021 |

2022 |

2021 |

| US$ in

thousands, except share and per share amounts, unaudited |

Amount |

|

Amount |

|

Amount |

|

Amount |

|

Net income |

$ |

1,865 |

|

|

$ |

8,465 |

|

|

$ |

6,171 |

|

|

$ |

11,479 |

|

| Net income

margin |

|

1.3 |

% |

|

|

6.4 |

% |

|

|

2.3 |

% |

|

|

4.8 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| Non-recurring expenses |

|

792 |

|

|

|

850 |

|

|

|

792 |

|

|

|

1,712 |

|

| Amortization of warrant

asset |

|

244 |

|

|

|

237 |

|

|

|

460 |

|

|

|

(57 |

) |

| Foreign currency translation

gain |

|

752 |

|

|

|

16 |

|

|

|

(97 |

) |

|

|

(6 |

) |

| Fair value measurement of

share warrants |

|

6,971 |

|

|

|

(4,187 |

) |

|

|

9,136 |

|

|

|

(6,987 |

) |

| Share-based payments |

|

1,533 |

|

|

|

144 |

|

|

|

2,655 |

|

|

|

504 |

|

| Gain on lease

terminations |

|

(1 |

) |

|

|

(5 |

) |

|

|

(367 |

) |

|

|

(7 |

) |

| Total

adjustments |

$ |

10,291 |

|

|

$ |

(2,945 |

) |

|

$ |

12,579 |

|

|

$ |

(4,841 |

) |

| Tax impact of

adjustments(a) |

|

(414 |

) |

|

|

(346 |

) |

|

|

(581 |

) |

|

|

(595 |

) |

| Adjusted net

income |

$ |

11,742 |

|

|

$ |

5,174 |

|

|

$ |

18,169 |

|

|

$ |

6,043 |

|

| Adjusted net income

margin |

|

8.4 |

% |

|

|

3.9 |

% |

|

|

6.8 |

% |

|

|

2.5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IBEX Limited |

|

Adjusted earnings per share - diluted |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per share -

diluted |

$ |

0.10 |

|

|

$ |

0.45 |

|

|

$ |

0.33 |

|

|

$ |

0.61 |

|

| Per share impact of

adjustments to net income |

|

0.52 |

|

|

|

(0.18 |

) |

|

|

0.64 |

|

|

|

(0.29 |

) |

| Adjusted earnings per

share - diluted |

$ |

0.62 |

|

|

$ |

0.27 |

|

|

$ |

0.97 |

|

|

$ |

0.32 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding - diluted |

|

18,859,744 |

|

|

|

18,815,099 |

|

|

|

18,753,021 |

|

|

|

18,884,220 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) The tax impact of each adjustment is

calculated using the effective tax rate in the relevant

jurisdictions.

EXHIBIT 2: EBITDA and Adjusted

EBITDAWe define “EBITDA” as net income before the effect

of the following items: finance expenses (including finance expense

related to right-of-use lease liabilities), income tax (benefit) /

expense, and depreciation and amortization (including depreciation

of right-of-use assets). We define “Adjusted EBITDA” as EBITDA

before the effect of the following items: non-recurring expenses

(including severance expense, litigation and settlement expenses,

costs related to COVID-19, and listing costs, as applicable),

amortization of warrant asset, foreign currency translation gains

or losses, fair value measurement of share warrants, share-based

payments, gain or loss on disposal of fixed assets and/or lease

terminations, and impairment of intangibles, as applicable. The

following table provides a reconciliation of net income to adjusted

EBITDA for the periods presented:

|

|

Three months ended December 31, |

|

Six months ended December 31, |

| US$ in

thousands, unaudited |

2022 |

|

2021 |

|

2022 |

|

2021 |

|

Net income |

$ |

1,865 |

|

|

$ |

8,465 |

|

|

$ |

6,171 |

|

|

$ |

11,479 |

|

| Net income margin |

|

1.3 |

% |

|

|

6.4 |

% |

|

|

2.3 |

% |

|

|

4.8 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| Finance expenses |

|

2,085 |

|

|

|

2,310 |

|

|

|

3,954 |

|

|

|

4,420 |

|

| Income tax expense |

|

2,065 |

|

|

|

1,340 |

|

|

|

3,155 |

|

|

|

1,933 |

|

| Depreciation and amortization |

|

8,755 |

|

|

|

8,669 |

|

|

|

17,440 |

|

|

|

16,312 |

|

| EBITDA |

$ |

14,770 |

|

|

$ |

20,784 |

|

|

$ |

30,720 |

|

|

$ |

34,144 |

|

| Non-recurring expenses |

|

792 |

|

|

|

850 |

|

|

|

792 |

|

|

|

1,712 |

|

| Amortization of warrant asset |

|

244 |

|

|

|

237 |

|

|

|

460 |

|

|

|

(57 |

) |

| Foreign currency translation gain |

|

752 |

|

|

|

16 |

|

|

|

(97 |

) |

|

|

(6 |

) |

| Fair value measurement of share warrants |

|

6,971 |

|

|

|

(4,187 |

) |

|

|

9,136 |

|

|

|

(6,987 |

) |

| Share-based payments |

|

1,533 |

|

|

|

144 |

|

|

|

2,655 |

|

|

|

504 |

|

| Gain on lease terminations |

|

(1 |

) |

|

|

(5 |

) |

|

|

(367 |

) |

|

|

(7 |

) |

| Adjusted

EBITDA |

$ |

25,061 |

|

|

$ |

17,839 |

|

|

|

43,299 |

|

|

|

29,303 |

|

| Adjusted

EBITDA margin |

|

18.0 |

% |

|

|

13.5 |

% |

|

|

16.2 |

% |

|

|

12.2 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EXHIBIT 3: Free cash flow

We define “free cash flow” as net cash provided

by operating activities less cash capital expenditures.

|

|

Three months ended December 31, |

|

Six months ended December 31, |

| US$ in

thousands, unaudited |

2022 |

|

2021 |

|

2022 |

|

2021 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by operating activities |

$ |

8,261 |

|

|

$ |

3,387 |

|

|

$ |

17,066 |

|

|

$ |

10,285 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Less: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash capital expenditures |

|

7,948 |

|

|

|

11,817 |

|

|

|

11,506 |

|

|

|

17,141 |

|

| Free cash

flow(1) |

$ |

313 |

|

|

$ |

(8,430 |

) |

|

$ |

5,560 |

|

|

$ |

(6,856 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Excluded from free cash flow are the

principal portion of right-of-use lease payments of $3,566 and

$3,411 for the quarter ended and $7,042 and $6,426 for the six

months ended December 31, 2022 and 2021, respectively. We believe

it is useful to consider these payments when analyzing free cash

flow as these amounts directly relate to revenue generating assets

used in operations.

EXHIBIT 4: Net debtWe define

“net debt” as total debt less cash and cash equivalents.

|

|

|

December 31, |

|

|

|

June 30, |

|

| US$ in

thousands, unaudited |

|

2022 |

|

|

|

2022 |

|

| Borrowings |

|

|

|

|

|

|

|

| Current |

$ |

4,488 |

|

|

$ |

14,689 |

|

| Non-current |

|

- |

|

|

|

338 |

|

|

|

$ |

4,488 |

|

|

$ |

15,027 |

|

| Leases |

|

|

|

|

|

|

|

| Current |

$ |

13,939 |

|

|

$ |

13,705 |

|

| Non-current |

|

72,103 |

|

|

|

76,004 |

|

|

|

$ |

86,042 |

|

|

$ |

89,709 |

|

| Total debt |

$ |

90,530 |

|

|

$ |

104,736 |

|

| Cash and cash equivalents |

|

38,082 |

|

|

|

48,831 |

|

|

Net debt |

$ |

52,448 |

|

|

$ |

55,905 |

|

| |

|

|

|

|

|

|

|

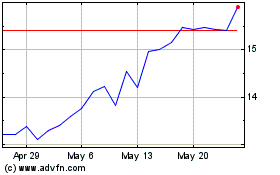

IBEX (NASDAQ:IBEX)

Historical Stock Chart

From May 2024 to Jun 2024

IBEX (NASDAQ:IBEX)

Historical Stock Chart

From Jun 2023 to Jun 2024