Datasea Inc. (NASDAQ: DTSS) ("Datasea" or the "Company"), a

technology company engaged in providing smart security solutions

and developing education-related technologies in China, announced

its financial results for the three months ended December 31, 2019.

Advances from Customers

On March 5, 2018, the Company entered into

separate agreements with two sales agents. Pursuant to the

agreements, the Company authorized the agents to market the

Company’s Safe Campus Management System. The term of the agreements

is for five years and will expire on March 6, 2023 and July 1,

2023, respectively. In accordance with ASU 2016-08, Principal

versus Agent Considerations (ASC 606), the Company determined that

it was the principal in these two contracts and as such, the

Company recorded the payments received from the two sales agents as

advances. The Company will recognize revenue from these contracts

as the sales agents sell the products and services to third

parties.

As of December 31 and June 30, 2019, the Company

recorded $1,300,638 and $1,318,897 of advances from the sales

agents, respectively.

Revenue

The Company did not generate any revenue during

three and six months ended December 31, 2019 and 2018.

Selling, General and Administrative Expenses

Selling expenses were $58,146 and $71,973 for

the three months December 31, 2019 and 2018, respectively. Selling

expenses were $109,321 and $148,852 for the six months December 31,

2019 and 2018, respectively. The decrease in selling expenses was

primarily attributed to a decrease in salary expenses.

General and administration expenses increased

$362,575, or 131.6% from $275,582 during the three months ended

December 31, 2018 to $638,157 during the same period in 2019. The

increases were attributed to increases in rent expenses and

approximately $285,000 of capitalized technology was expensed

during three months ended December 31, 2019. General and

administration expenses increased $443,263, or 88.2% from $502,153

during the six months ended December 31, 2018 to $945,416 during

the same period in 2019. The increases were attributed to increases

in rent expenses and approximately $285,000 of capitalized

technology was expensed during three months ended December 31,

2019.

The Company incurred research and development

expenses of $69,158 and $120,365 during the three and six months

ended December 31, 2019, respectively, comparing $41,114 and

$103,885 during the same period in 2018. The increase was

attributed to the increase in salary expense since the Company

hired more staff in research and development department.

Net Loss

Due to our lack of recurring revenue, the

Company generated net losses of $751,032 and $1,148,018 for the

three and six months ended December 31, 2019, respectively,

$379,712 and $743,937 for the same period in 2018.

Cash and Financial Position

As of December 31, 2019, the Company had cash

and cash equivalents of $ 2,804,740, compared to $ 6,072,637 as of

June 30, 2019.

The Company had a working capital of $ 1,105,913

as of December 31, 2019 compared to working capital of $4,568,461

as of June 30, 2019.

Net cash used in operating activities was

$1,572,243 during the six months ended December 31, 2019, which

consisted of the Company’s net loss of $1,148,018, offset by

depreciation and amortization of $13,186, a change of prepaid

expenses and other current assets of $271,654, and a change of

accrued expenses and other payables of $163,636.

Net cash used in investing activities totaled

$1,608,538 for the six months ended December 31, 2019, which

primarily related to cash paid for the acquisition of office

furniture and equipment of $208,538, and for intangible assets of

$1,400,000.

Net cash used in financing activities was

$84,227 during the six months ended December 31, 2019, which

primarily consisted of payment of a shareholder loan, net of

$84,227.

About Datasea Inc.Datasea is a

technology company in China engaged in providing smart security

solutions and developing education-related technologies. Datasea

leverages its proprietary technologies, intellectual property,

innovative products and market intelligence to provide

comprehensive and optimized security solutions and

education-related technologies to its clients. Datasea has been

certified as one of the Zhongguancun High Tech Enterprises in

recognition of its achievement in high technology products.

Datasea's security and technology engineers and experts create,

design, build and run various security systems and education

technologies tailored to its clients' needs. Through its

professional team and strong expertise in the industry, Datasea

offers its clients a broad portfolio of security solutions, along

with strategic advice and ongoing management of their security

infrastructure, and digital education tools or programs. For

additional company information, please visit:

ir.shuhaixinxi.com.

Cautionary Note Regarding

Forward-Looking StatementsThis press release contains

forward-looking statements within the meaning of Section 21E of the

Securities Exchange Act of 1934 and as defined in the U.S. Private

Securities Litigation Reform Act of 1995. These forward-looking

statements can be identified by terminology such as "will,"

"expects," "anticipates," "future," "intends," "plans," "believes,"

"estimates," "target," "going forward," "outlook" and similar

statements. Such statements are based upon management's current

expectations and current market and operating conditions, and

relate to events that involve known or unknown risks, uncertainties

and other factors, all of which are difficult to predict and many

of which are beyond Datasea's control, which may cause Datasea's

actual results, performance or achievements to differ materially

and in an adverse manner from anticipated results contained or

implied in the forward-looking statements. Further information

regarding these and other risks, uncertainties or factors is

included in Datasea's filings with the U.S. Securities and Exchange

Commission, which are available at www.sec.gov. Datasea does not

undertake any obligation to update any forward-looking statement as

a result of new information, future events or otherwise, except as

required under law.

IR contact:Dragon Gate

Investment Partners LLCTel: +1(646)-801-2803Email:

DTSS@dgipl.com

DATASEA INC.CONSOLIDATED

BALANCE SHEETS

| |

|

December 31, |

|

|

June 30, |

|

| |

|

2019 |

|

|

2019 |

|

| |

|

(Unaudited) |

|

|

(Audited) |

|

| ASSETS |

|

|

|

|

|

|

| Current Assets |

|

|

|

|

|

|

|

Cash |

|

$ |

2,804,740 |

|

|

$ |

6,072,637 |

|

|

Inventory |

|

|

74,432 |

|

|

|

73,294 |

|

|

Prepaid expenses and other current assets |

|

|

253,621 |

|

|

|

105,932 |

|

| Total Current Assets |

|

|

3,132,793 |

|

|

|

6,251,863 |

|

| |

|

|

|

|

|

|

|

|

|

Property and equipment, net |

|

|

242,458 |

|

|

|

41,116 |

|

|

Intangible assets, net |

|

|

1,951,504 |

|

|

|

555,811 |

|

|

Prepaid expense - non current |

|

|

126,396 |

|

|

|

- |

|

|

Escrow |

|

|

600,000 |

|

|

|

600,000 |

|

|

Right-of-use assets |

|

|

1,114,892 |

|

|

|

- |

|

| Total

Assets |

|

$ |

7,168,043 |

|

|

$ |

7,448,790 |

|

| |

|

|

|

|

|

|

|

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Current Liabilities |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

52,771 |

|

|

$ |

13,088 |

|

|

Accrued expenses and other payables |

|

|

93,996 |

|

|

|

264,684 |

|

|

Advances from customer |

|

|

1,300,638 |

|

|

|

1,318,897 |

|

|

Loan payable-shareholder |

|

|

- |

|

|

|

86,733 |

|

|

Operating lease liabilities |

|

|

579,475 |

|

|

|

- |

|

| Total Current Liabilities |

|

|

2,026,880 |

|

|

|

1,683,402 |

|

| |

|

|

|

|

|

|

|

|

| Other liability |

|

|

|

|

|

|

|

|

|

Operating lease liabilities |

|

|

535,417 |

|

|

|

- |

|

| Total Other Liability |

|

|

535,417 |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

| Total

Liabilities |

|

|

2,562,297 |

|

|

|

1,683,402.0 |

|

| |

|

|

|

|

|

|

|

|

| Commitments and

Contingencies |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Stockholders’

Equity |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Common stock, $0.001 par value, 375,000,000 shares authorized,

20,943,846 shares issued and outstanding at December 31, 2019 and

June 30, 2019, respectively |

|

|

20,944 |

|

|

|

20,944 |

|

|

Additional paid-in capital |

|

|

11,104,666 |

|

|

|

11,104,666 |

|

|

Accumulated comprehensive income |

|

|

178,281 |

|

|

|

189,906 |

|

|

Deficit |

|

|

(6,698,145 |

) |

|

|

(5,550,128 |

) |

| Total Stockholders’

Equity |

|

|

4,605,746 |

|

|

|

5,765,388 |

|

| |

|

|

|

|

|

|

|

|

| Total Liabilities and

Stockholders’ Equity |

|

$ |

7,168,043 |

|

|

$ |

7,448,790 |

|

DATASEA INC.CONSOLIDATED

STATEMENTS OF OPERATIONS AND COMPREHENSIVE

LOSS(Unaudited)

| |

|

Three Months Ended |

|

|

Six Months Ended |

|

| |

|

December 31, 2019 |

|

|

December 31, 2018 |

|

|

December 31, 2019 |

|

|

December 31, 2018 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues |

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

| Cost of goods

sold |

|

|

194 |

|

|

|

- |

|

|

|

194 |

|

|

|

- |

|

| Gross

defict |

|

|

(194 |

) |

|

|

- |

|

|

|

(194 |

) |

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling expenses |

|

|

58,146 |

|

|

|

71,973 |

|

|

|

109,321 |

|

|

|

148,852 |

|

|

General and administrative expenses |

|

|

638,157 |

|

|

|

275,582 |

|

|

|

945,416 |

|

|

|

502,153 |

|

|

Research and development expenses |

|

|

69,158 |

|

|

|

41,114 |

|

|

|

120,365 |

|

|

|

103,885 |

|

| Total operating

expenses: |

|

|

765,460 |

|

|

|

388,669 |

|

|

|

1,175,102 |

|

|

|

754,890 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from

operations |

|

|

(765,654 |

) |

|

|

(388,669 |

) |

|

|

(1,175,296 |

) |

|

|

(754,890 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income (expense) : |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other (expense) income, net |

|

|

3,088 |

|

|

|

460 |

|

|

|

(6,416 |

) |

|

|

(3,465 |

) |

|

Interest income |

|

|

11,534 |

|

|

|

8,497 |

|

|

|

33,694 |

|

|

|

14,418 |

|

| Total other

income |

|

|

14,622 |

|

|

|

8,957 |

|

|

|

27,278 |

|

|

|

10,953 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

|

(751,032 |

) |

|

|

(379,712 |

) |

|

|

(1,148,018 |

) |

|

|

(743,937 |

) |

| Other comprehensive

loss |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign currency translation

adjustment |

|

|

(18,238 |

) |

|

|

(7,450 |

) |

|

|

(11,625 |

) |

|

|

24,123 |

|

| Total comprehensive

loss |

|

$ |

(769,270 |

) |

|

$ |

(387,162 |

) |

|

$ |

(1,159,643 |

) |

|

$ |

(719,814 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss per

share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted |

|

$ |

(0.04 |

) |

|

$ |

(0.02 |

) |

|

$ |

(0.05 |

) |

|

$ |

(0.04 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average shares

outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted |

|

|

20,943,846 |

|

|

|

19,445,150 |

|

|

|

20,943,846 |

|

|

|

19,308,455 |

|

DATASEA INC.CONSOLIDATED

STATEMENTS OF CASH FLOWS(Unaudited)

| |

|

Six Months Ended |

|

| |

|

December 31, 2019 |

|

|

December 31, 2018 |

|

| |

|

|

|

|

|

|

| Cash flows from

operating activities: |

|

|

|

|

|

|

|

Net loss |

|

$ |

(1,148,018 |

) |

|

$ |

(743,937 |

) |

| Adjustments to reconcile net

loss to net cash used in operating activities: |

|

|

|

|

|

|

|

|

| Depreciation and

amortization |

|

|

13,186 |

|

|

|

19,319 |

|

| Changes in current assets and

current liabilities: |

|

|

|

|

|

|

|

|

|

Inventory |

|

|

(2,121 |

) |

|

|

278 |

|

|

Prepaid expenses and other assets |

|

|

(271,654 |

) |

|

|

1,409 |

|

|

Right-of-use assets |

|

|

(1,097,886 |

) |

|

|

- |

|

|

Accrued expenses and other payables |

|

|

(163,636 |

) |

|

|

(71,915 |

) |

|

Operating lease liabilities |

|

|

1,097,886 |

|

|

|

- |

|

| Net cash used in operating

activities |

|

|

(1,572,243 |

) |

|

|

(794,846 |

) |

| |

|

|

|

|

|

|

|

|

| Cash flows from

investing activities: |

|

|

|

|

|

|

|

|

|

Acquisition of office equipment |

|

|

(208,538 |

) |

|

|

(15,754 |

) |

|

Acquisition of intangible assets |

|

|

(1,400,000 |

) |

|

|

(14,583 |

) |

| Net cash used in investing

activities |

|

|

(1,608,538 |

) |

|

|

(30,337 |

) |

| |

|

|

|

|

|

|

|

|

| Cash flows from

financing activities: |

|

|

|

|

|

|

|

|

|

Payment of loan payable - shareholder, net |

|

|

(84,227 |

) |

|

|

(17,508 |

) |

|

Net proceeds from sale of common stock |

|

|

- |

|

|

|

4,748,422 |

|

|

Net proceeds from issuance of common stock |

|

|

- |

|

|

|

307,724 |

|

| Net cash provided by financing

activities |

|

|

(84,227.00 |

) |

|

|

5,038,638 |

|

| |

|

|

|

|

|

|

|

|

| Effect of exchange

rate changes on cash |

|

|

(2,890 |

) |

|

|

28,567 |

|

| |

|

|

|

|

|

|

|

|

| Net (decrease)

increase in cash |

|

|

(3,267,897 |

) |

|

|

4,242,022 |

|

| |

|

|

|

|

|

|

|

|

| Cash – beginning of

period |

|

|

6,072,637 |

|

|

|

1,031,486 |

|

| |

|

|

|

|

|

|

|

|

| Cash – end of

period |

|

$ |

2,804,740 |

|

|

$ |

5,273,508 |

|

| |

|

|

|

|

|

|

|

|

| Supplemental

disclosures of cash flow information: |

|

|

|

|

|

|

|

|

| Cash paid for interest |

|

$ |

- |

|

|

$ |

- |

|

| Cash paid for income tax |

|

$ |

- |

|

|

$ |

- |

|

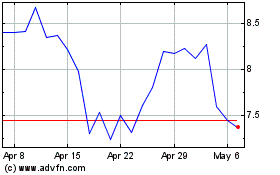

Datasea (NASDAQ:DTSS)

Historical Stock Chart

From Mar 2024 to Apr 2024

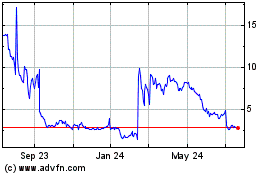

Datasea (NASDAQ:DTSS)

Historical Stock Chart

From Apr 2023 to Apr 2024